Professional Documents

Culture Documents

Audit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) No

Uploaded by

suniljaithwarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) No

Uploaded by

suniljaithwarCopyright:

Available Formats

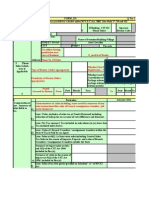

AUDIT REPORT

PART-3

SCHEDULE-IV

1) Eligibility Certificate (EC) No. Certificate of Entitlement (COE) No.

a)

b)

c)

Please tick whichever is applicable

2) Mode of incentive Exemption from tax Deferment of tax payable

3) Type of Unit New Unit Expansion Unit

4) Computation of Net Turnover of Sales liable to tax

Sr. Particulars As per Return As per Audit Difference

No.

1 2 3 4 5

a) Gross turnover of sales including, taxes as

well as turnover of non sales transactions

like value of Branch Transfers,

Consignment transfers and job work

charges etc.

b) Less: - Turn-Over of Sales (including

taxes thereon) including inter-state

Consignments and Branch Transfers

Covered under Schedule I, II, III or V

c) Balance:- Turn-Over Considered

under this Schedule (a-b)

Less:-Value of Goods Return (inclusive of

d) tax), including reduction of sale price on

account of rate difference and discount.

e) Less:-Net Tax amount (Tax included in

sales shown in (c) above less Tax included

in (a) and (d) above)

f) Less:-Value of Branch Transfers /

Consignment Transfers within the State if

is to be paid by the Agent.

g) Less:-Sales u/s 8 (1) i.e. Interstate Sales

including Central Sales Tax, Sales in the

course of imports, exports and value of

Branch Transfers/ Consignment transfers

outside the State

h) Less: - Sales of tax-free goods specified in

Schedule A

i) Less:-Sales of taxable goods fully exempted

u/s. 8(4) [other than sales under section 8 (1)

and shown in Box 4(g)]

Signature and Seal of Auditor 40

j) Less:-Sales of taxable goods fully exempted

u/s. 8 [other than sales under section 8(1)

and 8 (4) and shown in Box 4(g)]

k) Less:-Job/Labour work charges

l) Less:-Other allowable

reductions/deductions, if any

m) Balance Net Turnover of Sales liable to

tax [c] –[d+e+f+g+h+i+j+k+l]

5) Computation of Sales tax payable under the MVAT Act

I. Turn-Over of Sales eligible for incentive (Deferment of Tax)

Sr. Rate of Tax As per Returns As per Audit Difference in

No. (%) Tax Amount Tax Amount Tax Amount

Turnover of Sales Turnover of Sales

(Rs.) (Rs.) (Rs.)

liable to tax (Rs.) liable to tax (Rs.)

1 2 3 4 5 6 7

a) 12.50

b) 4.00

c) 1.00

d)

e) Sub-Total-A

II. Other Sales (Turn-Over of Sales Non-eligible for Incentives)

Sr. No. Rate of Tax Turnover of Sales Tax Amount Turnover of Sales Tax Amount Difference in

(%) liable to tax (Rs.) (Rs.) liable to tax (Rs.) (Rs.)

Tax Amount

(Rs.)

a) 12.50

b) 4.00

c) 1.00

d)

e) Sub-Total-B

III Total A+B

5A) Sales Tax collected in Excess of the As per Returns As per Audit Difference

Amount of Tax payable

Signature and Seal of Auditor 41

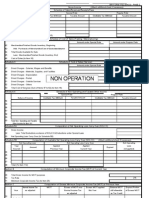

6) Computation of Purchases Eligible for Set-off

Sr. As per Returns As per Audit Difference

Particulars

No. (Rs.) (Rs.) (Rs.)

1 2 3 4 5

a) Total Turn-Over of Purchases including

taxes, value of Branch Transfers /

consignment transfers received and

Labour/ job work charges.

b) Less:- Turn-Over of Purchases Covered

under Schedule I, II, III or V

c) Balance:- Turn-Over of Purchases

Considered under this Schedule (a-b)

d) Less:-Value of Goods Return (inclusive of

tax), including reduction of purchase price

on account of rate difference and discount.

e) Less:-Imports (Direct imports)

f) Less:-Imports (High seas purchases)

g) Less:-Inter-State purchases

h) Less:-Inter-State Branch Transfers/

Consignment Transfers received

i) Less:-Within the State Branch Transfers /

Consignment Transfers received where tax

is to be paid by an Agent

j) Less:-Within the State purchases of

taxable goods from un-registered dealers

k) Less:-Purchases of the taxable goods from

registered dealers under MVAT Act, 2002

and which are not eligible for set-off

l) Less:-Within the State purchases of

taxable goods which are fully exempted

from tax u/s 8 [other than u/s 8(1)] and

41(4)

Signature and Seal of Auditor 42

m) Less:-Within the State purchases of tax-

free goods specified in Schedule “A”

n) Less:-Other allowable deductions

/reductions, if any. (Please Specify)

o) Balance: Within the State purchases of

taxable goods from registered dealers

eligible for set-off

(c) – (d+e+f+g+h+i+j+k+l+m+n)

7) Tax rate wise break-up of Purchases from registered dealers eligible for set-off as per Box 6(o)

above

Sr. Rate of As per Returns As per Audit

No. Tax Difference in

Net Turnover of Net Turnover Tax

Tax Amount

Purchases Tax Amount of Purchases Amount

Eligible for Set – (Rs.) Eligible for (Rs.)

Off (Rs.) Set –Off (Rs.) (Rs.)

1 2 3 4 5 6 7

a) 12.50%

b) 4.00%

c)

d)

e)

TOTAL

8) Computation of Refund/Set-off claim.

Sr. Difference

No. As per Return As per Audit in Tax

Particulars Amount

Purchase Value Tax Purchase Tax

Rs. Amount Value Rs. Amount

a) Within the State purchases

of taxable goods from

registered dealers eligible

for set-off as per Box 7

above

Signature and Seal of Auditor 43

b) Less: - Reduction in the

amount of set off u/r 53

(1) of the corresponding

purchase price of

(Schedule C, D & E) the

goods

Less: - Reduction in the

amount of set off u/r 53

(2) of the of the

corresponding purchase

price of (Schedule B, C, D

& E) the goods

c) Less: - Reduction in the

amount of set off under

any other Sub-rule of rule

53

d) Amount of Refund or

Set-off available [(a) –

(c+b)]

e) Amount of Refund

relating to Raw

Materials for use in

manufacture of goods

eligible for incentives

f) Amount of Set-off

relating other purchases.

9) Computation of Tax Payable

Sr. Particulars As per Return As per Audit Difference

No. (Rs.) (Rs.)

1 2 3 4 5

9A) Aggregate of credit available for the period covered under Audit

Refund or Set off available as per

a)

Box 8 (f)

Signature and Seal of Auditor 44

b) Amount already paid (Details as per

Annexure-A)

c) Excess Credit if any, as per Schedule

I, II, III, or V to be adjusted against

the liability as per this Schedule

d) Adjustment of ET paid under

Maharashtra Tax on Entry of Goods

into Local Areas Act, 2002/ Motor

Vehicle Entry Tax Act, 1987

e) Amount Credited as per Refund

adjustment order (Details as per

Annexure-A)

f) Any other (Please Specify)

g) Total Available Credit

(a+b+c+d+e+f)

9B) Sales tax payable and adjustment of CST / ET payable against available credit

a) Sales Tax Payable as per Box 5 (III)

Less:- Sales Tax deferred as per

Box-5 I.(e)

b) Excess Credit as per this Schedule

adjusted on account of M.VAT

payable, if any, as per Schedule I, II,

III or V

c) Adjustment on account of CST

payable as per Schedule VI for the

period under Audit

d) Adjustment on account of ET

payable under the Maharashtra Tax

on Entry of Goods into Local Areas

Act, 2002/Motor Vehicle Entry Tax

Act, 1987

e) Amount of Sales Tax Collected in

Excess of the amount of Sales Tax

payable, if any as per Box 5A

Signature and Seal of Auditor 45

f) Interest Payable under Section 30 (2)

g) Total Amount.(a+b+c+d+e+f)

9C) Tax payable or Amount of Refund Available

1 2 3 4 5

a) Total Amount payable as per

Box 9B(g)

b) Aggregate of Credit Available as

per Box 9A(g)

c) Total Amount Payable (a-b)

d) Total Amount Refundable (b-a)

10) Details of benefits availed under the Package Scheme of Incentives (Details to be given separately

for each EC)

COE No. Eligibility Period FROM TO

LOCATION OF THE UNIT

10A) Calculation of Cumulative Quantum of Benefits (CQB) Under-rule 78(2)(a)

As per Returns As per Audit

Rate of Turnover of Turnover of

Sr. Difference in

Tax

Sales Eligible CQB Amount Sales Eligible CQB Amount

No. CQB Amount

(%)

Goods liable (Rs.) Goods liable to (Rs.)

(Rs.)

to Tax (Rs.) Tax (Rs.)

a) 12.50

b) 4.00

c)

d)

e) Sub-Total-A

10B) Calculation of Cumulative Quantum of Benefits (CQB) Under-rule 78(2)(b)

As per Returns As per Audit

Rate of

Sr. Tax Difference in

Turnover of Sales Turnover of Sales CQB Amount

No. Eligible Goods

CQB Amount

Eligible Goods

(%) (Rs.) (Rs.) CQB Amount (Rs.)

liable to Tax (Rs.) liable to Tax (Rs.)

1 2 3 4 5 6 7

a) 12.50

Signature and Seal of Auditor 46

b) 4.00

c)

d)

e) Sub-Total-A

10C) TOTAL

(A+B)

10D) Calculation of Deferment of Benefits Under-rule 81.

As per Returns As per Audit

Turnover of Turnover of Difference in

Sr. Particulars Amount

Sales of Amount Sales of

No. (Rs.) Deferrable Tax

Eligible (Rs.) Eligible Goods

Goods liable (Deferrable) liable to Tax (Deferrable) Amount

to Tax (Rs.) (Rs.)

a) Amount of MVAT

payable

b) Amount of CST

payable

c) Total Amount of

Tax Deferred

10E) Status of CQB u/r 78 / Tax deferment u/r 81

Sr.

Particulars As per Return As per Audit Difference

No.

a) Sanctioned monetary ceiling

b) Opening balance of the monitory ceiling at the

beginning of the period under Audit.

c) Less: Amount of CQB / Tax deferment for the

period under Audit as per Box 10 C or 10-D

(c), as the case may be

d) Less: Amount of Refund claimed as per Rule

79 (2)

e) Less:-Benefit of Luxury Tax claimed for TIS-

99 under Luxury Tax Act, 1987 for this

period.

Signature and Seal of Auditor 47

f) Closing balance of the monitory ceiling at the

end of the period under Audit

[( b) - (c+d+e)]

11) Details of benefits availed under the Package Scheme of Incentives (Details to be given separately

for each EC)

COE No. Eligibility Period FROM TO

LOCATION OF THE UNIT

11A) Calculation of Cumulative Quantum of Benefits (CQB) Under-rule 78(2)(a)

As per Returns As per Audit

Rate of

Turnover of Turnover of

Sr. Difference in

Tax Sales Eligible CQB Amount Sales Eligible

No. CQB Amount CQB Amount

(%)

Goods liable (Rs.) Goods liable to (Rs.)

(Rs.)

to Tax (Rs.) Tax (Rs.)

1 2 3 4 5 6 7

a) 12.50

b) 4.00

c)

d)

e) Sub-Total-A

11B) Calculation of Cumulative Quantum of Benefits (CQB) Under-rule 78(2)(b)

As per Returns As per Audit

Rate of Turnover of Turnover of

Sr. Difference in

Tax Sales Eligible CQB Amount Sales Eligible CQB Amount

No. CQB Amount

(%) Goods liable (Rs.) Goods liable to (Rs.)

(Rs.)

to Tax (Rs.) Tax (Rs.)

a) 12.50

b) 4.00

c)

d)

Signature and Seal of Auditor 48

e) Sub-Total-A

11C) TOTAL

(A+B)

11D) Calculation of Deferment of Benefits Under-rule 81.

As per Returns As per Audit

Turnover of Turnover of

Sr. Particulars Amount Difference in

Sales of Amount Sales of

No. (Rs.) Amount (Rs.)

Eligible (Rs.) Eligible Goods

Goods liable (Deferrable) liable to Tax (Deferrable) (Deferrable)

to Tax (Rs.) (Rs.)

a) Amount of MVAT

payable

b) Amount of MVAT

payable

c) Total Amount of

Tax Deferred

11E) Status of CQB u/r 78 / Tax deferment u/r 81

Sr. As per Return As per Audit Difference

Particulars

No.

a) Sanctioned monetary ceiling

b) Opening balance of the monitory ceiling at the

beginning of the period under Audit which the

return is filed

c) Less: Amount of CQB / Tax deferment for the

period under Audit as per Box 11 C or 11-D (c),

as the case may be

d) Less: Amount of Refund claimed as per Rule 79

(2)

e) Less:-Benefit of Luxury Tax claimed for TIS-99

under Luxury Tax Act, 1987 for this period.

f) Closing balance of the monitory ceiling at the end

of the period under Audit [( b) - (c+d+e)]

Signature and Seal of Auditor 49

12) Details of benefits availed under the Package Scheme of Incentives (Details to be given

separately for each EC)

COE No. Eligibility Period FROM TO

LOCATION OF THE UNIT

12A) Calculation of Cumulative Quantum of Benefits (CQB) Under-rule 78(2)(a)

Rate of As per Returns As per Audit

Tax

(%) Turnover of Turnover of

Difference in

Sales Eligible Sales Eligible CQB Amount

CQB Amount CQB Amount

Goods liable (Rs.) Goods liable to (Rs.)

(Rs.)

to Tax (Rs.) Tax (Rs.)

a) 12.50

b) 4.00

c)

d)

e) Sub-Total-A

12B) Calculation of Cumulative Quantum of Benefits (CQB) Under-rule 78(2)(b)

Rate of As per Returns As per Audit

Tax

(%) Turnover of Turnover of

Difference in

Sales Eligible Sales Eligible CQB Amount

CQB Amount CQB Amount

Goods liable (Rs.) Goods liable to (Rs.)

(Rs.)

to Tax (Rs.) Tax (Rs.)

a) 12.50

b) 4.00

c)

d)

e) Sub-Total-A

Signature and Seal of Auditor 50

12C) TOTAL

(A+B)

12D) Calculation of Deferment of Benefits Under-rule 81.

As per Returns As per Audit

Turnover of Turnover of Difference in

Sr. Particulars Amount

Sales of Amount Sales of Amount

No. (Rs.)

Eligible (Rs.) Eligible Goods (Rs.)

Goods liable (Deferrable) liable to Tax (Deferrable) (Deferrable)

to Tax (Rs.) (Rs.)

a) Amount of MVAT

payable

b) Amount of MVAT

payable

c) Total Amount of

Tax Deferred

12E) Status of CQB u/r 78 / Tax deferment u/r 81

Sr.

No.

Particulars As per Return As per Audit Difference

a) Sanctioned monetary ceiling

b) Opening balance of the monitory ceiling at

the beginning of the period under Audit

c) Less: Amount of CQB / Tax deferment for

the period under Audit as per Box 12 C or

12-D (c), as the case may be

d) Less: Amount of Refund claimed as per

Rule 79 (2)

e) Less:-Benefit of Luxury Tax claimed under

TIS under Luxury Tax Act, 1987 for this

period.

Closing balance of the monitory ceiling at

f) the end of the period under Audit.

[( b) - (c+d+e)]

Signature and Seal of Auditor 51

You might also like

- Audit Report PART-3 Schedule-IDocument6 pagesAudit Report PART-3 Schedule-IsuniljaithwarNo ratings yet

- SCH 3Document8 pagesSCH 3suniljaithwarNo ratings yet

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaNo ratings yet

- Form 231 Sharp EnterprisesDocument8 pagesForm 231 Sharp Enterprisesqaid_duraiyaNo ratings yet

- Form 231Document9 pagesForm 231Pushkar JoshiNo ratings yet

- Revised Quarterly Return Under Section 24 of The Bihar Value Added Tax Act, 2005Document20 pagesRevised Quarterly Return Under Section 24 of The Bihar Value Added Tax Act, 2005gurudev21No ratings yet

- CST Form IDocument12 pagesCST Form Ianilshukla1969No ratings yet

- Form Jvat 409Document2 pagesForm Jvat 409Suzanne BradyNo ratings yet

- Form Vat - IiiDocument4 pagesForm Vat - IiihrsolutionNo ratings yet

- GSTR-9A Filing: Compounding Tax ReturnDocument10 pagesGSTR-9A Filing: Compounding Tax ReturnDimPze SathishNo ratings yet

- 27860151571V 27860151571C Venktesh Trading CompanyDocument7 pages27860151571V 27860151571C Venktesh Trading CompanyAdesh NaharNo ratings yet

- Vat R2 2016 - 2017Document4 pagesVat R2 2016 - 2017Hotel sapphireNo ratings yet

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocument7 pagesForm VAT-R2: (See Rule 16 (2) ) Ddmmyygovind_2363No ratings yet

- GSTR9 10JHBPS7007C1ZR 032019Document8 pagesGSTR9 10JHBPS7007C1ZR 032019karanNo ratings yet

- Form 231Document9 pagesForm 231sanjay jadhav100% (5)

- 27201451249V M1 1703 Hist PDFDocument6 pages27201451249V M1 1703 Hist PDFPriyanka AgrawalNo ratings yet

- Form 231 Errors Sno Error Line No Error BOX No Error Box DescriptionDocument9 pagesForm 231 Errors Sno Error Line No Error BOX No Error Box DescriptionnitinnawarNo ratings yet

- Form 23ACDocument6 pagesForm 23ACNikkhil GuptaaNo ratings yet

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoNo ratings yet

- Form 231 Errors Sno Error Line No Error BOX No Error Box DescriptionDocument9 pagesForm 231 Errors Sno Error Line No Error BOX No Error Box DescriptionNishant GoyalNo ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- GSTR9 18acvpa7546a1zk 032022Document8 pagesGSTR9 18acvpa7546a1zk 032022SUBHASH MOURNo ratings yet

- Creditable Tax Withheld: Goods ManufacturedDocument12 pagesCreditable Tax Withheld: Goods ManufacturedNino FrondozoNo ratings yet

- Monthly VAT Return SampleDocument35 pagesMonthly VAT Return SampleJohnHKyeyuneNo ratings yet

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Document12 pages1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanNo ratings yet

- Mvat f231Document5 pagesMvat f231pgotaphoeNo ratings yet

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- GSTR9 29aaqfm8617b1zz 032022Document8 pagesGSTR9 29aaqfm8617b1zz 032022helloNo ratings yet

- 18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionDocument2 pages18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionWUTYI THINNNo ratings yet

- GSTR9 27aahcb1010d1zg 032023Document8 pagesGSTR9 27aahcb1010d1zg 032023arpindlavNo ratings yet

- GSTR9 29aahcv2115k1z5 032020Document8 pagesGSTR9 29aahcv2115k1z5 032020MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- GSTR-9C 09awdpk5848f1zb 29122023Document8 pagesGSTR-9C 09awdpk5848f1zb 29122023suraj888999No ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- Form VAT R2Document10 pagesForm VAT R2murarirahul80% (5)

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- RT3 Form Tax Return DetailsDocument4 pagesRT3 Form Tax Return DetailsbalaramNo ratings yet

- PART1 (Details of Turnover/transfers) Deductions:: Form Rt3Document4 pagesPART1 (Details of Turnover/transfers) Deductions:: Form Rt3balaramNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9RM PlusNo ratings yet

- Kanya KarungalDocument13 pagesKanya KarungalramNo ratings yet

- GSTR-9 Annual ReturnDocument16 pagesGSTR-9 Annual ReturnRehana shahNo ratings yet

- CST AppealDocument3 pagesCST AppealvnbanjanNo ratings yet

- CFS Format - Oct 2022Document2 pagesCFS Format - Oct 2022Kartik SujanNo ratings yet

- GSTR9 22aabcn2864p1z7 032018Document8 pagesGSTR9 22aabcn2864p1z7 032018Sumit K JhaNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument13 pagesIntermediate Examination: Suggested Answers To Questionsnarendra225No ratings yet

- VAT Audit ProceduresDocument3 pagesVAT Audit ProceduresAnthony Martinez OrasaNo ratings yet

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document6 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Katherine OlidanNo ratings yet

- Multiple Choice Questions: Profit and Loss Statements 161Document8 pagesMultiple Choice Questions: Profit and Loss Statements 161MOHAMMED AMIN SHAIKHNo ratings yet

- GSTR-9C 09absfa5984a1z3 29122023Document8 pagesGSTR-9C 09absfa5984a1z3 29122023suraj888999No ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- MVAT IntroductionDocument28 pagesMVAT IntroductionAmolaNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- Form GSTR - 9Document21 pagesForm GSTR - 909 AYUSHI TIWARI BCOM 2HNo ratings yet

- Monthly VAT ReturnDocument34 pagesMonthly VAT ReturnEdris MatovuNo ratings yet

- Audit Report Form 88Document12 pagesAudit Report Form 88TarifNo ratings yet

- Advanced Accounts EXAM J21Document26 pagesAdvanced Accounts EXAM J21Harshwardhan PatilNo ratings yet

- GSTR9 09abepk8302l1zh 032018Document8 pagesGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNo ratings yet

- Form 704 Sales Tax Audit ReportDocument55 pagesForm 704 Sales Tax Audit Reportmaahi7No ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- SCH 5Document6 pagesSCH 5suniljaithwarNo ratings yet

- SCH 2Document5 pagesSCH 2suniljaithwarNo ratings yet

- AnnexureDocument16 pagesAnnexuresuniljaithwarNo ratings yet

- SCH 6Document4 pagesSCH 6suniljaithwarNo ratings yet

- 704 - VatDocument20 pages704 - VatsuniljaithwarNo ratings yet