Professional Documents

Culture Documents

Vat R2 2016 - 2017

Uploaded by

Hotel sapphireOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat R2 2016 - 2017

Uploaded by

Hotel sapphireCopyright:

Available Formats

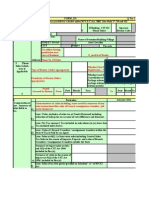

Form VAT-R2

[See rule 16(2) ]

1. Dealer’s Identity

a.Return for the Year :

Year 2016-17 From Date 01/04/2016 To Date 31/03/2017

b. Name and Style of Business HOTEL SAPPHIRE

c. TIN 06101610682

d. Address NR. DIMPLE CINEMA JAGADHRI,----, ----, , ----, Jagadhari, Haryana -

135001

e. Ward 05

Note:- Difference, if any, in return and book version of figures given in this return be explained by attaching a reconciliation statement

containing break-up of the figures in the category of sales/purchase etc. to which it relates as per the quarterly returns

2. Gross turnover, taxable turnover of sales and computation of tax (See sections 2(1)(u), 3, 6 and 7 of the Act)

(a) Description (b) Value of goods

2A Sale price received/receivable in respect of goods sold plus value of goods exported out of State or disposed of

otherwise than by sale or sent for sale to local agents

(I) As per column 2A(b) of the quarterly returns in Form VAT-R1 filed by the dealer for the year ₹2,43,15,591.05

(II) As per the books of account for the year ₹2,43,15,591.00

(III) As per balance sheet for the year ₹2,43,15,591.00

Difference, if any (i) [(I) - (II)] ₹0.05

(ii) [(I) - (III)] ₹0.05

2B Deductions

(i) Total of deductions as per column 2B(10)b of quarterly returns in Form VAT-R1 filed by the dealer for the year ₹0.00

(ii) Corresponding figure as per the books of account for the year ₹0.00

(iii)Difference, if any [(I) - (II)] ₹0.00

2C Taxable turnover of sales

(I) Total of the value as shown in 2C(b) of quarterly returns in Form VAT-R1 filed by the dealer for the year {2A(I)(b) - ₹2,43,15,591.05

2B(I)(b)}

(II) As per the books of accounts for the year {2A(II)(b) - 2B(II)(b)} ₹2,43,15,591.00

(III) Difference, if any [(I) - (II)] ₹0.05

(a) Description (b) Amount

2D Aggregate of price/value of goods (i)Total of the sales/transfers as per (ii)Total of the sales/transfers as (iii) Difference, if any

quarterly returns filed by the dealer per the books of account for the

for the year year

(a)(I) Sales Turnover as per return ₹2,43,15,591.05 ₹2,43,15,591.05 ₹0.00

(a)(II) Sales Turnover as declared in ₹0.00 ₹0.00 ₹0.00

LS10

(b)(I) Net taxable turnover [(a)(i) + (a)(ii)] ₹2,43,15,591.05 ₹2,43,15,591.05 ₹0.00

(b)(II) Tax amount ₹32,52,162.45 ₹32,52,162.45 ₹0.00

3. Purchase, import and receipt of goods and computation of tax paid on purchases made in the State

(a) Description (b) Amount

Aggregate of price/value of goods (I) Total of the purchases/receipts (ii)Total of the purchases/ receipts (iii)Difference, if any

as per quarterly returns filed by the as per the books of account for the

dealer for the year year

A Purchased / received for sale ₹6,90,243.00 ₹6,90,243.00 ₹0.00

during the year except the

purchases in the State as shown in

B below.

B. (I) Purchases from VAT dealers ₹56,89,855.50 ₹56,89,855.50 ₹0.00

on tax invoice

(II) Other purchases in the State ₹4,77,006.00 ₹4,77,006.00 ₹0.00

a(I) Purchase turnover as per ₹56,89,855.50 ₹56,89,855.50 ₹0.00

3(a)B(I)

a(II) Tax paid as per 3(a)B(I) ₹5,48,062.34 ₹5,48,062.34 ₹0.00

b(I) Increase/Decrease in Purchase ₹0.00 ₹0.00 ₹0.00

turnover as effect of return of goods

(de-)/escalation as per LP-8(local)

b(i)(a)Increase/Decrease in ₹0.00 ₹0.00 ₹0.00

Purchase turnover as effect of

return of goods (de-)/escalation as

per LP-8(interstate, others)

b(II) Increase/Decrease in ₹0.00 ₹0.00 ₹0.00

Purchase tax as effect of return of

goods (de-)/escalation as per LP-8

VAT Reference No: RF19103190353548, dated: 10/03/2019 Page 1 of 4

(c) Net purchase turnover ₹68,57,104.50 ₹68,57,104.50 ₹0.00

[(a)(I)+(b)(I)]

(d) Tax paid on purchases made in ₹5,48,062.34 ₹5,48,062.34 ₹0.00

the State [(a)(II)+(b)(II)]

Note : 1. If balance sheet is consolidated of the business in Haryana and of the branches out side state of Haryana, a separate

reconciliation statement is; required wherein sales and purchases relating to the business inside the state should be mentioned.

2. Total as per the books of account in column 2A(ii)(b) will also include the sale of scrap, by products, waste, vehicles and capital

goods.

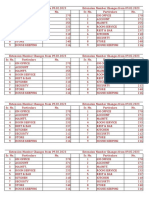

4. Aggregate of tax levied on sale or purchase

(1) Sale tax as per 2D(b)(ii) ₹32,52,162.45

(2) Purchase tax as per 9B(II) ₹0.00

(3) Total tax (1) + (2) ₹32,52,162.45

5. Computation of input tax (See section 8 of the Act)

(1) Tax paid on purchases made in the State as per 3(d)(ii) ₹5,48,062.34

(2) Less tax paid on purchases, not part of input tax as per 8A(II) ₹0.00

(3) Input tax (1) – (2) ₹5,48,062.34

6. Tax payable, refundable or adjustable (See section 20 of the Act)

(1) Tax payable 4(3)- 5(3) ₹27,04,100.11

(2) ITC brought forward from previous year ₹0.00

(3) Tax adjusted under CST Act ₹0.00

(4) Prior Period Adjustments ₹0.00

(5) Balance tax payable/Excess as per the annual return ₹27,04,100.11

(6) Tax deposited as per the quarterly returns ₹27,11,765.00

(i) Tax ₹27,11,765.00

(ii) Interest ₹0.00

(7) Tax deposited as per 7 Below ₹0.00

(i) Tax ₹0.00

(ii) Interest ₹0.00

(8) Balance tax payable/Excess ₹-7,664.89

(9) Refund claimed ₹7,664.89

(10) Excess carried forward ₹0.00

Note : if 6(1) is a negetive value, the absolute value thereof will first be adjusted against under the CST Act, if any and the balance carried

forward for adjustment future tax liability but refund may be claimed in case of -(i) export of goods out of India in rate of tax or

(iii)inadvertent excess payment of tax, by making an application.

7. Details of tax deposited in addition to quarterly returns (R1), can be filled by using R2 form utility in point no. 7.

Sr No. Name of treasury GRN Date GRN No Type of Instrument Instrument No. Instrument Date Amount

where tax deposited

or Bank on which

DD / Pay order

drawn

1 Jagadhri 16/05/2016 19030559 Demand Draft 38531 16/05/2016 ₹1,93,000.00

2 Jagadhri 16/06/2016 19500910 Demand Draft 38681 15/06/2016 ₹2,60,000.00

3 Jagadhri 15/07/2016 19887677 Demand Draft 38844 15/07/2016 ₹2,00,000.00

4 Jagadhri 18/08/2016 20443502 Demand Draft 39081 16/08/2016 ₹2,40,000.00

5 Jagadhri 16/09/2016 20836877 Demand Draft 39251 15/09/2016 ₹2,42,000.00

6 Jagadhri 17/10/2016 21202363 Demand Draft 39398 17/10/2016 ₹2,00,000.00

7 Jagadhri 16/11/2016 21716473 Demand Draft 39621 15/11/2016 ₹2,35,000.00

8 Jagadhri 15/12/2016 22133763 Demand Draft 39783 15/12/2016 ₹2,33,000.00

9 Jagadhri 16/01/2017 22944640 Demand Draft 39941 16/01/2017 ₹2,14,000.00

10 Jagadhri 17/02/2017 24282726 Demand Draft 40181 16/02/2017 ₹2,77,000.00

11 Jagadhri 17/02/2017 24295248 Demand Draft 40182 16/02/2017 ₹15,000.00

12 Jagadhri 16/03/2017 25754615 Demand Draft 40338 15/03/2017 ₹1,61,000.00

13 Jagadhri 20/04/2017 26586099 Demand Draft 40575 20/04/2017 ₹2,10,000.00

Total ₹26,80,000.00

7A Details of tax deducted at source by the contractee(s)

VAT Reference No: RF19103190353548, dated: 10/03/2019 Page 2 of 4

Sr No. Name of the Name of the Name of GRN No GRN Date Amount of TDS

procurement agency contractee treasury where Deposited in the favour

tax deposited or of Return filer for the

Bank on which period

DD / Pay order

drawn

₹

Total ₹0.00

7B Details of tax deducted at source by procurement agencies

Sr No. Name of the TIN of the Name of GRN No GRN Date Amount of TDS

procurement agency procurement treasury where Deposited in the favour

agency tax deposited or of Return filer for the

Bank on which period

DD / Pay order

drawn

₹

Total ₹0.00

7C Details of refund adjustment order claimed and adjusted

Sr No. Office from where RAO issued RAO No RAO Date RAO Amount

1 Sales Tax Department 992 22/03/2016 ₹29,765.00

Total ₹29,765.00

7 D. Total of 7,7A,7B & 7C ₹27,09,765.00

8. Computation of tax paid in respect of goods purchased in the State from VAT dealers on tax invoice which is not to form part of input

tax (See section 8(1) and Schedule E to the Act)

(A) Purchase value of goods purchased from VAT dealers on tax (A) (b) Purchase value

invoice onwhich credit of input tax is not admissible

I As per the quarterly returns filed by the dealer for the year, which is ₹0.00

sum total of figures in column 9 of VAT-R1

II Total as per the books of account for the year ₹0.00

Difference, if any [(I) – (II)] ₹0.00

B. Input tax not admissible for 8A(I)

(I) Input tax for 8A(I) ₹0.00

(II) Input tax for 8 A(II) ₹0.00

(III) Difference if any 8B(I)-8B(II) ₹0.00

9.Computation of tax paid in respect of goods purchased in the State form Vat dealers on tax invoice which is not to form part of input

tax (See section 8(1) andSchedule E to the Act)(As per form WS 1)

Circumstances in which purchase tax levied(1) Total Purchase Input tax to be

value of goods reversed(3))

taxable at

different rates

(2)

A. Petroleum based fuels and natural gas purchased from VAT dealers on tax invoice and not resold ₹0.0 ₹0.0

B (1) (i) Capital goods purchased from VAT dealers on tax invoice, For use mainly - In the manufacture of ₹0.0 ₹0.0

exempted goods

B (1) (ii) Capital goods purchased from VAT dealers on tax invoice, For use mainly - In mining ₹0.0 ₹0.0

B (1) (iii) Capital goods purchased from VAT dealers on tax invoice, For use mainly - In the telecommunication ₹0.0 ₹0.0

network

B (1) (iv) Capital goods purchased from VAT dealers on tax invoice, For use mainly - In the generation and ₹0.0 ₹0.0

distribution of electric energy or other form of power

B (2) Capital goods purchased from VAT dealers on tax invoice Which forms part of gross block on the day ₹0.0 ₹0.0

cancellation of registration certificate takes effect

C (1) All goods, except mentioned at A and B above, purchased from VAT dealers on tax invoice when:- Used in ₹0.0 ₹0.0

the telecommunications network, in mining or in the generation and distribution of electricity or other form of

power

C (2) All goods, except mentioned at A and B above, purchased from VAT dealers on tax invoice when:- Exported ₹0.0 ₹0.0

out of State

C (3) All goods, except mentioned at A and B above, purchased from VAT dealers on tax invoice when:- ₹0.0 ₹0.0

Disposed of otherwise than by sale

C (4) All goods, except mentioned at A and B above, purchased from VAT dealers on tax invoice when:- Used in ₹0.0 ₹0.0

manufacture or packing of exempted goods (except when such goods are sold in course of export out of India)

C (5) (i) All goods, except mentioned at A and B above, purchased from VAT dealers on tax invoice when:- Used ₹0.0 ₹0.0

in manufacture or packing of taxable goods, which goods are, - exported out of State

C (6) All goods, except mentioned at A and B above, purchased from VAT dealers on tax invoice when:- Left in ₹0.0 ₹0.0

stock, whether in the form purchased or in manufacture or processed form, on the day cancellation of the

registration certificate takes effect

C (7) All goods, except mentioned at A and B above, purchased from VAT dealers on tax invoice when:- Liquor ₹0.0 ₹0.0

as defined in the Punjab Excise Act, 1914(1 of 1914) When sold in the state by Bar licensees (Licenses L-4/L-5/L-

12C/L-12G/L-10E)

VAT Reference No: RF19103190353548, dated: 10/03/2019 Page 3 of 4

D (3) All goods including those mentioned at A and B above when sold at a sale price lower than the purchase ₹0.0 ₹0.0

price

C (8) All goods, except mentioned at A and B above, purchased from VAT dealers on tax invoice when:- sold by ₹0.0 ₹0.0

Canteen Store Department

D (1) All goods including those mentioned at A and B above when the goods are sold as such in the course of ₹0.0 ₹0.0

inter-state trade or commerce

D (2) All goods including those mentioned at A and B above when the goods are used in the manufacture of ₹0.0 ₹0.0

goods are sold in the course of the inter-state trade or commerce

9. Purchase tax (See section 3(3) of the Act)

Purchase value of goods

(I) Total purchase value of goods as per point no. 10 of quarterly returns ₹0.00

filed by the dealers

(II)Total purchase value as per the books of account for the year ₹5,48,062.34

(III)Difference, if any (I)-(II) ₹-5,48,062.34

Purchase tax on goods

(I)Total purchase tax as per quarterly returns filed by the dealer ₹0.00

(II)Total purchase tax as per the books of account for the year ₹0.00

(III)Difference, if any (I)-(II) ₹0.00

Note : Where any goods purchased in the State are used or disposed of partly in the circumstances mentioned in column (a) against

entries at serial number (1) and (2) above and partly otherwise, the purchase tax leviable on such goods shall be computed pro rate.

10.Purchase tax Worksheet(See section 3(3) of the Act)(As per form WS 2)

Circumstances in which purchase tax levied(1) Total Purchase Total Purchase

value of goods Tax (3)

taxable at

different rates

(2)

Taxable goods purchased in the State without payment of tax when such goods or the goods manufactured there ₹0.0 ₹0.0

from are either exported out of State or used or disposed of (except when sold in the course of export out of India

in a manner that no tax or CST is payable to the State.)

Goods purchased in the State at lower rate of tax for specified purposes but not made use of for the said ₹0.0 ₹0.0

purposes Tax computed under proviso to section 7(5)

Declaration

I, hereby, solemnly affirm that I am authorised to furnish this returns and all its contents including all annexures, lists, declaratio certificates and

other documents appended to it or filed with it are true, correct and complete and nothing has been concealed therein.

VAT Reference No: RF19103190353548, dated: 10/03/2019 Page 4 of 4

You might also like

- Form VAT R2Document10 pagesForm VAT R2murarirahul80% (5)

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- Audit Report PART-3 Schedule-IDocument6 pagesAudit Report PART-3 Schedule-IsuniljaithwarNo ratings yet

- GSTR9 18acvpa7546a1zk 032022Document8 pagesGSTR9 18acvpa7546a1zk 032022SUBHASH MOURNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- GSTR9 19anypg3791m1zy 032022 PDFDocument8 pagesGSTR9 19anypg3791m1zy 032022 PDFManprit MahalNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- GSTR9 29aaqfm8617b1zz 032022Document8 pagesGSTR9 29aaqfm8617b1zz 032022helloNo ratings yet

- SCH 3Document8 pagesSCH 3suniljaithwarNo ratings yet

- GSTR9 29aahcv2115k1z5 032020Document8 pagesGSTR9 29aahcv2115k1z5 032020MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- GSTR9 09abepk8302l1zh 032018Document8 pagesGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNo ratings yet

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoNo ratings yet

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocument4 pagesForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424No ratings yet

- GSTR9 10JHBPS7007C1ZR 032019Document8 pagesGSTR9 10JHBPS7007C1ZR 032019karanNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- GSTR9 09bwbpk7755a1zk 032021Document8 pagesGSTR9 09bwbpk7755a1zk 032021Ankit JainNo ratings yet

- GSTR4 33aqnpb5923e1z5 2021-22Document4 pagesGSTR4 33aqnpb5923e1z5 2021-22Sudhar SanNo ratings yet

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNo ratings yet

- GSTR9 27aahcb1010d1zg 032023Document8 pagesGSTR9 27aahcb1010d1zg 032023arpindlavNo ratings yet

- Kanya KarungalDocument13 pagesKanya KarungalramNo ratings yet

- Audit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NoDocument12 pagesAudit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NosuniljaithwarNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9RM PlusNo ratings yet

- GSTR9 22aabcn2864p1z7 032018Document8 pagesGSTR9 22aabcn2864p1z7 032018Sumit K JhaNo ratings yet

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- GSTR9Document8 pagesGSTR9legendry007No ratings yet

- GSTR9 33AAACA7962L1ZH 032022-FinalDocument8 pagesGSTR9 33AAACA7962L1ZH 032022-FinalVASUMATHY SURESHNo ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- CST Form IDocument12 pagesCST Form Ianilshukla1969No ratings yet

- Audit Report Form 88Document12 pagesAudit Report Form 88TarifNo ratings yet

- Form Jvat 409Document2 pagesForm Jvat 409Suzanne BradyNo ratings yet

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocument7 pagesForm VAT-R2: (See Rule 16 (2) ) Ddmmyygovind_2363No ratings yet

- 57175bos46307p7 Finalnew A PDFDocument13 pages57175bos46307p7 Finalnew A PDFANIL JARWALNo ratings yet

- 23 tax juneDocument16 pages23 tax junemistryankusNo ratings yet

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaNo ratings yet

- GST Audit Report PDFDocument12 pagesGST Audit Report PDFSagar BadaniNo ratings yet

- Form 23ACDocument6 pagesForm 23ACNikkhil GuptaaNo ratings yet

- Form 704 Sales Tax Audit ReportDocument55 pagesForm 704 Sales Tax Audit Reportmaahi7No ratings yet

- GSTR9Document21 pagesGSTR9Sadiya ShaikhNo ratings yet

- GSTR4 08ajhpp6900g1z5 2021-22Document4 pagesGSTR4 08ajhpp6900g1z5 2021-22Naveen VishwaniNo ratings yet

- GSTR-9C ReconciliationDocument12 pagesGSTR-9C ReconciliationShrishti enterprisesNo ratings yet

- Agricultural Income and Tax LiabilityDocument6 pagesAgricultural Income and Tax LiabilityAnaadi1No ratings yet

- GSTR-9C ReconciliationDocument9 pagesGSTR-9C ReconciliationVineet KhuranaNo ratings yet

- VAT Form DetailsDocument4 pagesVAT Form DetailsIshan KhandelwalNo ratings yet

- Form 16 TDS certificateDocument8 pagesForm 16 TDS certificateVikas PattnaikNo ratings yet

- Revised Quarterly Return Under Section 24 of The Bihar Value Added Tax Act, 2005Document20 pagesRevised Quarterly Return Under Section 24 of The Bihar Value Added Tax Act, 2005gurudev21No ratings yet

- FORM 202: Popular EnterpriseDocument4 pagesFORM 202: Popular Enterprisesam3461No ratings yet

- 22-23 Annual IT 02052023 0210pmDocument8 pages22-23 Annual IT 02052023 0210pmWint PaingNo ratings yet

- GSTR3B 18acvpa7546a1zk 032023Document4 pagesGSTR3B 18acvpa7546a1zk 032023SUBHASH MOURNo ratings yet

- JAIPUR NATIONAL UNIVERSITY MBA Dual IV Corporate Tax Management ExamDocument4 pagesJAIPUR NATIONAL UNIVERSITY MBA Dual IV Corporate Tax Management ExamAditya SharmaNo ratings yet

- GSTR-9C 09absfa5984a1z3 29122023Document8 pagesGSTR-9C 09absfa5984a1z3 29122023suraj888999No ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- Indian Income Tax Return: Part A General InformationDocument8 pagesIndian Income Tax Return: Part A General InformationDevbrat BoseNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pradip kr BhattacharyaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Sanjay SanNo ratings yet

- Caf 1 Ia Spring 2021Document6 pagesCaf 1 Ia Spring 2021Abdul Jabbar Pechuho0% (1)

- Form 16 2019 20Document4 pagesForm 16 2019 20Kishan SinghNo ratings yet

- Form 231Document9 pagesForm 231Pushkar JoshiNo ratings yet

- Revised Kay Inns ResolutionDocument2 pagesRevised Kay Inns ResolutionHotel sapphireNo ratings yet

- 27a RTKK03027D 26Q Q3 202223Document1 page27a RTKK03027D 26Q Q3 202223Hotel sapphireNo ratings yet

- 27a Ptls20832a 26Q Q3 202223Document1 page27a Ptls20832a 26Q Q3 202223Hotel sapphireNo ratings yet

- Ext09 02 23Document1 pageExt09 02 23Hotel sapphireNo ratings yet

- 27a RTKK03027D 24Q Q3 202223Document1 page27a RTKK03027D 24Q Q3 202223Hotel sapphireNo ratings yet

- Sapphire Hotel Quotation For Iron Centre and Dispenser 30 Nov 2020Document2 pagesSapphire Hotel Quotation For Iron Centre and Dispenser 30 Nov 2020Hotel sapphireNo ratings yet

- Hotel Sapphire 39KwDocument9 pagesHotel Sapphire 39KwHotel sapphireNo ratings yet

- Wall Elev - DDDocument1 pageWall Elev - DDHotel sapphireNo ratings yet

- Rate applicability on banquet hall servicesDocument5 pagesRate applicability on banquet hall servicesHotel sapphireNo ratings yet

- Circular No 26 Attachement - Letter For Increase in Sum Insured - 1Document1 pageCircular No 26 Attachement - Letter For Increase in Sum Insured - 1Hotel sapphireNo ratings yet

- Consti 1 NotesDocument7 pagesConsti 1 NotesCatNo ratings yet

- City Government of Makati vs. OdeñaDocument3 pagesCity Government of Makati vs. OdeñaGraceNo ratings yet

- Info Pack - InvictusDocument4 pagesInfo Pack - InvictusSomething FunnyNo ratings yet

- Ethics SyllabusDocument2 pagesEthics SyllabusGaurav SinghNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument6 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledTob MoradosNo ratings yet

- Topic 1 Overview of Financial Management and Financial EnvironmentDocument68 pagesTopic 1 Overview of Financial Management and Financial EnvironmentMicaella Fevey BandejasNo ratings yet

- 200 SPANISH AND ENGLISH PAST TENSE VERBSDocument5 pages200 SPANISH AND ENGLISH PAST TENSE VERBSElvis Escobar VelasquezNo ratings yet

- Misamis University: Second Semester SY: 2021-2022Document5 pagesMisamis University: Second Semester SY: 2021-2022Empowered ConsumerismNo ratings yet

- The Environmental Impact Assessment in Sri Lanka: Deshan BandaraDocument65 pagesThe Environmental Impact Assessment in Sri Lanka: Deshan BandaraVindula RanawakaNo ratings yet

- Probation - Policy 2021Document11 pagesProbation - Policy 2021ABHINAV KAUTUKNo ratings yet

- 542LRDJO424469 Statement of AccountDocument2 pages542LRDJO424469 Statement of AccountHusen KasamNo ratings yet

- Law Reading For Executive Magistrate Volume IDocument235 pagesLaw Reading For Executive Magistrate Volume IManishNo ratings yet

- Bba 4thsem 2017Document6 pagesBba 4thsem 2017yamini chauhanNo ratings yet

- Prime White Cement Vs IacDocument2 pagesPrime White Cement Vs IacNegou Xian TeNo ratings yet

- PadmaAwards2018 E 25012018Document4 pagesPadmaAwards2018 E 25012018NDTV100% (14)

- Jurnal InterDocument8 pagesJurnal InterOlivia FantyNo ratings yet

- RENTALJKHKDocument2 pagesRENTALJKHKSRINIVASREDDY PIRAMALNo ratings yet

- Municipal Corporation of Greater Mumbai: User Manual of Traffic & Co-Ordination NOC For Licensed ArchitectDocument16 pagesMunicipal Corporation of Greater Mumbai: User Manual of Traffic & Co-Ordination NOC For Licensed ArchitectMrigank AggarwalNo ratings yet

- BRC PWD ReportDocument64 pagesBRC PWD ReportJudy AndorNo ratings yet

- Court upholds dismissal of criminal case upon DOJ orderDocument5 pagesCourt upholds dismissal of criminal case upon DOJ orderLuna KimNo ratings yet

- Ross, Lawrence & Selph and Antonio T. Carrascoso, JR., For Appellant. Camus & Delgado For AppelleesDocument30 pagesRoss, Lawrence & Selph and Antonio T. Carrascoso, JR., For Appellant. Camus & Delgado For Appelleespoint clickNo ratings yet

- Political Caricature Analysis American PeriodDocument3 pagesPolitical Caricature Analysis American PeriodVenus SalgadoNo ratings yet

- Research EthicsDocument11 pagesResearch EthicsThe ProfessorNo ratings yet

- 2 Libby 9e Guided Examples Chapter 9 ExercisesDocument4 pages2 Libby 9e Guided Examples Chapter 9 Exercisesthanh subNo ratings yet

- English: Quarter 3 - Module 5CDocument21 pagesEnglish: Quarter 3 - Module 5CRaisa Lima Darauay86% (7)

- Schneckloth v. BustamonteDocument1 pageSchneckloth v. BustamonteDannaIngaranNo ratings yet

- Polgov ExamDocument3 pagesPolgov ExamSer KikoNo ratings yet

- Paul's Prison Epistles - Lesson 4 - Forum TranscriptDocument22 pagesPaul's Prison Epistles - Lesson 4 - Forum TranscriptThird Millennium MinistriesNo ratings yet

- 1 Control Valve (Main)Document5 pages1 Control Valve (Main)Putra JawaNo ratings yet

- Official Press Release Allen SchimmelpfennigDocument2 pagesOfficial Press Release Allen Schimmelpfennig25 NewsNo ratings yet