Professional Documents

Culture Documents

Problem On Stolen Cash

Uploaded by

JonellOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem On Stolen Cash

Uploaded by

JonellCopyright:

Available Formats

Engaging Activity A

The Fruity Company had weak internal controls over its cash transactions. Facts about its

cash position at November 30, 2020 were as follows:

The cash books showed a balance of P94,508, which included undeposited receipts. A

credit of P500 on the bank's records did not appear on the books of the company. The

balance per bank statement was P77,750. Outstanding checks were no. 8420 for P581,

no. 8422 for P750, no. 8430 for P1,266, no. 8621 for P954, no. 8623 for P1,034, and no.

8632 for P726.

The cashier stole all undeposited receipts in excess of P18,972 and prepared the following

reconciliation:

Balance per books, Nov. 30, 2020 P94,508

Add: Outstanding Checks

8621 P 954

8623 1,034

8632 726 2,714

97,222

Less undeposited receipts 18,972

Balance per bank, Nov. 30,2020 78,250

Less unrecorded credit 500

True cash, Nov. 30,2020 77,750

Activity questions:

1. What is the correct amount of cash that should be on hand for deposit on November

30, 2020?

2. How much was stolen by the cashier?

3. How did the cashier attempted to conceal his theft. Explain.

4. What is wrong with the prepared bank reconciliation?

5. Taking only the information given, what internal control deficiencies allowed the

cashier to steal cash and conceal his theft?

6. What is the adjusted cash balance as of November 30, 2020?

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Answer Each of Ms. Martines Questions and Explain How You Arrives at Your AnswerDocument1 pageAnswer Each of Ms. Martines Questions and Explain How You Arrives at Your AnswerJonellNo ratings yet

- Laurenz R. Patawe - Activity 1PART2 PDFDocument2 pagesLaurenz R. Patawe - Activity 1PART2 PDFJonellNo ratings yet

- Barcenas, Jonell C. Mrs. Yang 3BSA-1: Entries: 2003Document2 pagesBarcenas, Jonell C. Mrs. Yang 3BSA-1: Entries: 2003JonellNo ratings yet

- Entries: 2003: Fair Value Adjustment in Bonds at Amortized CostDocument2 pagesEntries: 2003: Fair Value Adjustment in Bonds at Amortized CostJonellNo ratings yet

- Lecture Guide No. 2 AE19.ChuaDocument5 pagesLecture Guide No. 2 AE19.ChuaJonellNo ratings yet

- Laguna State Polytechnic University: Republic of The Philippines Province of LagunaDocument7 pagesLaguna State Polytechnic University: Republic of The Philippines Province of LagunaJonellNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document2 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Problem On Stolen Cash Solution:: Cash That Should Be On Hand For Deposit P22,569Document2 pagesProblem On Stolen Cash Solution:: Cash That Should Be On Hand For Deposit P22,569JonellNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Notes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1Document2 pagesNotes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1JonellNo ratings yet

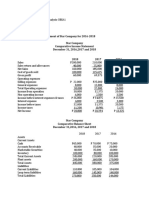

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Directions: Submit Using Your Own Respective Email On Time. Research The Definition of The Following TermsDocument1 pageDirections: Submit Using Your Own Respective Email On Time. Research The Definition of The Following TermsJonellNo ratings yet

- PC Tool User Instructions Manual PDFDocument11 pagesPC Tool User Instructions Manual PDFJonellNo ratings yet

- AccAud ProbDocument6 pagesAccAud ProbJonellNo ratings yet

- Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document2 pagesStar Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet