Professional Documents

Culture Documents

RMC No. 108-2020 Annex B

Uploaded by

Joel SyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No. 108-2020 Annex B

Uploaded by

Joel SyCopyright:

Available Formats

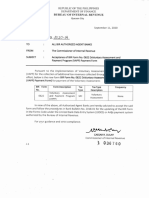

(To be filled up the BIR) Annex “B”

DLN: PSIC: PSOC:

Voluntary Assessment BIR Form No.

Republic of the Philippines

Department of Financei

Bureau of Internal Revenue

and Payment Program (VAPP)

Payment Form

0622August 2020

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 Return Period/Date of Transction/Date of Death 2 For the 3 Year Ended (MM/DD/YYYY)

(MM/DD/YYYY)

Calendar Fiscal

4 Number of Sheet/s Attached 5 Alphanumeric Tax Code (ATC) 6 Tax Type Code 7 Tax Type Description

MC Voluntary Assessment

Part I Background Information

8 Taxpayer Identification Number (TIN) 9 RDO Code 10 Taxpayer Classification 9 Line of Business/Occupation

I N

12 Taxpayer's (Last Name, First Name, Middle Name for Individuals) / (Registered Name for Non-Individuals) 13 Email Address

Name

14 Trade 15 Contact Number

Name

16 Registered 17 ZIP Code

Address

18 Source of Computation Self Assessment Per BIR Notice

Part II VAPP Amount

19 Total Voluntary Tax Payable Per BIR Form No. 2119, Part II, Item no. 21 / Per BIR Notice, in case of additional payment required)

20 Less: Voluntary Tax Paid from previous BIR Form No. 0622, if any

21 Voluntary Tax Still Due (Item no. 19 less Item no. 20)

I/We declare under the penalties of perjury that this payment form has been made in good faith, verified by me/us and to the best of my/our knowledge and

belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Further, I/we give my consent to the processing of my/our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and

lawful purposes.

(If Authorized Representative, attach authorization letter and indicate TIN)

For Individual: For Non-Individual:

Signature over Printed Name of Taxpayer/ Signature over Printed Name of President/Vice President/

Authorized Representative/Tax Agent Authorized Office or Representative/Tax Agent

(indicate title/designation and TIN) (indicate title/designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Atty's Roll No. (if, applicable) (MM/DD/YYYY) (MM/DD/YYYY)

Part III D e t a i l s of P a y m e n t

Date

Particulars Drawee Bank/Agency Number Amount

MM DD YYYY

20 Cash

21 Check

Machine Validation/Revenue Official Receipt Details (If not filed with the bank) Stamp of Receiving Office/AAB and Date of Receipt

(RO's Signature/Bank Teller's Initial)

Taxpayer Classification: I - Individual N - Non-Individual

BIR Form No. 0622 - PAGE 2

Alphanumeric Tax Code (ATC)

ATC Description

On the revenue collected through Voluntary Assessment and Payment Program (VAPP)

MC341 Income Tax (IT), Value-Added Tax (VAT), Percentage Tax (PT), Estate Tax (ET), and Documentary Stamp Tax (DST) other than DST on One-Time

Transactions (ONETT)

MC342 Final Withholding Taxes (On Compensation, Fringe Benefits, etc.) and Creditable Withholding Taxes (CWT) other than CWT on ONETT

MC343 Taxes on ONETT, such as Estate Tax, Donor's Tax, Capital Gains Tax (CGT), ONETT-related CWT/Expanded Withholding Tax, and DST

BIR Form No. 0622 - Voluntary Assessment and Payment Program (VAPP) Payment form

Guidelines and Instructions

Who Shall Use This Form

Any person, natural or juridical, including estates and trusts, liable to pay any internal revenue taxes covering the taxable year ending

December 31, 2018, and fiscal year ending on last day of the months of July 2018 to June 2019 who due to inadvertence or otherwise

erroneously paid his/its internal revenue tax liabilities or failed to file tax returns/pay taxes, may avail of the VAPP pursuant to RR No. 21-

2020.

Where to Pay

This payment form shall be accomplished in three (3) copies [original for Large Taxpayers (LT) Office/Revenue District Office (RDO),

duplicate for the taxpayer and triplicate for the collecting agent]. The amount payable shall be paid with the Authorized Agent Bank (AAB)

under the LT Office/RDO having jurisdiction over the taxpayer. In places where there are no AABs, this form shall be filed and the tax shall

be paid to the Revenue Collection Officer (RCO) under the LT Office/RDO having jurisdiction over the taxpayer. The RCO shall issue an

Electronic Revenue Official Receipt (eROR) or manually issued ROR therefor.

Where the form is filed with an AAB, the taxpayer must accomplish and submit BIR-prescribed deposit slip, which the bank teller

machine-validate as evidence that payment was received by the AAB. The AAB receiving the form shall stamp mark with the word

“Received” on the form and also machine validate the form as proof of filing and VAPP payment of the taxpayer. The machine validation

shall reflect the date of payment, amount paid and transactions code, the name of the bank, branch code, teller’s code and teller’s initial.

Bank debit memo number and date should be indicated in the form for taxpayers paying under the bank debit system.

For one-time transactions (ONETT) involving sale of real property, this form shall be filed and tax shall be paid with the AAB/RCO

under the RDO having jurisdiction over the location of the property.

How to Accomplish

Taxpayers, including those registered in the electronic Filing and Payment System (eFPS), have to download this form from the BIR

website and fill-up the form. If the taxpayer wants to avail of the benefit of the program, his availment should cover both Sections 9.a and

9.b of RR No. 21-2020. Separate payment forms should be accomplished and paid for these sections. Likewise, if availment will also cover

Section 9.c, a separate payment form should be prepared and paid.

Attachment

For additional payment arising from BIR Notice, copy of the said notice to this payment form.

Note:

1. This form shall cover tax liabilities for one (1) taxable year/period and/or taxable ONETT for a particular period in 2018.

2. Payment should be in cash as a condition to avail of the privilege under RR No. 21-2020. Hence, non-cash modes of payment such as

Tax Debit Memo and the like, will not qualify as a valid payment. Payment through e-payment channels (e.g., G-Cash and PayMaya)

is not allowable.

3. For additional payment per BIR Notice, copy of the proof of payment shall be submitted to the concerned LT Office/RDO prior to

issuance of the Certificate of Availment.

You might also like

- IRS FAQ On The Recovery Rebate CreditDocument32 pagesIRS FAQ On The Recovery Rebate CreditCurtis Heyen100% (1)

- Optavia LLC 100 International Drive Baltimore, MD 21202-1099Document1 pageOptavia LLC 100 International Drive Baltimore, MD 21202-1099Kristin ThorntonNo ratings yet

- Ateneo Tax 2019 PDFDocument231 pagesAteneo Tax 2019 PDFKenneth MonderoNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- 2019 20 PDFDocument7 pages2019 20 PDFSanjeet SinghNo ratings yet

- Cash and Accrual Basis of Accounting, Single Entry and Error CorrectionDocument11 pagesCash and Accrual Basis of Accounting, Single Entry and Error CorrectionJoana Trinidad100% (3)

- Delisted Top Withholding Agents - Non-IndividualDocument20 pagesDelisted Top Withholding Agents - Non-IndividualJoel SyNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- BIR Form No. 0608 PDFDocument2 pagesBIR Form No. 0608 PDFPaolo MartinNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- IFRIC 23 Client Memo TemplateDocument8 pagesIFRIC 23 Client Memo TemplateCk Bongalos Adolfo100% (1)

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- BIR Form 0605Document4 pagesBIR Form 0605Rudy Bangaan63% (8)

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022CheRylNo ratings yet

- Worksheet (Dajao)Document2 pagesWorksheet (Dajao)John DajaoNo ratings yet

- Payment Form: Under Tax Compliance Verification Drive/Tax MappingDocument2 pagesPayment Form: Under Tax Compliance Verification Drive/Tax MappingtristanjohnmagrareNo ratings yet

- Additional Withholding Agents - Non-IndividualsDocument14 pagesAdditional Withholding Agents - Non-IndividualsJoel SyNo ratings yet

- Payment Form: Voluntary Assessment and Payment Program (VAPP)Document2 pagesPayment Form: Voluntary Assessment and Payment Program (VAPP)Joel SyNo ratings yet

- BIR Form No. 0622 - Rev - Guidelines2correctedDocument2 pagesBIR Form No. 0622 - Rev - Guidelines2correctedjomarNo ratings yet

- BIR Form No. 2119 - Rev - Guidelines2Document3 pagesBIR Form No. 2119 - Rev - Guidelines2rhea CabillanNo ratings yet

- Enhanced Voluntary Assessment Program Payment Form: Kawanihan NG Rentas InternasDocument3 pagesEnhanced Voluntary Assessment Program Payment Form: Kawanihan NG Rentas InternasNepean Philippines IncNo ratings yet

- RMC No. 108-2020 Annex ADocument3 pagesRMC No. 108-2020 Annex AJoel SyNo ratings yet

- Annex A - Application Form BIR Form 2119Document2 pagesAnnex A - Application Form BIR Form 2119Antonio Reyes IVNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022Danel Dave BarbucoNo ratings yet

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- PH Bir 0605Document2 pagesPH Bir 0605Anonymous onBMYp9YNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas Internasromualdo sawayNo ratings yet

- 0605Document3 pages0605iris virtudezNo ratings yet

- Payment FormDocument2 pagesPayment FormDaryl Jay YubalNo ratings yet

- BIR Form 0605 - Annual Registration FeeDocument2 pagesBIR Form 0605 - Annual Registration FeeRonn Robby Rosales100% (3)

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasFratz LaraNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument1 pagePayment Form: Kawanihan NG Rentas InternasAnonymous onBMYp9YNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasLandsNo ratings yet

- 0619-E Jan 2018 Rev Final-1-1Document8 pages0619-E Jan 2018 Rev Final-1-1cahiligjoyceNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605Troa BartonNo ratings yet

- 20992NAP Payment Form ReDocument1 page20992NAP Payment Form ReTzuyu TchaikovskyNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022Angeline Mae Quintana GalayNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008Jaime II LustadoNo ratings yet

- BIR Form 0616 Amnesty Tax Payment Form PDFDocument1 pageBIR Form 0616 Amnesty Tax Payment Form PDFLeichelle BautistaNo ratings yet

- Amnesty Tax Payment Form: Kawanihan NG Rentas InternasDocument1 pageAmnesty Tax Payment Form: Kawanihan NG Rentas InternasAtty Rester John NonatoNo ratings yet

- Form 0605Document2 pagesForm 0605Fildehl JaniceNo ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument1 pagePayment Form: Kawanihan NG Rentas InternasCeslhee AngelesNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasLimarOrravanNo ratings yet

- Bir Form 0605Document2 pagesBir Form 0605crypto RN100% (1)

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022justgracelifeNo ratings yet

- Anned B & c-0605Document2 pagesAnned B & c-0605Rosmae BerrasNo ratings yet

- Anned B & c-0605Document2 pagesAnned B & c-0605da6795582No ratings yet

- 1601 eDocument3 pages1601 eJulius Sangalang100% (1)

- 0619-E Jan 2018 Rev Final-1Document6 pages0619-E Jan 2018 Rev Final-1cahiligjoyceNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument1 pagePayment Form: Kawanihan NG Rentas InternasJrryNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Mavi Manalo-NarvaezNo ratings yet

- EWT For The OCT-23 PeriodDocument12 pagesEWT For The OCT-23 Periodqhi.cgmacatiagNo ratings yet

- Monthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)Document4 pagesMonthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)docdocdeeNo ratings yet

- 1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pages1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Ivan ChuaNo ratings yet

- Monthly Remittance Form: For Creditable Income Taxes Withheld (Expanded)Document1 pageMonthly Remittance Form: For Creditable Income Taxes Withheld (Expanded)Jonalyn BalerosNo ratings yet

- BIR Form 0605 Payment FormDocument2 pagesBIR Form 0605 Payment FormJasOn Evangelista100% (2)

- 1604E Jan 2018 ENCS Final Annex BDocument2 pages1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Payment Form: Kawanihan NG Rentas InternasDocument4 pagesPayment Form: Kawanihan NG Rentas InternasMarinella Catahan MagalingNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022pcrubin27No ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasAlverastine AnNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Alexa Reyes de GuzmanNo ratings yet

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)appipinnim100% (2)

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoDerwin AraNo ratings yet

- BIR Form 0605Document2 pagesBIR Form 0605Kathleen Anne CabreraNo ratings yet

- Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 pageMonthly Remittance Return: of Income Taxes Withheld On CompensationSafferon SaffronNo ratings yet

- Bir Form 1600Document9 pagesBir Form 1600Vincent De GuzmanNo ratings yet

- Annex C 0621-EADocument1 pageAnnex C 0621-EAMELLICENT LIANZANo ratings yet

- RMC No. 16-2022Document2 pagesRMC No. 16-2022Joel SyNo ratings yet

- Revenue Memorandum Circular No.Document5 pagesRevenue Memorandum Circular No.Joel SyNo ratings yet

- RMO No. 34-2020 - DigestDocument1 pageRMO No. 34-2020 - DigestJoel SyNo ratings yet

- Bir Form No. 0622Document2 pagesBir Form No. 0622Joel SyNo ratings yet

- RMC No. 46-2021Document1 pageRMC No. 46-2021Joel SyNo ratings yet

- BB No. 2020-14Document1 pageBB No. 2020-14Joel SyNo ratings yet

- Annex A - Certificate of AvailmentDocument1 pageAnnex A - Certificate of AvailmentJoel SyNo ratings yet

- RMO No. 34-2020Document1 pageRMO No. 34-2020Joel SyNo ratings yet

- Annex F - Cancelled LAs-TVNsDocument2 pagesAnnex F - Cancelled LAs-TVNsJoel SyNo ratings yet

- RR 21-2020 (Digest)Document4 pagesRR 21-2020 (Digest)Joel SyNo ratings yet

- Annex CDocument1 pageAnnex CJoel SyNo ratings yet

- BIR Updates Issue No. 15Document1 pageBIR Updates Issue No. 15Joel SyNo ratings yet

- RR No. 21-2020Document10 pagesRR No. 21-2020Joel SyNo ratings yet

- RR No. 11-2020 April 29, 2020Document15 pagesRR No. 11-2020 April 29, 2020Joel SyNo ratings yet

- Chapter 3 - Page 6 Financial Statement Analysis Answer: D Diff: M NDocument2 pagesChapter 3 - Page 6 Financial Statement Analysis Answer: D Diff: M NpompomNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun KumarNo ratings yet

- POA Test - Accruals and PrepaymentsDocument2 pagesPOA Test - Accruals and PrepaymentsGeneva GomezNo ratings yet

- Solved Sanlucas Inc Provides Home Inspection Services To Its Clients TheDocument1 pageSolved Sanlucas Inc Provides Home Inspection Services To Its Clients TheDoreenNo ratings yet

- Commission Structure & Earning Potential - GST Suvidha Kendra PDFDocument4 pagesCommission Structure & Earning Potential - GST Suvidha Kendra PDFvikasNo ratings yet

- Chapter 14 Akun Keuangan TugasDocument2 pagesChapter 14 Akun Keuangan Tugassegeri kecNo ratings yet

- Sales Tax ExerciseDocument2 pagesSales Tax ExercisepremsuwaatiiNo ratings yet

- DT (Q&a)Document186 pagesDT (Q&a)mktg.seagullshippingNo ratings yet

- Total IncomeDocument4 pagesTotal IncomeSiddharth VaswaniNo ratings yet

- BIR Ruling 383-15 - Dividends Received by Luxembourg Entity (Participation Exemption)Document5 pagesBIR Ruling 383-15 - Dividends Received by Luxembourg Entity (Participation Exemption)Jerwin DaveNo ratings yet

- Departmental Finals Answer Key PDFDocument4 pagesDepartmental Finals Answer Key PDFJacob AcostaNo ratings yet

- Gatchalian v. CollectorDocument6 pagesGatchalian v. CollectorSosthenes Arnold MierNo ratings yet

- Cost-Volume-Profit Analysis: A Managerial Planning ToolDocument24 pagesCost-Volume-Profit Analysis: A Managerial Planning ToolRyan Fernandes PanggabeanNo ratings yet

- INVOICE - RA Bill 01Document1 pageINVOICE - RA Bill 01cevinoth60% (5)

- Income Tax Law and Practice, Code-301 - BBA (G.) & BBA (B & I) - Sem. VDocument264 pagesIncome Tax Law and Practice, Code-301 - BBA (G.) & BBA (B & I) - Sem. VYashNo ratings yet

- Instructions For Filling Up Form No. 49BDocument5 pagesInstructions For Filling Up Form No. 49Btejas_1988No ratings yet

- Computation of Total Income (As Per Normal Provisions) Income From Salary (Chapter IV A) 4746736Document10 pagesComputation of Total Income (As Per Normal Provisions) Income From Salary (Chapter IV A) 4746736nABSAMNNo ratings yet

- 5a.capital Gains - Important NoteDocument3 pages5a.capital Gains - Important NoteKansal AbhishekNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument6 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsCyrill L. MarkNo ratings yet

- Multan Electric Power Company: Say No To CorruptionDocument1 pageMultan Electric Power Company: Say No To CorruptionArslan RiazNo ratings yet