Professional Documents

Culture Documents

Payment Form: Kawanihan NG Rentas Internas

Uploaded by

glydelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payment Form: Kawanihan NG Rentas Internas

Uploaded by

glydelCopyright:

Available Formats

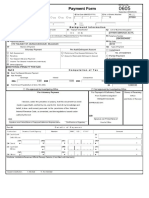

(To be filled up the BIR)

DLN: PSIC: PSOC:

BIR Form No.

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Payment Form

July 1999 (ENCS)

0605

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 For the Calendar Fiscal 3 Quarter 4 Due Date ( MM / DD / YYYY) 5 No. of Sheets 6 ATC

2 Year Ended Attached

( MM / YYYY ) 1st 2nd 3rd 4th

7 Return Period ( MM / DD / YYYY ) 8 Tax Type Code BCS No./Item No. (To be filled up by the BIR)

7 8

Part I Background Information

9 Taxpayer Identification No. 10 RDO Code 11 Taxpayer Classification 12 Line of Business/Occupation

I N

13 Taxpayer's 13 14 Telephone Number

Name

(Last Name, First Name, Middle Name for Individuals) / (Registered Name for Non-Individuals)

15 Registered 16 Zip Code

Address

17 Manner of Payment 18 Type of Payment

Voluntary Payment Per Audit/Delinquent Account Installment

Self-Assessment Penalties Preliminary/Final Assessment/Deficiency Tax No. of Installment

Tax Deposit/Advance Payment Accounts Receivable/Delinquent Account Partial

Income Tax Second Installment

Payment (Individual)

Full Others (Specify)

Payment

Part II Computation of Tax

19

19 Basic Tax / Deposit / Advance Payment

20 Add: Penalties Surcharge Interest Compromise

20A 20B 20C 20D

21 Total Amount Payable (Sum of Items 19 & 20D) 21

For Voluntary Payment For Payment of Deficiency Taxes Stamp of Receiving

From Audit/Investigation/ Office

Deliquent Accounts and Date of Receipt

I declare, under the penalties of perjury, that this document has been

APPROVED BY:

made in good faith, verified by me, and to the best of my knowledge and

belief, is true and correct, pursuant to the provisions of the National

Internal Revenue Code, as amended, and the regulations issued under

authority thereof.

22B

22A Signature over Printed Name of

Signature over Printed Name of Taxpayer/Authorized Representative Title/Position of Signatory Head of Office

Part III D e t a i l s of P a y m e n t

Particulars Drawee Bank/Agency Number MM DD YYYY Amount

23 Cash/Bank 23

Debit Memo

24A 24B 24C 24D

24 Check

25 Tax Debit 25A 25B 25C

Memo

26A 26B 26C 26D

26 Others

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

Taxpayer Classification: I - Individual N - Non-Individual

BIR Form 0605 (ENCS) - PAGE 2

ATC NATURE OF PAYMENT ATC NATURE OF PAYMENT ATC NATURE OF PAYMENT

II 011 Pure Compensation Income Tobacco Products XP120 Avturbo Jet Fuel

II 012 Pure Business Income XT010 & XT020 Smoking and Chewing Tobacco XP130 & XP131

Kerosene II 013 Mixed (Compensation and Business) XT030 Cigars XP170

Asphalts MC 180 Vat/Non-Vat Registration Fee XT040 Cigarettes Packed By Hand XP150 & XP160

LPG Gas

MC 190 Travel Tax XT050-XT130 Cigarettes Packed By Machine XP010, XP020 & Basetocks, Lubes and

MC 090 Tin Card Fees Tobacco Inspection Fees XP190 Greases

MC010 & MC020 Tax Amnesty XT080 Cigars XP040 Waxes and Petrolatum

MC 040 Income from Forfeited Properties XT090 Cigarettes XP030 Processed Gas

MC 050 Proceeds from Sale of Rent Estate XT100 & XT110 Leaf Tobacco & Other Manufactured Tobacco Miscellaneous Products/Articles

MC 060 Energy Tax on Electric Power Consumption XT120 Monitoring Fees XG020-XG090 Automobiles

MC 031 Deficiency Tax Petroleum Products XG100-XG120 Non Essential Goods

MC 030 Delinquent Accounts/Accounts Receivable XP070 Premium (Leaded) Gasoline Mineral Products

FP 010 - FP 930 Fines and Penalties XP060 Premium (Unleaded) Gasoline XM010 Coal & Coke

MC 200 Others XP080 Regular Gasoline XM020 Non Metallic & Quarry Resources

Excise Tax on Goods XP090 & XP100 Naptha & Other Similar Products XM030 Gold and Chromite

Alcohol Products XP110 Aviation Gasoline XM040 Copper & Other Metallic Minerals

XA010-XA040 Distilled Spirits XP140 Diesel Gas XM050 Indigenous Petroleum

XA061-XA090 Wines XP180 Bunker Fuel Oil XM051 Others

XA051-XA053 Fermented Liquor

TAX TYPE

Code Description Code Description Code Description

RF REGISTRATION FEE CS CAPITAL GAINS TAX - Stocks WC WITHHOLDING TAX-

COMPENSATION TR TRAVEL TAX-PTA ES ESTATE TAX WE WITHHOLDING

TAX-EXPANDED

ET ENERGY TAX DN DONOR'S TAX WF WITHHOLDING TAX-FINAL

QP QUALIFYING FEES-PAGCOR VT VALUE-ADDED TAX WG WITHHOLDING TAX - VAT

AND OTHER MC MISCELLANEOUS TAX PT PERCENTAGE TAX

PERCENTAGE TAXES

XV EXCISE-AD VALOREM ST PERCENTAGE TAX - STOCKS WO WITHHOLDING TAX-OTHERS (ONE-

TIME TRAN- XS EXCISE-SPECIFIC SO PERCENTAGE TAX - STOCKS (IPO) SACTION NOT

SUBJECT TO CAPITAL

XF TOBACCO INSPECTION AND SL PERCENTAGE TAX - SPECIAL LAWS GAINS TAX)

MONITORING FEES DS DOCUMENTARY STAMP TAX WR WITHHOLDING TAX - FRINGE

BENEFITS IT INCOME TAX WB WITHHOLDING TAX-BANKS AND OTHER WW WITHHOLDING TAX

- PERCENTAGE TAX CG CAPITAL GAINS TAX - Real Property FINANCIAL INSTITUTIONS ON

WINNING AND PRIZES

BIR Form No. 0605 - Payment Form

Guidelines and Instructions

Who Shall Use Where the return is filed with an AAB,

the lower portion of the return must be

Every taxpayer shall use this form, in triplicate, properly machine-validated and stamped by the

to pay taxes and fees which do not require the use of a Authorized Agent Bank to serve as the receipt of

tax return such as second installment payment for payment. The machine validation shall reflect the

income tax, deficiency tax, delinquency tax, date of payment, amount paid and transaction

registration fees, penalties, advance payments, code, and the stamp mark shall show the name of

deposits, installment payments, etc. the bank, branch code, teller’s name and teller’s

initial. The AAB shall also issue an official receipt

When and Where to File and Pay or bank debit advice or credit document,

This form shall be accomplished: whichever is applicable, as additional proof of

payment.

1. Everytime a tax payment or penalty is

due or an advance payment is to be made; One set of form shall be filled-up for each kind

2. Upon receipt of of tax and for each taxable period.

a

demand letter/assessment notice Attachments

and/or collection letter from the BIR; and

3. Upon payment of annual registration fee 1. Duly approved Tax Debit Memo, if applicable;

for new business and for renewals on or 2. Copy of letter or notice from the BIR for which

before January 31 of every year. this payment form is accomplished and the

tax is paid whichever is applicable:

This form shall be filed and the tax shall be a. Pre-Assessment / Final Assessment

paid with any Authorized Agent Bank (AAB) Notice/Letter of

under the jurisdiction of the Revenue District Demand b. Post Reporting

Office where the taxpayer is required to Notice

register/conducting business/producing articles c. Collection Letter of

subject to excise tax/having taxable transactions. In Delinquent/ Accounts Receivable

places where there are no AABs, this form shall d. Xerox copy of the

be filed and the tax shall be paid directly with the return (ITR)/Reminder Letter in

Revenue Collection Officer or duly Authorized case of payment of second

City Or Municipal Treasurer of the Revenue installment on income tax.

District Office where the taxpayer is required to

register/conducting business/producing articles Note: All background information must

subject to excise tax/having taxable transactions, be properly filled up.

who shall issue Revenue Official Receipt (BIR The last 3 digits of the 12-digit TIN refers to the

Form No. branch code.

2524) therefor.

ENCS

You might also like

- Credit ReportDocument19 pagesCredit ReportJaimee Tepper100% (3)

- Business PermitDocument1 pageBusiness PermitVELOX MABUHAYNo ratings yet

- Statement 02-AUG-19 AC 40963607 PDFDocument4 pagesStatement 02-AUG-19 AC 40963607 PDFDanielNo ratings yet

- Birth EditableDocument1 pageBirth Editablegian baseNo ratings yet

- Annex C.2: Sworn Application For Tax ClearanceDocument1 pageAnnex C.2: Sworn Application For Tax ClearanceIan Bernales OrigNo ratings yet

- Name of Auditee Nature of Audit Audit Period Audit Start Date End Date Audit StaffDocument3 pagesName of Auditee Nature of Audit Audit Period Audit Start Date End Date Audit StaffAmitmil MbbsNo ratings yet

- 1702 July 08Document7 pages1702 July 08Jchelle Lustre DeligeroNo ratings yet

- CPWA CODE 101-150 (Guide Part 4) PDFDocument15 pagesCPWA CODE 101-150 (Guide Part 4) PDFshekarj80% (5)

- Certificate of Live Birth (COLB)Document2 pagesCertificate of Live Birth (COLB)larryjoerivera00No ratings yet

- Electronic Official Receipt: City Government of Manila City Treasurer'S OfficeDocument2 pagesElectronic Official Receipt: City Government of Manila City Treasurer'S OfficeBarangay 708 Zone 78 District VNo ratings yet

- Notice of AwardDocument54 pagesNotice of AwardJasmin UrbanozoNo ratings yet

- New Zealand VisaDocument16 pagesNew Zealand Visagpn1006No ratings yet

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- Electronic Business Permit - Renewal: Subject To InspectionDocument3 pagesElectronic Business Permit - Renewal: Subject To InspectionRose Salminao100% (1)

- Makati City Business Registration FlowDocument4 pagesMakati City Business Registration FlowAika Chescka DucaNo ratings yet

- Processing and Issuance of Approved ONETT Computation Sheet of Tax Due On Estate With No Other Tax LiabilitiesDocument1 pageProcessing and Issuance of Approved ONETT Computation Sheet of Tax Due On Estate With No Other Tax LiabilitiesJewelyn CioconNo ratings yet

- Seller Agreement - Big BasketDocument9 pagesSeller Agreement - Big BasketIshan Gaurav50% (2)

- Tax InvoiceDocument1 pageTax InvoiceDebarghya ChoudhuryNo ratings yet

- Trade LicenceDocument1 pageTrade Licencekellymtuku25No ratings yet

- 1701A Annual Income Tax ReturnDocument3 pages1701A Annual Income Tax ReturnWa37354No ratings yet

- Permit IssuedDocument1 pagePermit IssuedRingoMaquinayNo ratings yet

- 1701A Annual Income Tax ReturnDocument1 page1701A Annual Income Tax ReturnmoemoechanNo ratings yet

- Annual Income Tax Return: (DonotentercentavosDocument2 pagesAnnual Income Tax Return: (DonotentercentavosKuhramaNo ratings yet

- Issuer Mastercard and Debit Test Cases - ManualDocument808 pagesIssuer Mastercard and Debit Test Cases - ManualFernando NiscaNo ratings yet

- 1905 January 2018 ENCS - Corrected PDFDocument3 pages1905 January 2018 ENCS - Corrected PDFJoseph Jr TengayNo ratings yet

- 2-4 Audited Financial StatementsDocument9 pages2-4 Audited Financial StatementsJustine Joyce GabiaNo ratings yet

- 267731702final PDFDocument5 pages267731702final PDFelmarcomonal100% (1)

- Accounting For Oracle ReceivablesDocument13 pagesAccounting For Oracle ReceivablesAshokNo ratings yet

- English Correspondence For BankingDocument103 pagesEnglish Correspondence For BankingaulyabellaaNo ratings yet

- Case Digest NIL - Without Rigor YetDocument3 pagesCase Digest NIL - Without Rigor YetKik EtcNo ratings yet

- Bir Form 1901Document2 pagesBir Form 1901jaciemNo ratings yet

- Table of ContentsDocument1 pageTable of ContentsMacLaw MacOfficeNo ratings yet

- 82255BIR Form 1701Document12 pages82255BIR Form 1701Leowell John G. RapaconNo ratings yet

- Notes To Financial StatementsDocument9 pagesNotes To Financial StatementsCheryl FuentesNo ratings yet

- Income From Business and Profession HandoutDocument29 pagesIncome From Business and Profession HandoutAnantha Krishna BhatNo ratings yet

- Old Form 0605 PDFDocument2 pagesOld Form 0605 PDFeugene badere50% (2)

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- 1701a - Page 2Document1 page1701a - Page 2Sygee BotantanNo ratings yet

- Mayor's Permit QC 2 - 2Document2 pagesMayor's Permit QC 2 - 2Zachary YapNo ratings yet

- NBR Tin Certificate 180261996183 PDFDocument1 pageNBR Tin Certificate 180261996183 PDFNewaz KabirNo ratings yet

- BIR FormsDocument30 pagesBIR FormsRoma Sabrina GenoguinNo ratings yet

- Employer'S Virtual Pag-Ibig Enrollment FormDocument2 pagesEmployer'S Virtual Pag-Ibig Enrollment FormJhonna Magtoto100% (2)

- 1701A Annual Income Tax ReturnDocument2 pages1701A Annual Income Tax ReturnJaneth Tamayo NavalesNo ratings yet

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- Tax Update RR 18-2012Document32 pagesTax Update RR 18-2012johamarz6245No ratings yet

- Electronic Official Receipt: City Government of Manila City Treasurer'S OfficeDocument1 pageElectronic Official Receipt: City Government of Manila City Treasurer'S OfficeMine MinisoNo ratings yet

- Business Permit Business Permit: General Santos City General Santos CityDocument1 pageBusiness Permit Business Permit: General Santos City General Santos Citybktsuna0201100% (1)

- 2316Document13 pages2316Ariel BarkerNo ratings yet

- 2307 New Template Ni PauDocument37 pages2307 New Template Ni Pau175pauNo ratings yet

- Bir Ruling 044-10Document4 pagesBir Ruling 044-10Jason CertezaNo ratings yet

- Bir 2013Document1 pageBir 2013karlycoreNo ratings yet

- Bir Form 2306 and 2307 MchsDocument3 pagesBir Form 2306 and 2307 Mchschristopher labastidaNo ratings yet

- Affidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hands This 1st Day of July 2019 atDocument1 pageAffidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hands This 1st Day of July 2019 atJheyps VillarosaNo ratings yet

- Gatepass Endorsement Request Form Rev06Document1 pageGatepass Endorsement Request Form Rev06Subic ForexNo ratings yet

- License To Operate FDADocument2 pagesLicense To Operate FDAx9hhzc28kb100% (1)

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- Interactive Credit Application Form PDFDocument2 pagesInteractive Credit Application Form PDFMaynard GlobioNo ratings yet

- 1801 Estate Tax Return FormDocument2 pages1801 Estate Tax Return FormMay DinagaNo ratings yet

- CTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceDocument74 pagesCTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceJerwin DaveNo ratings yet

- SEC Cover Sheet For AFSDocument1 pageSEC Cover Sheet For AFSLorenz Samuel GomezNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- Electronic Payment Payor Enrollment Form: Landbank of The Philippines - BranchDocument1 pageElectronic Payment Payor Enrollment Form: Landbank of The Philippines - BranchKilikili East100% (1)

- 2551q BIR FormDocument2 pages2551q BIR FormJenniferFajutnaoArcos0% (1)

- Bir FormsDocument25 pagesBir FormsAngel Mae ToreniadoNo ratings yet

- Cfei Permit ChecklistDocument2 pagesCfei Permit ChecklistThe MatrixNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- Annex C-1 - Summary of System DescriptionDocument4 pagesAnnex C-1 - Summary of System DescriptionChristian Albert HerreraNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasFratz LaraNo ratings yet

- Anned B & c-0605Document2 pagesAnned B & c-0605da6795582No ratings yet

- Anned B & c-0605Document2 pagesAnned B & c-0605Rosmae BerrasNo ratings yet

- AICTE-adi 1Document31 pagesAICTE-adi 1Syed Tarooq AfnanNo ratings yet

- Agreement For Sale - Aflose Holdings Limited - 27th September 2017Document16 pagesAgreement For Sale - Aflose Holdings Limited - 27th September 2017Emeka NkemNo ratings yet

- Bir Form 2306Document3 pagesBir Form 2306Rebecca McdowellNo ratings yet

- Business Services Class 11 Notes Business Studies - 7114551Document8 pagesBusiness Services Class 11 Notes Business Studies - 7114551TanishqNo ratings yet

- Africa 2013Document12 pagesAfrica 2013djajadjajaNo ratings yet

- Nego Case DigestsDocument9 pagesNego Case DigestsgabbieseguiranNo ratings yet

- Mar0525 PDFDocument24 pagesMar0525 PDFShubhamNo ratings yet

- Oblicon Cases 3rd SetDocument324 pagesOblicon Cases 3rd SetmarkpascoNo ratings yet

- NayatiDocument8 pagesNayatidianpebri83No ratings yet

- The Institute of Finance ManagementDocument27 pagesThe Institute of Finance Managementcall0% (1)

- Destination RegistrationDocument1 pageDestination RegistrationmelissaNo ratings yet

- ZPH Rapid Rush Quotation and SpecificationDocument6 pagesZPH Rapid Rush Quotation and SpecificationMark DyNo ratings yet

- Codification Annex ING Format Descriptions Strategic v1.0 - tcm162-110480Document24 pagesCodification Annex ING Format Descriptions Strategic v1.0 - tcm162-110480rahul_agrawal165No ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Revised MOA Paul Andrew Pilapil Lot 1181-BDocument3 pagesRevised MOA Paul Andrew Pilapil Lot 1181-BttunacaoNo ratings yet

- Delhi MallDocument32 pagesDelhi MallNidhi YadavNo ratings yet

- Advcash - Merchantapi-1.6 enDocument40 pagesAdvcash - Merchantapi-1.6 enOkan FestusNo ratings yet

- SOD Risk-Summarysap-With-Mitigating-ControlsDocument15 pagesSOD Risk-Summarysap-With-Mitigating-ControlsMarcio RodriguesNo ratings yet

- Confirmation 2NDDocument2 pagesConfirmation 2NDsunny singhNo ratings yet