Professional Documents

Culture Documents

Entry Load and Exit Load of All Scheme

Uploaded by

purrab divakarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Entry Load and Exit Load of All Scheme

Uploaded by

purrab divakarCopyright:

Available Formats

Entry Load and Exit Load of all Scheme

Entry Load Exit Load Eligible scheme

Mirae Asset Cash Management Fund

Nil Mirae Asset Savings Fund

Mirae Asset Tax Saver Fund

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date

of allotment of units: Nil.

Mirae Asset Emerging Bluechip Fund

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to Mirae Asset Equity Savings Fund

the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO): Mirae Asset Focused Fund

•If redeemed within 1 year (365 days) from the date of allotment: 1% Mirae Asset Great Consumer Fund

•If redeemed after 1 year (365 days) from the date of allotment: NIL Mirae Asset Hybrid Equiry Fund

Mirae Asset Healthcare Fund

N/A II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out,

Mirae Asset Large Cap Fund*

STP out):

Mirae Asset Mid Cap Fund

•If redeemed within 1 year (365 days) from the date of allotment: 1%

•If redeemed after 1 year (365 days) from the date of allotment: NIL

If redeemed within 6 months (182 days) from the date of allotment – 0.50% ;

Mirae Asset Dynamic Bond Fund

If redeemed after 6 months (182 days) from the date of allotment – Nil

If redeemed within 1 month (30 days) from the date of allotment – 0.25% ;

Mirae Asset Short Term Fund

If redeemed after 1 month (30 days) from the date of allotment – Nil

Not Applicable (The units under the scheme cannot be directly redeemed prior to the maturity of the Mirae Asset Fixed Maturity Plan -

Scheme with the Mutual Funds as the units will be listed on the stock exchange) Series III-1122 Days

You might also like

- Poor Mans James Bond 2Document498 pagesPoor Mans James Bond 2terrencebelles88% (8)

- Income Tax: CA Raj K AgrawalDocument195 pagesIncome Tax: CA Raj K AgrawalRaj Das67% (3)

- Resonance Booklet of Coordination CompoundsDocument39 pagesResonance Booklet of Coordination CompoundsAlok pandey75% (12)

- Question Bank OrganometallicsDocument6 pagesQuestion Bank OrganometallicsHimanshu Gusain100% (4)

- Lecture 10 CmaDocument8 pagesLecture 10 CmaUmair HayatNo ratings yet

- 016610024Document8 pages016610024Saleh BreakerboyNo ratings yet

- Accounting Chap 10 - Sheet1Document2 pagesAccounting Chap 10 - Sheet1Nguyễn Ngọc Mai100% (1)

- Entry Exit Load For All SchemesDocument2 pagesEntry Exit Load For All SchemesAkash ChoudharyNo ratings yet

- June26 2018-Modification in The Features of SWP Changes in Exit Load in Few Schemes of Mirae Asset Mutual Fund PDFDocument1 pageJune26 2018-Modification in The Features of SWP Changes in Exit Load in Few Schemes of Mirae Asset Mutual Fund PDFkhushrootsNo ratings yet

- IdbiDocument2 pagesIdbiRavi SarkarNo ratings yet

- Baroda Mutual Fund Brokerage Structure - Perod July - Sept 2021Document1 pageBaroda Mutual Fund Brokerage Structure - Perod July - Sept 2021nil PatelNo ratings yet

- A Prospectus PDFDocument75 pagesA Prospectus PDFdeep mardiaNo ratings yet

- Birla Sun Life Dynamic Bond FundDocument3 pagesBirla Sun Life Dynamic Bond FundrajdashrvceNo ratings yet

- Mirae Asset Factsheet-February 2019 PDFDocument20 pagesMirae Asset Factsheet-February 2019 PDFAshish BeriwalNo ratings yet

- Ppdaaf PresentationDocument21 pagesPpdaaf PresentationChirag PanditNo ratings yet

- 8211 ICICIPrudential IndiaOpportunitiesFund ProductNoteDocument3 pages8211 ICICIPrudential IndiaOpportunitiesFund ProductNoteKiranmayi UppalaNo ratings yet

- MIRAE Factsheet June 2017Document16 pagesMIRAE Factsheet June 2017adiNo ratings yet

- Securities and Exchange Board of India: CircularDocument4 pagesSecurities and Exchange Board of India: CircularDeepak KannoujiaNo ratings yet

- What Is A Mutual Fund?Document33 pagesWhat Is A Mutual Fund?Vaishali JoshiNo ratings yet

- PRODUCT DECK MAY '23 ADocument34 pagesPRODUCT DECK MAY '23 Apatidarneelam12345No ratings yet

- Purification of IncomeDocument2 pagesPurification of IncomeAbdul Aziz MuhammadNo ratings yet

- Sid - Sbi Capital Protection Oriented Fund - Series A (Plan 7)Document76 pagesSid - Sbi Capital Protection Oriented Fund - Series A (Plan 7)Neeraj Singh RainaNo ratings yet

- Mirae Factsheet April17Document16 pagesMirae Factsheet April17Dashang G. MakwanaNo ratings yet

- Capital Gain AY 2022-23 With SolutionsDocument15 pagesCapital Gain AY 2022-23 With SolutionsKrish Goel100% (1)

- Product Handbook For Signature Indexed Universal Life Select (II)Document56 pagesProduct Handbook For Signature Indexed Universal Life Select (II)Jake KohNo ratings yet

- ACC2001 Lecture 3Document35 pagesACC2001 Lecture 3michael krueseiNo ratings yet

- Financial Statements of Banking Companies: © The Institute of Chartered Accountants of IndiaDocument44 pagesFinancial Statements of Banking Companies: © The Institute of Chartered Accountants of IndiaHarikrishnaNo ratings yet

- Ind As 105 Non Current Assets Held For Sale and Discontinued OperationsDocument9 pagesInd As 105 Non Current Assets Held For Sale and Discontinued OperationsSRIKANTH REDDY YANNAMNo ratings yet

- NFO Tata Growing Economies Infrastructure FundDocument12 pagesNFO Tata Growing Economies Infrastructure FundDrashti Investments100% (1)

- Profit or Loss Pre and Post Incorporation: Learning ObjectivesDocument20 pagesProfit or Loss Pre and Post Incorporation: Learning Objectivesjsus22No ratings yet

- TYBAF Unit-1 Banking CO.Document17 pagesTYBAF Unit-1 Banking CO.sofiya syedNo ratings yet

- Unit 3 - Capital GainsDocument32 pagesUnit 3 - Capital GainsVaishnaviNo ratings yet

- 馬 鞍 山 鋼 鐵 股 份 有 限 公 司 Maanshan Iron & Steel Company LimitedDocument35 pages馬 鞍 山 鋼 鐵 股 份 有 限 公 司 Maanshan Iron & Steel Company Limitedl chanNo ratings yet

- Profits and Gains of Business or ProfessionDocument15 pagesProfits and Gains of Business or ProfessionShruti PaulNo ratings yet

- ICICI Balanced Advantage Fund - One PagerDocument2 pagesICICI Balanced Advantage Fund - One PagerjoycoolNo ratings yet

- 29 PDFDocument58 pages29 PDFAradhna BhasinNo ratings yet

- Magnum Gilt Fund: "The Safety of Government Securities With The Convenience of A Mutual Fund"Document21 pagesMagnum Gilt Fund: "The Safety of Government Securities With The Convenience of A Mutual Fund"allmutualfundNo ratings yet

- Capitulo 6Document19 pagesCapitulo 6Sara CarvalhoNo ratings yet

- Personal Finance and PlanningDocument15 pagesPersonal Finance and Planningcroy02770No ratings yet

- Income From Capital Gain by Vishal GoelDocument57 pagesIncome From Capital Gain by Vishal Goelgoel76vishal100% (1)

- Prudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)Document2 pagesPrudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)api-349453187No ratings yet

- Pfrs 5 - Nca Held For Sale & Discontinued OpnsDocument23 pagesPfrs 5 - Nca Held For Sale & Discontinued OpnsAdrianIlagan100% (1)

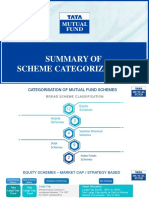

- Summary of Scheme CategorizationDocument20 pagesSummary of Scheme CategorizationyasirNo ratings yet

- NCA Held For Sale and Disc Operation-DiscussionDocument3 pagesNCA Held For Sale and Disc Operation-DiscussionJennifer ArcadioNo ratings yet

- Indian Financial Systems, Institutions and Markets - NPADocument84 pagesIndian Financial Systems, Institutions and Markets - NPASahil Sheth100% (1)

- 8198 ICICIPrudential BalancedAdvantageFund ProductNoteDocument3 pages8198 ICICIPrudential BalancedAdvantageFund ProductNoteKiranmayi UppalaNo ratings yet

- Income From Capital GainDocument11 pagesIncome From Capital Gainkomil bogharaNo ratings yet

- Audit of Item of FS Notes by CA Kapil GoyalDocument9 pagesAudit of Item of FS Notes by CA Kapil GoyalAbhimanyu Kumar ranaNo ratings yet

- Sundaram BNP Paribas Energy Opportunities FundDocument8 pagesSundaram BNP Paribas Energy Opportunities FundDrashti Investments100% (9)

- The Primary Objective of The Scheme Is To Generate Long Term Capital Appreciation. However, There Can Be No Assurance That The Investment Objective of The Scheme / Plans Will Be AchievedDocument10 pagesThe Primary Objective of The Scheme Is To Generate Long Term Capital Appreciation. However, There Can Be No Assurance That The Investment Objective of The Scheme / Plans Will Be AchievedSouvik NandiNo ratings yet

- 8202 ICICIPrudential SmallCapFund ProductNoteDocument3 pages8202 ICICIPrudential SmallCapFund ProductNoteShravan RatheeshNo ratings yet

- Session6 7 PublicIssuesDocument27 pagesSession6 7 PublicIssuesKanika AhujaNo ratings yet

- HDFC MF Monthly Income Plan LTP December 2012Document18 pagesHDFC MF Monthly Income Plan LTP December 2012khadenileshNo ratings yet

- Profit OR Loss PRE AND Post Incorporation: After Studying This Unit, You Will Be Able ToDocument29 pagesProfit OR Loss PRE AND Post Incorporation: After Studying This Unit, You Will Be Able ToNitesh MattaNo ratings yet

- Non Current Assets Held For SaleDocument31 pagesNon Current Assets Held For SaleKimivy BusaNo ratings yet

- Corporation AccountingDocument12 pagesCorporation AccountingLien LaurethNo ratings yet

- 1Document23 pages1Shishir SinghNo ratings yet

- Insolvency and Bankruptcy CodeDocument18 pagesInsolvency and Bankruptcy CodeSudip Issac SamNo ratings yet

- 8196 ICICIPrudential EquityandDebtFund ProductNoteDocument3 pages8196 ICICIPrudential EquityandDebtFund ProductNoteKiranmayi UppalaNo ratings yet

- Zerodha Nifty LargeMidcap 250 Index Fund - SIDDocument100 pagesZerodha Nifty LargeMidcap 250 Index Fund - SIDBALAJiNo ratings yet

- Introducing : Microsoft Dynamics 365Document32 pagesIntroducing : Microsoft Dynamics 365arunchennai1No ratings yet

- Sundaram Alternate Assets LimitedDocument7 pagesSundaram Alternate Assets LimitedSabSab MukNo ratings yet

- Recovery of LoansDocument50 pagesRecovery of LoansRajul AgrawalNo ratings yet

- Chamber's Journal January 06 PDFDocument6 pagesChamber's Journal January 06 PDFManisha SinghNo ratings yet

- Capital Gains 1Document55 pagesCapital Gains 1apurvaapurvaNo ratings yet

- Palak Pappu, Andhra Style Palak PappuDocument1 pagePalak Pappu, Andhra Style Palak Pappupurrab divakarNo ratings yet

- Mems PDFDocument4 pagesMems PDFpurrab divakarNo ratings yet

- GooglepreviewDocument35 pagesGooglepreviewpurrab divakar0% (1)

- HIL Simulation To Test Mechatronic Component in Automotive Engineering PDFDocument16 pagesHIL Simulation To Test Mechatronic Component in Automotive Engineering PDFpurrab divakarNo ratings yet

- Thermal Analysis of Fins With Varying Geometry of Different MaterialsDocument3 pagesThermal Analysis of Fins With Varying Geometry of Different Materialspurrab divakarNo ratings yet

- Additive Manufacturing: SciencedirectDocument5 pagesAdditive Manufacturing: Sciencedirectpurrab divakarNo ratings yet

- 3 D Vision Feedback For Nanohandling Monitoring in A Scanning Electron MicroscopeDocument24 pages3 D Vision Feedback For Nanohandling Monitoring in A Scanning Electron Microscopepurrab divakarNo ratings yet

- Applied Thermal Engineering: F. Illán, M. AlarcónDocument7 pagesApplied Thermal Engineering: F. Illán, M. Alarcónpurrab divakarNo ratings yet

- Tool For Turbine Engine Closed-Loop Transient Analysis (TTECTrA) Users' Guide PDFDocument88 pagesTool For Turbine Engine Closed-Loop Transient Analysis (TTECTrA) Users' Guide PDFpurrab divakarNo ratings yet

- Ali Zare, Timothy A. Bodisco, MD Nurun Nabi, Farhad M. Hossain, Zoran D. Ristovski, Richard J. BrownDocument15 pagesAli Zare, Timothy A. Bodisco, MD Nurun Nabi, Farhad M. Hossain, Zoran D. Ristovski, Richard J. Brownpurrab divakarNo ratings yet

- Steady-State and Transient Heat Transfer Through Fins of Complex GeometryDocument17 pagesSteady-State and Transient Heat Transfer Through Fins of Complex Geometrypurrab divakarNo ratings yet

- Ch08-Testbank PDFDocument30 pagesCh08-Testbank PDFAdrienne Chelsea GabayNo ratings yet

- Chapter 17: Alcohols and Phenols: Based On Mcmurry'S Organic Chemistry, 9 EditionDocument99 pagesChapter 17: Alcohols and Phenols: Based On Mcmurry'S Organic Chemistry, 9 Edition張湧浩No ratings yet

- XII - The P-Block ElementsDocument6 pagesXII - The P-Block ElementsRanjan BhatNo ratings yet

- Introductions To Polymers PDFDocument32 pagesIntroductions To Polymers PDFkiran parveNo ratings yet

- Valencia Reginald Audit Excercise On InvestmentsDocument6 pagesValencia Reginald Audit Excercise On InvestmentsReginald ValenciaNo ratings yet

- Rafael Luis C. Pamonag December 17, 2020 Bsba-2A TTH (9:00-10am) Fm120:Financial Management Final ExamDocument2 pagesRafael Luis C. Pamonag December 17, 2020 Bsba-2A TTH (9:00-10am) Fm120:Financial Management Final ExamMarjonNo ratings yet

- CHEMISTRY 18.1 Full Report Exer 4Document7 pagesCHEMISTRY 18.1 Full Report Exer 4Xian DonosoNo ratings yet

- Blockchain For Better Green Finance Law EnforcementDocument2 pagesBlockchain For Better Green Finance Law EnforcementViktorNo ratings yet

- Shriram Transport Financ NCDDocument2 pagesShriram Transport Financ NCDRajib LayekNo ratings yet

- Homework - 2 - Reinvestment Risk - Credit RiskDocument2 pagesHomework - 2 - Reinvestment Risk - Credit RisksinbdacutieNo ratings yet

- The Clerk Was More Familiar With The Process For Felonies, But Did Not Note AnyDocument2 pagesThe Clerk Was More Familiar With The Process For Felonies, But Did Not Note AnyLeisa R RockeleinNo ratings yet

- ACJC H2 CHEM P1 (Worked Solution)Document26 pagesACJC H2 CHEM P1 (Worked Solution)Zach EganNo ratings yet

- ch18 Chapter 18 Questions For BosonDocument135 pagesch18 Chapter 18 Questions For Bosonalpha567No ratings yet

- 3.3 CHM622 NMRDocument42 pages3.3 CHM622 NMRsharifah sakinah syed soffianNo ratings yet

- Affidavit of Individual Surety: (See Instructions On Reverse)Document3 pagesAffidavit of Individual Surety: (See Instructions On Reverse)BRANDON WARNER100% (1)

- Fundamentals of Organic ChemistryDocument131 pagesFundamentals of Organic ChemistryApoorv Sharma100% (1)

- Group 6 Drug DesignDocument13 pagesGroup 6 Drug DesignBaguma MichaelNo ratings yet

- FFM Capital Markets Ex2Document2 pagesFFM Capital Markets Ex2TommyG92No ratings yet

- Electrocyclic Reactions: Dr. Harish ChopraDocument35 pagesElectrocyclic Reactions: Dr. Harish ChopraHarish ChopraNo ratings yet

- Far 2 q05 MP Long QuizDocument2 pagesFar 2 q05 MP Long QuizanndyNo ratings yet

- BIO 11 Lab 02 2004 Enz. Copy - DoDocument10 pagesBIO 11 Lab 02 2004 Enz. Copy - DoKizzy Anne Boatswain CarbonNo ratings yet

- Philequity Peso Bond Fund: Navps As of Dec 27, 2019Document1 pagePhilequity Peso Bond Fund: Navps As of Dec 27, 2019Marlon DNo ratings yet

- Quiz 2 BP With Answers PDFDocument4 pagesQuiz 2 BP With Answers PDFspur iousNo ratings yet

- Effective Interest Method of Amortization Calculator 1Document33 pagesEffective Interest Method of Amortization Calculator 1Brev PNo ratings yet