Professional Documents

Culture Documents

Travelers Insurance: Focusing On Climate Change and Natural Disaster Risk

Uploaded by

Shivani KarkeraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Travelers Insurance: Focusing On Climate Change and Natural Disaster Risk

Uploaded by

Shivani KarkeraCopyright:

Available Formats

Travelers Insurance: Focusing on Climate Change and Natural Disaster

Risk

Situation Analysis:

Travelers Companies Inc. was founded in 1846 by J.G. Batterson and nine Hartford

businessmen. It became the second-largest US Commercial property-casualty insurance

underwriter and the third largest US personal underwriter. The company was divided into

three reportable business segments: (1) Business Insurance, (2) Financial, Professional &

International Insurance, and (3) Personal Insurance. In 2011, the US endured its most

expensive and destructive year with severe weather and climate incidents. In 2012, this trend

continued. The trends didn’t go unnoticed by Travelers. A majority of insured losses due to

natural disaster events directly impacted Travelers' P&C business. Travelers used several

proprietary and third-party computer models to analyze the risk of catastrophic events.

Travelers’ underwriting took into account the exposure of the client risk to the risk of rate

premiums, premium collections, premium investments, claim payouts, and reinsurance

contracts. Climate change could create uncertainty about risk levels dependent on natural

disasters and extreme weather events. It may also change other facets of the corporate plan of

the firm, including underwriting, contracts, capital structure, and assessment of future

liabilities. How would Travelers manage to provide affordable, comprehensive insurance and

satisfy shareholders at the same time reducing climate change risk? Travelers needed to

defend their policyholders but still had to build a strategy that would boost market equity and

its $73.8 billion6 portfolio of investments.

The problem Evan Blue is confronting arises from a study by Ceres Sustainability Advocacy

group calling for businesses to take climate change into considerations in their risk

projections and to build mitigation plans. The fictional Vice president of Traveler’s Insurance

is responsible for updating the company’s board of management about the issue the following

day. This will determine if there is a strategic argument for taking steps in response to the

danger of climate change. What is the liability of the organization and how incorporating

climate change into its risk model would render it a stronger underwriter or a priced out of

other markets?

You might also like

- The Merger or Insolvency Alternative in The Insurance IndustryDocument26 pagesThe Merger or Insolvency Alternative in The Insurance IndustrySrujan JNo ratings yet

- Risk Management With Help of InsuranceDocument22 pagesRisk Management With Help of InsuranceKurosaki IchigoNo ratings yet

- Lemonade TextDocument2 pagesLemonade TextSanti Hernandez RoncancioNo ratings yet

- Executive SummaryDocument53 pagesExecutive SummaryRohit VkNo ratings yet

- Longevity Risk: U.S. Insurers Tackle The Challenges of "Happily Ever After"Document5 pagesLongevity Risk: U.S. Insurers Tackle The Challenges of "Happily Ever After"api-227433089No ratings yet

- The Allocation of Catastrophe RiskDocument12 pagesThe Allocation of Catastrophe RiskAlex PutuhenaNo ratings yet

- InsuranceDocument53 pagesInsuranceRohit VkNo ratings yet

- Go Policy (Insurance Broker) : Student's Name: Student's Id: Date: Word Count: 2000Document12 pagesGo Policy (Insurance Broker) : Student's Name: Student's Id: Date: Word Count: 2000Mayur SoNo ratings yet

- Understanding Disaster Insurance: New Tools for a More Resilient FutureFrom EverandUnderstanding Disaster Insurance: New Tools for a More Resilient FutureNo ratings yet

- InsuranceDocument2 pagesInsuranceRavi AgarwalNo ratings yet

- Recruitment of Advisors in IciciDocument77 pagesRecruitment of Advisors in Icicipadamheena123No ratings yet

- Risk Management in Insurance PDFDocument51 pagesRisk Management in Insurance PDFathar100% (3)

- Risk Management Full NotesDocument40 pagesRisk Management Full NotesKelvin Namaona NgondoNo ratings yet

- Risk Management: How to Use Different Insurance to Your BenefitFrom EverandRisk Management: How to Use Different Insurance to Your BenefitNo ratings yet

- Insurance Industry in IndiaDocument91 pagesInsurance Industry in IndiaOne's JourneyNo ratings yet

- Dissertation ReinsuranceDocument4 pagesDissertation ReinsuranceWriteMyPaperSingapore100% (1)

- Insurance CompanyDocument54 pagesInsurance CompanyDhoni KhanNo ratings yet

- Risk Management in General Insurance BusDocument20 pagesRisk Management in General Insurance BusSuhas SiddarthNo ratings yet

- Avrupada Vicdani Ret Sorunu Istemden NorDocument36 pagesAvrupada Vicdani Ret Sorunu Istemden NorengineuurNo ratings yet

- Key Trends in Risk Management Further ReadingDocument6 pagesKey Trends in Risk Management Further ReadingSiddhantpsinghNo ratings yet

- Lazear20070411Document6 pagesLazear20070411losangelesNo ratings yet

- Insurance Companies As Financial Intermediaries: Risk and ReturnDocument54 pagesInsurance Companies As Financial Intermediaries: Risk and Returnfareha riazNo ratings yet

- SwissRe Understanding ReinsuranceDocument23 pagesSwissRe Understanding ReinsuranceHaldi Zusrijan PanjaitanNo ratings yet

- Insurance Concepts: January 1998Document18 pagesInsurance Concepts: January 1998sunny rockyNo ratings yet

- Sigma4 2014 enDocument36 pagesSigma4 2014 enHarry CerqueiraNo ratings yet

- The Economics of Catastrophe Risk InsuranceDocument19 pagesThe Economics of Catastrophe Risk Insurancelosangeles100% (1)

- Reinsurance: January 1998Document28 pagesReinsurance: January 1998Shubham KanojiaNo ratings yet

- Key Principles For Climate-Related Risk InsuranceDocument24 pagesKey Principles For Climate-Related Risk InsuranceCenter for American ProgressNo ratings yet

- EconomicsofRMI8 23 2018Document42 pagesEconomicsofRMI8 23 2018manisha_jha_11No ratings yet

- Statistical Concepts of A Priori and A Posteriori Risk Classification in InsuranceDocument38 pagesStatistical Concepts of A Priori and A Posteriori Risk Classification in InsuranceAhmed FenneurNo ratings yet

- Student Name: L. Sai Radha Krishna Topic Name: Reinsurance Related Laws ROLL - NO: 2016055 / ADocument15 pagesStudent Name: L. Sai Radha Krishna Topic Name: Reinsurance Related Laws ROLL - NO: 2016055 / Apradeep punuruNo ratings yet

- A Guide To Directors' Officers' Liability in Europe1 - tcm915-520123Document20 pagesA Guide To Directors' Officers' Liability in Europe1 - tcm915-520123AbhishekNo ratings yet

- Progressive Final PaperDocument16 pagesProgressive Final PaperJordyn WebreNo ratings yet

- POI MaterialDocument11 pagesPOI MaterialMukesh ChoudharyNo ratings yet

- Parametric Insurance For DisastersDocument6 pagesParametric Insurance For DisastersMohammed Touhami GOUASMINo ratings yet

- Reinsurance - Insuring The InsurerDocument61 pagesReinsurance - Insuring The Insurerkristokuns100% (1)

- Chapter - I Enterprise Risk Management: An IntroductionDocument37 pagesChapter - I Enterprise Risk Management: An IntroductionkshitijsaxenaNo ratings yet

- Risk Management: Alternative Risk Transfer: StructureDocument21 pagesRisk Management: Alternative Risk Transfer: StructureRADHIKAFULPAGARNo ratings yet

- 9629 PDFDocument12 pages9629 PDFfherremansNo ratings yet

- Commentary 454 0Document24 pagesCommentary 454 0Juan M. Nava DavilaNo ratings yet

- Financial Risks and Management: GlossaryDocument6 pagesFinancial Risks and Management: GlossaryhbNo ratings yet

- Document PDFDocument22 pagesDocument PDFMahedrz Gavali100% (1)

- Rahul File848848484884184Document61 pagesRahul File848848484884184Rahul GargNo ratings yet

- Actuary: Occupation Names Occupation Type Activity Sectors Description Competencies Education Required See Related JobsDocument13 pagesActuary: Occupation Names Occupation Type Activity Sectors Description Competencies Education Required See Related Jobsrohit utekarNo ratings yet

- FAIS AssignmentDocument17 pagesFAIS AssignmentSalman SaeedNo ratings yet

- Intern ReportDocument39 pagesIntern ReportSAKIB AL HASANNo ratings yet

- The Relation Between Capital Structure, Interest Rate Sensitivity, and Market Value in The Property-Liability Insurance IndustryDocument30 pagesThe Relation Between Capital Structure, Interest Rate Sensitivity, and Market Value in The Property-Liability Insurance Industrystephyl0722No ratings yet

- 120 Financial Planning Handbook PDPDocument10 pages120 Financial Planning Handbook PDPMoh. Farid Adi PamujiNo ratings yet

- Introduction PDF 2Document12 pagesIntroduction PDF 2Vijay GilatarNo ratings yet

- BMA 2020 Climate Change Survey ReportDocument16 pagesBMA 2020 Climate Change Survey ReportBernewsAdminNo ratings yet

- Blackbook Project On Insurance PDFDocument77 pagesBlackbook Project On Insurance PDFMayuri L0% (1)

- Blackbook Project On Insurance PDFDocument77 pagesBlackbook Project On Insurance PDFMayuri L100% (1)

- A Simulation of The Insurance Industry The ProblemDocument43 pagesA Simulation of The Insurance Industry The ProblemDavidon JaniNo ratings yet

- 14 Reinsurance PDFDocument28 pages14 Reinsurance PDFHalfani MoshiNo ratings yet

- 14 Reinsurance PDFDocument28 pages14 Reinsurance PDFHaider AliNo ratings yet

- EWS ReportDocument21 pagesEWS ReportppayonggNo ratings yet

- EY Credit Risk ManagementDocument10 pagesEY Credit Risk ManagementTroden MukwasiNo ratings yet

- Risk Management NotesDocument86 pagesRisk Management NotesbabuNo ratings yet

- Before Analysing Whether To Go For 1Document2 pagesBefore Analysing Whether To Go For 1Shivani KarkeraNo ratings yet

- Ship Name: Date: SPEED (MPH) Rotation DISTANCE/miles: Cargo DiscriptionDocument1 pageShip Name: Date: SPEED (MPH) Rotation DISTANCE/miles: Cargo DiscriptionShivani KarkeraNo ratings yet

- 2009 12 JRC White Certificates PDFDocument62 pages2009 12 JRC White Certificates PDFShivani KarkeraNo ratings yet

- The Ceiling On Project Capacity and Contracted Load RemovedDocument1 pageThe Ceiling On Project Capacity and Contracted Load RemovedShivani KarkeraNo ratings yet

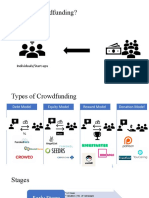

- What Is Crowdfunding?: Individuals/Start-ups FundingDocument3 pagesWhat Is Crowdfunding?: Individuals/Start-ups FundingShivani KarkeraNo ratings yet

- Caprica Energy and Its ChoicesDocument1 pageCaprica Energy and Its ChoicesShivani KarkeraNo ratings yet

- Pros and ConsDocument4 pagesPros and ConsShivani KarkeraNo ratings yet

- Energy Management 20-21Document11 pagesEnergy Management 20-21Shivani KarkeraNo ratings yet

- SITUATION ANALYSIS Morgan StanleyDocument1 pageSITUATION ANALYSIS Morgan StanleyShivani KarkeraNo ratings yet

- Real World Examples of Successful Crowdfunding Ventures: Social MediaDocument2 pagesReal World Examples of Successful Crowdfunding Ventures: Social MediaShivani KarkeraNo ratings yet

- Case Facts and AnalysisDocument2 pagesCase Facts and AnalysisShivani KarkeraNo ratings yet

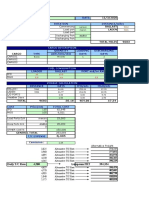

- 2019 AnalysisDocument3 pages2019 AnalysisShivani KarkeraNo ratings yet

- Instruments For Financing Carbon Savings For Large ProgrammesDocument20 pagesInstruments For Financing Carbon Savings For Large ProgrammesShivani KarkeraNo ratings yet

- Template Positive Case With Exposure in Schools - 07202020Document2 pagesTemplate Positive Case With Exposure in Schools - 07202020Shivani KarkeraNo ratings yet

- Sample Notification Letters SchoolDocument3 pagesSample Notification Letters SchoolShivani KarkeraNo ratings yet

- Venture Capital Method With Multiple Rounds.Document4 pagesVenture Capital Method With Multiple Rounds.Shivani KarkeraNo ratings yet

- Venture Capital Method: Investment ScenariosDocument2 pagesVenture Capital Method: Investment ScenariosShivani KarkeraNo ratings yet

- PGDM - V - SM (Tri-IV) Course Outline - 2020 - 2.5 CreditDocument5 pagesPGDM - V - SM (Tri-IV) Course Outline - 2020 - 2.5 CreditShivani KarkeraNo ratings yet

- Adani Institute of Infrastructure Management (AIIM) PGDM 20219-21 (Trim. IV) Managing Energy BusinessDocument2 pagesAdani Institute of Infrastructure Management (AIIM) PGDM 20219-21 (Trim. IV) Managing Energy BusinessShivani KarkeraNo ratings yet

- Venture Capital Method With Dilution.Document6 pagesVenture Capital Method With Dilution.Shivani KarkeraNo ratings yet

- Adani Institute of Infrastructure Management Trimester IV Port and Shipping ManagementDocument3 pagesAdani Institute of Infrastructure Management Trimester IV Port and Shipping ManagementShivani KarkeraNo ratings yet

- Stats SumsDocument2 pagesStats SumsShivani KarkeraNo ratings yet

- Adani Institute of Infrastructure Management (AIIM) PGDM 20219-21 (Trim. IV) Global Carbon FinanceDocument3 pagesAdani Institute of Infrastructure Management (AIIM) PGDM 20219-21 (Trim. IV) Global Carbon FinanceShivani KarkeraNo ratings yet

- Learner Achievement VerificationDocument2 pagesLearner Achievement VerificationShivani KarkeraNo ratings yet

- Jetblue: Relevant Sustainability Leadership (A) : Situational AnalysisDocument1 pageJetblue: Relevant Sustainability Leadership (A) : Situational AnalysisShivani KarkeraNo ratings yet

- Transportation Policymaking in Beijing and Shanghai: Contributors, Obstacles and ProcessDocument23 pagesTransportation Policymaking in Beijing and Shanghai: Contributors, Obstacles and ProcessShivani KarkeraNo ratings yet