Professional Documents

Culture Documents

Real World Examples of Successful Crowdfunding Ventures: Social Media

Uploaded by

Shivani KarkeraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real World Examples of Successful Crowdfunding Ventures: Social Media

Uploaded by

Shivani KarkeraCopyright:

Available Formats

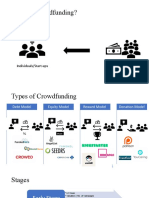

Crowdfunding is when individuals or start-ups use an online platform to gain funding for a project

Crowdfunding makes use of the easy accessibility of vast networks of people

through social media and crowdfunding websites to bring investors and

entrepreneurs together, with the potential to increase entrepreneurship by

expanding the pool of investors beyond the traditional circle of owners,

relatives and venture capitalists.

Crowdfunding provides a forum to anyone with an idea to pitch it in front of

waiting investors.

Crowdfunding sites generate revenue from a percentage of the funds raised.

There are four types of crowdfunding sites

Debt Based Site: Contributors receive interest payments in exchange for their contributions.

Examples – Funded here, crowdo and moolah cents

Equity based sites: Contributors receive shares in exchange for their contributions. Examples- Angel

list, Funnel, Seeders, and Cap bridge

Reward Based Platforms : Contributors are promised rewards in exchange for their support like first

priority access to the product once it goes live. Examples- Kickstarter, Indigogo and eulalee.

Donations based platforms where donations are charitable and usually tax deductible examples-

Indigogo, pateron, u caring and friend fund.

Crowdfunding websites have to invest heavily in their platforms upfront and slowly build up scale,

so before investing in a crowdfunding platform, its important to consider it’s stage of growth

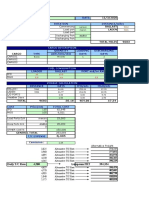

In the early stage the main focus should be on customer traction, one can gauge this by the amount

of momentum being build among project initiators and investors therefore the key valuation metrics

include Valuation divide by No. of Campaigns, Valuation divide by Successful Campaigns, Valuation

divide by Funds raised

In the growth stage, the aim is to prove the revenue model and to scale up as rapidly as possible,

therefore the key valuation metrics include Valuation divide by Funding value, Valuation divide by

revenue.

Finally, in the late stage the goal is to maximize profitability and cash flow, while maintaining growth,

therefore the key valuation metrics include Valuation divide by revenue, Valuation divide by EBITDA

and the P/E Ratios.

Real World Examples of Successful Crowdfunding

Ventures

For instance, Oculus VR, the American company specializing in virtual

reality hardware and software products, was funded through the site. In 2012,

founder Palmer Luckey launched a Kickstarter campaign to raise money to

make virtual reality headsets designed for video gaming available to

developers. The campaign crowdfunded $2.4 million, ten times the original

goal of $250,000. In March 2014, Facebook, Inc. (FB) acquired Oculus VR for

$2.3 billion in cash and stock.

Before you get too excited at the idea of “free money,” there are some drawbacks of

crowdfunding that you should consider as well.

Crowdfunding campaigns typically require a lot of work on the business

owner’s side (that’s you). You’ll have to convince people to contribute to your

business idea. You will likely need to offer them something in return (e.g. a pre-sale, a

free product, elite status, etc.). And, you’ll have to keep the momentum going

throughout the campaign. Many business owners report that it can be a very time-

consuming process.

If you don’t reach your financing goal, with certain crowdfunding platforms you

might not get any of the funds you did raise.

Nonetheless, crowdfunding has been a very successful way for many businesses to

raise much needed working capital. If you’re looking for specific crowdfunding

options, this helpful guide might be a good place to start your research.

You might also like

- CrowdfundingDocument5 pagesCrowdfundingMehwish SiddiquiNo ratings yet

- Crowd Funding in European Union: Types of CrowdfundingDocument6 pagesCrowd Funding in European Union: Types of CrowdfundingAdvait NaikNo ratings yet

- Crowdfunding Secrets: A Comprehensive Guide to Successfully Funding Your Next ProjectFrom EverandCrowdfunding Secrets: A Comprehensive Guide to Successfully Funding Your Next ProjectNo ratings yet

- Crowdfunding in FintechDocument6 pagesCrowdfunding in FintechhukaNo ratings yet

- Crowdfunding FAQ: Read This Article by Crowdfunding DojoDocument4 pagesCrowdfunding FAQ: Read This Article by Crowdfunding DojoPaolo VelcichNo ratings yet

- Cash from the Crowd: How to crowdfund your ideas and gain fans for your successFrom EverandCash from the Crowd: How to crowdfund your ideas and gain fans for your successRating: 4 out of 5 stars4/5 (1)

- Crowdfunding FM&IDocument4 pagesCrowdfunding FM&IAnkita GaikwadNo ratings yet

- Angel Investing and CrowdfundingDocument16 pagesAngel Investing and CrowdfundingPrachi BharadwajNo ratings yet

- Crowdfunding: IntroductionDocument7 pagesCrowdfunding: IntroductionSoham BhurkeNo ratings yet

- Equity Crowdfunding - The Complete Guide For Startups and - Nathan Rose - 2016 - Stonepine Publishing - 9780473377984 - Anna's ArchiveDocument183 pagesEquity Crowdfunding - The Complete Guide For Startups and - Nathan Rose - 2016 - Stonepine Publishing - 9780473377984 - Anna's ArchivedanicalalalaNo ratings yet

- Crowdfunding Talk DR AminulDocument2 pagesCrowdfunding Talk DR AminulWm NajmuddinNo ratings yet

- 10 Funding Options To Raise Startup Capital For BusinessDocument32 pages10 Funding Options To Raise Startup Capital For BusinessAnjani Kumar SinhaNo ratings yet

- Crowdfunding Thesis PDFDocument5 pagesCrowdfunding Thesis PDFhollyschulzgilbert100% (2)

- Crowdfunding For Architects: 5 Essentials Models You Should KnowDocument2 pagesCrowdfunding For Architects: 5 Essentials Models You Should KnowSema JainNo ratings yet

- AnushaDocument4 pagesAnushaAbc XyzNo ratings yet

- The Customer-Funded Business (Review and Analysis of Mullins' Book)From EverandThe Customer-Funded Business (Review and Analysis of Mullins' Book)Rating: 4.5 out of 5 stars4.5/5 (2)

- Crowdfunding: Unit 18Document11 pagesCrowdfunding: Unit 18Heet DoshiNo ratings yet

- CROWDFUNDINGDocument11 pagesCROWDFUNDINGvarun bhaskarNo ratings yet

- Crowdfunding Is by DefinitionDocument2 pagesCrowdfunding Is by DefinitionasunNo ratings yet

- Capital Catalyst: The Essential Guide to Raising Funds for Your BusinessFrom EverandCapital Catalyst: The Essential Guide to Raising Funds for Your BusinessNo ratings yet

- Tyfintech 07 LawDocument13 pagesTyfintech 07 Lawpratham raghaniNo ratings yet

- Startup Fundraising 101Document8 pagesStartup Fundraising 101CrowdfundInsiderNo ratings yet

- Beyond Bankable: Business Funding for the Modern EntrepreneurFrom EverandBeyond Bankable: Business Funding for the Modern EntrepreneurRating: 5 out of 5 stars5/5 (1)

- Equity Crowdfunding Facts You Need To KnowDocument5 pagesEquity Crowdfunding Facts You Need To KnowHotelierCoNo ratings yet

- Case of Study 4Document2 pagesCase of Study 4Lorena AvilaNo ratings yet

- Equity Crowdfunding GuideDocument9 pagesEquity Crowdfunding GuideAgroEmpresario ExportadorNo ratings yet

- A Study On Crowd FundingDocument29 pagesA Study On Crowd FundingDev ShahNo ratings yet

- ForbesDocument6 pagesForbesapi-352273609No ratings yet

- Startup Funding Rounds: 60% of All Startups NeedDocument9 pagesStartup Funding Rounds: 60% of All Startups Needs gurung100% (1)

- Marketing Guide For Investment CrowdfundingDocument11 pagesMarketing Guide For Investment CrowdfundingAliElkhatebNo ratings yet

- Equity Crowdfunding ThesisDocument6 pagesEquity Crowdfunding Thesisnicolecochranerie100% (2)

- The Venture CrowdDocument36 pagesThe Venture CrowdNestaNo ratings yet

- Equity CrowdfundingDocument13 pagesEquity CrowdfundingantonyNo ratings yet

- Devashis Mitra Devashis Mitra Devashis Mitra Devashis Mitra Devashis MitraDocument6 pagesDevashis Mitra Devashis Mitra Devashis Mitra Devashis Mitra Devashis MitraStevano Soplanit MendozaNo ratings yet

- A Guide To CrowdfundingDocument3 pagesA Guide To CrowdfundingAyne NewtonNo ratings yet

- 5 Massive Impacts of CrowdfundingDocument19 pages5 Massive Impacts of Crowdfundingemilio_catellani45No ratings yet

- UNIT 2.2 (21BCAS52) CrowdfundingDocument15 pagesUNIT 2.2 (21BCAS52) CrowdfundingbhoomikasettyNo ratings yet

- Alternative FinanceDocument43 pagesAlternative FinancePragathi SundarNo ratings yet

- Your First Kickstarter Campaign: Step by Step Guide to Launching a Successful Crowdfunding ProjectFrom EverandYour First Kickstarter Campaign: Step by Step Guide to Launching a Successful Crowdfunding ProjectNo ratings yet

- Crowdfunding in IndiaDocument13 pagesCrowdfunding in IndiaAarti GuptaNo ratings yet

- Crowdfunding Success Code: Learn the secrets to getting more money with crowdfunding projects.From EverandCrowdfunding Success Code: Learn the secrets to getting more money with crowdfunding projects.No ratings yet

- Stages in Venture Capital FundingDocument3 pagesStages in Venture Capital FundingMohammed Awwal NdayakoNo ratings yet

- Crowd FundingDocument4 pagesCrowd Fundingsarans456No ratings yet

- Funding Sources For StartUPDocument5 pagesFunding Sources For StartUPMayuri RavatNo ratings yet

- How to Get Funding For Your New Product IdeaFrom EverandHow to Get Funding For Your New Product IdeaRating: 4.5 out of 5 stars4.5/5 (6)

- Roll Your Own Crowdfunding - DIY Approach - Crowdfunding SoftwareDocument2 pagesRoll Your Own Crowdfunding - DIY Approach - Crowdfunding SoftwareBluNoteNo ratings yet

- Explain The Sources of Funding For A Start-UpDocument6 pagesExplain The Sources of Funding For A Start-UpChandra KeerthiNo ratings yet

- Crowdfunding 101Document4 pagesCrowdfunding 101gaurnityanandaNo ratings yet

- Crowdfunding ChecklistDocument16 pagesCrowdfunding ChecklistBluNoteNo ratings yet

- Crowdfunding Blackbook ProjectDocument94 pagesCrowdfunding Blackbook ProjectMihirNo ratings yet

- ReportDocument37 pagesReportNguyễn Ngọc Hà MyNo ratings yet

- Before Analysing Whether To Go For 1Document2 pagesBefore Analysing Whether To Go For 1Shivani KarkeraNo ratings yet

- What Is Crowdfunding?: Individuals/Start-ups FundingDocument3 pagesWhat Is Crowdfunding?: Individuals/Start-ups FundingShivani KarkeraNo ratings yet

- Travelers Insurance: Focusing On Climate Change and Natural Disaster RiskDocument1 pageTravelers Insurance: Focusing On Climate Change and Natural Disaster RiskShivani KarkeraNo ratings yet

- The Ceiling On Project Capacity and Contracted Load RemovedDocument1 pageThe Ceiling On Project Capacity and Contracted Load RemovedShivani KarkeraNo ratings yet

- 2009 12 JRC White Certificates PDFDocument62 pages2009 12 JRC White Certificates PDFShivani KarkeraNo ratings yet

- Ship Name: Date: SPEED (MPH) Rotation DISTANCE/miles: Cargo DiscriptionDocument1 pageShip Name: Date: SPEED (MPH) Rotation DISTANCE/miles: Cargo DiscriptionShivani KarkeraNo ratings yet

- Pros and ConsDocument4 pagesPros and ConsShivani KarkeraNo ratings yet

- Instruments For Financing Carbon Savings For Large ProgrammesDocument20 pagesInstruments For Financing Carbon Savings For Large ProgrammesShivani KarkeraNo ratings yet

- 2019 AnalysisDocument3 pages2019 AnalysisShivani KarkeraNo ratings yet

- Caprica Energy and Its ChoicesDocument1 pageCaprica Energy and Its ChoicesShivani KarkeraNo ratings yet

- Adani Institute of Infrastructure Management (AIIM) PGDM 20219-21 (Trim. IV) Global Carbon FinanceDocument3 pagesAdani Institute of Infrastructure Management (AIIM) PGDM 20219-21 (Trim. IV) Global Carbon FinanceShivani KarkeraNo ratings yet

- SITUATION ANALYSIS Morgan StanleyDocument1 pageSITUATION ANALYSIS Morgan StanleyShivani KarkeraNo ratings yet

- Case Facts and AnalysisDocument2 pagesCase Facts and AnalysisShivani KarkeraNo ratings yet

- Energy Management 20-21Document11 pagesEnergy Management 20-21Shivani KarkeraNo ratings yet

- Template Positive Case With Exposure in Schools - 07202020Document2 pagesTemplate Positive Case With Exposure in Schools - 07202020Shivani KarkeraNo ratings yet

- PGDM - V - SM (Tri-IV) Course Outline - 2020 - 2.5 CreditDocument5 pagesPGDM - V - SM (Tri-IV) Course Outline - 2020 - 2.5 CreditShivani KarkeraNo ratings yet

- Venture Capital Method With Multiple Rounds.Document4 pagesVenture Capital Method With Multiple Rounds.Shivani KarkeraNo ratings yet

- Sample Notification Letters SchoolDocument3 pagesSample Notification Letters SchoolShivani KarkeraNo ratings yet

- Venture Capital Method: Investment ScenariosDocument2 pagesVenture Capital Method: Investment ScenariosShivani KarkeraNo ratings yet

- Learner Achievement VerificationDocument2 pagesLearner Achievement VerificationShivani KarkeraNo ratings yet

- Adani Institute of Infrastructure Management (AIIM) PGDM 20219-21 (Trim. IV) Managing Energy BusinessDocument2 pagesAdani Institute of Infrastructure Management (AIIM) PGDM 20219-21 (Trim. IV) Managing Energy BusinessShivani KarkeraNo ratings yet

- Venture Capital Method With Dilution.Document6 pagesVenture Capital Method With Dilution.Shivani KarkeraNo ratings yet

- Stats SumsDocument2 pagesStats SumsShivani KarkeraNo ratings yet

- Adani Institute of Infrastructure Management Trimester IV Port and Shipping ManagementDocument3 pagesAdani Institute of Infrastructure Management Trimester IV Port and Shipping ManagementShivani KarkeraNo ratings yet

- Jetblue: Relevant Sustainability Leadership (A) : Situational AnalysisDocument1 pageJetblue: Relevant Sustainability Leadership (A) : Situational AnalysisShivani KarkeraNo ratings yet

- Transportation Policymaking in Beijing and Shanghai: Contributors, Obstacles and ProcessDocument23 pagesTransportation Policymaking in Beijing and Shanghai: Contributors, Obstacles and ProcessShivani KarkeraNo ratings yet

- Hong Kong Regulation of Crowd FundingDocument61 pagesHong Kong Regulation of Crowd FundingHassan TiznitiNo ratings yet

- Massolution - Abridged Crowd Funding Industry ReportDocument30 pagesMassolution - Abridged Crowd Funding Industry ReportRip Empson67% (6)

- Explain The Sources of Funding For A Start-UpDocument6 pagesExplain The Sources of Funding For A Start-UpChandra KeerthiNo ratings yet

- Angel DealsDocument112 pagesAngel DealsSwapnilsagar VithalaniNo ratings yet

- Convergence Finance Litepaper v1Document7 pagesConvergence Finance Litepaper v1renhaojie520live.cnNo ratings yet

- UpStart Business PlanDocument32 pagesUpStart Business PlanJarodSalinas-DickNo ratings yet

- Business Plan For Your Food Truck BusinessDocument9 pagesBusiness Plan For Your Food Truck BusinesssuzukiNo ratings yet

- Situational AnalysisDocument19 pagesSituational Analysisapi-369631980100% (4)

- A Conceptualized Investment Model of Crowdfunding (2013) PDFDocument26 pagesA Conceptualized Investment Model of Crowdfunding (2013) PDFMiguel_RomeroNo ratings yet

- New Venture Creation Important QuestionDocument39 pagesNew Venture Creation Important QuestionSahib RandhawaNo ratings yet

- SWOT Analysis of Financial Technology in The BankiDocument9 pagesSWOT Analysis of Financial Technology in The BankiArif HasanNo ratings yet

- Etrp TRCK 2 - Etrp 8 Part 5Document39 pagesEtrp TRCK 2 - Etrp 8 Part 5Kaitlinn Jamila AltatisNo ratings yet

- Safefund: Crowdfunding Platform Based On Blockchain: 1.1 BackgroundDocument5 pagesSafefund: Crowdfunding Platform Based On Blockchain: 1.1 BackgroundSyed Rahman AhmedNo ratings yet

- Kotler Pom15 Im 03Document26 pagesKotler Pom15 Im 03Syed Kashif AliNo ratings yet

- MindenDocument916 pagesMindenKaizer PéterNo ratings yet

- Fintech in India-Opportunities and ChallengesDocument14 pagesFintech in India-Opportunities and Challengescaalokpandey2007No ratings yet

- Bok:978 3 319 42448 4Document319 pagesBok:978 3 319 42448 4Amgad AlsisiNo ratings yet

- Over 50 Fundraising Event IdeasDocument37 pagesOver 50 Fundraising Event IdeasJesus PriorNo ratings yet

- Fintech Landscape F PDFDocument1 pageFintech Landscape F PDFRatan Manehani100% (2)

- CP18 - 20 - Loan-Based ( Peer-To-peer') and Investment-Based Crowdfunding Platforms - Feedback On Our Post-Implementation Review and Proposed Changes To The Regulatory FrameworkDocument156 pagesCP18 - 20 - Loan-Based ( Peer-To-peer') and Investment-Based Crowdfunding Platforms - Feedback On Our Post-Implementation Review and Proposed Changes To The Regulatory FrameworkMuhammad Syukri B Mohd ShahNo ratings yet

- B2+ UNITS 9 and 10 CLILDocument2 pagesB2+ UNITS 9 and 10 CLILana maria csalinasNo ratings yet

- Morality White Paper 1.0.1 (English) PDFDocument28 pagesMorality White Paper 1.0.1 (English) PDFjihnNo ratings yet

- IMTC 633 Part5Document6 pagesIMTC 633 Part5Ajit KumarNo ratings yet

- From Technology Transfer To Open IPR: BackgroundDocument15 pagesFrom Technology Transfer To Open IPR: Backgroundxxx1000No ratings yet

- CrowdfundingDocument7 pagesCrowdfundingNavhin MichealNo ratings yet

- German Music Market ReportDocument39 pagesGerman Music Market Reportqaraj44No ratings yet

- List of Game Crowd Funding ProjectsDocument32 pagesList of Game Crowd Funding ProjectsCrystal LeungNo ratings yet

- Mba Hult Brochure 2024 25Document63 pagesMba Hult Brochure 2024 25akhilNo ratings yet

- Topic2 Part1Document16 pagesTopic2 Part1Abdul MoezNo ratings yet

- Borser Business Plan For Crypto CurrencyDocument68 pagesBorser Business Plan For Crypto Currencyzeedanshan75% (4)