Professional Documents

Culture Documents

Caso Iese Financiero

Uploaded by

JohnatanSolorzanoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caso Iese Financiero

Uploaded by

JohnatanSolorzanoCopyright:

Available Formats

F-869-E

Rev. 12/2013

This document is an authorized copy for the course “Finance for Managers” taught by Prof. Miguel Antón

PolyPanel. Financing Growth

Introduction

At the beginning of 2008, PolyPanel, a successful, growing company, asked for a line of

credit with a maximum of €500,000 to finance inventories and credit to customers.

PolyPanel was founded in 2003 and after rapid growth was able to make a profit in its third

year of operations. The prospects of the company were good for the coming years. The

company submitted its financial statements to the bank (see Exhibits 1 and 2). One of the

bank’s credit analysts visited the company and interviewed the founder and general manager,

Mr. Lichtstein. The following comments are a summary of his opinions.

The Business

PolyPanel is a retail distributor of panels for the construction or modification of houses and

industrial warehouses. The panels can be used as ceilings or walls; they are easy to install,

light and resistant, but expensive. There are a variety of materials for every use. PolyPanel

sells mainly sandwich panels,1 but it also has panels of polycarbonate, metacrilate, plastic,

etc. For each material there are several choices of color, thickness, etc. PolyPanel also sells

the accessories to finish the installation. In total, PolyPanel has around 200 references

(different products).

The typical client is a small contractor that works in new buildings or reforms of old ones.

There are also final clients that do their own repairs at home. At present, PolyPanel has

around 2,000 clients registered. Around 55% of sales are concentrated in the six months

around summer.

1 Two metal sheets with polyurethane inside that work very well as isolation material.

This case was prepared by Professor Eduardo Martínez Abascal as the basis for class discussion rather than to illustrate

either effective or ineffective handling of an administrative situation. September 2012. Revised in December 2013.

Copyright © 2012 IESE. To order copies contact IESE Publishing via www.iesep.com. Alternatively, write to iesep@iesep.com,

send a fax to +34 932 534 343 or call +34 932 534 200.

No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any

form or by any means – electronic, mechanical, photocopying, recording, or otherwise – without the permission of IESE.

Last edited: 7/10/18

1

F-869-E PolyPanel. Financing Growth

PolyPanel is located in a growing industrial area in the vicinity of Munich. Asked about

competition, Mr. Lichtstein answers:

“The only big competitor is my former company, but they have worse service and slightly

higher prices. In the area there are around 20 distributors of other construction materials

This document is an authorized copy for the course “Finance for Managers” taught by Prof. Miguel Antón

that sell panels, but with much less variety of products and services; for example, they

have around 10 panels as opposed to the 200 we have. We have more references, better

service to the customer and faster delivery at a very reasonable price. In theory, a winning

formula, but nevertheless I assume that every competitor may steal some potential

customers from us.

As in any distribution company, purchasing and management of the inventory is crucial.

PolyPanel typically buys a big truckload (1,000 m2 of panel) three times a week and the

supplier issues a 60-day bill. The main supplier represents 80% of purchases and is one of

the world leaders.

PolyPanel cuts the big panels to the measurements required by the customer (a typical

order is for around 20 m2 – 40 m2). The cutting process is crucial: up to five points of

margin could be lost if the process is not done with careful planning in order to avoid

waste. Another crucial point is to have plenty of products (references) available for quick

delivery (two to three days) to the customer. At present, PolyPanel has around 20,000 m 2

of panel, or roughly €400,000, in stock.”

Management and Personnel

Mr. Lichtstein (41), manager and founder of the company, is in charge of purchases and

finance. He had worked for 10 years with his main competitor (four of them as a general

manager) before starting his own company in 2003 at the age of 36. Educational background:

civil engineer.

There is one sales director plus one sales person that visit potential customers regularly. One

person is in charge of the warehouse, aided by three employees, and, finally, there is one truck

driver. In total, one general manager, two managers and five employees. The employees have a

20% stake in the company; the other 80% is in the hands of Mr. Lichtstein and his father.

Profit & Loss and Financial Situation

According to Mr. Lichtstein,

“the first three years of operations, from 2003 to 2005, were really tough: we had to

invest a lot in inventory and reform the facilities, plus hire new people and train them,

plus define the product catalog, selling process, etc.… really hectic! And, on top of that,

you don’t have enough customers to make a profit. But I am really satisfied: we achieved

terrific growth, tripling sales in only three years; we already have a team of committed

people, good customer satisfaction and product reliability.

In 2007, we had sales of almost €3 million and a reasonable profit of €50,000. I see a lot

of sales growth potential. For example, in Lombardy (Italy) a medium-size distributor of

2 IESE Business School-University of Navarra

PolyPanel. Financing Growth F-869-E

panels sells around €5 million. In Bavaria we have more industrial activity, economic

growth and fewer distributors of panels. I don’t see any reason why we couldn’t reach

€5 million or €7 million in sales in a few years. My target is 25% sales growth annually

during the next three years. If we maintain our COGS at around 70%, with that level of

This document is an authorized copy for the course “Finance for Managers” taught by Prof. Miguel Antón

sales I am convinced we will make a good profit.

Our main investment is the inventory (we typically have around 60 days of sales) and

receivables from customers (60-day bill for most of the customers, although there are a

few that are billed at 90 days). We pay the supplier at 60 days; if we pay cash they offer

a 2% discount for early payment, but so far I haven’t used it. Our investment in fixed

assets is as small as possible. We have a rented warehouse of 900 m2 plus another 200 m2

for administrative offices. Most of the machinery is also rented.

By far, the main problem during these first years has been the lack of financing. I started

with only the €60,000 that I could gather from my father and my small savings. I knew

that we would have losses during the first years and we didn’t have the money to cover

them. But if you wait until you get all the money you need, you never start the business.

I thought: go for it, and we will see how to survive.

I have been trying to get money from anywhere. After two years, in 2005 we increased

capital. At present we have invested €300,000 of our own money, which I got from

mortgaging my house. The second year I borrowed from friends.2 I have negotiated with

many banks and savings banks to get credit lines. At present, I have seven of around

€50,000 each. Now I want to replace these seven lines with only one of half a million

euros, and with only one saving bank that understands our business. With this move we

will have tackled the permanent cash stress.”

Perspective of the Bank

The director of the local branch of the savings bank knew Mr. Lichtstein since the very

beginning of PolyPanel. He had granted a line of credit of €50,000 in 2004. Now, in 2007, the

savings bank was looking for growth opportunities and expansion, especially to support local

and promising new companies. PolyPanel could be one of them. After four years (2002-2005)

of slow growth (around 0%), the economic environment in Germany was clearly improving:

economic growth reached almost 4% during the years 2006-2007 and the perspective for the

coming years, especially within the industry, was optimistic.

As part of the credit analysis, the savings bank had contacted the main supplier of PolyPanel,

who provided a good opinion about Mr. Lichtstein.

“We have had commercial relations with Mr. Lichtstein during the last four years. He is

our main distributor in Bavaria. We knew that he would face the typical problems of a

new company, but we bet on him. He is prudent, a hard worker, keeps control of the costs

and financing, and has sound judgment about his business.”

2 In the balance sheet: “other liabilities.”

IESE Business School-University of Navarra 3

F-869-E PolyPanel. Financing Growth

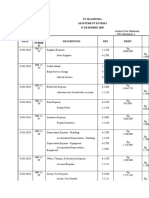

Exhibit 1

PolyPanel. Profit & Loss Account

This document is an authorized copy for the course “Finance for Managers” taught by Prof. Miguel Antón

Forecast

P&L (Thousands of Euros) 2004 2005 2006 2007 2008 2009 2010

Sales 977 1,500 2,200 2,936 3,650

COGS 684 1,035 1,540 2,052

Transportation & commercial exp. 69 108 145 208

Gross margin 224 357 515 676

Salaries 166 203 253 336 − − −

Overhead 120 153 181 221 − − −

Opex (operational expenses) 286 356 434 557

EBITDA -62 1 81 119

Depreciation 20 33 31 31 30 30 30

EBIT -83 -32 50 88

Financial results -8 -15 -22 -30

Profit before taxes -91 -47 28 58

Taxes (25%) 23 12 -7 -15

Net income -68 -35 21 44

Pro memoriam:

Purchases 775 1,052 1,656 2,179

Salary of Mr. Lichstein 60 90 90 100

New investments in FA 1 117 9 8

P&L Ratios Media Assumptions

Growth of sales 170% 24% 25% 25%

COGS / Sales 70% 70% 70%

Transportation / Sales 7% 7% 7%

Gross margin / Sales

Growth of salaries 46% − − −

Growth of overhead 20% − − −

Growth of opex 34% − − −

Opex / Sales 19% 19% 19%

EBITDA / Sales

ROS (Net income / Sales)

RONA (EBIT / Net assets)

ROE (Net income / Equity)

Interest rate, average 6% 6% 6%

Guidelines

1. Calculate the P&L ratios and then do your analysis.

2. For the forecast, use the assumptions in bold and green.

Source: Own elaboration.

4 IESE Business School-University of Navarra

PolyPanel. Financing Growth F-869-E

Exhibit 2

PolyPanel. Balance Sheets

SAF Forecast

This document is an authorized copy for the course “Finance for Managers” taught by Prof. Miguel Antón

Balance (thousand €) 2004 2005 2006 2007 2004-07 2008 2009 2010

Cash 1 8 6 6 0 0 0

Receivables 188 305 473 649

Other 42 56 38 18 0 0 0

Inventory 192 209 325 452

Current assets 423 578 842 1.125

Non current assets 60 144 123 100 100 100 100

TOTAL ASSETS 483 722 965 1.225

Payables to suppliers 131 210 390 400

Promissory notes with supplier 162

Other liabilities 151 74 35 22 0 0 0

Bank lines of credit 100 122 202 310 Leave it empty. See line 68.

Current liabilities 382 406 627 894

Long term debt 100 200 200 150 120 90 60

Capital 150 300 300 300

Reserves -81 -149 -184 -163

Net income of the year -68 -35 21 44

Equity 1 116 137 181

LIABILITIES + EQUITY 483 722 964 1.225

Credit needed 0 0 0

SAF Forecast

Short Balance Sheet 2004 2005 2006 2007 2004-2007 2008 2009 2010

NFO 140 286 411 535

NCA, not current asset, net 60 144 123 100

NA, net assets 200 430 534 635

D, Bank debt 200 322 402 460

E, Equity 1 116 137 181

Liabilities + Equity 201 438 539 641

Cash surplus (+) or credit (-) 1 8 6 6

NFO vs. WC

NFO 140 286 411 535

WC 41 172 215 231

Cash (+) or credit (-) net -99 -114 -196 -304

Balance ratios

Days of collection 80 80 80

Days of inventory 80 80 80

Days of payment 90 90 90

NFO / Sales

Source: Own elaboration.

IESE Business School-University of Navarra 5

You might also like

- Prueba de PreeceDocument18 pagesPrueba de PreeceSebastián AlmagroNo ratings yet

- Working Capital Management PDFDocument238 pagesWorking Capital Management PDFdarshinidave21No ratings yet

- 6) Fundamentals-Entrepreneurial-Management - tcm41-190276 PDFDocument7 pages6) Fundamentals-Entrepreneurial-Management - tcm41-190276 PDFHaris -No ratings yet

- Loewe: Commitment To Lean Management?Document8 pagesLoewe: Commitment To Lean Management?Hamza MoshrifNo ratings yet

- Spring Week GuideDocument32 pagesSpring Week Guidevimanyu.tanejaNo ratings yet

- Bang & Olufsen (B&O)Document17 pagesBang & Olufsen (B&O)Katarzyna KluczekNo ratings yet

- Almanac of Business and Industrial Financial RatiosDocument14 pagesAlmanac of Business and Industrial Financial Ratiosapi-32128050% (1)

- Ltcma Full ReportDocument130 pagesLtcma Full ReportclaytonNo ratings yet

- PolyPanel PrepSheet Week 2Document1 pagePolyPanel PrepSheet Week 2satyaban sahoo100% (1)

- Amplify University TrainingDocument11 pagesAmplify University Trainingshariz500100% (1)

- Group Project 2, S011Document1 pageGroup Project 2, S011Himanshu MalikNo ratings yet

- Case Study BriefingDocument5 pagesCase Study BriefingZohaib AhmedNo ratings yet

- 6 Unit 8 Corporate RestructureDocument19 pages6 Unit 8 Corporate RestructureAnuska JayswalNo ratings yet

- IEUK22 IBD - Work Sample Brief and DebriefDocument15 pagesIEUK22 IBD - Work Sample Brief and DebriefChia-Ju ChengNo ratings yet

- London 2011Document32 pagesLondon 2011Amandine JayéNo ratings yet

- TRANSFER PRICING AT TIMKEN Update 2017Document13 pagesTRANSFER PRICING AT TIMKEN Update 2017ihsan hassouneNo ratings yet

- MOR 555: Designing High-Performance Organizations: Padler@usc - EduDocument18 pagesMOR 555: Designing High-Performance Organizations: Padler@usc - EduRandip SonowalNo ratings yet

- Individual Assignment 1 - Analysis For Quality Alloys, IncDocument9 pagesIndividual Assignment 1 - Analysis For Quality Alloys, IncCarolina JativaNo ratings yet

- Solving The Solutions ProblemDocument5 pagesSolving The Solutions ProblemAshish MurchiteNo ratings yet

- FIN4414 TapleyDocument31 pagesFIN4414 TapleyAnz Rosaceña CompuestoNo ratings yet

- Assignment Grading Course: Name Strategy Map For Domestic Auto Parts Your Name Professor's Name (Optional) UniversityDocument4 pagesAssignment Grading Course: Name Strategy Map For Domestic Auto Parts Your Name Professor's Name (Optional) UniversityADITYAROOP PATHAKNo ratings yet

- Case Interviews 2 11-12 PDFDocument194 pagesCase Interviews 2 11-12 PDFPoojaKumariNo ratings yet

- Gyration Keyboard ManualDocument24 pagesGyration Keyboard Manualichung819No ratings yet

- FS Consulting Capital Markets - Case Study 1 (Regulatory Change)Document1 pageFS Consulting Capital Markets - Case Study 1 (Regulatory Change)FabrizioNo ratings yet

- Repuestas Cap 1 Investments 2010 Bodie, Kane, MarcusDocument6 pagesRepuestas Cap 1 Investments 2010 Bodie, Kane, MarcusElkin CalderonNo ratings yet

- Crown Cork Seal SolutionDocument6 pagesCrown Cork Seal SolutionkarthikawarrierNo ratings yet

- Michigan Case Deck 2005-2006Document101 pagesMichigan Case Deck 2005-2006Constantin Wedekind100% (1)

- Marden Company Group 4Document2 pagesMarden Company Group 4Pulkit Puri100% (1)

- Case Study PlansDocument2 pagesCase Study Plansalina lorenaNo ratings yet

- TransdigmDocument4 pagesTransdigmTMFUltimateNo ratings yet

- Barclays Capital and The Sale of Del Monte Foods - 313036 - ESPAÑOLDocument24 pagesBarclays Capital and The Sale of Del Monte Foods - 313036 - ESPAÑOLclaudiaNo ratings yet

- M&A Course SyllabusDocument8 pagesM&A Course SyllabusMandip LuitelNo ratings yet

- Apple Company's High Switching Cost To Enforce Customer Loyalty.Document10 pagesApple Company's High Switching Cost To Enforce Customer Loyalty.Diyaree FayliNo ratings yet

- Financial Modeling Resource GuideDocument7 pagesFinancial Modeling Resource GuideIshaan Tarkunde100% (1)

- Introduction To Valuation: Case: Liston Mechanics CorporationDocument9 pagesIntroduction To Valuation: Case: Liston Mechanics CorporationKunal MehtaNo ratings yet

- Fin 653Document6 pagesFin 653adhi_nub0% (1)

- Case Discussion Questions Fall 2010Document6 pagesCase Discussion Questions Fall 2010j_zaikovskayaNo ratings yet

- Mid Term Exam - BM - 19P104Document5 pagesMid Term Exam - BM - 19P104RahulSamaddarNo ratings yet

- Dell Computers Case StudyDocument22 pagesDell Computers Case StudyDeepak SahniNo ratings yet

- IIM Ahmedabad Summer Placements 2015-16 Job Description FormDocument2 pagesIIM Ahmedabad Summer Placements 2015-16 Job Description FormAnonymous H8AZMsNo ratings yet

- Leading Across Cultures at Michelin (A)Document6 pagesLeading Across Cultures at Michelin (A)Teodora BirslNo ratings yet

- Precision Worldwide, Inc. Case StudyDocument3 pagesPrecision Worldwide, Inc. Case Studytico6020% (1)

- How To Build A Pitch Deck: Duvet BusinessDocument24 pagesHow To Build A Pitch Deck: Duvet Businessabhinav5424No ratings yet

- Final AssignmentDocument4 pagesFinal AssignmentAftab MajeedNo ratings yet

- Fs App BibleDocument28 pagesFs App Bibleroy064No ratings yet

- How To Think Like A Strategy Consultant A Primer For General Managers1Document3 pagesHow To Think Like A Strategy Consultant A Primer For General Managers1jexxicuhNo ratings yet

- Mid MarketDocument234 pagesMid Marketfarafin100% (1)

- Sem1 DR - BRR Case Module1Document4 pagesSem1 DR - BRR Case Module1dhrjmjnNo ratings yet

- WST Macros Add-In InstructionsDocument3 pagesWST Macros Add-In InstructionsTrader CatNo ratings yet

- SybilaDocument2 pagesSybilaragastrmaNo ratings yet

- Better World BooksDocument11 pagesBetter World BooksAditya GargNo ratings yet

- Corality SMART Guideline 3Document2 pagesCorality SMART Guideline 3Ziv SadeNo ratings yet

- AVK Corporate Brochure PDFDocument48 pagesAVK Corporate Brochure PDFhosny1987No ratings yet

- Emmtrix Technologies: Patent Negotiations in High-Tech Academic SpinoffsDocument6 pagesEmmtrix Technologies: Patent Negotiations in High-Tech Academic SpinoffsAli RebbajNo ratings yet

- Eco Revive Feasibility Study 2018-2019Document100 pagesEco Revive Feasibility Study 2018-2019Lynell Demafelix LlorenteNo ratings yet

- Nestlé Philippines Awarded Grant For Coffee Project: Wastewater Treatment Plants Showcase Nestlé's Compliance CultureDocument7 pagesNestlé Philippines Awarded Grant For Coffee Project: Wastewater Treatment Plants Showcase Nestlé's Compliance CultureConradoCantoIIINo ratings yet

- A. Company, Product Profile and Financial PlanDocument5 pagesA. Company, Product Profile and Financial PlanJubilyn LiborNo ratings yet

- A Technical Report On Six 6 Months StudeDocument24 pagesA Technical Report On Six 6 Months StudeAdeyinka Samuel AdedejiNo ratings yet

- J Esthet Restor Dent - 2018 - Corcodel - Effects of Staining and Polishing On Different Types of Enamel Surface SealantsDocument7 pagesJ Esthet Restor Dent - 2018 - Corcodel - Effects of Staining and Polishing On Different Types of Enamel Surface Sealantsbodas de plata Odontologia UNFVNo ratings yet

- I Panels: One Hand. One Bill. One EnvironmentDocument17 pagesI Panels: One Hand. One Bill. One Environmentprashant agarwalNo ratings yet

- Souvenirs To ForgetDocument21 pagesSouvenirs To ForgetJohnatanSolorzanoNo ratings yet

- Megamarketing The Creation of Markets As A SocialDocument20 pagesMegamarketing The Creation of Markets As A SocialJohnatanSolorzanoNo ratings yet

- When Brand Attitudes Affect The Customer Satisfaction-Loyalty Relation - The Moderating Role of Product InvolvementDocument14 pagesWhen Brand Attitudes Affect The Customer Satisfaction-Loyalty Relation - The Moderating Role of Product InvolvementJohnatanSolorzanoNo ratings yet

- A Survey of Addictive Software DesignDocument12 pagesA Survey of Addictive Software DesignJohnatanSolorzanoNo ratings yet

- When - Brand - Attitudes - Affect - The - Customer20151108 5526 1qmux2b With Cover Page v2Document12 pagesWhen - Brand - Attitudes - Affect - The - Customer20151108 5526 1qmux2b With Cover Page v2JohnatanSolorzanoNo ratings yet

- MegamarketingDocument11 pagesMegamarketingJohnatanSolorzanoNo ratings yet

- BRM R3 - Dimensions of Brand PersonalityDocument11 pagesBRM R3 - Dimensions of Brand PersonalityHEM BANSALNo ratings yet

- Annual Report 2017 Parcial PDFDocument5 pagesAnnual Report 2017 Parcial PDFJohnatanSolorzanoNo ratings yet

- PT SejahteraDocument2 pagesPT Sejahtera202010415109 ADITYA FIRNANDONo ratings yet

- M5&M6 SC - Other AJE & WorksheetDocument47 pagesM5&M6 SC - Other AJE & WorksheetLady Ysabel HechanovaNo ratings yet

- Sample Bakery Business PlanDocument12 pagesSample Bakery Business PlanLoloy DiangoNo ratings yet

- CH 1 Funamentals of Acct - II - InventoriesDocument35 pagesCH 1 Funamentals of Acct - II - InventoriesNatnael AsfawNo ratings yet

- Advance Accounting B.com Part 2 Chapter 2 Notes3Document20 pagesAdvance Accounting B.com Part 2 Chapter 2 Notes3Anonymous 0SAPpOKtKNo ratings yet

- NABARDDocument58 pagesNABARDbibinNo ratings yet

- ZCMA6082 S7 SS2223 Group ProjectDocument26 pagesZCMA6082 S7 SS2223 Group ProjectNOR ADLI HAKIM BIN ZAKARIANo ratings yet

- Cash Flow Analysis - Docx in Food and InnsDocument53 pagesCash Flow Analysis - Docx in Food and InnsLokesh Reddy Kalijavedu0% (1)

- Financial Feasibility: 4.1 Total Start Up Cash NeededDocument5 pagesFinancial Feasibility: 4.1 Total Start Up Cash NeededAmna Arif100% (1)

- ECPL Case Study DocumentDocument4 pagesECPL Case Study Documentdvishal7No ratings yet

- Reconstitution & Admission of PartnerDocument21 pagesReconstitution & Admission of PartnerSagar ManghwaniNo ratings yet

- Learning Resource 1 Lesson 4 PDFDocument14 pagesLearning Resource 1 Lesson 4 PDFJerald Jay Capistrano Catacutan100% (1)

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument25 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsCherry Velle TangogNo ratings yet

- Management Accounting Chapter 2Document74 pagesManagement Accounting Chapter 2yimerNo ratings yet

- Chapter 13 Advacc2Document27 pagesChapter 13 Advacc2Anthony Ariel Ramos Depante0% (1)

- Accounting For InventoriesDocument9 pagesAccounting For InventoriesPrince AngelNo ratings yet

- Cv1e SM ch06 PDFDocument10 pagesCv1e SM ch06 PDFYu FengNo ratings yet

- 06 Financial Statement Preparation, Closing Entries, and Reversing EntriesDocument18 pages06 Financial Statement Preparation, Closing Entries, and Reversing Entriescarlo bundalianNo ratings yet

- QuestionsDocument117 pagesQuestionsPriyanshu BhattacharyaNo ratings yet

- Acca f7Document76 pagesAcca f7iftikharali1100% (6)

- Partnership NotesDocument31 pagesPartnership NotesAimee100% (1)

- تمرين 1Document4 pagesتمرين 1نجم الدين طه الشرفيNo ratings yet

- Absorption and Marginal CostingDocument58 pagesAbsorption and Marginal CostingtokyadaluNo ratings yet

- Accounting For Joint and By-ProductsDocument16 pagesAccounting For Joint and By-ProductsElla DavisNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPalex v.m.No ratings yet

- Dlta - Icmd 2009 (B01)Document4 pagesDlta - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence LoplopNo ratings yet

- Sap Fico Fi NotesDocument191 pagesSap Fico Fi NotesSampad Das100% (1)

- Gulane Cleaners Accounting WorksheetDocument4 pagesGulane Cleaners Accounting WorksheetsanchezrowNo ratings yet

- Financial Statements of A CompanyDocument34 pagesFinancial Statements of A CompanykingNo ratings yet

- How to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpFrom EverandHow to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpRating: 4 out of 5 stars4/5 (74)

- 101 Great Answers to the Toughest Interview QuestionsFrom Everand101 Great Answers to the Toughest Interview QuestionsRating: 3.5 out of 5 stars3.5/5 (29)

- Get That Job! The Quick and Complete Guide to a Winning InterviewFrom EverandGet That Job! The Quick and Complete Guide to a Winning InterviewRating: 4.5 out of 5 stars4.5/5 (15)

- Consulting Interview: How to Respond to TOP 28 Personal Experience Interview QuestionsFrom EverandConsulting Interview: How to Respond to TOP 28 Personal Experience Interview QuestionsRating: 5 out of 5 stars5/5 (3)

- Unbeatable Resumes: America's Top Recruiter Reveals What REALLY Gets You HiredFrom EverandUnbeatable Resumes: America's Top Recruiter Reveals What REALLY Gets You HiredRating: 5 out of 5 stars5/5 (2)

- A Joosr Guide to... What Color is Your Parachute? 2016 by Richard Bolles: A Practical Manual for Job-Hunters and Career-ChangersFrom EverandA Joosr Guide to... What Color is Your Parachute? 2016 by Richard Bolles: A Practical Manual for Job-Hunters and Career-ChangersRating: 4 out of 5 stars4/5 (1)

- The Resume and Cover Letter Phrase Book: What to Write to Get the Job That's RightFrom EverandThe Resume and Cover Letter Phrase Book: What to Write to Get the Job That's RightRating: 4 out of 5 stars4/5 (9)

- COBOL Programming Interview Questions: COBOL Job Interview PreparationFrom EverandCOBOL Programming Interview Questions: COBOL Job Interview PreparationRating: 4.5 out of 5 stars4.5/5 (2)

- How to Make Money and Bigger Tips as a WaitressFrom EverandHow to Make Money and Bigger Tips as a WaitressRating: 3 out of 5 stars3/5 (1)

- The Elements of Resume Style: Essential Rules for Writing Resumes and Cover Letters That WorkFrom EverandThe Elements of Resume Style: Essential Rules for Writing Resumes and Cover Letters That WorkNo ratings yet

- Job Interview: Outfits, Questions and Answers You Should Know aboutFrom EverandJob Interview: Outfits, Questions and Answers You Should Know aboutRating: 5 out of 5 stars5/5 (4)

- Job Interview: The Complete Job Interview Preparation and 70 Tough Job Interview Questions with Winning AnswersFrom EverandJob Interview: The Complete Job Interview Preparation and 70 Tough Job Interview Questions with Winning AnswersRating: 4 out of 5 stars4/5 (7)

- Developing Soft Skills: An On-the-Go WorkshopFrom EverandDeveloping Soft Skills: An On-the-Go WorkshopRating: 4 out of 5 stars4/5 (7)

- Job Interview: How to Talk about Weaknesses, Yourself, and Other Questions and AnswersFrom EverandJob Interview: How to Talk about Weaknesses, Yourself, and Other Questions and AnswersRating: 4.5 out of 5 stars4.5/5 (15)

- The Resume That Gets You Hired: Secrets of Writing Powerful Resume & Cover Letter to Land Your Dream Job, Samples & Templates IncludedFrom EverandThe Resume That Gets You Hired: Secrets of Writing Powerful Resume & Cover Letter to Land Your Dream Job, Samples & Templates IncludedRating: 3.5 out of 5 stars3.5/5 (8)

- The Complete Cover Letter Examples PackageFrom EverandThe Complete Cover Letter Examples PackageRating: 3.5 out of 5 stars3.5/5 (4)

- Top Notch Executive Resumes: Creating Flawless Resumes for Managers, Executives, and CEOsFrom EverandTop Notch Executive Resumes: Creating Flawless Resumes for Managers, Executives, and CEOsRating: 5 out of 5 stars5/5 (1)

- The STAR Method Explained: Proven Technique to Succeed at InterviewFrom EverandThe STAR Method Explained: Proven Technique to Succeed at InterviewRating: 4 out of 5 stars4/5 (4)

- The 250 Job Interview Questions: You'll Most Likely Be Asked...and the Answers That Will Get You Hired!From EverandThe 250 Job Interview Questions: You'll Most Likely Be Asked...and the Answers That Will Get You Hired!Rating: 4 out of 5 stars4/5 (5)

- How to Get a Job Using LinkedIn? The Most Effective Way to Get the Job of Your DreamsFrom EverandHow to Get a Job Using LinkedIn? The Most Effective Way to Get the Job of Your DreamsRating: 5 out of 5 stars5/5 (29)

- Top Secret Executive Resumes, Updated Third EditionFrom EverandTop Secret Executive Resumes, Updated Third EditionNo ratings yet

- How to Get a Good Job After 50: A step-by-step guide to job search successFrom EverandHow to Get a Good Job After 50: A step-by-step guide to job search successNo ratings yet

- Virtual Gal Friday's Virtual Assistant Start Up GuideFrom EverandVirtual Gal Friday's Virtual Assistant Start Up GuideRating: 4 out of 5 stars4/5 (2)

- Nailing the Job Interview Freeway Guide: Prepare and Get Hired!From EverandNailing the Job Interview Freeway Guide: Prepare and Get Hired!Rating: 4 out of 5 stars4/5 (7)

- Rise: The Secret Art Of Getting Promotion: Steps For Advancing Your Career, Standing Out As A Leader, And Liking Your Life And JobFrom EverandRise: The Secret Art Of Getting Promotion: Steps For Advancing Your Career, Standing Out As A Leader, And Liking Your Life And JobNo ratings yet

- Amazon Interview Secrets: How to Respond to 101 Popular Amazon Leadership Principles Interview QuestionsFrom EverandAmazon Interview Secrets: How to Respond to 101 Popular Amazon Leadership Principles Interview QuestionsRating: 5 out of 5 stars5/5 (4)