Professional Documents

Culture Documents

Asset Based Valuation

Asset Based Valuation

Uploaded by

Bhosx Kim0 ratings0% found this document useful (0 votes)

820 views13 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

820 views13 pagesAsset Based Valuation

Asset Based Valuation

Uploaded by

Bhosx KimCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

(ee (on edah yw ui lterasy

ASSET-BASED VALUATION

in business, there are alot of opportunities available inthe

Investors are eager to expand their portfolio by securing more a

and improving their basket of investment to mitigate the risk anj

;

AUS,

im

their returns. Most investors diversify their investment in various"

opportunities, but the challenge is determining the value on how my |

ct

are willing to acquire it. they

Asset has been defined by the industry as transactions that wg

yield future economic benefits as a result of past transactions. Hence wf

\alue of investment opportunites is highly dependent on the value that

asset will generate from now until the future. The value should ~

aS0 includ

all cash fiows that will be generated until the disposal of the asset,

In practice, observe valuation as a sensitive and confidential activ

in their portfolio management. Valuation should be kept confidential to ato,

the company to negotiate a better position for them to acquire an

‘opportunity. Since the value of the assets will depend on its ability to

‘generate economic benefits. It is more challenging to determine the values

green field investment since all shall be based on purely estimate than

brown field. Recall, the green field investments are those started from

scratch while brown field investment are those opportunities that either

partially or fully operational. Brown field investments are those already in te

going concem state, as most business are in the optimistic perspective tha

they will grow in the future. Therefore, they can also be considered as going

concer business opportunities (CBOs). Going concem business

opportunities are those businesses that has a long term into infinite

operational period.

The beauty of GCBOs is that we already have a reference for the

performance either on similar nature of business or from its historical

performance. With this, the risk indicators can be identified easily and

therefore can be quantified accordingly. The Committee of Sponsoring

Organization of the Treadway Commission (COSO) suggests that risk

management principles must be observed as well in doing businesses and

determining its value. It was noted in their report that the benefits of having

a sound Enterprise-wide Risk Management allows for the company to:

(1) increase the opportunities; os

(2) facilitates the management and identification of the risk fac!

that affect the business;

es a ee

—!

Seca

(3) identify or create cost-efficient opportunities

(4) manages the performance variability

(6) improve management and distribution of resources across the

enterprise; and

(6) make the business more resilient to abrupt changes.

‘The importance of identifying the risk is to enable the investors to quantify

the impact of the risk and/or the cost of managing these risks. Theoretically,

in valuation since it is more on the economic benefits valuation to determine

the asset value, the pertinent and anticipated outfiows must be included.

The critical part in valuing an opportunity is determining is value as

an asset for the investor or the enterprise. For GCBOs, there are different

‘approaches that can be used, the most popular are: discounted cash flows

or DCF analysis and comparable companies analysis, and economic value

added

Discounted Cash Flows Analysis

In Financial Management, it has been discussed that a way to

determine the value of an investment opportunity is by determining the

actual cash generated by 2 particular asset. Recall that discounted cash

flows analysis can be done by determining the net present value of the Net

Cash Flows of the investment opportunity. In Conceptual Framework and

‘Accounting Standards, it was discussed the that the cash flows are

presented and analyzed based on their sources and activities which are

categorized as operating, investing and financing. In determining the value

of an asset, the cash flows are important reference or inputs. Note that in

determining the value of the asset what should be included are the amount

of cash that will be available for the claims of the equity owners.

‘The Net Cash Flows are the amounts of cash available for

distribution to both debt and equity claim from the business or asset. This is

calculated from the net cash generated from operations and for investment

over time, For GCBO, the net cash flows generated will be based on the

cash flows from operating and investing activities, since this represents

already the amount eared or will be earned from the business and the

‘amount that is required for you to infuse in the operations to generate more

profit. Theoretically, it can be equated as:

Lr

Free Cash Flows

= Revenue ~ Operating Expe

~ Capital Expenditures

AEE Mae tyars

nditures —

Taxes

Let's bear in mind that this is cash flows ba

majors and professionals, you should consider t

expenditures mentioned here pertains to those

Level of Eamings Before Interest, Depreciation

allow the investor to determine the true value o

amount it economically generated less the am

advantage of EBITDA is that it already exclud

cost of financing the asset, taxes you pay to t!

‘should be accounted separately, and depreci

Bart ofthe capital expencitures which will be deducted separ,

EBITDA Margin or the level of earnings you earn from the sales eni

ab

investor to have an overview ofthe opportunity they are going to wea

among others. a

Sed. For

rm

above the EBITDA ,

and Amortization, yy Velo:

f the asset based on Aa

unt youve spent, te?

5 interest that epretens

he government because st?

lation and amortization 4

ately as

There are two levels of Net Cash Flows: (1) Net Cash Fi

Firm; and (2) Net Cash Flows to Equity. The Net Cash Fiowe 1

represents the cash flows which was described in the

This is the amount made available to both debt and e

the company. The Net Cash Flo

flows made available to the equi

or the outstanding liabilities to

the company,

|0WS to the

10 the Finn

Preceding paragraph

quity claims against

ws to Equity represents the amount of cash

lity stockholders after deducting the net deb

he creditors less available cash balance of

‘Since GCBOs is assumed to Operates in a long period of time to

almost perpetuity. The risk and fetums are inherent to the ‘Opportunity

‘should also be quantified. Furthermore, the economic value that will be

Generated by the assets is expected to stable after some point in time, since

the projections are reliant on certain assumptions made. The challenge for

the determination of the value of the asset is to also account for the

economic returns that it will generate in perpetuity. This is addressed by the

Terminal Value. Terminal Value represents the value of the company in

Perpetuity or in a going concern environment. The convenient way to

determine the terminal value or terminal cash flows is through this equation

CFn

Meera uae

TV = Terminal Value

CFn = Farthest net cash flows

9 = growth rate

To illustrate, suppose that a company assumes net cash flows as

follows:

‘Year| Net Cash Flows

(in million Php) __|

|

5.00

— 5.50

6.05

6.66

7.32

eo}

lon}

In the given illustration, you may note that the net cash flows are growing

annually. Assuming this is a GCBO, and itis expected that the net cash

flows will behave on a normal trend. The growth rate (g) is computed using

compounded annual growth rate formula

NCFe = net cash flows at the beginning

latest net cash flows

latest time

Substituting the given figures the growth is computed as

g= 0.10

‘The growth rate is 0.10 or conversely 10%. In the illustration it will be

assumed that the company will continuously grow by 10% from 5 year

onwards. With this, the terminal value is Php 73.20 Million computed as

follows

TV = 73.20

The net present value of the Net Cash Flows represents

the assets. It may be recalled futher that the assets are financed by gett

and equity. Hence, these are the claims which are presented at the ight

side of the Statement of Financial Position, under an account form of

reporting

the value og

The discounted cash flows analysis factors in all the projecteg

stream of cash flows that the project, opportunity or investment

it in present ime to determine whether the investment made on this year

would be less than the value it will generate in the future, that means the

investment yielded an amount sufficient to cover the investment and

allowing the investors to eern more. Same principle applies that the best

Cpportunity is the one that wil yield the highest net present value or solely

the opportunity will result into a positive amount it should be accepted

Conservatively, the total outstanding liabilities must be considered and

deducted versus the asset value to determine the amount appropriated to

the equity shareholders. This is called the equity value, The opportunity that

will result to the highest equity value is considered.

NG Valuing

DCF Analysis is most applicable to use when the following are

available:

* Validated Operational and Financial Information

+ Reasonable appropriated cost of capital or required rate of reun

* New quantifiable information

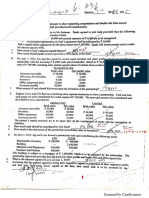

Supposed Bagets Corporation projected to generate the following for the

next five years, in million pesos:

Revenue | Operating Exp™ Taxes

2.88 65.01 8.36

102.17 71.52 9.19

112.38 78.67 70.11

123.82, 86.53 11.43

135.98 95.19 12.24

Me eae oats

“Operating Expenses exclude depreciation and amortization

The capital expenditures that was purchased and invested in the company

amounted to Php 100 Million. The terminal value was assumed to be

computed using 10% growth rate. It was noted further that there is an

outstanding loan of PhpS0 Million. If you are going to purchase 50% of

Bagets Corporation, assuming a 7% required return, how much would you

be willing to pay?

(ron pesos Year

2 2 eee

Reverse Toni] 1238] 2362

Les: Operating Expenses (exd Depredaton] 7s? 3553

ess Income Taves Paid [ 929 101] 1233

ess Capital Exp Tae [

Net Cash Flows toaco| 1950] 2145] 7500) 2596 [ 2856)

fas: Terminal value T_T 556

[ree Cosh Flows wooo] 1950] zia5| 2500] a5s6| 3140

|yttply Dscount Facer OD zoo] oss[ oar] om] 076] 7

[Discounted Fre Cash Flows sono | 1a23 | aa7e[ 1926] 1980] 2356

Fre cash Flows. firm 200.00

Les: Oustanding oars 0)

Free Cash Flows Equity 7000

Based on the foregoing information, the value of Bagets Corporation equity

is Php 150 Million. If the amount at stake is only 50% then the amount to be

paid is Php13.33 Million (Php26.65 x 50%).

Comparable Company Analysis

In Financial Management, financial ratios are used as tools to

assess and analyze business results. Recall that one of these purposes can

be used to determine the value. These financial ratios are P/E Ratio, Book

to Market Ratio, Dividend Yield Per Share and EBITDA Multiple. Ratios or

Multiples are useful tools for doing comparative company analysis. The

advantage of having ratios and multiples is that it creates better and relevant

comparison knowing that opportunities or investments have distinct drivers

of their performance. Economic Value Added can also be used as a

‘comparator or as tool in comparable company analysis.

Comparable company analysis is a technique that uses relevant

drivers for growth and performance that can be used as proxy to set a

reasonable estimate for the value of an asset or investment prospective

(Rene

In determining the value using comparable company ana

following factors must be considered: NSIS the

eae Urey

+ Comparators must be at least with the similar o

similar industry

* Total and absolute values should not be compareg

+ Variables used in determining the ratios must be ¢

+ Period of observation must be comparable

+ Non quantitative factors must also be considered

Perations oy

he same

Price - Earnings Ratio

PIE Ratio represents the relationship of the m

share and the earnings per share. It sends the signal

the market perceives the value of the company as cor

it actually earned. P/E Ratio is computed using the fo

arket Valu py

on how much

MPAKEd to vty

mula

Market Value Per Share

ee ne

Fe Earnings Per Share

To illustrate, Chandelier Co. is a listed company with the

market value per share of Php12.0 and reported earnings per share

‘of Php4.0. Using the equation the P/E ratio is 3. This means that he

Chandelier Company can create 3x the value of what it earns.

PIE Ratio is also known as P/E Multiples or Price Mutiples

To determine the value of a company, using P/E ratio. Management

accountants and analysts uses P/E of the comparable company. Far

instance, an Jopet Hotels and Leisure is a hospitality company.

Based on the income statement of the company, it reported earnings

of Php7.00 per share. Based on the listed companies under

hospitality industry the average P/E ratio is 4.25. With the foregoing

information, you can expect that the value of Jopet Hotels and

Leisure is Php29.75 per share [Php29.75 = Php7.00 x 4.25]

Book-to-Market Ratio

Book-to-Market ratio is used to determine the appreciation

the market to the value of the company as oppose tothe valle

feported under its Statement of Financial Position. It may ber

that the book values of the company are based on historical cos"

MUN anes

and does not purely incorporates the value of the market. However,

the only limitation of this ratio is that certain values incorporated

does not represent the true value of the company. Hence, further

due diligence is imperative

Book-to-Market ratio is computed using this equation:

Net Book Value Per Share

Book to Marker oot ereernae

iz Market Value Per Share

Book Value per share can be derived by dividing the net book value

to the number of outstanding shares available to common or

ordinary. Net book value is the difference of the total assets and the

total liabilities, This represents the claim of the equity stockholders to

the company

To illustrate, Chandelier Co. reported a Book Value per share of

Php36 and with a market value per share of Php12.50. The Book-to-

Market ratio is 2.80 which is computed as follows:

35.0

Mu =

Book to Market = ==,

Book to Market = 2.80

This means that for every Php36 per share that is owned by a

stockholder it is 2.8x larger than its value in the market.

If Book-to-Market approach is used for comparable company

analysis, the key component of the financial statement needed is the

Statement of Financial Position. To illustrated, Jopet Hotels and

Leisure reported a book value per share of Pnp16.5 and the

hospitality industry average Book-to-Market is 0.5 then the value of

Jopet Hotels and Leisure can be estimated around Php33 per share

[Php33 = Php 16.50 / 0.5}

Dividend-Yield Ratio

Dividend Yield Ratio describes the relationship between the

dividends received per share and the appreciation of the market on

the price of the company. Dividend-Yield Ratio is also known as

dividend multiple. Next to Price Earnings Multiple this is more

popular tool because it provides the investors with the value which

PE

METHODOLOGIES

PETE hace een

they can actually get from the company. This 's under the pri

Bird-incthe-Hand Theory popularized by Myron Gordon ang ome

Lintner. The theory assumes that the value of the firm is affe John

the dividends the company pays. ted by

The Dividend Yield Ratio (DYR) is computed using this equation

Dividend Per Share

DYR = Trarket Value Per Share

To illustrate, Chandelier Co. declared and paid dividends of

Php1.50 per share and their market value per share is Php12.50

Based on the foregoing, the dividend yield ratio is 0.12 computed as

follows.

Dividend Per Share

Php1.50

yR=

DYR = Fipi250

DYR = 0.12

This means that for every Php1.50 dividends they pay it wil

translate into 12% of the market value of the equity. Using this as @

tool for comparable company analysis, DYR will works as a multiplier

to the dividends per share declared by the company.

‘Suppose, that Jopet Hotels and Leisure declared Php1.5 pet

share and the average dividend multiple of the similar industry,

0.047. The market value per share is then can be estimated to be

around Php31.91 per share [Php31.91 = Php1.50 / 0.047]

EBITDA Muttiple

EBITDA or Earnings Before Interest, Taxes, Depreciation and

‘Amortization represents for the net amount of revenue after

deducting operating expenses and before deducting financial fixed

costs, taxes and non-cash expenses. Given the components,

EBITDA can serve as a proxy of cash flows from operating activi

before tax. Traditionally, cash flows from operating activities

Cerrar erered

represents is computed by collections less payments for operating

expenses or indirectly, net income add back depreciation and

amortization and adjusted to working capital adjustments.

EBITDA Multiple is determined by this equation

EBITDA Multiple = Market Value per Share

EBITDA per share

EBITDA per share is derived by dividing EBITDA into

outstanding share for common equity or ordinary share. To illustrate,

Chandelier Co. reported EBITDA per share of Php6 and the market

value per share being Php12.0. Given the equation the EBITDA

Multiple is 2 (2 = Php12.0 + Php6.0]

This means that the value of the firm to the market is 2x for

every peso of EBITDA eared, In practice, others adjusted the

EBITDA to incorporate costs relative to other quantified risks. This is

done by adding more costs or recognizing contingent expenses to

generate @ more conservative EBITDA results which will serve as

river for the value of the market.

To illustrate, Jopet Hotels and Leisure reported an EBITDA

multiple of Php8.50 per share. The average EBITDA multiple of the

hospitality industry is 3.5. Given the foregoing, the value of the equity

is about Php29.75 [Php29.75 = Php8.50 x 3],

To illustrate further, it also assumed that will have to procure

insurance and security costs to protect the plant assets of the

company. This is about Php0.5 per share. Given this additional

information on the foregoing, the value of equity is Php28.0 [Php28.0

= (Php8.50 ~ Php0.50) x 3.5]. You may note that the value of the

firm decreased by Php1.75 [Php1.75 — Php29.75 - Php28.0] after

the risk management cost is incorporated.

In summary, comparable company analysis uses tools to enable the

comparison between companies given the differences in 3s — Strategy,

Structure and Size. The objective is to enable the analyst or management

‘accountant to determine the value of the company based on the behavior of

similar businesses in the industry that more or less captured the risks

factors and other micro and macro-economic considerations.

(Renee

Inthe given itstration we can compare the results generated yi

comparable company analysis under various tools discusseg:

EBA Multicle Dividend Mutile Book to-market

We can say that after using various comparative tools the

price of Jopet

Hotels and Leisure is between Php29.75 to Php33.00, subject to due

diligence.

Economic Value Added

The most conventional way to determine the value of the asset is

through its economic value added. In Economics and Financial

Management, economic value added (EVA) is the convenient for this is

assessing the ability of the firm to support its cost of capital with i's earings

EVA Is the excess of the earnings ater deducting the cost of capital The

assumption is that the excess shall be accumulated for the fir the higher

the excess the better.

The elements that must be considered in using EVA are.

+ Reasonableness of earnings or returns

+ Appropriate cost of capital

The earnings can easily be determined, especially for GCBOs,

based on their historical performance or the performance of the similarly

situated company in terms of the 3s and risk appetite. The appropriate cost

Of capital will be lengthily discussed in the succeeding chapters can be

Cea or ater

determined based on the mix of financing that will be employed for the

asset. The EVA is computed using this formula.

EVA = Earnings ~ Cost of Capital

Cost of Capital = Investment value x Rate of Cost Capital

To illustrate, Chandelier Co. projected earnings to be Php350 Million

per year. The board of directors decided to sell the company for Php1,500

Million with a cost of capital appropriate for this type of business is 10%.

Given the foregoing the EVA is Php200 [Php350 — (Php1,500 x 10%}. The

result of Php200 Million means that the value offered by the company is

reasonable to for the level of earnings it realized on an average and

sufficient to cover for the cost for raising the capital

Other factors to be considered in Valuation:

Once the value of the asset has been established, there are factors

that can be considered to properly value the asset. These are the earning

accretion or dilution, equity control premium and precedent transactions.

Earning accretion are additional value inputted in the calculation that

would account for the increase in value of the firm due to other quantifiable

attributes like potential growth, increase in prices, and even operating

efficiencies. Eamings dilution works differently. But in both cases, these

should also be considered in the sensitivity analysis.

Equity Control premium is the amount that is added to the value of

the firm in order to gain control of it. Precedent transactions, on the other

hand, are experiences, usually similar with the opportunities available.

These transactions are considered risks that may affect further the ability to

realize the projected earings.

In determining the value of equi

first. Asset based valuation

Methodologies on asset based valuation are discounteq cas

or DCF analysis, comparable company analysis and €Conoy

added.

Discounted cash flows analysis is meticulous but more Conservatins

method or approach that can be use to determine the asset vais

it clearly demonstrate the movement of the transactions mi

Comparable company analysis is used to value the asset based op

the performance of simitar companies or firms within the same

industry. Ratios and multiples are good tools in order to Compare the

companies apples to apples e.g. PIE ratio, Book-to-Market Rati,

Dividend Yield, and EBITDA Multiple

Economic Value Added is a form of income approach in determing

the value of the company by determining any excess of the average

earnings after deducting the cost of capital.

Other valuation approaches are Earning Accretion that based the

value on the incremental attributes of the Project or assets; and

Equity control premium is the amount added to the value of the firm

in order to gain control

IS necessary t0 value the ay

Set

Sh flys

MI val

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Problem 2-1: Pagador, Janelyne CDocument6 pagesProblem 2-1: Pagador, Janelyne CBhosx KimNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Lecture 5 - Donor - S TaxDocument4 pagesLecture 5 - Donor - S TaxBhosx KimNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- I - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Document279 pagesI - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Bhosx KimNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- PFRS 3, Business Combination: A) Formation of A Joint Venture - PFRS 11, Joint ArrangementsDocument7 pagesPFRS 3, Business Combination: A) Formation of A Joint Venture - PFRS 11, Joint ArrangementsBhosx KimNo ratings yet

- Other Percentage TaxDocument42 pagesOther Percentage TaxBhosx KimNo ratings yet

- VCMDocument19 pagesVCMBhosx Kim100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- BOI ForDocument5 pagesBOI ForBhosx KimNo ratings yet

- Tax Incentives in Developing Countries - A Case Study-Singapore and PhilippinesDocument29 pagesTax Incentives in Developing Countries - A Case Study-Singapore and PhilippinesBhosx KimNo ratings yet

- COVID-19 Community Quarantines in The PhilippinesDocument7 pagesCOVID-19 Community Quarantines in The PhilippinesBhosx KimNo ratings yet

- Customer Relationship - Business Model CanvasDocument6 pagesCustomer Relationship - Business Model CanvasBhosx KimNo ratings yet

- Effect of Tax Incentives On The Growth of SMEs in RwandaDocument10 pagesEffect of Tax Incentives On The Growth of SMEs in RwandaBhosx KimNo ratings yet

- Avoid The Four Perils of CRMDocument14 pagesAvoid The Four Perils of CRMBhosx KimNo ratings yet

- Problem 13Document3 pagesProblem 13Bhosx KimNo ratings yet

- Idic ModelDocument12 pagesIdic ModelBhosx KimNo ratings yet

- Quiz Par. FRM & OpDocument4 pagesQuiz Par. FRM & OpReymart Castillo HamoNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationBhosx KimNo ratings yet

- Module 2A - CVP AnalysisDocument5 pagesModule 2A - CVP AnalysisBhosx KimNo ratings yet

- Dokumen - Tips Labor Law Memory AidDocument75 pagesDokumen - Tips Labor Law Memory AidBhosx KimNo ratings yet

- Lesson 1 1 PDFDocument14 pagesLesson 1 1 PDFBhosx KimNo ratings yet

- Donors TaxDocument29 pagesDonors TaxBhosx Kim100% (3)

- Final Deptal (10-14-18)Document5 pagesFinal Deptal (10-14-18)Bhosx KimNo ratings yet

- Principles of ValuationDocument20 pagesPrinciples of ValuationBhosx KimNo ratings yet

- Valuation Concepts and MethodologiesDocument17 pagesValuation Concepts and MethodologiesBhosx Kim20% (5)

- Midterm (08-14-16)Document6 pagesMidterm (08-14-16)Bhosx KimNo ratings yet

- Advac 1 Final Deptal (10-2-16) PDFDocument12 pagesAdvac 1 Final Deptal (10-2-16) PDFBhosx KimNo ratings yet

- Estate TaxDocument48 pagesEstate TaxBhosx Kim100% (1)

- Donors TaxDocument15 pagesDonors TaxBhosx KimNo ratings yet

- Intro To Donors Tax BanggawanDocument8 pagesIntro To Donors Tax BanggawanBhosx KimNo ratings yet

- Training and Mentoring: Necessity For Orientation TrainingDocument6 pagesTraining and Mentoring: Necessity For Orientation TrainingBhosx KimNo ratings yet