Professional Documents

Culture Documents

FM (Timbang, 2015) - Introduction

FM (Timbang, 2015) - Introduction

Uploaded by

Hannaniah Pabico100%(4)100% found this document useful (4 votes)

5K views13 pagesOriginal Title

FM (Timbang, 2015)- Introduction

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(4)100% found this document useful (4 votes)

5K views13 pagesFM (Timbang, 2015) - Introduction

FM (Timbang, 2015) - Introduction

Uploaded by

Hannaniah PabicoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

The finance manager plays a vital role in the

‘gompany’s success. As cash flows into the company,

the finance manager thinks of how it will be used

daily and how it will help the firm sustain its

‘operations in the future. If finance is in the heart of

“everything that goes on in the company, managing

fis difficult because the person handling it must be

fnvolved in every activity thatthe firm may perform.

"The financial manager has to be in touch with the

‘operations, marketing, and overall strategy of the

‘company.

Inthe past, the finance manager was only involved

simple bookkeeping tasks such as documentation,

"record-keeping, preparation of financial reports, and

‘payments of the company's bills (Van Horne, 2005),

As time went by, the task of the finance manager

‘evolved, going deeply inco the major aspects of the

firm's activites. This roe critically developed to what

‘is now known as financial management.

ee saree

Atthe end of the chapter, students are

expected to be able to:

+ discuss the primary objective of

financial management;

distinguish profit maximization from

stockholders’ wealth maximization;

identify the primary functions of the

finance manager;

analyze problems that are applicable

to finance;

differentiate between sole’

proprietorship, partnership,

and corporation; and

define the basic features, advantages,

and disadvantages of the diferent

forms of business organization.

‘Normally, financial management is immediately associated with accounting, a common mistake made

bby most individuals. In reality financial management is more than that, Real financial management starts

“swhere accounting ends.

Financial management is more concerned with raising, allocating, and controlling the firm's Funds. In

‘times of financial trouble, the finance manager must find ways o get ts financial position in order. Should

‘therm borrow money? Ista shore-rerm or long-term need? Did the firm generate enough funds to sustain

‘ts activities? Should they issue additional shares of stocks and would these be preferred or common? These

are the kinds of questions that one has to answer when dealing with financing.

[fthe firm has enough money, the finance manager again has to know how to allocate the money in

‘order to generate wealth forthe stockholders. Should the firm invest it in short-term marketable securities

‘or long-term investments, pay their debts, or pay dividends to their stockholders?

oS | abe aia

AA dividend policy decision is another aspect of financial management that has to be addressed. One

‘must be able to suggest what dividend policy the firm should adopt. Dividend policy plays a significane

role in enticing investors. Thus, the policy chosen by the firm determines the kind of investors the firm will

have and the kind of a company ie will be in the Future.

The Firm's Goal

The economic problem—a fundamental theoretical principle in the operational dynamics of an

economy—states that human wants or needs are unlimited but resources are finite. To satisfy their unlimited

wants, people would seek to maximize the utilities of whatever resources they posses. Utilities include

satisfaction, pleasure, or usefulness. However, maximizing utility is only possible if the people concerned

‘ould produce savings out oftheir earnings and do whatever they want to do with it. People always have

the options to choose what to do with their earnings. They can spend, save, or invest it. Spending could

satisfy wants immediately but not maximize utility because it makes one lose the opportunity to have more

carnings if saved. On the other hand, people who choose to save their money defer the enjoyment of this

resources in the hope of earning more so that they can bette enjoy i in the Future.

People who save theit money in order to invest it could have a beter chance of satisfying their wants and

‘maximizing its tility. The primary objective of the firm's Finance manager is to maximize the return that

it could offer to the people who trust the company. People who invest in the stock of a particular company

will contribute towards maximizing their investments utility

People who buy shares of stocks become the common stockholders of the company and therefore

collectively own it. Management of operations is delegated to finance managers who seek to maximize the

value of the firm’s common stock. This is done by increasing the marker price of the stock. How ist done?

‘The firm must be able to increase its value by creating a good name in terms of profitability, liqui

effectiveness of management, and sustainability ofthe operations. The firm must be able to play a major

role in the economy and in the industry to where it belongs. In this way, the market forces wil favor them

and create value by increasing the demands for heir shares. As the demand for their shares increases, and

with limited authorized capital stocks to issue, the price of the stock goes higher.

In conclusion, the generally accepted goal of the firm is to maximize the wealth of its common

stockholders through the value ofits common stock (Kolb & Demong, 1988).

Why not Maximize Profit?

Finance people disagree with accounting people over one point: the primary objective of conducting =

business People in finance always tend to say “maximize stockholders’ wealth” while those in accounting

would say “maximize profits.” This argument has been going on for many years. Though finance and

accounting are related, the people in these specialized areas could not agree as to which one really contributes

to making sound financial decisions.

Finance people need accounting to have the necessary financial information to make quality decisions.

{In makingan analysis, financial and non-financial data are scrutinized to suit the need of decision-making.

Finance people also use more tools and techniques that would make the financial reports very useful, On

the other hand, the accounting people are more involved in preparing financial reports for both the internal

and external users. The manner of reporting is based on certain accounting standards.

‘of the arguments that oppose profit maximization as the main objective in financial management

‘change in profi is also a change in isk,

Profit maximization does not consider risk or uncertainty, whereas wealth maximization does

(Shim & Siegel, 2006). For instance, a firm whose annual sales is P1,000,000 per year likes to atain

‘220% increase in the succeeding year. In doing so, the firm decides to change its credit policy by

prolonging it credit rerm from 30 days to 45 days. Surely, because of an increase in credit term,

the buyer who would benefit from such increase will buy more from the seller and in effect, the

sales will increase due tothe relaxation of the credit term. Here, the seller whose main objective is

to increase the company’s sales overlooks the impact of such move on its cash flow. The sales would

hhave increased, bu the inflow of cash is hampered because ofan investment made on the receivables,

‘In wealth maximization, before offering an increase in credit term, the cost and benefit should

first be measured. The firm should try to answer questions like:

* Will the relaxation of the credit term bring more benefits than the cost of investing in

accounts receivable?

‘+ Is the benefit more than the cost of capital invested in accounts receivable?

If the answers to the preceding questions are yes, then the firm may change its credit policy.

Ik fails to determine the timing of benefits.

In profit maximization, the timing of the benefits is not considered. ‘The firm does not care

if che cash flow is higher or lower in the early years ofthe project. Higher cash inflow in the early

years would mean better benefits to the firm because ofthe possibility of generating other potential

income. However, this is only «rue ifthe alternatives under consideration would give the same cash

benefits over the same number of years.

Example:

Consider Projects A and B with their corresponding cash inflows per year A firm is choosing

which between the two alternative five-year projects will give better benefits.

Project A shows an increasing cash inflow from year 1 to year 5 from 1.50 to 350. On the

‘other hand, Project B has a declining cash inflow from year 1 to year 5 from 4,0 to 1.0. Ifthe firm

does nor consider other factors in making a sound decision, choosing cither Project A or Project B

docs not make any difference, Besides, at the end of five yeas, both projects will give them a cash

inflow of 12.

A

20 35 1200

B 400

introduction to Financial Management

ww

i

i

3

i

However, in financial management, the following analysis must be done before making a

decision:

Consider that the rate of return for five years is 12%.

Net Cash Inflow

Xan nfow py ot cash tntoms NAECASNINDOW py of casnintows

Text 150 re 400 337

Yer2—-200 19 $00 an

ters 250 ir 200 ue

tara 280 19 200 127

vers 50 199 to os7

a2 oz

‘Afver considering the present values of the annual cash inflows for five years, Project B, with

inflows’ present value of 9.22, is better than Project A whose inflows’ present value is only 8.29.

Likewise, ifonly che cash inflows for the first rwo years are

considered, Project B wil stil perform

better due to a higher recovery of cash in the early years. The company can invest the cash inflows

in other earning activities that will help increase the net income.

‘Accounting profits cannot be measured accurately.

“The reported accounting profits are mere estimates of how much net income is generated for 8

particular period of time, The eal accounting profits are only measured atthe end ofthe life ofthe

compai

‘or not. It is for this same reason why financial management is

Icisonly by chat time that the company may determine ifits entire operation is successful

is more concerned with the cash inflows

rather than the accounting profits. The profit itself does not generate cash if sales connected ro it

are on credit. The finance manager measures the cas

accounting profit.

flows which are then invested to generate

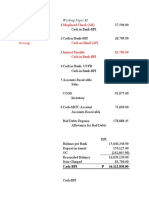

Profit Maximization versus Stockholders’ Wealth Maximization

Goat Objective Aavantages

Prot Obtainlarge 1. Caleulating pros easy.

Maximizaton smounto!

2. Determining thetink

ieee ‘between financial decisions

aa prose simpe

icioideg”” “Achieve” Theiong enn s emphasized

wet ig MRS 2 Riskoruncenaintyis

Monmizaion masevase > Rongncs

SESSION 5m ining ofretume taken

{nto account

4, Stockholders return is

‘considered,

1 The short term is more

emphasized.

2. Risk or uncertainty is ignored

3. The timing of retuns does not

matter.

4, Immediate resources are

necessary.

1 There is no clear relationship

between financial decisions

and stock price.

2, Management aruiety

and frustration may be

experienced.

Source Shim, J Ky & Siegel J. G. (2006). Shaun’ oniline of financial management. rd ed). New York: McGraw-Hill Book

‘Company.

of Financial Managers

Fonancal manager ofthe firm plas a crucial ole inthe company’s goals, plies and sucess

‘bilities of the financial manager include the following:

nvestment decision

“This emails an outflow of resources with the expecratons of a benefit in che form of cash

decision is the most important of the three decisions

‘becomes the firms life support system in continuing

tts existence; thus, the allocation of funds must be prudently done. Since the Future benefits are

ae tare igh creainy, investment proposals must reengnize the existence of rik, Laverne

aa Malu interme of their expeted recuns and comesponding sks thar could ast

‘the firm's valuation in the market.

A

To accepting or rejecting an investment proposal a flr may use capital ‘budgeting technique

ae etd the dime value of money (discounted payback period, internal rae of en 1

presen value, and profitability indes) or one that docs not (6+ ‘payback period and accounting

rate of retutr).

Financing decision

“The financial manager finds ways wo provide money forthe actives of the frm. He or she

must know where to outsource its funds. Shoreterm or Tong:-term debtor equity financing has 0

Bust Te manager eases the best possible inancing mix ox capil sructare For she

‘company in order to meet the expected return on an investment.

“The main idea in financing decision is ro look for resources that will give the company the

lowest weighted average cost of capital.

Dividend policy decision

equally important to know what sound dividend policy i good financial signal to the

marke he contin ssesesthe company. Firms with good history of dividend payment have

Fetes potential nuring investors. Dividend declaration reflects a profitable sats ‘of the company.

Hire ether hand, companies with earnings retention have more funds for ineesutsnt hhence,

it indicates the growth potential of che company. To pay oF not to pay dividends relics basically

wnat sion nade bythe board of directors through the advice piven by the nance mans.

the aforementioned financial responsibilities ae carted our by the treasures,

ins (CO). The reasureris responsible For managing corporate assets and

+ budgeting the capital financing the business, formulating a ced policy

vonfolo. The weasuer basally handle externa financing mater. "he

‘of which ae financial and cost accounting, taxes, budgeting»

ee The chit fancier oveecs he ete Financ airy and seve 2

Sxdviser in finance matters to the board of direcrors.

rr)

The role of finance in a typical corporate business organization is as follows.

in

ma

a

ee

=e

pt

The common functions of the controller include accounting and Financial reporting, internal aud

cost accounting, tax accounting, planning for contro, evaluating and consulting, government report

protection of assets, nd economic appraisal

The treasurer's common functions ate cash management, banking relationship, finding sources

financing, financial planning, investment planning, capital budgeting, risk management, investor relat

cd credit and collection,

Financial Decisions and Risk-Return Trade-off

Ie is significant to note chat an increase in retuen is coupled by a corresponding increase in risk

cannot be expected that whatever financial decision is made will immediately favor the firm. The fina

manager’ obligation isto ascertain that such rsk present is tolerable. Risk is common and ubiquitous

could be credit, nancial, political, interest, and social. The firm must recognize the risk and include ¢

in whatever financial decisions it will make. The aphorism “the higher the return, the higher the risk” m

always be kept in mind

Types of Business Organizations

The three major forms of business organizations are sole proprietorship, partnership, and corporat

ay firms are frst organized as sole proprietorships, being the most simple ofthe three. As the yeas

by, this form of business organization tends to evolve into a partnership and finally into a corporation.

The Sole Proprietorship

A sole proprietorship isa business owned bya single person. Typically, che individual proprietor orig

finances the firm by using his or her personal savings, supplemented by bank or government loans.

The proprietorship form of organization is the simplest form of a legal organization, since no fo

procedures are needed to establish the business. The owner is only required to comply with specific

icensing laws in order to start selling goods of services to the public. The business entity itself is general

Fequirements, and has no

the sole proprietorship provides

"er, the control held by the

with differences of opinion

8 Policies or making other

tbe to taxaon, However income are 8 filed

r pebusines. Thus, the income tax te app be thesole

‘ora income fom all soures and his or he vay deductions

BERS Fr principal disadvantages of sole he nctorships are limited life and the unlimited liabiliey of

BS Upon the death or reinemmenr the owner, the current business must be dissolved inasmuch as

Bese normally no provisions for the continuity ofthe business Furthermore, unlimited lability makes

penne PeePtctorship personaly liable for ck firm’

FP Poonal assets are legally available ro, satisfy business deb

S actions and debts. This means that the

Asother dis.

Teis dfficul for an org

other businesses to borrow large sums of money

'e Sole Proprietorship

Ens of formation. A single propre rorship is simple to establish. Ie does not require tedious

Ssumentaions similar to partnership or corporation,

Control over operations. There

@perations, thereby specdin,

Be shating of profs. All profits ofthe business belongs only eo the owner

Ssmpliiy. A proprcrorship is subject to less ‘overnment regulations compared with a Partnership

© corporation,

However, the incor

* included and shal be a part of the incor ‘generated by the owner which is

PPP to tar. The taxis graduated based on ‘oral income of the taxpayer.

8 of the Sole Proprietorship

Pimited life. Death or bankrupecy of th

Unlimited liailiy

Remiation of skills A proprio, as compared with she busines associates ina partnership and a

Seabee att tions in the applicaions of silk uit rae to see a proprietor who has

BME sille involving finance, marking, ant operations

0 | munca. nanan

The Partnership

‘A partnership is composed of two or more persons who agree to contribute money, property, of services

for the purpose of dividing the profits between or among themselves. ‘Two or more persons, called the

partners, own the business. Ics a more formal type of a legal organization than the sole proprietorship but

much less formal than a corporation

A basic requirement for the registration ofa partnership with the Securities and Exchange Commission

(SEC) is the filing of the Articles of Co-partnership. The SEC is a government body that supervises the

affairs of the partnership and corporate forms of businesses. The following information is contained in the

articles of co-partnership:

Name of the partnership

Principal place of business

Date of effectivity and life ofthe partnership

Purpose of the partnership

5. Names, addresses, and contributions of che partners

6. Agreement as to the manner of management of the partnership

‘Manner of dividing the profits becween or among the partners

8, Manner of liquidating the partnership with the rights and duties of the partners

9. Arbitration of disputes

Likea proprietorship, a partnership is simple to organize and is subject ro few government regulations

Ic also has a limited life. Death, bankruptcy, or withdrawal of a partner results in the dissolution of the

business. Similarly, admission of a new partner to an existing partnership either by contribution of capital

or by acquisition of an interest from an old partner requires the formation of a new partnership.

The individual partner's actions can actually obligate the busines if they are performed within the

scope of the partnership. Additionally, each partner becomes personally liable for the business. Like a

proprietorship, a partnership has unlimited liability. The partners ae jointly and individually liable for the

debts of the partnership; in other words, in the event that the partnership is unable to pay its debts, the

partners’ personal assets will be available to satisfy creditors’ claims. However, for a limited partner, the

liability is Limited only to the extent of his or her capital contribution to the partnership,

Partners can distribute profits oF losses from the business in many different ways. Ifno prior agreement

exist, the profits are divided equally among the partners or some other ratios, aking into consideration

some pertinent factors like the partners capital contribution, goodwill contribution, and special ability and

experience in the field

The tax for the partnership depends on whether the partnership isa general professional partnership or

just an ordinary partnership. The ordinary partnership is subject to a tax similar to that of a corporation

which is 30%. The general professional partnership is tax-exempt for the sole purpose of exercising the

partners’ common profession (National Internal Revenue Cade, Sections 20 and 24).

of the Partnership

fim BB ye halesne ii group of people tha share experts in runing the barre

& The combined capital resources of the partners of

ffer better capitalization as compared with those

of a sole proprietorship.

the

athe

s of the Partnership

© Limited life. Withdrawal, death, or bankruptcy of a partner will result in the dissolution of a

partnership. Likewise, admission ofa new partner ends the old partnership.

2 Unlimited liability. Each partner is personally liable

to creditors for debts incurred by other partners

acting for the partnership.

Mutual agency, Each partner isan agent ofthe company and c

her acts within the scope of the partnership business.

an obligate the partnership for his

% Difficulty in raising capital. Although iis somewhat easier for partnerships wo obran the capital

required for expanding operations than it is for proprctorships, iis stil diffcule to raise huge

amounts of partnership capital since the ability todo so is limited by the partnes’ personal wealth

and borrowing power.

k The Corporation

the

A corporation is an artificial being created by the operation of law having the right of succession and the

ower, attributes, and properties expesly authorized by law or incident ots existence (Corporation Code

of the Philippines, Section 1). A corporation is a mult-owner organization that is recognize! as se

legal entity by law. Accordingly, c can enter into contracts and can sue or be sed. Since che co

legal person, a corporate officer signing a loan as an agent for a corporation

or risks. The corporation is responsible for its own acts tothe extent

individual stockholders. Thus, one ofthe main reasons for inc

poration is

the is not putting personal assets

ofits own assets only, not those of the

‘orporating.a partnership or proprietorship is

fo protect the owners’ personal assets from losses beyond the amount invested in the business

the

the

the

The owners of a corporation are called shareholders or stockholders. The ownership interest in the

company is evidenced by readily transferable shares of stock issued (or sold) by the cor

oration. The

Ind

shareholders ofa corporation indirectly contro the regular operations of the busines bye

directors who actually manage the corporation. In this management set-up, the board of direson, selec

the corporation's officers who run the day-to-day operations, and establishes general

This circuitous route noewithstanding, the ult

conporate policies.

imate control of a corporation rests with the shareholders

for Unlike the partnership and proprietorship forms of business organizations, the corporate form facilitates

the acquisition of large amounts of capital needed for

sale of addicional shares of stock

he

pansion, This can be accomplished through the

to new owners by issuing stock certificates represents

the enterprise. The stock certificates ownership can be easily transferred any time in the future. Since the

borrowing capacity of a profitable corporation is far greater than that of a

because ofits limited liability, building

proprietorship of a partnership

*w plants and facilities, renovating old ones, and purchasi

‘equipment as means of expanding the existing operations are greatly f

of legal organization

acilcated by using the corporate form

SS | rmanciat manncsscenr} port

Since corporations have several owners, itis usually necessary to establish a management team—

which may include one or more owners—to carry on the operations of the business. The members ofthis

‘management team composed of corporation officers and employees act as agents for the corporation and

conduct its business as a separate legal person with the same rights, duties, and responsibilities of a natural

person. A sharcholder has no power to bind the corporation to contracts, unlike a partner or a proprietor.

In addition, shareholders enjoy limited lability, which means that they are protected from personal losses

beyond the amount of their investment. In contrast with general professional partnerships and proprietorships,

corporate income is subject to taxation; that i, corporations are required to pay income taxes and file separate

tax returns. Shareholders do not have to include their corporation's net income in their personal tax returns

except for those earnings actually paid out to them in the form of dividends. Accordingly, corporate income

‘may be taxed twice: first, as the corporation's income, and second, if dividends are declared, these are taxed

again as shareholders’ income.

Advantages of the Corporation

1. Limited liability. The special legal status enjoyed by the corporation acts as a bartierto protect the

lownersshareholders from losses beyond the amount of their investment.

2. Indefinite life. Unlike in proprietorships and partnerships, the life ofthe corporate form of business

‘organization is not affected by the withdrawal of sharcholders in any way since the corporation is

treated legally s if it were a person separate from its owners

3. No mutual agency. Sharcholders who are not legal agents or officers are unable to bind a corporation

by their actions. If they own many shares, they may bear a strong influence on its management

team but cannot unilaterally bind the corporation legally without the specific authorization of the

corporation itself

4, Ease of obtaining additional capital. Corporations are aptly structured for borrowing large sums of

money. They also have a legal structure that enables them to sell small ownership interests (hares)

to the general public

5. Ease of transfer of ownership interest, Since ownership of the corporation is via shares of stock,

itis simple to transfer ownership interest. Shareholders can ordinasily sell their shares to others

without obtaining the company’s approval wheteas a sole proprietorship cannot sll partial interests

in business, nor can a partner sella partnership interest without dissolving the partnership.

6. Separate legal entity. By virtue o its special legal status, a corporation has the power to buy, own,

or sell property. Furthermore, it can enter into contracts and can sue or be sued,

Disadvantages of the Corporation

1. Double taxation. Corporate income is intially subject to the payment of income taxes by the

corporate entity itself, and then the shareholders are required to pay income taxes on the portion

of corporate earnings distributed to them in the form of dividends.

2. More government control. Corporations are governed and influenced largely by national government

regulations.

‘More costly to organize. The establishment of a corporation entails the payment of legal fees.

More involved decision-making process. Incorporations, making important business decisions may

be quite time-consuming. They ae usually referred up to the chain of command, often necessitating

the agreement and final approval of the board of directors ofthe corporation.

agag © POPPER

a

€

d

5 Dilution of earnings and control. A typical corporation has a large number of sharcholders who

‘ust share the earnings and control ofthe corporation with many other owners,

Agency Theory

The agency theory poses a porential conflict of interest between the stockholders and the managers.

Seek conflict starts when the stockholders entrust to the managers the authority to make decision for

= firm. The managers, with the power vested upon them, may have personal goals that clash with the

seckholders’ wealth maximization.

This theory exists due to the creation of an agency relationship. This relationship is borne as soon as an

Seaividual or group of people, called the principals, hire the service ofan individual or organization cal

= agen, to perform a service and exercise decision-making for the principal.

The primary agency relationships are those between:

2 Stockholders and managers

‘An agency problem will likely exist when the manager owns a very small percentage of th

‘company’s stock. When the firm is a sole proprietorship and the manager is also the owner, he or

she will presumably function to maximize his or her personal wealth. However, when the owner

‘manager decides ro share the company with an outside investor by making the firm a corporation

a potential problem may arise, Ifthe proprietor worked to his or her full potential before, this time

with shared ownership, he or she may tend to relax a bit, knowing that some of the wealth will

‘now accrue to the other stockholders. At the same time, the owner-manager may be litle loo

with the mony or use more of its earnings knowing that some of the costs will be borne by the

other stockholders.

In many large corporations, potential agency conflicts are noted specially when the managers do

not own a small percentage of the company's stocks. However, managers may be encouraged to act in

‘maximizing stockholders’ wealth by giving them incentives for good performance and punishment

for poor performance. Some of the incentives that maybe offered are as follows: increase in salary

bonus, stock options, promotions, travel, and many more. For poor performance, the punishment

‘maybe as follows: no bonus, threat of termination, or no increase in salary. Other devices that

‘may be used by the company so that the managers will act in accordance with the interest of the

stockholders are threat of takeovers by another company and shutdown.

b. Stockholders and creditors

Aside from the conflicts between the stockholders and managers, a conflict may also arise

between stockholders and creditors. Stockholders’ claims over the assets of the company are just a

residue after deducting the creditors’ claims. In the same manner, creditors also have a claim over

the firm's earnings through interests and principal payments. The firm's creditors grant loans

rates based on the firm's capital structure, expected future cash flows, profitability, and stability

‘The conflice berween stockholders and creditors is more evident when the stockholders, through

management, undertake a huge project that is too risky for the firm and has been overlooked by the

creditors upon granting of the loan. If there isan increased risk, creditors will undoubtedly increase

their interest rate and provide a smaller amount of loan. If the project succeeds, all benefits will

80 to the stockholders at the disadvantage of the creditor receiving a less interest rate on the loan.

FS | rmmvens amore rat

Misconceptions about Financial Management

Ifthe project does not succeed, the creditors will have to share inthe losses ofthe firm because of

‘the possibility of non-payments of interest and principal

‘Due to the conflicts berween these two parties, creditors attempt to prorect themselves against

sxockholders by puting restrictive covenants on the loan. Some examples are restrictions on declaring

ddivdends, issuance of bonds, and accumulating capital assets.

Some of the most usual misconceptions about financial management ae listed as follows:

inancial management is accounting.

“The most common mistake is thinking that financial management is accounting because

i utiles nancial statements to arrive at certain decisions. Ie is true that financial information

tevessary to ative ata sound decision s provided by accounting, However, he tools used in making

vTeislon are different from the ones used in accounting, Accounting has a standard to be followed

While financial management doesnot have any. The tools and techniques used by finance people

Tre more sophisticated and more scientific and vary depending on what decison is needed.

‘Accounting provides financial information useful forthe common needs of multiple users. In

financial management, decision-making is directed to specific Financial uses.

2, Financial management isa review of mathematics.

rmulas are used before arriving at a decision. With

annuities, and other values, finance is thought to

wgin financial

Tn making financial decisions, alot of for

the computation of present values, furure values,

be too much mathematical. Mathematics is always present in every decision-makins

management, Toa certain extent, t also uses calculus, math of investments, and algebra before

arriving ta decision. Like in ccounting, mathematics is one ofthe tools used in decision-making

3, Financial management isa branch of statistics.

Statistics is used at times to ascertain the risks involved in decision-making, Standard deviations,

correlation coefficient, coeficient of determinations, and forecasting tools and techniques are used

se measure the risk before making financial decisions. With saristic as part ofthe decision-making

process it is hought tha Financial management is a branch of statistics

Social Responsibility

“The primary responsbility of financial

the market price of the stock. Do companies

are firms also equally responsible forthe welfare oftheir employees, customers,

they belong? Iris understandable that Firms hae tobe responsible o thir employes by providing sem

‘eth good working conditions to che environment by not polluing the airand water; and thes cus

ty prodacing quality oods or services in the most efficent way. However, be socially responsible 1

management isto maximize the stockholders wealth through

hhave to operate strictly in their stockholders’ best interests of

‘and the communities where

firm has to incur costs.

Social responsibilty implies addtional costs roche company. Notall firms are willing to take hat ex

cost ander follow the rules and regulations st forth by good standards. For instance it given a chan

setvest which would an investor choose: a company that. maximizes the use of chit funds by investi

Fan gains RO consi: i soil obligation ora company thats socially responsible with most of xa

ie? Mose ofthe time, the answer could be the former than the latter,

of investing is to maximize return. Afterall,

Docs it mean that companies should not be socially responsible? The answer is, not necessarily. Ir only

Sep that social responsibility has to be mandated rather than voluntary o neue burden will not

fe shouldered by a single firm, but rather, distributed uniformly among busineace Thee social benefit

Perseus in the forms of clear guidelines in hing people, laws on pollution, anebarune actions, mining

Es; Product safery and other similar actions cha ar likely wo be effective are eaal het and enforced by

mh canent: However, these actions should be implemented in full cooperation between he, industry

ad the government and that the costs and benefits of such are estimated ant Properly taken into account.

study made on the hazardous effects of plastics, fast-food restaurants are now using paper cups which can

Sail be recycle and are biodegradable. Companies like PLDT, San Miguel Corporation, and others are

eda ar 28 Gavad Kalingt’ housing projects, These are only some ofthe examples thar day foe

$e hing as par of ther corporate socal responsibilty. They belive thar hevoleaf ote is to promote

Public good, not jst the good ofthe firms’ shareholders. As tated by the presidens of th Body Shop,

mis impossible to separate business from social responsibilty. For other firms, scially responsible endeavors

ay Not be expensive at all. They would incur more cost if they do not follow the aac, pred standards of

Production and good business management procedures. Many industries in the past suffered losses, o even

more became bankrupt due to lawsuit as a result of being socially responsible

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Business PlanDocument27 pagesBusiness PlanHannaniah Pabico78% (37)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Exercise 1 Margarett Company: Sales BudgetDocument4 pagesExercise 1 Margarett Company: Sales BudgetHannaniah PabicoNo ratings yet

- Audit of CashDocument5 pagesAudit of CashHannaniah PabicoNo ratings yet

- Illustration On Situs and Gross EstateDocument2 pagesIllustration On Situs and Gross EstateHannaniah PabicoNo ratings yet

- Test Ii: Misplaced Check (AR)Document10 pagesTest Ii: Misplaced Check (AR)Hannaniah PabicoNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument32 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledHannaniah PabicoNo ratings yet

- RFBT QuizzesDocument4 pagesRFBT QuizzesHannaniah PabicoNo ratings yet

- FM (Timbang 2015) - Horzontal & Vertical AnalysisDocument12 pagesFM (Timbang 2015) - Horzontal & Vertical AnalysisHannaniah PabicoNo ratings yet

- AccountingDocument1 pageAccountingHannaniah Pabico100% (6)

- Intermediate Accounting 3Document10 pagesIntermediate Accounting 3Hannaniah PabicoNo ratings yet