Professional Documents

Culture Documents

Intermediate Accounting 3

Uploaded by

Hannaniah Pabico0 ratings0% found this document useful (0 votes)

36 views10 pagesThis document discusses the conceptual framework for financial accounting and auditing principles.

The conceptual framework provides guidance for standards setting, preparing financial reports, and interpreting standards. It aims to reduce inconsistencies and creative accounting. The framework outlines key concepts like recognition, measurement, presentation and enhances qualities like comparability.

The document also discusses auditing regulation. The accountancy profession plays a vital role in business and is intended to provide objective counsel. It is a specialized field that requires mastery of skills obtained through training. Regulatory bodies like the Board of Accountancy in the Philippines establish qualifications and powers to govern the practice of accountancy.

Original Description:

Original Title

NOTESSS.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses the conceptual framework for financial accounting and auditing principles.

The conceptual framework provides guidance for standards setting, preparing financial reports, and interpreting standards. It aims to reduce inconsistencies and creative accounting. The framework outlines key concepts like recognition, measurement, presentation and enhances qualities like comparability.

The document also discusses auditing regulation. The accountancy profession plays a vital role in business and is intended to provide objective counsel. It is a specialized field that requires mastery of skills obtained through training. Regulatory bodies like the Board of Accountancy in the Philippines establish qualifications and powers to govern the practice of accountancy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views10 pagesIntermediate Accounting 3

Uploaded by

Hannaniah PabicoThis document discusses the conceptual framework for financial accounting and auditing principles.

The conceptual framework provides guidance for standards setting, preparing financial reports, and interpreting standards. It aims to reduce inconsistencies and creative accounting. The framework outlines key concepts like recognition, measurement, presentation and enhances qualities like comparability.

The document also discusses auditing regulation. The accountancy profession plays a vital role in business and is intended to provide objective counsel. It is a specialized field that requires mastery of skills obtained through training. Regulatory bodies like the Board of Accountancy in the Philippines establish qualifications and powers to govern the practice of accountancy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 10

INTERMEDIATE ACCOUNTING 3 User’s Decision

Conceptual Framework for Financial Accounting -Buying, selling, holding entity

(Revised) -Exercising votes on

Why Develop Conceptual Framework? -providing or settling loan

- Stochastic Solutions User’s Assessment

- Judgments, Models, Estimates -prospects for future net cash inflows

- Conflicting Standards

- Creative accounting -mngt. Stewardship of economic resources

- Political Forces Information needed

- Rule-based system

-economic resources, claims against entities

*Conceptual Framework is not an accounting standard

itself. Existing IFRS will prevail than the C.F. -how efficient and effective the mngt. in discharging

the economic resources

Purpose of C.F

Users of F.S

1. Assist the board to develop IFRS Standards

2. Assist preparers of financial reports to develop -Investors (Potential and current)

consistent accounting policies for transactions -Lenders and other Creditors

3. Assist all parties to understand and interpret

-Employees

standards

-Suppliers and other trade creditors

Effectivity of the C.F

-Government agencies (to regulate the activities, taxes)

-Immediately for the Board and the IFRS

Interpretations Committee -Public (contribute to the locality, giving job

opportunities)

- Annual Periods on or after Jan1, 2020, those develop

an accounting policy based on C.F Information provided by reporting entity

Why revised it? -Financial Position

-Priority by stakeholder -financial performance

-Filling the gaps (guidance on measurement etc.) -Changes in economic resources and claims

-Updating Objectives of Reporting entity

-Clarifying -Consolidated F.S (parents and subsidiary)

Main Changes? -Unconsolidated (parents only)

(New) -Combined (not related consolidated entity e.g.

siblings’s entity FS)

-Measurement and factors it consider in selecting

*Underlying Assumption- Going Concern Basis

-Presentation and disclosure (When to classify)

Fundamental Q.C

-Derecognition (guidance in removing items in F.S)

*Relevance--- Predictive Value and Confirmatory

(Updated)

Vaue; Materiality (magnitude of info to where item

-Definition could be measured)

-Recognition (When to?) *Faithful Representation--- Neutrality (free from bias,

(Clarified) use of exercise of prudence), Complete (all relevant

info must be included), Free from error (not

-Prudence (neutrality) accurately, but doesn’t have mistakes and error);

-Management Stewardship (Need of information) Measurement Uncertainty

-Measurement Uncertainty Enhancing Q.C

-Substance(/) over form *Comparability--- consistency

*Verifiability--- consensus, different users can reach 1. Fair Value- reflects market participants current

same thoughts about financial information (although measurement about amount, timing and

not purely) uncertainty

2. Value in Use/ Fulfillment Value- Current

*Timeliness--- capable of influence users at a time

expectations in an item. Present value of future

*Understandability--- clearly and concisely; cash flows, from continuing use until its

reasonable knowledge disposal

Cost- pervasive Constraint. “Cost should not exceed its 3. Current Cost- reflects the condition of the item

benefits.” in the current time. (Net Realizable Value)

ASSET- elements are: Presentation and Disclosure Concepts

1. Rights- to use, to sell, pledge the object, -Effective Communication of FS

other undefined rights. -Should have Communication tools

2. potential for economic benefits- does not

Statement of Profit or Loss

need to be certain. It’s only necessary that

at least one circumstances it’ll give benefit. Other Comprehensive Income

3. Control- present ability to direct resource Concept of Recycling- income and expensive in OCI

used. are not subsequently recycled. Hence, it will be

LIABILITY- elements are: directed to the equity.

1. no practical ability to avoid or transfer- only in Concepts of Capital

liquidation (under such circumstances) Financial C- Capital=Net Assets

2. obligation to transfer an economic resource- it

does not need to be certain. Physical C-Capital= Productivity Capacity

3. present obligation as a result of past events-

had already obtained economic resource.

4. executory contract- equally unperformed,

establishes single asset/liability for the

inseparable right/obligation to exchange

economic resource.

Recognition – inclusion of item that meets definition

of an account (A,L,Eq,I,&Ex)

Recognition Criteria

1. Relevance- Existence Uncertainty, Low

Probability of flow of economic benefits

2. Faithful Representation – Measurement

Uncertainty, Recognition Inconsistency

(Accounting mismatch), Presentation and

Disclosure

Derecognition- removal of all or part of recognized

asset or liability in the financial position

Application

1. Asset- losses control in the item

2. Liability- no longer have the present obligation

Measurement of Elements

Historical Cost- reflects price of transaction, original

cost when acquired by entity.

Current Value

AUDITING PRINCIPLES BOA is composed of a Chairman and six (6) members, a

vice chairman is elected. The four sectors shall, as much as

AUDITING AND ASSURANCE PRINCIPLE possible be equitably represented in the board

Qualifications

THE ACCOUNTANCY PROFESSION: PRACTICE AND

1. Must be natural born citizen and resident of the Ph.

REGULATION

2. Must be a duly registered CPA with AT LEAST 10 years

Accountancy – plays a VITAL ROLE in the overall

of work experience in any practice of accountancy

business and economic environment.

3. Must be a good moral character and must not have been

Accounting – Language of business

convicted of crimes involving moral turpitude

Profession

4. Must not have any pecuniary interest, in any educational

Definition Characteristics

institution conferring and academic degree necessary for

admission to the practice of accountancy or where review

Vocation Mastery of particular class in preparation for CPALE are being offered or

Specialized educational intellectual skill, acquired conducted.

training by training and education. Note: Five (5) nominees of PICPA will be passed to PRC,

Intended to supply Adhere by its member PRC will pick three (3) to be recommend to the Philippine

objective counsel and to a common code of president and the president will appoint one (1)to be the

service to others values and conduct chairman of BOA .

For a direct and definite Acceptance of duty to Powers and function of the board

compensation, apart from society To prescribe and adopt the rules and regulations to carry

expectation of other gain out the act.

For the practice of accountancy

Regulation of the accountancy profession Supervise the registration, licensure and practice

Timeline To administer oaths

1923 – legally recognized as a profession in the To issue, suspend, revoke or reinstate certificate

Philippines when Act No. 3105on March 17, 1923 was of registration

approved by the 6th Ph. Legislature To adopt official seal

1967 – Accountancy act of 1967 or RA No. 5166 was To prescribe or adopt a code of ethics

approved on August 4, 1967 To monitor conditions and adopt measures

1975 – Revised accountancy law or PD No. 692 was To conduct an oversight of audit quality

approved on May 5, 1975 As to control

2004 – Philippine Accountancy Act of 2004 or RA 9298 To investigate violation and to issue summons

was approved on July 28, 2004 To issue cease and desist order to violators

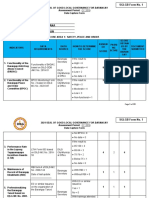

Objectives of RA 9298 To punish for contempt of the board

Standardization and regulation of accounting education For educational

The examination for registration of CERTIFIED Prepare, adopt, issue or amend the syllabi of the

PUBLIC ACCOUNTANT subjects for examination

The supervision, control, and regulation of the practice To ensure that all higher accounting educational

of accountancy in the Philippines. institution comply with the policies, standards and

Note: Organizations that has the primary duty to effectively requirements of the course prescribed by CHED or other

enforce or implement the provision of RA 9298 are both the authorized government offices or CPE council

PRC and the BOA. To exercise such other powers as may be provided by

Scope of practice / Sectors of RA 9298 law which are necessary of incidental to the carrying out of,

Commerce and industry (employer – employee the express powers granted to the board to achieve the

relationship) objectives and purpose

Education or academe (teacher – student relationship) Grounds for suspension or removal of member of the

Government (employer (government) – employee board;

relationship) 1. Neglect of duty or incompetence

Public accountancy ( Client – Service provider 2. Violation or tolerance of any violation of RA9298 and its

relationship) IRR

Note: 3. FINAL JUDGEMENT of crimes involving moral

When the business has an annual revenue of AT LEAST turpitude

10,000, 000 pesos or has a paid-up capital of more than 4. Manipulation or rigging of the CPALE results

5,000,000 pesos, an accounting position or role are required Note: Only Philippine president has the power to remove

to be occupied by a duly registered CPA and suspend.

The department chair or its equivalent must be duly Examination, Registration and Licensure

registered CPA when BSA program is being offered in Qualifications of applicants for CPALE

college with other business course 1. Resident of the Philippines

Composition and Appointment process 2. Is of a good moral character

3. Is a BS Accountancy degree holder -any person or persons assigned operational responsibility

4. Must not been convicted of any criminal offense for the firm’s system of quality control has sufficient and

involving moral turpitude appropriate experience and ability, and the necessary

Scope of examination (current in RA 9298) authority, to assume that responsibility

1. AFAR b. relevant ethical requirements

2. Auditing -Independence- which enable the firm to:

3. FAR 1. Communicate its independence requirements to

4. MAS its personnel

5. RFBT 2. Identify and evaluate circumstances and

6. Tax relationships that create threats to independence, and to take

Note: Subject to the approval of PRC, may revise or appropriate action or, if considered appropriate, to withdraw

exclude subjects and their syllabi, and add new ones as the from the engagement

need arises. However, the changes shall not be more often .Shall require:

than once every three (3) years. 1. Engagement partners to provide firm with

Required ratings relevant info’s about client engagements

1. General average of AT LEAST 75% 2. Personnel to notify firm of threats to

2. There should be no grades lower than 65% independence; so that it can be (i) readily determined, (ii)

3. To be considered as conditional, the MAJORITY of the update records, (iii) take appropriate action

subjects should have grades of AT LEAST 75%, provided .atleast annually, shall obtain written confirmation of

that the candidates shall take an examination in the compliance with the policies about independence

remaining subjects with in two (2) years from the preceding .Establish policies and procedures:

examination, provided further that if the candidate fails to 1. Setting out criteria for determining need for

obtain AT LEAST GA of 75% and a rating of AT LEAST safeguards to reduce familiarity threat

65% in each of the subjects reexamined, he shall be 2. Requiring the rotation of the engagement partner

considered as failed in the entire examination. responsible for the Q.C review

Registration of CPA c. Acceptance and continuance of client relationship and

1. Certificate of Registration – primary proof of acceptance specific engagements

in the accountancy profession with lifetime validity .Continue where the firm:

2. Professional I.D. – immediate proof being a CPA that is 1. is competent to perform engagement and has

renewable every 3 years capabilities

3. Special or temporary permit - for foreign CPA called for 2. can comply with ethical requirements

specific purpose, who is engaged as professor, lecturer or 3. has considered the integrity of the client

critic, or who is an internationally recognized expert or .Policies requires:

specialization 1. obtain such info’s before accepting an

engagement with new client

QUALITY CONTROL FOR FIRMS THAT PERFORM 2. if there’s potential conflict of interest,

AUDITS AND REVIEWS OF FINANCIAL determine whether it is appropriate to accept

STATEMENTS, AND OTHER ASSURANCE AND engagement

RELATED SERVICES ENGAGEMENTS 3. if issues are identified, firm should document

-Engagement quality control review- process designed to how these issues were resolved

provide an objective evaluation of the significant judgments .Information haven’t been found earlier which would cause

the engagement team made and the conclusions it reached decline of engagement. Policies shall include:

in formulating the report. 1. professional and legal responsibilities that apply

- Network – A larger structure: to the circumstances

(i) That is aimed at cooperation, and 2. possibility of withdrawing from the engagement

(ii) That is clearly aimed at profit or cost-sharing or and client relationship

shares common ownership, control or management, d. Human resources

common quality control policies and procedures, common 1. perform in accordance with professional

business strategy, the use of a common brand name, or a standards and regulatory and legal requirements

significant part of professional resources. 2. enable firm to issue reports appropriated in the

-Professional standards – AASC Engagement Standards, as circumstances

defined in the AASC’s Preface to the Philippine Standards -Assignment of engagement teams

on Quality Control, Auditing, Review, Other Assurance and .Requiring that:

Related Services, and relevant ethical requirements. 1. identity and role of E.P are communicated to

*Elements of a System of Q.C key members of client mngt.

-creates policies and procedures to address: 2. Has competences, capabilities and authority to

a. Leadership responsibilities for quality within the firm perform the role

-promote an internal culture recognizing that quality is 3. Responsibilities are clearly defined and

essential in performing engagements communicated to the partner.

e. engagement performances Difference of Opinion

.Includes: -shall establish policies for dealing it

1. matters relevant to promoting consistency in the 1. conclusions reached be documented and

quality of engagement performance implemented

2. supervision responsibilities 2. report not be dated until matter is resolved

3. review responsibilities Engagement Documentation

-be determined on the basis that work of less experienced -Completion of the Assembly of Final Engagement Files

team members is reviewed by more experienced (complete it on a timely basis after reports have been

engagement team members. finalized)

-Consultation –provide with reasonable assurances that: -Confidentiality, Safe Custody, Integrity, Accessibility, and

1. Appropriate consultation takes place on difficult Retrievability of the Engagement Documentation

matter -Retention of Engagement Documentation

2. Sufficient resources are available f. monitoring

3. Nature and scope of, and conclusions are -Monitoring the Firms Q.C Policies and Procedures (must

documented and are agreed by both be relevant, adequate and operating effectively)

4. Conclusions from consultations are implemented 1. Include an ongoing consideration and evaluation

-Engagement Q.C Review *() of firm’s system of QC, including inspection of one

1. require () for all audits of FS of listed entities completed engagement for each partner

2. Set out criteria which all other audits and reviews 2. Require responsibility for monitoring process to

of historical financial info shall be evaluated be assigned to each partner with sufficient knowledge and

3. Require () for all engagements, meeting the experience

criteria established 3. Require those performing engagements and

-Engagement report should not be dated until the reviewer are not involved in inspecting engagements

completion of the () -Evaluating, Communicating and Remedying Identified

-Should include: Deficiencies (determine)

1. Discussion of significant matters with 1. Instances that do not necessarily indicate firm’s

engagement partner system of Q.C is insufficient to provide it with reasonable

2. Review of the FS or other subject matter info and assurance that it complies with professional standards

proposed report 2. Systemic, repetitive or other significant

3. Review of selected engagement documentation deficiencies requiring prompt corrective action

relating to significant judgement the team made and the . Shall communicate it to relevant partners and the

conclusion it reached recommendations for remedial act (which incudes)

4. Evaluation of conclusion reached 1. Taking appropriate remedial act

-Considered the ff: 2. Communication of the findings to those

1. Team’s evaluation of firm’s independence in responsible for training and professional

relation to specific engagement development

2. Whether appropriate consultation has taken place 3. Changes to QC policies and procedures

on matters involving differences of opinions or other 4. Disciplinary action against those who fail to

difficult matters, and conclusions thereof comply, esp. those do so repeatedly.

3. Whether documentation selected for review -Firm shall communicate at least annually the results of the

reflects work performed monitoring, including:

Criteria for Eligibility of () 1. Description of the monitoring procedures

.Through: performed

1. Technical qualifications required to perform the 2. Conclusion drawn

role including necessary experience and 3. where relevant, description of systemic,

authority repetitive or other significant deficiencies and of the actions

2. Degree to which () can be consulted without taken to resolved it.

compromising reviewer’s objectivity -Some firms operate as part of networks and operate under

. Maintain objectivity of () common monitoring policies. It shall require:

. Shall provide for the replacement of () where reviewer’s 1. Atleast annually, network communicate overall

ability may be impaired scope, extent and results of monitoring process to

Documentation of () appropriate individuals within network

1. Procedures have been performed 2. communicate any identified deficiencies

2. Review has been completed on or before date -Complaints and Allegations (deals with)

of report 1. work performed fails to comply with professional

3. Reviewer is not aware of any unresolved standards and regulatory and legal requirements

matters that would cause to believe that 2. non-compliance with firm’s system of QC

significant judgement of the team made and . Shall establish clearly defined channels for firm personnel

conclusions weren’t appropriate to raise their concerns.

-Documentation of the System of QC -have experience with relevant regulatory requirements, or

. Require appropriate documentation to provide evidence of ability to gain necessary skills and knowledge effectively

operation of each element of its system -sufficient personnel with competence and capabilities

. Require retention of documentation for a period of time -experts are available

sufficient to permit those perform monitoring procedures to -meeting criteria and eligibility requirements to perform

evaluate firms’ compliance engagement Q.C review

. requiring documentation of complaints and allegation and -able to complete engagement within reporting deadline.

the responses to them. Integrity of client

*Application -identity and business reputation of clients owner/mngt

-PSQC does not call for compliance with requirements that -nature of operations and business practices

are not relevant in circumstances of sole practitioner with -information about attitude of client towards internal control

no staff. environment

-Documentation and communication of policies for smaller -Whether maintaining firm’s fees as low as possible

firms may be less formal and extensive than for larger ones. -indication of inappropriate limitation in scope of work

Leadership Responsibilities for quality within the firm -indications that client is involved in money laundering or

-Promotion of quality-oriented internal culture depends on other criminal activities

clear, consistent and frequent actions and messages from all -reason for proposed appointment of firm and non-

levels of firm’s management: reappointment of the previous firm.

1. perform work that complies with professional -identity and business reputation of related parties.

standards and regulatory legal requirements *sources of information may include:

2. issue reports appropriated in the circumstances. -Communication with existing or previous servers, and

-These actions and messages be communicated (trainings, discussions with other parties

seminars, newsletters, memoranda etc.) -Inquiry of personnel and 3rd Parties

-Should recognize that firm’s business strategy is subject to -Background searches of relevant databases

overriding requirement for firm to achieve quality in all Withdrawal

engagement. Internal culture includes: --Discussing appropriate action that firm might take based

1. Establishment of policies that address performance on relevant facts or circumstances

evaluation to its personnel -If appropriate to withdraw, discuss the reason for it

2. Assignment of management responsibilities -Consider where legal requirement for firm to remain in

3. Provision of sufficient resources for development and place, or report th withdrawal; together with the reasons for

support of Q.C withdrawal, to regulatory authorities

Relevant Ethical Requirements -documenting significant matters, consultations,

Philippine Ethics Code includes conclusions and basis

1. Integrity Human Resource

2. Objectivity -for recruitment, performance evaluation, capabilities,

3. Professional competence and care competence, career development, promotion, compensation

4. Confidentiality and estimation of personal needs.

5. Professional Behavior Competence- gain through: Professional education,

-Reinforced by: professional development, work experience, coaching by

1. Leadership of the firm more experienced staff, independence education

2. Education and training Engagement Teams- consideration of:

3. Monitoring -understanding of, and practical experience with,

4. Process for dealing with non-compliance engagement of similar nature and complexity through

Written Confirmation trainings

-May be in paper or electronic form - professional standards and regulatory and legal

Familiarity threat requirements

-nature of engagement, extent to which it involves a matter -Technical knowledge and expertise

of public interest -Knowledge of relevant industries

-length of service of senior personnel on engagement -Ability to apple professional judgement

Considerations specific to public sector audit -understanding of firm’s QC policies.

organizations Engagement Performance

-Public sector entity is significant for the purpose of -Consistency in Q of E.P (through policies and procedures)

expanded Q.C procedures -Supervision (Tracking progress, Considering competence

Acceptance and Continuance of Client Relationship and and capabilities, Addressing significant matters arising

Specific Engagements during, Identifying matters for consultation by more

Competence, Capabilities and Resource experienced team)

-Personnel have knowledge of relevant industries or subject -Review

matter -Consultation (discussion, documentation)

*Engagement Quality Control Review

Criteria: *implements to avoid unauthorized alteration or loss of

1. Nature of engagement, including extent of matter engagement documentation may include those that:

of public interest • Enable the determination of when and by whom

2. Identification of unusual circumstances or risks in engagement documentation was created, changed or

engagement reviewed;

3. Whether laws or regulations require engagement • Protect the integrity of the information at all stages of

QC review. the engagement, especially when the information is

Nature, Timing and Extent of EQCR shared within the engagement team or transmitted to

The engagement report is not dated until the other parties via the Internet;

completion of the engagement quality control review. • Prevent unauthorized changes to the engagement

However, documentation of the engagement quality documentation; and

control review may be completed after the date of the • Allow access to the engagement documentation by the

report. engagement team and other authorized parties as

Conducting review in a timely manner at necessary to properly discharge their responsibilities.

appropriate stage. *Controls that the firm designs and implements to

Extent may depend on complexity of maintain the confidentiality:

engagement. The performance of EQCR doesn’t reduce • The use of a password among engagement team

the responsibilities of the engagement partner. members to restrict access to electronic engagement

documentation to authorized users.

EQCR of Listed Entity • Appropriate back-up routines for electronic engagement

Significant risks identified during the engagement and documentation at appropriate stages during the

the responses to those engagement.

risks. • Procedures for properly distributing engagement

• Judgments made, particularly with respect to materiality documentation to the team members at the start of the

and significant risks. engagement, processing it during engagement, and

• The significance and disposition of corrected and collating it at the end of engagement.

uncorrected misstatements • Procedures for restricting access to, and enabling proper

identified during the engagement. distribution and confidential storage of, hardcopy

• The matters to be communicated to management and engagement documentation.

those charged with *Require engagement teams to:

governance and, where applicable, other parties such as • Generate scanned copies that reflect the entire content

regulatory bodies. of the original paper documentation, including manual

signatures, cross-references and annotations;

Criteria for Eligibility of EQCR • Integrate the scanned copies into the engagement files,

-Sufficient and Appropriate Technical expertise, including indexing and signing off on the scanned copies

experience and authority as necessary; and

-consultation with EQCR • Enable the scanned copies to be retrieved and printed as

-Objectivity of EQCR necessary

Where practicable, is not selected by the -Retention of Engagement Documentation (vary with the

engagement partner; nature of engagement and firm’s circumstances)

Does not otherwise participate in the engagement *Ordinarily be no shorter than 7yrs from date of auditor’s

during the period of review; report

Does not make decisions for the engagement -Ownership of engagement documentation (property of the

firm, generally)

team; and

Monitoring

Is not subject to other considerations that would Evaluation of the system of QC includes:

threaten the reviewer’s objectivity. • Analysis of:

Difference of Opinion o New developments in professional standards and

-Effective procedures encourage identification of regulatory and legal requirements, and how they are

differences of opinion at early stage reflected in the firm’s policies and procedures where

-May include consulting another practitioner or firm appropriate;

Engagement Documentation o Written confirmation of compliance with

-Completion of the Assembly of Final Engagement Files

policies and procedures on independence;

(may prescribe time limit per each report issued in respect

o Continuing professional development,

of subject information of an entity.)

-Confidentiality, safe custody, integrity, accessibility and including training; and

retrievability of engagement documentation o Decisions related to acceptance and

continuance of client relationships and specific

engagements.

• Determination of corrective actions to be taken and

improvements to be made in the system, including the

provision of feedback into the firm’s policies and

procedures relating to education and training.

• Communication to appropriate firm personnel of

weaknesses identified in the system, in the level of

understanding of the system, or compliance with it.

• Follow-up by appropriate firm personnel so that

necessary modifications are promptly made to the quality

control policies and procedures.

-Inspection cycle policies may specify cycle that spans Fraud Triangle Theory

3yrs. Depending on the factors such as: -explains the factors that lead to fraud and other unethical

• The size of the firm. behavior.

• The number and geographical location of offices. Three factors:

• The results of previous monitoring procedures. 1. Pressure: can include money problems, debts,

• The degree of authority both personnel and offices have addiction and bills. Greed can also be one, but

• The nature and complexity of the firm’s practice and it usually needs to be associated with injustice.

organization. 2. Opportunity: arises where there is a chance to

• The risks associated with the firm’s clients and specific commit act without high chance of getting

engagements. caught.

Communicating Deficiencies (need not include 3. Rationalization: mindset of a person to commit

identification of specific engagement concerned) unethical acts, manages to justify what he is

Complaints and allegations about to do.

-source- may originate within and outside firm Using the Fraud Triangle

-investigation policies and procedures -to analyze the vulnerability to fraud, provides a way

• Has sufficient and appropriate experience;

to avoid being victimized.

• Has authority within the firm; and

Relieve pressure- working to relieve these issues can

• Is otherwise not involved in the engagement.

Documentation of System of QC help prevent criminal behavior

-form and content includes: size of firm and number of Minimize opportunity- review internal control and

offices, nature and complexity of firm address current or future vulnerabilities.

-Appropriate documentation Target Rationalization- shall create zero tolerance

• Monitoring procedures, including the procedure for policy towards fraudulent behavior.

selecting completed engagements to be inspected.

• A record of the evaluation of: Rationalizing Fraud

o Adherence to professional standards and -Research shows that individuals who behave

regulatory and legal requirements; unethically usually experience guilt or discomfort

o Whether the system of quality control has been

before committing deviant act, and try to reduce it

appropriately designed and effectively implemented; and

through rationalization.

o Whether the firm’s quality control policies and

Thinking Like a Crook- Regulators instruct auditors to

procedures have been appropriately applied, so that

reports that are issued by the firm or engagement partners pay attention to some factual clues, such as “behavior

are appropriate in the circumstances. indicating displeasure or dissatisfaction with the

• Identification of the deficiencies noted, an evaluation of company or its treatment of the employee,” without an

their effect, and the basis for determining whether and explanation of why and how such clues relate to

what further action is necessary. fraudsters’ rationalizations.

This same criticism has been leveled at COSO’s

Integrated Framework. Principle 8 under the “Risk

Assessment” component instructs executives to

explicitly consider fraud risk potential and assess

rationalization; however, COSO provides few

examples of potential fraud rationalizations and does

not link them directly with relevant antifraud

procedures.

AUDITING APPLICATION

Taking the risk out of risk assessment

You might also like

- (C2) Basic Accounting ConceptsDocument3 pages(C2) Basic Accounting ConceptsVenus LacambraNo ratings yet

- Lesson 2 - Accounting Concepts and PrinciplesDocument5 pagesLesson 2 - Accounting Concepts and PrinciplesJeyem AscueNo ratings yet

- Handout 2 Concepts and Principles of AccountingDocument5 pagesHandout 2 Concepts and Principles of AccountingRyzha JoyNo ratings yet

- Conceptual Framework For Financial Reporting ReviewerDocument7 pagesConceptual Framework For Financial Reporting ReviewerPearl Jade YecyecNo ratings yet

- Revised Conceptual Framework 1st LessonDocument18 pagesRevised Conceptual Framework 1st LessonheeeyjanengNo ratings yet

- FAR 1 NotesDocument7 pagesFAR 1 NotesDavEriKevNo ratings yet

- Accounting Concepts and Principles - Chapter 2Document12 pagesAccounting Concepts and Principles - Chapter 2Nicole DomingoNo ratings yet

- ACC 203 Module 2 Conceptual FrameworkDocument26 pagesACC 203 Module 2 Conceptual FrameworkMitch Giezcel DrizNo ratings yet

- Conceptual FrameworkDocument9 pagesConceptual FrameworkheeeyjanengNo ratings yet

- Assist The International Accounting Objective of General Purpose Financial ReportingDocument5 pagesAssist The International Accounting Objective of General Purpose Financial ReportingVince Angelo AparicioNo ratings yet

- Standards and The Conceptual Framework Underlying Financial AccountingDocument26 pagesStandards and The Conceptual Framework Underlying Financial AccountingLodovicus LasdiNo ratings yet

- Financial Analysis and Reporting Introduction CourseDocument2 pagesFinancial Analysis and Reporting Introduction CourseRamjie MercadoNo ratings yet

- Overview of Accounting: Republic Act 9298-Philippine Accountancy Act of 2004Document60 pagesOverview of Accounting: Republic Act 9298-Philippine Accountancy Act of 2004John Rowell Bulay-ogNo ratings yet

- ACCOUNTING REVIEWER Accounting Priciples and AssumptionsDocument2 pagesACCOUNTING REVIEWER Accounting Priciples and AssumptionsMary Ingrid Arellano RabulanNo ratings yet

- Summary Notes - Conceptual Framework - Objective of Financial ReportingDocument5 pagesSummary Notes - Conceptual Framework - Objective of Financial ReportingEDMARK LUSPENo ratings yet

- Conceptual Framework Underlying Financial Reporting: Thursday, January 9, 2020 9:45 PMDocument10 pagesConceptual Framework Underlying Financial Reporting: Thursday, January 9, 2020 9:45 PMClyde Ian Brett PeñaNo ratings yet

- Chapter 3 - Statement of Financial Position and The Notes To The Financial StatementsDocument12 pagesChapter 3 - Statement of Financial Position and The Notes To The Financial StatementsKarla AquinoNo ratings yet

- Conceptual Framework: Board & IFRS FoundationDocument5 pagesConceptual Framework: Board & IFRS FoundationJames Dayagbil IINo ratings yet

- Iii. Conceptual FrameworkDocument4 pagesIii. Conceptual FrameworkKawaii SevennNo ratings yet

- Sources of CapitalDocument8 pagesSources of Capitaljessa cardenasNo ratings yet

- Fa (Mubs) Mba 2018-19Document185 pagesFa (Mubs) Mba 2018-19henrywasulaNo ratings yet

- Accounting ReviewerDocument9 pagesAccounting ReviewerLearni SarabiaNo ratings yet

- Conceptual Framework PAS 1 With Answer KeyDocument12 pagesConceptual Framework PAS 1 With Answer KeyRichel Armayan33% (3)

- AE221 - 1 Basic FS - Financial Postion - Income StatementDocument11 pagesAE221 - 1 Basic FS - Financial Postion - Income StatementRei GaculaNo ratings yet

- Conceptual Framework PAS 1 With Answer KeyDocument11 pagesConceptual Framework PAS 1 With Answer KeyRichel Armayan67% (21)

- Basic Financial Statements: Conceptual FrameworkDocument11 pagesBasic Financial Statements: Conceptual FrameworkNhel AlvaroNo ratings yet

- Chapter 4 Accounting Concepts and PrinciplesDocument14 pagesChapter 4 Accounting Concepts and PrinciplesAngellouiza MatampacNo ratings yet

- 3 Concepts in AccountingDocument59 pages3 Concepts in Accountingedward peraltaNo ratings yet

- Key Things To Know: Objectives of Financial ReportingDocument2 pagesKey Things To Know: Objectives of Financial ReportingIbrarNo ratings yet

- Accounting Concepts and PrinciplesDocument43 pagesAccounting Concepts and PrinciplesOliver RomeroNo ratings yet

- OBLICON Definition of TermsDocument9 pagesOBLICON Definition of TermsKimmy ShawwyNo ratings yet

- Conceptual FramewwrokDocument5 pagesConceptual FramewwrokJohn Wallace ChanNo ratings yet

- Conceptual Framework and Financial Statements SummaryDocument5 pagesConceptual Framework and Financial Statements SummaryAndrea Mae ManuelNo ratings yet

- Rev. CH2Document3 pagesRev. CH2Mark RanekNo ratings yet

- Purpose of The Conceptual FrameworkDocument7 pagesPurpose of The Conceptual Frameworkbugaspearl0No ratings yet

- Far 2Document6 pagesFar 2Marjorie UrbinoNo ratings yet

- Module-1 Intro To AccountingDocument4 pagesModule-1 Intro To AccountingPam Salalima AlemaniaNo ratings yet

- CFAS Chapter 2-7 Conceptual FrameworkDocument3 pagesCFAS Chapter 2-7 Conceptual FrameworkKaren CaelNo ratings yet

- Cfas Chapter 3 Qualitative Characteristics: Free From ErrorDocument5 pagesCfas Chapter 3 Qualitative Characteristics: Free From ErrorKyle RiegoNo ratings yet

- What Is AccountingDocument8 pagesWhat Is Accountingmy tràNo ratings yet

- Fabm1 - Reviewer: AccountingDocument7 pagesFabm1 - Reviewer: AccountingBaluyut, Kenneth Christian O.No ratings yet

- 11Document27 pages11James Gliponio CamanteNo ratings yet

- Cbactg01 Chapter 1 ModuleDocument16 pagesCbactg01 Chapter 1 ModuleJohn DavisNo ratings yet

- Conceptual Framework Chapter 1-10Document112 pagesConceptual Framework Chapter 1-10Earone MacamNo ratings yet

- Chapter 2 - Acctg Concepts & PrinciplesDocument20 pagesChapter 2 - Acctg Concepts & PrinciplesEowyn DianaNo ratings yet

- 3 Important Activities Included in The Definition of AccountingDocument10 pages3 Important Activities Included in The Definition of AccountingPrecious ViterboNo ratings yet

- CFAS Notes Unit1Document2 pagesCFAS Notes Unit1BabeEbab AndreiNo ratings yet

- Chapter 4 2019 0 NewDocument61 pagesChapter 4 2019 0 Newnomthandazomtshweni574No ratings yet

- Conceptual Framework: Theoretical FoundationDocument13 pagesConceptual Framework: Theoretical FoundationAnne Jeaneth SevillaNo ratings yet

- Accounting ConceptsDocument3 pagesAccounting ConceptsVic BalmadridNo ratings yet

- Conceptual Framework (Part 1)Document3 pagesConceptual Framework (Part 1)Eui KimNo ratings yet

- Far ReviewerDocument2 pagesFar ReviewerBANGONON, ANGELIKA B.No ratings yet

- Valuation Concepts and MethodsDocument5 pagesValuation Concepts and MethodsYami HeatherNo ratings yet

- Intensive Basic AccountingDocument4 pagesIntensive Basic AccountingMaryll Cyan Magnaye100% (2)

- ACCOUNTINGDocument6 pagesACCOUNTINGFe VhieNo ratings yet

- MODULE 2 Accounting Concepts and PrinciplesDocument4 pagesMODULE 2 Accounting Concepts and PrinciplesKatherine MagpantayNo ratings yet

- Chapter 1 - Introduction To Cost & Management AccountingDocument30 pagesChapter 1 - Introduction To Cost & Management AccountingJiajia MoxNo ratings yet

- Reviewer Acca 102Document12 pagesReviewer Acca 102Nicole FidelsonNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- CPA Review Notes 2019 - Audit (AUD)From EverandCPA Review Notes 2019 - Audit (AUD)Rating: 3.5 out of 5 stars3.5/5 (10)

- Exercise 1 Margarett Company: Sales BudgetDocument4 pagesExercise 1 Margarett Company: Sales BudgetHannaniah PabicoNo ratings yet

- C) Scarlett's Total Share in The Net Income Is P21 688Document4 pagesC) Scarlett's Total Share in The Net Income Is P21 688Hannaniah PabicoNo ratings yet

- C) Scarlett's Total Share in The Net Income Is P21 688Document4 pagesC) Scarlett's Total Share in The Net Income Is P21 688Hannaniah PabicoNo ratings yet

- Workbook 2Document1 pageWorkbook 2Hannaniah PabicoNo ratings yet

- Audit of ARInvDocument6 pagesAudit of ARInvHannaniah PabicoNo ratings yet

- Audit of CashDocument5 pagesAudit of CashHannaniah PabicoNo ratings yet

- Test Ii: Misplaced Check (AR)Document10 pagesTest Ii: Misplaced Check (AR)Hannaniah PabicoNo ratings yet

- Performance Task AAADocument4 pagesPerformance Task AAAHannaniah PabicoNo ratings yet

- Investment in A/R: Current SalesDocument12 pagesInvestment in A/R: Current SalesHannaniah PabicoNo ratings yet

- Test Ii: Misplaced Check (AR)Document10 pagesTest Ii: Misplaced Check (AR)Hannaniah PabicoNo ratings yet

- Intermediate Accounting 3Document10 pagesIntermediate Accounting 3Hannaniah PabicoNo ratings yet

- Illustration On Situs and Gross EstateDocument2 pagesIllustration On Situs and Gross EstateHannaniah PabicoNo ratings yet

- Intermediate Accounting 3Document10 pagesIntermediate Accounting 3Hannaniah PabicoNo ratings yet

- Workbook 2Document1 pageWorkbook 2Hannaniah PabicoNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument32 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledHannaniah PabicoNo ratings yet

- Business Finance TGDocument338 pagesBusiness Finance TGgrascia201082% (11)

- RFBT QuizzesDocument4 pagesRFBT QuizzesHannaniah PabicoNo ratings yet

- AccountingDocument1 pageAccountingHannaniah Pabico100% (6)

- Unclaimed Balances Law (PD 679)Document3 pagesUnclaimed Balances Law (PD 679)MaricrisNo ratings yet

- Business PlanDocument27 pagesBusiness PlanHannaniah Pabico78% (37)

- Corporate Governance: 2017 RESULTSDocument58 pagesCorporate Governance: 2017 RESULTSFachrurrozi Iyunk100% (1)

- VA CJMDocument552 pagesVA CJMLoki57No ratings yet

- CL 4.2 - Interested Parties and Internal & External Issue TrackerDocument17 pagesCL 4.2 - Interested Parties and Internal & External Issue TrackersalmanNo ratings yet

- Form Tech-3 FullDocument17 pagesForm Tech-3 FullAhmad FawadNo ratings yet

- Digital GovernanceDocument23 pagesDigital GovernanceHanafi SLank100% (2)

- Letter To Manchester Superintendent Dr. Debra LivingstonDocument8 pagesLetter To Manchester Superintendent Dr. Debra LivingstonRebecca LavoieNo ratings yet

- Ucal Fuel AR 2018Document144 pagesUcal Fuel AR 2018Puneet367No ratings yet

- Food Safety in Fast Food RestaurantsDocument10 pagesFood Safety in Fast Food RestaurantsIan PatrickNo ratings yet

- GRI G4 Construction and Real Estate Sector DisclosuresDocument98 pagesGRI G4 Construction and Real Estate Sector DisclosuresMaximillian AgustarNo ratings yet

- Technology Developers v. CA RESOLUTIONDocument3 pagesTechnology Developers v. CA RESOLUTIONStradivariumNo ratings yet

- Comprehensive Anti Corruption Guidelines For Curriculum ChangeDocument136 pagesComprehensive Anti Corruption Guidelines For Curriculum ChangeLisa Stinocher OHanlonNo ratings yet

- SHRM NotesDocument72 pagesSHRM NotesChithraNo ratings yet

- Identifying Information Region Barangay City/Municipality: ProvinceDocument19 pagesIdentifying Information Region Barangay City/Municipality: Provincemichael ricafortNo ratings yet

- Essentials of Cyber SecurityDocument84 pagesEssentials of Cyber SecurityAshsun100% (2)

- IBM Insurance ModelsDocument8 pagesIBM Insurance ModelstparajiaNo ratings yet

- How We Work With Suppliers: Upholding Apple's Values in Our Supply ChainDocument18 pagesHow We Work With Suppliers: Upholding Apple's Values in Our Supply ChainNguyễn Văn NghĩaNo ratings yet

- HTTPS:// S Ell Ercen TR Al - Ama Zon GP / Help/g1801Document6 pagesHTTPS:// S Ell Ercen TR Al - Ama Zon GP / Help/g1801Aliful Islam HasibNo ratings yet

- Guide For Writing A Memorandum of Understanding (MOU)Document5 pagesGuide For Writing A Memorandum of Understanding (MOU)mujahid100% (1)

- SBP Circular-On Revised Guidelines On Remuneration PracticesDocument2 pagesSBP Circular-On Revised Guidelines On Remuneration PracticesMeeroButtNo ratings yet

- Annual Report 2013Document158 pagesAnnual Report 2013Shoaib HasanNo ratings yet

- ARC524-18 - Architecture Comprehensive Course 2: Assignment No. 8: Building Utilities 5Document17 pagesARC524-18 - Architecture Comprehensive Course 2: Assignment No. 8: Building Utilities 5Melaine A. FranciscoNo ratings yet

- IAPP CIPM Privacy Program Management 2nd EdDocument9 pagesIAPP CIPM Privacy Program Management 2nd Edformytempuse0% (8)

- Sample Daycare Business Plan PDFDocument13 pagesSample Daycare Business Plan PDFsujrulz100% (2)

- Capability Statement For Morgan StanleyDocument2 pagesCapability Statement For Morgan StanleyvTech SolutionNo ratings yet

- Asif KhaskheliDocument4 pagesAsif KhaskheliMisbhasaeedaNo ratings yet

- Job Description Regional Finance Controller East Asia June 2017 PDFDocument3 pagesJob Description Regional Finance Controller East Asia June 2017 PDFprince kevin latojaNo ratings yet

- HITRUST CSF v9.6.0 Summary of ChangesDocument2 pagesHITRUST CSF v9.6.0 Summary of ChangesElizabeth PatrickNo ratings yet

- Pakistan IFRSDocument16 pagesPakistan IFRSNasirNo ratings yet

- Generator Maintenance Tender InstructionsDocument24 pagesGenerator Maintenance Tender Instructions213eknoNo ratings yet

- Negotiation Plan: It'S All in The Driving Seat - For Happy TaxiDocument5 pagesNegotiation Plan: It'S All in The Driving Seat - For Happy TaxiKunwarbir Singh lohatNo ratings yet