Professional Documents

Culture Documents

MODULE 2 Accounting Concepts and Principles

Uploaded by

Katherine MagpantayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MODULE 2 Accounting Concepts and Principles

Uploaded by

Katherine MagpantayCopyright:

Available Formats

COLLEGE OF BUSINESS AND MANAGEMENT

Dr. Glen D.V. De Leon, CPA

glen.deleon@dlsau.edu.ph

Module 2

Accounting Concepts and Principles________________________________________________

LEARNING OBJECTIVES:

After studying this chapter, you should be able to:

1. Give examples of accounting concepts and principles.

2. Apply the concepts in solving accounting problems.

Basic Accounting Concepts

1. Separate entity concept 7. Time Period

2. Historical cost concept 8. Stable monetary unit

3. Going concern assumption 9. Materiality concept

4. Matching 10. Cost-benefit

5. Accrual Basis 11. Full disclosure principle

6. Prudence (or Conservatism) 12. Consistency concept

• Separate entity concept – The business is viewed as a separate entity, distinct from its

owner(s). Only the transactions of the business are recorded in the books of accounts.

The personal transactions of the business owner(s) are not recorded.

• Historical cost concept (Cost principle) – assets are initially recorded at their acquisition

cost.

FINANCIAL ACCOUNTING & REPORTING 1

• Going concern assumption – The business is assumed to continue to exist for an

indefinite period of time.

• Matching – Some costs are initially recognized as assets and charged as expenses only

when the related revenue is recognized.

• Accrual Basis of accounting – income is recorded in the period when it is earned rather

than when it is collected, while expense is recorded in the period when it is incurred

rather than when it is paid.

• Prudence – The observance of some degree of caution when exercising judgments

under conditions of uncertainty. Such that, if there is a choice between a potentially

unfavorable outcome and a potentially favorable outcome, the unfavorable one is

chosen. This is necessary so that assets or income are not overstated and liabilities or

expenses are not understated.

• Reporting Period – The life of the business is divided into series of reporting periods.

• Stable monetary unit – Assets, liabilities, equity, income and expenses are stated in

terms of a common unit of measure, which is the peso in the Philippines. Moreover, the

purchasing power of the peso is regarded as stable. Therefore, changes in the

purchasing power of the peso due to inflation are ignored.

• Materiality concept – An item is considered material if its omission or misstatement

could influence economic decisions. Materiality is a matter of professional judgment and

is based on the size and nature of an item being judged.

• Cost-benefit – The costs of processing and communicating information should not

exceed the benefits to be derived from the information’s use.

• Full disclosure principle – Information communicated to users reflect a balance between

detail and conciseness, keeping in mind the cost-benefit principle.

• Consistency concept – Like transactions are accounted for in like manner from period to

period.

Philippine Financial Reporting Standards (PFRSs)

The PFRSs are Standards and Interpretations adopted by the FRSC. They consist of the

following:

1. Philippine Financial Reporting Standards (PFRSs);

2. Philippine Accounting Standards (PASs); and

3. Interpretations

Qualitative Characteristics

I. Fundamental Qualitative Characteristics

i. Relevance (Predictive Value, Confirmatory Value, Materiality)

ii. Faithful Representation (Completeness, Neutrality,

Free from error)

II. Enhancing Qualitative Characteristics

i. Comparability

ii. Verifiability

iii. Timeliness

iv. Understandability

FINANCIAL ACCOUNTING & REPORTING 2

Fundamental vs. Enhancing

• The fundamental qualitative characteristics are the characteristics that make information

useful to users.

• The enhancing qualitative characteristics are the characteristics that enhance the usefulness of

information

Relevance

• Information is relevant if it can affect the decisions of users.

• Relevant information has the following:

a. Predictive value – the information can be used in making predictions

b. Confirmatory value – the information can be used in confirming past predictions

c. Materiality – is an ‘entity-specific’ aspect of relevance.

Faithful representation

• Faithful representation means the information provides a true, correct and complete depiction

of what it purports to represent.

• Faithfully represented information has the following:

a. Completeness – all information necessary for users to understand the phenomenon

being depicted is provided.

b. Neutrality – information is selected or presented without bias.

c. Free from error – there are no errors in the description and in the process by which the

information is selected and applied.

Enhancing Qualitative Characteristics

1. Comparability – the information helps users in identifying similarities and differences between

different sets of information.

2. Verifiability – different users could reach consensus as to what the information purports to

represent.

3. Timeliness – the information is available to users in time to be able to influence their decisions.

4. Understandability – users are expected to have:

a. reasonable knowledge of business activities; and

b. willingness to analyze the information diligently.

FINANCIAL ACCOUNTING & REPORTING 3

Barnes & Noble. Nobles, Scott, et al. (2019). College Accounting (11th ed). Cengage Learning.

Beticon, J., Hinayon, M., and Ireneo, S. (2019). Fundamentals of Accounting. Manila: FCA

Publishing.

Empleo, P., German, C., and Cruz. (2019). Fundamentals of Accounting Vol. 2. Mutual Books,

Inc.

Millan Z.V. (2019) Financial Accounting and Reporting

Saguinsin, A. T. (2013). Basic Concept of Accounting.

“The Spirit of the Lord will rest on him — the Spirit of wisdom and of understanding, the Spirit of counsel and

of might, the Spirit of the knowledge and fear of the Lord.“ (Isaiah 11:2)

- END -

FINANCIAL ACCOUNTING & REPORTING 4

You might also like

- Chapter 4 Accounting Concepts and PrinciplesDocument14 pagesChapter 4 Accounting Concepts and PrinciplesAngellouiza MatampacNo ratings yet

- Lesson 2 - Accounting Concepts and PrinciplesDocument5 pagesLesson 2 - Accounting Concepts and PrinciplesJeyem AscueNo ratings yet

- Handout 2 Concepts and Principles of AccountingDocument5 pagesHandout 2 Concepts and Principles of AccountingRyzha JoyNo ratings yet

- Chapter 2 - Acctg Concepts & PrinciplesDocument20 pagesChapter 2 - Acctg Concepts & PrinciplesEowyn DianaNo ratings yet

- ACCTG - 1 - Chapter 1 & 2Document39 pagesACCTG - 1 - Chapter 1 & 2Aldeguer Joy PenetranteNo ratings yet

- Accounting Concepts and PrinciplesDocument41 pagesAccounting Concepts and PrinciplesDon Jack Caalim100% (1)

- ACCTG Module 2Document17 pagesACCTG Module 22022310910No ratings yet

- Accounting ReportDocument4 pagesAccounting ReportKrystelle Lori A. QuiachonNo ratings yet

- Chapter 2 Acctg Concepts PrinciplesDocument17 pagesChapter 2 Acctg Concepts PrinciplesRosela Dela Vega100% (6)

- Accounting Concepts and Principles - Chapter 2Document12 pagesAccounting Concepts and Principles - Chapter 2Nicole DomingoNo ratings yet

- FAR Module 2Document16 pagesFAR Module 2Fuentes, Ferdelyn F.No ratings yet

- Conceptual FrameworkDocument9 pagesConceptual FrameworkheeeyjanengNo ratings yet

- Chapter 2 - Acctg Concepts & PrinciplesDocument16 pagesChapter 2 - Acctg Concepts & PrinciplesJhonne Lester M. MallillinNo ratings yet

- Chapter 2 Acctg 101Document4 pagesChapter 2 Acctg 101ana angelesNo ratings yet

- Chapter 2 - Acctg Concepts & PrinciplesDocument17 pagesChapter 2 - Acctg Concepts & PrinciplesJudy Mar Valdez, CPA100% (1)

- Accounting Concepts and PrinciplesDocument4 pagesAccounting Concepts and PrinciplesKathrine Nicole FernanNo ratings yet

- Chapter 2 - Acctg Concepts - PrinciplesDocument19 pagesChapter 2 - Acctg Concepts - PrinciplesWenjunNo ratings yet

- Introduction To AccountingDocument27 pagesIntroduction To AccountingarkanaptnNo ratings yet

- Module 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVDocument56 pagesModule 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVCale Robert RascoNo ratings yet

- CH2: Conceptual Framework Conceptual Framework Is:: Specific Requirements For A Particular AreaDocument4 pagesCH2: Conceptual Framework Conceptual Framework Is:: Specific Requirements For A Particular Area7th libraryNo ratings yet

- LESSON 1.3 Accounting Concepts and PrinciplesDocument11 pagesLESSON 1.3 Accounting Concepts and PrinciplesEl Rey SalvadorNo ratings yet

- Elements of Financial StatementDocument33 pagesElements of Financial StatementKertik Singh100% (1)

- CH 2 Acctg Concepts PrinciplesDocument22 pagesCH 2 Acctg Concepts PrinciplesSassy BitchNo ratings yet

- Acc701 Frame Work Accounting and Reporting 1: Betty FataiDocument44 pagesAcc701 Frame Work Accounting and Reporting 1: Betty FataiYvonne AlasinaNo ratings yet

- Accounting Concepts and PrinciplesDocument5 pagesAccounting Concepts and PrinciplesAlex EiyzNo ratings yet

- Conceptual Framework: & Accounting Standards Lecture AidDocument19 pagesConceptual Framework: & Accounting Standards Lecture AidFuentes, Ferdelyn F.No ratings yet

- Financial Accounting and Reporting Lesson 1 2 3Document12 pagesFinancial Accounting and Reporting Lesson 1 2 3kim fernandoNo ratings yet

- ACCOUNTINGDocument6 pagesACCOUNTINGFe VhieNo ratings yet

- Accounting ReviewerDocument9 pagesAccounting ReviewerLearni SarabiaNo ratings yet

- FABM1 - Module 4 Accounting Concepts and PrinciplesDocument5 pagesFABM1 - Module 4 Accounting Concepts and Principlesaeyesha.regaloNo ratings yet

- Chapter 4 2019 0 NewDocument61 pagesChapter 4 2019 0 Newnomthandazomtshweni574No ratings yet

- Chapter 2 - Acctg Concepts & PrinciplesDocument15 pagesChapter 2 - Acctg Concepts & PrinciplesR RoseNo ratings yet

- Accounting Accounting Concepts and Principles G. Ong: Page 1 of 2Document2 pagesAccounting Accounting Concepts and Principles G. Ong: Page 1 of 2ClaireNo ratings yet

- Module 3 - Conceptual Framework (Chapter3)Document47 pagesModule 3 - Conceptual Framework (Chapter3)No NotreallyNo ratings yet

- CLASS NOTES Topic 8 Conceptual Framework of AccountingDocument11 pagesCLASS NOTES Topic 8 Conceptual Framework of AccountingKiasha WarnerNo ratings yet

- Chapter 1 Conceptual FrameworkDocument5 pagesChapter 1 Conceptual FrameworkJOMAR FERRERNo ratings yet

- ACC 203 Module 2 Conceptual FrameworkDocument26 pagesACC 203 Module 2 Conceptual FrameworkMitch Giezcel DrizNo ratings yet

- Conceptual Framework (Part 1)Document3 pagesConceptual Framework (Part 1)Eui KimNo ratings yet

- 1 - Overview of AccountingDocument19 pages1 - Overview of AccountingZackie LouisaNo ratings yet

- Acc140 NotesDocument72 pagesAcc140 NotesSalim Yusuf BinaliNo ratings yet

- Conceptual Framework For Financial ReportingDocument8 pagesConceptual Framework For Financial ReportingsmlingwaNo ratings yet

- 1 - Overview of AccountingDocument17 pages1 - Overview of AccountingBunnie CaronanNo ratings yet

- Chapter 2: Accounting Concepts and PrinciplesDocument2 pagesChapter 2: Accounting Concepts and PrinciplesShemara AlonzoNo ratings yet

- 01 - Lec - Conceptual FrameworkDocument5 pages01 - Lec - Conceptual FrameworkYoung MetroNo ratings yet

- ACCCOB2 Conceptual Framework For Financial Reporting PPT T1AY2223-1Document59 pagesACCCOB2 Conceptual Framework For Financial Reporting PPT T1AY2223-1Clement ChuaNo ratings yet

- 1 - Overview of Accounting - 2039637638Document19 pages1 - Overview of Accounting - 2039637638corinbernadette28macayanNo ratings yet

- (C2) Basic Accounting ConceptsDocument3 pages(C2) Basic Accounting ConceptsVenus LacambraNo ratings yet

- Conceptual FrameworkDocument19 pagesConceptual FrameworkRej Villamor100% (2)

- 1 - Overview of AccountingDocument17 pages1 - Overview of AccountingAresta, Novie MaeNo ratings yet

- Module-1 Intro To AccountingDocument4 pagesModule-1 Intro To AccountingPam Salalima AlemaniaNo ratings yet

- CFAS Module Week 3-4Document13 pagesCFAS Module Week 3-4Yamit, Angel Marie A.No ratings yet

- CFAS - Lec. 1 OVERVIEW OF ACCOUNTINGDocument17 pagesCFAS - Lec. 1 OVERVIEW OF ACCOUNTINGlatte aeri100% (1)

- Topic 3. Qualitative Characteristics of Useful Financial InformationDocument2 pagesTopic 3. Qualitative Characteristics of Useful Financial InformationJericca BlancoNo ratings yet

- Lecture Notes 1Document12 pagesLecture Notes 1N3rd But CoolNo ratings yet

- Topic 2 Principles Assumptions and Elements of Financial Statements-ADocument28 pagesTopic 2 Principles Assumptions and Elements of Financial Statements-ABasilina OsitaNo ratings yet

- ACC106 Chapter 2Document17 pagesACC106 Chapter 2ErynNo ratings yet

- 1 - Overview of AccountingDocument19 pages1 - Overview of AccountingMichelle Matubis Bongalonta100% (7)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- T2 Homework 2Document3 pagesT2 Homework 2Aziz Alusta OmarNo ratings yet

- Why Facts Don't Change Our MindsDocument13 pagesWhy Facts Don't Change Our MindsNadia Sei LaNo ratings yet

- SAES-L-610 PDF Download - Nonmetallic Piping in Oily Water Services - PDFYARDocument6 pagesSAES-L-610 PDF Download - Nonmetallic Piping in Oily Water Services - PDFYARZahidRafiqueNo ratings yet

- MCQS For The Mid Term Exams Chapter 8Document8 pagesMCQS For The Mid Term Exams Chapter 8dort developersNo ratings yet

- ANSYS SimplorerDocument2 pagesANSYS Simplorerahcene2010No ratings yet

- Purple Futuristic Pitch Deck PresentationDocument10 pagesPurple Futuristic Pitch Deck PresentationRidzki F.RNo ratings yet

- 15 TribonDocument10 pages15 Tribonlequanghung98No ratings yet

- Opposite Integers1Document2 pagesOpposite Integers1Hapsari C. Hanandya NannaNo ratings yet

- Numerical Study of Depressurization Rate During Blowdown Based On Lumped Model AnalysisDocument11 pagesNumerical Study of Depressurization Rate During Blowdown Based On Lumped Model AnalysisamitNo ratings yet

- Subaru Transmission Solenoid DiagramDocument5 pagesSubaru Transmission Solenoid DiagramJosh HatchNo ratings yet

- Integrated Chinese Vol 4 TextbookDocument444 pagesIntegrated Chinese Vol 4 Textbookcuriousbox90% (10)

- Lucas - Econometric Policy Evaluation, A CritiqueDocument28 pagesLucas - Econometric Policy Evaluation, A CritiqueFederico Perez CusseNo ratings yet

- PDF Kajaria Report Final - CompressDocument40 pagesPDF Kajaria Report Final - CompressMd Borhan Uddin 2035097660No ratings yet

- 33198Document8 pages33198tatacpsNo ratings yet

- Why Are You Applying For Financial AidDocument2 pagesWhy Are You Applying For Financial AidqwertyNo ratings yet

- System 9898XT Service ManualDocument398 pagesSystem 9898XT Service ManualIsai Lara Osoria100% (3)

- TCM FD20-25Document579 pagesTCM FD20-25Socma Reachstackers100% (2)

- Urban Worksheet - StudentDocument29 pagesUrban Worksheet - StudentChris WongNo ratings yet

- Watson SPEECH TO TEXT Code Snippet.rDocument2 pagesWatson SPEECH TO TEXT Code Snippet.rLucia Carlina Puzzar QuinteroNo ratings yet

- Data Center Cooling SolutionsDocument24 pagesData Center Cooling SolutionsGemelita Ortiz100% (1)

- Biology 20 Unit A Exam OutlineDocument1 pageBiology 20 Unit A Exam OutlineTayson PreteNo ratings yet

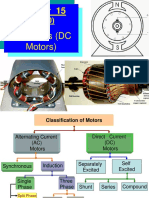

- Chapter 15.1.2.3 DC Drives PPT II Spring 2012Document56 pagesChapter 15.1.2.3 DC Drives PPT II Spring 2012Muhammad Saqib Noor Ul IslamNo ratings yet

- MIT15 093J F09 Rec04Document4 pagesMIT15 093J F09 Rec04santiago gonzalezNo ratings yet

- Module 5 Lesson 5.1 - For ResearchDocument16 pagesModule 5 Lesson 5.1 - For ResearchJohn Clieford AdarayanNo ratings yet

- Tapiwa Steve Mandaa - 165070 - Assignsubmission - File - Innovation Management Paper DraftDocument7 pagesTapiwa Steve Mandaa - 165070 - Assignsubmission - File - Innovation Management Paper DraftTapiwaNo ratings yet

- Engineering Council of South Africa: Training and Mentoring Guide For Professional CategoriesDocument26 pagesEngineering Council of South Africa: Training and Mentoring Guide For Professional CategoriesMECHANICAL ENGINEERINGNo ratings yet

- BDC Questions and AnswersDocument14 pagesBDC Questions and AnswerssatishNo ratings yet

- Mud Motor DV826Document1 pageMud Motor DV826CAMILO ALFONSO VIVEROS BRICEÑONo ratings yet

- TGA User ManualDocument310 pagesTGA User Manualfco85100% (1)

- Class NotesDocument610 pagesClass NotesNiraj KumarNo ratings yet