Professional Documents

Culture Documents

Adjusted Retained Earnings Statement

Uploaded by

Serazul Arafin MrinmoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusted Retained Earnings Statement

Uploaded by

Serazul Arafin MrinmoyCopyright:

Available Formats

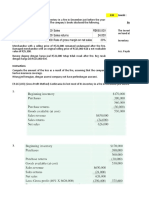

P4-7 Retained Earnings Statement [Prior Period Adjustments]

Acadian Corp

Retained Earnings Statement/Statement of Changes in Equity

For the year ended December 31, 2019

Particulars Amount Total

Retained Earnings January 1, 2019 [Given] $257,600

Add: Correction of error from prior period income 2018 25,400

Less: Adjust for change in accounting principles (23,200)

Retained Earnings January 1, 2019 [Adjusted] $259,800

Add: Income from operation [Net Income] 84,500

Gain on sale of investments 41,200

Refund on litigation with government 21,600

Deduct: Write off goodwill (60,000)

Loss on discontinued operations (35,000)

Net Income [Adjusted] 52,300

Deduct: Cash dividend declared (32,000)

Retained Earnings December 31, 2019 $280,100

(b)

1. Gain on sale of investments—body of income statement. [Heading: Other Revenue and Gain]

This gain should not be shown net of tax on the income statement.

2. Refund on litigation with government—body of income statement, possibly unusual item.

[Heading: Other Revenue and Gain] This refund should not be shown net of tax on the income

statement.

3. Loss on discontinued operations—body of the income statement, [Heading: Discontinued

operation] following the caption, “Income from continuing operations.”

4. Write-off of goodwill—body of income statement, possibly un-usual item. [Heading: Other

Revenue and Gain] The write-off should not be shown net of tax on the income statement.

E4-12 [Retained Earnings Statement]

(a)

McEntire Corporation

Retained Earnings Statement

For the year ended December 31, 2019

Particulars Amount Total

Retained Earnings January 1, 2019 $225,000

(40,000 + 125,000 + 160,000)- (50,000 + 50,000)

PRIOR PERIOD ADJUSTMENTS

Correction of depreciation error [net of $5,000 tax] [25,000- (20,000)

(25,000 X 20%)]

Cumulative decrease in income from change in inventory (36,000)

methods [net of $9,000 tax] [45,000-(45,000 X 20%)]

Retained Earnings January 1, 2019 [Adjusted] $169,000

Add: Net Income [$220,000 – ($220,000 X20%)] 176,000

Less: Dividends (100,000)

Retained Earnings December 31, 2019 $245,000

(b) Total retained earnings would still be reported as $245,000. A restriction does not affect total

retained earnings; it merely labels part of the retained earnings as being unavailable for

dividend distribution. Retained earnings would be reported as follows:

Appropriated $ 70,000

Unappropriated $175,000

Total $245,000

You might also like

- TUGAS AKM III WEEK 2 KELAS LDocument10 pagesTUGAS AKM III WEEK 2 KELAS LRifda Amalia100% (1)

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Tugas Akuntansi Keuangan LanjutanDocument8 pagesTugas Akuntansi Keuangan LanjutanMin DaeguNo ratings yet

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- Firda Arfianti - LC53 - Consolidated Workpaper, Wholly Owned SubsidiaryDocument3 pagesFirda Arfianti - LC53 - Consolidated Workpaper, Wholly Owned SubsidiaryFirdaNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document3 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Audrey NataliaNo ratings yet

- E21 16Document2 pagesE21 16Warmthx0% (1)

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- CH 06Document50 pagesCH 06Dr-Bahaaeddin Alareeni100% (1)

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDocument9 pagesTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsan100% (1)

- 9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Document4 pages9165c46e55b3c94881023e5273552304_934c2b7d81261f58f1850f8a973dcd60Christy Angkouw0% (1)

- Akuntansi Keuangan LanjutanDocument28 pagesAkuntansi Keuangan LanjutanYulitaNo ratings yet

- Ch.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesDocument7 pagesCh.16 Dilutive Securities and Earnings Per Share: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Forum 6Document1 pageForum 6cecillia lissawatiNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- Partnership OperationDocument37 pagesPartnership OperationMuchamad RifaiNo ratings yet

- ch04 PDFDocument4 pagesch04 PDFMosharraf HussainNo ratings yet

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNo ratings yet

- E22 3Document2 pagesE22 3bellaNo ratings yet

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Document6 pagesZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiNo ratings yet

- Nurul Aryani - Quis 2Document3 pagesNurul Aryani - Quis 2Nurul AryaniNo ratings yet

- FM-BINUS-AA-FPU-78/V2R0 Audit CaseDocument4 pagesFM-BINUS-AA-FPU-78/V2R0 Audit CaseIkhsan Uiandra Putra SitorusNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsanNo ratings yet

- Ananda Febrian P.S - 041911333118 - Tugas Akm 8Document5 pagesAnanda Febrian P.S - 041911333118 - Tugas Akm 8sari ayuNo ratings yet

- Test 2 HomeworkDocument12 pagesTest 2 HomeworkMiguel CortezNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Transfer Pricng SolutionDocument3 pagesTransfer Pricng SolutionchandraprakashNo ratings yet

- CH16Document80 pagesCH16mahinNo ratings yet

- Problems Chapter 7Document9 pagesProblems Chapter 7Trang Le0% (1)

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroNo ratings yet

- Soal Akm1Document2 pagesSoal Akm1putri50% (2)

- Erika Christina - LD53 - Latihan KPDocument14 pagesErika Christina - LD53 - Latihan KPNatasha HerlianaNo ratings yet

- Subsidiary Preferred Stock CalculationsDocument3 pagesSubsidiary Preferred Stock CalculationsAlya Sufi IkrimaNo ratings yet

- Accounting Textbook Solutions - 39Document19 pagesAccounting Textbook Solutions - 39acc-expert0% (1)

- Tugas 2 AklDocument3 pagesTugas 2 Akledit andraeNo ratings yet

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahNo ratings yet

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDocument3 pagesMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNo ratings yet

- Tugas AklDocument8 pagesTugas AklFebryanthi SNNo ratings yet

- ACCT550 Homework Week 1Document6 pagesACCT550 Homework Week 1Natasha DeclanNo ratings yet

- IFRS 15 Session4 Handout 1Document2 pagesIFRS 15 Session4 Handout 1Simon YossefNo ratings yet

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsDocument22 pagesAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Amirah Zahra Ariri - Soal Latihan Akuntansi ManajemenDocument7 pagesAmirah Zahra Ariri - Soal Latihan Akuntansi ManajemenHafizd FadillahNo ratings yet

- Assignment P18-6Document2 pagesAssignment P18-6Nur Faizah FauziahNo ratings yet

- Contoh Dan Soal Cash FlowDocument9 pagesContoh Dan Soal Cash FlowAltaf HauzanNo ratings yet

- ACCT 2062 Homework #2Document22 pagesACCT 2062 Homework #2downinpuertorico100% (1)

- Pertemuan 11 Chapter 21 Kieso Ed 3 (LANJUTAN)Document73 pagesPertemuan 11 Chapter 21 Kieso Ed 3 (LANJUTAN)Abraham KristianNo ratings yet

- Week13 SolutionsDocument14 pagesWeek13 SolutionsRian RorresNo ratings yet

- Essence Company Blends and Sells Designer FragrancesDocument2 pagesEssence Company Blends and Sells Designer FragrancesElliot Richard100% (1)

- AKL PartnershipDocument3 pagesAKL PartnershipNanda Latifa PutriNo ratings yet

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDocument14 pagesSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- Chapter 7. KeyDocument8 pagesChapter 7. KeyHuy Hoàng PhanNo ratings yet

- 2014ER FAR Simulations Solutions - PG PDFDocument113 pages2014ER FAR Simulations Solutions - PG PDFSecular Sylhet100% (1)

- Homework Chapter 12Document28 pagesHomework Chapter 12Trung Kiên NguyễnNo ratings yet

- Income Statement SimDocument5 pagesIncome Statement Simjustwon100% (1)

- Module 2 Statement of Comprehensive IncomeDocument8 pagesModule 2 Statement of Comprehensive IncomeStella MarieNo ratings yet

- Chapter Fifteen SolutionsDocument21 pagesChapter Fifteen Solutionsapi-3705855No ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Adjusting Entry-Solutions of ExercisesDocument4 pagesAdjusting Entry-Solutions of ExercisesSerazul Arafin MrinmoyNo ratings yet

- Uhura Resort Adjusting and Closing EntriesDocument3 pagesUhura Resort Adjusting and Closing EntriesSerazul Arafin MrinmoyNo ratings yet

- Assignment On Chapter 04Document1 pageAssignment On Chapter 04Serazul Arafin MrinmoyNo ratings yet

- Conceputal Framework-On Campus TaskDocument2 pagesConceputal Framework-On Campus TaskSerazul Arafin MrinmoyNo ratings yet

- W8 FormDocument1 pageW8 FormMattia PerosinoNo ratings yet

- Q3 Navin PackagingDocument3 pagesQ3 Navin PackagingRishabh ChawlaNo ratings yet

- Assignment # 3: Fundamentals of AccountingDocument1 pageAssignment # 3: Fundamentals of AccountingMara Shaira Siega100% (3)

- Guidelines and Procedures For Applying Tax Treaty Relief AvailmentDocument1 pageGuidelines and Procedures For Applying Tax Treaty Relief Availmentlaica valderasNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)DupanNo ratings yet

- Philippines donor's tax problemsDocument2 pagesPhilippines donor's tax problemsFria Mae Aycardo AbellanoNo ratings yet

- Theory and Precatice of GSTDocument3 pagesTheory and Precatice of GSTakking0146No ratings yet

- GSTR 3B Calculation Summary - JushTNDocument6 pagesGSTR 3B Calculation Summary - JushTNShail MehtaNo ratings yet

- POA Assignment Week 4Document16 pagesPOA Assignment Week 4Rara Rarara30No ratings yet

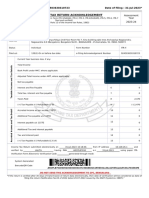

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- Commissioner of Internal Revenue v. Glenshaw Glass Co. Commissioner of Internal Revenue v. William Goldman Theatres, IncDocument8 pagesCommissioner of Internal Revenue v. Glenshaw Glass Co. Commissioner of Internal Revenue v. William Goldman Theatres, IncScribd Government DocsNo ratings yet

- RJR Weekly Bulletin #217Document6 pagesRJR Weekly Bulletin #217vivsubs18No ratings yet

- Midterm Exam-Adjusting EntriesDocument5 pagesMidterm Exam-Adjusting EntriesHassanhor Guro BacolodNo ratings yet

- INCOME TAX AND GST. JURAZ-Module 4Document8 pagesINCOME TAX AND GST. JURAZ-Module 4TERZO IncNo ratings yet

- Philippine Tax Treaty Relief ApplicationDocument2 pagesPhilippine Tax Treaty Relief ApplicationKoji ZerofourNo ratings yet

- Tax Laws June2020 Old Syllabus - CS ExecutiveDocument824 pagesTax Laws June2020 Old Syllabus - CS ExecutivePravinNo ratings yet

- Tugas Chapter 22Document14 pagesTugas Chapter 22hayyu rachma annisaNo ratings yet

- New Form Barangay Budget Preparation FileDocument10 pagesNew Form Barangay Budget Preparation FileReynold Renzales Aguilar100% (3)

- Attachment AccountingDocument6 pagesAttachment Accountingtaylor swiftyyyNo ratings yet

- CSS Accounting & Auditing PapersDocument3 pagesCSS Accounting & Auditing PapersMasood Ahmad AadamNo ratings yet

- Take Home Assignment Introduction of Accounting: InstructionsDocument6 pagesTake Home Assignment Introduction of Accounting: InstructionsPutri SerlyNo ratings yet

- RR No. 8 2018Document35 pagesRR No. 8 2018zul fanNo ratings yet

- Taxation I Course SyllabusDocument4 pagesTaxation I Course Syllabuszeigfred badanaNo ratings yet

- Purchase Order Goods Vat or Non Vat With 2306 and 2307Document17 pagesPurchase Order Goods Vat or Non Vat With 2306 and 2307marivic dyNo ratings yet

- Chart of AccountDocument7 pagesChart of Accountacahalim1103No ratings yet

- Unit-3 Financial-Statements Class-Exercise QuestionsDocument2 pagesUnit-3 Financial-Statements Class-Exercise QuestionsElsa MendozaNo ratings yet

- Cir v. St. Lukes and Dlsu v. CirDocument4 pagesCir v. St. Lukes and Dlsu v. CirRem SerranoNo ratings yet

- The Must-Know Facts About Housing Allowance: TaxesDocument4 pagesThe Must-Know Facts About Housing Allowance: Taxeseasygoing1No ratings yet

- Calculation of Return and WACC: Wacc E D+ E × + D D+E × RDDocument3 pagesCalculation of Return and WACC: Wacc E D+ E × + D D+E × RDTamim ChowdhuryNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023bluetrans expressNo ratings yet