Professional Documents

Culture Documents

Capital Gain Tax On Shares in The Eu 1 PDF

Uploaded by

Eugene FrancoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Gain Tax On Shares in The Eu 1 PDF

Uploaded by

Eugene FrancoCopyright:

Available Formats

PKF International Limited

Capital Gains Tax on Shares in

the EU Anno 2020

PKF International Tax Network is pleased to provide you with an overview of capital gains tax on shares realized by private

individuals in the EU (incl. Switzerland).

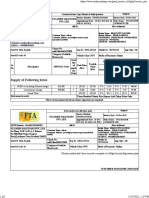

Country Personal income tax rate Capital gain tax on shares realized by If capitals gain tax applies: what rate? Are changes in tax law expected?

private individual

Austria Progressive tax rates from 25% to 55% Yes 27.5% No

Belgium Progressive tax rates from 25% to 50% (the No n/a Unofficially there are rumors to introduce a

first EUR 8.800 is tax-exempt) general 15% capital gain tax in Belgium.

However, no amendments to Belgium tax

law are made yet.

Bulgary Flat rate of 10% tax on worldwide income No n/a No

(including the gain)

Croatia Progressive tax rates from No 12% plus city surtax No

24% (up to HRK 30.000 monthly tax base)

to 36% (over HRK 30.000 monthly tax base) Unless the shares were held less than 2

years

Cyprus Progressive tax rates from 20% to 35% (the No 20% on the difference in the fair value of No

first EUR19.500 is tax-exempt) the property and the fair acquisition value

Unless shares of a Company which holds

immovable property in Cyprus

Czech Republic 15%, with a 7% additional tax rate for Yes 15% No

income from employment and business

income exceeding in total 48 times the

avarage salary

Denmark Progressive tax rates from approx. 25% to Yes The total of all realized capital gains and Recently the 2020 State Budget

56,6% dividends are taxed at 27% below DKK negotiations took place. Part of these

55,300 (EUR 7,413) and 42% above this negotiations was to raise the 42% tax limit

threshold. to 45%, but it did not become a part of the

budget.

Estonia Flat rate of 20% on worldwide income, incl. No n/a No

the gain (the first EUR 6.000 is tax-exempt)

Finland Progressive tax rates up to 56,4% Yes 30% up to EUR 30.000 and 34% above No (plans for) changes have been

EUR 30.000 published until early 2020.

France Progressive tax rates from 0% to 49% Yes if the person is a French tax resident. • Flat tax of 30%, or;

No

• progressive tax rates (for shares held

For foreign tax residents, the sale of before 2018 possibility to apply a rebate

French shares can trigger capital gain tax for length of holding) + 17,2%

if the individual (and family) has held >25%

of the shares of the company at any time

during the last 5 years

Germany Progressive tax rates from 14% to 47,475% Yes • shareholding < 1%: flat rate of 26,375%

(plus church tax, if applicable) incl. church tax (or personal tax rate, if The flat rate taxation is criticized, but there

lower) are no specific plans for amendments.

• shareholding ≥ 1%: 60% of the capital

gain at personal tax rate

Greece Progressive tax rates from 9% to 44% Yes A 15% flat rate applies, whilst capital No

losses on shares can be carried-forward

The taxation applies to the sale of: up to 5 years to be compensated with

• shares of non listed enterprises future gains (immovable property: 0%)

• at least 0,5% of shares of listed

companies

Gains are exempted from taxation in the

following cases:

• sale of shares of listed companies that

were acquired before 1.1.2009

• sale of less than 0,5% of shares of

listed companies

Hungary 15% Yes 15% and an additional 17,5% social Expectedly the social contribution tax rate

contribution tax is due if certain conditions will be reduced at the end of 2020.

are not met.

Ireland Progressive tax rates from 20% to 50% Yes 33% It is hoped that the Entrepreneur Relief

with an Entrepreneur Relief of 10% for may be extended. However, no

proceeds up to EUR 1m for disposal of amendments to Irish tax law have been

certain business assets or shares, if made yet.

certain conditions are met.

Italy Progressive tax rates from 23% to 43% Yes 26% (since 01/01/2019). Before individuals No

had to apply progressive tax rates on a

part of the capital gain.

Latvia Progressive tax rates from 20% to 31,4% Yes 20% No

PKF International Limited

Country Personal income tax rate Capital gain tax on shares realized by If capitals gain tax applies: what rate? Are changes in tax law expected?

private individual

Lithuania Progressive tax rate: 15% or 20% which No n/a No

depends on the level of annual income of

certain income type, including capital gain

on realized shares (in 2020 the rate of 20%

applies on income above EUR 104.278)

Luxembourg Progressive tax rates from 0% (up to EUR Yes For Luxembourg tax residents: No

11.265) to max 45.78% (as from EUR

200.004) and including the employment The capital gain equals the difference • Shares held <6 months are taxed at the

fund contribution of max. 9%. between sale price and acquisition price ordinary progressive income tax rates

(max 45.78%) + dependence insurance

contribution of 1,4%-

• Shares held ≥6 months and non-

significant (i.e. less or equal to 10%

together with his spouse or children)

shareholding in the concerned capital

company are tax exempt-

• Shares held ≥6 months and significant

shareholding in the concerned capital

company: taxed at the ½ global rate

(max. 22.89%) + dependence insurance

contribution of 1,4%. An allowance/tax

rebate of EUR 50.000 (doubled for the

spouses/partners jointly taxable)

applies to capital gains on disposal of

significant shareholdings (and capital

gains on disposal of real estate),

renewable every 10 years

Malta Progressive tax rates from 15% to 35% Yes, although there are some exceptions Taxed at the standard progressive No

including: personal tax rates

• transfer of malta Government Bonds

and Stocks

• transfer of shares in a company listed

on the Malta Stock Exchange

• donations to close relatives and

philanthropic insitutions approved under

the Income Tax Act

Netherlands Progressive rates from 37,35% (incl. social Yes, in case of a substantial shareholding From 26,25% (2020) to 26,9% (2021) No

security) to 49,5% (typically shareholdings of 5% or more)

Poland Progressive tax rates from 17% to 32% Yes 19% No

Portugal Progressive tax rates from 14,5% to 48%. Yes • Flat rate of 28% with a 50% reduction of No

the tax basis (effective rate of 14%) for

capital gains with the sale of shares

issued by micro/small enterprises, or;

• Option to include the capital gains

generated during the year in his/her

aggregate tax basis (i.e. together with

other categories of income) subject to

the standard progressive tax rates (max

48%)

Romania Flat tax rate of 10% Yes 10% No

Slovakia No input received No input received No input received No input received

Slovenia Progressive tax rates from 16% to 50% Yes 27,5% (prior to 2020 the tax rate was 25%) No

Spain Progressive tax rates from 19% to 48% Yes Progressive tax rates from 19% to 23% The change of Government could lead to

an increase in the tax rate. However, no

amendments to Spanish tax law are made

yet.

Sweden Progressive tax rates from 30% to 50% Yes, however most private individuals can 30% (for shares not held in ISK) Not at the moment, but an extensive

hold in listed shares in a so called ISK overhaul is expected in the future

(Investment Savings Account) to avoid

capital gains tax and tax on dividends

Switzerland Progressive tax rates at the federal level Generally no n/a No

(from 0,77% to to 11,5%) and in most

cantons level (of maximum ca. 41,27%). Private capital gains on movable assets If taxed (cfr. exemptions), depending on

(e.g. shares) are normally tax-exempt capital stake / holding period / private

Individuals with a taxable income below throughout Switzerland as long as an business or non-business property status /

CHF 14.500 and couples with a taxable individual does not qualify as being a level of taxation (federal / cantonal) up to

income below CHF 28.300 no federal tax is professional securities dealer or unless 50% of a capital gain / dividend income

levied. Some cantons have also introduced they have been requalified into a dividend may be tax exempt.

a flat rate taxation. income (e.g. in case of a so-called

“transposition” or “indirect partial

liquidation”)

United Kingdom Progressive tax rates from 20% to 45% Yes • 0% if a SEIS or EIS There is discussion that Entrepreneurs’

(England, Wales and Northern Ireland) and • 10% if Entrepreneurs' Relief or Relief may be reformed (as stated in the

from 19% to 46% (Scotland) Investors' Relief qualifies Conservative Party manifesto) in the

Budget which will take place on

• 20% otherwise 11/03/2020.

The content of this overview has been compiled and coordinated on 4 February 2020 by both Kurt De Haen (kurt.dehaen@pkf-vmb.be)

and Janke Tierens (janke.tierens@pkf-vmb.be) of PKF-VMB Tax Consultants cvba. Please contact Kurt or Janke should you have any

questions, comments or suggestions

PKF International Limited administers a family of legally independent firms and does not accept any responsibility or liability for the actions or inactions

of any individual member or correspondent firm or firms.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- U.S. Taxation of Foreign Source: Income-Deferral and The Foreign Tax CreditDocument26 pagesU.S. Taxation of Foreign Source: Income-Deferral and The Foreign Tax CreditEugene FrancoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Revenue Guidance Note On Exchange Traded Funds (Etfs)Document4 pagesRevenue Guidance Note On Exchange Traded Funds (Etfs)Eugene FrancoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 2016 08 08 Managing Wealth 2016 Presentations PDFDocument121 pages2016 08 08 Managing Wealth 2016 Presentations PDFEugene FrancoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The FIRPTA Investment Guide: For Foreign Investments in Certain US Oil and Gas AssetsDocument16 pagesThe FIRPTA Investment Guide: For Foreign Investments in Certain US Oil and Gas AssetsEugene FrancoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Capital Gain Tax On Shares in The Eu 1 PDFDocument2 pagesCapital Gain Tax On Shares in The Eu 1 PDFEugene FrancoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 2016 08 16 Joint LIA ITI Seminars 20152 PDFDocument145 pages2016 08 16 Joint LIA ITI Seminars 20152 PDFEugene FrancoNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- May 2 - Asset ProtectionDocument19 pagesMay 2 - Asset ProtectionEugene FrancoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 14radiantbarriers 1Document2 pages14radiantbarriers 1Eugene FrancoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- NYSE - BX. Dear Unit Holder - PDFDocument9 pagesNYSE - BX. Dear Unit Holder - PDFEugene FrancoNo ratings yet

- 1619 HAUSER-Dealer-Status Condo Article in PDFDocument14 pages1619 HAUSER-Dealer-Status Condo Article in PDFEugene FrancoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 2016 Multifamily Review & Forecast: Les Binkley Boyle Investment CompanyDocument36 pages2016 Multifamily Review & Forecast: Les Binkley Boyle Investment CompanyEugene FrancoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Depreciation Schedule For Mobile Homes - Mobile Home University - Mobile Home Park Investing ForumDocument3 pagesDepreciation Schedule For Mobile Homes - Mobile Home University - Mobile Home Park Investing ForumEugene FrancoNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Guide Pay FileDocument72 pagesGuide Pay FileAlina ErezanuNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- To Real Estate Investments: The Expert GuideDocument10 pagesTo Real Estate Investments: The Expert GuideEugene FrancoNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- BOMA ExplainedDocument23 pagesBOMA ExplainedArchidexterNo ratings yet

- A Comparison Of: CTA IndexesDocument14 pagesA Comparison Of: CTA IndexesEugene FrancoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- EY Tax Immigration Issues PDFDocument15 pagesEY Tax Immigration Issues PDFEugene FrancoNo ratings yet

- Flexco NaturalElements Wood DataSheet PDFDocument5 pagesFlexco NaturalElements Wood DataSheet PDFEugene FrancoNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Oz Kiwi Briefing Paper June 2013 PDFDocument17 pagesOz Kiwi Briefing Paper June 2013 PDFEugene FrancoNo ratings yet

- SEISBIT® 3D: The New Seismic While Drilling Data Acquisition SystemDocument10 pagesSEISBIT® 3D: The New Seismic While Drilling Data Acquisition SystemEugene FrancoNo ratings yet

- Pemex and NXT Joint Technical Paper For Ngo Cartagena July 24 2013 - FinalDocument17 pagesPemex and NXT Joint Technical Paper For Ngo Cartagena July 24 2013 - FinalEugene FrancoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Seismic LoggingDocument152 pagesSeismic LoggingEugene FrancoNo ratings yet

- Wind Utility Ownership and Procurement Strategies in The US Wind Sector 8220101Document12 pagesWind Utility Ownership and Procurement Strategies in The US Wind Sector 8220101Eugene FrancoNo ratings yet

- ZEPower Energy Risk 2011Document1 pageZEPower Energy Risk 2011Eugene FrancoNo ratings yet

- Manoj Gupta Offer LetterDocument2 pagesManoj Gupta Offer LettersknagarNo ratings yet

- Income Tax BasicsDocument20 pagesIncome Tax BasicsShivajee SNo ratings yet

- CSCSummarized - Invoice - 387273date10022022inamount2,44552Document16 pagesCSCSummarized - Invoice - 387273date10022022inamount2,44552Penélope FatimaNo ratings yet

- Florida Palms Country Club Adjusts Its Accounts Monthly Club MembersDocument1 pageFlorida Palms Country Club Adjusts Its Accounts Monthly Club Memberstrilocksp SinghNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Vat Declaration FormDocument5 pagesVat Declaration FormYohannes AssefaNo ratings yet

- Business TaxationDocument19 pagesBusiness TaxationrylNo ratings yet

- Personal Reliefs and RebatesDocument3 pagesPersonal Reliefs and RebatesJong HannahNo ratings yet

- Profit and Loss Statement TemplateDocument3 pagesProfit and Loss Statement TemplateMervat AboureslanNo ratings yet

- Chapter 3Document4 pagesChapter 3Frances Garrovillas100% (2)

- 2017 TXN - TXT 2 - PDF - BitcoinDocument4 pages2017 TXN - TXT 2 - PDF - BitcoinDaniel NaeNo ratings yet

- Account Statement From 21 May 2023 To 21 Nov 2023Document15 pagesAccount Statement From 21 May 2023 To 21 Nov 2023ranjeetatirkey1988No ratings yet

- Gen Principles of TaxationDocument437 pagesGen Principles of TaxationJurilBrokaPatiñoNo ratings yet

- Print Invoice Old - PHPDocument1 pagePrint Invoice Old - PHPDishank RastogiNo ratings yet

- InvoiceDocument1 pageInvoiceMayank SatnalikaNo ratings yet

- MuhsinDocument154 pagesMuhsinVenusAuto VailaturNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Credit Cards WebquestDocument2 pagesCredit Cards Webquestapi-263722937100% (1)

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDocument3 pagesBill of Supply For Electricity: BSES Rajdhani Power LimitedAman K. SinghNo ratings yet

- Toshiba vs. CIR - G.R. No. 157594, March 09, 2010Document20 pagesToshiba vs. CIR - G.R. No. 157594, March 09, 2010Marian Dominique AuroraNo ratings yet

- Appendix 48 - PCVDocument13 pagesAppendix 48 - PCVHelen Paragas Solivar AranetaNo ratings yet

- Total Fee Includes 5% With Holding Tax.: Fee Can Be Deposited in Any Branch of UBLDocument1 pageTotal Fee Includes 5% With Holding Tax.: Fee Can Be Deposited in Any Branch of UBLArslan AnjumNo ratings yet

- Invoice 2Document1 pageInvoice 2Ajay MarwalNo ratings yet

- FBR SopsDocument105 pagesFBR SopsWaheed Ur Rehman WeedNo ratings yet

- Hotel Ibis Trans Studio BandungDocument2 pagesHotel Ibis Trans Studio BandungTedy Andiono100% (4)

- Estimate NCS/NW/582: Nexsus Cyber Solutions Opc PVT LTDDocument2 pagesEstimate NCS/NW/582: Nexsus Cyber Solutions Opc PVT LTDmkm969No ratings yet

- 8 LPC-format PDFDocument2 pages8 LPC-format PDFKamran AliNo ratings yet

- Acceptable Tax ID FormsDocument1 pageAcceptable Tax ID Formsnachi1984No ratings yet

- Chapter 3 Employment Income A 202Document79 pagesChapter 3 Employment Income A 202ateen rizalmanNo ratings yet

- OutputDocument7 pagesOutputUna Balloons0% (1)

- Most Important Terms & Conditions: Schedule of ChargesDocument10 pagesMost Important Terms & Conditions: Schedule of ChargeschintanpNo ratings yet

- Consolidated Statement Formula02 PDFDocument3 pagesConsolidated Statement Formula02 PDFNiña Rica PunzalanNo ratings yet