Professional Documents

Culture Documents

Solved The Following Independent Items For The A Tre Dupuis During The Year

Uploaded by

Doreen0 ratings0% found this document useful (0 votes)

11 views1 pageOriginal Title

Solved the Following Independent Items for the a Tre Dupuis During the Year

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageSolved The Following Independent Items For The A Tre Dupuis During The Year

Uploaded by

DoreenCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

solved: The following independent items for The a tre

Dupuis during the year

solved: The following independent items for The a tre Dupuis during the year

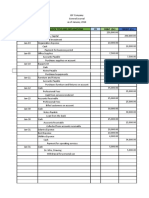

The following independent items for The?a?tre Dupuis during the year ended November 30,

2017, may require a transaction journal entry, an adjusting entry, or both. The company records

all prepaid costs as assets and all un

GET THE ANSWER>> https://solutionlly.com/downloads/solved-the-following-independent-

items-for-the-a-tre-dupuis-during-the-year

solved: The following independent items for The a tre Dupuis during the year

The following independent items for The?a?tre Dupuis during the year ended November 30,

2017, may require a transaction journal entry, an adjusting entry, or both. The company records

all prepaid costs as assets and all unearned revenues as liabilities and it adjusts accounts

annually.1. Supplies on hand amounted to $950 on November 30, 2017. On January 31, 2017,

additional supplies were purchased for $2,880 cash. On November 30, 2017, a physical count

showed that supplies on hand amounted to $670.2. The?a?tre Dupuis puts on 10 plays each

season. Season tickets sell for $200 each and 310 were sold in August for the upcoming

2017-2018 season, which starts in September 2017 and ends in June 2018 (one play per

month). The?a?tre Dupuis credited Unearned Revenue for the full amount received.3. The total

payroll for the theatre is $4,500 every Wednesday for employee salaries earned during the

previous five-day week (Wednesday through Sunday). Salaries were last paid (and recorded)

on Wednesday, November 29. In 2017, November 30 falls on a Thursday. The next payday is

Wednesday, December 6, 2017.4. The?a?tre Dupuis rents the theatre to a local seniors' choir,

which uses the space for rehearsals twice a week at a rate of $425 per month. The new

treasurer of the choir accidentally sent a cheque for $245 on November 1. The treasurer

promised to send a cheque in December for the balance when she returns from her vacation.

On December 4, The?a?tre Dupuis received a cheque for the balance owing from November

plus all of December's rent.5. On June 1, 2017, the theatre borrowed $11,000 from La caisse

populaire Desjardins at an annual interest rate of 4.5%. The principal and interest are to be

repaid on February 1, 2018.6. Upon reviewing the books on November 30, 2017, it was noted

that the utility bill for the month of November had not yet been received. A call to Hydro-

Que?bec determined that the utility bill was for $1,420. The bill was paid on December 10.7.

Owned a truck during the year that had originally been purchased on December 1, 2013, for

$37,975. The truck's estimated useful life is eight years.Instructions(a) Prepare the journal

entries to record the original transactions for items 1 through 5.(b) Prepare the year-end

adjusting entries for items 1 through 7.(c) Prepare the journal entries to record:1. the payment of

wages on Wednesday, December 6 (item 3).2. The receipt of the cheque from the seniors' choir

on December 4 (item 4).3. The payment of the utility bill on December 10 (item 6).4. The

payment of the note and interest on February 1, 2015 (item 5).TAKING IT FURTHERThere are

three basic reasons why an unadjusted trial balance may not contain complete or up-to-date

data. List these reasons and provide examples of each one using items 1 to 7 to illustrate your

explanation.View Solution:

solved: The following independent items for The a tre Dupuis during the year

GET THE ANSWER>> https://solutionlly.com/downloads/solved-the-following-independent-

items-for-the-a-tre-dupuis-during-the-year

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Following Is River Tours Limited S Unadjusted Trial Balance atDocument2 pagesThe Following Is River Tours Limited S Unadjusted Trial Balance atMiroslav GegoskiNo ratings yet

- Quiz Inter1 After Mid (20171)Document1 pageQuiz Inter1 After Mid (20171)Yusuf RaharjaNo ratings yet

- Desrosiers LTD Had The Following Long Term Receivable Account Balances at PDFDocument2 pagesDesrosiers LTD Had The Following Long Term Receivable Account Balances at PDFTaimur TechnologistNo ratings yet

- Muse Daycare Centre MDC Has Been Providing Daycare Services To PDFDocument1 pageMuse Daycare Centre MDC Has Been Providing Daycare Services To PDFTaimour HassanNo ratings yet

- The Unadjusted Trial Balance of Clancy Inc at December 31 PDFDocument2 pagesThe Unadjusted Trial Balance of Clancy Inc at December 31 PDFTaimur TechnologistNo ratings yet

- The Following Information Concerns The Adjusting Entries To Be RecordedDocument1 pageThe Following Information Concerns The Adjusting Entries To Be RecordedHassan JanNo ratings yet

- Laroche Landscaping Has Collected The Following Data For The December PDFDocument1 pageLaroche Landscaping Has Collected The Following Data For The December PDFhassan taimourNo ratings yet

- Terrific Temps Fills Temporary Employment Positions For Local Businesses SomeDocument2 pagesTerrific Temps Fills Temporary Employment Positions For Local Businesses SomeAmit PandeyNo ratings yet

- On November 1 2017 The Account Balances of Pine EquipmentDocument2 pagesOn November 1 2017 The Account Balances of Pine EquipmentDoreenNo ratings yet

- On December 31 2016 Vail Company Owned The Following Assets VailDocument1 pageOn December 31 2016 Vail Company Owned The Following Assets VailHassan JanNo ratings yet

- A Review of The Ledger of Dempsey Company at December: Unlock Answers Here Solutiondone - OnlineDocument1 pageA Review of The Ledger of Dempsey Company at December: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- On August 1 2014 Delanie Tugut Began A Tour CompanyDocument1 pageOn August 1 2014 Delanie Tugut Began A Tour CompanyTaimour HassanNo ratings yet

- Ianthe Limited A Manufacturer of Small Tools Provided The FollowingDocument2 pagesIanthe Limited A Manufacturer of Small Tools Provided The FollowingLet's Talk With HassanNo ratings yet

- Comprehensive ProblemDocument3 pagesComprehensive ProblemRahul100% (1)

- The Unadjusted Trial Balance of Imagine LTD at December 31 2014 PDFDocument1 pageThe Unadjusted Trial Balance of Imagine LTD at December 31 2014 PDFTaimur TechnologistNo ratings yet

- Marvelous Music Provides Music Lessons To Student Musicians Some StudentsDocument2 pagesMarvelous Music Provides Music Lessons To Student Musicians Some Studentstrilocksp Singh0% (2)

- Near The End of Its First Year of Operations DecemberDocument2 pagesNear The End of Its First Year of Operations DecemberMiroslav GegoskiNo ratings yet

- Practice For Final ExamDocument7 pagesPractice For Final ExamNgọc Hân TrầnNo ratings yet

- ACC101 Group Assignment Guideline StudentDocument15 pagesACC101 Group Assignment Guideline StudentTruong Dinh Bao Chau (K16HCM)No ratings yet

- On December 1 2014 Boline Distributing Company Had The FollowingDocument1 pageOn December 1 2014 Boline Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- AtelengDocument2 pagesAtelengGarp BarrocaNo ratings yet

- For The Past Several Years Derrick Epstein Has Operated ADocument1 pageFor The Past Several Years Derrick Epstein Has Operated AM Bilal SaleemNo ratings yet

- Ogonquit Enterprises Prepares Annual Financial Statements and Adjusts Its AccountsDocument1 pageOgonquit Enterprises Prepares Annual Financial Statements and Adjusts Its AccountsMiroslav GegoskiNo ratings yet

- On December 1 2011 John and Patty Driver Formed ADocument2 pagesOn December 1 2011 John and Patty Driver Formed Atrilocksp SinghNo ratings yet

- Dunn Sporting Goods Sells Athletic Clothing and Footwear To RetaDocument1 pageDunn Sporting Goods Sells Athletic Clothing and Footwear To RetaM Bilal SaleemNo ratings yet

- The Following Transactions Occur Over The Remainder of The Year AugDocument2 pagesThe Following Transactions Occur Over The Remainder of The Year AugBube KachevskaNo ratings yet

- Main Street Antiques LTD S Comparative Balance Sheet at December 31Document3 pagesMain Street Antiques LTD S Comparative Balance Sheet at December 31CharlotteNo ratings yet

- Next Job Inc Provides Employment Consulting Services The Company AdjustsDocument2 pagesNext Job Inc Provides Employment Consulting Services The Company Adjuststrilocksp SinghNo ratings yet

- On December 31 2014 The Following Unadjusted Trial Balance Was PDFDocument1 pageOn December 31 2014 The Following Unadjusted Trial Balance Was PDFLet's Talk With HassanNo ratings yet

- Rainy Day Umbrella Corporation Had The Following Balances at December PDFDocument1 pageRainy Day Umbrella Corporation Had The Following Balances at December PDFLet's Talk With HassanNo ratings yet

- T0 2022-2023 MS FA - Roussel - Exercise and SolutionDocument2 pagesT0 2022-2023 MS FA - Roussel - Exercise and SolutionPAURUSH GUPTANo ratings yet

- Latihan Adjusment Journal-Akbar-21102003Document4 pagesLatihan Adjusment Journal-Akbar-21102003Akbar Maulana RamadhanNo ratings yet

- On July 1 2006 Leon Cruz Established An Interior DecoratingDocument1 pageOn July 1 2006 Leon Cruz Established An Interior DecoratingM Bilal SaleemNo ratings yet

- The Following Independent Events For Repertory Theatre LTD During TheDocument2 pagesThe Following Independent Events For Repertory Theatre LTD During TheMiroslav GegoskiNo ratings yet

- ACC Test 1 2017Document8 pagesACC Test 1 2017kumalozandile41No ratings yet

- REVISI - 041911535029 - Helen Puja MelaniaDocument29 pagesREVISI - 041911535029 - Helen Puja MelaniaHelen PujaNo ratings yet

- On December 1 2010 Sleezer Distributing Company Had The FollowDocument1 pageOn December 1 2010 Sleezer Distributing Company Had The FollowM Bilal SaleemNo ratings yet

- On November 1 2014 The Following Were The Account BalancesDocument1 pageOn November 1 2014 The Following Were The Account BalancesAmit PandeyNo ratings yet

- Ken Hensley Enterprises Inc Is A Small Recording Studio inDocument2 pagesKen Hensley Enterprises Inc Is A Small Recording Studio intrilocksp SinghNo ratings yet

- Chapter 3 ExerciseDocument14 pagesChapter 3 ExerciseLy Chanraksmey100% (1)

- Bourque Corporation Began Operations On January 2 Its Year EndDocument1 pageBourque Corporation Began Operations On January 2 Its Year EndMiroslav GegoskiNo ratings yet

- Problem Set ADocument14 pagesProblem Set ADyenNo ratings yet

- Kelompok 13 Kelas N - Pengantar Praktik Pengauditan Minggu 14Document18 pagesKelompok 13 Kelas N - Pengantar Praktik Pengauditan Minggu 14Aqsal IndraNo ratings yet

- The Transactions Completed by Music Depot During November 2015 Were PDFDocument1 pageThe Transactions Completed by Music Depot During November 2015 Were PDFTaimur TechnologistNo ratings yet

- For The Past Several Years Dawn Lytle Has Operated ADocument1 pageFor The Past Several Years Dawn Lytle Has Operated AM Bilal SaleemNo ratings yet

- Presented Below Is Information Pertaining To Delsnyder Specialty Foods ADocument1 pagePresented Below Is Information Pertaining To Delsnyder Specialty Foods ALet's Talk With HassanNo ratings yet

- For The Past Several Years Steffy Lopez Has Operated ADocument2 pagesFor The Past Several Years Steffy Lopez Has Operated Atrilocksp SinghNo ratings yet

- Deb Sikes Started Her Practice As A Design Consultant OnDocument1 pageDeb Sikes Started Her Practice As A Design Consultant Onhassan taimourNo ratings yet

- On June 1 2014 Ellie Hopkins Established An Interior DecoratingDocument1 pageOn June 1 2014 Ellie Hopkins Established An Interior DecoratingAmit PandeyNo ratings yet

- On December 1 2015 Prosen Distributing Company Had The FollowingDocument1 pageOn December 1 2015 Prosen Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- Solved 1 Compute The Amount of Interest During 2015 2016 andDocument1 pageSolved 1 Compute The Amount of Interest During 2015 2016 andJusta MukiriNo ratings yet

- The Trial Balance For Cozy Fireplaces Inc For December 31Document1 pageThe Trial Balance For Cozy Fireplaces Inc For December 31Hassan JanNo ratings yet

- Acco Final #2Document9 pagesAcco Final #2chelsiereyes633No ratings yet

- FC Trans Rem - NotesDocument3 pagesFC Trans Rem - NotesVenz LacreNo ratings yet

- FDNACCT Group Case 1T2021 Island Video Practice SetDocument38 pagesFDNACCT Group Case 1T2021 Island Video Practice SetJasmine ActaNo ratings yet

- CPA Ireland-Financial-Accounting-April-2018Document19 pagesCPA Ireland-Financial-Accounting-April-2018Mwenda MongweNo ratings yet

- Cambridge Ordinary LevelDocument20 pagesCambridge Ordinary LevelVimansa JayakodyNo ratings yet

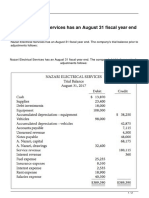

- Nazari Electrical Services Has An August 31 Fiscal Year EndDocument2 pagesNazari Electrical Services Has An August 31 Fiscal Year EndCharlotteNo ratings yet

- Nicole S Getaway Spa Ngs Continues To Grow and Develop NicoleDocument1 pageNicole S Getaway Spa Ngs Continues To Grow and Develop NicoleHassan JanNo ratings yet

- DNP805 Module 2 AssignmentDocument3 pagesDNP805 Module 2 AssignmentDoreenNo ratings yet

- DNP800 Assignment BENCHMARK Assessment, Implementation, and ReviewDocument1 pageDNP800 Assignment BENCHMARK Assessment, Implementation, and ReviewDoreenNo ratings yet

- DNP825 How Are EthicalDocument2 pagesDNP825 How Are EthicalDoreenNo ratings yet

- DNP830 Module 6 AssignmentDocument3 pagesDNP830 Module 6 AssignmentDoreenNo ratings yet

- DNP830 Module 1 AssignmentDocument2 pagesDNP830 Module 1 AssignmentDoreenNo ratings yet

- DNP800 4 DiscussionsDocument1 pageDNP800 4 DiscussionsDoreenNo ratings yet

- DNP835 Healthcare Challenges Have Changed Dramatically in The LastDocument1 pageDNP835 Healthcare Challenges Have Changed Dramatically in The LastDoreenNo ratings yet

- DNP820 Module 5 AssignmentDocument2 pagesDNP820 Module 5 AssignmentDoreenNo ratings yet

- DNP835 Using Concepts and Ideas That You Have Learned in ThisDocument2 pagesDNP835 Using Concepts and Ideas That You Have Learned in ThisDoreenNo ratings yet

- DNP805 Module 3 DiscussionDocument1 pageDNP805 Module 3 DiscussionDoreenNo ratings yet

- DNP830 Module 3 AssignmentDocument2 pagesDNP830 Module 3 AssignmentDoreenNo ratings yet

- DNP805 Module 4 AssignmentDocument3 pagesDNP805 Module 4 AssignmentDoreenNo ratings yet

- DNP800 Assignment Successful Data Collection ToolsDocument1 pageDNP800 Assignment Successful Data Collection ToolsDoreenNo ratings yet

- DNP810 Module 5 AssignmentDocument4 pagesDNP810 Module 5 AssignmentDoreenNo ratings yet

- DNP810 Module 7 AssignmentDocument4 pagesDNP810 Module 7 AssignmentDoreenNo ratings yet

- DNP805 Module 1 AssignmentDocument4 pagesDNP805 Module 1 AssignmentDoreenNo ratings yet

- DNP830 Module 7 AssignmentDocument3 pagesDNP830 Module 7 AssignmentDoreenNo ratings yet

- DNP800 Assignment Sharing KnowledgeDocument1 pageDNP800 Assignment Sharing KnowledgeDoreenNo ratings yet

- DNP805 Module 6 AssignmentDocument2 pagesDNP805 Module 6 AssignmentDoreenNo ratings yet

- DNP825 What Information Is The ECQM LibraryDocument2 pagesDNP825 What Information Is The ECQM LibraryDoreenNo ratings yet

- DNP820 Module 6 AssignmentDocument1 pageDNP820 Module 6 AssignmentDoreenNo ratings yet

- DNP820 Module 4 AssignmentDocument2 pagesDNP820 Module 4 AssignmentDoreenNo ratings yet

- DNP830 Module 4 AssignmentDocument2 pagesDNP830 Module 4 AssignmentDoreenNo ratings yet

- DNP800 Assignment Ensuring Mandated Care Is DeliveredDocument1 pageDNP800 Assignment Ensuring Mandated Care Is DeliveredDoreenNo ratings yet

- DNP825 Create A Process Map by Using The Same Health Care SystemDocument2 pagesDNP825 Create A Process Map by Using The Same Health Care SystemDoreenNo ratings yet

- Consider A Setting Where We Have A Faulty Device Assume That The Failure Can Be Caused by ADocument1 pageConsider A Setting Where We Have A Faulty Device Assume That The Failure Can Be Caused by ACharlotteNo ratings yet

- DNP840 Describe The Strategic Planning Process For andDocument1 pageDNP840 Describe The Strategic Planning Process For andDoreenNo ratings yet

- Consider A Two Layer Network of The Form Shown in Figure 5 1 With The Addition of ExtraDocument1 pageConsider A Two Layer Network of The Form Shown in Figure 5 1 With The Addition of ExtraCharlotteNo ratings yet

- DNP825 Explain What Relationships Would Be Helpful To The NurseDocument1 pageDNP825 Explain What Relationships Would Be Helpful To The NurseDoreenNo ratings yet

- DNP820 Module 3 AssignmentDocument1 pageDNP820 Module 3 AssignmentDoreenNo ratings yet

- New 2302 Exam2Document10 pagesNew 2302 Exam2Reanne Claudine LagunaNo ratings yet

- Financial Statements PreparationDocument6 pagesFinancial Statements Preparationana lopezNo ratings yet

- Accounting Journal (Shiela) Output 1Document5 pagesAccounting Journal (Shiela) Output 1TJ JT100% (1)

- Working Backwards From Net Income - CFO GuyDocument2 pagesWorking Backwards From Net Income - CFO GuyMessias MorettoNo ratings yet

- Banks: Its Role in The Financial Life of A NationDocument13 pagesBanks: Its Role in The Financial Life of A NationEhsan Karim100% (1)

- Foundations of Entrepreneurship: Basic Accounting and Financial StatementsDocument89 pagesFoundations of Entrepreneurship: Basic Accounting and Financial StatementsTejaswi BandlamudiNo ratings yet

- P3-5a, p3-2b William 6081901032 FDocument13 pagesP3-5a, p3-2b William 6081901032 FWilliam Wihardja0% (1)

- P5 - Chapter 9 DIVISIONAL PERFORMANCE APPRAISAL AND TRANSFER PRICINGDocument10 pagesP5 - Chapter 9 DIVISIONAL PERFORMANCE APPRAISAL AND TRANSFER PRICINGDhruvi AgarwalNo ratings yet

- CSM New Name and Strategy ENG V1Document2 pagesCSM New Name and Strategy ENG V1Renan EscalanteNo ratings yet

- Economics of HealthcareDocument14 pagesEconomics of Healthcarepoemaung100% (1)

- CH 4 - Brief Exercises - 16thDocument18 pagesCH 4 - Brief Exercises - 16thkesey100% (2)

- Workshop 2 SolutionsDocument10 pagesWorkshop 2 SolutionsJohan ShahNo ratings yet

- Exam1 Practice Exam SolutionsDocument37 pagesExam1 Practice Exam SolutionsSheehan T Khan100% (3)

- Production Theory ELE D4 2 PDFDocument102 pagesProduction Theory ELE D4 2 PDFnadieNo ratings yet

- Informa??es de Companhias em Recupera??o Judicial Ou ExtrajudicialDocument35 pagesInforma??es de Companhias em Recupera??o Judicial Ou ExtrajudicialMPXE_RINo ratings yet

- Ebix: New Problems Emerge in Singapore, Sweden, and IndiaDocument30 pagesEbix: New Problems Emerge in Singapore, Sweden, and IndiagothamcityresearchNo ratings yet

- Management Accounting Report BudgetDocument42 pagesManagement Accounting Report BudgetBilly Maravillas Dela CruzNo ratings yet

- Audit of Stockholders' EquityDocument32 pagesAudit of Stockholders' EquityReverie Sevilla100% (3)

- How I Trade For A Living - Chapter 1Document7 pagesHow I Trade For A Living - Chapter 1William Lee0% (1)

- Olam Annual Report Fy19 - 3 in 1 PDFDocument298 pagesOlam Annual Report Fy19 - 3 in 1 PDFMario EscobarNo ratings yet

- Account Code Complete)Document721 pagesAccount Code Complete)Humayoun Ahmad Farooqi100% (37)

- Time Value of Money - MbaDocument36 pagesTime Value of Money - MbaFranchezka PegolloNo ratings yet

- Business Administration Curriculum Macroeconomics OutlineDocument2 pagesBusiness Administration Curriculum Macroeconomics OutlineAbdul WajidNo ratings yet

- Philex Mining Corporation: Company DescriptionDocument4 pagesPhilex Mining Corporation: Company DescriptionEdel MartinezNo ratings yet

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDocument36 pagesFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (35)

- Unit 1 TaxationDocument72 pagesUnit 1 TaxationAnshul SinghNo ratings yet

- WESTERN MINOLCO CORPORATION v. CIRDocument8 pagesWESTERN MINOLCO CORPORATION v. CIRKhate AlonzoNo ratings yet

- Natco Nirmal Bang PDFDocument8 pagesNatco Nirmal Bang PDFN SNo ratings yet

- 01 TallyPrime Material FinalDocument25 pages01 TallyPrime Material FinalRishi SrivastavaNo ratings yet

- Job Description For A HotelDocument33 pagesJob Description For A HotelLianne Carmeli B. FronterasNo ratings yet