Professional Documents

Culture Documents

1.chap 1-3

Uploaded by

Bryan Natad0 ratings0% found this document useful (0 votes)

9 views2 pagesThis document defines cash and cash equivalents and discusses their accounting treatment. It defines cash as unrestricted funds that are immediately available, and cash equivalents as highly liquid short-term investments that can be quickly converted to cash. Items considered cash include cash on hand, in bank accounts, and cash funds. Cash equivalents are investments that will mature within 3 months. The document also discusses petty cash funds and bank reconciliation, noting that bank reconciliation is needed to reconcile the cash balance per the company's books to the bank's records, taking into account reconciling items like deposits in transit and outstanding checks.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines cash and cash equivalents and discusses their accounting treatment. It defines cash as unrestricted funds that are immediately available, and cash equivalents as highly liquid short-term investments that can be quickly converted to cash. Items considered cash include cash on hand, in bank accounts, and cash funds. Cash equivalents are investments that will mature within 3 months. The document also discusses petty cash funds and bank reconciliation, noting that bank reconciliation is needed to reconcile the cash balance per the company's books to the bank's records, taking into account reconciling items like deposits in transit and outstanding checks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pages1.chap 1-3

Uploaded by

Bryan NatadThis document defines cash and cash equivalents and discusses their accounting treatment. It defines cash as unrestricted funds that are immediately available, and cash equivalents as highly liquid short-term investments that can be quickly converted to cash. Items considered cash include cash on hand, in bank accounts, and cash funds. Cash equivalents are investments that will mature within 3 months. The document also discusses petty cash funds and bank reconciliation, noting that bank reconciliation is needed to reconcile the cash balance per the company's books to the bank's records, taking into account reconciling items like deposits in transit and outstanding checks.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

CASH & CASH EQUIVALENTS

Concept of Cash – Unrestricted and immediately available for use.

Concept of Cash Equivalents- short term highly liquid investments

that are readily convertible into cash.

Items considered as cash:

1. Cash on Hand

2. Cash in Bank

3. Cash fund: a. for current- Cash equivalent

b. for noncurrent- Long term investment

Items considered as Cash Equivalent:

-investments that are bought 3 months before maturity.

Accounting for Petty Cash Fund

Imprest Fund System Fluctuating Fund System

-fixed amount is reserved,Memo entry -nagalaw ung mismong PCF account

lang gagawin kapag nagamit ung pera kapag nagagamit ung pera sa fund.

sa fund.

BANK RECONCILIATION

A statement which brings into agreement the cash balance per book and bank.

Incidentally there are three kinds of deposits, bank recon is necessary for

demand deposit only.

Book reconciling items Bank reconciling items

1.Credit memo (+) – dagdag sa account na di 1.Deposit in Transit (+)

pa natin recorded. 2.Outstanding checks (-)

2.Debit memo (-) – deduction sa account na di

pa natin recorded.

Only the book reconciling items require adjusting entries on the book of depositor.

Errors are reconciling items of party which committed them.

Adjusted balance method

Book Balance xxx Bank Balance xxx

add: credit memo xxx add: Deposit in transit xxx

total xxx total xxx

less: debit memo (xxx) less: outstanding checks (xxx)

adjusted book balance xxx adjusted bank balance xxx

You might also like

- Bank ReconciliationDocument3 pagesBank ReconciliationAngelika Mari RabeNo ratings yet

- Module 1C - Bank ReconciliationDocument4 pagesModule 1C - Bank ReconciliationtoshirohanamaruNo ratings yet

- Bank Recon and Proof of CashDocument6 pagesBank Recon and Proof of Cashamargocherrymae780No ratings yet

- Topic - Cash & Cash EquivalentsDocument3 pagesTopic - Cash & Cash EquivalentsMhae DuranNo ratings yet

- Module 3Document5 pagesModule 3Simoun EnriqueNo ratings yet

- Intermediate AccountingDocument7 pagesIntermediate Accountingjaninasachadelacruz0119No ratings yet

- Bank ReconciliationDocument24 pagesBank ReconciliationCyrelle MagpantayNo ratings yet

- Bank Reconciliation, Petty Cash & Voucher SystemDocument4 pagesBank Reconciliation, Petty Cash & Voucher SystemYellow CarterNo ratings yet

- Financial Accounting 1: Cash EquivalentsDocument5 pagesFinancial Accounting 1: Cash EquivalentsKristine dela CruzNo ratings yet

- CA5105 - Bank ReconciliationDocument2 pagesCA5105 - Bank ReconciliationczarliseNo ratings yet

- Bank ReconciliationDocument19 pagesBank ReconciliationSheenaGaliciaNew100% (4)

- Module 1b - Bank ReconDocument37 pagesModule 1b - Bank ReconChen HaoNo ratings yet

- Chapter 2 & 3 - Bank Recon and Proof of CashDocument3 pagesChapter 2 & 3 - Bank Recon and Proof of CashAvia Chelsy DeangNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationMary Jullianne Caile SalcedoNo ratings yet

- Chapter 3 Bank ReconDocument20 pagesChapter 3 Bank Reconfrancis.p.mallariNo ratings yet

- Chapter 2b Bank ReconciliationDocument17 pagesChapter 2b Bank ReconciliationFreziel Jade NatividadNo ratings yet

- FABM Notes 1 Bank ReconciliationDocument4 pagesFABM Notes 1 Bank ReconciliationnahatdoganNo ratings yet

- Ch#7 BANK RECONCILIATION STATEMENTDocument4 pagesCh#7 BANK RECONCILIATION STATEMENTeaglerealestate31No ratings yet

- Important FormulasDocument30 pagesImportant FormulasFiona MiralpesNo ratings yet

- Cfas CashDocument5 pagesCfas CashGeelyka MarquezNo ratings yet

- Module 2. Part 2 - Bank Reconciliation Proof of CashDocument26 pagesModule 2. Part 2 - Bank Reconciliation Proof of Cashlord kwantoniumNo ratings yet

- C2 - Bank ReconciliationDocument6 pagesC2 - Bank ReconciliationJcMCariñoNo ratings yet

- ACTBAS 2 - Lecture 7 Internal Control and Cash, Bank ReconciliationDocument5 pagesACTBAS 2 - Lecture 7 Internal Control and Cash, Bank ReconciliationJason Robert MendozaNo ratings yet

- Notes Chapter 6Document2 pagesNotes Chapter 6syafaNo ratings yet

- 01 - Cash and Cash Equivalents (P1 - 13)Document9 pages01 - Cash and Cash Equivalents (P1 - 13)Earl ENo ratings yet

- 03 Bank ReconciliationDocument5 pages03 Bank ReconciliationalteregoNo ratings yet

- 3 Bank ReconcilationDocument4 pages3 Bank ReconcilationThalia Angela HipeNo ratings yet

- FABM2-MODULE 9 - With ActivitiesDocument7 pagesFABM2-MODULE 9 - With ActivitiesROWENA MARAMBANo ratings yet

- Mastering FARDocument4 pagesMastering FARAsellusprimus BlinkNo ratings yet

- Fabm2 Q2 M3 - 4Document9 pagesFabm2 Q2 M3 - 4Zeus MalicdemNo ratings yet

- Cash and Cash Equivalents 1Document22 pagesCash and Cash Equivalents 1Mark GilNo ratings yet

- Royal CollegeDocument66 pagesRoyal CollegeHussen AbdulkadirNo ratings yet

- FAR1 - Cash and Cash Equivalents + ReceivablesDocument3 pagesFAR1 - Cash and Cash Equivalents + ReceivablesHoney MuliNo ratings yet

- CCEDocument4 pagesCCEせい じよNo ratings yet

- Bank Reconciliation ReviewerDocument2 pagesBank Reconciliation Reviewerfred ferrera jrNo ratings yet

- Intermediate Accounting 1Document49 pagesIntermediate Accounting 1Harry EvangelistaNo ratings yet

- Bank Reconciliation NotesDocument4 pagesBank Reconciliation NotesGerson ManawisNo ratings yet

- Cash and Receivable - Pre Rev - Questions ONLY PDFDocument9 pagesCash and Receivable - Pre Rev - Questions ONLY PDFNove Joy Majadas PatacNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementMuhammad BilalNo ratings yet

- Int Acc 1Document49 pagesInt Acc 1kookie bunnyNo ratings yet

- Chapter 5 Bank Reconciliation StatementDocument2 pagesChapter 5 Bank Reconciliation StatementDeveender Kaur JudgeNo ratings yet

- Module 2 - Bank ReconciliationDocument21 pagesModule 2 - Bank ReconciliationJennalyn S. GanalonNo ratings yet

- XFARDocument14 pagesXFARRIZA SAMPAGANo ratings yet

- Bank Reconciliation Statements - BW ClassDocument5 pagesBank Reconciliation Statements - BW ClassDananjaya RajapakshaNo ratings yet

- Cash and Cash Equivalents and Receivables SummariesDocument15 pagesCash and Cash Equivalents and Receivables SummariesLorraine Mae RobridoNo ratings yet

- FINACC1 - Cash and Cash Equivalents + ReceivablesDocument3 pagesFINACC1 - Cash and Cash Equivalents + ReceivablesJerico DungcaNo ratings yet

- Cash and Cash Equivalents (Class Notes)Document5 pagesCash and Cash Equivalents (Class Notes)IAN PADAYOGDOGNo ratings yet

- Week 1-Growth of Accounting Practice of AccountingDocument9 pagesWeek 1-Growth of Accounting Practice of AccountingMark Anthony Llovit BabaoNo ratings yet

- Green Aesthetic Thesis Defense Presentation - 20240315 - 171147 - 0000Document49 pagesGreen Aesthetic Thesis Defense Presentation - 20240315 - 171147 - 0000joyce jabileNo ratings yet

- Chapter 2-Chapter 5Document17 pagesChapter 2-Chapter 5Jenn sayongNo ratings yet

- Financial Accounting and Reporting: Cash and Cash Equivalent CashDocument4 pagesFinancial Accounting and Reporting: Cash and Cash Equivalent CashJAPNo ratings yet

- Bankasdasd Das AsdDocument9 pagesBankasdasd Das AsdRia AthirahNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- Bank ReconciliationDocument26 pagesBank ReconciliationQuennie Kate RomeroNo ratings yet

- 3.1 - Cash Lecture NotesDocument4 pages3.1 - Cash Lecture NotesxxxNo ratings yet

- FAR (Final Outline)Document3 pagesFAR (Final Outline)Faith JandayanNo ratings yet

- Topic 6 - Bank ReconciliationRev (Students)Document26 pagesTopic 6 - Bank ReconciliationRev (Students)Romzi100% (1)

- Topic 6 - Bank ReconciliationRev (Students)Document32 pagesTopic 6 - Bank ReconciliationRev (Students)Novian Dwi RamadanaNo ratings yet

- Chapter 6 Bank ReconciliationRev StudentsDocument20 pagesChapter 6 Bank ReconciliationRev StudentsNemalai VitalNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- Research Paper Case Study of Grab Car DriverDocument73 pagesResearch Paper Case Study of Grab Car DriverBryan NatadNo ratings yet

- The Availment of Grab Offering The ProblDocument22 pagesThe Availment of Grab Offering The ProblBryan NatadNo ratings yet

- Apec IncorporarDocument189 pagesApec IncorporarBryan NatadNo ratings yet

- An Exploratory Study On Uber GrabCar andDocument14 pagesAn Exploratory Study On Uber GrabCar andBryan NatadNo ratings yet

- BSA Group 6 Chapter 2Document25 pagesBSA Group 6 Chapter 2Bryan NatadNo ratings yet

- Management Science: Linear Programming: Minimization ModelDocument7 pagesManagement Science: Linear Programming: Minimization ModelBryan NatadNo ratings yet

- 131 119 80 48 17 5 Total Result 5 17 48 80 119 131 400Document5 pages131 119 80 48 17 5 Total Result 5 17 48 80 119 131 400Bryan NatadNo ratings yet

- Derivatives Financial InstrumentDocument1 pageDerivatives Financial InstrumentBryan NatadNo ratings yet

- 6.1 Investment-ClassificationDocument1 page6.1 Investment-ClassificationBryan NatadNo ratings yet

- Accounts Receivable: Methods of Estimating Doubtful AccountsDocument1 pageAccounts Receivable: Methods of Estimating Doubtful AccountsBryan NatadNo ratings yet

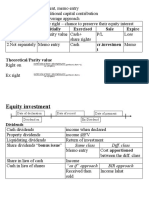

- Initially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Document8 pagesInitially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Bryan NatadNo ratings yet

- 4.receivable FinancingDocument2 pages4.receivable FinancingBryan NatadNo ratings yet

- Property, Plant & EquipmentDocument5 pagesProperty, Plant & EquipmentBryan NatadNo ratings yet

- Vol 2 Valix PDFDocument35 pagesVol 2 Valix PDFBryan NatadNo ratings yet