Professional Documents

Culture Documents

Topic - Cash & Cash Equivalents

Uploaded by

Mhae Duran0 ratings0% found this document useful (0 votes)

10 views3 pagesIntermediate Accounting 1, Cash and Cash Equivalents

Original Title

Topic- Cash & Cash Equivalents

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIntermediate Accounting 1, Cash and Cash Equivalents

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesTopic - Cash & Cash Equivalents

Uploaded by

Mhae DuranIntermediate Accounting 1, Cash and Cash Equivalents

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

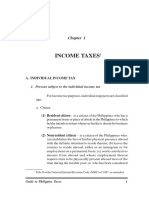

Intermediate

Accounting 1 - Cash and Cash Equivalents

Definition:

1. Cash – includes money and negotiable instruments (such as checks, money orders, etc.) that are

acceptable by the bank for deposit and immediate encashment. To be classified as cash

(current assets), an item must be unrestricted and immediately available for current

operations.

2. Cash equivalents – are short term, highly liquid investments that are readily convertible into

cash and so near their maturity that they represent insignificant risks of changes in interest

rates.

Composition:

1. Cash – currency coins and bills (cash awaiting deposit, cash deposited with bank checking,

savings, demand deposit), cash funds, checks, drafts, money order, etc.

2. Cash equivalents – time deposit, treasury bills and notes, money market accounts etc.

Valuation:

1. Benchmark – at face value.

2. Alternative – at estimated realizable value (if the financial institution holding the cash and cash

equivalents is suffering from major financial difficulties)

Classifications:

1. As current asset

a. Cash and cash equivalents – for presentation purposes only (details are shown in the notes

to financial statements.)

b. Separately shown

2. As non-current asset

a. Long term investment

b. Other Non-current asset

Special Treatments:

1. Investments in time Deposit, Treasury Bills & Notes, Money Market Instruments

a. If 3 months or less - Cash and cash equivalents

b. In more than 3 months but within 1 year - Short term Investments

c. If more than 1 year - Long term investments

2. Compensating balance

a. If not legally restricted as to withdrawal - Cash and cash equivalents

b. If legally restricted to as withdrawal

Related to a short term borrowing - Current asset (separately shown)

Related to as long term borrowing - Non-current asset (long term

investment)

3. Bank Overdraft

a. If amount is material

Of the same bank - apply the rule of offset

Of different banks - Current Liability

b. If amount is not material - Apply the rule of offset

4. Checks

a. Undelivered – means not yet given to payees.

b. Postdated – means given or not yet given to payees but withdrawal at a certain future date.

c. Stale – means cannot be withdrawn because they have been long outstanding.

6. Cash in closed banks - Presented as non-current asset.

7. Proper Treatment of Non-Cash Items

a. Employees values and advances (IOUs) & Advances to salesmen - Non Trade receivables.

b. Postdated customers checks - Trade Receivables

c. NSF customer check – Trade Receivable

d. Cash due memoranda for money advances –Non-Trade Receivable

e. Note or draft left with bank for collection – Trade Receivable, before collection; Cash, after

collection.

f. Postage Stamps – Supplies inventory

g. Documentary Stamps – Prepaid taxes

h. Stocks, Bonds, government securities – Long term or short term investments

i. Time deposits (not subject to pre-termination) – Long term or short term investments

Petty Cash Fund

- It represents bills and coins that are set aside to accommodate small disbursements of cash.

- It may be accounted for using:

Imprest System: Fluctuating System:

Establishment of the Fund: Establishment of the fund:

Petty Cash fund xx Petty Cash Fund xx

Cash in bank xx Cash in Bank xx

Petty Cash Expenses: Petty Cash Expenses:

No Journal Entry Expenses xx

Replenishment of petty cash vouchers: Petty Cash Fund xx

Expenses xx Replenishment of Petty cash vouchers:

Cash in Bank xx Petty Cash Fund xx

Cash in bank xx

Adjustment for no replenishment: Adjustment for no Replenishment:

Expenses xx No Journal Entry

Petty Cash Fund xx

Bank reconciliation:

It is prepared to reconcile the cash in bank balances per client and per bank. Adjustments are made

only in the books of the client after compromising the balances reflected in the client’s books of accounts and

the bank statement.

The (3) methods in bank reconciliation are:

(a) Adjustment balance method

(b) Book to bank balance method

(c) Bank to book method

Adjusted Balance Method

Balance per book xx Balance per bank xx

Add: Credit memos xx Add Deposit in transit xx

Book errors xx Bank errors xx

Total: xx Total: xx

Less: Debit memos xx less: Outstanding checks xx

Book errors xx Bank errors xx

Adj. Balance per book xx Adj. balance per book xx

Book to Bank Balance Method Bank to Book Balance Method

Balance per book xx Balance per bank xx

Add: Credit Memos xx Add: Debit memos xx

Outstanding Checks xx Deposit in transit xx

Book errors xx Book errors xx

Bank errors xx Bank errors xx

Total: xx Total xx

Less: Debit memos xx Less: Credit Memos xx

Deposit in transit xx Outstanding checks xx

Book errors xx Book errors xx

Bank errors xx Bank errors xx

Balance per Bank xx Balance per book xx

You might also like

- Practice Problems - Notes and Loans Receivable: General InstructionsDocument2 pagesPractice Problems - Notes and Loans Receivable: General Instructionseia aieNo ratings yet

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonNo ratings yet

- Chap 8Document13 pagesChap 8MichelleLeeNo ratings yet

- ABM003 N5 CaneteDocument17 pagesABM003 N5 CaneteCriscel EstrellaNo ratings yet

- Proof of Cash: Two-Date Bank ReconcilationDocument8 pagesProof of Cash: Two-Date Bank ReconcilationKarlo D. ReclaNo ratings yet

- Yu - Activity 7 - Arts 1 (J)Document2 pagesYu - Activity 7 - Arts 1 (J)Jay Mark YuNo ratings yet

- Topic 8 Receivable Financing Rev Students 653Document39 pagesTopic 8 Receivable Financing Rev Students 653Nemalai VitalNo ratings yet

- ACC 201 Cheat Sheet: by ViaDocument1 pageACC 201 Cheat Sheet: by ViaAnaze_hNo ratings yet

- Financial Accounting 1Document17 pagesFinancial Accounting 1Mellanie SerranoNo ratings yet

- Pq-Cash and Cash EquivalentsDocument3 pagesPq-Cash and Cash EquivalentsJanella PatriziaNo ratings yet

- ACTIVITY 40 KEYDocument4 pagesACTIVITY 40 KEYMAXINE CLAIRE CUTINGNo ratings yet

- Quiz 1Document11 pagesQuiz 1Sam VeraNo ratings yet

- Answer Key Far Assessment Questionairre 1Document22 pagesAnswer Key Far Assessment Questionairre 1Johnfree VallinasNo ratings yet

- Partners HIP - Pretest: - Introduction and FormationDocument38 pagesPartners HIP - Pretest: - Introduction and FormationKristia AnagapNo ratings yet

- Kant's Moral Philosophy AssessmentDocument4 pagesKant's Moral Philosophy AssessmentJoash Lee AcebronNo ratings yet

- Proof of Cash+2-1Document35 pagesProof of Cash+2-1Eunice FulgencioNo ratings yet

- C2 Bank ReconciliationDocument22 pagesC2 Bank ReconciliationKenzel lawasNo ratings yet

- This Study Resource Was: Problem IDocument8 pagesThis Study Resource Was: Problem IMs VampireNo ratings yet

- Prelim Learning Task 1 PDFDocument5 pagesPrelim Learning Task 1 PDFAdrian FaminianoNo ratings yet

- Proof of cash reconciliation guideDocument27 pagesProof of cash reconciliation guideSophia Ysabel DagohoyNo ratings yet

- Ch. 1 HW Solutions-9eDocument19 pagesCh. 1 HW Solutions-9eNgNo ratings yet

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- Calculate allowance for doubtful accounts for Barr CompanyDocument5 pagesCalculate allowance for doubtful accounts for Barr CompanyAbbygailNo ratings yet

- Reviewer1 PDFDocument4 pagesReviewer1 PDFspur iousNo ratings yet

- Cash AssignmentDocument2 pagesCash AssignmentRocelyn OrdoñezNo ratings yet

- PS 1Document4 pagesPS 1BlackRoseNo ratings yet

- DiscussionDocument2 pagesDiscussionhy_saingheng_7602609No ratings yet

- Semi FinalDocument2 pagesSemi FinalCarlo Jay BasulNo ratings yet

- 12bank ReconciliationDocument17 pages12bank ReconciliationAndrei JacobNo ratings yet

- LatihanDocument7 pagesLatihanDeny WilyartaNo ratings yet

- Chapter 5 Estimation of Doubtful AccountsDocument11 pagesChapter 5 Estimation of Doubtful Accountsmarites yuNo ratings yet

- Investor Analysis and Potential Accounting FraudDocument2 pagesInvestor Analysis and Potential Accounting FraudAccounting 201No ratings yet

- Accounting for Cash, Receivables and InventoriesDocument12 pagesAccounting for Cash, Receivables and InventoriesPaupau100% (1)

- Definition of Credit and CollectionsDocument5 pagesDefinition of Credit and CollectionsDrew MerezNo ratings yet

- Effects of Transactions for Zabeth Rosales Freight ServicesDocument1 pageEffects of Transactions for Zabeth Rosales Freight ServicesHessiel Mae Jumalon Garcines100% (1)

- ACC 111 Answer KeyDocument7 pagesACC 111 Answer KeyMAXINE CLAIRE CUTINGNo ratings yet

- Financial reporting and accounting principlesDocument3 pagesFinancial reporting and accounting principlescece vergieNo ratings yet

- Assignment 2 ACFAR 1231 Bank ReconciliationDocument3 pagesAssignment 2 ACFAR 1231 Bank ReconciliationkakaoNo ratings yet

- Chapter 9 Problems on Notes Receivable DiscountingDocument3 pagesChapter 9 Problems on Notes Receivable DiscountingAnne MauricioNo ratings yet

- The Feature of Unlimited Liability Covers All PartnersDocument1 pageThe Feature of Unlimited Liability Covers All PartnersJAHNHANNALEI MARTICIONo ratings yet

- AE 112 Midterm QUIZ 2 - SolutionsDocument10 pagesAE 112 Midterm QUIZ 2 - SolutionsAllondra DapengNo ratings yet

- Inter-Acct1Document6 pagesInter-Acct1.No ratings yet

- Receivables Financing ProblemsDocument2 pagesReceivables Financing ProblemsAdam CuencaNo ratings yet

- TAKE HOME EXAM Partnership LiquidationDocument22 pagesTAKE HOME EXAM Partnership LiquidationMaria Kathreena Andrea AdevaNo ratings yet

- Final Round - 1ST - QDocument6 pagesFinal Round - 1ST - QwivadaNo ratings yet

- Midterm exam partnership and corporation accountingDocument2 pagesMidterm exam partnership and corporation accountingJj Abad BoieNo ratings yet

- Ia1.activity 3Document1 pageIa1.activity 3kathie alegarme100% (1)

- ACFAR 2132 PAA1 InventoriesDocument15 pagesACFAR 2132 PAA1 InventoriesGabrielle Joshebed AbaricoNo ratings yet

- CH 11 Question Book - Not ReconciliationDocument5 pagesCH 11 Question Book - Not Reconciliationahmed0% (1)

- Quiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsDocument3 pagesQuiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsPaula BautistaNo ratings yet

- Included in December 31 Checkbook BalanceDocument1 pageIncluded in December 31 Checkbook BalanceXI MonteroNo ratings yet

- PrelimsDocument24 pagesPrelimsRhea BadanaNo ratings yet

- Merchandise Business Class PerformanceDocument5 pagesMerchandise Business Class PerformanceGrace GamillaNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- Accounting Assignment 1Document2 pagesAccounting Assignment 1Hamna FarooqNo ratings yet

- Cash and Cash Equivalent LatestDocument53 pagesCash and Cash Equivalent LatestxagocipNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationAngelika Mari RabeNo ratings yet

- UM TAGUM COLLEGE Cash Receivables OverviewDocument9 pagesUM TAGUM COLLEGE Cash Receivables OverviewNove Joy Majadas PatacNo ratings yet

- Cash and Cash Equivalents (Class Notes)Document5 pagesCash and Cash Equivalents (Class Notes)IAN PADAYOGDOGNo ratings yet

- Cash and Cash Equivalents and Receivables SummariesDocument15 pagesCash and Cash Equivalents and Receivables SummariesLorraine Mae RobridoNo ratings yet

- Chapter 2 - Obligations of The Partners Section 3Document7 pagesChapter 2 - Obligations of The Partners Section 3Mhae DuranNo ratings yet

- Chapter 2 - Obligations of The Partners Section 2Document3 pagesChapter 2 - Obligations of The Partners Section 2Mhae DuranNo ratings yet

- Chapter 2 - Obligations of The Partners Section 1Document12 pagesChapter 2 - Obligations of The Partners Section 1Mhae DuranNo ratings yet

- ASSIGNMENT - MIDTERM With ANSWERSDocument3 pagesASSIGNMENT - MIDTERM With ANSWERSMhae DuranNo ratings yet

- Assignment 3 - BUS 105Document3 pagesAssignment 3 - BUS 105Mhae DuranNo ratings yet

- Chapter 1: Framework of AccountingDocument3 pagesChapter 1: Framework of AccountingMhae DuranNo ratings yet

- Assignment - Semi Final With AnswersDocument2 pagesAssignment - Semi Final With AnswersMhae DuranNo ratings yet

- Tax Changes You Need To KnowDocument20 pagesTax Changes You Need To KnowJustine Kate Ferrer BascoNo ratings yet

- 2010 - 2015 - Tax RemediesDocument23 pages2010 - 2015 - Tax RemediesramszlaiNo ratings yet

- Midterm Exam 2020 With AnswersDocument11 pagesMidterm Exam 2020 With AnswersMhae Duran50% (2)

- Assignment - Semi Final With AnswersDocument2 pagesAssignment - Semi Final With AnswersMhae DuranNo ratings yet

- 2010-2015 Tax Bar Based On The 2015 Bar Syllabus PDFDocument124 pages2010-2015 Tax Bar Based On The 2015 Bar Syllabus PDFNin BANo ratings yet

- Income TaxesDocument76 pagesIncome TaxesJa FranciscoNo ratings yet

- Sgsoc Esia Oils Cameroon LimitedDocument299 pagesSgsoc Esia Oils Cameroon LimitedcameroonwebnewsNo ratings yet

- Free Fall LabDocument1 pageFree Fall Labapi-276596299No ratings yet

- Tech Elevator School Catalog, 2020 PDFDocument29 pagesTech Elevator School Catalog, 2020 PDFjohanmulyadi007No ratings yet

- Fund Flow StatementDocument17 pagesFund Flow StatementPrithikaNo ratings yet

- 1.1 Online Shopping Is The Process Whereby Consumers Directly Buy Goods Services Ete From ADocument5 pages1.1 Online Shopping Is The Process Whereby Consumers Directly Buy Goods Services Ete From Aഅർജുൻ പിണറായിNo ratings yet

- How To Add Message Queuing Feature - Dell IndiaDocument2 pagesHow To Add Message Queuing Feature - Dell Indiayuva razNo ratings yet

- HR Functions and ProceduresDocument7 pagesHR Functions and ProceduresSandeep KumarNo ratings yet

- Harmonization and Standardization of The ASEAN Medical IndustryDocument75 pagesHarmonization and Standardization of The ASEAN Medical IndustryGanch AguasNo ratings yet

- Letter From Empower Oversight and Nixon Peabody To CongressDocument3 pagesLetter From Empower Oversight and Nixon Peabody To CongressThe FederalistNo ratings yet

- Basic Terms of AccountingDocument24 pagesBasic Terms of AccountingManas Kumar Sahoo100% (1)

- Harty Vs Municipality of VictoriaDocument1 pageHarty Vs Municipality of VictoriaArah Mae BonillaNo ratings yet

- MAD Lab Manual - List of ExperimentsDocument24 pagesMAD Lab Manual - List of Experimentsmiraclesuresh67% (3)

- Emerald Garment VS CaDocument2 pagesEmerald Garment VS CaNorthern SummerNo ratings yet

- Boston Scientific Corporation v. Mabey, 10th Cir. (2011)Document8 pagesBoston Scientific Corporation v. Mabey, 10th Cir. (2011)Scribd Government DocsNo ratings yet

- A Review of Solar Photovoltaic System Maintenance StrategiesDocument8 pagesA Review of Solar Photovoltaic System Maintenance StrategiessamNo ratings yet

- Green Buildings and Rating Systems PDFDocument106 pagesGreen Buildings and Rating Systems PDFHarsheen kaurNo ratings yet

- Excel Basics1 ShortcutsDocument14 pagesExcel Basics1 ShortcutsJMFMNo ratings yet

- Communication Skills: Condition of Slums in IndiaDocument17 pagesCommunication Skills: Condition of Slums in Indiahappyskd1993No ratings yet

- Enjoy Magazine - May 2019Document16 pagesEnjoy Magazine - May 2019Stanley KellyNo ratings yet

- Distillation TypesDocument34 pagesDistillation TypesJoshua Johnson100% (1)

- Chapter 1Document18 pagesChapter 1Tabassum AkhtarNo ratings yet

- Managing People and OrganisationsDocument50 pagesManaging People and OrganisationsOmkar DesaiNo ratings yet

- Definition (Art. 1458)Document10 pagesDefinition (Art. 1458)Fatima SladjannaNo ratings yet

- Sanel Core HMODocument13 pagesSanel Core HMOAutomotive Wholesalers Association of New EnglandNo ratings yet

- 2023 Congressional Baseball Sponsorship PackagesDocument2 pages2023 Congressional Baseball Sponsorship PackagesSpencer BrownNo ratings yet

- STD 2 ComputerDocument12 pagesSTD 2 ComputertayyabaNo ratings yet

- Journal of Cleaner Production: Peide Liu, Baoying Zhu, Mingyan Yang, Xu ChuDocument12 pagesJournal of Cleaner Production: Peide Liu, Baoying Zhu, Mingyan Yang, Xu ChuccNo ratings yet

- Dollar ReportDocument26 pagesDollar ReportNirati AroraNo ratings yet

- Esaote MyLab70 Service Manual PDFDocument206 pagesEsaote MyLab70 Service Manual PDFPMJ75% (4)

- Physiology and Physiological Disorders of PepperDocument45 pagesPhysiology and Physiological Disorders of PepperKwesiga Julius75% (4)