Professional Documents

Culture Documents

C2 Bank Reconciliation

Uploaded by

Kenzel lawas0 ratings0% found this document useful (0 votes)

68 views22 pagesOriginal Title

C2-Bank-Reconciliation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

68 views22 pagesC2 Bank Reconciliation

Uploaded by

Kenzel lawasCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 22

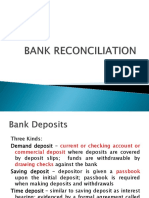

Bank Reconciliation

Valix, C. T. et al. Intermediate Accounting Volume 1. (2019). Manila:

GIC Enterprises & Co.; Inc.

Bank Deposits

Kinds of Bank Deposits

Demand Deposit Savings Deposit Time Deposit

Current account / Checking Depositor is given a passbook Evidenced by a formal

Account / Commercial Deposit upon initial deposit; passbook agreement embodied in an

where deposits are covered by is required when making instrument called Certificate

deposit slips and where funds deposits and withdrawals of Deposit; may be pre-

are withdrawable on demand terminated or withdrawn on

by drawing checks against the demand or after a certain

bank period of time agreed upon.

Non-interest bearing Interest-bearing Interest-bearing

For bank reconciliation

What is a bank reconciliation?

(refer to page 49 for sample)

A statement which brings into agreement the two reciprocal accounts/records:

❑ the cash balance per book

❑ the cash balance per bank as shown in the bank statement provided by the

bank at the end of each month

Bank Statement

(refer to page 57 for sample)

A monthly report of the bank to the depositor showing:

1. The cash balance per bank at the beginning

2. The deposits made by the depositor and acknowledged by the

bank

3. The checks drawn by the depositor and paid by the bank

(canceled checks)

4. The daily cash balance per bank during the month

Reconciling Items

Book Reconciling Items Bank Reconciling Items

• Credit Memos • Deposits in Transit

• Debit Memos • Outstanding Checks

• Errors • Errors

Credit Memos

❑Items not representing deposits CREDITED by the bank to the account of the

depositor but not yet recorded by the depositor as cash receipts.

❑Have the effect of increasing the bank balance.

❑Typical examples:

1. Notes receivable collected by the bank in favor of the depositor and credited

to the account of the depositor

2. Proceeds of bank loan credited to the account of the depositor

3. Matured time deposits transferred by the bank to the current account of the

depositor

Credit Memos

Reconciling Item Bank Record Book Record Reconciliation AJE – Books

NR collected by + Bank Not yet + Book CIB

bank recorded BSC

N/R

Interest Income

Proceeds of Bank + Bank Not yet + Book CIB

Loan recorded Loans Payable

Matured time + Bank Not yet + Book CIB

deposit recorded CIB–Time Deposit

transferred to

current account

Debit Memos

❑Items not representing checks paid by the bank which are CHARGED or

DEBITED by the bank to the account of the depositor but not yet recorded by

the depositor as a cash disbursement.

❑Have the effect of decreasing the bank balance.

❑Typical examples:

1. NSF or No Sufficient Fund Checks / DAIF or Drawn Against Insufficient Fund

Checks

2. Technically Defective Checks

3. Bank Service Charges

4. Reduction of Loan

Debit Memos

Reconciling Item Bank Record Book Record Reconciliation AJE – Books

NSF Check -Bank Not yet -Book A/R

recorded CIB

Technically -Bank Not yet -Book A/R

Defective Check recorded CIB

Bank Service -Bank Not yet -Book BSC

Charge recorded CIB

Reduction of -Bank Not yet -Book Loans Payable

Loan recorded Interest Expense

CIB

Deposits in Transit

❑Collections already recorded by the depositor as cash receipts but not yet reflected on the

bank statement

❑Include:

1. Collections already forwarded to the bank for deposit but too late to appear in the bank

statement

2. Undeposited collections or those still in the hands of the depositor/ cash on hand awaiting

delivery to the bank for deposit

Deposits in Transit

Bank Record Book Record Reconciliation AJE – Books

Not yet recorded +Book +Bank None

Outstanding Checks

❑Checks already recorded by the depositor as cash disbursements but not yet reflected in the bank

statement.

❑Include:

1. Checks drawn already given to payees but not yet presented for payment.

2. Certified Checks

▪ One where the bank has stamped on its face the word “accepted” or “certified” indicating

sufficiency of funds.

▪ When the bank certifies a check, the account of the depositor is immediately debited or

charged to insure the eventual payment of check.

▪ Should be deducted from the total outstanding checks (if included therein) because they are

no longer outstanding for bank reconciliation purposes.

Outstanding Checks

Bank Record Book Record Reconciliation AJE – Books

Not yet recorded -Book -Bank None

Some Errors and Their Correction

Error Bank Record Book Record Reconciliation AJE – Books

Understatement Correct Actual Deposit + Book CIB

of Cash Receipts Amount of > A/R

on the books of Deposit Recorded Amount

Depositor of Collection

Understatement Correct Actual Check Drawn - Book A/P

of Checks Drawn Amount of > CIB

by the Depositor Check / Recorded Amount

Payment of Payment

Some Errors and Their Correction

Error Bank Record Book Record Reconciliation AJE –

Books

Deposit of Actual Deposit Correct - Bank None

another entity < Amount of

credited by the Amount Recorded Deposit

bank to

depositor’s

account

Check of another Actual Check Paid Correct + Bank None

entity charged to < Amount of

the depositor’s Amount Recorded Check /

account Payment

Some Errors and Their Correction

Errors are reconciling items of the party which

committed them.

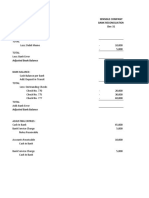

Forms of Bank Reconciliation

Adjusted Balance Book to Bank Method Bank to Book Method

Method

Book balance and bank Book balance is Bank balance is

balance are brought to a reconciled with the bank reconciled with the book

correct cash balance that balance or the book balance or the bank

must appear on the SFP. balance is adjusted to balance is adjusted to

equal the bank balance. equal the bank balance.

Book / Bank Balance Book Balance Bank Balance

= = =

Correct Balance Bank Balance Book Balance

Forms of Bank Reconciliation

Adjusted Balance Book to Bank Bank to Book

Method Method Method

Book Balance Balance per Book Balance per Bank

+ Credit Memo + Credit Memo + Debit Memo

- Debit Memo + Outstanding Checks + Deposit in Transit

+- Book Error - Debit Memo - Credit Memo

= Adjusted Book Balance - Deposit in Transit - Outstanding Checks

= Bank Balance = Book Balance

Bank Balance

+ Deposit in Transit

- Outstanding Checks

+-Book Error

= Adjusted Bank Balance

General Procedures

(Use problem 2-2 on page 54-55 as illustrative problem)

a) Determine the balance per book and the balance per bank

b) Trace the cash receipts to the bank statement to ascertain whether there are deposits not

yet acknowledged by the bank (Deposit in Transit)

c) Trace the checks issued to the bank statement to ascertain whether there are checks not yet

presented for payment (Outstanding Checks)

d) The bank statement should be examined to determine whether there are bank credits

(Credit Memo) or bank debits (Debit Memo) not yet recorded by the depositor

e) Watch out for errors. Again, errors are reconciling items of the party which committed them.

End of Chapter

You might also like

- Policy On Revolving Fund and Petty Cash FundDocument6 pagesPolicy On Revolving Fund and Petty Cash Fundmarvinceledio100% (3)

- SALES PURCHASE AGREEMENT MOU for 9 TRILLION TONNES LNGDocument20 pagesSALES PURCHASE AGREEMENT MOU for 9 TRILLION TONNES LNGfunny movieNo ratings yet

- 12bank ReconciliationDocument17 pages12bank ReconciliationAndrei JacobNo ratings yet

- Bank Reconciliation Statement PreparationDocument10 pagesBank Reconciliation Statement PreparationAngela PaduaNo ratings yet

- Welcome Letter - 203319753 PDFDocument6 pagesWelcome Letter - 203319753 PDFRITIK DESHBHRATARNo ratings yet

- Bank Reconciliation and Petty Cash NotesDocument3 pagesBank Reconciliation and Petty Cash NotesCyrus MulopeNo ratings yet

- Ust Jpia Inventories Reviewer Ca51010 PDFDocument10 pagesUst Jpia Inventories Reviewer Ca51010 PDFLlyana paula SuyuNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationMary Jullianne Caile SalcedoNo ratings yet

- Sensible Company Bank Reconciliation Dec-31Document8 pagesSensible Company Bank Reconciliation Dec-31OwO OwONo ratings yet

- Intacc Bank ReconDocument4 pagesIntacc Bank ReconMichelle EsternonNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2Document11 pagesFundamentals of Accountancy, Business, and Management 2Honey ShenNo ratings yet

- Audit 2 - TheoriesDocument2 pagesAudit 2 - TheoriesJoy ConsigeneNo ratings yet

- Topic: Adjusting Entries / Adjustments Compiled By: Sir Ghalib HussainDocument8 pagesTopic: Adjusting Entries / Adjustments Compiled By: Sir Ghalib HussainGhalib HussainNo ratings yet

- Bank Reconciliation GuideDocument17 pagesBank Reconciliation GuideFreziel Jade NatividadNo ratings yet

- Bank Reconciliation: Irene Mae C. Guerra, CPADocument25 pagesBank Reconciliation: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- The Path to Billionaire Status: Mastering Wealth Creation and Success StrategiesFrom EverandThe Path to Billionaire Status: Mastering Wealth Creation and Success StrategiesNo ratings yet

- Special Accounting JournalsDocument7 pagesSpecial Accounting JournalsHo Ming LamNo ratings yet

- Accounting 2 - 4rd ModuleDocument4 pagesAccounting 2 - 4rd ModuleJessalyn Sarmiento TancioNo ratings yet

- Basic Documents and Transactions Related To Bank DepositsDocument18 pagesBasic Documents and Transactions Related To Bank DepositsSophia NicoleNo ratings yet

- Chap 7 Cash & Cash EquivalentsDocument1 pageChap 7 Cash & Cash EquivalentsRey Joyce AbuelNo ratings yet

- MEDINA - Homework 2 (Midterm)Document9 pagesMEDINA - Homework 2 (Midterm)Von Andrei MedinaNo ratings yet

- 11 - Bank Reconciliation NotesDocument3 pages11 - Bank Reconciliation NotesJann GataNo ratings yet

- 2.1F Diy-Mcq (Answer Key)Document5 pages2.1F Diy-Mcq (Answer Key)Chinito Reel CasicasNo ratings yet

- Financial reporting and accounting principlesDocument3 pagesFinancial reporting and accounting principlescece vergieNo ratings yet

- Cash and Cash Equivalents FundamentalsDocument9 pagesCash and Cash Equivalents FundamentalsElaineJrV-IgotNo ratings yet

- Far 03 Cash and Cash EquivalentsDocument22 pagesFar 03 Cash and Cash EquivalentsYuri CaguioaNo ratings yet

- Fabm 2Document170 pagesFabm 2Asti GumacaNo ratings yet

- Reviewer: Accounting For Manufacturing OperationsDocument16 pagesReviewer: Accounting For Manufacturing Operationsgab mNo ratings yet

- Urdaneta City University College of Business Management and Accountancy San Vicente West, Urdaneta City 2428 Pangasinan, PhilippinesDocument13 pagesUrdaneta City University College of Business Management and Accountancy San Vicente West, Urdaneta City 2428 Pangasinan, Philippinesthalia alfaroNo ratings yet

- Proof of Cash+2-1Document35 pagesProof of Cash+2-1Eunice FulgencioNo ratings yet

- Analyze Financial StatementsDocument9 pagesAnalyze Financial StatementsChristine MiguelNo ratings yet

- Appropriations of Retained EarningsDocument6 pagesAppropriations of Retained EarningsJessa Mae BanseNo ratings yet

- IA For Prelims FinalDocument438 pagesIA For Prelims FinalCeline Therese BuNo ratings yet

- Petty Cash Fund ModuleDocument7 pagesPetty Cash Fund ModuleSecret-uploaderNo ratings yet

- Bank Deposits Documents and Transactions GuideDocument20 pagesBank Deposits Documents and Transactions GuideAlyssa Nikki VersozaNo ratings yet

- Quiz 1 BWFF2033Document2 pagesQuiz 1 BWFF2033otaku himeNo ratings yet

- COSTCO Section 1Document11 pagesCOSTCO Section 1Paula BautistaNo ratings yet

- Quiz Bank Recon and Proof of CashDocument3 pagesQuiz Bank Recon and Proof of CashAlexander ONo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument30 pagesFinancial Statements, Cash Flow, and TaxesVincent BuyanNo ratings yet

- Bank - Reconciliatio Statement PowerpointDocument61 pagesBank - Reconciliatio Statement PowerpointLoida Yare LauritoNo ratings yet

- Understanding Cash and Cash EquivalentsDocument43 pagesUnderstanding Cash and Cash EquivalentsMarriel Fate CullanoNo ratings yet

- PrelimsDocument24 pagesPrelimsRhea BadanaNo ratings yet

- Quiz-Inventory TheoryDocument4 pagesQuiz-Inventory TheoryCaila Nicole ReyesNo ratings yet

- Finman Test BankDocument3 pagesFinman Test BankATHALIAH LUNA MERCADEJASNo ratings yet

- Inventory Estimation MethodsDocument14 pagesInventory Estimation Methodskrisha milloNo ratings yet

- Chapter 7: Receivables: Principles of AccountingDocument50 pagesChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- LECT22s BANK RECONCILIATION StudentDocument10 pagesLECT22s BANK RECONCILIATION StudentLalaland Acads100% (1)

- Accounting for Merchandising Businesses Inventory SystemsDocument15 pagesAccounting for Merchandising Businesses Inventory SystemsAple Balisi100% (1)

- Bank Accounts ExplainedDocument10 pagesBank Accounts ExplainedPrincess DuquezaNo ratings yet

- A-Standards of Ethical Conduct For Management AccountantsDocument4 pagesA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNo ratings yet

- Las1 Q2 BankreconDocument12 pagesLas1 Q2 BankreconCharlyn CastroNo ratings yet

- 01 CashandCashEquivalentsNotesDocument7 pages01 CashandCashEquivalentsNotesVeroNo ratings yet

- Chapter 2 Bank Reconciliation (Gatdc)Document20 pagesChapter 2 Bank Reconciliation (Gatdc)Joan LeonorNo ratings yet

- ABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Document45 pagesABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Willie Montes Poblacion Jr.No ratings yet

- QuizDocument13 pagesQuizPearl Morni AlbanoNo ratings yet

- Financial Accounting Part 1Document11 pagesFinancial Accounting Part 1christineNo ratings yet

- 2020 Int Acc 1 - ReceivablesDocument45 pages2020 Int Acc 1 - ReceivablesNICOLE HIPOLITONo ratings yet

- Conceptual Framework and Accounting Standards: Chapter 1: The Accountancy ProfessionDocument39 pagesConceptual Framework and Accounting Standards: Chapter 1: The Accountancy ProfessionStudent 101No ratings yet

- True or False Accounting Concepts ExplainedDocument7 pagesTrue or False Accounting Concepts ExplainedJan Allyson BiagNo ratings yet

- Review Questions ReceivablesDocument38 pagesReview Questions ReceivablesJamaeca PascoNo ratings yet

- Client Selection and RetentionDocument20 pagesClient Selection and RetentionJurie MayNo ratings yet

- Accounts PayableDocument4 pagesAccounts PayableTina ParkNo ratings yet

- Group 7_Enabling Assessment - Research OutputDocument27 pagesGroup 7_Enabling Assessment - Research OutputKenzel lawasNo ratings yet

- LAWAS_MODULE_1-ENABLING_ASSESSMENT_ANSWER_SHEETDocument1 pageLAWAS_MODULE_1-ENABLING_ASSESSMENT_ANSWER_SHEETKenzel lawasNo ratings yet

- Research-Defense-Grading-Sheet-Oral-Presentation-revised-3-COPIESDocument3 pagesResearch-Defense-Grading-Sheet-Oral-Presentation-revised-3-COPIESKenzel lawasNo ratings yet

- Kenzel Lawas - BSA11 - Enabling Assessment 6 Individual ReflectionDocument1 pageKenzel Lawas - BSA11 - Enabling Assessment 6 Individual ReflectionKenzel lawasNo ratings yet

- Summary-of-Suggestions-Oral-Defense-1-COPY-Copy (1)Document1 pageSummary-of-Suggestions-Oral-Defense-1-COPY-Copy (1)Kenzel lawasNo ratings yet

- Kenzel Lawas - BSA11 - Module 1 Enabling Assessment Jesus' Mission and The Kingdom of GodDocument5 pagesKenzel Lawas - BSA11 - Module 1 Enabling Assessment Jesus' Mission and The Kingdom of GodKenzel lawasNo ratings yet

- Group 7_Enabling Assessment - Research OutputDocument27 pagesGroup 7_Enabling Assessment - Research OutputKenzel lawasNo ratings yet

- Script for TedTalkDocument7 pagesScript for TedTalkKenzel lawasNo ratings yet

- Script for TedTalkDocument7 pagesScript for TedTalkKenzel lawasNo ratings yet

- C1 Cash and Cash EquivalentsDocument34 pagesC1 Cash and Cash EquivalentsKenzel lawasNo ratings yet

- Kenzel Lawas - BSA11 - Enabling Assessment - Environmental SelfDocument2 pagesKenzel Lawas - BSA11 - Enabling Assessment - Environmental SelfKenzel lawasNo ratings yet

- Kenzel Lawas - BSA11 - Enabling Assessment - Environmental SelfDocument2 pagesKenzel Lawas - BSA11 - Enabling Assessment - Environmental SelfKenzel lawasNo ratings yet

- Kenzel Lawas - BSA11 - Lasallian FestivalDocument2 pagesKenzel Lawas - BSA11 - Lasallian FestivalKenzel lawasNo ratings yet

- Kenzel Lawas - BSA11 - Lasallian FestivalDocument2 pagesKenzel Lawas - BSA11 - Lasallian FestivalKenzel lawasNo ratings yet

- Kenzel Lawas - BSA11 - Enabling Assessment 6 Individual ReflectionDocument1 pageKenzel Lawas - BSA11 - Enabling Assessment 6 Individual ReflectionKenzel lawasNo ratings yet

- Kenzel Lawas - BSA11 - EA2Document2 pagesKenzel Lawas - BSA11 - EA2Kenzel lawasNo ratings yet

- C8 Recievable Financing Pledge Assignment FactoringDocument32 pagesC8 Recievable Financing Pledge Assignment FactoringAngelie LaxaNo ratings yet

- Kenzel Lawas - Formative Assessment 1 Self - Awareness AssessmentDocument3 pagesKenzel Lawas - Formative Assessment 1 Self - Awareness AssessmentKenzel lawasNo ratings yet

- C5 Estimation of Doubtful AcccountsDocument17 pagesC5 Estimation of Doubtful AcccountsKenzel lawasNo ratings yet

- Script in EA2 in MathDocument3 pagesScript in EA2 in MathKenzel lawasNo ratings yet

- Script in EA2 in MathDocument3 pagesScript in EA2 in MathKenzel lawasNo ratings yet

- References For EA2 in Mathematics in The Modern WorldDocument1 pageReferences For EA2 in Mathematics in The Modern WorldKenzel lawasNo ratings yet

- Instructions For Games (Compiled)Document2 pagesInstructions For Games (Compiled)Kenzel lawasNo ratings yet

- Group1 BSA13 EA6Document5 pagesGroup1 BSA13 EA6Kenzel lawasNo ratings yet

- Group1 BSA13 EA6Document5 pagesGroup1 BSA13 EA6Kenzel lawasNo ratings yet

- Kenzel Lawas - Formative Assessment 1 Self - Awareness AssessmentDocument3 pagesKenzel Lawas - Formative Assessment 1 Self - Awareness AssessmentKenzel lawasNo ratings yet

- Instructions For Games (Compiled)Document2 pagesInstructions For Games (Compiled)Kenzel lawasNo ratings yet

- Question 4 (CP01) - Requirement 1 and 2Document2 pagesQuestion 4 (CP01) - Requirement 1 and 2Kenzel lawasNo ratings yet

- Team KAEDS Brochure PresentationDocument10 pagesTeam KAEDS Brochure PresentationKenzel lawasNo ratings yet

- Question 4 (CP01) - Requirement 1 and 2Document2 pagesQuestion 4 (CP01) - Requirement 1 and 2Kenzel lawasNo ratings yet

- Tanzania Revenue Authority: Institute of Tax AdministrationDocument28 pagesTanzania Revenue Authority: Institute of Tax AdministrationMoud KhalfaniNo ratings yet

- AP.2806 Investments PDFDocument6 pagesAP.2806 Investments PDFMay Grethel Joy Perante0% (1)

- Employee Self Service - BSNL ERP User ManualDocument88 pagesEmployee Self Service - BSNL ERP User ManualsandyNo ratings yet

- Natural Gas Market in Gujarat - InfralineEnergyDocument4 pagesNatural Gas Market in Gujarat - InfralineEnergyInfraline EnergyNo ratings yet

- ACI Worldwide Helps Customers Capitalize on Payments BoomDocument4 pagesACI Worldwide Helps Customers Capitalize on Payments BoomreadbooksreadNo ratings yet

- Construction of Smart Bus Shelters and E-Toilets in MangaluruDocument68 pagesConstruction of Smart Bus Shelters and E-Toilets in MangaluruGanesh BhandaryNo ratings yet

- ABC Hotel Management SystemDocument68 pagesABC Hotel Management SystemWaruna Priyantha Munasingha100% (1)

- Satender NewDocument34 pagesSatender NewShivam SinghNo ratings yet

- It 2Document44 pagesIt 2Business RecoveryNo ratings yet

- Session 3-2: Fintech, Financial Literacy, and Consumer Saving and Borrowing: The Case of Thailand by Thammarak MoenjakDocument23 pagesSession 3-2: Fintech, Financial Literacy, and Consumer Saving and Borrowing: The Case of Thailand by Thammarak MoenjakADBI Events100% (1)

- GMI Questions and Their Answers in EnglishDocument18 pagesGMI Questions and Their Answers in EnglishfaheemaslamNo ratings yet

- Appendix 38 - Instructions - RCIDocument2 pagesAppendix 38 - Instructions - RCIhehehedontmind meNo ratings yet

- Chapter 4: Joint Venture: Rohit AgarwalDocument4 pagesChapter 4: Joint Venture: Rohit Agarwalbcom100% (2)

- Cost AccountingDocument36 pagesCost AccountingNikhil PatelNo ratings yet

- Truth in Lending ActDocument30 pagesTruth in Lending ActjayrenielNo ratings yet

- Tax RTP May 2020Document35 pagesTax RTP May 2020KarthikNo ratings yet

- Kinds of Contract of SaleDocument8 pagesKinds of Contract of SaleJoyceNo ratings yet

- Auditing Problems Quiz 01 SolutionsDocument8 pagesAuditing Problems Quiz 01 SolutionsCrestinaNo ratings yet

- HANA T-CODESDocument15 pagesHANA T-CODESCatapang Mona LizaNo ratings yet

- ICICI Bank Sapphiro Credit Cards Membership KitDocument25 pagesICICI Bank Sapphiro Credit Cards Membership Kitshikharjain101995No ratings yet

- FIA FA1 Mock Exam - QuestionsDocument16 pagesFIA FA1 Mock Exam - Questionsmarlynrich3652100% (4)

- Assignment Accounting of ReceivablesDocument2 pagesAssignment Accounting of Receivablesmisa moonNo ratings yet

- PowerWater Maintenance2015Document9 pagesPowerWater Maintenance2015Engr Muhammad HussainNo ratings yet

- Tally Prime Record BookDocument19 pagesTally Prime Record Bookmuneest19No ratings yet

- Hemant Maniar Vs Longshine Global EnterpriseDocument12 pagesHemant Maniar Vs Longshine Global EnterpriseSonali JainNo ratings yet

- Tax101 Module 02 - Taxes, Tax Laws and Tax Administration V 1.0Document10 pagesTax101 Module 02 - Taxes, Tax Laws and Tax Administration V 1.0Genevieve AnoreNo ratings yet

- Direct Debit SetupDocument2 pagesDirect Debit Setupishtee894No ratings yet