Professional Documents

Culture Documents

Introduction To Game Theory and Its Application in Electric Power Markets Singh PDF

Introduction To Game Theory and Its Application in Electric Power Markets Singh PDF

Uploaded by

Wilian GuamánOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Game Theory and Its Application in Electric Power Markets Singh PDF

Introduction To Game Theory and Its Application in Electric Power Markets Singh PDF

Uploaded by

Wilian GuamánCopyright:

Available Formats

Introduction to Game Theory and Its Application in Electric Power Markets

for nonzero-sum games was first formu- oner’s dilemma. In the original version of

HARRY SlNGH lated by John Nash, and the Nash equi- the game, there are two players, A and B,

librium is now a universally used who can either cooperate with each

solution concept. other and refuse to provide evidence or

Game theory is a discipline that is used Noncooperative games can be they can defect and implicate the other

to analyze problems of conflict among described using two kinds for formats. player. A concise representation of this

interacting decision makers. It may The first format is the normal or strate game was provided by Aumann. Each

be considered as a generalization of

decision theory to include multiple

players or decision makers.

The concepts used in game the-

ory can be traced back to the work

of Cournot, Bertrand, and v a n

Stackelberg. However, it was not

until 1928 that van Neumann pub-

lished the general theory for solv-

ing zero-sum games. The general

theory for solving zero sum games

became more widely known in 1944

with the work of von Neumann and

Morgenstern. Many of the impor-

tant developments in the field took

place during the period from 1950

t o 1960. The best known among

these is the concept of Nash equi-

librium. Game theory gained addi-

tional prominence as a subject in

1994, when the Nobel prize for eco-

nomics was awarded jointly to John

Harsanyi, John Nash, and Rienhard

Selten for their contributions to the

analysis of equilibria in noncooper-

ative games.

Game theory can be classified

into two areas: cooperative and non-

cooperative. This tutorial provides a gic form, and the second is the exten- player A and B must announce to a refer-

quick introduction to noncooperative sive form. In the sfrutegic form,one deals ee “Give me $1,000” or “Give the other

game theory using applications in elec- with a set of players, a set of choices or player $3,000.” The money under either

tric power markets. strategies available to the players, and a strategy comes from a third party. The

set of payoffs corresponding to these cooperate strategy for each player is to

Noncooperative strategies. The payoff for a given player give the other player $3,000, while the

Game Theory depends not only on the strategy cho- defect strategy is to take $1,000,The pay-

Noncooperative games can be zero-sum sen by that player but also on the strate offs for A and B can be represented as

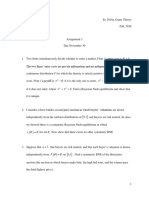

games or nonzero-sum games. In zero- gies chosen by t h e o t h e r players. shown in Figure 1.

sum games, t h e gains of one player Additionally, it is assumed that the rules The Nash equilibrium in this game

equal the losses of the other player. of the game, the strategies available to involves each player choosing t h e

The solution of zero-sum games was the players, and the payoffs are com- defect strategy even though this is not

first formulated by von Neumann and mon knowledge. Each player is assumed the strategy that maximizes the payoff

Morgenstern. In nonzeromm games, the to act rationally to maximize its profit. for a player. The payoffs for both play-

gains of one player d o not equal the Perhaps the best known problem in e r s can be increased if they both

losses of the other player. The solution noncooperative game theory is the pris- choose the cooperate strategy. Howev-

18 IEEE Computer Applications in Power

strategy j , their payoffs o r Noncooperative games a r e t h e

I Payoff ($) 1 Player B

Cooperate, Defect I gains are represented by a,,

and b,, respectively. A mixed

strategy for player I is a vec-

tor x whose i-th component

foundation for some of the standard

models in oligopoly. The study of oli-

gopoly models is essential to study

market power.

represents the probability of

choosing p u r e strategy i. Cournot Duopoly

Thus x , 2 0 and Z x , = 1. A A Cournot model involves a duopoly

mixed strategy for player I1 is game in which two firms produce an

Figure 1. Prisoner’s dilemma defined analogously. If x and y identical product and must decide how

are a pair of mixed strategies much to produce without knowing the

er, this is not a stable outcome as each for players I and II, their expected gains output decision of the other. For conve-

player h a s a n incentive t o defect are x’Ay and x’By, respectively. A pair of nience, assume that each firm’s cost is

regardless of what the other player mixed strategies (x*, y‘) is said to be a 0. Assume that xI and x, represent the

chooses. A Nash equilibrium exists if, Nash equilibrium if output decisions of each firm. The mar-

for a given set of strategies chosen by ket price is represented by p(x,+x,),

other players, each player’s strategy is (x*)’Ay* t YAY* V x t 0, Z X =~1 where p ( x ) is t h e inverse demand

an optimal response to those strategies. curve. The profits or payoffs for each

Thus, at a Nash equilibrium, a player’s and firm are 1,= p(x, t x,)x? The strategy of

payoff decreases if it changes its strate- each firm is to choose xi in order to

gy assuming all other players’ strategies (x*)’By* 2 (x*)’By V y t 0, Cyi = 1. maximize its profit without knowing the

remain the same. decision of the other firm.

Finite nonzero-sum games are also In other words, (x*,y*) is a Nash equi-

called bimatrix games, given the nota- librium if neither player can gain by uni- Bertrand Duopoly

tion used to represent the payoffs in the laterally changing its strategy. Under a Bertrand model, each firm must

game. A bimatrix game T(A, B) consists A particularly interesting special choose the price at which it is willing to

of two players, each of whom has a case of a Nash equilibrium is a Nash produce. Ignoring bounds on output,

finite number of actions called pure equilibrium in pure strategies, i.e., one we can assume that the lower priced

strategies. When player I chooses pure in which the probability of choosing a firm will capture market share and that

strategy i and player II chooses pure particular strategy is 1 for each player. both firms will have equal outputs at

lllEUROSTAG

Software for the simulation of power system dynamics

A continuous display of both fast and slow phenomena

Accurate simulat

Automatic inte

avenue Ariane 7 , av du GCn6ral de Gaulle

B- I200 Brussels (Belgium) -92 I 4 I Clamart (France)

Tel +32 2 773 79 41 Tei +33 I 47 65 56 00

Fax +32 2 773 88 90 Fax +33 I 47 65 46 88

E-mail eurostag@edf.fr

Product Info - www.ieee.o~magazines/DirectAceess

ma. If both players cooperate, the strike price, and the buyer pays

-

they c a n both charge t h e the seller if the pool price falls below

monopoly price. However, the strike price. A one-way CfD is simi-

each player has an incentive to lar to a financial option contract and

reduce its price slightly and also includes an option fee in addition

capture market s h a r e , even to the strike price and contract quan-

though it knows that both play- tity. Under a one way contract, differ-

ers will be worse off i f they ence payments are made only if the

both cut price. pool p r i c e rises a b o v e t h e s t r i k e

Difference

Payments

price, as shown in Figure 3.

Market Power T h e effect of a CfD is t o fix o r

Mitigation bourid the revenue for a generator. In

Ygiire 2. Payment streams in a CfD Market power can be defined the extreme, where the entire output

as the ability of a market par- of a generator is contracted under a

ticipant to raise prices above CfD, the generator's revenue will be

t h e competitive level by completely insulated from market

$IMWtl price variations, and, consequently,

A two-way restricting output or restrict-

ing new entrants. Horizontal the generator should have no incen-

Strike market power is often associ- tive to raise prices. Ideally, one would

Price ated with a single firm or a few like to contract just the appropriate

firms controlling a large part of fraction of output required to mitigate

the supply. market power.

Hours Although generation divesti- To illustrate how CfDs can elimi-

A: Seller pays buyer, B: Buyer pays seller nate incentives to raise prices, we will

ture has been used as a reme-

d y for t h i s problem in t h e set up a simple Cournot model with

Figure 3. Two-way CID electric power industry, it is two generators (A and B) and one

not always a viable option. In load, as shown in Figure 5. Each of the

such instances, financial con- generators has an incremental cost of

tracts s u c h as contracts for $lO/MWh and a maximum output of

differences (CfD) can be used 75 MW. The strategic decision for the

to accomplish what might be generators is to choose a level of out-

termed as virtual divestiture. put that maximizes their profits. The

Game theory can be used to price is s e t by t h e demand curve,

I

I

study t h e effects of CfDs on which is also shown in Figure 5. We

,

Hours

bidding incentives. The pur- will a s s u m e t h a t e a c h g e n e r a t o r

Figure 4. One-way CfD pose of a CfD is to insulate the chooses between two levels of output,

supplier against the temporal a high output of 75 MW and a low out-

II I price variations in the market. put of 20 MW, as shown in Figure 6.

I A$lO/MWh

The low output may be interpreted as

..l--T-

0 - 75 MW

45

40

ference between

the contract Output(MW) 1 Generator B

Hiah I Low - -

1

pricc ai111 t l i e -- A's output

--c-tt .

prc-vuili iig iiiiir- High

0-150MW 50 100 150 MWh 75 9 s output

B $lO/MWh krt or pool A

0-75MW 20 ' 20 A'soutput

price, as clrpict- LOW

c d i i i Figure 2. 75 20 9 s outpu1

Figure 5. A two generation game A Cil) call be ~. - . .

either twc-way or Figure 6 Output decisions of A and B

equal price. If x@) represents the mar- one-way. A two-

ket demand function, the payoff or prof- way CfD is similar to a

Generator B

it of firm 1 can be represented as financial futures contract Price ($/MWh)

and is defined in terms of High ILow

i.

PAP,) if PI <P2 a strike price ($/MWh),

%(PIA)= P I ~ ( P I )if~ ~ p I = p 2 (1) and a quantity (MWh). As

if PI > P I shown in Figure 2, for the

defined quantity, the sell-

A Bertrand game has a structure er pays the buyer if the

similar to that of the prisoner's dilem- pool price rises above Figure 7. Prices corresponding to output decisions

20 IEEE Computer Applications in Power

for IEEE Computer Applications in Power

EEE Computer Applications in The articles are published with- consultants to tell of unique appli-

I Power is a quarterly magazine

sponsored by the IEEE Power

Engineering Society and

tlet1ic:;itetl to the eicctri-

out discussion or closure, but they

receive peer review from the maga-

cations of computers t o improve

system operation and performance,

and working. QrouDs . . within

thc, trchnicnl socielirs t o

cai powvr i n d u s t r y . I t s tlisscwiiiatc- thcir informa-

focus is 0 1 1 the ai)pIica- tioii to a wid? reiitlcrsliii)

tion of digital d e v i c e s before finalizing conclu-

and associated software s i o n s in p a p e r s o r s t a n -

for power s y s t e m plan- Information for Authors of dards. Articles should be

ning, construction, opera- Technlcal Papers, Articles and about 5,000 words, includ-

tion, maintenance, a n d ing For Further reading,

control Biographies, t a b l e s , a n d

We welcome articles g r a p h i c s . A preliminary

t h a t would not involve copy should b e sent to

the technical details that S.H Horowitz, E-mail

would appeal only to experts within zine's editorial board and selected s.horowitzQ ieee.org or FAX (614)

a specific discipline but would be advisors. T h e articles provide a 777-8057, with followup discussion

of interest t o t h e general power platform for manufacturers and uni- b y E-mail o r p h o n e , (614) 876

engineering community, academe, versity researchers to describe on- 0802, on applicability and submis-

and students. going developments, utilities and sion schedules.

Unbalanced & Balanced Power Flow

*Harmonic Power Flow

Power Quality Analysis (motor starting,

* Short Circuit Analysis

Arbitrary Complex Fault

Network Frequency Scan

Unbalanced & YBalancedCoadFlow

' Short Circuit Analysis

- Overcurrent Protection Coordination

Line Sag &Tension Analysis

* Quick Analysis Programs

- (Fault, Voltage Drop,Motor Flicker Analysi:

Transformer EconomicsISizing

Conductor EconomicsISizing

* EMF Prolile for OIH & UIG Systems

Line & Cable Constants proqrams

(604) 467-8715 Fax: (604) 467-2687

Internet e-mail : powersiOistar.ca

Website : httd/home.istar.ca//-Dowersil

Product Info - www.ieee.org/magazines/DirectAccess Product Info - www.ieee.org/magazines/DireetAeceas

Equity arguments call strained Unit Commitment; Market Power

for solutions that allocate Evaluation in Power Systems with Conges-

Generator B c o s t s t o coalitions in a tion; Market Power Mitigation; Some

Profit ($) manner that guarantees Things Experiments Reveal About Market

that all coalition members Power Opportunities Offered by a Con-

are at least as well off as strained Transmission System; The Best

Generator 2250 B s Drofit

Game in Town: NERC's TLR Rules; and

they would be if they were

A's profit not a part of the coalition. Hacking with Megawatts: Gaming via Gov-

B s profit This is sometimes called ernor Control in a Competitive Generation

the stand-alone test. Solu- Environment.

tions that exactly allocate

Figure 8. Profits without CfD the total costs and satisfy For Further Reading

withholding of capacity with a motiva- the stand-alone test, are Game Theory Applications in Electric Power

tion t o increase prices. If prices called core solutions. Alternative solu- Market.s, IEEE tutorial,99TP-136. 1999.

increase sufficiently, the generator can tion concepts such a s t h e Shapley R. Aumann, "Game Theory," in The New

make a higher profit at the low output. Value are also possible. Palgrave, eds. J. Eatwell, M. Milgate, P.

Newman. McMillan.

London, 1987.

D. Fudenberg, J.

Tirole, Game Theo-

ry, The MIT Press,

Cambridge, 1991.

D. Fudenberg,

1 1

D.K. Levine, "The

I A Low

I550

2475 I

-500

-500 BsprofitI

A's profit

II A Low

650

2575

1700

1700 1

As profit

B's profit

Theory of Learning

i n Games," T h e

MIT Press, Cam-

-I

figure 9.Profits with CfD for 30 MW

bridge, 1998.

i p r e 10. Profits with CfD for 10 MW

D.A. Kreps. Game

There are four possible cases to The emphasis in cooperative game Theory and Economic Modeling, Clarendon

consider, depending on the decision theory is on solutions that are equi- Press, Oxford, 1990.

of each generator. The prices corre- table. In contrast, noncooperative H.R.Varian, Microeconomic Analysis,

sponding to these cases are shown in game theory helps us study efficient W.W. Norton and Co., New York, third edi-

Figure 7. Figure 8 shows a Nash equi- solutions under new market designs. tion, 1992.

librium for the case when both gener- Just as we study the stability of an J . von Neumann, 0. Morgenstern,

ators choose low levels of output to engineering system, we can s t u d y Theory o f Games and Economic Behavior,

maximize their profits. However, if a how efficient a market design might Princeton University Press, Princeton

CfD is applied to 30 MW of the genera- be by using game theory. NJ, 1944.

t o r s output, t h e Nash equilibrium The examples in this article were H.P. Young, "Cost Allocation," in Hand-

changes, as shown in Figure 9. The highly simplified. There a r e many book o f Come Theory with Economic Appli-

strike price in the CfD is assumed to other problems that deal with t h e cations, volume 2 , eds. R. Aumann, S. Hart,

equal t h e competitive price of behavior of market participants in North Holland, Elsevier. Amsterdam, 1994.

$40/MWh. In this case, profits a r e transmission networks under con-

maximized at the competitive price gestion that the reader will find of Biography

corresponding to the high output by interest. Harry Singh is manager of Electricity Eco-

each generator. Similarly, Figure 10 nomics at PG&E Energy Services (PG&E

shows the profits if a CfD is applied to Acknowledgment Energy Services is not the same company as

10 MW of the output. This tutorial is based on excerpts from the Pacific Gas and Electric Company, the utility

Game Theory Applications in Electric Power PG&E Energy Services is not regulated by

Cooperative Game Theory Markeb tutorial, which was prepared for the California Public Utilities Commission,

Cooperative game theory, which is presentation at the 1999 IEEE PES Winter and you do not have to buy PG&E Energy

quite different from noncooperative Meeting. The 103-page multiauthor tutori- Services' products in order to continue to

game theory, is generally applied to al book (99TP-136) can be ordered receive qualip regulated services from Pacif-

solve allocation problems. The vari- through IEEE Customer Service. Chapters ic Gas and Electric Company.) Prior to join-

ous solutions proposed for coopera- include: Introduction; Analyzing Strategic ing PG&E Energy Services, he worked with

tive games can b e i n t e r p r e t e d a s Bidding Behavior in Transmission Net- the Pacific Gas and Electric Company in

alternative solutions to an allocation works; Using Game Theory to Study Mar- San Francisco, where he was a part of the

problem. The key ideas involve the ket Power in Simple Networks; Bidding team responsible for setting up the Califor-

concept of coalitions or groups that Strategies for Lagrangian Relaxation Based nia IS0 and PX. He received a PhD in elec-

are formed to benefit from economies Power Auctions; Risk Management Using trical engineering from the University of

of scale. Game Theory in Transmission Con- Wisconsin at Madison.

22 IEEE ComputerApplications in Power

You might also like

- Shreve S.E. Stochastic Calculus For Finance IIDocument570 pagesShreve S.E. Stochastic Calculus For Finance IITaylor MartinNo ratings yet

- Game Theory - PresentationDocument17 pagesGame Theory - Presentationsaachi anandNo ratings yet

- Game THeoryDocument15 pagesGame THeoryEngineerMq100% (8)

- Exploring The Duopoly of PLDT and Globe Telecom - A Game Theory Approach - Deza, Moreno, Rey, NG TioDocument10 pagesExploring The Duopoly of PLDT and Globe Telecom - A Game Theory Approach - Deza, Moreno, Rey, NG TioBrUnoMorenoNo ratings yet

- Unit 13Document12 pagesUnit 13massNo ratings yet

- Topic Four-Theory of GamesDocument58 pagesTopic Four-Theory of GamesMister PhilipsNo ratings yet

- Extensive Form GamesDocument22 pagesExtensive Form GamesLeon AshleyNo ratings yet

- Gaming Theory - Study NotesDocument51 pagesGaming Theory - Study Notesbarakkat72No ratings yet

- Introduction To Evolutionary Game TheoryDocument25 pagesIntroduction To Evolutionary Game TheoryMaria GianfredaNo ratings yet

- Game TheoryDocument25 pagesGame Theoryashok_k_alexanderNo ratings yet

- Lesson 25 Game TheoryDocument25 pagesLesson 25 Game TheoryMousumi MajumdarNo ratings yet

- ProblemBank203 2Document86 pagesProblemBank203 2canerNo ratings yet

- Chapter 13Document20 pagesChapter 13Rajveer SinghNo ratings yet

- Game Theory: Principles and ApplicationsDocument31 pagesGame Theory: Principles and Applicationsjai hahNo ratings yet

- Game Theory: Game Is of Decision He Theory Determine The Rules of Rational Makers. They HaveDocument5 pagesGame Theory: Game Is of Decision He Theory Determine The Rules of Rational Makers. They HaveVikramjeet SinghNo ratings yet

- Topic2 BayesianDocument4 pagesTopic2 BayesianDorin KatuuNo ratings yet

- Robert AumannDocument27 pagesRobert AumannPaul TenderNo ratings yet

- Significance of Game TheoryDocument15 pagesSignificance of Game TheoryAasim TajNo ratings yet

- Chap 1: Normal Form Games: Step 1: Each Player Simultaneously and Independently Chooses An ActionDocument6 pagesChap 1: Normal Form Games: Step 1: Each Player Simultaneously and Independently Chooses An ActionFayçal SinaceurNo ratings yet

- Game Theory CompiledDocument29 pagesGame Theory CompiledMuhammad NadeemNo ratings yet

- GTDocument31 pagesGTMD. TasneemNo ratings yet

- Introduction To Game TheoryDocument16 pagesIntroduction To Game TheorySony RamadhanNo ratings yet

- An Introductory Review On Quantum Game Theory: Wenjie Liu1, Jingfa Liu, Mengmeng Cui Ming HeDocument4 pagesAn Introductory Review On Quantum Game Theory: Wenjie Liu1, Jingfa Liu, Mengmeng Cui Ming HegeekmastaNo ratings yet

- Chapter 3st Extension GTDocument10 pagesChapter 3st Extension GTJadeNo ratings yet

- Game Theory Strategies For Decision Making - A Case Study: N. Santosh RanganathDocument5 pagesGame Theory Strategies For Decision Making - A Case Study: N. Santosh RanganathSofia LivelyNo ratings yet

- Game TheoryDocument47 pagesGame TheoryAda TeachesNo ratings yet

- Introduction To Game Theory: Yale Braunstein Spring 2007Document39 pagesIntroduction To Game Theory: Yale Braunstein Spring 2007Gábor Mátyási100% (1)

- GT ChapbookDocument37 pagesGT ChapbookRizky fajar RamadhanNo ratings yet

- Computational Game TheoryDocument6 pagesComputational Game TheoryNishiya VijayanNo ratings yet

- Theory of Games Von NeumannDocument12 pagesTheory of Games Von NeumannyoppiNo ratings yet

- Congestion Games and Potentials ReconsideredDocument19 pagesCongestion Games and Potentials Reconsideredsjdjd ddjdjfNo ratings yet

- Public MonitoringDocument13 pagesPublic MonitoringmiguNo ratings yet

- M M M M M M M M M: Koppar & Associates, Chartered Accountants 6/30/2011Document34 pagesM M M M M M M M M: Koppar & Associates, Chartered Accountants 6/30/2011osman basha0% (1)

- Notes 1st Year PHDDocument89 pagesNotes 1st Year PHDmauricio carrillo oliverosNo ratings yet

- GAMET2T4Document8 pagesGAMET2T4Majid KhanNo ratings yet

- Game TheoryDocument5 pagesGame TheoryJoseph AyodejiNo ratings yet

- Balancing Zero-Sum Games With One Variable Per Strategy: Albert Julius Liu and Steve MarschnerDocument9 pagesBalancing Zero-Sum Games With One Variable Per Strategy: Albert Julius Liu and Steve MarschnerGuestNo ratings yet

- Game Theory Is "The Study ofDocument32 pagesGame Theory Is "The Study ofndmudhosiNo ratings yet

- Game TheoryDocument12 pagesGame TheoryMưaBayNo ratings yet

- Game Theory 2Document14 pagesGame Theory 2Ola AhmedNo ratings yet

- Games of Perfect Information, Predatory Pricing and The Chain-Store ParadoxDocument9 pagesGames of Perfect Information, Predatory Pricing and The Chain-Store ParadoxÁlvaro OlórteguiNo ratings yet

- Unit 5 Sequential GamesDocument25 pagesUnit 5 Sequential GamesVicent Sebastià SospedraNo ratings yet

- A Short Introduction To Game TheoryDocument22 pagesA Short Introduction To Game TheoryDeepansh TyagiNo ratings yet

- Game Theory and Its ApplicationsDocument14 pagesGame Theory and Its ApplicationsOnur SahinturkNo ratings yet

- Game TheoryDocument11 pagesGame TheoryMUTATIINA MARKNo ratings yet

- Game Theory-Normal Form Games: Key WordsDocument30 pagesGame Theory-Normal Form Games: Key WordsPrem Kumar GarapatiNo ratings yet

- Game Theory Notes PDFDocument5 pagesGame Theory Notes PDFUtpal Bora0% (1)

- Draft On Game TheoryDocument4 pagesDraft On Game TheoryPranay SomaniNo ratings yet

- 6.254: Game Theory With Engineering Applications Lecture 3: Strategic Form Games - Solution ConceptsDocument27 pages6.254: Game Theory With Engineering Applications Lecture 3: Strategic Form Games - Solution ConceptsRyanNo ratings yet

- Each. Game Theory DefinitionsDocument14 pagesEach. Game Theory DefinitionsTirupal PuliNo ratings yet

- Lecture I-II: Motivation and Decision Theory - Markus M. MÄobiusDocument9 pagesLecture I-II: Motivation and Decision Theory - Markus M. MÄobiuskuchbhirandomNo ratings yet

- Game Theory Project Oct '08Document16 pagesGame Theory Project Oct '08Ruhi SonalNo ratings yet

- Game TheoryDocument50 pagesGame TheoryBadri VNo ratings yet

- Chapter 5 - Game Theory: HistoryDocument59 pagesChapter 5 - Game Theory: Historyabc123No ratings yet

- Chapter 4 Game TheoryDocument7 pagesChapter 4 Game TheoryMaria Teresa VillamayorNo ratings yet

- Zero-Sum Game: SolutionDocument6 pagesZero-Sum Game: SolutionFirman HamdanNo ratings yet

- Chapter 5 - Game Theory: HistoryDocument59 pagesChapter 5 - Game Theory: Historyabc123No ratings yet

- Algeabric Game THDocument5 pagesAlgeabric Game THRamadurga PillaNo ratings yet

- Econ 2010a - Assignment 3Document2 pagesEcon 2010a - Assignment 3Jason BridgesNo ratings yet

- Duffy JennyDocument37 pagesDuffy JennyMK IslamNo ratings yet

- CH 6 CDocument21 pagesCH 6 CvuduyducNo ratings yet

- KEQ FV and PV TablesDocument4 pagesKEQ FV and PV TablesRaj ShravanthiNo ratings yet

- Sher-E-Bangla Agricultural University: Assignment OnDocument12 pagesSher-E-Bangla Agricultural University: Assignment OnMd Aulad HossainNo ratings yet

- Round Tree ManorDocument3 pagesRound Tree ManorMahidhar SurapaneniNo ratings yet

- Certified Risk Management Professional (CRMP)Document2 pagesCertified Risk Management Professional (CRMP)DesuyNo ratings yet

- Problem Set 08 With SolutionsDocument7 pagesProblem Set 08 With SolutionsMinh Ngọc LêNo ratings yet

- Single Index ModelDocument3 pagesSingle Index ModelPinkyChoudhary100% (1)

- 6 Value at Risk PDFDocument32 pages6 Value at Risk PDFvidyaNo ratings yet

- CMBI ABS Australian Census Power BI Sample V1.0Document183 pagesCMBI ABS Australian Census Power BI Sample V1.0KurniaNo ratings yet

- RCT LectureDocument64 pagesRCT LectureAKNTAI002No ratings yet

- M. Amir Hossain PHD: Course No: Emba 502: Business Mathematics and StatisticsDocument31 pagesM. Amir Hossain PHD: Course No: Emba 502: Business Mathematics and StatisticsSP VetNo ratings yet

- Forecasting: EM6113-Engineering Management TechniquesDocument40 pagesForecasting: EM6113-Engineering Management TechniquesasadNo ratings yet

- ch1 The Nature of Regression AnalysisDocument12 pagesch1 The Nature of Regression AnalysisyukeNo ratings yet

- Present Value TablesDocument2 pagesPresent Value TablesFreelansir100% (1)

- Box-Pierce Test of Autocorrelation in Panel Data Using StataDocument4 pagesBox-Pierce Test of Autocorrelation in Panel Data Using Statacarlos castilloNo ratings yet

- MFX Module 3 Properties of Time SeriesDocument76 pagesMFX Module 3 Properties of Time SeriesThanh NguyenNo ratings yet

- Examples Game TheoryDocument22 pagesExamples Game TheoryPeter MastersNo ratings yet

- Corteestructural, Series PDFDocument6 pagesCorteestructural, Series PDFJhon Diego Vargas OliveiraNo ratings yet

- Lec08 PDFDocument26 pagesLec08 PDFalb3rtnetNo ratings yet

- Tugas Rancob RalDocument3 pagesTugas Rancob RalWilly BrodusNo ratings yet

- Makr.2 13t. PDFDocument430 pagesMakr.2 13t. PDFქეთი კუპატაძეNo ratings yet

- CH 4 Demand EstimationDocument27 pagesCH 4 Demand EstimationNovhendraNo ratings yet

- Panel Data 4: Fixed Effects Vs Random Effects ModelsDocument8 pagesPanel Data 4: Fixed Effects Vs Random Effects ModelsIrina AlexandraNo ratings yet

- Bioequivalence and Bioavailability Forum - Three-Way Crossover BABE StudiesDocument27 pagesBioequivalence and Bioavailability Forum - Three-Way Crossover BABE StudiesLazlo M RNo ratings yet

- MCQs Unit 4 Correlation and RegressionDocument14 pagesMCQs Unit 4 Correlation and Regressionsita rautela0% (1)

- Introduction To Sensitivity Analysis Graphical Sensitivity Analysis Sensitivity Analysis: Computer Solution Simultaneous ChangesDocument56 pagesIntroduction To Sensitivity Analysis Graphical Sensitivity Analysis Sensitivity Analysis: Computer Solution Simultaneous ChangesKh KHNo ratings yet

- SW 2e Ex ch07Document4 pagesSW 2e Ex ch07Nuno AzevedoNo ratings yet

- Statistical InferenceDocument47 pagesStatistical InferenceYoga RomdoniNo ratings yet

- 2.2 TVM Chapter 3 DamodaranDocument24 pages2.2 TVM Chapter 3 DamodaranPartha Protim SahaNo ratings yet