Professional Documents

Culture Documents

Return To:: John Henry Doe

Uploaded by

Belinda BucetaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Return To:: John Henry Doe

Uploaded by

Belinda BucetaCopyright:

Available Formats

RECORDING REQUESTED BY: Pg Qty: Test

©™John Henry Doe, Sui Juris, AR [sic],

RETURN TO:

©™John Henry Doe, Sui Juris, AR [sic],

℅ Postmaster USPO General Delivery

Any City, California state 00000 00000 ZIP Exempt

non domestic, without the UNITED STATES

Date Recorded Above space provided for Recorder's use only.

DOCUMENT TITLE SECURITY AGREEMENT

No. SA-1-111819610033-HJD [birth date in numbers then last 4 of SSI]

NON-NEGOTIABLE AND NON-TRANSFERABLE

DEBTOR: Creditor/Agent/Secured Party:

JOHN HENRY DOE©™, trade-name ©™John Henry Doe

any and all derivatives thereof c/o Postmaster General, USPO, General Delivery

SUCH and SUCH HOSPITAL Nevada City, California state 95959 00000 ZIP Exempt

ADDRESS OF HOSPITAL Non domestic, without the UNITED STATES

CITY, STATE 12345 2014 AD DMM Reg. 1.1.135; Public Law 91-375, Sec. 403

Federal Employer Identification Number: (FEIN) 12-3456789

SOCIAL SECURITY NUMBER: 123-45-6789 Exemption Identification (EID) 123456789

ALL MEN KNOWN BY THESE PRESENTS: This NON- NEGOTIABLE AND NON-TRANSFERABLE SECURITY

AGREEMENT (“Agreement”) is made and entered into on ______ Day of the __________ Month in the Year of our Lord Two

Thousand and Fourteen by and between the ‘real man’ John Henry Doe©™; herein after known as Agent and or Secured Party

and the Stramineus homo/Dummy Corporation JOHN HENRY DOE©™; herein after known as “DEBTOR” (STATE BIRTH

CERTIFICATE 7124-000064 on reverse in red letters B95163693 and SOCIAL SECURITY # 123-45-6789), and John Henry

Doe©™ hereinafter “Agent/Secured Party” Federal Employer Identification Number 12-3456789 herein after known as FEIN. The

Parties acknowledge they agree to be bound by the terms of this Commercial Security Agreement as follows:

AGREEMENT

In consideration for the DEBTOR agreeing to provide certain Collateral and goods, identified herein below, and certain

accommodations to the DEBTOR, including, but not limited to, allow the DEBTOR to act as an instrument, functioning primarily as a

transmitting utility, for the purpose of conducting commercial activity for the benefit of the Agent/Secured Party; and, as security for

payment of all sums due, or to become due or owing by DEBTOR to Secured Party, DEBTOR hereby grants to Secured Party a

security interest in the Collateral described herein below and agrees to provide to Secured Party the Indemnification Bond also

contained herein below.

COLLATERAL LIST

All Accounts, Bonded Promissory Notes numbered JHD1,000 through JHD20,000, the reservation of account numbers §JHD1000

through §JHD20,000 for use as seen fit by Agent/Secured Party, Contract Rights, Chattel Paper, General Intangibles, Inventory,

Equipment and Fixtures; whether owned now or acquired later; all accessions, additions, replacements, and substitutions; all records

of any kind relating to any of the foregoing; all proceeds (including insurance, bonds, stocks, general intangibles and accounts

proceeds), together with all the other real and personal property including but not limited to: ALL hospital, county, state, federal or

international Birth Certificates registered in the DEBTOR name and ALL documents and or instruments created using said birth

documents; Utah Driver/Operator’s License Number 9123465870; any possible potential licenses of any kind issued by any entity for

any reason or use what so ever and all documents and/or instruments created using said license number; Social Security Number

(SSN) 111-33-2222, and all documents and/or instruments created using said SSN and all proceeds thereof; all DEBTOR’S Treasury

Accounts and all proceeds thereof; Federal Employer Identification Number (FEIN) 54-6730033 and all documents and/or instruments

created using said FEIN and all proceeds thereof; Exemption Identification Number 546730033 and all documents and/or instruments

created using said Exemption Identification Number and all proceeds thereof; and all documents and/or instruments created using said

Exemption Identification Number and all proceeds thereof; real estate described as not yet attained or acquired; proceeds, products,

accounts and fixtures from crops, mine head, wellhead, with transmitting utilities etc.. rents, wages, all income, land and mineral,

water and air rights, cottages, house(s), buildings, bank accounts, bank deposit box(es) and the contents therein, savings account,

retirement plans, stocks, bonds, securities, benefits from trusts, inheritances gotten or to begotten, inventory in any source, all

machinery either farm or industrial, livestock, livestock equipment, vehicles, auto(s), truck(s) including and not limited to my 1994

Chevrolet Pickup Vehicle Identification Number 1HTC1VS1VSTHEM and California License plate Number 1B23456, 1998

Volkswagen Bug Vehicle Identification Number 1HTC1VS1VSTHEM and California License plate Number 2B34567, all cars, Four

Page 1 of 4 SECURITY AGREEMENT No. SA-1-073119600123-KBB

wheelers, all boats and water craft, aircraft, motor homes, 5th wheel trailers or mobile homes, motorcycles, jewelry, wedding bands

and/or rings, watch(es), household goods, appliances, any type furniture, kitchen utensils, cooking utensils, radio(s), television(s),

musical instruments, antiques, sports equipment, all arma, guns, hand guns, and any type property held for my benefit by either myself

or others, until the dishonor agreement, held by the DEBTOR is satisfied to full and acknowledgment of the same is completed.

Any property not specifically listed, named, or specified by make, model, serial number, etc., is expressly herewith included

as collateral of DEBTOR is included as the same, as applies to any and all 'property' as described in detail in additional UCC-1's or

UCC-3's under necessity in the exercise of the right of Redemption in behalf of the DEBTOR.

The DEBTOR agrees to notify all employers and creditors of the same, as all DEBTOR'S wages are

property of the Secured Party and are noticed accordingly. The DEBTOR 'S rights include the use of said

Collateral as may be needed from time to time.

NOTE; Secured Party reserves the right to add or amend this private security agreement by addition of Schedule A's as needed or

necessary on behalf of the DEBTOR.

FIDELITY BOND

KNOW ALL MEN BY THESE PRESENT, that I, JOHN HENRY DOE©™, (DEBTOR), am held

firmly bound unto John-Henry: Doe©™, (Secured Party) in the sum of present Collateral Values and any

debts or losses claimed by any and all persons against the Commercial Transactions and Investments of

aforesaid Collateral up to the penal sum of Nine Hundred Trillion Dollars ($900,000,000,000,000.00) lawful

money of the united States of America, for the payment of which, well and truly be made, I bind myself, my

heirs, executors, administrators and third party assigns, jointly and severally and firmly by these presents.

The conditions of the above bond is, that whereas the Collateral described herein and utilized for the purpose of transmitting

goods in Commercial Activity by the DEBTOR are in pursuance of the Statutes in such case made and provided indentured to the

Secured Party by which indenture the said Secured Party covenanted to do certain things as stated in this agreement and DEBTOR,

with regard to conveying goods and services in Commercial Activity to the Secured Party, covenants to serve as a 'commercial'

transmitting utility therefore and, as assurance of fidelity, grants to the Secured Party a Security Interest in the above described

Collateral.

The conditions of this obligation are such that if the Secured Party suffers any loss of Vested Rights in

the said Collateral Property or Monetary Losses due to debts claimed against the aforesaid Collateral Property,

or the DEBTOR, who binds himself by this obligation to make advance payments from the DEBTOR’S treasury,

IMF, BMF, IRAF, EPMF (temporary, permanent and current) accounts to any and all who make debt claims

against any of the Collateral or Vested Rights in said Collateral of the Secured Party. This obligation shall bind

the DEBTOR in all respects, to fully and faithfully comply with all applicable provisions of law.

This bond shall effect as of the date hereon and shall remain in full force and effect until the surety

(DEBTOR) is released from liability by the written order of the UNITED STATES and provided that the surety

may cancel this bond and be relieved of further liability hereunder by delivery within thirty (30) days, written

notice to the Secured Party. Such cancellation shall not affect any liability incurred or accrued by DEBTOR

hereunder prior to the termination of said thirty (30) day period. The DEBTOR will promptly reissue a bond

before the end of the thirty (30) day period of an amount equal to or greater than the value of this instrument

unless the parties agree otherwise.

INDEMNITY CLAUSE

The DEBTOR, without the benefit of discussion or division, does hereby agree, covenant and undertake

to indemnify, defend and hold the Secured Party harmless, from and against any and all claims, losses,

liabilities, costs, interests and expenses (herein after referred to as “claims” or a "claim") including, without

restriction, all legal costs, interests, penalties and fines suffered or incurred by the Indemnified Party arising as a

result of the Indemnified Party having it's personal guarantee with respect to any loan or generally any

indebtedness of the DEBTOR, including, without in any way restricting, the generality of the foregoing amount

owing by the DEBTOR to all creditors.

The Indemnified Party (Secured Party) shall promptly advise the Indemnifying Party (DEBTOR) of any

Claim, inter alia, and provide the same with full details thereof, including copies of any document,

correspondence, suit or action received by or served upon the Indemnified Party. The Indemnified Party shall

fully cooperate with the Indemnifying Party in any discussion, negotiations or other proceedings relating, to any

Claim.

DEFAULT

The following shall constitute the event(s) of default hereunder:

Page 2 of 4 SECURITY AGREEMENT No. SA-1-073119600123-KBB

1.) Failure by DEBTOR to pay any debt secured hereby when due;

2.) Failure by DEBTOR to perform any obligations secured hereby when the same should be performed;

3.) Any breach of any warranty by DEBTOR contained in this Security Agreement; or

4.) Any loss, damage, expense, or injury accruing to Secured Party by virtue of the commercial transmitting-utility function of

DEBTOR.

5.) Evidence that a statement, warranty, or representation made or implied in this agreement by DEBTOR, is false or misleading

in any material respect, either now or at the time made or furnished.

6.) Dissolution of termination of DEBTOR'S existence as a legal entity, the insolvency of DEBTOR, the appointment of a

receiver for all or any portion of DEBTOR'S property, an assignment for the benefit of public creditors, or the commencement

of proceedings under bankruptcy or insolvency laws by or against DEBTOR.

7.) Commencement of foreclosure, whether by action of a tribunal, self-help, repossession, or other method, by a creditor of

DEBTOR against the collateral.

8.) Garnishment of DEBTOR'S deposit accounts or employment funds.

CURE OF DEFAULT

If a fault or dishonor under this agreement is curable through an account held by DEBTOR but managed by the UNITED

STATES or one of its subdivisions, agents, officers, or affiliates, such fault or dishonor may be cured by the DEBTOR with

authorization by Secured Party; and upon advice by the fiduciary that the fault or dishonor has been cured, and no event of default will

have occurred. A dishonor under this agreement, initiated by third party intervention, will not cause a default if such intervention is

challenged by DEBTOR by its good faith effort to confirm or disprove the validity or reasonableness of a public claim which is the

basis of the public creditor' s proceeding; but DEBTOR must, in that event, deposit such surety with Secured Party as is necessary to

indemnify the Secured Party from loss.

ACCELERATION

In the event of default, Secured Party may declare the entire indebtedness immediately due and payable without notice.

LIQUIDATION OF COLLATERAL

In the event of default, Secured Party shall have full power to privately or publicly sell, lease, transfer, or otherwise deal with

the collateral or proceeds or products there-from, in his own name or in the name of the DEBTOR. All expenses related to the

liquidation of collateral shall become a part of the DEBTOR'S indebtedness. Secured Party may, at his discretion, transfer part or all of

the collateral to his/her own name or to the name of nominee.

The Debtor agrees to notify all employers and creditors of the same, as all Debtor’s property is of this date property of the

Secured Party.

This privately held SECURITY AGREEMENT is not dischargeable in bankruptcy court as the property of the Secured Party

is exempt from levy.

COMMERCIAL OATH AND VERIFICATION

California state )

) Commercial Oath Verified Declaration

Nevada county )

Declarant, ©™John Henry Doe, under his Commercial Oath with unlimited liability proceeding in good faith being of sound mind

states that the facts contained herein are true, correct, complete and not misleading to the best of Declarant's private firsthand

knowledge and belief under penalty of International Commercial Law. ©™John Henry Doe will also sign by accommodation on

behalf of JOHN HENRY DOE©™.

The Secured Party accepts all signatures in accord with UCC 3-419.

DEBTOR: JOHN HENRY DOE©™

Acceptance:

X: ©™

DEBTOR'S Signature

Secured Party accepts DEBTOR'S signature in accord with UCC §§ 1-201(39), 3-401 (b) and 3-419.

Secured Party: ©™John Henry Doe

Secured Party's Signature - Autograph Common Law

All Rights Reserved Without Prejudice.

So Certified Without the UNITED STATES.

ACCEPTANCE

By my own hand and seal knowingly and voluntarily,

Page 3 of 4 SECURITY AGREEMENT No. SA-1-073119600123-KBB

By: ,AR

Seal Date

FOR ALL COMMUNIQUÉS ELSEWHERE:

"All Rights Reserved, Without Prejudice"

By: ©™John-Henry: Doe, Sui Juris, AR [sic],

Secured Party, Creditor, Third Party Interest Intervenor,

Attorney in Fact, Agent and Authorized Representative for:

d/b/a JOHN HENRY DOE™©, DEBTOR (ens legis)

℅ Postmaster General, USPO, General Delivery

AnyCity, California state 00000 00000 ZIP Exempt

non domestic, without the UNITED STATES

NOTARY ATTACHED

Notice: Using a Notary on this document does not create an adhesion contract with the state, nor does it alter my status in any

manner, but is used only for identification and certification purposes and not for entrance into any foreign jurisdiction. All rights are

reserved. Without prejudice.

WHEREFORE: Further affiant saith not

CERTIFICATE OF ACKNOWLEDGEMENT

State of CALIFORNIA )

County of NEVADA )

On _____________ before me, __________________________________, personally appeared John Henry Doe, who proved

(insert name and title of the officer)

to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and

acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s)

on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument. I certify under

PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

(Seal)

WITNESS my hand and official seal.

X:

SIGNATURE OF NOTARY PUBLIC

END OF DOCUMENT

Page 4 of 4 SECURITY AGREEMENT No. SA-1-073119600123-KBB

You might also like

- Security Agreement 1Document6 pagesSecurity Agreement 1Nate Bruce100% (2)

- Ucc Security Agreement SampleDocument9 pagesUcc Security Agreement SampleEVI100% (23)

- Generic Security AgreementDocument4 pagesGeneric Security AgreementFreeman Lawyer100% (20)

- Commercial Security AgreemenDocument4 pagesCommercial Security AgreemenFreeman Jackson100% (4)

- Security Agreement - Secured PartyDocument7 pagesSecurity Agreement - Secured PartyCo100% (32)

- Commercial Security AgreementDocument4 pagesCommercial Security AgreementMichael Kovach83% (6)

- SecurityAgreement 3Document2 pagesSecurityAgreement 3Jeremiah HartNo ratings yet

- Commercial Security AgreementDocument5 pagesCommercial Security AgreementIrth OrbitsNo ratings yet

- Commercial Security AgreementDocument11 pagesCommercial Security AgreementGee Penn98% (46)

- Security Agreement Template CTC3Document9 pagesSecurity Agreement Template CTC3Rita100% (10)

- SPC Abc Security Agrmnt PDFDocument6 pagesSPC Abc Security Agrmnt PDFChristian Comunity100% (3)

- Revised Indeminity BondDocument3 pagesRevised Indeminity BondUndra WatkinsNo ratings yet

- OSA 2015 (Schedule A)Document3 pagesOSA 2015 (Schedule A)Anonymous nYwWYS3ntV100% (3)

- UCC Security AgreementDocument4 pagesUCC Security AgreementRDL100% (1)

- Ucc Financing Statement AddendumDocument3 pagesUcc Financing Statement AddendumAndre Duke CoulterNo ratings yet

- List of CollateralDocument5 pagesList of Collateraldouglas jonesNo ratings yet

- Affidavit of Reservation of Rights UCC 1Document1 pageAffidavit of Reservation of Rights UCC 1Antoinne FritzNo ratings yet

- Hold Harmless AgreementDocument3 pagesHold Harmless Agreementdaisy tolliver100% (5)

- UCC ContractsDocument8 pagesUCC ContractslawaffiliatedNo ratings yet

- 4 Hold Harmless Agreement SampleDocument3 pages4 Hold Harmless Agreement SampleAli ElNo ratings yet

- Power of AttorneyDocument2 pagesPower of AttorneyADILAH CURRY ©™100% (1)

- Affidavit of Birth: FurthermoreDocument3 pagesAffidavit of Birth: FurthermoreAashi50% (2)

- Notice About w-4Document2 pagesNotice About w-4Apollo Myles Lafrance El100% (1)

- 1-5d Non Negotiable Security Agmt - RDW09221985NNSA0001Document1 page1-5d Non Negotiable Security Agmt - RDW09221985NNSA0001RICHARDDWASHINGTONNo ratings yet

- Limited Power of AttorneyDocument2 pagesLimited Power of AttorneyJoseph_Carapuc_1850No ratings yet

- Affidavit of Competency: Republic of The Philippines) Manila) S.SDocument1 pageAffidavit of Competency: Republic of The Philippines) Manila) S.ScisnarFNo ratings yet

- Schedule A and Indemnity Bond - TemplateDocument3 pagesSchedule A and Indemnity Bond - TemplateShevis Singleton Sr.100% (7)

- Security Agreement All Assets of Personal PropertyDocument17 pagesSecurity Agreement All Assets of Personal PropertyJPF100% (6)

- Hold Harmless and Indemnity Agreement - Prince Assani BoatwrightDocument3 pagesHold Harmless and Indemnity Agreement - Prince Assani BoatwrightSasha Ravae Naborne100% (1)

- Filingdetail PDFDocument2 pagesFilingdetail PDFGiannis Karkalatos100% (3)

- Hold Harmless Agreement Protects Against ClaimsDocument3 pagesHold Harmless Agreement Protects Against ClaimsGarrett GroverNo ratings yet

- CHS Common Law ClaimDocument46 pagesCHS Common Law ClaimJacky Shen100% (2)

- Affidavit in Support of Complaint For Breach of Fiduciary Duty by Public Officers PDFDocument17 pagesAffidavit in Support of Complaint For Breach of Fiduciary Duty by Public Officers PDFL03A06No ratings yet

- Notice Statement 2015Document2 pagesNotice Statement 2015Anonymous nYwWYS3ntVNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)HACKER XNNo ratings yet

- 2A-505. Cancellation and Termination and Effect of Cancellation, Termination, Rescission, or Fraud On Rights and RemediesDocument2 pages2A-505. Cancellation and Termination and Effect of Cancellation, Termination, Rescission, or Fraud On Rights and RemediesSheldon JungleNo ratings yet

- TREVON CALEB WILLIAMS Copyright ClaimDocument3 pagesTREVON CALEB WILLIAMS Copyright ClaimTre Snatch100% (2)

- Private Agreement Sample - Doc - 0Document2 pagesPrivate Agreement Sample - Doc - 0chazphelps1100% (12)

- Schedule ADocument1 pageSchedule Aloanmod1No ratings yet

- Legal Notice Demand AttachmentDocument21 pagesLegal Notice Demand Attachmentjudicejr100% (1)

- Right to Travel NoticeDocument4 pagesRight to Travel NoticeED CurtisNo ratings yet

- PJP Templet Hold Harmless Indemnity AgreeDocument4 pagesPJP Templet Hold Harmless Indemnity AgreeBILLY100% (1)

- Private Agreement TemplateDocument2 pagesPrivate Agreement TemplateRita100% (1)

- Ucc 3Document2 pagesUcc 3fh14101995100% (2)

- Securities and Exchange Commission (SEC) - Formt-1Document7 pagesSecurities and Exchange Commission (SEC) - Formt-1highfinanceNo ratings yet

- Hold Harmless and Indemnity Agreement No Hid - 220221 - Hhia Non-Negotiable - Private Between The PartiesDocument2 pagesHold Harmless and Indemnity Agreement No Hid - 220221 - Hhia Non-Negotiable - Private Between The Partiesliz knight100% (1)

- BC BondDocument1 pageBC BondJason Henry100% (2)

- INDEMNITYBONDtemplateDocument2 pagesINDEMNITYBONDtemplateAlberto Martinez100% (1)

- Performance Bond: (See Instructions On Reverse)Document2 pagesPerformance Bond: (See Instructions On Reverse)Pamela HowardNo ratings yet

- Legal Security Agreement SimpleDocument1 pageLegal Security Agreement SimpleFreeman Lawyer100% (2)

- Indemnity ClauseDocument1 pageIndemnity ClauseTerence LimNo ratings yet

- Common Law Copyright NoticeDocument2 pagesCommon Law Copyright NoticeAlfred E Colvin. Sr75% (4)

- Indemnity Agreement TemplateDocument4 pagesIndemnity Agreement TemplatePawPaul Mccoy100% (4)

- Hold-Harmless (Indemnity) AgreementDocument11 pagesHold-Harmless (Indemnity) AgreementSteve Smith100% (4)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Constitution of the State of Minnesota — 1876 VersionFrom EverandConstitution of the State of Minnesota — 1876 VersionNo ratings yet

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)From EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)No ratings yet

- Nonprofit Law for Religious Organizations: Essential Questions & AnswersFrom EverandNonprofit Law for Religious Organizations: Essential Questions & AnswersRating: 5 out of 5 stars5/5 (1)

- Companies Act 1994 Final PDFDocument7 pagesCompanies Act 1994 Final PDFCryptic LollNo ratings yet

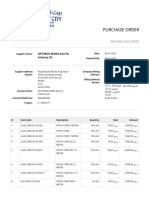

- Pur Ord 2023 00005Document5 pagesPur Ord 2023 00005Jan CagoNo ratings yet

- 2007 01 Contract Law Exam Notes FINAL PDFDocument105 pages2007 01 Contract Law Exam Notes FINAL PDFDavid Olorato NgwakoNo ratings yet

- Jacinto Vs Kaparaz - G.R. No. 81158 May 22, 1992Document1 pageJacinto Vs Kaparaz - G.R. No. 81158 May 22, 1992Renz MacionNo ratings yet

- Act Strengthening Secured TransactionsDocument17 pagesAct Strengthening Secured TransactionsStudent AccountNo ratings yet

- Assignment - LLC Membership Interests in - (1 Person)Document2 pagesAssignment - LLC Membership Interests in - (1 Person)crystalNo ratings yet

- Philippine Products Company Vs Primateria IncDocument2 pagesPhilippine Products Company Vs Primateria IncMark Joseph Altura YontingNo ratings yet

- Halliburton Offshore Services Inc Vs Vedanta LimitDocument37 pagesHalliburton Offshore Services Inc Vs Vedanta Limitsri charannNo ratings yet

- Icc IncotermDocument113 pagesIcc Incotermermiastes6600No ratings yet

- Unit 1: Introduction To Partnership AccountsDocument29 pagesUnit 1: Introduction To Partnership AccountsTisha ShahNo ratings yet

- HDCS010 Heavy Duty Engine CleanerDocument2 pagesHDCS010 Heavy Duty Engine CleanerTinasheNo ratings yet

- Pre Final Quiz 1Document2 pagesPre Final Quiz 1Xiu MinNo ratings yet

- E-Auction Process Document - Shirt Company - 11 Nov 2022 PDFDocument55 pagesE-Auction Process Document - Shirt Company - 11 Nov 2022 PDFRishabh VakhariaNo ratings yet

- ESL Band ContractDocument7 pagesESL Band ContractAshley PeoplesNo ratings yet

- Phil. Lawin Bus vs. CADocument1 pagePhil. Lawin Bus vs. CAFairyssa Bianca SagotNo ratings yet

- Cebu Salvage Corp V Phil. Home AssuranceDocument1 pageCebu Salvage Corp V Phil. Home Assurancejudith_marie1012100% (2)

- Sale by Non OwnersDocument13 pagesSale by Non OwnersWasim Iqbal Manhas0% (1)

- Due Diligence ChecklistDocument2 pagesDue Diligence ChecklistMaireira NaturalsNo ratings yet

- General Banking Law: Republic Act No. 8791 Definition of "Bank"Document4 pagesGeneral Banking Law: Republic Act No. 8791 Definition of "Bank"Chincel G. ANINo ratings yet

- Cdo Ip FirmsDocument2 pagesCdo Ip FirmsAshton FNo ratings yet

- Business and Corporate Law AssignmentDocument3 pagesBusiness and Corporate Law AssignmentSaif Ali Khan BalouchNo ratings yet

- Sabenza Nomination ExampleDocument1 pageSabenza Nomination Examplejose andres manchadoNo ratings yet

- Pregunta: Finalizado Puntúa 0,0 Sobre 1,0Document21 pagesPregunta: Finalizado Puntúa 0,0 Sobre 1,0Jhon CardozoNo ratings yet

- Kslu Unit 3 Q & A Company LawDocument47 pagesKslu Unit 3 Q & A Company LawMG MaheshBabuNo ratings yet

- Essentials of A Valid OfferDocument2 pagesEssentials of A Valid OfferManav Marwaha60% (5)

- Catotocan vs. Lourdes School of Quezon City Et Al.Document2 pagesCatotocan vs. Lourdes School of Quezon City Et Al.Nej AdunayNo ratings yet

- Last Two Years Projects For SEM VIDocument837 pagesLast Two Years Projects For SEM VIjohann_747100% (1)

- Provisions To Memorize in ObliconDocument6 pagesProvisions To Memorize in ObliconMary ruth DavidNo ratings yet

- Prentice Halls Federal Taxation 2013 Corporations Partnerships Estates and Trusts 26th Edition Pope Solutions ManualDocument26 pagesPrentice Halls Federal Taxation 2013 Corporations Partnerships Estates and Trusts 26th Edition Pope Solutions ManualTiffanyHernandezwako100% (38)

- W5 ADDRESS SolutionDocument169 pagesW5 ADDRESS SolutionDemontre BeckettNo ratings yet