Professional Documents

Culture Documents

Tutorial V Accounting For Extractive Industries

Tutorial V Accounting For Extractive Industries

Uploaded by

Measly Veets0 ratings0% found this document useful (0 votes)

14 views1 pageThis document discusses accounting for extractive industries and provides examples of journal entries using different accounting methods. It asks the reader to define key terms, compare accounting methods, discuss when to account for restoration costs, and provide journal entries for a mining company under both the area-of-interest and full-cost methods.

Original Description:

Original Title

Tutorial V Accounting for Extractive Industries

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses accounting for extractive industries and provides examples of journal entries using different accounting methods. It asks the reader to define key terms, compare accounting methods, discuss when to account for restoration costs, and provide journal entries for a mining company under both the area-of-interest and full-cost methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageTutorial V Accounting For Extractive Industries

Tutorial V Accounting For Extractive Industries

Uploaded by

Measly VeetsThis document discusses accounting for extractive industries and provides examples of journal entries using different accounting methods. It asks the reader to define key terms, compare accounting methods, discuss when to account for restoration costs, and provide journal entries for a mining company under both the area-of-interest and full-cost methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

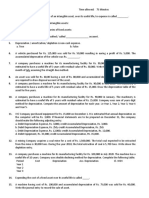

Tutorial V: Accounting for Extractive Industries

1. Define what is ‘area of interest’

2. Would the full-cost method or the area of-interest method of accounting for extractive

industries provide a greater volatility of earnings?

3. When should a company in the extractive industries start accounting for restoration costs?

4. Generally speaking, what costs should be included in cost of inventory of an entity involved

in extractive industries? Explain your answer.

5. When would you use time as the basis of amortising pre-production costs incurred in a

mining venture?

6. Extracto Limited commences operations on 1 January 2017. During 2017 Extracto Ltd

explores three areas and incurs the following costs:

______________________________________________________

Exploration and evaluation expenditure

($m)

_____________________________________________________

Good 23

Bad 16

Indifferent 25

_____________________________________________________

In 2018 oil is discovered at Good Site. Bad Site is abandoned. Indifferent Site has not

reached a stage that permits a reasonable assessment of or otherwise of economically

recoverable reserves, and active and significant operations in the area of interest are

continuing. In relation to the exploration and evaluation expenditures incurred at Good Site

and Indifferent Site, 80 per cent of the expenditures related to property, plant and

equipment, and the balance relates to the intangible assets.

In 2018 development cost of $27 million are incurred at Good Site (to be written off on

production basis) $20 million of this expenditure relates to property, plant and equipment

and the balance relates to intangible assets. Good Site is estimated to have 15 000 000

barrels. The current sale price is $30 per barrel. Three million barrels are extracted at a

production cost of $4 million and 1.9 million barrels are sold.

Required

Provide the necessary journal entries using:

a. the area-of-interest method

b. the full cost method

You might also like

- Form 2A - 2M LG Dep Heads (CM) - CertificationsDocument17 pagesForm 2A - 2M LG Dep Heads (CM) - CertificationsArjay Aleta100% (2)

- Test Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 6th Edition by StickneyDocument35 pagesTest Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 6th Edition by StickneyTiffany CarswellNo ratings yet

- IAS 36 Impairment of AssetsDocument7 pagesIAS 36 Impairment of AssetsMazni Hanisah0% (1)

- Sample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaDocument36 pagesSample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaChristen CastilloNo ratings yet

- Quiz - Depreciation Part 1.2020Document2 pagesQuiz - Depreciation Part 1.2020marchraid3No ratings yet

- Chapter 1 Extra-Credit AssignmentDocument16 pagesChapter 1 Extra-Credit AssignmentShipra SinghNo ratings yet

- Exam For AccountingDocument16 pagesExam For AccountingLong TranNo ratings yet

- Study Material CH.-2 Goodwil ValuationDocument9 pagesStudy Material CH.-2 Goodwil Valuationvsy9926No ratings yet

- MIDTERM - Farm Business ManagementDocument3 pagesMIDTERM - Farm Business Managementrobelyn veranoNo ratings yet

- Final ExamDocument12 pagesFinal ExamKang JoonNo ratings yet

- FABM 2 - Midterm ExamDocument6 pagesFABM 2 - Midterm ExamJessica Esmeña100% (1)

- DepreciationDocument3 pagesDepreciationAdnan ShabeerNo ratings yet

- December 2011, CA-CPT Question Paper (Based On Memory) : No.1 For CA/CWA & MEC/CECDocument16 pagesDecember 2011, CA-CPT Question Paper (Based On Memory) : No.1 For CA/CWA & MEC/CECSanjeev SharmaNo ratings yet

- At 7Document9 pagesAt 7Leah Jane Tablante Esguerra100% (1)

- MC KTQTe1Document3 pagesMC KTQTe1Huy HàNo ratings yet

- E3 - Depreciation of Non-Current AssetsDocument17 pagesE3 - Depreciation of Non-Current Assetsanson100% (1)

- 2017 Sem1 Final Revision QuestionsDocument4 pages2017 Sem1 Final Revision Questionsbrip selNo ratings yet

- Acct 1 Bexam 1 SampleDocument22 pagesAcct 1 Bexam 1 SampleMarvin_Chan_2123No ratings yet

- FABM 2 ExamDocument3 pagesFABM 2 ExamJoshua Atencio0% (1)

- Management Accounting 2Document3 pagesManagement Accounting 2ROB101512No ratings yet

- FINALDocument3 pagesFINALSherlene Antenor SolisNo ratings yet

- 7 Responsibility AccountingDocument4 pages7 Responsibility AccountingRey Mariel YbasNo ratings yet

- Chapter 10 Noncurrent Assets: Discussion QuestionsDocument6 pagesChapter 10 Noncurrent Assets: Discussion QuestionskietNo ratings yet

- C. From The Cash Basis of Accounting To The Accrual Basis of AccountingDocument11 pagesC. From The Cash Basis of Accounting To The Accrual Basis of Accountingelaine aureliaNo ratings yet

- Management AccountingDocument12 pagesManagement AccountingS BNo ratings yet

- Costing Full Length 1 (SM) - May 24Document10 pagesCosting Full Length 1 (SM) - May 24Jyoti ManwaniNo ratings yet

- CA CPT Question Paper 2018Document31 pagesCA CPT Question Paper 2018Gaurav JainNo ratings yet

- First Quarter Test Grade 12: Fundamental of ABM-2Document2 pagesFirst Quarter Test Grade 12: Fundamental of ABM-2manuel hipolitoNo ratings yet

- Week 7 HWMDocument8 pagesWeek 7 HWMJarongchai Keng HaemaprasertsukNo ratings yet

- Q92 - Balance of PaymentDocument3 pagesQ92 - Balance of PaymentcelinebcvNo ratings yet

- Sixth Departmental QuizDocument8 pagesSixth Departmental QuizMica R.No ratings yet

- FINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsDocument11 pagesFINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsAmie Jane Miranda100% (1)

- Befa Mid-Ii B.tech Iii YearDocument5 pagesBefa Mid-Ii B.tech Iii YearNaresh GuduruNo ratings yet

- Introduction To Economics Final Eam - Bu16 - 2019Document7 pagesIntroduction To Economics Final Eam - Bu16 - 2019MaysamNo ratings yet

- Exercise Over Chapter 18 Name - Key - 1. List The Five Areas of Farm Business AnalysisDocument2 pagesExercise Over Chapter 18 Name - Key - 1. List The Five Areas of Farm Business AnalysisJenny VarelaNo ratings yet

- ACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionDocument14 pagesACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionXiaoying XuNo ratings yet

- Fin3 TutorialDocument3 pagesFin3 TutorialReveJoyNo ratings yet

- Final Long Quiz - FM203Document3 pagesFinal Long Quiz - FM203Sherlene Antenor SolisNo ratings yet

- Managerial Accounting, 6e: Achievement Test 5: Chapters 9-10Document9 pagesManagerial Accounting, 6e: Achievement Test 5: Chapters 9-10Ley EsguerraNo ratings yet

- Finals Sa1: Depreciation and Depletion: MC TheoryDocument8 pagesFinals Sa1: Depreciation and Depletion: MC TheoryShaina NavaNo ratings yet

- 750400457d1f0 Mains 365 Economy IIIDocument33 pages750400457d1f0 Mains 365 Economy IIIGaurav RaiNo ratings yet

- FA II - 1st Sitting Exam - 2021 - 2022-3Document18 pagesFA II - 1st Sitting Exam - 2021 - 2022-3ferrandarnaudNo ratings yet

- Prelims Managerial EconDocument4 pagesPrelims Managerial EconALMA MORENANo ratings yet

- Ty Bcom PDF Sample QuiestionsDocument49 pagesTy Bcom PDF Sample QuiestionsAniket VyasNo ratings yet

- Acctg 13Document23 pagesAcctg 13Fatima ZaharaNo ratings yet

- 8 Wasting Assets PDFDocument2 pages8 Wasting Assets PDFGayle LalloNo ratings yet

- Application Form MPSSIRS 2014Document5 pagesApplication Form MPSSIRS 2014Ar Raj YamgarNo ratings yet

- MIDTERMDocument3 pagesMIDTERMSafh SalazarNo ratings yet

- PPSC Section Officer 2023 (Series-A)Document21 pagesPPSC Section Officer 2023 (Series-A)Menu GargNo ratings yet

- At 7Document7 pagesAt 7Joshua GibsonNo ratings yet

- ReasoningDocument80 pagesReasoningwork workNo ratings yet

- MCQ On FM PDFDocument28 pagesMCQ On FM PDFharsh snehNo ratings yet

- Cfas Chapeter Exam PpeDocument3 pagesCfas Chapeter Exam PpeCASTILLO, MA. CHEESA D.No ratings yet

- Bc24062-Governor Secretariat (Charged)Document4 pagesBc24062-Governor Secretariat (Charged)NiamatNo ratings yet

- IAS 36 Impairment of Assets (2021)Document12 pagesIAS 36 Impairment of Assets (2021)Tawanda Tatenda HerbertNo ratings yet

- Inv AppDocument83 pagesInv AppMueen KhanNo ratings yet

- Study Guide CH 12Document7 pagesStudy Guide CH 12Stephanie RobinsonNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet