Professional Documents

Culture Documents

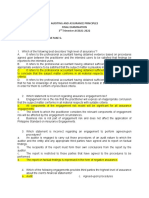

Audit 1 Midterm Exams Part I True or False 50 Points Instruction: Write TRUE If The Statement Is Correct and Write FALSE If The

Uploaded by

rico mangawili0 ratings0% found this document useful (0 votes)

82 views6 pagesOriginal Title

Audit-1-.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

82 views6 pagesAudit 1 Midterm Exams Part I True or False 50 Points Instruction: Write TRUE If The Statement Is Correct and Write FALSE If The

Uploaded by

rico mangawiliCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

AUDIT 1

MIDTERM EXAMS

PART I TRUE OR FALSE 50 POINTS

Instruction: Write TRUE if the statement is correct and write FALSE if the

statement is wrong. Use CAPITAL LETTERS. (Two points each)

1. The purpose of internal audit is to evaluate the adequacy and

effectiveness od company’s internal controls.

2. The primary responsibility for the adequacy of disclosure in the

financial statements rests with the Auditor in charge of the field work.

3. The auditor’s responsibility for the financial statements is confined to

the expression of his/her opinion.

4. Independent auditing is a branch of accounting.

5. Reports on agreed-upon procedures are intended to be distributed to

any party whom the client wishes.

6. The report on agreed- upon procedures engagement should contain

identification of the purpose for which the agreed-upon procedures

were performed.

7. Independence is required in compilation and agreed-upon procedures.

8. When performing a compilation engagement, the practitioner if

required to obtain general knowledge of the business and operations of

the entity.

9. A management consulting engagement to provide IT advice to a client

is as example of an assurance engagement.

10. The objective of an assurance engagement is to assist the

company in preparing its financial statements.

11. There are four separate parties involved in an audit

engagement.

12. The framework defines and describes the elements and

objectives of an assurance engagement.

13. Criteria are the standards or benchmarks used to evaluate or

measure the subject matter of an assurance engagement.

14. Relevant criteria contribute to conclusions that assist decision-

making by the intended user.

15. In an assurance engagement, the person or class of persons

whom the professional accountant prepares the report for aa specific

use or purpose is the management.

16. Subject matter is the outcome of the evaluation or measurement

of a subject matter.

17. In direct reporting engagements the subject matter information

is in the form of an assertion by the responsible party that is made

available to the intended users.

18. The objective of a reasonable assurance engagement is to

reduce the assurance engagement risk to an acceptably high level in

the circumstances of the engagement as the basis for a positive form

of expression of the practitioner’s conclusion.

19. In assertion based assurance engagements, the evaluation or

measurement of the subject matter against criteria is performed by

the responsible party.

20. Sufficiency is the measure of the quality of evidence. The

quantity of evidence needed is affected by the quality of such evidence

(the higher the quality, the less may be required).

21. Reducing assurance risk to zero is very rarely attainable or cost

beneficial and because the practitioner may not have the required

assurance knowledge and skills to gather and evaluate evidence.

22. The purpose of Financial Statement audit is to assure the future

viability of the entity by expressing an opinion in the entity’s financial

statements.

23. The auditor is required to comply with all PSA’s relevant to the

audit of an entity’s financial statements.

24. Management, and where appropriate, those charged with

governance, have responsibility for the preparation and presentation of

the financial statements in accordance with the applicable Philippine

Standards in Auditing.

25. A government audit is typically designed to determine whether

the auditee has complied with applicable laws and regulations.

PART II MULTIPLE CHOICE QUESTIONS 40 POINTS

Instruction: Write your answer in the space provided on the left side. Use

CAPITAL LETTERS. (Two points each)

1. This happens when managers generally have more information about

the financial position and operations of the entity compared to the

stockholders

a. Information asymmetry c. Agency problem

b. Stakeholder theory d. Value relevance theory

2. This type of audit involves a review of an organization’s procedures to

determine whether the organization has adhered to specific

procedures, rules or regulations set down by some higher authority.

a. Financial Statement Audit c. Compliance Audit

b. Operational Audit d. Internal Audit

3. Which of the following is an independent appraisal activity established

within an entity as a service to the entity?

a. External Auditing c. Financial Auditing

b. Internal Auditing d. Compliance Auditing

4. A structured representation of financial information, including the

related notes, intended to communicate an entity’s economic

resources or obligations at a point in time or the changes therein for a

period of time in accordance with a financial reporting framework.

a. Annual Report c. Accounting Records

b. Engagement Documentation d. Financial Statements

5. The primary responsibility for the prevention and detection of fraud

and error rests with

a. The company’s management

b. The external auditor, the company’s management and those

charged with governance

c. The company’s management and those charged with governance

d. Those charged with governance

6. Primary responsibility for the assertions in financial statements rests

with the:

a. Audit partner assigned to the engagement

b. Senior auditor in charge of the field work

c. Staff auditor who drafts the statements

d. Clients management

7. The main way(s) to reduce the information risk is to have

a. The users verify the information

b. The users share the information risk with management

c. Financial statements audited

d. All of the above

8. Which of the following is incorrect regarding the general principles of

an audit?

a. The auditor should comply with the Code of Ethics for professional

ethics for CPA’s

b. The auditor should conduct an audit in accordance with PSAs

c. The auditor should plan and perform an audit with an attitude of

professional skepticism

d. The auditor would ordinarily expect to find evidence to support

management representations and assume they are necessarily

correct

9. This term refers to the application of relevant training, knowledge and

experience, within the context provided by auditing, accounting and

ethical standards, in making informed decisions about the courses of

action that are appropriate in the circumstances of the audit

engagement

a. Professionalism c. Professional Judgement

b. Conservatism d. Materiality

10. The auditor’s opinion

a. Certifies the correctness of the financial statement

b. Is an assurance as to the future viability of the entity

c. Enhances the credibility of the financial statements

d. Is an assurance as to the efficiency with which the management

has conducted the affairs of the entity, but not effectiveness

11. What is the level of assurance and form of conclusion in a review

engagement?

a. Reasonable, Positive c. Positive, Reasonable

b. Limited, Negative d. Negative, Limited

12. Absolute assurance in auditing is not attainable as a result of

such factors as all of the following except:

a. Need for judgement c. Use of testing

b. Lack of expertise d. Inherent Limitations in internal control

13. Which of the following best describes operational audit?

a. It requires constant review by internal auditors of the

administrative controls as they relate to operations of the company.

b. It concentrates on implementing financial and accounting control in

a newly organized company

c. It attempts and is deigned to verify the fair presentation of a

company’s results of operations.

d. It concentrates on seeking out aspects of operations in which waste

would be reduced by the introduction of controls.

14. Which of the following best describes assurance services?

a. Independent professional services that are intended to enhance the

credibility of information to meet the needs of an intended user.

b. Services designed to express an opinion on the fairness of historical

financial statements based on the results of an audit.

c. The preparation of financial statements or the collection,

classification, and summarization of other financial information.

d. Services designed for the improvement of operations, resulting in

better outcomes.

15. The following are components of assurance engagement risk,

except

a. Inherent risk c. Detection risk

b. Control risk d. Business risk

16. What type of assurance engagement is involved when the

practitioner expresses a positive form of conclusion?

a. Limited assurance engagements

b. Positive assurance engagements

c. Reasonable assurance engagements

d. Absolute assurance engagements

17. Which statement is true concerning evidence in an assurance

engagement?

a. Sufficiency is the measure of the quantity of evidence

b. Appropriateness is the measure of the quality of evidence, that is,

its reliability and persuasiveness

c. The reliability of evidence is influenced not by its nature but by its

source

d. Obtaining more evidence may compensate for its poor quality

18. The auditor’s satisfaction as to the reliability of an assertion

being made by one party for use by another party is called

a. Opinion b. Assurance c. Examination d. Verification

19. Which of the following is not generally considered a procedure

followed by a practitioner in obtaining a reasonable basis for the

expression of a review conclusion?

a. Obtain written representations from management

b. Apply analytical procedures

c. Make inquiries of management

d. Assess fraud risk

20. A financial statement audit aids in communication of economic

data because the audit

a. Assures the readers of financial statements that any fraudulent

activity has been corrected

b. Guarantees that financial data are fairly presented

c. Lends credibility to the financial statements

d. Confirms the accuracy of management’s financial representations.

PART III ESSAY 10 POINTS

Instruction: Write your answer on the space provided. Give a brief

discussion on the following questions. ( 5 POINTS each)

A. In your own understanding, what do you think is the reason why the

intended users wanted the Financial Statement to be audited by an

independent external party?

B. Differentiate Assurance, Attest and Audit.

You might also like

- Test Bank - Assurance Principles (Cpar) LDocument56 pagesTest Bank - Assurance Principles (Cpar) Ljsus22100% (8)

- Auditing Theory Test BankDocument32 pagesAuditing Theory Test BankJane Estrada100% (2)

- AT Quizzer 1 Overview of Auditing Answer Key PDFDocument11 pagesAT Quizzer 1 Overview of Auditing Answer Key PDFKimyMalaya100% (5)

- Auditing Theory-2018Document26 pagesAuditing Theory-2018Suzette VillalinoNo ratings yet

- Unit 1 - Fundamentals of Auditing and Assurance ServicesDocument20 pagesUnit 1 - Fundamentals of Auditing and Assurance ServicesJalieha MahmodNo ratings yet

- Auditing Theory Test BankDocument31 pagesAuditing Theory Test BankLyza96% (53)

- AT Quizzer 1 - Overview of Auditing (2TAY1718)Document12 pagesAT Quizzer 1 - Overview of Auditing (2TAY1718)JimmyChaoNo ratings yet

- c121 Task 2Document6 pagesc121 Task 2Willie HarringtonNo ratings yet

- Auditing ReviewerDocument26 pagesAuditing ReviewerCynthia PenoliarNo ratings yet

- At 92 Cpar PW PDFDocument12 pagesAt 92 Cpar PW PDFglcpaNo ratings yet

- Auditing Theory: (Test Bank) Gerardo S. RoqueDocument82 pagesAuditing Theory: (Test Bank) Gerardo S. RoqueYukiNo ratings yet

- Fundamentals of Auditing and AssuranceDocument40 pagesFundamentals of Auditing and Assurancetyler1No ratings yet

- Custody Semi FinalDocument7 pagesCustody Semi FinalAlfonso DosNo ratings yet

- Auditing Theory ComprehensiveDocument14 pagesAuditing Theory ComprehensiveMary GarciaNo ratings yet

- AT Quiz 1Document2 pagesAT Quiz 1CattleyaNo ratings yet

- CPAR 1stPBDocument12 pagesCPAR 1stPBMae Danica CalunsagNo ratings yet

- GARCIA v. LACUESTADocument1 pageGARCIA v. LACUESTAMhareyNo ratings yet

- Preboard 1Document9 pagesPreboard 1Janica Berba100% (1)

- AT 3rdbatch 1stPBDocument12 pagesAT 3rdbatch 1stPBvangieolalia100% (2)

- EXCERPT 4 - Apolinario MabiniDocument8 pagesEXCERPT 4 - Apolinario MabiniNikoruNo ratings yet

- PSBA AT Quizzer 1 - Fundamentals of Auditing and Assurance Services 2SAY2021Document12 pagesPSBA AT Quizzer 1 - Fundamentals of Auditing and Assurance Services 2SAY2021Abdulmajed Unda MimbantasNo ratings yet

- Department of Accountancy: Page - 1Document14 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- ADR Course OutlineDocument6 pagesADR Course OutlineJohn JohnsNo ratings yet

- Global City: Characteristics, Indicators and Role in GlobalizationDocument10 pagesGlobal City: Characteristics, Indicators and Role in GlobalizationBrian DuelaNo ratings yet

- CARE BEST INTERNATIONAL Vs SECDocument2 pagesCARE BEST INTERNATIONAL Vs SECcha100% (1)

- Theories Cash - PpeDocument45 pagesTheories Cash - PpeClene DoconteNo ratings yet

- Audit Process and Audit Planning With AnswerDocument12 pagesAudit Process and Audit Planning With AnswerR100% (1)

- AT Quizzer 1 - Fundamentals of Auditing and Assurance ServicesDocument12 pagesAT Quizzer 1 - Fundamentals of Auditing and Assurance ServicesGabNo ratings yet

- QUIZ No. 1Document6 pagesQUIZ No. 1Kathleen FrondozoNo ratings yet

- QUIZ No. 1Document6 pagesQUIZ No. 1KathleenNo ratings yet

- Material No. 1Document6 pagesMaterial No. 1Jen AnchetaNo ratings yet

- Question in Auditing TheoryDocument20 pagesQuestion in Auditing TheoryJeric YangNo ratings yet

- DQAT2Document7 pagesDQAT2Kurt dela TorreNo ratings yet

- Auditing TheoryDocument12 pagesAuditing TheorymilleranNo ratings yet

- Audit 1stDocument10 pagesAudit 1stFrie NdshipMaeNo ratings yet

- Audit Assurance and Principles Quiz No. 2Document9 pagesAudit Assurance and Principles Quiz No. 2Xel Joe BahianNo ratings yet

- AuditingDocument8 pagesAuditingNan Laron ParrochaNo ratings yet

- Auditing Theory Test BankDocument24 pagesAuditing Theory Test BankJenica SaludesNo ratings yet

- Auditing ReviewerDocument8 pagesAuditing ReviewerSeanaNo ratings yet

- Audit Theory Test Bank and Assurance ServicesDocument29 pagesAudit Theory Test Bank and Assurance ServicesChristine Jane AbangNo ratings yet

- Auditing Theory Comprehensive Exam - Jan2021Document16 pagesAuditing Theory Comprehensive Exam - Jan2021Aireen MacapangalNo ratings yet

- AT - PreWeek - May 2022Document24 pagesAT - PreWeek - May 2022Miguel ManagoNo ratings yet

- Aaconapps2 00-C92pb1aDocument14 pagesAaconapps2 00-C92pb1aJane DizonNo ratings yet

- Short Quiz 1Document11 pagesShort Quiz 1AMNo ratings yet

- 92-FIRST PB-AUD ExamDocument11 pages92-FIRST PB-AUD ExamReynaldo corpuzNo ratings yet

- AT Preweek B93 - QuestionnaireDocument16 pagesAT Preweek B93 - QuestionnaireSilver LilyNo ratings yet

- Chapter7 QuizzerDocument5 pagesChapter7 Quizzermisonim.eNo ratings yet

- Auditing and AssuranceDocument21 pagesAuditing and AssuranceCathelyn SaliringNo ratings yet

- Reviewer Auditing Theory and ProblemsDocument65 pagesReviewer Auditing Theory and ProblemsJerome MorenoNo ratings yet

- CEBU CPAR CENTER - 1st PreboardDocument24 pagesCEBU CPAR CENTER - 1st PreboardMary Alcaflor BarcelaNo ratings yet

- 2020 - Summer Class Auditing IDocument7 pages2020 - Summer Class Auditing Iarya starkNo ratings yet

- Audit Evidence ReliabilityDocument31 pagesAudit Evidence ReliabilityKaisher JaomeNo ratings yet

- Auditor's primary responsibility and assurance servicesDocument14 pagesAuditor's primary responsibility and assurance servicesTricia Mae FernandezNo ratings yet

- DLSL CPA Board AssuranceDocument5 pagesDLSL CPA Board AssurancePrincessAngelaDeLeonNo ratings yet

- Auditing Principles CW4-Chapter-1-MCDocument5 pagesAuditing Principles CW4-Chapter-1-MCLorie RoncalNo ratings yet

- Auditing Theory Preboard ExamDocument6 pagesAuditing Theory Preboard ExamJoy AbingNo ratings yet

- Auditing Standards and ProceduresDocument15 pagesAuditing Standards and ProceduresXulian ChanNo ratings yet

- Bsac303 Final Examination - RoldanDocument16 pagesBsac303 Final Examination - RoldanJheraldinemae RoldanNo ratings yet

- Auditing Theory Test BankDocument26 pagesAuditing Theory Test Bankdfgmlk dsdwNo ratings yet

- At 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerDocument6 pagesAt 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerRei-Anne Rea100% (1)

- Audit II Mid ExamDocument4 pagesAudit II Mid ExamTesfaye SimeNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Lit1 MidtermDocument3 pagesLit1 Midtermrico mangawiliNo ratings yet

- Lit Assignment 2Document1 pageLit Assignment 2rico mangawiliNo ratings yet

- CHAPTER 3 MGMT AnswersDocument1 pageCHAPTER 3 MGMT Answersrico mangawiliNo ratings yet

- TITLE: God Sees The Truth But Waits SETTING: Vladimir, Inn, Prison CharactersDocument2 pagesTITLE: God Sees The Truth But Waits SETTING: Vladimir, Inn, Prison Charactersrico mangawiliNo ratings yet

- LIT ACTivity 4Document1 pageLIT ACTivity 4rico mangawiliNo ratings yet

- Lit 1 ACT.3Document3 pagesLit 1 ACT.3rico mangawiliNo ratings yet

- TITLE: God Sees The Truth But Waits SETTING: Vladimir, Inn, Prison CharactersDocument1 pageTITLE: God Sees The Truth But Waits SETTING: Vladimir, Inn, Prison Charactersrico mangawiliNo ratings yet

- Arts 3Document1 pageArts 3rico mangawiliNo ratings yet

- Community Tax Certificate DetailsDocument1 pageCommunity Tax Certificate Detailsrico mangawiliNo ratings yet

- Art Appreciation 2Document1 pageArt Appreciation 2rico mangawiliNo ratings yet

- How Government Corruption Affects EconomiesDocument1 pageHow Government Corruption Affects Economiesrico mangawiliNo ratings yet

- Activity 2 Capital Budgeting 2Document3 pagesActivity 2 Capital Budgeting 2rico mangawiliNo ratings yet

- Art Appreciation 2Document1 pageArt Appreciation 2rico mangawiliNo ratings yet

- Activity 2 Capital Budgeting 2Document3 pagesActivity 2 Capital Budgeting 2rico mangawiliNo ratings yet

- BIR Provides "Rich Broth" For CorruptionDocument4 pagesBIR Provides "Rich Broth" For Corruptionrico mangawiliNo ratings yet

- Audit 1 Midterm Exams Part I True or False 50 Points Instruction: Write TRUE If The Statement Is Correct and Write FALSE If TheDocument6 pagesAudit 1 Midterm Exams Part I True or False 50 Points Instruction: Write TRUE If The Statement Is Correct and Write FALSE If Therico mangawiliNo ratings yet

- How Does Corruption Affect Economic Growth?: New ResearchDocument3 pagesHow Does Corruption Affect Economic Growth?: New Researchrico mangawiliNo ratings yet

- How Does Corruption Affect Economic Growth?: New ResearchDocument3 pagesHow Does Corruption Affect Economic Growth?: New Researchrico mangawiliNo ratings yet

- Answer: A. DatabaseDocument1 pageAnswer: A. Databaserico mangawiliNo ratings yet

- Genres of Drama/FilmsDocument29 pagesGenres of Drama/Filmsrico mangawiliNo ratings yet

- ETHICSDocument1 pageETHICSrico mangawiliNo ratings yet

- How Does Corruption Affect Economic Growth?: New ResearchDocument3 pagesHow Does Corruption Affect Economic Growth?: New Researchrico mangawiliNo ratings yet

- E BookforPolGove2016Document12 pagesE BookforPolGove2016rico mangawiliNo ratings yet

- Presented By:Walsie, Sheila May S.: Crime Rate in The PhilippinesDocument2 pagesPresented By:Walsie, Sheila May S.: Crime Rate in The Philippinesrico mangawiliNo ratings yet

- E BookforPolGove2016 PDFDocument162 pagesE BookforPolGove2016 PDFStephanie AplacaNo ratings yet

- The of The Global Economy: FutureDocument198 pagesThe of The Global Economy: FutureAli JaanNo ratings yet

- Fin160 BudgetingDocument2 pagesFin160 Budgetingrico mangawiliNo ratings yet

- Tanggop-Castog Wedding WitnessesDocument2 pagesTanggop-Castog Wedding Witnessesrico mangawiliNo ratings yet

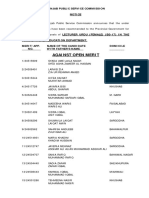

- Against Open Merit: Punjab Public Service Commission NoticeDocument11 pagesAgainst Open Merit: Punjab Public Service Commission Noticesami ullahNo ratings yet

- Democracy and Development in IndiaDocument6 pagesDemocracy and Development in IndiaMarvin AugustineNo ratings yet

- Rules and regulations for Philippine naturalizationDocument7 pagesRules and regulations for Philippine naturalizationHestia VestaNo ratings yet

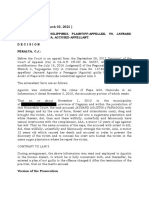

- Case Digest 1Document2 pagesCase Digest 1Arianne Grace AberdeNo ratings yet

- Bioethics Session 15 SASDocument4 pagesBioethics Session 15 SASSandyNo ratings yet

- MN 2 011 40Document2 pagesMN 2 011 40P Venkata SureshNo ratings yet

- Case No. 221424 & No. 247718Document44 pagesCase No. 221424 & No. 247718Jeizle MartinezNo ratings yet

- A Case Study Analysis of The Montreal (CANADA) Chapter of The Hells Angels Outlaw Motorcycle Club (HAMC) (1995-2010) : Applying The Crime Business Analysis Matrix (CBAM)Document22 pagesA Case Study Analysis of The Montreal (CANADA) Chapter of The Hells Angels Outlaw Motorcycle Club (HAMC) (1995-2010) : Applying The Crime Business Analysis Matrix (CBAM)Ryan29No ratings yet

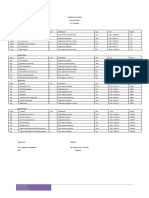

- Manpower Schedule PlanDocument2 pagesManpower Schedule PlanrohNo ratings yet

- SCHEDULE OF CLASSES 2023 2nd SemesterDocument1 pageSCHEDULE OF CLASSES 2023 2nd Semesterarhe gaudelNo ratings yet

- Full Text of Rev Msigwa's Apology To MR - Abdulrahman KinanaDocument38 pagesFull Text of Rev Msigwa's Apology To MR - Abdulrahman KinanaAhmad Issa MichuziNo ratings yet

- Instant Download Introductory Chemistry 6th Edition Tro Test Bank PDF Full ChapterDocument28 pagesInstant Download Introductory Chemistry 6th Edition Tro Test Bank PDF Full Chapterveramurray6qr7u100% (6)

- Constitution Notes2Document44 pagesConstitution Notes2San MitNo ratings yet

- HNBGU BEd Entrance Fee Payment ChallanDocument1 pageHNBGU BEd Entrance Fee Payment ChallanDaksh InfotechNo ratings yet

- A Marxist Analysis On Class Conflict in The Novel of Sir William GoldingDocument5 pagesA Marxist Analysis On Class Conflict in The Novel of Sir William GoldingCharess Barrios KhaiNo ratings yet

- Https Dua7c.com Students Student Print1.Php Exam Id 12Document1 pageHttps Dua7c.com Students Student Print1.Php Exam Id 12Mohammad RaqeebNo ratings yet

- Mwachiro - Effects of Internal Controls On Revenue Collection - A Case of Kenya Revenue AuthorityDocument60 pagesMwachiro - Effects of Internal Controls On Revenue Collection - A Case of Kenya Revenue Authoritygabriel katamaNo ratings yet

- Political Science Optional Strategy for UPSCDocument4 pagesPolitical Science Optional Strategy for UPSCSourabh PawarNo ratings yet

- Cases On ADVOCATE MISCONDUCTDocument3 pagesCases On ADVOCATE MISCONDUCTather juneidNo ratings yet

- Valuation of residential property in ShimlaDocument11 pagesValuation of residential property in ShimlaManuj DogerNo ratings yet

- DAVAO ORIENTAL STATE UNIVERSITY BANAYBANAY EXTENSION CAMPUS INSTRUCTIONAL MATERIALDocument20 pagesDAVAO ORIENTAL STATE UNIVERSITY BANAYBANAY EXTENSION CAMPUS INSTRUCTIONAL MATERIALRizalyn SunquitNo ratings yet

- RF Support Wight For VSAT AntennaDocument1 pageRF Support Wight For VSAT Antennasalim djezzarNo ratings yet

- Supreme Court Rules on Interest Payment for Delayed Loan ObligationDocument11 pagesSupreme Court Rules on Interest Payment for Delayed Loan ObligationRozaiineNo ratings yet