Professional Documents

Culture Documents

G.R. No. 146175 June 30, 2008 SIMEON M. VALDEZ, Petitioner, vs. Government Service Insurance System, Respondent

Uploaded by

Patricia Nicole BalgoaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

G.R. No. 146175 June 30, 2008 SIMEON M. VALDEZ, Petitioner, vs. Government Service Insurance System, Respondent

Uploaded by

Patricia Nicole BalgoaCopyright:

Available Formats

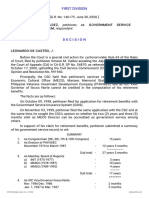

G.R. No.

146175 June 30, 2008 12 years 5 months -

SIMEON M. VALDEZ, petitioner,

vs. Sub total 5 months

GOVERNMENT SERVICE INSURANCE SYSTEM,

respondent. 27 years 5 months 5. As Director of MECO

Before the Court is a special civil action for certiorari under 3. As Member, Board of Regents 1 Jan. 1993 to 31 Dec. 1994

Rule 65 of the Rules of Court, filed by petitioner Simeon M.

Valdez assailing the July 31, 2000 Decision1 of the Court of a) INIT (1975-1977) -

Appeals (CA) in CA-G.R. SP No. 54870, as reiterated in its

Resolution2 of October 17, 2000, upholding the Civil Service - 2 year

Commission’s (CSC’s) January 14, 1999 Opinion and

Resolution No. 991940. 3 years 1 Jan. 1995 to March 1995

Principally, the CSC held that petitioner’s services rendered in b) MMSU (1978-1987) -

the Manila Economic Cultural Office (MECO), Mariano

Memorial State University (MMSU), Philippine Veterans - 3 months

Investment Development Company (PHIVIDEC) and as OIC

Vice-Governor of Ilocos Norte cannot be credited in the 10 years Sub total

computation of his retirement benefits.

c) MMSU (1989-1992) -

The facts are as follows:

- 2 years 3months

On October 09, 1998, petitioner filed his application for

retirement benefits with the Government Service Insurance 4 years REMARKS

System (GSIS).

Sub total 1. Please note therefore that there is overlapping of my services

On November 03, 1998, petitioner filed the same application at PHIVIDEC & MMSU. My services of 12 years 5 months

with the CSC and at the same time, he sought the CSC’s opinion - with PHIVIDEC should be counted and only 4 years and 7

on whether his two (2) years and three (3) months stint as months with MMSU where there is no overlapping.

MECO Director can be accredited as government service among 17 years

others. 2. My services as OIC Governor should not be counted as I was

4. As OIC Vice-Governor Ilocos Norte still with PHIVIDEC during the 6 months I served as OIC Vice-

In support of his claim for retirement benefits, petitioner Governor.

submitted a summary of his government service record, to wit: Nov. 1986-Dec. 1986

3. Therefore the length of service to be credited for my

SUMMARY - retirement will cover only the following:

1. As Congressman (5th, 6th, 7th & 10th Congress) 2 months a) As Congressman

- Jan. 1, 1987 to Mar. 1987 -

15 years - 15 years

2. As Director of PHIVIDEC November 1974 to March 1987 3 months b) As Director of PHIVIDEC

- Sub total -

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 1 | 20

12 years 5 months offices and renders the required office hours. This rule has been

emphasized in CSC Resolution No. 90-1087, pertinent portion Displeased, petitioner sought reconsideration of the subject CSC

c) As Board of Regent MMSU of which reads as follows: opinion in a Letter5 addressed to the CSC and the GSIS.

Petitioner insisted on the inclusion of his services rendered in

- "Under the Leave Law and Rules, Leave Privileges are accorded the MECO, PHIVIDEC and MMSU in the computation of his

only to regular, temporary, provisional or casual officials and retirement benefits pursuant to Sections 10 (b) and 2 (l) of

4 years 7 months employees who are rendering full time service in an agency or Republic Act (RA) No. 8291.6

government. However, the status of appointment of employees

d) As Director of MECO in the government further identify certain specifications in the The GSIS indorsed7 the Letter to the CSC with a view that the

entitlement of leave privileges; hence, a part-time employee is same is within the jurisdiction of the latter.

- not entitled to leave unless he works part-time in two different

offices and renders the required office hours (Manual of Leave The CSC, for its part, rendered Resolution No. 9919408 dated

2 years 3 months Administration, p.3.2). Thus it is completely inconceivable that August 31, 1999 denying petitioner’s request for reconsideration

members of the various Regulatory Board of the PRC who hold of the subject CSC opinion, thus:

Total concurrently other positions in the civil service are, at the same

time on full-time basis in other positions. x x x To grant them WHEREFORE, the Commission hereby resolves to deny the

- leave benefits in consideration of their services would be instant request of Simeon Valdez. Accordingly, the assailed

tantamount to double compensation, the receipt of which is Opinion is affirmed.

33 years 15 months constitutionally prescribed. x x x This has to be so, otherwise

they would be enjoying leave privileges over and above what is Petitioner then elevated the matter to the CA by way of petition

On February 23, 1999, petitioner received two mails, one from provided in the leave Law and Rules (Valdez v. Commission on for review on certiorari against the CSC and the GSIS. There,

the CSC and the other from GSIS. The letter from CSC Audit: GR 87277, 25 May 1989). Besides, CSC Memorandum petitioner argued that his services rendered as Director of

contained the challenged January 14, 1999 Opinion3 denying Circular No. 43, series of 1989 (Retirement of Employees MECO should have been credited for retirement purposes and

the accreditation of petitioner’s services as former Director of Holding More than One Positions), is explicit that ‘an that his salary thereat should have been the highest remuneration

MECO and of PHIVIDEC and as Member of the Board of appointment to a second position must be regarded only as considered in the computation of his retirement benefits.

Regents of MMSU, pertinently reading as follows: imposing additional duties to the regular functions of an Petitioner likewise insisted that his respective tenures as

employee and consequently an employee can retire only from Member of the Board of Regents of Ilocos Norte Institute of

Section 2 (1), Article IX of the 1987 Constitution provides that his regular or main position and not from his additional Technology (INIT) and the MMSU, as Director of the

the "civil service embraces all branches, subdivisions, position." PHIVIDEC and as OIC Vice-Governor of Ilocos Norte be

instrumentalities and agencies of the Government, including included as government service in the computation of his

government-owned or controlled corporations with original Let is (sic) be stressed that for purposes of computation of retirement benefits.

charters." (Underscoring Ours). Equivocably, subsidiary government service, only "full-time services with

corporations created under the Corporation Code are not compensation" are included (Section 10 (b), RA 8291). On July 31, 2000, the CA rendered the herein challenged

considered part of the Civil Service. Since MECO is a Moreover, under Section 2(l) of RA 8291, "compensation" decision dismissing the petition and affirming both the January

subsidiary corporation of the government governed by its refers to the basic pay or salary received by an employee, 14, 1999 Opinion and Resolution No. 991940 of the CSC.

Articles of Incorporation and By-Laws, whatever services pursuant to his election/appointment, excluding per diems, Dispositively, the Decision reads:

rendered therein shall not be considered part and parcel of bonuses, overtime pay, honoraria, allowances and other

government service. emoluments received in addition to the basic pay which are not With the foregoing, the assailed CSC Opinion dated 14 January

integrated into the basic pay under existing laws. (Underscoring 1999 and Resolution No. 991940 dated 31 August 1999 are

xxx Ours) hereby AFFIRMED.

We note that at the time you were still a member of the Board of Premised on our answer in your first query, your services at the SO ORDERED.

Regents of the Mariano Marcos State University (MMSU) from MECO for 2 years and 3 months did not earn any leave credit

1978 to 1992, you were likewise holding the positions of for you. Thereafter, petitioner filed a motion for reconsideration of the

Philvidic Director (November 1974-March 1987) and as OIC- foregoing decision and for the first time raised as an issue the

Vice Governor (August 1986-March 1987). As such, it must be The correspondence from the GSIS contained a Letter4 and a lack of jurisdiction of the CSC and the CA over the case.

reiterated that a part-time employee is not entitled to leave Retirement Voucher informing petitioner of the approval of his

benefits unless he works part-time in two different government retirement benefits computed on the basis of the CSC’s opinion.

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 2 | 20

In the resolution of October 17, 2000, the CA denied PETITIONER THE RIGHT TO A RETIREMENT BENEFITS perusal of the record shows that no such finding was ever made,

petitioner’s motion for reconsideration. COMPUTED AT HIS HIGHEST SALARY RATE WITH neither by the CSC in its January 14, 1999 Opinion and

MECO. Resolution No. 991940 nor by the CA in the herein challenged

Petitioner now comes to this Court via this petition for July 31, 2000 Decision in CA-G.R. SP No. 54870, as reiterated

certiorari. Although the CSC was the author of the challenged The petition is utterly bereft of merit. the resolution of October 17, 2000.

issuances which were affirmed by the CA and in fact it was a

respondent in the case below, it was not impleaded in the instant First off, petitioner’s argument that the GSIS violated RA No. The remaining three assigned errors being interrelated, we shall

petition. Petitioner now lays all the blame on the GSIS as he 8291 when it indorsed petitioner’s claim to the CSC for address them together. Petitioner would have the Court reverse

raises the following assigned errors: resolution is untenable. Section 10 of RA No. 8291, otherwise the CA’s rejecting his assertion that his services rendered in the

known as the "Government Service Insurance System Act of MECO, MMSU, PHIVIDEC and as OIC Vice-Governor of

I. 1997," explicitly authorizes the GSIS and the CSC to work hand Ilocos Norte should be credited in the computation of his

in hand in the computation of service in the government for the retirement benefits. We are not convinced for two reasons. First,

THE INDORSEMENT OF THE GSIS OF PETITIONER’S purpose of availment of the retirement benefits under the said the assailed CA decision affirming the impugned CSC issuances

CLAIM FOR RETIREMENT BENEFITS TO THE CSC Act. Pertinently, the said Act provides: is anchored on law and jurisprudence. Thus, we quote with

SUFFERS JURAL INFIRMITY AND ALL THE RESULTING approval the following excerpt from the decision of the CA:

CSC PROCEEDINGS AND RESOLUTIONS THEREON ARE Sec. 10. Computation of Service.―(a) The computation of

NULL AND VOID AB INITIO, INCLUDING THE NOW service for the purpose of determining the amount of benefits None other than the 1987 Constitution of the Philippines, the

QUESTIONED COURT OF APPEALS DECISION AND payable under this Act shall be from the date of original Highest Law of the Land, confines the scope of the civil service

RESOLUTION (ANNEXES A AND B), FOR LACK OF appointment/election, including periods of service at different as embracing "all the branches, subdivisions, instrumentalities

JURISDICTION. times under one or more employers, those performed overseas and agencies of the government, including government-owned

under the authority of the Republic of the Philippines, and those and controlled corporations with original charters."

II. that may be prescribed by the GSIS in coordination with the

Civil Service Commission. xxx

ASSUMING THAT CSC AND THE COURT OF APPEALS

HAVE JURISDICTION, THE HOLDING THAT Besides, the petitioner himself sought the CSC’s opinion on In Philippine National Company-Energy Development

PETITIONER’S CLAIM FOR RETIREMENT BENEFITS matters related to his application for retirement. He too filed a Corporation v. Leogardo, 175 SCRA 26, 30 (1989), the

HAD ALREADY PRESCRIBED IS DEFINITELY A LEGAL motion for the CSC to reconsider its opinion. Surely, the GSIS Supreme Court categorically ruled that "under the present law,

ERROR. could not be faulted for merely referring his letter seeking the test in determining whether a government-owned or

reconsideration of the CSC opinion which was addressed to the controlled corporation is subject to the Civil Service Law is the

III. GSIS, stated, "I respectfully seek to reconsider the denial of the manner of its creation such that government corporations

Chairman of the Civil Service Commission of the other benefits created by special charter are subject to its provision while those

ASSUMING THAT CSC AND THE COURT OF APPEALS xxx." Moreover, the GSIS’ action on petitioner’s claim relied on incorporated under the General Corporation Law are not within

HAVE JURISDICTION, THE DENIAL OF THE the CSC’s Opinion.9 Unless the CSC would reconsider or revise its coverage."

ACCREDITATION OF PETITONER’S SERVICES its earlier opinion, which it did not, it was unlikely for the GSIS

RENDERED WITH MECO IS PLAINLY A LEGAL ERROR. to reconsider its previous opinion, given the statutory mandate With this in mind, the CSC was not in error in holding that:

for the said two institutions of government to coordinate on the

IV. matter of computation of government services of retirees. "It is noted that MECO was created before the effectivity of the

1987 Constitution. In this regard, granting without admitting

THE LACK OF JURISDICTION EXTENDS TO THE COURT While it is a rule that jurisdictional question may be raised at that at the time of its incorporation (during the effectivity of the

OF APPEALS’ AFFIRMING THE EXCLUSION OF any time, this, however, admits of an exception where, as in this 1973 Constitution) MECO was yet under the coverage of the

PETITIONER’S SERVICES RENDERED WITH INIT, case, estoppel has supervened. The Court has, time and again, Philippine Civil Service, the appellant’s (i.e., petitioner’s

MMMCST, MMSU, PHIVEDEC AND OIC VICE- frowned upon the undesirable practice of a party submitting his services rendered thereat for that period, however, still cannot

GOVERNOR OF ILOCOS NORTE. case for decision and then accepting the judgment only if be accredited as government service because at the time of his

favorable, and attacking it for lack of jurisdiction when retirement/filing of the case/complaint, the abovequoted

V. adverse.10 provision (i.e., Section 2(1), Article IX) of the 1987 Constitution

has already come into effect. As held by the Honorable Supreme

THE LACK OF JURISDICTION OF THE CSC AND THE Secondly, petitioner argues that the CSC and the CA Court in Lumanta, et al. vs. National Labor Relations

COURT OF APPEALS, LAWLESSLY DEPRIVED erroneously held that his claim had already prescribed. A Commission and Food Terminal, Inc. (170 SCRA 79),

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 3 | 20

‘jurisdiction is determined as of the time of the filing of the Sec. 5. The Congress shall provide for the standardization of herein petition should be dismissed pursuant to SC Circular No.

complaint.’" compensation of government officials and employees, including 2-90.16

those in government-owned or controlled corporations with

The established rule is that the statute (in this case, the original charters, taking into account the nature of the WHEREFORE, in view of the foregoing, the petition is

Constitution) in force at the time of the commencement of the responsibilities pertaining to, and the qualifications required for DISMISSED and the assailed decision and resolution of the CA

action determines the jurisdiction of the court (in this case, the their positions. are AFFIRMED.

administrative body).

The salary received by petitioner during his stint at MECO SO ORDERED.

It was likewise no error for the CSC to deny accreditation of appears to be way beyond that authorized by RA No. 6758,12

petitioner’s services rendered for MMSU, PHIVIDEC and INIT, otherwise known as the Salary Standardization Law. For this G.R. No. L-49535 October 28, 1988*

concurrently, because of the lack of sufficient basis to compute reason, it is doubtful that petitioner’s employment with the ROMANA M. CRUZ, petitioner,

services rendered therefor converted to their full-time MECO is embraced by the civil service. Otherwise, the salary vs.

equivalent, reckoned in hours or days actually rendered, using a rate received by petitioner from MECO would not have been HON. FRANCISCO TANTUICO and HON. GREGORIO

Forty-(40) hour week and 52 weeks a year as basis, in legally feasible, unless there was a law exempting the MECO G. MENDOZA, in their capacity as Acting Chairman and

accordance with Section 5.3, Rule V of the Rules and from the Salary Standardization Law. Treasurer of the Philippines of the Commission on Audit

Regulations Implementing the Government Service Insurance and the Bureau of Treasury, respondents.

System Act of 1997. Finally, the instant petition purports to be a petition for certiorari

under Rule 65 of the Rules of Court. However, a cursory The relief sought from the Court, in addition to the setting aside

Relevantly, the last paragraph of Section 10 of RA No. 8291 reading of the issues raised discloses that petitioner’s arguments of certain orders of respondent COA Acting Chairman, is the

dictates that for purposes of computation of government service, are not anchored on lack of jurisdiction but on questions of law issuance of an order for the release of petitioner's retirement

only full-time services with compensation are included: which fall within the realm of petitions for review on certiorari benefits. Preliminary to the grant or denial thereof, this Court is

under Rule 45 of the Rules of Court. asked to pass upon the liability of petitioner Romana M. Cruz

For the purpose of this section, the term service shall include for paying upon presentment several treasury warrants with a

full time service with compensation: Provided, That part time It is an elementary principle that a petition for certiorari under total value of P21,545.08, but which turned out to be issued to

and other services with compensation may be included under Rule 65 cannot be used if the proper remedy is appeal. Being an fictitious payees.

such rules and regulations as may be prescribed by the GSIS. extraordinary remedy, a party can only avail himself of

certiorari, if there is no appeal, or any plain, speedy, and An investigation of the anomaly revealed that it was the

While petitioner invokes the proviso in the above-quoted adequate remedy in the ordinary course of law.13 Here, appeal handiwork of a "syndicate" composed of employees of the

provision of law, the GSIS, which has been given the authority is the correct mode but was not seasonably utilized by the Budget Commission and the Department of Education and

to include part-time services in the computation, has pointed out petitioner. Resort to this petition for certiorari is, therefore, Culture (DEC). Using falsified computations and service

that the services in the MMSU, PHIVIDEC and as OIC Vice- improper because certiorari cannot be used as a substitute for a records, some sixty-eight (68) treasury warrants were issued and

Governor of Ilocos Norte cannot be credited because, aside from lost remedy of appeal.14 Petitions for certiorari are limited to made payable to fictitious or "ghost" teachers in Region IX

having been rendered part-time in said agencies, the said resolving only errors of jurisdiction. It is not to stray at will and (Zamboanga del Sur), all of which appeared to be genuine and

positions were without compensation as defined in Section 2(i) resolve questions or issues beyond its competence such as errors duly signed by the authorized signatories of the DEC. Twenty-

of RA No. 8291.11 of judgment. For, it is basic that certiorari under Rule 65 is a eight (28) of these warrants are the subject of this case.

remedy narrow in scope and inflexible in character. It is not a

Petitioner’s insistence that the emoluments he received as general utility tool in the legal workshop.15 It offers only a Acting on the request of the Treasurer of the Philippines that the

MECO director be the basis in the computation of his retirement limited form of review. Its principal function is to keep an encashment of the treasury warrants be dishonored and that the

benefits, the same being the highest basic salary rate, is inferior tribunal within its jurisdiction. It can be invoked only appropriate "charge back be undertaken, the National Cashier

unavailing. Indeed, the salaries that he received at the time he for an error of jurisdiction, that is, one where the act complained recommended that action to effect restitution be taken against

served as MECO director were unusually high for any position of was issued by the court, officer or a quasi-judicial body the parties to the falsification, particularly, Editha Gonzales and

covered by the civil service. Petitioner received a monthly pay without or in excess of jurisdiction, or with grave abuse of Ceferino M. Cruz, instead of proceeding against Romana Cruz

of P40,000.00 in addition to a P65,000.00 representation and discretion which is tantamount to lack or in excess of who was considered to have done her routine task as paying

travel allowance and US$2,500.00 per diem for overseas board jurisdiction. It is not to be used for any other purpose, such as to teller and to have acted in good faith in encashing the treasury

meetings. The Constitution itself mandated the standardization cure errors in proceedings or to correct erroneous conclusions of warrants [Rollo, pp. 36-37.]

of compensation of government officials and employees covered law or fact, as what petitioner would like the Court to venture

by the civil service under Article IX B, Section 5, viz: into. A petition for certiorari not being the proper remedy to Subsequently, however, the Auditor assigned to the Treasury

correct errors of judgment as alleged in the instant case, the Vault and Banking Audit Division of the Bureau of Treasury

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 4 | 20

requested the National Cashier to "cause the dishonor of the 1. Petitioner denies any liability for the value of the

subject warrants and the encashment thereof charged back to the [Rollo, p. 50.] subject treasury warrants. Assailing the order of the respondent

account of the banks concerned or to Miss Cruz, as the case may COA Acting Chairman as embodied in the 2nd indorsement,

be." [Rollo, p. 38.] The first charge back against Miss Cruz as Manifesting his disagreement with the above ruling, the petitioner contends that basing her liability on the theory that

made on August 17, 1976 in the amount of the P15,308.91 and Treasurer under the 5th indorsement opined ". . . that the loss of she was the last indorser thereof is erroneous, as she was not an

subsequently increased by P6,236.17 on August 23, 1976 thus government funds arising from the encashment of the subject indorser.

making her total cash accountabilities amount to P21,545.08. treasury warrants as a result of the negligent act of the DEC in

The Auditor also formally demanded that petitioner produce the issuing these treasury warrants to fictitious persons, should be The facts support the conclusion that petitioner was not an

missing funds while the Acting National Cashier required her to borne by the DEC and not by Miss Romana Cruz who paid them indorser of the treasury warrants. Her only participation in the

increase her cash accountability [Rollo, p. 40.] in good faith and pursuant to her duty as Cashier IV of this encashment of the treasury warrants was in her capacity as

Treasury to pay treasury warrants and government checks cashier or paying teller of the Bureau of Treasury. Her act of

In her written explanations to these demands, petitioner stressed presented to her for payment." [Rollo, pp. 51-53.] paying the amounts reflected on the treasury warrants did not

that she paid the warrants in good faith as there was nothing on constitute an indorsement but a discharge by payment of the

their faces or in the endorsements to raise any doubt as to their A request for reconsideration of the order of the respondent instruments.

genuineness. Petitioner requested that in lieu of charging her for COA Acting Chairman contained in the 2nd indorsement was

the shortage, "the same be dropped from the cash book and filed by petitioner on February 20, 1978. This was followed by a Petitioner submits that since the questioned treasury warrants

simultaneously recorded as a receivable (from the guilty request, sometime in August, 1978, addressed to the COA were genuine in all respects, she had no way of determining

party/parties) on the books of the Bureau of Treasury [Rollo, pp. Acting Chairman for the early issuance of a clearance in whether the same were payable to fictitious or non-existing

41-42.] connection with petitioner's retirement from the Bureau of payees.

Treasury on March 30, 1978 [Rollo, p. 56.]

Acting on the matter which was formally referred to him, the It is not disputed that on the face of the treasury warrants, there

respondent Commission on Audit (COA) Acting Chairman On November 27, 1978, petitioner received a letter from appeared no irregularity The warrants were signed by the

issued the following: respondent Treasurer dated November 13, 1978 informing her authorized signatories of the DEC. Furthermore, Editha

that under the 8th indorsement, the COA Acting Chairman Gonzales, the party who presented the treasury warrants for

2nd Indorsement denied her appeal and letter of reconsideration while reiterating encashment, was a bona fide employee of the DEC who

October 25, 1976 his previous directive under the 2nd indorsement. The regularly cashed warrants with the petitioner and was therefore

Treasurer's letter particularly stated: known to her personally. Considering these circumstances, the

Respectfully returned, thru the Manager, Accountancy Office, encashment by the petitioner of the subject treasury warrants did

this Commission, to the Treasurer of the Philippines, Bureau of xxx xxx xxx not amount to an act of negligence for which she should be

the Treasury, Manila. made liable.

This Treasury expressed its support to your representation under

It appearing from these papers that it was Miss Romana Cruz, its 5th indorsement to the Chairman of the Commission on The view that petitioner had not been negligent is shared by the

Cashier IV, Cash Division, that Bureau, who paid the treasury Audit dated November 18, 1977, xerox copy enclosed, but Bureau itself, which has cleared her of any responsibility for the

warrants in question totalling P21,545.08 to wrong or fictitious unfortunately, the COA has a different view. defalcation. In the investigations conducted after discovery of

payees and, therefore, is the last indorser liable for the value the anomaly, she was never implicated. Thus, when the

thereof, it is hereby directed that she be required to restore and That being the case, much to our regret, the value of the subject perpetrators were charged before the then Court of First Instance

restitute to that Bureau the said amount, without prejudice to her 28 treasury warrants in the total amount of P21,545.08 is being of Manila for Estafa Thru Falsification on eighty-three (83)

right of recourse against the guarantors of said warrants, if any. deducted from your retirement benefits from this Treasury, the counts, she was not included in the charge.

same to be applied in refund of your shortage of P21,545.08 in

In case of failure of Miss Cruz to effect the restitution of said your accountability, arising from the encashment of the said In behalf of the public respondents, the Solicitor General

amount as herein directed, her salary should be withheld subject 28 treasury warrants. [Rollo, p. 57.] counters that petitioner's failure as a paying teller to ascertain

pursuant to Section 624 of the Revised Administrative Code and that the person who presented the warrants was not a holder in

applied in settlement of her liability. In this petition for review on certiorari, the petitioner seeks a due course renders her liable for the value thereof,

ruling setting aside the orders of the respondent COA Acting notwithstanding that the third endorser who encashed the said

Advice of the action taken herein is desired. Chairman contained in the 2nd and 8th indorsements and for the treasury warrants was known to her, and, therefore adequately

release of the amount of P21,545.08 in her favor. Identified. To support this contention, he cites the Manual of the

(Sgd.) Francisco S. Tantuico, Jr. Bureau of Treasury which provides as follows:

Acting Chairman

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 5 | 20

Sec. 3250.1. Requirements when party is an indorsee.— 30, 1978 were never withheld. Thus, the order of the Treasurer be attached or levied upon execution. *** The respondents

When the party encashing the warrant or check is an indorsee, to deduct the value of the treasury warrants from her retirement contend that the withholding of the corresponding amount of the

he shall be referred first to the National Cashier before any benefits [Rollo, p. 57.] petitioner's gratuity was made with a view to its application to

payment is made by the Paying Teller. The National Cashier the payment of his indebtedness to the Government, and that

shall interview the party and should be satisfied that the party is Consequently, on March 30, 1978, petitioner applied with and such action is authorized by section 624 of the Administrative

a holder in due course or has legal or rightful title to the was cleared by the Bureau of Treasury from all money and Code which provides that "When any person is indebted to the

instrument. The encashing party should also be required to property responsibilities, except for the sum of P21,545.08 government of the Philippine Islands or Government of the

present any of the documents (identification papers) enumerated representing the value of the twenty-eight (28) treasury warrants United States, the Insular Auditor may direct the proper officer

in Section 3250.0 above. [Rollo, p. 123.] The Bureau of Treasury released to the to withhold the payment of any money due him or his estate, the

petitioner the sum of P23,980.77 under TW No. B-04,623,521, same to be applied in satisfaction of such indebtedness.

At this stage, Sec. 3250.1 of the Manual of the Bureau of dated January 2, 1979, as "retirement gratuity" [Rollo, p. 124.]

Treasury cannot be made the basis for holding the petitioner Presumably, since there was an order to deduct the amount of While Section 3 of Act No. 4051 refers merely to attachment or

liable considering the absence from the record of any mention of P21,545.08 from her retirement benefits, the amount of levy upon execution, we are of the opinion that the exemption

any investigation concerning her possible liability under said P23,980.77 released to her was only a portion of the total should be liberally construed in favor of the pensioner. Pension

section. Thus, facts that would prove or disprove her liability amount she was entitled to. in this case is a bounty flowing from the graciousness of the

under this section were never established. Moreover, in the Government intended to reward past services and, at the same

series of indorsements by the public respondents leading to the As mentioned above, no neligence attended the petitioner's time, to provide the pensioner with the means with which to

present case, See. 3250.1 was never mentioned as the basis for encashment of the treasury warrants. Even assuming that. she support himself and his family. Unless otherwise clearly

petitioner's liability. In fact, the respondent COA Acting could be held liable for non- compliance with or violation of provided, the pension should insure wholly to the benefit of the

Chairman ruled that petitioner was liable for a totally different some rule or regulation, this Court agrees with the petitioner that pensioner. It is true that the withholding and application of the

reason, i.e. that she was the last indorser of the treasury warrants Section 624 of the Revised Administrative Code cannot be amount involved was had under section 624 of the

[Rollo, p. 50.] It is only now that she has brought her case construed to authorize a deduction of the value of the treasury Administrative Code and not by any judicial process, but if the

before this Court that petitioner is sought to be held liable on the warrants from her retirement benefits. Said section provides: gratuity could not be attached or levied upon execution in view

basis of Sec. 3250.1. This cannot be allowed, for otherwise it of the prohibition of section 3 of Act No. 4051, the

would be tantamount to sanctioning a change of theory on Sec. 624. Retention of salary for satisfaction of indebtedness.— appropriation thereof by administrative action, if allowed, would

appeal, which would be unfair to the adverse party [Philippine When any person is indebted to the Government of the lead to the same prohibited result and enable the respondents to

Rabbit Bus Lines, Inc. v. Phil-American Forwarders, Inc., G.R. Philippine Islands (or Government of the United States), the do indirectly what they can not do directly under section 3 of

No. L-25142, March 25, 1975, 63 SCRA 231.] Insular Auditor may direct the proper officer to withhold the Act No. 4051. Act No. 4051 is a later statute having been

payment of any money due him or his estate, the same to be approved on February 21, 1933, whereas the Administrative

Having established that petitioner was not negligent in applied in satisfaction of such indebtedness. Code of 1917 which embodies section 624 relied upon by the

encashing the treasury warrants, justice dictates that she should respondents was approved on March 10 of that year.

not be made personally liable for the consequent losses. The Solicitor General, in his comment, is in agreement with the Considering section 3 of Act No. 4051 as an exception to the

petitioner that her retirement pay may not be withheld by general authority granted in section 624 of the Administrative

2. An analysis of the arguments presented as they relate administrative fiat to answer for the shortage incurred while in Code, antagonism between the two provisions is avoided. [Id. at

to the facts would show that the issue petitioner actually poses is office [Rollo, p. 99.] This has also been the interpretation 264; Emphasis supplied.]

the propriety of the Treasurer's order to deduct the amount of applied by the respondent COA Acting Secretary in similar

P21,545.08, the value of the twenty-eight (28) treasury warrants, cases [Rollo, pp. 62-63.] WHEREFORE, the petition is GRANTED and the order of the

from her retirement benefits, as embodied in the Treasurer's respondent COA Acting Chairman Francisco S. Tantuico Jr. to

letter to her dated November 13, 1978 [Rollo, p. 57], That the retirement pay accruing to a public officer may not be withhold payment of petitioner's salary and the consequent

considering that nowhere is it stated in the COA Acting withheld and applied to his indebtedness to the government is directive of the respondent Treasurer Gregorio G. Mendoza to

Chairman's 2nd and 8th indorsements that the amount should be settled. In Hunt v. Hernandez [G.R. No. 45665, 36 O.G. 263 deduct the amount of P21,545.08 from petitioner's retirement

deducted from her retirement benefits. In fact, the 2nd (1937], the Court, through Justice Laurel, explained why. benefits are SET ASIDE. This decision is IMMEDIATELY

indorsement provided that her salary should be withheld and EXECUTORY.

applied in settlement of her liability ** while the 8th The question to be determined is whether or not the gratuity of

indorsement merely reiterated the 2nd [Rollo, pp. 50 and 59.] the petitioner in this case can be withheld and applied to the SO ORDERED.

payment of his remaining indebtedness to the San Lazaro

Despite the orders of the Acting Chairman of the Commission Investment Fund notwithstanding the provision of section 3 of G.R. No. 96422 February 28, 1994

on Audit, petitioner's salaries prior to her retirement on March Act No. 4051 that the gratuity provided for in this Act shall not

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 6 | 20

FRANCISCO S. TANTUICO, JR., petitioner, all equipment acquired during the tenure of his two Respondent Chairman rendered a Decision dated November 20,

vs. predecessors. 1989, in the administrative case filed against the principal

HON. EUFEMIO DOMINGO, in his capacity as Chairman members of the first inventory committee. He found them guilty

of the Commission on Audit, ESTELITO SALVADOR, On May 7, 1987, respondent Chairman indorsed petitioner's as charged and issued them a reprimand. The other members

MARGARITO SILOT, VALENTINA EUSTAQUIO, retirement application to the Government Service Insurance were meted a stern warning, except for one who was exonerated

ANICIA CHICO and GERMINIA PASCO, respondents. System (GSIS), certifying, among other matters, that petitioner for not taking part in the preparation of the inventory report.

was cleared of money and property accountability (Rollo, p. 52).

This is a petition for certiorari, prohibition and mandamus, with The application was returned to the COA pursuant to R.A. No. In a letter dated December 21, 1989, a copy of which was

prayer for temporary restraining order or preliminary injunction, 1568, which vests in the COA the final approval thereof. received by petitioner on December 27, 1989, respondent

under Rule 65 of the Revised Rules of Court. Chairman informed petitioner of the approval of his application

On September 25, 1987, the inventory committee finally for retirement under R.A. No. 1568, effective as of March 9,

The petition mainly questions the withholding of one-half of submitted its report, recommending petitioner's clearance from 1986 (Rollo, pp. 68-69). However, respondent Chairman added:

petitioner's retirement benefits. property accountability inasmuch as there was no showing that

he personally gained from the missing property or was primarily . . . In view, however, of the audit findings and inventory report

I liable for the loss thereof (Rollo, pp. 53-58). adverted to above, payment of only one-half (½) of the money

value of the benefits due you by reason of such retirement will

On January 26, 1980, petitioner was appointed Chairman of the Not satisfied with the report, respondent Chairman issued a be allowed, subject to the availability of funds and the usual

Commission on Audit (COA) to serve a term of seven years Memorandum directing the inventory committee to explain why accounting and auditing rules. Payment of the balance of said

expiring on January 26, 1987. Petitioner had discharged the no action should be filed against its members for failure to retirement benefits shall be subject to the final results of the

functions of Chairman of the COA in an acting capacity since complete a physical inventory and verification of all equipment; audit concerning your fiscal responsibility and/or accountability

1975. for exceeding their authority in recommending clearances for as former Chairman of this Commission.

petitioner and Chairman Guingona; and for recommending

On December 31, 1985, petitioner applied for clearance from all petitioner's clearance in total disregard of Section 102 of P.D. In a letter dated January 22, 1990, petitioner requested full

money, property and other accountabilities in preparation for his No. 1445 (Government Auditing Code of the Philippines). The payment of his retirement benefits.

retirement. He obtained the clearance applied for, which covered members of the committee were subsequently administratively

the period from 1976 to December 31, 1985. The clearance had charged. Petitioner was furnished a copy of the report of the special audit

all the required signatures and bore a certification that petitioner team in the letter dated December 21, 1989 of respondent

was "cleared from money, property and/or other accountabilities On January 2, 1988, respondent Chairman created a special Chairman on January 29, 1990, nearly a year after its

by this Commission" (Rollo, p. 44). audit team for the purpose of conducting a financial and completion. Attached to a copy of the report was a letter dated

compliance audit of the COA transactions and accounts during November 14, 1989 from respondent Chairman, who required

After the EDSA Revolution, petitioner submitted his courtesy the tenure of petitioner from 1976 to 1984 (COA Office Order petitioner to submit his comment within 30 days (Rollo, p. 153).

resignation to President Corazon C. Aquino. He relinquished his 88-10677; Rollo, pp. 66-67).

office to the newly appointed Chairman, now Executive Petitioner submitted a letter-complaint, wherein he cited certain

Secretary Teofisto Guingona, Jr. on March 10, 1986. That same On February 28, 1989, the special audit team submitted its defects in the manner the audit was conducted. He further

day, he applied for retirement effective immediately. report stating: (i) that the audit consisted of selective review of claimed that the re-audit was not authorized by law since it

post-audit transactions in the head offices and the State covered closed and settled accounts.

Petitioner sought a second clearance to cover the period from Accounting and Auditing Center; (ii) that the audit disclosed a

January 1, 1986 to March 9, 1986. All the signatures necessary number of deficiencies which adversely affected the financial Upon petitioner's request, he was furnished a set of documents

to complete the second clearance, except that of Chairman condition and operation of the COA, such as violations of which he needed to prepare his comment. He was likewise given

Guingona, were obtained. The second clearance embodies a executive orders, presidential decrees and related rules and another 30-days to submit it.

certificate that petitioner was "cleared from money, property regulations; and (iii) that there were some constraints in the

and/or accountability by this Commission" (Rollo, p. 49). audit, such as the unavailability of records and documents, and A series of correspondence between petitioner and respondent

Chairman Guingona, however, failed to take any action thereon. personnel movements and turnover. While the report did not Chairman ensued. On September 10, 1990, petitioner requested

make any recommendation, it instead mentioned several a copy of the working papers on which the audit report was

Chairman Guingona was replaced by respondent Chairman. A officials and employees, including petitioner, who may be based. This was denied by respondent Chairman, who claimed

year later, respondent Chairman issued COA Office Order No. responsible or accountable for the questioned transactions that under the State Audit Manual, access to the working paper

87-10182 (Rollo, p. 50), which created a committee to inventory (Rollo, pp. 73, 147-151). was restricted. Petitioner's reconsideration was likewise denied

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 7 | 20

and he was given a non-extendible period of five days to submit general authority granted in Section 624 of the Administrative

his comment. Whatever infirmities or limitations existed in said clearances Code, antagonism between the two provisions is avoided (Hunt

were cured after respondent Chairman favorably indorsed v. Hernandez, 64 Phil. 753 [1937]).

Instead of submitting his comment, petitioner sought several petitioner's application for retirement to the Government Service

clarifications and specification, and requested for 90 days within Insurance System and recommended its approval to take effect Under Section 4 of R.A. No. 1568 (An Act to Provide Life

which to submit his comment, considering that the report on March 10, 1986. In said endorsement, respondent Chairman Pension to the Auditor General and the Chairman or Any

covered a ten-year period of post-audited transactions. Ignoring made it clear that there were no pending administrative and Member of the Commission of Elections), the benefits granted

petitioner's request, respondent Chairman demanded an criminal cases against petitioner (Rollo, p. 52). by said law to the Auditor General and the Chairman and

accounting of funds and a turn over of the assets of the Fiscal Members of the Commission on Elections shall not be subject to

Administration Foundation, Inc. within 30 days. Regardless of petitioner's monetary liability to the government garnishment, levy or execution. Likewise, under Section 33 of

that may be discovered from the audit concerning his fiscal P.D. No. 1146, as amended (The Revised Government Service

II responsibility as former COA Chairman, respondent Chairman Insurance Act of 1977), the benefits granted thereunder "shall

cannot withhold the benefits due petitioner under the retirement not be subject, among others, to attachment, garnishment, levy

Petitioner then filed the instant petition. As prayed for by laws. or other processes."

petitioner, this Court issued a temporary restraining order on

January 17, 1991. In Romana Cruz v. Hon. Francisco Tantuico, 166 SCRA 670 Well-settled is the rule that retirement laws are liberally

(1988), the National Treasurer withheld the retirement benefits interpreted in favor of the retiree because the intention is to

Petitioner argues that notwithstanding the two clearances of an employee because of his finding that she negligently provide for the retiree's sustenance and comfort, when he is no

previously issued, and respondent Chairman's certification that allowed the anomalous encashment of falsified treasury longer capable of earning his livelihood (Profeta vs. Drilon, 216

petitioner had been cleared of money and property warrants. SCRA 777 [1992]).

accountability, respondent Chairman still refuses to release the

remaining half of his retirement benefits — a purely ministerial In said case, where petitioner herein was one of the respondents, Petitioner also wants us to enjoin the re-audit of his fiscal

act. we found that the employee had been cleared by the National responsibility or accountability, invoking the following grounds:

Treasurer from all money and property responsibility, and held

Petitioner was already issued an initial clearance during his that the retirement pay accruing to a public officer may not be 1. The re-audit involved settled and closed accounts

tenure, effective December 31, 1985 (Rollo, p. 44). All the withheld and applied to his indebtedness to the government. which under Section 52 of the Audit Code can no longer be re-

required signatures were present "is cleared from money, opened and reviewed;

property and/or accountabilities by this commission" with the In Tantuico, we cited Justice Laurel's essay on the rationale for

following notation: the benign ruling in favor of the retired employees, thus: 2. The re-audit was initiated by respondent Chairman

alone, and not by the Commission as a collegial body;

No property accountability under the Chairman's name as the . . . Pension in this case is a bounty flowing from the

person. Final clearance as COA Chairman subject to the graciousness of the Government intended to reward past 3. The report of the special audit team that recommended

completion of ongoing reconciliation of Accounting & services and, at the same time, to provide the pensioner with the the re-audit is faulty as the team members themselves admitted

P(roperty) records and to complete turnover of COA property means with which to support himself and his family. Unless several constraints in conducting the re-audit, e.g. unavailability

assigned to him as agency head. otherwise clearly provided, the pension should inure wholly to of the documents, frequent turn-over and movement of

the benefit of the pensioner. It is true that the withholding and personnel, etc.;

xxx xxx xxx application of the amount involved was had under Section 624

of the Administrative Code and not by any judicial process, but 4. The re-audit covered transactions done even after

The responsibility of the Chairman for the disbursement and if the gratuity could not be attached or levied upon execution in petitioner's retirement;

collection accounts of this Commission for CYs Sept. '75 to view of the prohibition of Section 3 of Act No. 4051, the

Aug. '85, were completely post-audited, however as of Dec. 31, appropriation thereof by administrative action, if allowed, would 5. He was not given prior notice of the re-audit;

1985, the suspensions and disallowances in the amounts of lead to the same prohibited result and enable the respondent to

P36,196,962.11 and P28,762.36 respectively are still in the do indirectly what they can not do directly under Section 3 of 6. He was not given access to the working papers; and

process of settlement (Rollo, pp. 44-45). the Act No. 4051. Act No. 4051 is a later statute having been

approved on February 21, 1933, whereas the Administrative 7. Respondents were barred by res judicata from

Petitioner also applied for a second clearance to cover the period Code of 1917 which embodies Section 624 relied upon by the proceeding with the re-audit (Rollo, pp. 19-40).

from January 1 to March 9, 1986, which application had been respondents was approved on March 10 of that year.

signed by all the officials, except the Chairman (Rollo, p. 49). Considering Section 3 of Act No. 4051 as an exception to the

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 8 | 20

The petition must fail insofar as it seeks to abort the completion would have been due to the retiree during the remaining years of

of the Are the benefits provided for under Social Security System his life were he still employed;

re-audit. While at the beginning petitioner raised objections to Resolution No. 56 to be considered simply as financial

the manner the audit was conducted and the authority of assistance for retiring employees, or does such scheme WHEREAS, the life annuity under R.A. 660, as amended, being

respondents to re-open the same, he subsequently cooperated constitute a supplementary retirement plan proscribed by closer to the monthly income that was lost on account of old age

with the examination of his accounts and transactions as a COA Republic Act No. 4968? than the gratuity under R.A. 1616, as amended, would best serve

official. the interest of the retiree;

The foregoing question is addressed by this Court in resolving

With respect to the legal objections raised by petitioner to the the instant petition for certiorari which seeks to reverse and set WHEREAS, it is the policy of the Social Security Commission

partial findings of the respondents with respect to his aside Decision No. 94-126[1]dated March 15, 1994 of to promote and to protect the interest of all SSS employees, with

accountability, such findings are still tentative. As petitioner has respondent Commission on Audit, which denied petitioners a view to providing for their well-being during both their

requested, he is entitled to a reasonable time within which to request for reconsideration of its adverse ruling disapproving working and retirement years;

submit his comment thereon. claims for financial assistance under SSS Resolution No. 56.

WHEREAS, the availment of life annuities built up by

But in order to prepare his comment, petitioner should be given The Facts premiums paid on behalf of SSS employees during their

access to the working papers used by the special audit team. The working years would mean more savings to the SSS;

audit report covered a period of ten years (1976-1985) and Petitioners Avelina B. Conte and Leticia Boiser-Palma were

involved numerous transactions. It would be unfair to expect former employees of the Social Security System (SSS) who WHEREAS, it is a duty of the Social Security Commission to

petitioner to comment on the COA's findings of the report retired from government service on May 9, 1990 and September effect savings in every possible way for economical and

without giving him a chance to verify how those findings were 13, 1992, respectively. They availed of compulsory retirement efficient operations;

arrived at. benefits under Republic Act No. 660.[2]

WHEREAS, it is the right of every SSS employee to choose

It has been seven years since petitioner's retirement. Since then In addition to retirement benefits provided under R.A. 660, freely and voluntarily the benefit he is entitled to solely for his

he was only paid half of his retirement benefits, with the other petitioners also claimed SSS financial assistance benefits own benefit and for the benefit of his family;

half being withheld despite the issuance of two clearances and granted under SSS Resolution No. 56, series of 1971.

the approval of his retirement application. As of the filing of this NOW, THEREFORE, BE IT RESOLVED, That all the SSS

petition on December 21, 1990, no criminal or administrative A brief historical backgrounder is in order. SSS Resolution No. employees who are simultaneously qualified for compulsory

charge had been filed against petitioner in connection with his 56,[3] approved on January 21, 1971, provides financial retirement at age 65 or for optional retirement at a lower age be

position as former Acting Chairman and Chairman of the COA. incentive and inducement to SSS employees qualified to retire encouraged to avail for themselves the life annuity under R.A.

to avail of retirement benefits under RA 660 as amended, rather 660, as amended;

WHEREFORE, the petition is GRANTED insofar as it seeks to than the retirement benefits under RA 1616 as amended, by

compel respondent Chairman of the COA to pay petitioner's giving them financial assistance equivalent in amount to the RESOLVED, FURTHER, That SSS employees who availed

retirement benefits in full and his monthly pensions beginning in difference between what a retiree would have received under themselves of the said life annuity, in appreciation and

March 1991. RA 1616, less what he was entitled to under RA 660. The said recognition of their long and faithful service, be granted

SSS Resolution No. 56 states: financial assistance equivalent to the gratuity plus return of

The petition is DENIED insofar as it seeks to nullify COA contributions under R.A. 1616, as amended, less the five year

Office Order No. 88-10677 and the audit report dated February RESOLUTION NO. 56 guaranteed annuity under R.A. 660, as amended;

28, 1989 but petitioner should be given full access to the

working papers to enable him to prepare his comment to any WHEREAS, the retirement benefits of SSS employees are RESOLVED, FINALLY, That the Administrator be authorized

adverse findings in said report. The temporary restraining order provided for under Republic Acts 660 and 1616 as amended; to act on all applications for retirement submitted by SSS

is LIFTED. employees and subject to availability of funds, pay the

WHEREAS, SSS employees who are qualified for compulsory corresponding benefits in addition to the money value of all

SO ORDERED. retirement at age 65 or for optional retirement at a lower age are accumulated leaves. (underscoring supplied)

entitled to either the life annuity under R.A. 660, as amended, or

[G.R. No. 116422. November 4, 1996] the gratuity under R.A. 1616, as amended; Long after the promulgation of SSS Resolution No. 56,

AVELINA B. CONTE and LETICIA BOISER-PALMA, respondent Commission on Audit (COA) issued a ruling,

petitioners, vs. COMMISSION ON AUDIT (COA), WHEREAS, a retirement benefit to be effective must be a captioned as 3rd Indorsement dated July 10, 1989,[4]

respondent. periodic income as close as possible to the monthly income that

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 9 | 20

disallowing in audit all such claims for financial assistance inoperative or abolished; Provided, That the rights of those who well-qualified personnel to pursue a career in the government

under SSS Resolution No. 56, for the reason that: -- are already eligible to retire thereunder shall not be affected. service, rather than in the private sector or in foreign

(underscoring supplied) countries ...

x x x the scheme of financial assistance authorized by the SSS is

similar to those separate retirement plan or incentive/separation On January 12, 1993, herein petitioners filed with respondent A more developmental view of the financial institutions grant of

pay plans adopted by other government corporate agencies COA their letter-appeal/protest[8] seeking reconsideration of certain forms of financial assistance to its personnel, we believe,

which results in the increase of benefits beyond what is allowed COAs ruling of July 10, 1989 disallowing claims for financial would enable government administrators to see these financial

under existing retirement laws. In this regard, attention x x x is assistance under Res. 56. forms of remuneration as contributory to the national

invited to the view expressed by the Secretary of Budget and developmental efforts for effective and efficient administration

Management dated February 17, 1988 to the COA General On November 15, 1993, petitioner Conte sought payment from of the personnel programs in different institutions.[11]

Counsel against the proliferation of retirement plans which, in SSS of the benefits under Res. 56. On December 9, 1993, SSS

COA Decision No. 591 dated August 31, 1988, was concurred Administrator Renato C. Valencia denied[9] the request in The Courts Ruling

in by this Commission. x x x. consonance with the previous disallowance by respondent COA,

but assured petitioner that should the COA change its position, Petitioners contentions are not supported by law. We hold that

Accordingly, all such claims for financial assistance under SSS the SSS will resume the grant of benefits under said Res. 56. Res. 56 constitutes a supplementary retirement plan.

Resolution No. 56 dated January 21, 1971 should be disallowed

in audit. (underscoring supplied) On March 15, 1994, respondent COA rendered its COA A cursory examination of the preambular clauses and provisions

Decision No. 94-126 denying petitioners request for of Res. 56 provides a number of clear indications that its

Despite the aforequoted ruling of respondent COA, then SSS reconsideration. financial assistance plan constitutes a supplemental

Administrator Jose L. Cuisia, Jr. nevertheless wrote[5] on retirement/pension benefits plan. In particular, the fifth

February 12, 1990 then Executive Secretary Catalino Macaraig, Thus this petition for certiorari under Rule 65 of the Rules of preambular clause which provides that it is the policy of the

Jr., seeking presidential authority for SSS to continue Court. Social Security Commission to promote and to protect the

implementing its Resolution No. 56 dated January 21, 1971 interest of all SSS employees, with a view to providing for their

granting financial assistance to its qualified retiring employees. The Issues well-being during both their working and retirement years, and

the wording of the resolution itself which states Resolved,

However, in a letter-reply dated May 28, 1990,[6] then The issues[10] submitted by petitioners may be simplified and further, that SSS employees who availed themselves of the said

Executive Secretary Macaraig advised Administrator Cuisia that re-stated thus: Did public respondent abuse its discretion when it life annuity (under RA 660), in appreciation and recognition of

the Office of the President is not inclined to favorably act on the disallowed in audit petitioners claims for benefits under SSS their long and faithful service, be granted financial assistance x

herein request, let alone overrule the disallowance by COA of Res. 56? x x can only be interpreted to mean that the benefit being

such claims, because, aside from the fact that decisions, order or granted is none other than a kind of amelioration to enable the

actions of the COA in the exercise of its audit functions are Petitioners argue that the financial assistance under Res. 56 is retiring employee to enjoy (or survive) his retirement years and

appealable to the Supreme Court[7] pursuant to Sec. 50 of PD not a retirement plan prohibited by RA 4968, and that Res. 56 a reward for his loyalty and service. Moreover, it is plain to see

1445, the benefits under said Res. 56, though referred to as provides benefits different from and aside from what a retiring that the grant of said financial assistance is inextricably linked

financial assistance, constituted additional retirement benefits, SSS employee would be entitled to under RA 660. Petitioners with and inseparable from the application for and approval of

and the scheme partook of the nature of a supplementary contend that it is a social amelioration and economic upliftment retirement benefits under RA 660, i.e., that availment of said

pension/retirement plan proscribed by law. measure undertaken not only for the benefit of the SSS but more financial assistance under Res. 56 may not be done

so for the welfare of its qualified retiring employees. As such, it independently of but only in conjunction with the availment of

The law referred to above is RA 4968 (The Teves Retirement should be interpreted in a manner that would give the x x x most retirement benefits under RA 660, and that the former is in

Law), which took effect June 17, 1967 and amended CA 186 advantage to the recipient -- the retiring employees whose augmentation or supplementation of the latter benefits.

(otherwise known as the Government Service Insurance Act, or dedicated, loyal, lengthy and faithful service to the agency of

the GSIS Charter), making Sec. 28 (b) of the latter act read as government is recognized and amply rewarded -- the rationale Likewise, then SSS Administrator Cuisias historical overview of

follows: for the financial assistance plan. Petitioners reiterate the the origins and purpose of Res. 56 is very instructive and sheds

argument in their letter dated January 12, 1993 to COA that: much light on the controversy:[12]

(b) Hereafter, no insurance or retirement plan for officers or

employees shall be created by employer. All supplementary Motivation can be in the form of financial assistance, during Resolution No. 56, x x x, applies where a retiring SSS employee

retirement or pension plans heretofore in force in any their stay in the service or upon retirement, as in the SSS is qualified to claim under either RA 660 (pension benefit, that

government office, agency or instrumentality or corporation Financial Assistance Plan. This is so, because Government has is, 5 year lump sum pension and after 5 years, life time pension),

owned or controlled by the government, are hereby declared to have some attractive remuneration programs to encourage or RA 1616 (gratuity benefit plus return of contribution), at his

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 10 | 20

option. The benefits under RA 660 are entirely payable by GSIS That the Res. 56 package is labelled financial assistance does with respect to what rules and regulations may be promulgated

while those under RA 1616 are entirely shouldered by SSS not change its essential nature. Retirement benefits are, after all, by such a body, as well as with respect to what fields are subject

except the return of contribution by GSIS. a form of reward for an employees loyalty and service to the to regulation by it. It may not make rules and regulations which

employer, and are intended to help the employee enjoy the are inconsistent with the provisions of the Constitution or a

Resolution No. 56 came about upon observation that qualified remaining years of his life, lessening the burden of worrying statute, particularly the statute it is administering or which

SSS employees have invariably opted to retire under RA 1616 about his financial support or upkeep.[13] On the other hand, a created it, or which are in derogation of, or defeat, the purpose

instead of RA 660 because the total benefit under the former is pension partakes of the nature of retained wages of the retiree of a statute.[17] Though well-settled is the rule that retirement

much greater than the 5-year lump sum under the latter. As a for a dual purpose: to entice competent people to enter the laws are liberally interpreted in favor of the retiree,[18]

consequence, the SSS usually ended up virtually paying the government service, and to permit them to retire from the nevertheless, there is really nothing to interpret in either RA

entire retirement benefit, instead of GSIS which is the main service with relative security, not only for those who have 4968 or Res. 56, and correspondingly, the absence of any doubt

insurance carrier for government employees. Hence, the retained their vigor, but more so for those who have been as to the ultra-vires nature and illegality of the disputed

situation has become so expensive for SSS that a study of the incapacitated by illness or accident.[14] resolution constrains us to rule against petitioners.

problem became inevitable.

Is SSS Resolution No. 56 then within the ambit of and thus As a necessary consequence of the invalidity of Res. 56, we can

As a result of the study and upon the recommendation of its proscribed by Sec. 28 (b) of CA 186 as amended by RA 4968? hardly impute abuse of discretion of any sort to respondent

Actuary, the SSS Management recommended to the Social Commission for denying petitioners request for reconsideration

Security Commission that retiring employees who are qualified We answer in the affirmative. Said Sec. 28 (b) as amended by of the 3rd Indorsement of July 10, 1989. On the contrary, we

to claim under either RA 660 or 1616 should be encouraged to RA 4968 in no uncertain terms bars the creation of any hold that public respondent in its assailed Decision acted with

avail for themselves the life annuity under RA 660, as amended, insurance or retirement plan -- other than the GSIS -- for circumspection in denying petitioners claim. It reasoned thus:

with the SSS providing a financial assistance equivalent to the government officers and employees, in order to prevent the

difference between the benefit under RA 1616 (gratuity plus undue and inequitous proliferation of such plans. It is beyond After a careful evaluation of the facts herein obtaining, this

return of contribution) and the 5-year lump sum pension under cavil that Res. 56 contravenes the said provision of law and is Commission finds the instant request to be devoid of merit. It

RA 660. therefore invalid, void and of no effect. To ignore this and rule bears stress that the financial assistance contemplated under SSS

otherwise would be tantamount to permitting every other Resolution No. 56 is granted to SSS employees who opt to retire

The Social Security Commission, as the policy-making body of government office or agency to put up its own supplementary under R.A. No. 660. In fact, by the aggrieved parties own

the SSS approved the recommendation in line with its mandate retirement benefit plan under the guise of such financial admission (page 2 of the request for reconsideration dated

to insure the efficient, honest and economical administration of assistance. January 12, 1993), it is a financial assistance granted by the SSS

the provisions and purposes of this Act. (Section 3 (c) of the management to its employees, in addition to the retirement

Social Security Law). We are not unmindful of the laudable purposes for promulgating benefits under Republic Act No. 660. (underscoring supplied for

Res. 56, and the positive results it must have had, not only in emphasis) There is therefore no question, that the said financial

Necessarily, the situation was reversed with qualified SSS reducing costs and expenses on the part of the SSS in assistance partakes of the nature of a retirement benefit that has

employees opting to retire under RA No. 660 or RA 1146 connection with the pay-out of retirement benefits and the effect of modifying existing retirement laws particularly

instead of RA 1616, resulting in substantial savings for the SSS gratuities, but also in improving the quality of life for scores of R.A. No. 660.

despite its having to pay financial assistance. retirees. But it is simply beyond dispute that the SSS had no

authority to maintain and implement such retirement plan, Petitioners also asseverate that the scheme of financial

Until Resolution No. 56 was questioned by COA. (underscoring particularly in the face of the statutory prohibition. The SSS assistance under Res. 56 may be likened to the monetary

part of original text; italics ours) cannot, in the guise of rule-making, legislate or amend laws or benefits of government officials and employees who are paid,

worse, render them nugatory. over and above their salaries and allowances as provided by

Although such financial assistance package may have been statute, an additional honorarium in varying amounts. We find

instituted for noble, altruistic purposes as well as from self- It is doctrinal that in case of conflict between a statute and an this comparison baseless and misplaced. As clarified by the

interest and a desire to cut costs on the part of the SSS, administrative order, the former must prevail.[15] A rule or Solicitor General:[19]

nevertheless, it is beyond any dispute that such package regulation must conform to and be consistent with the

effectively constitutes a supplementary retirement plan. The fact provisions of the enabling statute in order for such rule or Petitioners comparison of SSS Resolution No. 56 with the

that it was designed to equalize the benefits receivable from RA regulation to be valid.[16] The rule-making power of a public honoraria given to government officials and employees of the

1616 with those payable under RA 660 and make the latter administrative body is a delegated legislative power, which it National Prosecution Service of the Department of Justice,

program more attractive, merely confirms the foregoing finding. may not use either to abridge the authority given it by the Office of the Government Corporate Counsel and even in the

Congress or the Constitution or to enlarge its power beyond the Office of the Solicitor General is devoid of any basis. The

scope intended. Constitutional and statutory provisions control monetary benefits or honoraria given to these officials or

02 OCTOBER 2017 LAW ON PUBLIC CORPORATION P a g e 11 | 20

employees are categorized as travelling and/or representation additional retirement benefits, on account of a bureaucratic boo- CAEDO, ROMEO C. QUILATAN, ESPERANZA

expenses which are incurred by them in the course of handling boo improvidently hatched by their higher-ups. It is clear to our FALLORINA, LOLITA BACANI, ARNULFO

cases, attending court/administrative hearings, or performing mind that petitioners applied for benefits under RA 660 only MADRIAGA, LEOCADIA S. FAJARDO, BENIGNO

other field work. These monetary benefits are given upon because of the incentives offered by Res. 56, and that absent BULAONG, SHIRLEY D. FLORENTINO, and LEA M.

rendition of service while the financial benefits under SSS such incentives, they would have without fail availed of RA MENDIOLA,

Resolution No. 56 are given upon retirement from service. 1616 instead. We likewise have no doubt that petitioners are Petitioners,

simply innocent bystanders in this whole bureaucratic rule- - versus -

In a last-ditch attempt to convince this Court that their position making/financial scheme-making drama, and that therefore, to COMMISSION ON AUDIT (COA), AMORSONIA B.

is tenable, petitioners invoke equity. They believe that they are the extent possible, petitioners ought not be penalized or made ESCARDA, MA. CRISTINA D. DIMAGIBA, and

deserving of justice and equity in their quest for financial to suffer as a result of the subsequently determined invalidity of REYNALDO P. VENTURA,

assistance under SSS Resolution No. 56, not so much because Res. 56, the promulgation and implementation of which they Respondents.

the SSS is one of the very few stable agencies of government had nothing to do with. G. R. No. 162372

where no doubt this recognition and reputation is earned x x x Promulgated:

but more so due to the miserable scale of compensation granted And here is where equity may properly be invoked: since SSS October 19, 2011

to employees in various agencies to include those obtaining in employees who are qualified for compulsory retirement at age

the SSS.[20] 65 or for optional retirement at a lower age are entitled to either This is a petition for review on certiorari under Rule 64 in

the life annuity under R.A. 660, as amended, or the gratuity relation to Rule 65 of the 1997 Rules of Court to annul and set

We must admit we sympathize with petitioners in their financial under R.A. 1616, as amended,[22] it appears that petitioners, aside the Commission on Audits Decision Nos. 2003-062 and

predicament as a result of their misplaced decision to avail of being qualified to avail of benefits under RA 660, may also 2004-004 dated March 18, 2003 and January 27, 2004,

retirement benefits under RA 660, with the false expectation that readily qualify under RA 1616. It would therefore not be respectively, for having been made without or in excess of

financial assistance under the disputed Res. 56 will also misplaced to enjoin the SSS to render all possible assistance to jurisdiction, or with grave abuse of discretion amounting to lack

materialize. Nevertheless, this Court has always held that equity, petitioners for the prompt processing and approval of their or excess of jurisdiction.

which has been aptly described as justice outside legality, is applications under RA 1616, and in the meantime, unless barred

applied only in the absence of, and never against, statutory law by existing regulations, to advance to petitioners the difference

or judicial rules of procedure.[21] In this case, equity cannot be between the amounts due under RA 1616, and the amounts they The Government Service Insurance System (GSIS) is joined by

applied to give validity and effect to Res. 56, which directly already obtained, if any, under RA 660. its Board of Trustees and officials, namely: Chairman

contravenes the clear mandate of the provisions of RA 4968. Hermogenes D. Concepcion, Jr.; Vice-Chairman and President

WHEREFORE, the petition is hereby DISMISSED for lack of and General Manager Winston F. Garcia (Garcia); Executive

Likewise, we cannot but be aware that the clear imbalance merit, there having been no grave abuse of discretion on the part Vice President and Chief Operating Officer Reynaldo P.

between the benefits available under RA 660 and those under of respondent Commission. The assailed Decision of public Palmiery; Trustees Leovigildo P. Arrellano, Elmer T. Bautista,

RA 1616 has created an unfair situation for it has shifted the respondent is AFFIRMED, and SSS Resolution No. 56 is hereby Leonora V. de Jesus, Fulgencio S. Factoran, Florino O. Ibaez,

burden of paying such benefits from the GSIS (the main declared ILLEGAL, VOID AND OF NO EFFECT. The SSS is and Aida C. Nocete; Senior Vice Presidents Aurora Mathay,

insurance carrier of government employees) to the SSS. Without hereby urged to assist petitioners and facilitate their applications Enriqueta Disuangco, Amalio Mallari, Lourdes Patag, and

the corrective effects of Res. 56, all retiring SSS employees under RA 1616, and to advance to them, unless barred by Asuncion C. Sindac; Vice Presidents Richard Martinez, Romeo

without exception will be impelled to avail of benefits under RA existing regulations, the corresponding amounts representing the C. Quilatan, and Gloria D. Caedo; and Managers Esperanza

1616. The cumulative effect of such availments on the financial difference between the two benefits programs. No costs. Fallorina, Lolita Bacani, Arnulfo Madriaga, Leocadia S.

standing and stability of the SSS is better left to actuarians. But Fajardo, Benigno Bulaong, Shirley D. Florentino, and Lea M.