0% found this document useful (0 votes)

717 views5 pagesModigliani-Miller Model Summary

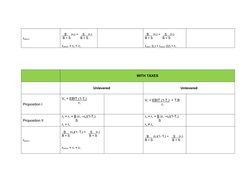

The document summarizes the Modigliani-Miller model with and without taxes. It presents two key propositions:

1) The value of a firm is equal to its earnings divided by the cost of capital, whether the firm is levered or unlevered.

2) The cost of equity is equal to the cost of capital plus a premium for financial risk. The levered firm has a higher cost of equity than the unlevered firm.

When taxes are included, the cost of debt is reduced by taxes paid, but the cost of equity and weighted average cost of capital formulas remain the same. An example application is also provided to illustrate the model without taxes.

Uploaded by

Anis SofiyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

717 views5 pagesModigliani-Miller Model Summary

The document summarizes the Modigliani-Miller model with and without taxes. It presents two key propositions:

1) The value of a firm is equal to its earnings divided by the cost of capital, whether the firm is levered or unlevered.

2) The cost of equity is equal to the cost of capital plus a premium for financial risk. The levered firm has a higher cost of equity than the unlevered firm.

When taxes are included, the cost of debt is reduced by taxes paid, but the cost of equity and weighted average cost of capital formulas remain the same. An example application is also provided to illustrate the model without taxes.

Uploaded by

Anis SofiyaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Overview of MM Model: Provides a summary of the Modigliani and Miller propositions with respective formulas and concepts without and with taxes.

- Application of Propositions Without Taxes: Explores specific applications of Modigliani and Miller propositions in a no-tax environment, using financial metrics and calculations.

- Application of Propositions With Taxes: Analyzes scenarios applying Modigliani and Miller propositions considering taxes, detailing impacts on unlevered and levered firms.

- Detailed Proposition Analysis: Delves into detailed analysis of Proposition II, emphasizing tax implications on financial structures and outcomes.