Professional Documents

Culture Documents

BSRM Steels LTD - Audited FS 19 PDF

BSRM Steels LTD - Audited FS 19 PDF

Uploaded by

Ahm Ferdous0 ratings0% found this document useful (0 votes)

157 views59 pagesOriginal Title

2.-BSRM-Steels-Ltd_Audited-FS-19.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

157 views59 pagesBSRM Steels LTD - Audited FS 19 PDF

BSRM Steels LTD - Audited FS 19 PDF

Uploaded by

Ahm FerdousCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 59

Auditor’s Report

&

Audited Financial Statements

Of

BSRM STEELS LIMITED.

For the year ended June 30, 2019.

rena rn svat

A.QASEM& CO, iS eteiten oe oe eae

Independent Auditor’s Report

To the Shareholders of BSRM Steels Limited

Report on the Audit of the Financial Statements

Opinion

We have audited the financial statements of BSRM Steels Limited(the Company), which comprise the statement

of financial position as at 30June, 2019, and the statement of profit or loss and other comprehensive income,

statement of changes in equity and statement of cash flows for the year then ended, and notes to the financial

statements, including a summary of significant accounting policies and other explanatory information,

In our opinion, the accompanying financial statements give true and fair view, in all material respects, of the

financial position of the Company as at 30June, 2019, and of its financial performance and its cash flows for the

year then ended in accordance with International Financial Reporting Standards (IFRS).

Basis for opinion

We conducted our audit in accordance with Intemational Standards on Auditing (ISAs). Our responsibilities

under those standards are further described in the Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the Company in accordance with the International

thies Standards Board for Accountants’ Code of Ethics for Professional Accountants (IESBA Code) together

with the ethical requirements that are relevant to our audit of the financial statements in Bangladesh, and we

hhave fulfilled our other ethical responsibilities in accordance with these requirements and the IESBA Code. We

believe thatthe audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Key audit matters

Key audit matters are those matters that, in our professional judgment, were of most significance in the audit of

the financial statements for 2018-19. These matters were addressed in the context of the audit of the financial

statements as a Whole, and in forming the auditor's opinion thereon, and we do not provide a separate opinion

tn these matters. For each matter below, our description of how our audit addressed the matter is provided in

that content

‘We have fulllled the responsibilities described in the Auditor’s responsibilities for the audit of the financial

statements section of our report, including in relation to these matters. Accordingly, our audit included the

Performance of procedures designed to respond to our assessment of the risks of material misstatement of the

financial statements. The results of our audit procedures, including the procedures performed to address the

matters below, provide the basis for our audit opinion on the accompanying financial statements

EY

EY rales tothe global orgeniztion, andlor one ot more of the independent member firms of Ernst & Young Glos! Limited mening wong

Key Audit Matter

How our audit addressed the key audit matter

‘The impact of the initial application of IFRS 15 on

‘the appropriateness of revenue recognition and

related disclosures - See note # 3.12 & #26 to the

financial statements.

Revenue of BD 61.060 billion is recognized in the

income statement of BSRM Steels Limited for the

‘year ended June 30, 2019. This material item is subject

to considerable inherent risk due to the complexity of

the systems necessary for properly recording and

identiying revenue and the high number of,

transactions from multiple region from which revenue

is being recognized. Against this background, the

proper application of the accounting standards is

considered to be complex and toa certain extent based |

‘on estimates and assumptions made by management,

In light ofthe fact thatthe high degree of complexity,

‘we assessed the Company's processes and controls for

recognizing revenue as part of our audit. Furthermore,

in order to mitigate the inherent risk in this audit area,

‘our audit approach included testing of the controls and

substantive audit procedures, ineluding:

We evaluated the Company's accounting policies

peeraining 10 revenue recognition and assessed

compliance withthe policies in terms of IFRS 15

Revenue from Contracts with Customers.

» We identified and tested controls related to

revenue recognition and our audit procedure

focused on assessing the invoicing and

‘measurement systems up to entries in the general

ledger. Examining customer invoices and receipts

‘of payment on a sample basis,

» We assessed that the contractual positions and

revenue for the year were presented and disclosed

in the financial statements

Key Audit Matter

Tow our audit addressed the key audit matter

Accuracy and completeness of disclosure of related |

party transactions - See note #10, #208 #38 to the |

financial statements,

We identified the accuracy and completeness of |

disclosure of related party transactions as set out in

respective notes to the financial statements as a key

audit matter due to the high volume of business

transactions with related parties during the year ended

30June 2019.

Our procedures in relation to the accuracy and

completeness of disclosure of related parties’

transactions included:

> Obiaining an understanding of the Company's

processes and procedures in respect of identifying

felated parties; approval and recording of related

party transactions including how management

etermines all transactions) balances with related

parties are determined at arm's length and entered

into in the normal course of business and further

fully diselosed in the financial statement,

> We tested, on a sample basis, related party

transaction’ with the underlying contracts and

other documents and for appropriate authorization

and epproval for such transaction.

We read minutes of shareholder meetings, board

meetings and minutes of meetings of those

charged with governance in connection with

transaction with related parties effected during the

Evaluating the completeness of the disclosures

through review of statutory information, books

and records and other documents obtained during

the course of our audit.

Other informati

included in the Company's 2018-19 Annual Report

“Management is responsible forthe other information. The other information comprises the information included

in the Annual Report, but does not include the Financial Statements and our Auditor's Report thereon.

‘Our opinion on the Financial Statements of the Company does not cover the other information and we do not

‘express any form of assurance conclusion thereon,

In connection with our audit ofthe nancial statements ofthe Company, our responsibilty isto read the other

information and, in doing so, consider whether the other information is materially inconsistent with the financial

statements of the Company and the Group of our knowledge obtained in the auditor otherwise appears to be

‘materially misstated, If, based on the work we have performed on the other information obtained prior to the

date of the auditor's report, we conclude that there is a material misstatement of this other information, we are

required to report that fact, Based on the information read and reviewed, we have nothing to report in this

regard,

Respons

ies of Management and Those Charged with Governance for the Financial Statements

‘Management is responsible for the preparation and fair presentation of the financial statements in accordance

with IFRSs, the Companies Act 1994, the Securities and Exchange Rules 1987 and other applicable laws and

regulations and for such internal control as management determines is necessary to enable the preparation of

financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company's ability to

continue as a going concem, disclosing, as applicable, matters related to going concern and using the going

concer basis of accounting Unless management cither intends to liquidate the Company or to cease operations,

(or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company's financial reporting process.

Auditor's responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free

from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our

‘pinion, Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in

accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arse from

fraud or error and are considered material if, individually or inthe aggregate, they could reasonably be expected

to influence the evonomic decisions of users taken on the basis ofthese financial statements.

‘As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional

skepticism throughout the audit, We also:

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or

eor, design and perform audit procedures responsive to those risks, and obtain audit evidence that is

sufficient and appropriate to provide a basis for our opinion. The isk of not detecting a material

misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion,

forgery, intentional omissions, mistepresentations, or the override of internal conte

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are

‘appropriate in the circumstances, but not forthe purpose of expressing an opinion on the effectiveness of the

‘Company's internal contro.

Evaluate the appropriateness of accounting polices used and the reasonableness of accounting estimates and

related disclosures made by management,

Conclude on the appropriateness of management's use of the going concern basis of accounting and, based

on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may

‘ast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a

v

‘material uncertainty exists, we are required to draw attention in our auditor's report tothe related disclosures

in the financial statements or, ifsuch disclosures are inadequate, to modify our opinion. Our conclusions are

based on the audit evidence obtained up to the date of our auditor’s report. However, future events or

conditions may cause the Company to cease to continue as a going concern.

Evaluate the overall presentation, structure and content ofthe financial statements, including the disclosures,

and whether the financial statements represent the underlying transactions and events in a manner that

achieves fair presentation,

‘We communicate with those charged with governance regarding, among other matters, the planned scope and.

timing of the audit and significant audit findings, including any significant deficiencies in internal control that

‘we identify during our audit

We also provide those charged with governance with a statement that we have complied with relevant ethical

requirements regarding independence, and to communicate with them all relationships and other matters that

‘may reasonably be thought to bear on our independence, and where applicable, related safeguards

From the matters communicated with those charged with governance, we determine those matters that were of

‘most significance in the audit of the financial statements of the current period and are therefore the key audit

matters. We describe these matters in our auditor's report unless law or regulation precludes public disclosure

about the matter or when, in extremely rare circumstances, we determine that a matter should not be

communicated in our report because the adverse consequences of doing so would reasonably be expected 10

‘outweigh the public interest benefits of such communication,

Report on other legal and regulatory requirements

In accordance with the Companies Act 1994 and the Securities and Exchange Rules 1987, we also report the

following:

i) We have obtained all the information and explanations which to the best of our knowledge and belief were

necessary for the purposes of our audit and made due verification thereof,

ii) In our opinion, proper books of account as required by law have been kept by the company so far as it

appeared from our examination of these books;

‘The statement of financial position and statement of profit or loss and other comprehensive income dealt

with by the report are in agreement with the books of account and returns; and

iv) The expenditure incurred was for the purposes of the company’s business.

A. Qasem & Co.

Chartered Accountants

Place: Chattogram

Date : September 16, 2019,

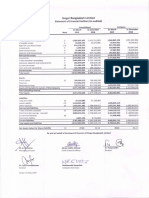

BSRM STEELS LIMITED

Statement of Financial Post

‘Asat June 30,2019

As at 30 June

019

ASSETS: Take Take

Now-Current Assets:

Propet, plant & equipment 4 -23,142,546283 —_9,563,331,987

Imangible Assess 5 48,503,285 27,629,844

Capita work-in-progress 6 Ms804831 2,841, 135.683

Investment in associates 1 347,000,041 __1,562.913,138

‘Total Now-Current Assets 26,793,863, 440_ —13,995,010,582

(Current Assets

Inventories 8 14.980.097.612—14,481,900.688,

Trade & Other Receivables 9 10,131,693.870 —— 6,460,423,187

Due fom related companies 10 8.505,984.818 6,970.340.583,

‘Advances, deposits and prepayments " 3976716412 2,954.281,030

Short Teem Investments 2 495,102,221 323,908,621

(Cash and cash equivalents a

Total Current Assets

Total Assets 45,680,555 312

nourry:

Share Capital 1402 3,789,528,000 _3,417,780,000,

Revaluation Reserve 7940930.965 —2,613.882,170,

Retained Earnings 9.196,763,654_ _6.777,298.362

Total Equity 30,897.219,619 900532

‘LIABILITIES

Now-Current Liabilities:

{Long term oa 1503 9,067,948,647——_+1,777,885,668

Defined benefit obligations Gratuity 16 164,439,863, 136,970,002

Defered tax abies 7 7301395,087 57.5.

‘Total Non-Curreat Lis T1.022.783.857_ __3.072.279.686,

‘Current Liabil

‘rade payable 8 3361610352 5,767,311,018,

Shor term loan 19 20.457,420,060_19.295.024,003,

‘Curremt portion of Long term loans 1802 2.294041,868——_1,093,625.713,

Duct related companies 20 4924790,19¢ —1,340.077.748,

Libis for expenses 2 011,064,188 4461 123854

Provision for income tax 2 732845,493 957,113,965

Provision for WPPF and Weifore Fund 23 107,383,636, 108,253,966,

Other Kailties 4 293,182,726 289,494,523

Contact abilities 2s 708,843,109 286,350,304

Total Current Lisbilites SS888.181,620_ _29,799.375,004

‘Total Liabilities $4.910.965,77_ —32,871,654,780

Equity & Liabilities GRB.IS4 796 15.80.5553

The accompanying notes 1 to 44 f ofthese financial statements, —,

Matvatte rector od ary

A. Qasem & Co.

Chartered Accountants

Place: Chatogram

Date : September 16,2019,

BSRM STEELS LIMITED

Statement of Profit oF Loss & Other Comprehensive Income

For the year ended June 30,2019

For the year ended 30 J

Notes 2019 2018

Ts

Revenue fom coniaets with ustomer 26 61,060,152,014 _48,289925,736

Cost of goods sold 27 __6,008.238,101) _ (43,410,757, 954)

Gross profit for the year 5051913913 4879,167,782

Seling and Distribution Expenses 28 (az27.104692)—(1304,112,525)

Administrative Expenses 2» (409.221,690

3.165,833.567

Other Operating come 3»

[Net Operating profit forthe year 369,052,974 580,697,858

Finance Costs 312.235.414.696) 039,113,061)

Finance Income 2 1,014,034,437 927369378

[Net Profit Before Tax and WPPF and Welfare Fa 2sT6TLT16 ——2,168908,175

Contribution 10 WPPF and Welfare Fund (107,383'536) 108,445.20)

7,040-289,080 | 2,060,488.966

Profit on Bargain Purchase 3 - 10,196,788

Share of profit of associates (Net oft) o 231,876,679

Net Profi before Tax 7308.532,437

Income tax expensex/benefi:

(Current Tax (arg.71220 ——_(552,700219)

Deferred tax 7 (131,421,082) 44,963,346

Not Profi after Tax 1,728,128,823 | 100,195.58

‘Other comprehensive income not tobe reclassified to profit or loss

Actuarial (0ss¥/gain on defined benefit plans 16 : 6.392.066)

Gain on evaluation of land (net of a8) 5340,715313 2

‘Share of tevauaton reserve of Associate (net of tx) 1.356,704.445

Total comprehensive income fr the year, net of tx Ba2S.S18.S81 1,797 40497

‘Total comprehensive income attributable to:

‘Owners ofthe company’ 8.428.548.581 797,403,492

45,548,581 _1,797,405,492

Earnings per share (EPS)

The accompanying notes 10 44 al pt ofthese financial statements

Mab Co tary

Signed as per our separate report of same dat

Place: Chattogram A. Qasem & Co,

Date: September 16,2019, (Chartered Accountants

GIN OT COROT

Too0"ss"e89)

90s'srs't

SIGOESOFEL

dS

6107 ‘0c aunp ye se aouereg

pred poop rou

aoare pongo pe so waning vonaidap aout sue nj

6107 “2unp O¢ Papua sax amp Joy xe1 Joye 101d 12N

donszs ese

SPr'rOL'9SE'T : siapossy Jo ansos91 uoREN|eAa1 Jo amy

. Pamss] auoys snuog,

- wonenjesoy puerT

Tes‘OVs 808 tae" s6r'LLL'9 8107 ‘10 Aing v6 se a9ueyeg

TES OUSBOBTI — TOPSOTLLED ——_OLVTSWEINT «OO USELIPE 8107 ‘oc sume ye se aouereR

Tourer) Tos eves) ; ped puoprasp jours

(ov0'z6e'e) (o90'z6e's) - suid young poujop wo ume}(ss

ere PBL'Y U6REN OT (eze'rse'r)) qunoure panyeaai pure soo uaastiaq uowetsaidap ut aouarayp

SSS'S6L'008'T ——_855'S6L'008'T £8107 ‘sung O€ popu s994 ayy 0 x1 JOYE 1YOId ION

‘pee esO'LET'T Ist'sae‘zs9 6L'S61'veS ‘OOSIE Jo uoR|sinboy

ess'sc'ereor —Lecors‘ozs'y = 909°010'rOI'z ooo'osecir'e £102 ‘10 Sing 38 se soueyet

nba veo |[ssueres pomeoy|] 2H | | ends aneys sunmogaed

6107 ‘0¢ 2unp papus seas a4 404

Aynbe wy soBuey Jo mous

GALATI STAGLS WASA

BSRM STEELS LIMITED

‘Statement of Cash Flows

For the year ended June 30, 2019

aa ss

Take “Taka

Cash flows from operating activities

Receipts from customers agains sales 37 824,569,044 ——47,363,113.218

CCash Paid to Suppliers, Operating and Other Expenses (60,572,087,318) (44,914,462,789)

Payment of interest-Net (1.221,380,259)_(1,011,743,683)

Income Tax Paid (702,980,574) ___ (684,574,633)

Net cash (used in)generated by operating activities G671.878.807) 752,382,113

Cash flows from investing activities

‘Acquistion of property, plant and equipment (8,609,432,909) (395,231,794)

Aadition of Capital work-inprogress 2695330813 (1,762,957,118)

Aiton of Intangible Assets (25816576) :

Proceeds from sale of property, plant and equipment 12,528,408 13,240,109

Increase in short term investments (171,193,600) 230,985,438

Net cash (used in)generated by investing activities (6.098,585,865) _(1,913,993.365)

Cash flows from financing activities

Dividend paid 41,775,000) ($12,662,500)

Receipt (Re-payment of long term loan 8,490,809,134 _1,198,081,650,

Receipts(Re-payment of Shor term loan 1,162,396,087 _(1,377,390,041)

Loan received from psi to) affliated companies and others 1,8490098,181—2,611,217,873

Decrease in Non-controlling interest (106,755,000)

Net cash provided by (used in) financing activities TIIOOSS I 1,612,451,982.

Net increase in cash and cash equivalent (abe) 390,065,700 450,790,729

© Opening cash and cash equivalents 524,690,721, 7389991,

Closing cash and cash equivalent (+e) 314,786,422 24,690,721

e

BSRM STEELS LIMITED

[Notes tothe Financial Statemeots

‘As at and for the year ended at 30 June 2019

1.00 Corporate tnformation

BBSRM Stes Limited (herein refered to as “BSL’, the company” was incorporated on 20 July, 2002, vide the extiate C-

No, 4392 of 2002 a Private Limited Company in Banplatesh under Companies Act 1996. The company was converted ta

Public Limited Company on 20 December 2006. The Company sisted with Dhaka Stock Exchange (OSE) and Chitagong Stock

xchange (CSE) a6 publi teded company. Trading ofthe shares of the company stared in two sock exchanges fom 18

Samay 2009.

‘The company has setup its rolling mil at 4, Foundetat Indusval Este, Latifpur,Sitakunda, Chitagong and commenced

commer prodcton from | Aptil 2008 The registered office of he company i sitte at Ali Mansion, 1207/1099, Sadarghat

Road, Citaong, Bangladesh.

‘The Honourable High Cour Division of Supreme Cour of Bagladesh ha approved the amalgamation of BSRM Iron Sel Co,

Lid (°BISCO) with BSRM Stels Limited 'BSRM°) on O8 August, 2017 and afer receiving the approval om The Honourable

igh Cout Division of Supreme Cour of Bangladesh and order fom the Regsar of loi Stock Companies and Fm, he Board

‘of Directors of BSRM Stel Limited has taken deison to effect the amalgamation from 01 October, 2017 and accordingly a per

the provision of sttion 228 & 229 ofthe Companies Act 1994 by wansering al aes and lites of BSRM Iron & Stel Co.

Liat ASIM Stes Limited.

‘The main objective ofthe company iso manufacture MS, products by seing up meling and reeling mils and marketing the

2.00 BASIS OF PREPARATION

2201 Statement of Compliance

‘The financial statements ave been prepred in accordance with the (Inerstional Financial Reporting Standards (IFRS), the

[Companies Act 1994, he Secures and Exchange Rules 1987 and other applicable las and regulations in angodssh, Cas ows

‘tom operating actives are prepared under dct metho a reserbed bythe Seuris and Exchange Ras 1987

(On 14 December 2017 the Inst of Chartered Accountants of Bangladesh (ICAB) has adopted Intemational Financ Reporting

Standards issued bythe International Aecourting Standards Board as IFRSs, As the [CAB previously adopted such standards as

Banglades Financial Reporting Standards without ary modiiation, this recent adoption will ot have any impact on the financial

statements ofthe Company going forward

A umber of new standards and amendments to standards are effective for anal periods begining on or fer 01 Jemiary 2018

dealer aplication Is permite.

2.02 Basis of Reporting

‘The financial statements ae prepared and presented for extemal wsers bythe company in scordance with identified! financial

reporting framework. Presentation has been made in compliance with the reqiemens of IAS 1 ~ “Presetation of Financial

Statements” The financial statements comprise of

2) A statement of financial position asa 30 June 2019

b) A statement of profi or loss and other compechensve income forthe year ended 30 June 2019

€) A statement of changes in equity forthe year ended 30 June 2019,

£8) statement of sh flows forthe yar ended 30 June 2019

«) Notes, comprising summary of nian ecouning policies an explanatory information,

2103 Other Regulatory Compliances

The company i ako required 10 comply with he eloing mar laws and regulations along with the Companies Act 1994:

‘The come Tax Orinanes, 1984

‘The Income Tax Rules, 1984

‘The Value Added Tax Act, 1998

The Vale Added Tax Rules, 1991

The Secures and Exchange Ordinance, 1969

“The Secures and Exchange Rules, 1987

‘Secuttis and Exchange Commission Act, 193

‘The Customs Act, 1969

8

c

b,

E

F

«

H,

L

‘These Finacial statements forthe year ended June 30,2019 have boon authorized for issue by the Board of Directors on 1h

September, 2019,

2.05 Basi of Measurement

‘Thee financial statements have been prepared ongoing concen bass under the historia cost convention except for some classes

of property, plant and equipment which are measured at ealued amount

206 Funetional and Presentation Curreney

‘These fnincial statements are presented in Bangladesh Taka (BDT) which i the company’ functional cureney. All oan

information presented in BD Taka hasbeen rounded of the nearest Taka excopt when eherwise Indicated,

2207 Going Concern

‘The Company has adequate esources to continue its operation for fresecable future and hence, the Financial statements have been

repre on going concem bss, As per managements assent there sre no meri uncertainties related to events o conditions

‘hich may east sgnfcant doubt upon the company's bility to cominue as gong concen.

Use of Estimates and Judgments

‘The prpartion of financial statements in conformity wih IFRS roqies management to make judgments, estimate and

assumptions that affect the aplication of accounting policies and the reported amounts of sels, allies, income and expenses

Enimates and assumption are reviewed onan ongoing bi

The estimates and underlying asumptons are based on past experience and various othe factors tat are blieved tobe reasonable

under the ccumstances, the result of which form the basis of making judgments about the carying values of asets and lilies

‘hat are not readily apparent rom other sources. Actual rsults may ifr fom these estimates.

Revisions to accountng estimates are recognised inthe period in which the estimate is revised if the revision affects only that

ei, onthe period of revision and fue periods ihe revision affects both curent and fture periods

In the process of applying entities accountng policies, management has made the following judgements, which have the most,

Significant effet onthe amounts recognised inthe nancial statements.

Proper plant and equipment ate: 400

Inangible asset Nate: 5.00

Inventories Nate: 8.00

Trade an oer rsevables ate: 9.00

Defined benefit obligations Gratuity Note: 16.00,

Deferred taxable Note: 17.00,

abies for expenses Nove: 21.00,

Provision for income ax Note: 22.00,

(Contingent iabilies Note: 40.00,

2.09 Investments in Associates

‘An associat san entity ove which the Group hs significant influence, Significh sence isthe power to participate inthe

financial and operating policy decisions of the investe, ut snot control o jin conv over those pols,

“The company's investment i astocstes is accounted for in the Financial Statements using the Equity Method. Uner the equity

method, the investment in an associate is inal recognied at cos, end the carying amount ie increased or decreased to

‘recognize the investors share ofthe prot or lst ofthe invete afer the date of acquisition which i lssified as noneurent

‘asses the statement of financial poston. The invests share of invests’ profit o asi reognized inthe investor's profit er

tos.

The stament of proto los reflects the company’s share ofthe resus of operations ofthe associate In adion, when thee has

licen change recognised ety in the equity ofthe asoclas, the company recognise it shar of any changs, when applicable,

fn the statement of shanges in equity. Unreaised gains and losses resuling fom wansactions berween the company ad the

soca ae eliminated tthe eteat of the interest in the soci.

‘The flancalstatements of the associate ae prepared forthe sme reporting pcos the Company.

210 Comparative Information

‘The financial statements provides Comparative infrmaton i respec ofthe previous period fr all amount reported inthe curent

pesio’s nancial statements. Comparative gure have been rearanged wherever considered necssry to ensure bate

ompaailiy with the current pio without easing any impact on the prt and value of ests and ibis a reported inthe

Fanci statment.

241 Consistency of presemation

Unies otherwise stated, te accountng polices and mathods of computition used in prepeition ofthe financial statements as

‘forthe year ened 30 June 2019 are consistent with these policies and methods appli in preparing te nancial statements

‘rhe yea ended 30 dune 2018,

300 SIGNIFICANT ACCOUNTING POLICIES

‘301 Current versus nomcurrent classification

‘The Company present assets and lables in th statement of fnacil potion based on cuenta suet clasifcaton

an assets eurrent when i

(© Expected tobe elise or mended sold or consumed nthe normal operating cyte

Held primarily forthe parpoe of trading

(© Expected tobe realised within twelve months aftr the epting period

oF

(© Cash orcash equivalent unless rested from beng exchanged or used to sel a iability fora east twelve

months arte repring period

Allotherases are clasifed as no-cutent,

‘Alibi is eurrent when:

© itis expe tbe sted inthe normal operating ele

(© Wished primarily for the purpose of trading

© Wisduetobesetled within tele months afer the reporting period

oF

(© There is no unconditional ght to defer the stlement of the ability for a ee twelve months fe the reporting

The company classifies aloe Libis as non cient,

Deferred ax assets and Hailes are classified a non-current estan bilities,

e

S08 Property, Pu

300 Fae Value Measurement

Fir value isthe price that would be receive f sell anasto paid to wane lability in an ordery transaction betwen market

Pariipant tthe messusment date. The fir valve measirement i based onthe presumption tha the ransetion 1 ell he asset

‘ewan the lib takes place either:

+ Inthe prinipl markt forthe asst or ibility

“Inthe absence ofa principal markt in the most advantageous market forthe aketo bility

‘When measuring the fr value ofan ae or ability, the emity es market obsorable daa as far as possible. Fle values are

categorie int ferent levels na five hierarchy ed onthe inputs wed in he valuation techniques as olows

Level 1: Quote prices (unadjusted) in active markets for idnial assets and ibis

Level 2: inputs eter than quoted pices included in Level I that are observable fr the asset or liability, either

let (Leas peices) or inet (i.e. dived fom prices),

Level Inputs forthe asset rib that re ot based on observable market data

he inputs sed to ease the fr valu of an ase or ibility might be categorize in fret levels ofthe fr ale hierarchy

‘she lowest evel input that is signifieant tothe entre measurement,

Flue relied disclosures for nancial instruments and non-financial assets th are measured a fi ale or where fi ales

are diclosed, are summarized inthe fllowing nots:

Property, plant and equipment under revaluation model Note

14 Equipment

tens of property, pan and equipments sated a cost, net of accurate depreciation and accumulated impsimen losses, if ny

Such cost inlodes the cost of replacing pat ofthe plan and equipment and borrowing costs for longer construction projects if

the recognition eters are met

‘The cost of an em of property, plan and equipment comprises:

1s purchase pric, import duty and non-refundable tases (ater dusting trade discount nd cet)

© Any cost dirty atibuable tothe acqison ofthe ase,

© The cost of sel-construredinstalld tests includes the cost of material, direst abou and any oer costs diel atribuable

‘obras the ass wo the locaton and condton necessary fr tt be capable of operat inthe intended manner andthe os of

sismanting ad removing the ems and restoring the site on which he ae locate

\When significant pans of plant and equipnent ae reqied wo be placed t interval the Group deprecits thm spare based

‘on ther specific wef lives Likewise, when a major inspeton Is perfomed. its eos is ecogised inthe cayng amount of the

plant and egupment asa replacement ifthe recognition ceria ere sate. Al ober fepair and malnonane costs ae recognised

in pric or fs as incurred. The preset value ofthe expected cost forthe desommisining ofan ase aer is ses inchded in

‘he cos of he espectiv asset if the ecognition criteria fora provision are met

“The cost of replacing or upgrading part of an iter of prope, plant an equipment i recognised inthe caring amount ofthe item

iit s probable that the future economic benefits embodied within the pat il low to the company and is cst can be measured

‘lily. The costo the day-to-day serving of prope, plat and equipment are ecorized in pofit or las.

&

Landis held oma feshold bass and isnot depreciate considering the walimited Hf. In rexpct of all other pope, pt and

equipment, deprecation is recognized in statement of prot or loss and other comprehensive income on sight line method over

"he estimated useful ves of propery, lam and equipment. Sigiicant parts of individual asset are assessed and i's component

has a use lie that i ferent fom the remainder of ht ait that component is depres separately.

Asset Category Useful Lives,

Plant & Machinery 128 year

Motor Vehicle 618 year

Fumiture nd Fintures Syear

Office Eauipment Sear

tory buildings 20 yer

Road and Pavements 20 year

Equipment ‘year

An item of propery, plant and euipnen and any significant part ntly recognised i derecognised upon dispose, at he date

"he recipient obtains contro or when no fate economic benefits are expected from is use or disposal. Any sano loss aiing on

‘derecogition ofthe asst (aeulated asthe dfeence between the net disposal proceeds and the caring amount ofthe ask!) it

inclded in the tatement of prot or loss when he ask isdrecognied

Reva

ion of Property, Plant

14 Equipment

‘Lands of the company were revalued by ACNABIN, Chartrod Accountants with asitance fom Pacific Surveyors Lt, BBL

‘Bhaban (Lesc-13), 12 Karwan Bszar Commercial Area, Dhak a8 a 7 August 2019. These asst were revalicd sing the ‘ir

‘market pie att loations and condition. A per evaation repo, the revaluation supisstod at BOT 5 607,062.337. This

revaluation has been recognized inthe books ofthe company it Jute 30, 2019.

Further disclosure rating to revaluation of and is provide in Ampexte

{Property plant and equipment (Revaluation model) Note 400

relation surplus is recorded in OCT and credited to the aset evaluation surplus in equity. However, to the extent ha it

revere evaluation dfs ofthe sme aset previously recognised in profit or los, the increase recognised in profit and loss.

2 revaluation deficit i ecogised inthe statement of profit or los, excep to the exert that toffee an existing sp 0 the

same asset econied inthe sae revation sp

An annus ante from the asst revaluation surplus to retained earnings i made fr the diference been deqreiton based on

the revalued carying amount ofthe asset and depreciation based on the aie’ original cost Additionally, accumulated

‘epreciton a the revaluation date eiminated aginst the gross carrying umount of the asst and the net amount is esate 1

the revalued amount ofthe asset, Upon disposal, any revaluation surplus lating to the paricular st Being sod i ranted 9

rained caning,

3.05 Intangible Aset

Intangible assets acauired separately ae measured on initial recognition at ast. The cost of intangible ses acquired in a busines

‘combination i ther fi value at he date of acquisition. Following inital recognition, intangible acts are cae cost es any

sccumulated amortisation and accumulated impaimnent loss. Interaly generated intangibles, excading capitalised developent

‘ots, are not capitalised an the related expenditure is elected in poi o ss in the petod in which the expendi i inated

The usefl ives of intangible asacts are assessed as citer finite or indefinite.

10

Intangible assets wth Site lives ae amortized over the wef economic fe and assessed for imprment whenever there is an

indication thatthe intangible suet may be pated. The anortsaton period and the amorstion method fran intangible asset

ith a fit sf fife ae reviewed at leat a the end of ec reporting period. Changes inthe expect useful fe or the expected

Patt of cocsumption of future economic benefits embodied inthe aset ae considered to modi the amortisation period 0°

Iehod, a8 approprss, and are ead as changes in accountng estimates. The amortstion expense on intangible ase wih

fie lives it recognised inthe statment of profit or loss in te expense category that is consistent with the fnction of the

mangle assets

Intangible assets with indefinite well lives ate ao mortise, but are etd for mpsiment annul, either ndvidually o atthe

cas generating unt level. The assesment of indfite life reviewed anual to eteine whee he indefinite life continues

tobe supportable. If ot, the change in useful ie om indefinite to nite fs made on a prospective bass

‘am intangible ase ie recognised upon disposal (Le at the date the recipient obiins cont!) or when no fture economic

benefits ar expected fom Hs we or disposal. Any gan or los arising upon drecognitin ofthe asst calculated a the difference

btwsen he nt disposal proceeds ad he carrying amount of he assets incided in he statement of proto ss.

A summary ofthe intangible assets, 5 Follows

“Teade Mark oracle 85 Sonware

Tear ) Finite 10 yen)

JAmorised ona straight ine Amortised ona

‘Amortsation method used aris straight line bass

era snr Acquired Acquired

3.06 Borrowing Costs

Borrowing costs directly atibuable tothe soquison eonstrton or prodution ofa ase that nce takes a substantial

sid of ime to gt rey for its intended seo sl are capitalized as part ofthe cot ofthese, Al eter baring oss ae

"xpensd inthe period in which they occur. Borrowing cost eons of ltrs an cher cst that an entity incurs in connection

‘vith borrowing of und,

3.07 Inventories

Inventories re measured atthe lower of eos and net realizable value

Cots inured in bringing each product tits present locaton and condition are accounted fe, follows:

{Raw mitra purchase cost ona weighted average bis

§ Fished goods and workin progres: cost of dret matt and labour and a proportion of manuactaring

‘overheads based on the normal operating capo, but excluding borowing cos.

[Net elsble value i he estimated sling price inthe ortinary couse of busines, less estimate costs of completion and the

tinted costs cesar to make the sale

3.08 Financial struments

‘finns struments ny cont hat gives ie oa financial att of ne entity and financial bili regu istrament of

nother entity

‘9 Financia assets

‘The company intalyrecognies loans and receivables and deposits onthe date hat they are oiginate, Al the ancl assets

re reeognid ily on the date hich the company bacomea party to the costractua provslons of the insurers.

. &

309

310

Financia assets are casi ino the following categories: financial ates a se value through profit or los, held to maturity,

Touns ad ecelable and avalble-forsale aaa ase.

2 nancial assets classified as at fir value though prof or los i tis eld for trading which acquired orneued pincialy

forthe purpose of selling oF epuehasing it in the nearer.

Held-o-maury invesments ae nonderivatve financial assis with fixed or determinable payments and fied maturity tat an

‘nty has the postive intetion and ability to hold to maturity. These sels ae inl recognised at fr valu plos my

‘rasan costs. Subsequent inal ecognion, they are measured at smortied cost using he eflesiveinret method

‘Loans ad receivables are nondeivative financial assets with fed ot determinable payments that are not uted in an ative

market. Such assets ae recognised intl a ur value pls any directly atibuable transaction cots. Sobwequent tial

‘scopnton, loans and receivables are measure a amortsed cost using the effestive interest method

Avallabeforsae financial assets are thove non-dervatve nancial ast that ae designated ae available forsale and ae not

Clasifed in anyother ctegoes of nancial asset. Generally, available forsale final ase are recognised nally at it

‘ale pls any dtetyatibutable wansaction cows and subsequent to inal recognition at fur vale othe than impairment losses

!ne recognized in thes comprehensive income.

4) Financia Waites

Financia iis are classified, a ntl recognition, as Gmail Ubiliies ot fr value plus wansaton eos that ae drety

tribuabe othe sue oF the Sania bil.

Am emi shall ecognise a financial ability ints statement of financial position when, and only when, heen becomes party

tothe eantaetsl provisions of he nerument

‘Loans and borrowings derivatives and payables re recognised slits when the entity becomes pry to the contac and as

a consequence, has alga obligton to pay cash.

‘After nil recognition, amenity shall measre ll nail isbilities a amortsed cost wing the eectve interest metho except

for financial abilities afi vale through profit or los, nancial ible that arise when transfer of nancial ase does nt

‘qualify for dereogniton,financiel guarantee contracts and commitnets to provide a oa ata below-market nee rae

Financia bites that are designated as hedged items are subject to the hedge accounting

‘Cash and cash equivalents

Csi and shore depois inthe statement of financial postion comprise ssh at hanks and on hand ad short-term deposits

vith amatryof thee mont ress, which are subject oa insignia sk of changes in vale

For the purpose ofthe statement of esh flows, cash and cas equivalents consi of cash and sorctem depos, a defined above,

nt of outstanding bank overrats as they are considered an integral pt of the company’s cash mangement.

Provisions, Contingent lability and C

ingen assets

Genera!

Provisions are recognised when the Company has a present obligation (egal or constructive) as result of past even, itis

probable that an culo of resources embodying economic benefits wl be required to ste the obligation snd a lable estimate

an be made of te amount of the obligation, When the Company expt same oll ofa provision o be reimbursed, for ramps

under an insurance contract, the reimbursement is recognised as Separate ase, bat only when the reimbursement is vill,

rain. The expense relating oa prvison i presented inthe saement of proto los net fay enbursement.

2

the eet of the time vale of money is material, provisions are discounted using a cutent prea tate tat reflects, when

appropriate, the sk specific tothe Hality. When discouig is used, the increase i he provision duet he passage of ime it

capri a «Bance ane

Contingent abies

Contingent ibility isa present obligation tha arses fom past events but is not recognised because It isnot probable that an

outow of resources enbodyng ceaomic benefits will be requted ta Stle the obligation and he amount ofthe obligation eannat

be messed wih sufientrelibiliy

Am amount of Tk. 23,083,915 27 was claimed by Customs, Excise and VAT authority, Bondor Cirle, Narayango) vide nothin.

VAT Warehouse (2 Bondorcicle/2012207 ated 03 November, 2014 for wade VAT onsale of 118269 MT Finishes goods

‘The company fled & writ petition 0.10833 of 2018 before the Honourable High Court Division of the Supreme Court of

‘Bangladesh andthe cou stayed the claim n view of above, no provision fo this lnm hasbeen made in he Finacial statmens,

Employee Benes

‘The company maintain both defined contribution plan and defined beef plan or its lhe permanent employes.

‘Defined Contribution plan

Defined contribution pln sa post employment benef plan under which te Company provides Benefis forall ofits permanent

‘employes. The recognised Employee Provident Fund is being considered as defined contribution plana it meets the recognition

‘itera specified for this purpose. All permanent employees contbute 10% of thei basic salary t the provident fund and the

Company also makes equal contibution This fd is recognised hy the National Board of Revenve (NBR), ander the First

Sched, Part B of Income Tax Ordinance 1984, The Company recognises contribution o defined contribution pan as an expense

wen an employee has rendered required services. The lal and constutve obligation is limited tothe amount it agrees to

contrbute othe fund. Obligations are created when they ae ue.

Defined beset plan

‘The company mainiains an unfunded gratuity scheme and provision in respect of whichis made annually forthe erployes

‘Gatiy benefit shal be payable onthe basis of company sevice andthe lst drawn basic salary ofthe employee as pe the

‘ollowing abl at th end of tremor, death inservice lasing employnent

Service length Benen

Less than S yeas of sevice Nil

qual oor more than § year of service “Two months lst awa basi slay foreach yar of sevice

‘Workers profi partspation and welfare funds

The company also recopised provision for workers profit participation and welfare funds @ 5% of net profit before tmx as per

Banglades our lw 2006

Revenue

‘The company bas applied IFRS 15 using the cumulative effet mathod and therefore the comparative information has not been

‘esated and continues tobe report under IAS 18, Under IFRS 1S, revenue is measured based on the consideration pected ina

‘onrat with a ester. The company recognizes revene when sisi a perfomance obistion by transfering contol over

goods toa customer.

“The company isin the business of providing MS. Bll and MLS. Rod, Revenue from coasts with customers i recognised when

‘cont! af the goods ae transfered tothe estomer aan amount tht eles the consideration whieh he Company expt to Be

‘led in exchange for those goods. The Company has generally conclude that iis the principal in is revenve arangemen'

because it pally contol the goods before eanferring tem tthe eustmer.

Revenue fom the sale of goods is measured atthe fie valu of the consideration recived or receivable net of Value Added Tax

(VAT). Gros tamover comprises local sles of MS. Rod, MS Billet, export of MS. Rod and includes VAT paid tthe

sas

sa

The company’s type performance obligations include the folowing

When perormance

Performance Obligation ices typeally

obligation sats ‘etinated

Revenue frm contracts with customers:

Bangladesh Pointin ime st factory gate The customer can poy the As pet management

transaction pice equal the exh approved pices.

Selig price in advance oF allowed

‘ere petod of 30 w 60 days.

India Poinintime at factory gate The estomer can pay the As pat management

transaction pice equal to the cash approved pres

seling price in advance oF allowed

eet petod of 301060 days.

“The Company considers whether there are other promise in he cont that ae separate performance obligation 19 which 2

ponton of the ansacion rice needs to be alloted In detemining the ansaction price for local sakes, the Company considers the

‘fot of variable consideration payable wo the customer

“The Company has variable considerations inched inthe contract with customers which are net off aginst the revenie fo

-atrminethewanscton pie. The variable onsdeaions are pre-determined. The fect of vaibl considerations on revenue s

‘nly rom coneat With ol customer

Earnings Per Share

Base engs po share (EPS) i excused by divdag the profit or loss forthe year by the weighed average numb of xdinary

shares outstanding during the year.

Dit EPS calculated by diving the net potable to orinry equity Roles ofthe Fund bythe weighed average

numb fordiary shares oustanding during the yea

‘Segment information

For management purposes, the company is organised nt business uns based on its product and has two reporbe segments, as

fallow

§ The MS Rod segment which produces diferent graded Ro¢ and sll he same to several dealers, end uss, ther corporate users

and some dcemed export to EPZ based companies.

{The MS Billets segment which produess diferent graded Biles and wansfer the sme wo produce MS Rod

‘No operating segments have een ageregated to form the above reportable operating septs.

“

‘The Company Secretary and General Manager Finance and Accounts i the Chief Operating Dession Maker (CODM) and

‘monitors the operating results ofits business units separately for the purpose of making dessins abou resource allocation and

performance assesment. Segment performance is evaluated based on profit or loss, Also, the company's financing (including

finance cost and finance income) and income taxes are managed on aguegaely and ae not lloeated 1a operating segments

Assets and Lisbilies ofthe company are maintained agaregately due to that, thse ate wot provided to the Chief Operating

Desision Make and are not allocated to operating segments.

‘Transfer prices between operating sepmeats are on an ans length basis in manner similar to ransations with hid pats,

‘Year ended MS. Rod MS. Billets Seomneg Adjustments Total

30 Jane 2019

Amount in Mitions

Revenue

External customers a7348 712 61,060 61,060

Intersegment 2i01 24912491)

Tota Revense Tae T6205 3.551 G91) a1 060

Income(Expenses)

— es (3,268) (4335) (97803) 2,303 ($5,500)

Employee benefits expenses (606) @52) 38) 838)

Depreciation and amertisaton (55) 65) 5)

Selling and distbuton cost 97) «07 (1072)

Adminiseative casts 2) 223) 23)

Share of profit of an asocate = a 298298

Segment Profit zt Tale 580 am) 3.58

Recomeilation of profit 209 2018

Segment profit 3si0 S98

Intrseument sales (is) 29)

‘ier operating income 16 4

Finance Costs 2235) 2.039)

inane income tole 27

Ceniaon "> WPF an ‘ign con

Profit on bargin purchase - 10

Shaw of profit of an ssosiate 298 238

Profit before 2338 208

Geographie torn 201g 201s

Revenue from exter

Country of Domicile 60.865.630026 | 4,160,129.934

Foreign Couns 194512.988 129,795,805,

Tata ioo0.9,014 —W.2895928.737

‘The revenue infomation above i based on the locations ofthe customers.

Revenue fom one eustomer amounted 10 BDT. 12927,719,47 arising fom sales inthe M.S Billets segment whichis 21.79% of

tot sles,

"Nomcurent ase infrmation has nt presented inthe financial statements and snot avallable secording to the geographical are.

L

15

3:15 Capital management

ae

a

Forthe purpose f the Company's capital management, capital includes issued capital, The primary objective ofthe Company's

capital management i 0 maximise the sharholéer value

‘The Company manages capa structure and makes austen in ight of changes in eo nomi codons andthe requlemeas

‘of the fimancial covenants. To maintain or adjust the capital structure, the company may adjust the dividend payment 10

Storcolders, ream capita oshaeholers o sue new shares. The Company monitors capital using a gearing ratio, which is net.

debt divided by vr capital pls net bt, The Company has faansal covenants to maintain the gearing ratio 70:30 or btier. The

Company incudes within net dt, incest bearing loans and borrowing less cash and cash equivalents.

2019 2018

Inert bearing loan 11361990515, 2,871,181,381

Short erm loan 203857420050 19,295'924003,

Less Cath and Cash quivalnts susse20 soason22)

Net Debt O.905.S4183 62414663

aay 2n307219619 12808900832

“Toa Capita 20397219619 12,808 900.532

Capital and net debe S1S01373772 4451315195

Gearing Ratio Bs6% 282%

Event ater the reporting period

[vents afer the rpsting period tht provide eddtona information about the companys postion atthe das of Statement of

Financial Position or those tat inca the going concer assumption isnot appropiate are refected in the Financial Statements

Evens fer the reporting period tha ae not ajstng events re disclosed in the notes when materia

‘Standards sued Dut nt ye fective

FERS 16 Lenses

IFRS 16 was isced in January 2016 andi eplaces IAS 17 Leates, RICA Determining whether an Arrangement consis a Lease,

S1C-15 Operating Lease-Incentives and SIC-27 Evaluating the Substance of Transactions Involving the Lezal For of a Leas.

TRS 16 set out dhe principles forthe revogallon, neasurenent presen and dssosure of aes and reales esses (e

scout forall lates under a singe on-blsnce sheet model inl o the accounting for Hance laces under IAS 17. The standard

Includes two recognition exemptions for lessees leases of "on-valus asst (ea, personal computa) and shore eases (Le,

leases wih lease tem of 12 months oss). At the commencement doo ease, a lesen will recognise lib) to make lease

‘aymen i the ese ibility and an asst represemting the righ to use the undering asst during the lease tem (i. the igh-

‘fs ss, Lessees wl be equied to separately ecognise the intrest expense on the lease liability andthe deprecation expense

cote ahofuse asset,

esses wl be alo required to remeasure the eas shiliy upon the ocurenceof certain events (eg change inthe lease tem,

8 change in fre lease payments resulting from a change in an index orate used to determine those payments). The lessee will

senerallyresgnie the amount of he re-measucmnent ofthe lease lilt as an adjusnent to the righ-o-ae as.

Lessor aeountng under IFRS 16 is subtantlly unchanged from toys accounting der IAS 17, Lessors will continue 0

last all eases using the same classification picile as in 4S 17 and distinguish between two types of eases: operating and

Tinance leases

RS 16, which i effective for annua periods beginning on or afer 1 January 2019, requires lessees and Iessors to make more

tensive disclosures thn under IAS 17

16

we,

Sa

aa — ow

&

vis wut

TE — aoe

suwcanae rvs

PSEC ‘s1oz9o0e 1 sy

ANTONY ONIAIVD

ETO HTH WCE 6107"20n¢ 0g ve 2.0

eae ~ Torso

HISTSUE9 covereoer

orsuoreare eset

cS wreare SED

rg

eves

oa mse ere t0ress

oreussost S00 385 15 siveccete

TOTVELE SELF aESGOTAT aor Wass

Torssrer) ov Tao (os on TeavLEE SO)

weetuw’s 00's

cczerows crus aaseor'st roster is

wsreecow'el Sur IELS swcisort orreteon Lar esvise'e

FREDO aS TPCT

score

savior

vesuzemt rovoneus

wiot pur specs Jp amruns, “oe some

POI HOMERIC Y= ANGNUATAOA NVI ALEMIONA. OF

TTT — orice ves LIF Tor BOP Torreon weTeVOL cor eoreIee ST WECST

TGFETOND Le 90'6 vow ereLE —— SLOISE IF etic TFS8L9—— FIFOSEPITT — FLFZIOTSEDL

Tosiet Tara DOOR EL Tats GFE LIOZOE

(ESTHET 7 Tse oe a Ts896E

sav ous'909 sos'eze's ——_os's10'ut 98s'209'311 Ley c10'6te

ourseD se sosserec ——onso'se our t9c'ere ous tor 982

‘sere oOse SorserOE OFF OTST SIF Tore SIS TOF SRST

Tow¥sroD > - LEC O)

aso'stvt 9s'tes'te wscosr'ole 2p Samp airy

Lest ooezee tat ee t07'es6 ‘ste yo 20uren Buwwado,

revnar's soesiste — cocurdyer —ueWuuYS —sswecreee't e107 ing 10 wo se ouEE

TOT WEALTH —_ONITATS soar TEWTOST — coz sung 9g wo se sume

~ Toos ve) (sex ven) = Tavuee) i860)

aecuisice arrests 224 3 Bump supp

cis'sones PLSTIO‘SEO'L — g10c"Me 19 Ho 8 oH

HOS FEETIOGET

re tees6E asc'oce fe sovcrc'ee

1109 Prepayments

ura esis sign

Tessa aa

1200 Shot Te nesimest

InvrnorsinFned Depo Rests no 4os.o.201 sonst

Beira weer

1201 tnveniens in Fed Dees Resp

ames rece

inet neon wide onan ross

‘he Cy Se Lmtd tess usin “9.5000

Hab Be inte tenes Dome? ase

NCC Bee Limi thre as 158

Ue Conmees Baa tiied La aan "me

Commercal Dako Colon PLC LE Maga rowan ——_tsomnan0

nia eg France nt Ue ose denen 347758

{Le Fence Lined eset aassoes ——2717a91

‘tran Bi Lied 0 LC Mai Soaoo 32887

Steed Cat ak ‘estan awargm —ronso108

[SD Fiane esnen Col eset ‘aims 3aa5es

{RC Bank ies LeMeraa dams 0592

[POC BagneshLinid Imam dims a6

‘A Atk id Lenn oti $3900

‘aa tema aaonass :

nwa Lim Invest SATS 256708

So ated LeNie aise :

‘ba on Li Lene 2y0iss3s 2.7000

na Hon

1340 Cash Cas gates

Gain no sess255 gest a0

Cota an a srsnsas sane

id Depot Resins as duis syeseaon

Se Sa

1901 cain:

deme asin sae

kay Sopp ino bo

Fray oie ssi 250000

Dita te om 2150007

Sitar iwo00 rioo0

oi sino seo

Knee ‘sna m6:

epee 6238

Mimemingh oe neo mam

Jonelalse amat0 ‘seat

Baron 409 20913

eel Wate fe on.00 528)

‘Sede agi

ae, oa

1302 Chat ani:

Same aes Brash

soem me 8C0) eee

‘Nok i eat

‘sen tamsu imemcoy ha

ore

ra

es

Sua ino Led Scrat

Sangean eet ascoy hea

Enea ee ‘eb

‘hae nd tos

tse ond

‘ek nid ead

thet mit 0) saat

Nara ghd sehen

Voom mana ine sco) oie oo

‘seen ined ‘eee

‘net ie 80) Soon)

avon nist scoy “Dat

Scan tm co) shea

Nec ina NCO) soo

Neca tinte sod

Crete Unt seed

Ni sed

‘ona nt ti

Seta itewbek ach o8co) oh an

Snack sat

Sirk tose ewe

‘fected fed

“tec hk asco) sos

“at ne 0) canons

{Connect a 850) oe aa

‘Sten nt vob

open ni oy Se

10 one soot

eisai (50) a

Na an oven

Neo poa inn! oad

ary ea init ‘See

‘Son bes trond ‘ba

ep in| copra

sZonaens “aa

tae sos

Neekin soot

son ‘ont

‘sh ns Sood

Nc enced poet

ont nse ate

Sonus ned “oat

“Naciy hatin sent

snakn ea

‘lank nian ate nl wakes mp bulbs sho inte bank ok reeset bak eve,

Accom

‘See Oo

‘ame st

et Dee

eet

‘eet oe

met Dee

ae Cpa

‘et eat

amet Ost

et Dee

ime at

me Dee

me Det

‘at ae

‘Sine Doo

meta

‘De

me epat

‘ne Dee

‘no Det

ime Ost

‘mea

‘ma pat

‘ime Depot

‘na Deo

‘no Det

‘ime Ot

et Depa

‘ma eat

‘et Oe

‘met Det

met et

Geet Dee

‘ne oat

cme Det

‘nee

‘me Dot

ime Da

‘ine Depot

‘me Dt

Ce Dest

‘ne Dopt

‘ino Dost

ime Det

‘ine Depot

{me Orit

me Depot

Sine Dot

‘ime Dot

et Dot

Seopa

men Dot

caret

‘no Dot

Core ep

Care eat

‘cme mot

Care eat

‘car eat

‘cet et

Coe eo

‘Cue Deon

SSG5SS S598 95 554 05 FRG GENRES SGEEREGEGEEERRSESEERE SSD

gags

(one

raise,

a

2500

oe

ves,

sis

vasa

ssn

sco

sass

Bie

mains

etacies

‘at

sea

Sara

maine

‘a

demas

vase

ssa

ss

20

cps

sats

sean

ast

epsasie

wie

1308 Had Dep seas

‘Sameotbanks ume Faring Rate ainterest

Abas Us UcMasie Sone %

‘Nem lr an a Ue Marin Sent Ea

nk Asin Limi ewan 3 mons 5525%

uch Bangla Bank Lined Ue wargis 3 mons som

hk Hak Lied Uc wie Sms oun

amar Ban iid Le wars 3 mons 30%

Morena Lined BGRLC Musi Smosh Somme

NEC Bank Lined UC Margin Sens Some

evr! Bon itd Uc ware Sons Stame

ra Bak Lined corse 3 moans 430550%

‘The Cy Ban Lite UC Main Sens ssa

United Commer Bak Li, UC Marin Sens a7

‘rs Ban Lie Le warn 3 mons ‘som

9 Share Cana:

4D Authorize opt

"75000000 Orin tre @ Te 10 en

2Son0000Peteace Shares @ TL. Deck

143.000.00 Orayses @ Tk 0 ach

04,3000 Ory sare T. 0 ech iy pup for sonsieration othe tan ath

21,750.00 Cx shes TR Oech aly pid ps Bom Shores (Fae Je 200)

54251,000 Ory shares @ TK. 10 ah yp ps Hos Shares Fr hepa ended 2010)

19273.0m Orin stares (2 TO aly ld was Bos tes (For er ede 2012),

7.50 Ordinyshares@ Te. 1 ack aly pad

1408 Chinon o shares by holding:

‘ls ter oss

Us an 308,

Fro 3.01 10000

Fro 10019 20000

From 2001930000

From 300019 40000

rm 5,011 100000

Fron 10 001 1.0.00

"408 Shasblling Posi;

Damecststarsbabers:

Spon Shareoles

(ther Sasol Reid Pari)

‘ter Sasa (Cenes

2 aa Stes (Fore ended 2018)

3300

33

a

os

a

ast

uae 3

ro

so

100%

Novo hares

Sas

oisox

98.00

+920 900 :

Hasn276 =

ssn6055, 36,300;810,

Sias3.s8 25960987

town y76803,

siatigat

oars "

wasn soaioazt

DooeTt —aonns9s

sez 3378088

ositw 2950000,

ooo. 000- 00.01, 500-

L4soo00010 489000000,

oso00m0 1 pssne0.00,

1700000 21700000

S2si0.00 542301000

3175.00 -

9 2500

ovot Shares Hating (4)

aa wae

359.16

suns

239676

ses

90029

aa

Toast

oe bua

ses asses

os 77400

1500

1801

sa

LonastemJoans:

Prine Bak Limits

tom Bank Lint: Sytem oan

DLC Fnanee Limes

Meghna Bank Limited

Redeemable ere Coupon Band

Midas nance Lied

‘Longer fame Maturity anaes

ae within oe year Cure portion

ue afer more han one ear Nancuent portion

Prime Bank Lites

Ester Bank Limited: Syne em an

Sandud Chartered Rank Syed ters oan

Megha Bark Limited

Redeemable Zere Coupon Bod

Mies Face Linas

Pre Ha Limes

Este Bank Limited: Syne erm an

Sandi Charred Bonk -Syete ta oan

Rodeamable Zero Coupon Bod

15065

1507

1508

1509)

1810

sees gma

somausire 1.086.280

BORD 612996107

° eo

: 670866

sumooasia

Saeostals 102810010

ETERS XCAR

aamoansss — onsasm

soeoaieny __Lzssest

Tiserg9asis: asst

ozs asaz7i8810

367.138

: 6742866

smagssaie 12088

asogmam i

as ie

2520 si6079

Sss6712508 —055,164280

Sasooesté

Imessi —ingo7n307

85997

BESET. TT 8

15.04 Terms of Prime Bank

Iotrest rate 9.75% er annum,

Disharsement

Te fl disbursement was made on May 29, 2017

Repayments

‘The loan i repayable in qual monthly installment staring from June 28,2017 and each month therefor $ years

Securities

|. arahagreament for Capital Machinery/Equpment and 01 (one) posta cheque covering ttl value of zara faiity

and 6 (6x) nos of post dated cheque covering each installment for tal value of zara

Purpose

To pay expenditures of contraction work of storage shod, storage be an floor development at Khulna warehouse.

IS.S astern Bank Limited: Syndicated term loan

Lenders:

The company entered into a separate syndicated lan agreement forthe BMRE on 03 Apel 2017 with Eastern Banke

Limited the lead aranger and 4 (ou) eter Banks and 2 (two) Financial Institutions

‘Total oun facilities: Tk, 426.500 crore.

‘Total loan faites: USD. 2.500 erore

Interest rate:BDT

Inert re 8 25%8,5% per rum cleus on que basis and vile depending onthe station of money

Interest atesUSD

Inte rato 3 months LIBOR 3.75% per annum calelated on quart bass and variable depending on the station

‘of money market

Disbursement:

“The first disbursement yas made on 19 June 2018,

Repayments

‘Thister loan is repayable in 20(oent) equal qual installments commencing from the end of 15th month of he ist

raw down date.

Securi

iL Registered Morgage over the project land measuring 9.6 aresand ll civil constuction thereon supported by reseed

General power of Atom.

4 Fixed and oating charge over machinery, plan and equipment

ii, Linon shares of BSRM StzlsLimited(owned by directors / shareholders value of which will be 110% of equivalent hit

‘vale ofthe project and measuring 124 eres tha ean othe morgage dt repualry estctions

|v. Corporate guaranise ofthe sister concems oH. Akberall & Co, Limite,

'¥-_Implementation guararie from the Sponsors

‘i, Demand promissory note from the company

Purpose

To impor required plant and machinery for installation of Billet Manufacturing Unit and to meet up cst of land

evelopment, building and civil contruction, fabrication works

a

15.06 Terms of DLC Finance Limited

“Total foun faites: Th, 300,00,000

Interest rate:

Interest ates 9.50% per annum.

Disbursement:

‘The fll disbursement was made on Joly 24,2017,

Repayments

“Theloan is repayable in equal monthly fstallznet starting tom August 242017 and euch month sere for 5 yeas

Securities:

i. Personal Guarantee

li, Post date cheque covering he entire principal amount

ii, Corporate guarantee of H.Akberal Co, Li

Purpose:

To meet expense fo industrial Ind development forthe under implementation melting mil, ivi and elec works and

repair and maintenance of machinery

1507 Terms of Jamun:

‘Tota loan faites:

Incerest rate:

Interest ates 12.50% per annum

Disbursement:

‘Theil disbursement was made on January 01,2018

Repayments

“The loan is epayable in equal monthly installment starting om January O1, 2018 and each month terete for 1 years

Securities:

| Documens oft to goods,

i Undated cheque frente LIC tit

iii Usual charge documents

W Personal Guarantee

Purpose:

import capital machinery

15:08. Terms of Meghna Bank Limited

‘Total loan faites: Th 46,400,000,

Iaerest rate

Tort ates 11.00% pee anna

Disbursement:

“The ul disbursement was made on October 01, 2017,

Repayments

Repayment tobe made 16 equal quarterly installments commencing fom 15th month from he date of disbursement.

Securities:

108607 LIC margin

31 Hypotheeation an machinery to be imped trop hank

iii Personal Guarante of all deetors of the Company backed by oar resolution

fi Corporate Guranee of BSRM Stes id.

Us charge documents,

Vi Post dated eee

Porpose

“Toimpon picces 28 MT furnace for Billet maufactuing wit.

i 2»

1509 Standard Chartered Bank - Syndi

Lenders:

‘The company entered ito a separate syndicated loan agreement for Balance Sheet re-aligamest through converting is

shor er loan into term oan on 21 Mazch 2019 with Standard Chartered Bank, the lead arranger and S (ive) oer

Interest rate

Interest rates 9.959% 1.50% per annum calculated on quarterly bass and variable depending onthe situation of money

snacket,

Disbursement:

‘The frst disbursement of BDT 418 Crore was made on 09 April 2019.

Repayments

Entiring outstanding inluding the accrue inert thereon shall be epald by 20 (wens) equal quarterly installments

stating fom the immediate next quarter end of First Disursement. Any shor fall if any must be repaid with the last

inetatlment

Securities:

Ist ranking pari pass charge on plant and machinery and all fixed assets ofthe company.

Personal guarantee ofall the diretors ofthe company.

‘Corporate Guarante of 1-H. AkberaliCo, Lid and 2. BSRM Wires Limite.

‘Other charge documents as per opinion of lenders common counsel and sandr prtie

Purpose:

Balance shect re-alignment through converting is shor term Ioan int term loan amounting Tk. 700 crore under

syndication finance being arranged by SCB.

15.10

15.10.01

a a

Take

Redeemable Zero Coupon Hond

‘Opening Balance 1,102,540,010 1,576,051,890

‘Add: Interest charged 89,086,448 139,130,142

Les: Interest payment (91,705,840) (137,879,446)

Less: Principal payment (520,936,204) (474,162,576)

Carrying amount ‘STB.OSAALS 7,102,540,010

Details of the Zero coupon bond

‘The company obtained consent from Bangladesh securities and Exchange Commission (BSEC) vide consent

letter reference: BSECICV/201$ dated on 28 Dee 2015 for issuing 2,450,892 nos, of redeemable zero coupon

bond of TK. 1,000 each o institutional investors through private placement.

‘Tenure:

From 6th month and upto 4 years fom the issue date (TBD).

Parpose:

Capital expenditure, refinance and equity investment in power project of the group under the name ‘Chittagong

Power Company Limited.

Subscription and issue:

‘Tota 2,450,568 nos, of bonds were subscribed on 25 April 2016 and 16 May 2016 for Taka 1,999,981,083 and

were issued accordingly on those days.

Discount rate:

The discount rae is 9.5% per year and interest is payable half-year

Listing:

Unlisted.

‘Transferability

Freely transferable subject to the terms and condition of term documents.

Redemption:

[In oqul instalment starting from the end ofthe 6th month from te issue date and each 6 month thereafter til

expiry (4 years).

a

160

90

vat

Defined nef obligations = Gratuity

Balance sat OL July, 2018

‘Ad: Lisi acquied through acquisition of ISCO

‘Aad: Caen seve cost,

‘Ad: Pst sarvie coe Plan amendments

‘Aa nares cost

‘Less: Payment made daring the year

Acturilose

Costa pan iby as per actuary

Deferred Tos Libis

Opening balance

|Add: Acquisition of BISCO

Provided during the ye

Investments in stocites

‘Texable deductible temporary difference of PPE and intangible asset (xcuing land)

Deferred tx on Revelation Surpus (Land)

Deferred inc on revaued potion of Assacioe

Provision for Gratuity

‘Tol

Adjusted during the year

Impact of depreation o evaantionsupias

‘Total

Closing Balance

Reconciliation of deferred ta labile (assets)

Commie gtane anata

reciieed GE a ae

Poe omy "ieu9806) =

Desa ten oe ;

Detainee | gamer sioasian

Dt ayn ee ee

Dee ty en sims soe

Revalud portion of Associate

“Total deferred tx abilities

“Trade Payables

BBSRM Stel ReRoling Mis Limited

BBSRM Lopsies Limited

SRM Wires Limited

[BSR Ste Mils Limited

[BSRM Recyling Industries Limited

[BSI spt Lime

thers

aoe mi

Take

136 970,002 neape

: 24983310

: 35.748,860

4319663 :

15388500) 786972

33920066,

ToS 736 970,002

Lisa 7s4016 01274007

- 406228008

BOT TEST

sos. |] c1s.653.360)

265,347,024

239,41831 :

(5367.4) (50,189

7.18638 T9883)

EECA] ERLE

5.5085 78170)

Taxable!

(Dedetily Deferred tx

temporary ile! (ants)

diterenee

Tae sa

(164439.863) (41,109,966)

7.952.905 940, 266,347.04

800 886,165 imams

1.396,12285, 239,418,631

1941,906 S238

t6si3.si¢ 12,636,366

Ss 4922.09

3266714210 5657,919387

00,09 :

266,980 266950

24973882 sisi2719,

3361.610382_ ——So7s11.01

Ge

9.00

wot

rom

1943

‘Short Toxo Loans

Loan aginst tt receipt (LATR)

Time lane

Demand oan

‘Bank overdraft and cash credit

Factoring Loan agains sles invoice

Labi for aceptd bil for payment

‘Loan Agains Trust Recsits ATR)

Bank Ass Limited

Prime Bark Limited

bal Bank Limited

Shah Islami Bank Limited

Utara Bank Limited

‘Time Loans

‘Dhaka Bank Limited

PDC Limited

‘aun Bank Limited

‘Midland Bank Limited

Prime Bank Limited

‘Shab Islami Bank Limit

‘The Trt Bank Limites

Demand Loans

Bank Asa Limites

BRAC Bank Limited

CCommercia! Bank of Cevlon ple

Eastern Bak Limited

HSBC

IFIC Bank Limite

"National Credit and Commerce Bank Limited

[National Finance Limited

Standard Chartered Bonk

The City Bank Limited

Trost Bank Limited

Usa Bank Limited

1901

1992

1903

1906

908

5,125,008 7

ass

Feo, 22.965

2019

Taka

233,185,827

2,508 82,988

795,509,968

2272345,148|

22.952,689

128015,147

35.721328

11449052

101,649,171

eo7zase1l

735,705,556

261397222

333,125,507

9.180283

309,916,657

502,283,886

105,111,111

1.827,100,000

120,000,000

299.438962

1397221876

1029717546

20

Taka

117,603,089

2,484,059,755

10,132,768,301

1,892, 114408,

19975377

4.928,302,072

79.295,024.008

eases

r0971,768

16,367,476,

37.616

13,301,835,

1,036300302

3444337

661,012.78

IGBTS

100,725,438,

130,850,000,

302,800,000

2304599,310

1024013,889

11034,069,299

19.04 Bank overraft and Cash Credit

‘NB Bank Limted-OD (BISCO)

‘Agron Bank LimiedsCC

Bink Al Fash Linted-OD

Bsc Bank Limtod- OD

BRAC Bank Limited-OD

BRAC Bank Limited-OD

Dhaka Bank Limited: OD

Dutch Banga Banik Limied-OD

IMC Bank Linited- OD BISCO)

Janata Bank Lined CC

Sanat Bank Limite OD (BISCO)

‘Mora Tas Bank Lint OD

‘atonal Crat and Commarse Ban Limited CC

‘avon! Cretan Commerce Bank Lined SOD

‘One Bank Limied-OD- (BISCO)

Pome Ban Listes: SOD

Promir Rank Limited CC

Publ Bank Limied- OD

‘pal Bank Limied-c

Standard Bank Lime C

South Bangla rca & Commerce Bank Lint SOD

‘Stat Bank of rine CC

‘Urtar Bnk Lino: CC

1905 Lilie fr asspi ils for ment (ABE)

‘Avan Bank Lime

‘AFAafh am Bank Limited

Bank Al-Fala Limit

nk Ast Limi

[BRAC Bank Limo

Commercial Bank of Coon

iy Bank Limied

[Dhaka Bank Larted

‘arch Bang Bank Limited

ase Bank Limits

wusuc

{FIC Bank Lied

‘smi ak Bangladesh Limited

Jamun Bak Lmtd

eran Bank Limited

National Bank Limited

[NCC Bank Limited

(ne Bank Lined

Prime Bank Lied

Pal Bank Lino

Rupa Bank Limited

Sandi Chae an

Trt Bal Lind

United Corner Bak Limited

rare Bsn imi

2000 Doe reaed companies

[SRM Stel Mis Limited

169.303

1sn.7543m1

385 82085,

36148161

0630190

(09282)

s20s4200

168202,01

wngs28s2

srasnsis

ors.

ws

5260

90495582

6969825)

1082017

137.80.085

23942573

ZEAE HB,

95,700,99)

ans)

230,648,798,

sigattast

1987.097

(31.802)

22650,21,

121 16.308

97316286

653158

530595

2asa70648

51613230

as0748)

30098010

nian257

(Goss)

2024500

23,503,819,

142.278 587

337300

TR

2uarsts

5400397

40908086

337,703,766,

17.265

1423737786

oss 30.113

smzsiass2

65004536

aa1arests

7.68213

or

197.302.001

2591693088

956.467.139,

suzas7 a8

12643

4924700.104

nem

aT8s0 56

16025 46

089

058

195:

25868;710

127.989.368

28619121

23538 08

stasis

320.338,

ss770539,

217595508,

aaron. 10s

2uass7241

151,561.59

45.689.988

153399.800

31070289,

aa

se07700