Professional Documents

Culture Documents

ACI Expl 2nd QTR 2019-20 PDF

Uploaded by

Ahm FerdousOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACI Expl 2nd QTR 2019-20 PDF

Uploaded by

Ahm FerdousCopyright:

Available Formats

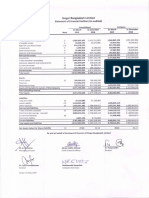

Advanced Chemical Industries Limited

2nd Quarter, FY 2019-20; Business Highlights & Reasons for Significant Deviations

ACI Limited is the parent of ACI Group and the consolidated key financial information for the 2nd Quarter of FY 2019-20

comparing with the Same Quarter Last Year (SQLY) and Previous Quarter This Year (PQTY) is highlighted below:

Executive Summary:

ACI Ltd. Q2 Q2 Q1 Q-Q Q-Q The consolidated operating expenses for the 2nd quarter is BDT

BDT Million 2019-20 2018-19 2019-20 SQLY PQTY 4,261 Mn which is higher than the SQLY by BDT 683 Mn. The

OpEx percentage to Sales is 24% of Revenue which is increased

Revenue 5,751 5,741 5,535 0.2% 4%

and decreased from 22% of the SQLY and 25% of PQTY

Gross Profit 2,724 2,592 2,735 5% -0.4% respectively.

OpEx 2,191 1,907 2,184 15% 0.3% 4,158 3,979 4,261

3,578 3,771

OpEx % to

38% 33% 39%

Revenue

PBT 771 531 366 45% 111%

NPAT 579 393 259 47% 124%

NOCF 914 355 505 157% 81%

ACI Limited as a stand-alone Company has reported a Revenue of Q2' 18-19 Q3' 18-19 Q4' 18-19 Q1' 19-20 Q2' 19-20

BDT 5,751 Mn for the 2nd quarter of FY 2019-20, a growth of 0.2%

Opex Opex %

from the Same Quarter Last Year (SQLY). The Gross Profit for the

2nd quarter has demonstrated a 5% growth from the SQLY. The The consolidated Net Profit After Tax (NPAT) for the 2nd

OpEx has increased by 15% from SQLY. Even without noteworthy quarter is BDT (401) Mn against BDT (46) Mn of SQLY. Despite

Sales growth, the PBT and NPAT has been remarkable with a 45% having the growth in the Revenue and Gross Profit, the 2nd

and 47% growth from SQLY respectively. In addition to that the quarter has demonstrated a loss compared to the SQLY

NOCF has exhibited a growth of 157% over SQLY. mostly because of the increased Operating Expenses and

Financing Cost due to pre-commercial expenses (depreciation

ACI Group Q2 Q2 Q1 Q-Q Q-Q & financing cost) of ACI HealthCare Limited established for

BDT Million 2019-20 2018-19 2019-20 SQLY PQTY manufacturing medicine for regulated markets especially for

Revenue 17,681 16,206 15,772 9% 12% USA, which is awaiting for obtaining approval from US FDA.

Gross Profit 5,306 4,769 4,727 11% 12%

Q2' 18-19 Q3' 18-19 Q4' 18-19 Q1' 19-20 Q2' 19-20

OpEx 4,261 3,578 3,979 19% 7%

(46)

OpEx % to

24% 22% 25%

Revenue

PBT (44) 318 (201) -114% 78% (312) (300)

(401)

Group PAT (401) (46) (300) -778% -34%

NOCF (969) (1,144) (416) 15% -133% (554)

NPAT NPAT %

ACI Limited as a group has shown a decent revenue growth in the

2nd quarter of FY 2019-20. It reported a Revenue of BDT 17,681 The consequential results of negative consolidated profit

Mn for the 2nd quarter of FY 2019-20, a growth of 9% from the (loss) ultimately generated a consolidated Earnings per Share

Same Quarter Last Year (SQLY). The Gross Profit for the 2nd quarter (EPS) of BDT (6.98) per share which was BDT (0.80) per share

has demonstrated a promising 11% and 12% growth from the in the SQLY. 1,421

SQLY and the Previous Quarter This Year (PQTY) respectively due

to the improved production efficiency and increased sales of

higher GP contributory products.

17,681

Q2' 18-19 Q3' 18-19 Q4' 18-19 Q1' 19-20 Q2' 19-20

16,865 (416)

(1,144) (969)

16,206

15,772

15,441 (2,153)

OCF OCF %

The consolidated Net Operating Cash Flows (NOCF) for the

Q2' 18-19 Q3' 18-19 Q4' 18-19 Q1' 19-20 Q2' 19-20 2nd quarter was BDT (969) Mn against BDT (1,144) of SQLY.

The 2nd quarter’s NOCF has a positive growth of 15% from

Revenue Growth QoQ that of SQLY indicating improved cash generation efficiency.

For any query please contact http://www.aci-bd.com

You might also like

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Nesco LTD - East India Sec PDFDocument7 pagesNesco LTD - East India Sec PDFdarshanmadeNo ratings yet

- Press 15jun20Document4 pagesPress 15jun20Rama MadhuNo ratings yet

- Capital Plastic 2021Document78 pagesCapital Plastic 2021JanosNo ratings yet

- Q4FY20 Earning UpdateDocument28 pagesQ4FY20 Earning UpdateSumit SharmaNo ratings yet

- Hemas Holdings PLC (HHL SL: LKR 69.00) : BRS Quarterly Results Snapshot - Q4 FY 19Document4 pagesHemas Holdings PLC (HHL SL: LKR 69.00) : BRS Quarterly Results Snapshot - Q4 FY 19Sudheera IndrajithNo ratings yet

- 2019 LBG q1 Ims CombinedDocument19 pages2019 LBG q1 Ims CombinedsaxobobNo ratings yet

- Interim Management StatementDocument10 pagesInterim Management StatementsaxobobNo ratings yet

- Voltas Dolat 140519 PDFDocument7 pagesVoltas Dolat 140519 PDFADNo ratings yet

- Coal India: Steady Performance...Document8 pagesCoal India: Steady Performance...Tejas ShahNo ratings yet

- UAE Equity Research - Agthia Group 4Q22 - First Look NoteDocument5 pagesUAE Equity Research - Agthia Group 4Q22 - First Look Notexen101No ratings yet

- Analyst PPT Q4FY20Document48 pagesAnalyst PPT Q4FY20BhjjkkNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Grasim Q3FY09 PresentationDocument47 pagesGrasim Q3FY09 PresentationJasmine NayakNo ratings yet

- Quarterly Update Q1FY22: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q1FY22: Century Plyboards (India) LTDhackmaverickNo ratings yet

- 2020 11 18 PH e Ssi PDFDocument8 pages2020 11 18 PH e Ssi PDFJNo ratings yet

- ITC - Deep Value Significant Opportunities To Unlock Value For ShareholdersDocument13 pagesITC - Deep Value Significant Opportunities To Unlock Value For ShareholdersYogeshNo ratings yet

- RKLISX/202 1-22/32: Sub: Investor's PresentationDocument13 pagesRKLISX/202 1-22/32: Sub: Investor's PresentationDr. Shekhar Pathak Kayakalp YogShalaNo ratings yet

- Balkrishna Industries LTD: Investor Presentation - May 2021Document31 pagesBalkrishna Industries LTD: Investor Presentation - May 2021Kpvs NikhilNo ratings yet

- Pakistan's EconomyDocument4 pagesPakistan's EconomyMuzzamil ShahzadNo ratings yet

- Q3FY22 Result Update DLF LTD.: Strong Residential Performance ContinuesDocument10 pagesQ3FY22 Result Update DLF LTD.: Strong Residential Performance ContinuesVanshika BiyaniNo ratings yet

- Final Quarterly Report 05 12 2023Document44 pagesFinal Quarterly Report 05 12 2023mazunmNo ratings yet

- Tata Motors Consolidated Q2 FY21 Results: EBIT Breakeven and Positive Free Cash Flows Delivered in The QuarterDocument4 pagesTata Motors Consolidated Q2 FY21 Results: EBIT Breakeven and Positive Free Cash Flows Delivered in The QuarterEsha ChaudharyNo ratings yet

- ITC Limited: Resilient Quarter Amidst Weak Industry DemandDocument5 pagesITC Limited: Resilient Quarter Amidst Weak Industry DemandGeebeeNo ratings yet

- Balkrishna Industries LTD: Investor Presentation February 2020Document30 pagesBalkrishna Industries LTD: Investor Presentation February 2020PIBM MBA-FINANCENo ratings yet

- Glenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateDocument9 pagesGlenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateAkatsuki DNo ratings yet

- Q3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedDocument10 pagesQ3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedbradburywillsNo ratings yet

- Deepak Fertilizers and ChemicalsDocument17 pagesDeepak Fertilizers and ChemicalsnakilNo ratings yet

- Dolat Capital - UB - Report - June - 2020Document11 pagesDolat Capital - UB - Report - June - 2020dnwekfnkfnknf skkjdbNo ratings yet

- Bajaj Electricals: Pinch From E&P To End SoonDocument14 pagesBajaj Electricals: Pinch From E&P To End SoonYash BhayaniNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- 21st Century Fox 5YR DCFDocument10 pages21st Century Fox 5YR DCFsoham sahaNo ratings yet

- P&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValueDocument66 pagesP&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValuePrabhdeep DadyalNo ratings yet

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- Annual Report - Attock CementDocument10 pagesAnnual Report - Attock CementAbdul BasitNo ratings yet

- IDirect SKFIndia Q2FY20Document10 pagesIDirect SKFIndia Q2FY20praveensingh77No ratings yet

- Q1 FY21 Adversely Impacted by COVID 1 9Document4 pagesQ1 FY21 Adversely Impacted by COVID 1 9Esha ChaudharyNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Micron Technology, Inc. Reports Results For The Fourth Quarter and Full Year of Fiscal 2023Document7 pagesMicron Technology, Inc. Reports Results For The Fourth Quarter and Full Year of Fiscal 2023CNY CentralNo ratings yet

- UAE Equity Research: First Look Note - 3Q22Document5 pagesUAE Equity Research: First Look Note - 3Q22xen101No ratings yet

- BP Group Financial Disclosures Databook 2019 and 2020Document53 pagesBP Group Financial Disclosures Databook 2019 and 2020Aldo A. Ayala C.No ratings yet

- Digitally Signed by Monika Jaggia Date: 2023.10.30 15:06:53 +05'30'Document36 pagesDigitally Signed by Monika Jaggia Date: 2023.10.30 15:06:53 +05'30'dipesh.shopNo ratings yet

- Accumulate: Growth Momentum Continues!Document7 pagesAccumulate: Growth Momentum Continues!sj singhNo ratings yet

- QuarterlyUpdateReport AngelOneLtd Q4FY23Document9 pagesQuarterlyUpdateReport AngelOneLtd Q4FY23Abhishek TondeNo ratings yet

- Digitally Signed by VIVEK Pritamlal Raizada Date: 2020.05.11 17:25:48 +05'30'Document20 pagesDigitally Signed by VIVEK Pritamlal Raizada Date: 2020.05.11 17:25:48 +05'30'DIPAN BISWASNo ratings yet

- Delta Corporation F20 Full Year Results 31 March - 2020Document3 pagesDelta Corporation F20 Full Year Results 31 March - 2020Mandisi MoyoNo ratings yet

- Itnl 4Q Fy 2013Document13 pagesItnl 4Q Fy 2013Angel BrokingNo ratings yet

- Motilal Oswal Sees 20% UPSIDE in Piramal Pharma Healthy RecoveryDocument8 pagesMotilal Oswal Sees 20% UPSIDE in Piramal Pharma Healthy RecoveryMohammed Israr ShaikhNo ratings yet

- Cyient: Poor Quarter Recovery Likely in The Current QuarterDocument9 pagesCyient: Poor Quarter Recovery Likely in The Current QuarterADNo ratings yet

- Muthoot Finance: CMP: INR650Document12 pagesMuthoot Finance: CMP: INR650vatsal shahNo ratings yet

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDocument17 pagesQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyNo ratings yet

- Investor Presentation FY20Document49 pagesInvestor Presentation FY20Nitin ParasharNo ratings yet

- Stocks in Focus:: Infected Count Death Toll Total RecoveredDocument10 pagesStocks in Focus:: Infected Count Death Toll Total RecoveredJNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Sun Pharma: CMP: INR909 TP: INR1,000 BuyDocument8 pagesSun Pharma: CMP: INR909 TP: INR1,000 BuyKannan JainNo ratings yet

- Vascon Engineers - Kotak PCG PDFDocument7 pagesVascon Engineers - Kotak PCG PDFdarshanmadeNo ratings yet

- Rnit Financial Summary PDFDocument21 pagesRnit Financial Summary PDFNaidu PNo ratings yet

- Bajaj Auto: Performance HighlightsDocument13 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- PTPP Uob 15 Mar 2022Document5 pagesPTPP Uob 15 Mar 2022Githa Adhi Pramana I GDNo ratings yet

- PH RCPortal Researchcds ID 1736&TYPE PDFDocument11 pagesPH RCPortal Researchcds ID 1736&TYPE PDFAljon HizonNo ratings yet

- 10 2022Document64 pages10 2022Ahm FerdousNo ratings yet

- Annual 2012Document12 pagesAnnual 2012Ahm FerdousNo ratings yet

- Annual 2013Document8 pagesAnnual 2013Ahm FerdousNo ratings yet

- US Put Off Derivatives Rules For A Decade Before Archegos Blew Up - Financial TimesDocument4 pagesUS Put Off Derivatives Rules For A Decade Before Archegos Blew Up - Financial TimesAhm FerdousNo ratings yet

- 2021 OctDocument64 pages2021 OctAhm Ferdous100% (1)

- Health PolicyDocument65 pagesHealth PolicyAhm FerdousNo ratings yet

- Lub-Rref (Bangladesh) Ltd. IPO NoteDocument8 pagesLub-Rref (Bangladesh) Ltd. IPO NoteAhm FerdousNo ratings yet

- Accounts SEBL1STMF 31MAR-18 PDFDocument10 pagesAccounts SEBL1STMF 31MAR-18 PDFAhm FerdousNo ratings yet

- Acme 2013-2014Document148 pagesAcme 2013-2014Ahm FerdousNo ratings yet

- Laaaaaafarge 1st Quarter Report 2021Document24 pagesLaaaaaafarge 1st Quarter Report 2021Ahm FerdousNo ratings yet

- 1st Quarter Financial Statements 2020Document13 pages1st Quarter Financial Statements 2020Ahm FerdousNo ratings yet

- LHBL Annual Report 2020Document267 pagesLHBL Annual Report 2020Ahm FerdousNo ratings yet

- VFSTHREAD Annual Report 2019-2020Document86 pagesVFSTHREAD Annual Report 2019-2020Ahm FerdousNo ratings yet

- 1st Quarter Report - tcm391-593715Document1 page1st Quarter Report - tcm391-593715Ahm FerdousNo ratings yet

- Advanced Chemical Industries LimitedDocument20 pagesAdvanced Chemical Industries LimitedAhm FerdousNo ratings yet

- Singer 3rd Quarter Financial Statements 2019 - WebsiteDocument12 pagesSinger 3rd Quarter Financial Statements 2019 - WebsiteAhm FerdousNo ratings yet

- Singer 2nd Quarter Financial Statements 2019 - WebsiteDocument12 pagesSinger 2nd Quarter Financial Statements 2019 - WebsiteAhm FerdousNo ratings yet

- Annuual Report-2018-19Document102 pagesAnnuual Report-2018-19Ahm FerdousNo ratings yet

- Singer 1st Quarter 2019 Financial StatementsDocument12 pagesSinger 1st Quarter 2019 Financial StatementsAhm FerdousNo ratings yet

- Singer Annual Report 2019 PDFDocument119 pagesSinger Annual Report 2019 PDFAhm FerdousNo ratings yet

- Annual Report 2018 PDFDocument122 pagesAnnual Report 2018 PDFAhm FerdousNo ratings yet

- 2nd Quarter Financial Statements 2020Document15 pages2nd Quarter Financial Statements 2020Ahm FerdousNo ratings yet

- (ILM Super Series) Institute of Leadership & Mana - Caring For The Customer Super Series, Fourth Edition - Pergamon Flexible Learning (2002)Document117 pages(ILM Super Series) Institute of Leadership & Mana - Caring For The Customer Super Series, Fourth Edition - Pergamon Flexible Learning (2002)bankadhi100% (1)

- Cardiff University PHD Thesis FormatDocument8 pagesCardiff University PHD Thesis Formatjessicareedclarksville100% (2)

- Beauty Salon Company Profile SampleDocument9 pagesBeauty Salon Company Profile SampleSanjay TulsankarNo ratings yet

- Personnel Planning and Recruiting: Gary DesslerDocument34 pagesPersonnel Planning and Recruiting: Gary DesslerRohit ChaudharyNo ratings yet

- A Text Book PDFDocument4 pagesA Text Book PDFAqib MalikNo ratings yet

- Multi Flasindo: Kaspul Anwar (MR)Document5 pagesMulti Flasindo: Kaspul Anwar (MR)Netty yuliartiNo ratings yet

- 1.4-2 - Evidence Plan (Template)Document2 pages1.4-2 - Evidence Plan (Template)J'LvenneRoz AnepolNo ratings yet

- Bakhresa CaseDocument12 pagesBakhresa CaseEldard KafulaNo ratings yet

- En04 de 1 Kết Hợp KeyDocument6 pagesEn04 de 1 Kết Hợp KeyAn NguyễnNo ratings yet

- MASTERY TAXATION October-2019 PDFDocument12 pagesMASTERY TAXATION October-2019 PDFJuvelyn Gregorio100% (1)

- Business Plan Flower Restaurant: Li Wei 8308165797 2012-5-29Document42 pagesBusiness Plan Flower Restaurant: Li Wei 8308165797 2012-5-29Hiwet MeseleNo ratings yet

- SAP Controlling Simplified: Mohammed RashidDocument13 pagesSAP Controlling Simplified: Mohammed RashidSUNNY LUNKERNo ratings yet

- Study On Recruitment and Selection ProcessDocument106 pagesStudy On Recruitment and Selection ProcessAnuj Sankaran91% (11)

- The Philippine IT BPM Industry Roadmap Executive Summary CompressedDocument55 pagesThe Philippine IT BPM Industry Roadmap Executive Summary Compressedpavanbagade27No ratings yet

- MRL2601 Assignment 01Document3 pagesMRL2601 Assignment 01Milanda MagwenziNo ratings yet

- Project Management Unit 2 PDFDocument16 pagesProject Management Unit 2 PDFVaibhav MisraNo ratings yet

- A Turnaround Story: Group 8: Yash, Ritu, Bhartesh, Smriti, Rahul, Piyush & JastejDocument17 pagesA Turnaround Story: Group 8: Yash, Ritu, Bhartesh, Smriti, Rahul, Piyush & JastejPratyush BaruaNo ratings yet

- English For Specific Purposes: Crayton WalkerDocument12 pagesEnglish For Specific Purposes: Crayton WalkerMohammed BanquslyNo ratings yet

- RemittanceDocument2 pagesRemittancePankaj NagarNo ratings yet

- Abdul Rehman CVDocument1 pageAbdul Rehman CVMOHSIN ALINo ratings yet

- Andre Gunder Frank - The Organization of Economic Activity in The Soviet Union - Weltwirtschaftliches Archiv, Bd. 78 (1957) PDFDocument54 pagesAndre Gunder Frank - The Organization of Economic Activity in The Soviet Union - Weltwirtschaftliches Archiv, Bd. 78 (1957) PDFLarissa BastosNo ratings yet

- UntitledDocument6 pagesUntitledBipin Kumar JhaNo ratings yet

- Lecture 10Document39 pagesLecture 10Zixin GuNo ratings yet

- 7-Building A Risk Culture Within The Supply ChainDocument8 pages7-Building A Risk Culture Within The Supply ChainHenry drago100% (1)

- RFP For Mizoram E-Services Portal and Cloud Enablement Implementation in Mikzoram SDC FINAL Ver 2Document221 pagesRFP For Mizoram E-Services Portal and Cloud Enablement Implementation in Mikzoram SDC FINAL Ver 2Lalrempuia LalrempuiaNo ratings yet

- Bill.1 - Preliminaries and General ItemsDocument1 pageBill.1 - Preliminaries and General ItemstikNo ratings yet

- Accounting Final ExamDocument40 pagesAccounting Final ExamdvNo ratings yet

- Chapter 4 Process SelectionDocument18 pagesChapter 4 Process Selectionmohammed mohammedNo ratings yet

- Background Asci ComputingDocument4 pagesBackground Asci Computinggrey73130No ratings yet

- Cibil - Report (P - JAYSINGH YADAV - 26 - 05 - 2023 12 - 23 - 04)Document5 pagesCibil - Report (P - JAYSINGH YADAV - 26 - 05 - 2023 12 - 23 - 04)Geeta MallahNo ratings yet