Professional Documents

Culture Documents

PH RCPortal Researchcds ID 1736&TYPE PDF

Uploaded by

Aljon Hizon0 ratings0% found this document useful (0 votes)

19 views11 pagesOriginal Title

httpswww.bdo.com.phRCPortalResearchcdsID=1736&TYPE=PDF

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views11 pagesPH RCPortal Researchcds ID 1736&TYPE PDF

Uploaded by

Aljon HizonCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

BDO Unibank, Inc.

and BDO Nomura

Securities, Inc are the distributors of

this report in the Philippines. No part

of this material may be (i) copied,

photocopied, or duplicated in any

form, by any means; or (ii)

redistributed without the prior written

consent of BDO Unibank, Inc. and

BDO Nomura Securities. Inc. Nomura

has authorized BDO Unibank, Inc. and

BDO Nomura Securities. Inc to re

distribute this report in the

Philippines.

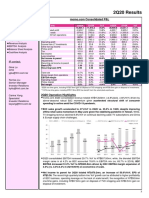

FY20F FY21F FY22F

in PHPmn Previous New % change Previous New % change Previous New % change

Net sales 195,011 165,660 -15.1% 219,485 190,614 -13.2% 243,565 214,355 -12.0%

Gross profit 30,394 17,309 -43.1% 35,882 25,253 -29.6% 39,750 30,233 -23.9%

GPM 15.6% 10.4% -5.1% 16.3% 13.2% -3.1% 16.3% 14.1% -2.2%

EBITDA 17,790 13,116 -26.3% 19,498 21,657 11.1% 20,637 22,678 9.9%

EBITDA margin 9.1% 7.9% -1.2% 8.9% 11.4% 2.5% 8.5% 10.6% 2.1%

Operating profit 5,411 (2,335) -143.2% 6,768 5,692 -15.9% 7,341 6,037 -17.8%

OPM 2.8% -1.4% -4.2% 3.1% 3.0% -0.1% 3.0% 2.8% -0.2%

Net income 4,032 (3,113) -177.2% 4,836 3,881 -19.7% 5,555 4,528 -18.5%

NPM 2.1% -1.9% -3.9% 2.2% 2.0% -0.2% 2.3% 2.1% -0.2%

EPS 3.64 (2.81) -177.2% 4.37 3.51 -19.7% 5.02 4.09 -18.5%

in PHPmn 1Q19 1Q20 % chg

System-wide sales 54,278 55,151 1.6%

Company revenues

Philippines 29,437 26,750 -9.1%

International 11,068 12,931 16.8%

Eliminations (151) (248)

Total revenues 40,354 39,433 -2.3%

Cost of Sales 33,696 35,396 5.0%

Gross Profit 6,658 4,037 -39.4%

Opex + A&P 4,554 5,368 17.9%

EBITDA 5,409 2,044 -62.2%

Operating income 2,098 (1,331) -163.4%

Share in JV 6 9

Net interest expense (678) (690)

Others 294 194

Profit before tax 1,720 (1,818)

Taxes 366 256

Minority interests (107) (281)

Perpetual capital distribution - (665)

Headline net income 1,461 (1,792) -222.7%

Normalized net income 2,076 (2,195) -205.7%

Margins 1Q19 1Q20 bps chg

GPM 16.5% 10.2% (626)

EBITDA Margin 13.4% 5.2% (822)

OPM 5.2% -3.4% (857)

NPM (normalized) 5.1% -5.6% (1,071)

YTD store network FY19A 1Q20 chg

Philippines

Jollibee 1,195 1,200 5

Chowking 617 613 (4)

Greenwich 284 283 (1)

Red Ribbon 502 505 3

Mang Inasal 611 614 3

Burger King 105 106 1

Pho24 1 1 -

Panda Express 1 1 -

Total Philippines 3,316 3,323 7

International

China

Yonghe King 339 344 5

Hongzhuangyuan 42 39 (3)

Dunkin' Donuts 8 8 -

Total China 389 391 2

US

Jollibee 39 41 2

Red Ribbon 33 33 -

Chowking 15 15 -

Smashburger 301 298 (3)

Coffee Bean 1,173 1,165 (8)

Canada

Jollibee 9 9 -

Total North America 1,570 1,561 (9)

Asia Pacific ex China and PH -

Jollibee 169 171 2

SuperFoods - Highlands Coffee 401 405 4

SuperFoods - Pho24 38 39 1

SuperFoods - Hard Rock Café 6 2 (4)

Total Asia Pacific 614 617 3

Middle East

Jollibee 46 46 -

Chowking 33 33 -

Total Middle East 79 79 -

Oceania

Jollibee Guam 1 1 -

Europe

Italy 1 1 -

United Kingdom 1 1 -

Total international 2,655 2,651 (4)

Grand total (including Smash) 5,971 5,974 3

Market cap Current price P/E (x) EV/EBITDA (x) ROE (%) EPS growth (%)

Company Ticker (USDmn) Rating (LCY) FY20F FY21F FY20F FY21F FY20F FY21F FY20F FY21F

Jollibee Foods Corp. JFC PM 2,507 Neutral 116.10 n.m. 33.1 10.3 6.1 -4.6% 4.6% -150.4% n.m.

Century Pacific Food CNPF PM 1,062 Buy 15.24 14.5 13.4 8.9 8.1 18.0% 17.0% 18.2% 8.2%

Emperador Inc. EMP PM 2,444 Neutral 7.80 25.7 23.6 18.7 17.8 7.4% 7.8% -29.6% 8.7%

Puregold Price Club PGOLD PM 2,631 Buy 46.35 19.3 16.8 7.6 6.6 10.3% 10.8% 2.2% 15.0%

Robinsons Retail Holdings RRHI PM 2,097 Buy 67.75 29.3 25.4 6.7 5.9 5.0% 5.5% -10.0% 15.1%

San Miguel Food and Beverage FB PM 7,320 Buy 62.95 28.6 24.9 9.9 8.8 16.2% 18.8% -27.2% 14.9%

Shakey's Pizza Asia Ventures PIZZA PM 172 Buy 5.72 12.2 10.5 8.4 7.2 13.2% 14.0% -19.8% 16.4%

SSI Group SSI PM 71 Buy 1.10 5.8 5.2 3.3 2.9 5.3% 5.7% -26.9% 12.1%

Universal Robina Corp. URC PM 5,426 Buy 125.10 30.6 26.6 14.8 13.2 9.7% 10.6% -22.1% 15.1%

Wilcon Depot WLCON PM 1,247 Reduce 15.46 54.6 44.0 19.5 16.3 7.8% 9.2% -41.1% 24.0%

Average ex-JFC 24.5 21.2 10.9 9.6 10.3% 11.0% -17.4% 14.4%

You might also like

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Document38 pagesNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNo ratings yet

- JFC - PH Jollibee Foods Corp. Annual Income Statement - WSJDocument1 pageJFC - PH Jollibee Foods Corp. Annual Income Statement - WSJフ卂尺乇ᗪNo ratings yet

- Fact Sheet Q1 2022Document10 pagesFact Sheet Q1 2022VijayNo ratings yet

- Hero Model - Equivalue 2Document48 pagesHero Model - Equivalue 2Neha RadiaNo ratings yet

- Glenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateDocument9 pagesGlenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateAkatsuki DNo ratings yet

- Brief About The Co Brands Competitive Positioning of The Co / Advantages Tracking Points Financials Incl Shareholding Pattern Valuation Rational SwotDocument42 pagesBrief About The Co Brands Competitive Positioning of The Co / Advantages Tracking Points Financials Incl Shareholding Pattern Valuation Rational SwotMitesh PatilNo ratings yet

- Tata MotorsDocument5 pagesTata Motorsinsurana73No ratings yet

- 4Q16 Earnings Eng FinalDocument18 pages4Q16 Earnings Eng FinalSabin LalNo ratings yet

- Investor Presentation Dec 2020Document20 pagesInvestor Presentation Dec 2020yashica shahNo ratings yet

- HMC DCF ValuationDocument31 pagesHMC DCF Valuationyadhu krishnaNo ratings yet

- Performance ReportDocument24 pagesPerformance ReportJuan VegaNo ratings yet

- MOIL 07feb20 Kotak PCG 00210 PDFDocument6 pagesMOIL 07feb20 Kotak PCG 00210 PDFdarshanmadeNo ratings yet

- Annual Report - Attock CementDocument10 pagesAnnual Report - Attock CementAbdul BasitNo ratings yet

- Orwe Oe 2022-07-17Document6 pagesOrwe Oe 2022-07-17BalbaaAmrNo ratings yet

- 4 Q 13 Earnings Release suzANODocument23 pages4 Q 13 Earnings Release suzANORicardo Salles SilveiraNo ratings yet

- Y-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%Document7 pagesY-O-Y Sales Growth % 18% 19% 12% 10% 1% 9% 2% 11% 2% - 2%muralyyNo ratings yet

- Financial Results Briefing Material For FY2019: April 1, 2018 To March 31, 2019Document30 pagesFinancial Results Briefing Material For FY2019: April 1, 2018 To March 31, 2019choiand1No ratings yet

- Q2FY11 Reliance Communications Result UpdateDocument4 pagesQ2FY11 Reliance Communications Result UpdateVinit BolinjkarNo ratings yet

- Delta Corp 1QFY20 Results Update | Sector: OthersDocument6 pagesDelta Corp 1QFY20 Results Update | Sector: OthersJatin SoniNo ratings yet

- Momo Operating Report 2Q20Document5 pagesMomo Operating Report 2Q20Wong Kai WenNo ratings yet

- National Foods Financial ReportDocument66 pagesNational Foods Financial ReportanonNo ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAnuj SaxenaNo ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAditi KhaitanNo ratings yet

- Box IPO Financial Model and ValuationDocument40 pagesBox IPO Financial Model and ValuationChulbul PandeyNo ratings yet

- Alibaba IPO: Prepared by - Dheeraj Vaidya, CFA, FRMDocument53 pagesAlibaba IPO: Prepared by - Dheeraj Vaidya, CFA, FRMHaysam TayyabNo ratings yet

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015Document19 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015rikky adiwijayaNo ratings yet

- Mahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Document14 pagesMahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Yash DoshiNo ratings yet

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- Q4FY20 Earning UpdateDocument28 pagesQ4FY20 Earning UpdateSumit SharmaNo ratings yet

- Ashok Leyland Kotak 050218Document4 pagesAshok Leyland Kotak 050218suprabhattNo ratings yet

- Booking Holdings Inc. (BKNG) 24 Years of Financial Statements Roic - AiDocument3 pagesBooking Holdings Inc. (BKNG) 24 Years of Financial Statements Roic - AiNicolas GomezNo ratings yet

- Alibaba IPO Financial ModelDocument54 pagesAlibaba IPO Financial ModelPRIYANKA KNo ratings yet

- Total Income - Annual: Sales Sales YoyDocument16 pagesTotal Income - Annual: Sales Sales YoyKshatrapati SinghNo ratings yet

- Target FinancialsDocument15 pagesTarget Financialsso_levictorNo ratings yet

- Fund Flow Statement - Feb-21Document128 pagesFund Flow Statement - Feb-21Suneet GaggarNo ratings yet

- Workshop 2Document11 pagesWorkshop 2Trần Ánh DươngNo ratings yet

- 2023.08.31 KMX Historical Financial STMT Info For AnalystsDocument33 pages2023.08.31 KMX Historical Financial STMT Info For AnalystsjohnsolarpanelsNo ratings yet

- Task 3 - Model AnswerDocument4 pagesTask 3 - Model AnswerHarry SinghNo ratings yet

- 1QFY19 Results Update | Sector: AutomobilesDocument12 pages1QFY19 Results Update | Sector: AutomobilesVivek shindeNo ratings yet

- Bajaj Auto Project TestDocument61 pagesBajaj Auto Project TestSauhard Sachan0% (1)

- E603 Jumbopresentation Sept23 GRDocument11 pagesE603 Jumbopresentation Sept23 GRpithikose2tou52No ratings yet

- Result Update Presentation - Q2 FY18: NOVEMBER 09, 2017Document11 pagesResult Update Presentation - Q2 FY18: NOVEMBER 09, 2017Mohit PariharNo ratings yet

- UntitledDocument7 pagesUntitledberti albertiNo ratings yet

- Gone Rural Historical Financials Reveal Growth Over TimeDocument31 pagesGone Rural Historical Financials Reveal Growth Over TimeHumphrey OsaigbeNo ratings yet

- JSW Steel LTD PDFDocument10 pagesJSW Steel LTD PDFTanzy SNo ratings yet

- Research Needed For Question 5Document4 pagesResearch Needed For Question 5Ahmed MahmoudNo ratings yet

- Madras FertilizersDocument1 pageMadras FertilizersinvestmentcallsNo ratings yet

- Apple Model - FinalDocument32 pagesApple Model - FinalDang TrangNo ratings yet

- 22 2Q Earning Release of LGEDocument18 pages22 2Q Earning Release of LGEThảo VũNo ratings yet

- Alibaba IPO Financial Model WallstreetMojoDocument52 pagesAlibaba IPO Financial Model WallstreetMojoJulian HutabaratNo ratings yet

- Aayush Agrawal PGPM-021-002 Disha Vishwakarma PGPM-021-019 Needhi Nagwekar PGPM-021-029 Vaibhav PGPM-021-059Document24 pagesAayush Agrawal PGPM-021-002 Disha Vishwakarma PGPM-021-019 Needhi Nagwekar PGPM-021-029 Vaibhav PGPM-021-059Needhi NagwekarNo ratings yet

- EOG ResourcesDocument16 pagesEOG ResourcesAshish PatwardhanNo ratings yet

- Honda Book 2Document5 pagesHonda Book 2nimra kianiNo ratings yet

- ValuationDocument6 pagesValuationsbkingkingkingNo ratings yet

- Fundamental Analysis PresentationDocument28 pagesFundamental Analysis Presentation354Prakriti SharmaNo ratings yet

- CSIQ 3Q21 Investor Presentation - 2021.12.6Document45 pagesCSIQ 3Q21 Investor Presentation - 2021.12.6Vitor MouraNo ratings yet

- Alibaba FCFEDocument60 pagesAlibaba FCFEAhmad Faiz SyauqiNo ratings yet

- B D E (BDE) : LUE ART XpressDocument18 pagesB D E (BDE) : LUE ART XpresshemantNo ratings yet

- Hero Motocorp DCF ValuationDocument66 pagesHero Motocorp DCF ValuationPrabhdeep DadyalNo ratings yet

- AENG 321 - Activity 4 - Napkin-ModelDocument1 pageAENG 321 - Activity 4 - Napkin-ModelAljon HizonNo ratings yet

- Timebooking Hazard - Double BillingDocument2 pagesTimebooking Hazard - Double BillingAljon HizonNo ratings yet

- VFR SymbolsDocument28 pagesVFR SymbolsgurpreetNo ratings yet

- Jeppview For Windows: List of Pages in This Trip KitDocument61 pagesJeppview For Windows: List of Pages in This Trip KitAljon HizonNo ratings yet

- TIMEBOOKING WORKORDER TYPE OF WORK REFERENCEDocument18 pagesTIMEBOOKING WORKORDER TYPE OF WORK REFERENCEAljon HizonNo ratings yet

- P92JSDocument14 pagesP92JSAljon HizonNo ratings yet

- Safety ManualDocument31 pagesSafety ManualAljon HizonNo ratings yet

- Math Exam: MTG Day Tentative Date Morning Session (8:00 - 12:00 PM) Afternoon Session (1:00 - 5:00 PM)Document1 pageMath Exam: MTG Day Tentative Date Morning Session (8:00 - 12:00 PM) Afternoon Session (1:00 - 5:00 PM)Aljon HizonNo ratings yet

- Alpha sub D versus Lift Coefficient data tableDocument8 pagesAlpha sub D versus Lift Coefficient data tableAljon HizonNo ratings yet

- Activity FormsDocument10 pagesActivity FormsAljon HizonNo ratings yet

- Aerostat KITEDocument20 pagesAerostat KITEAljon HizonNo ratings yet

- Engr. JomarieDocument11 pagesEngr. JomarieAljon HizonNo ratings yet

- Brief Biodata of AileenDocument2 pagesBrief Biodata of AileenAljon HizonNo ratings yet

- Aerostat KITEDocument20 pagesAerostat KITEAljon HizonNo ratings yet

- Aerostat KITEDocument20 pagesAerostat KITEAljon HizonNo ratings yet

- Comp 411 - Naca 2415Document1 pageComp 411 - Naca 2415Aljon HizonNo ratings yet

- Civil Service CommissionDocument9 pagesCivil Service CommissionAljon Hizon100% (1)

- AENG 514 Lecture and Quiz NotesDocument2 pagesAENG 514 Lecture and Quiz NotesAljon HizonNo ratings yet

- Comp 411 - Naca 23018Document1 pageComp 411 - Naca 23018Aljon HizonNo ratings yet

- 1-3-1 Format PDF - Engr BassDocument1 page1-3-1 Format PDF - Engr BassAljon HizonNo ratings yet

- 1-3-1 Format PDF - Engr BassDocument1 page1-3-1 Format PDF - Engr BassAljon HizonNo ratings yet

- Ab-Initio Training RequirementsDocument1 pageAb-Initio Training RequirementsAljon HizonNo ratings yet

- Activity FormsDocument10 pagesActivity FormsAljon HizonNo ratings yet

- Banking Regulations: Reasons For The Regulation of BanksDocument6 pagesBanking Regulations: Reasons For The Regulation of BanksMarwa HassanNo ratings yet

- Analyzing Hershey Company's Strategic Position Using BCG, IE, and Grand Strategy MatricesDocument2 pagesAnalyzing Hershey Company's Strategic Position Using BCG, IE, and Grand Strategy MatriceslionalleeNo ratings yet

- Webpay 170410200339Document125 pagesWebpay 170410200339jeyanthan88100% (2)

- Recruitment and Selection at HDFCDocument28 pagesRecruitment and Selection at HDFCVinod0% (1)

- Business Law and RegulationsDocument5 pagesBusiness Law and RegulationsLoida Joy AvellanaNo ratings yet

- E&Y Peru White PaperDocument94 pagesE&Y Peru White Papertr10101No ratings yet

- Cra Dispute Letter 1Document1 pageCra Dispute Letter 1KNOWLEDGE SOURCE100% (2)

- Objectives of AuditingDocument22 pagesObjectives of AuditingArjun M JimmyNo ratings yet

- Treynor RatioDocument1 pageTreynor Ratiosana_sr_96No ratings yet

- International Business Management: AssignmentDocument16 pagesInternational Business Management: AssignmentkeshavNo ratings yet

- Villarama Christian Michael AS1Document11 pagesVillarama Christian Michael AS1ThortheGreayNo ratings yet

- Hedging PDFDocument6 pagesHedging PDFIraiven ShanmugamNo ratings yet

- Tax Invoice: M/S. Panakala & Co., Chartered Accountants Prop.: C.A K Panakala Rao Indian Bank-Bill ToDocument1 pageTax Invoice: M/S. Panakala & Co., Chartered Accountants Prop.: C.A K Panakala Rao Indian Bank-Bill Tomanoj mohanNo ratings yet

- Homework on Share-Based PaymentsDocument4 pagesHomework on Share-Based PaymentsCharles TuazonNo ratings yet

- Managing Business Finances: Section 17.1Document18 pagesManaging Business Finances: Section 17.1Thiên TíuNo ratings yet

- Fabm1 Module 5Document16 pagesFabm1 Module 5Randy Magbudhi50% (4)

- Basic Accounting Notes (Finale)Document33 pagesBasic Accounting Notes (Finale)Chreann Rachel100% (3)

- Pontipedra Rex Cotoner CVDocument4 pagesPontipedra Rex Cotoner CVCassandra LopezNo ratings yet

- Documents ListDocument8 pagesDocuments ListHaresh RajputNo ratings yet

- Movie Analysis (Revilla & Sanchez)Document2 pagesMovie Analysis (Revilla & Sanchez)Ceej RevsNo ratings yet

- Memo of Part SatisfactnDocument5 pagesMemo of Part SatisfactnVandhiya ThevanNo ratings yet

- TS Grewal Solutions for Class 12 Accountancy Chapter 7 - Calculating Goodwill and Partner's Gains/SacrificesDocument34 pagesTS Grewal Solutions for Class 12 Accountancy Chapter 7 - Calculating Goodwill and Partner's Gains/SacrificesblessycaNo ratings yet

- Cash Flow Statement GuideDocument37 pagesCash Flow Statement GuideAshekin MahadiNo ratings yet

- Guarantor Agreement: For Residential LettingsDocument3 pagesGuarantor Agreement: For Residential LettingsJan LeeNo ratings yet

- IPO Prospectus Explained: Key Details and Importance for InvestorsDocument3 pagesIPO Prospectus Explained: Key Details and Importance for InvestorshrikilNo ratings yet

- NAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsDocument2 pagesNAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsRoss John JimenezNo ratings yet

- Start-Ups and Early Stage Companies: A Valuation InsightDocument11 pagesStart-Ups and Early Stage Companies: A Valuation InsightViktorNo ratings yet

- General Elective Course List SEMESTER 1, 2021 Hanoi Campus: Please Click For Course Guide InformationDocument3 pagesGeneral Elective Course List SEMESTER 1, 2021 Hanoi Campus: Please Click For Course Guide InformationQuynh NguyenNo ratings yet

- O2 Annual Phone Plan StatementDocument3 pagesO2 Annual Phone Plan Statementsaad.asifhamidNo ratings yet

- Solution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDocument18 pagesSolution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDeanBucktdjx100% (35)