Professional Documents

Culture Documents

Homework FIN

Uploaded by

das4130 ratings0% found this document useful (0 votes)

4 views2 pagesMr. Cartwright needs to borrow money to expand his lumber business, but the loan being discussed with Northrop National Bank exceeds what is needed for expenses and would leave excess cash. As the company's advisor, the author recommends taking the loan because borrowing is necessary for expansion, but the company's financial ratios analyzed by the banker show weak liquidity and increasing debt levels, making the large loan too risky. The author concludes they would not authorize the loan as the company's negative cash flows put it at risk of not meeting obligations.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMr. Cartwright needs to borrow money to expand his lumber business, but the loan being discussed with Northrop National Bank exceeds what is needed for expenses and would leave excess cash. As the company's advisor, the author recommends taking the loan because borrowing is necessary for expansion, but the company's financial ratios analyzed by the banker show weak liquidity and increasing debt levels, making the large loan too risky. The author concludes they would not authorize the loan as the company's negative cash flows put it at risk of not meeting obligations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesHomework FIN

Uploaded by

das413Mr. Cartwright needs to borrow money to expand his lumber business, but the loan being discussed with Northrop National Bank exceeds what is needed for expenses and would leave excess cash. As the company's advisor, the author recommends taking the loan because borrowing is necessary for expansion, but the company's financial ratios analyzed by the banker show weak liquidity and increasing debt levels, making the large loan too risky. The author concludes they would not authorize the loan as the company's negative cash flows put it at risk of not meeting obligations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Cartwright Lumber Company

Mr. Cartwright has to borrow so much money in order to expand

his business. Several debts expenses and need to be covered

before he can move forward to expand, even the business is

profitable it doesn’t provide enough money to liquidate those

amounts. However the amount that is being discussed by

Northrop National bank exceed the amount need for his expenses

making available cash for future needs, Mr. cartwright doesn’t

need that much of a loan to put into his business.

As a Mr. Cartwright advisor I would recommend to take the loan.

Borrowing cash is necessary to expand the business and although

making some changes to the operating system would be

beneficiary to help with the expansion there is not enough access

to cash to do it. Taking such a loan would be necessary to expand

and maintain the operations running as they are now; in not

doing it so a slower pace growth is predicted.

As a banker the starting analysis will be the current ratio as 2001

was 1.8 in 2002 1.58 in 203 1.45 and the first quarter of 2014 1.35

it is still below the average index.

And the quick ratio as 2001 .88 in 2002 .72 in 2003 .66 and the

first quarter of 2004 .54 where the average index is 1.00 the

liquidity position of the company is very week.

The inventory turnover for the company started in 2001 as 7.10

2002 6.17 in 2003 6.33 with an average of 6.57 in the three years

passing the index of 6.1

The company’s DSO are increasing since the past years in 2001

36.77 days 2002 40.25 years in 2003 42.9 years and in the first

quarter of 2004 43.7 the average index is 32 days meaning that

the collection on sales is too slow. The asset turnover ratio in

2001 was 2.8, 2.7 in 2002 and 2.8 in 2003, which pass the index of

2.6 a good point to exceed

Cartwright’s debt to asset ratio was .55 in 2001, .58 in 2002, .62 in

2003 and if Cartwright increases this debt more with a larger loan

it is projected to get to .75 in 2004. Very risky move when there is

not enough cash flow available.

In conclusion I would not authorize the loan to Mr. Cartwright

company the rations presented reflect that having a negative cash

flows puts them at risk to not meet the obligatory requirements

of the loan even having sustainable assets to support the loan the

bank will take a big risk in doing it. Unless there is a strategy

where the operations let more cash flow into the company is very

unlikely that they would meet the requirements for this loan.

You might also like

- Cartwright Lumber Company Paper EXAMPLEDocument5 pagesCartwright Lumber Company Paper EXAMPLEJose SermenoNo ratings yet

- BANK 311 SlidesDocument18 pagesBANK 311 SlidesMaha AlanjawiNo ratings yet

- 15 - Nishikant Dhawale - EAI-17-112Document4 pages15 - Nishikant Dhawale - EAI-17-112NISHIKANT DHAWALENo ratings yet

- Butler Lumber Case Study SolutionDocument8 pagesButler Lumber Case Study SolutionBagus Be WeNo ratings yet

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionMichelle Rodríguez100% (1)

- Financial Analysis For Sapphire Fibres LimitedDocument6 pagesFinancial Analysis For Sapphire Fibres LimitedRashmeen NaeemNo ratings yet

- Cartwright Lumber Company PaperDocument5 pagesCartwright Lumber Company PaperJose Sermeno50% (2)

- Bigger Isn't Always BetterDocument17 pagesBigger Isn't Always BetterSherin Kalam100% (9)

- A Report On Silver River Manufacturing CompanyDocument59 pagesA Report On Silver River Manufacturing CompanyManish JaiswalNo ratings yet

- Star River PembahasanDocument8 pagesStar River PembahasanGloria Lisa SusiloNo ratings yet

- To Our Business Partners: (In Millions, Except Per Share Data)Document10 pagesTo Our Business Partners: (In Millions, Except Per Share Data)maxamsterNo ratings yet

- 1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesDocument2 pages1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesJane SmithNo ratings yet

- Tarangini: From ZM's DeskDocument5 pagesTarangini: From ZM's DeskBoinzb TNo ratings yet

- Final Exam Finance Intensive Week Winter 2013 Submitted By: Jaydeep ParmarDocument5 pagesFinal Exam Finance Intensive Week Winter 2013 Submitted By: Jaydeep Parmardilipkhatri019255No ratings yet

- Crystal Solutions Private Limited: 3.1 Company ProfileDocument11 pagesCrystal Solutions Private Limited: 3.1 Company ProfileManasvi NigamNo ratings yet

- Cart Wright ToDocument1 pageCart Wright ToStephanie YoungNo ratings yet

- Star River Electronics.Document5 pagesStar River Electronics.Nguyen Hieu100% (3)

- Butler Lumber Company Case SolutionDocument18 pagesButler Lumber Company Case SolutionNabab Shirajuddoula71% (7)

- Finamn 1Document11 pagesFinamn 1michean mabaoNo ratings yet

- Appraisal For Yire Cattle Ranch LTDDocument8 pagesAppraisal For Yire Cattle Ranch LTDPrince Akonor AsareNo ratings yet

- Introduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Document10 pagesIntroduction To Financial Management FIN 254 (Assignment) Spring 2014 (Due On 24th April 10-11.00 AM) at Nac 955Shelly SantiagoNo ratings yet

- Fin254 Project Team DynamicDocument12 pagesFin254 Project Team Dynamicfarah zarinNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisBharatsinh SarvaiyaNo ratings yet

- SocietyOne Shareholder Update December 11 2013Document8 pagesSocietyOne Shareholder Update December 11 2013Philip GardinerNo ratings yet

- Bank Decision MakingDocument3 pagesBank Decision Makingjob_deloitte7440No ratings yet

- 3.0 Liquidity and Financial StabilityDocument4 pages3.0 Liquidity and Financial StabilityJeThro LockingtonNo ratings yet

- Deluxe SolutionDocument6 pagesDeluxe SolutionR K Patham100% (1)

- FM Analysis November 2019Document13 pagesFM Analysis November 2019Mancit 21No ratings yet

- Week 7 Revision Exercise (Quest)Document4 pagesWeek 7 Revision Exercise (Quest)Eleanor ChengNo ratings yet

- Second Examination - Finance 3320 - Spring 2011 (Moore)Document9 pagesSecond Examination - Finance 3320 - Spring 2011 (Moore)Randall McVayNo ratings yet

- Kota Fiber Case StudyDocument17 pagesKota Fiber Case StudyNirajGhimireNo ratings yet

- Financial and Managerial Accounting MCQDocument36 pagesFinancial and Managerial Accounting MCQdevansh1221100% (1)

- Butler Lumber Company: Following Questions Are Answered in This Case Study SolutionDocument3 pagesButler Lumber Company: Following Questions Are Answered in This Case Study SolutionTalha SiddiquiNo ratings yet

- Star River Electronics LTDDocument5 pagesStar River Electronics LTDAdam Amru100% (1)

- American Apparel. Drowning in Debt?Document7 pagesAmerican Apparel. Drowning in Debt?Ojas GuptaNo ratings yet

- Current RatioDocument10 pagesCurrent RatioAnugya GuptaNo ratings yet

- Complete Kota FibresDocument13 pagesComplete Kota FibresSiti NadhirahNo ratings yet

- Butler Lumber Company: An Analysis On Estimating Funds RequirementsDocument17 pagesButler Lumber Company: An Analysis On Estimating Funds Requirementssi ranNo ratings yet

- Term Loans Case StudyDocument8 pagesTerm Loans Case StudyneemNo ratings yet

- Learn Some Forensic Accounting - An Indian Case StudyDocument10 pagesLearn Some Forensic Accounting - An Indian Case StudySunilNo ratings yet

- Fca B SiddharthDocument12 pagesFca B SiddharthSiddharth SangtaniNo ratings yet

- Case SolutionDocument9 pagesCase Solutiontiko100% (1)

- Financial Statement Analysis CaseDocument1 pageFinancial Statement Analysis CaseKevin James Sedurifa OledanNo ratings yet

- Analysis of Financial StatementsDocument6 pagesAnalysis of Financial StatementsMandeep SharmaNo ratings yet

- 9711 SOLUTIONS UpdatedDocument20 pages9711 SOLUTIONS Updatedhaseeb ahmedNo ratings yet

- Butler Lumber Final First DraftDocument12 pagesButler Lumber Final First DraftAdit Swarup100% (2)

- Butler Lumber CaseDocument4 pagesButler Lumber CaseLovin SeeNo ratings yet

- ButlerDocument1 pageButlerPrakhar RatheeNo ratings yet

- Esther Daniel International, Inc.: Group 8 MWF 3:30 PM - 4:30 PM ARCDocument3 pagesEsther Daniel International, Inc.: Group 8 MWF 3:30 PM - 4:30 PM ARCRichel ArmayanNo ratings yet

- IBF Term ReportDocument12 pagesIBF Term Reportabdulhadees48No ratings yet

- GROUP5 Biggerisntalwaysbetter Case StudyDocument27 pagesGROUP5 Biggerisntalwaysbetter Case StudyJasmine Cate JumillaNo ratings yet

- Corporate Action Ananlysis of Tata SteelDocument6 pagesCorporate Action Ananlysis of Tata SteelSumit JhaNo ratings yet

- 3 CompaniesreportfinanceDocument45 pages3 CompaniesreportfinanceMarisha RizalNo ratings yet

- Butler Lumber Case AnalysisDocument2 pagesButler Lumber Case AnalysisDucNo ratings yet

- Credit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.From EverandCredit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.No ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsFrom EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNo ratings yet

- Proposal Analysis Techniques and When To Use ThemDocument3 pagesProposal Analysis Techniques and When To Use Themdas413No ratings yet

- Fundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonDocument17 pagesFundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. Houstondas413No ratings yet

- Proposal Analysis Techniques and When To Use ThemDocument3 pagesProposal Analysis Techniques and When To Use Themdas413No ratings yet

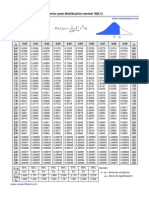

- Tabla ZDocument1 pageTabla Zfredsaint100% (1)

- AccessDocument2 pagesAccessdas413No ratings yet

- Unofficial Transcript: Registrar's O Ce - 4701 Limestone Road - Wilmington, DE 19808 - (302) 225-6265Document2 pagesUnofficial Transcript: Registrar's O Ce - 4701 Limestone Road - Wilmington, DE 19808 - (302) 225-6265das413No ratings yet

- Classes TopicsDocument1 pageClasses Topicsdas413No ratings yet

- Quiz ThreeDocument5 pagesQuiz Threedas413No ratings yet