Professional Documents

Culture Documents

Intermediate Accounting Volume I

Uploaded by

Mary Claudette Unabia0 ratings0% found this document useful (0 votes)

13 views1 pageOriginal Title

INTERMEDIATE ACCOUNTING VOLUME I.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageIntermediate Accounting Volume I

Uploaded by

Mary Claudette UnabiaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

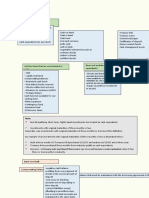

CASH AND CASH EQUIVALENTS (CHAPTER 1)

Cash – money (layman’s term) *BSP treasury bill purchased one year ago cannot qualify

as a cash equivalent

Money – standard medium of exchange in business

transactions

– refers to the currency and coins which are in

circulation and legal tender

Cash – connotes more than money (accounting’s term)

– money and any other negotiable instrument

that is payable in money and acceptable by the

bank for deposit and immediate credit

Postdated checks received cannot be considered as cash

yet because these checks are UNACCEPTABLE by the bank

for deposit and immediate credit or outright encashment

Unrestricted Cash – for an item to be recognized as

“cash”, it must be unrestricted in use

– cash must be readily available in the payment

of current obligations and not be subject to any

restrictions, contractual or otherwise

CASH ITEMS

Cash on Hand Cash in Bank Cash Fund

-undeposited cash -demand deposit (set aside for

-customer’s checks -checking account current

-traveler’s checks -saving deposit purposes)

-bank drafts (unrestricted as -petty cash fund

-money order to withdrawal) -payroll fund

-dividend fund

Cash equivalents – short-term and highly liquid

investments that are readily convertible into cash

and so near their maturity that they present

insignificant risk of changes in value because of

changes in interest rates

Examples of cash equivalent:

-three – month BSP treasury bill

-three-year BSP treasury bill purchased three

months before date of maturity

-three-month time deposit

-three-month money market instrument or

commercial paper

-preference shares with specified redemption

date and acquired three months before

redemption date

Equity securities – cannot qualify as cash equivalents

because shares do not have a maturity date

(some equity securities are issued with a maturity

date)

*what is important is the date of purchase which should

be THREE MONTHS OR LESS BEFORE MATURITY

You might also like

- Notes IA1 PirntDocument18 pagesNotes IA1 PirntBack upNo ratings yet

- Aud 1&2 - CceDocument6 pagesAud 1&2 - Ccecherish melwinNo ratings yet

- Cash and Cash EquivalentsDocument34 pagesCash and Cash EquivalentsJennalyn S. GanalonNo ratings yet

- Ia1 NotesDocument23 pagesIa1 NotesAssej C AustriaNo ratings yet

- Cash and Cash EDocument3 pagesCash and Cash EShaira BugayongNo ratings yet

- FAR 1 REVIEWER (Unfinished)Document3 pagesFAR 1 REVIEWER (Unfinished)Ruth MuldongNo ratings yet

- Cash and Cash EquivalentsDocument6 pagesCash and Cash EquivalentsPamela Mae PlatonNo ratings yet

- Intermediate AccountingDocument33 pagesIntermediate AccountingHannah Baniqued100% (1)

- Cash & Cash EquivalentsDocument8 pagesCash & Cash Equivalentsbona jirahNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsJUST KINGNo ratings yet

- 01 Intermediate Accounting 1 Cash and Cash EquivalentsDocument9 pages01 Intermediate Accounting 1 Cash and Cash EquivalentsRoyu BreakerNo ratings yet

- Lecture No.1 Cash Cash Equiv TheoriesDocument3 pagesLecture No.1 Cash Cash Equiv TheoriesbsasociondaisyremarieNo ratings yet

- and Highly Liquid Investment Readily Convertible Into CashDocument3 pagesand Highly Liquid Investment Readily Convertible Into CashGirl Lang AkoNo ratings yet

- Accounting NotesDocument20 pagesAccounting NotesAnonymous PersonNo ratings yet

- Audit ProblemsDocument47 pagesAudit ProblemsShane TabunggaoNo ratings yet

- Audit ProblemsDocument32 pagesAudit ProblemsShane TabunggaoNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- Intacc ReviewerDocument20 pagesIntacc ReviewerAvos NnNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash Equivalentsshe lacks wordsNo ratings yet

- Cash and Cash EquivalentsDocument37 pagesCash and Cash EquivalentsReiner Jan AlcantaraNo ratings yet

- CFAS Chapter 4 - Cash and Cash EquivalentsDocument3 pagesCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNo ratings yet

- (Studocu) Int Acc Chapter 1 - Valix, Robles, Empleo, MillanDocument3 pages(Studocu) Int Acc Chapter 1 - Valix, Robles, Empleo, MillanHufana, ShelleyNo ratings yet

- Ia1 ReviewerDocument10 pagesIa1 ReviewerVeronica SarmientoNo ratings yet

- CashDocument3 pagesCashKimNo ratings yet

- Cash and Cash Equivalents Cash (Money)Document1 pageCash and Cash Equivalents Cash (Money)Erika LanezNo ratings yet

- Cash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheDocument4 pagesCash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheannyeongNo ratings yet

- CCE NotesDocument7 pagesCCE NotesHavanah Erika Dela CruzNo ratings yet

- NOTESmidtermDocument6 pagesNOTESmidtermAlexis Jhan MagoNo ratings yet

- Cash and Cash Equivalents (Summary Notes)Document3 pagesCash and Cash Equivalents (Summary Notes)Song Ji HyoNo ratings yet

- Audit - Cash and Cash Equivalents PDFDocument15 pagesAudit - Cash and Cash Equivalents PDFSiena Farne100% (1)

- Cash & Cash EquivalentsDocument20 pagesCash & Cash Equivalentsalexis prada100% (2)

- Cash & Cash Equivalents, LECTURE &EXERCISESDocument16 pagesCash & Cash Equivalents, LECTURE &EXERCISESNMCartNo ratings yet

- Cash & Cash Equivalents, Lecture &exercisesDocument16 pagesCash & Cash Equivalents, Lecture &exercisesNMCartNo ratings yet

- Intermediate Accounting 1: Cash and Cash EquivalentDocument17 pagesIntermediate Accounting 1: Cash and Cash EquivalentClar AgramonNo ratings yet

- Module 5 - Substantive Test of CashDocument6 pagesModule 5 - Substantive Test of CashJesievelle Villafuerte NapaoNo ratings yet

- FAR LectureDocument6 pagesFAR Lecturewingsenigma 00No ratings yet

- Cash - LectureDocument2 pagesCash - LectureJasperNo ratings yet

- Summary of Cash and Cash EquivalentsDocument4 pagesSummary of Cash and Cash EquivalentsMhico Mateo100% (1)

- Far.03 Cash and Cash EquivalentsDocument8 pagesFar.03 Cash and Cash EquivalentsRhea Royce CabuhatNo ratings yet

- Far ReviewerDocument5 pagesFar ReviewerKairo ZeviusNo ratings yet

- Cash & Cash Equivalents, Lecture &exercisesDocument16 pagesCash & Cash Equivalents, Lecture &exercisesDessa GarongNo ratings yet

- NU - Audit of Cash and Cash EquivalentsDocument14 pagesNU - Audit of Cash and Cash EquivalentsDawn QuimatNo ratings yet

- Compiled Lessons - Far 1Document23 pagesCompiled Lessons - Far 1Gwyn OliverNo ratings yet

- Cash and ReceivablesDocument25 pagesCash and ReceivablesOjv FgjNo ratings yet

- Sta Clara - Summary Part 1Document49 pagesSta Clara - Summary Part 1Carms St ClaireNo ratings yet

- Basic Accounting REVIEWERDocument1 pageBasic Accounting REVIEWERglamfactorsalonspaNo ratings yet

- Acccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Document7 pagesAcccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Rey HandumonNo ratings yet

- Cash and Cash Equivalents PDFDocument4 pagesCash and Cash Equivalents PDFJade Gomez100% (1)

- Statement of Financial PositionDocument9 pagesStatement of Financial PositionJEAN YVES BRAVONo ratings yet

- Chapter 1 Cash and Cash Equivalents AutoRecoveredDocument44 pagesChapter 1 Cash and Cash Equivalents AutoRecoveredJhonielyn Regalado RugaNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsCamille Joyce Corpuz Dela CruzNo ratings yet

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- Cash and Cash EquivalentsDocument31 pagesCash and Cash EquivalentsMark LouieNo ratings yet

- If Silent As To Date of Acquisition, Assume As Current: Cash and Cash Equivalents 1. CashDocument3 pagesIf Silent As To Date of Acquisition, Assume As Current: Cash and Cash Equivalents 1. CashKent Raysil PamaongNo ratings yet

- C7 Lecture NotesDocument3 pagesC7 Lecture NotesJonathan NavalloNo ratings yet

- 00 Quick Notes - Cash and Cash Equivalents PDFDocument6 pages00 Quick Notes - Cash and Cash Equivalents PDFBecky GonzagaNo ratings yet

- Notes (Audit Prob)Document6 pagesNotes (Audit Prob)kodzuken.teyNo ratings yet

- Cfas - Cash and Cash EquivalentsDocument5 pagesCfas - Cash and Cash EquivalentsYna SarrondoNo ratings yet

- Cash Part1Document7 pagesCash Part1cuaresmamonicaNo ratings yet

- Law On Partnership and Corporation by Hector de LeonDocument41 pagesLaw On Partnership and Corporation by Hector de LeonMary Claudette Unabia100% (3)

- Ethics, Fraud, and Internal Control (Chapter 3)Document6 pagesEthics, Fraud, and Internal Control (Chapter 3)Mary Claudette UnabiaNo ratings yet

- Vol 3 Chapter 6Document5 pagesVol 3 Chapter 6Mary Claudette UnabiaNo ratings yet

- The Information System (Chapter 1)Document3 pagesThe Information System (Chapter 1)Mary Claudette UnabiaNo ratings yet

- An Overview of Transaction Processing (Chapter 2)Document8 pagesAn Overview of Transaction Processing (Chapter 2)Mary Claudette UnabiaNo ratings yet

- An Overview of Transaction Processing (Chapter 2)Document8 pagesAn Overview of Transaction Processing (Chapter 2)Mary Claudette UnabiaNo ratings yet

- Ethics, Fraud, and Internal Control (Chapter 3)Document6 pagesEthics, Fraud, and Internal Control (Chapter 3)Mary Claudette UnabiaNo ratings yet

- The Information System (Chapter 1)Document3 pagesThe Information System (Chapter 1)Mary Claudette UnabiaNo ratings yet

- Vol 1 Chap 10 InventoriesDocument7 pagesVol 1 Chap 10 InventoriesMary Claudette UnabiaNo ratings yet

- IA Vol 1 Chap 10 & 11Document5 pagesIA Vol 1 Chap 10 & 11Mary Claudette UnabiaNo ratings yet

- Chap 10 and 11Document5 pagesChap 10 and 11Mary Claudette UnabiaNo ratings yet

- Chap 12,13, and 14Document6 pagesChap 12,13, and 14Mary Claudette UnabiaNo ratings yet

- Vol 3 Chapter 6Document5 pagesVol 3 Chapter 6Mary Claudette UnabiaNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsFrom EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsRating: 5 out of 5 stars5/5 (1)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)