Professional Documents

Culture Documents

Assignment On GI, NOLCO & MCIT - 2020

Assignment On GI, NOLCO & MCIT - 2020

Uploaded by

Damdam Alunan0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

Assignment on GI, NOLCO & MCIT - 2020.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageAssignment On GI, NOLCO & MCIT - 2020

Assignment On GI, NOLCO & MCIT - 2020

Uploaded by

Damdam AlunanCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

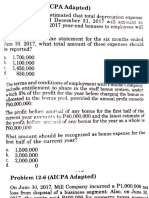

Central Philippine University

Exercise 2 – Tax 41

Name: ______________________________ Course: _____________Score: __________

A. A corporation started operating in year 2011 presented the following:

2015 2016 2017 2018 2019

Gross Income - P 150,000 P 200,000 P 300,000 P1,000,000 P 800,000

Net Income/(Loss)- (30,000) 15,000 (25,000) 100,000 61,250

Income Tax Due P__________ P_________ P_________ P__________ P_______

B. A corporation engaged Leasing of Real Property for a decade presented the following data

for the year 2019. Excess MCIT in 2018 was P45,000

Quarter Gross Income Net Income Income tax still due

1 2,500,000 140,000 ?

2 3,000,000 180,000 ?

3 3,200,000 265,000 ?

4 3,500,000 250,000 ?

C. A corporation reported for the year 2019:

Authorized and issued Capital ……………………………… 30,000,000

Retained Earnings, 2018 ……………………………………. 50,000,000

Gross Income ……………………………………………….. 7,000,000

Net Income from Operation…………………………………. 300,000

Dividends received from a foreign corp.………. ………….. 100,000

Dividends Paid ……………………………………………… 3,000,000

Improperly Accumulated Earnings Tax is P____________

You might also like

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document10 pagesAP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Bernadette Panican100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- AFAR Part 1 Page 1-20Document2 pagesAFAR Part 1 Page 1-20Tracy Ann AcedilloNo ratings yet

- Interim Financial Reporting NotesDocument3 pagesInterim Financial Reporting NotesRogin Erica AdolfoNo ratings yet

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- p1 OsDocument1 pagep1 OsLeika Gay Soriano OlarteNo ratings yet

- Intax-Activity 1Document1 pageIntax-Activity 1Venus PalmencoNo ratings yet

- #3 Deferred Taxes PDFDocument3 pages#3 Deferred Taxes PDFjanus lopezNo ratings yet

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Document3 pagesName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- Accountancy, Business and Management August 2-3, 2018: Mindanao Mission Academy Business FinanceDocument2 pagesAccountancy, Business and Management August 2-3, 2018: Mindanao Mission Academy Business FinanceHLeigh Nietes-Gabutan100% (1)

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Multiple Choice-ProbDocument5 pagesMultiple Choice-ProbAngela RuedasNo ratings yet

- Tax On CorporationDocument2 pagesTax On CorporationMervidelleNo ratings yet

- Quizzz Intac 3Document10 pagesQuizzz Intac 3lana del reyNo ratings yet

- Tax On Corporations Part 2Document3 pagesTax On Corporations Part 2Tet AleraNo ratings yet

- Financial Accounting Part 3Document6 pagesFinancial Accounting Part 3Christopher Price67% (3)

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAlliah Mae ArbastoNo ratings yet

- 6806 - Operating Segment and Interim ReportingDocument2 pages6806 - Operating Segment and Interim ReportinglllllNo ratings yet

- 6806 Operating Segment and Interim ReportingDocument2 pages6806 Operating Segment and Interim ReportingEsse ValdezNo ratings yet

- (Final) Acco 20133 - Income TaxationDocument19 pages(Final) Acco 20133 - Income TaxationJona kelssNo ratings yet

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Income Tax QuizDocument1 pageIncome Tax QuizMervidelleNo ratings yet

- Las# 5 - (Iaa) Error CorrectionDocument7 pagesLas# 5 - (Iaa) Error CorrectionStella MarieNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- Of Shares Of: ST ND RDDocument6 pagesOf Shares Of: ST ND RDKingChryshAnneNo ratings yet

- Exercise Questions On NT and MCITDocument2 pagesExercise Questions On NT and MCITDamdam AlunanNo ratings yet

- Balance Sheet Errors: Problem 1Document2 pagesBalance Sheet Errors: Problem 1Alyana SandiegoNo ratings yet

- Afar (2018-2022)Document49 pagesAfar (2018-2022)Princess KeithNo ratings yet

- 03 Resa Pas 8 ScanDocument21 pages03 Resa Pas 8 Scanby ScribdNo ratings yet

- AP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryDocument4 pagesAP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryAngela AlejandroNo ratings yet

- Template - QE - BLT For Incoming 4th YrDocument12 pagesTemplate - QE - BLT For Incoming 4th YrJykx SiaoNo ratings yet

- Activity 2Document3 pagesActivity 2LFGS Finals0% (1)

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Document12 pagesChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionJay-L TanNo ratings yet

- Fat Deferred Income TaxDocument2 pagesFat Deferred Income Taxnicole bancoroNo ratings yet

- Chapter 10Document8 pagesChapter 10Coursehero PremiumNo ratings yet

- Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Document3 pagesUse The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Irvin LevieNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Intermediate Accounting Chapters 9,10Document31 pagesIntermediate Accounting Chapters 9,10Jonathan NavalloNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxRed YuNo ratings yet

- Interim Financial Reporting-AssignmentDocument5 pagesInterim Financial Reporting-AssignmentLourdrandal AbellaNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1Angel RosalesNo ratings yet

- Ia3 IsDocument3 pagesIa3 IsMary Joy CabilNo ratings yet

- Interim and Segment ReportingDocument3 pagesInterim and Segment ReportingLui100% (2)

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- Quiz 1 IntaxDocument5 pagesQuiz 1 IntaxTOMAS, JACKY LOU C.No ratings yet

- Income Taxation 1Document4 pagesIncome Taxation 1nicole bancoroNo ratings yet

- SOL QUIZ RIT II and IIIDocument68 pagesSOL QUIZ RIT II and IIIouia iooNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxCamille GarciaNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxShaira Bugayong0% (2)

- KF Eliminations For RMYCDocument8 pagesKF Eliminations For RMYCFranz Josef De GuzmanNo ratings yet

- Income Tax Due and PayableDocument2 pagesIncome Tax Due and PayableJpoy RiveraNo ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross IncomeSetty HakeemaNo ratings yet

- Activity 2 - 4B UpdatesDocument3 pagesActivity 2 - 4B UpdatesAngelo HilomaNo ratings yet

- Exercise Questions On NT and MCITDocument2 pagesExercise Questions On NT and MCITDamdam AlunanNo ratings yet

- Notes:: Deduction Individuals Estates Trusts Corp. PartnershipsDocument19 pagesNotes:: Deduction Individuals Estates Trusts Corp. PartnershipsDamdam AlunanNo ratings yet

- Exercise On Gross IncomeDocument2 pagesExercise On Gross IncomeDamdam AlunanNo ratings yet

- Deductions SummaryDocument8 pagesDeductions SummaryDamdam AlunanNo ratings yet

- IGNACIO, Angelie M. (USA MLS-Intern (IDH) ) Page 1Document10 pagesIGNACIO, Angelie M. (USA MLS-Intern (IDH) ) Page 1Damdam AlunanNo ratings yet