Professional Documents

Culture Documents

Exercise Questions On NT and MCIT

Uploaded by

Damdam Alunan0 ratings0% found this document useful (0 votes)

66 views2 pagesOriginal Title

Exercise questions on NT and MCIT.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views2 pagesExercise Questions On NT and MCIT

Uploaded by

Damdam AlunanCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Central Philippine University

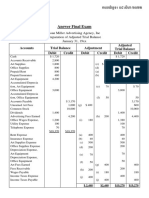

Exercise Quiz – Tax 41

Name:___________________________ Course:_______________ Score:____________

A. A corporation engaged Auto Repair Shop for a decade presented the

following data for the year 2019:

Service Income …………………………….. 4,500,000

Interest Income on peso deposits …………… 30,000

Salaries of mechanics ……………………… 1,250,000

Auto supplies and parts used…...………….. 1,000,000

Office Salaries……………………………….. 595,000

Other administrative expenses …………… 170,000

Service Income …………………………………. 4,500,000

Less: COS

Salaries of mechanics ……… 1,250,000

Auto Supplies & parts …….. 1,000,000 2,250,000

Gross Income …………………………………. 2,250,000

Less: Operating Expenses

Office Salaries ……………. 595,000

Others ……………………… 170,000 765,000

Net Income from Operations ………………… 1,485,000

Other Income: Interest Income ……………… 30,000

Net Income Before Tax ………………………. 1,515,000

1. Gross Income is P2,250,000

2. MCIT is P45,000 (P2,250,000 X 2%)

3. Normal Income Tax using OSD is (2,250,000 x 60%) =

P1,350,000 x 30% = P 405,000

4. Normal Income Tax using itemized deduction____________

P1,485,000 x 30% = P445,500

5. Income Tax due/payable using itemized deduction is

P445,500

Income tax due/payable using OSD = P405,000

B. A corporation who started operating in January 2007, reported the

following:

2009 2010 2011 2012 2013 2014

Sales 700,000 980,000 1,000,000 1,100,000 903,500 1,250,000

COS 360,000 350,000 230,000 920,000 643,000 875,000

GI 340,000 630,000 770,000 180,000 260,500 375,000

Expenses 320,000 590,000 748,000 168,500 250,000 305,000

Net Income 20,000 40,000 22,000 11,500 10,500 70,000

MCIT ……. NA 12,600 15,400 3,600 5,210 7,500

NT ……….. 6,000 12,000 6,600 3,450 3,150 21,000

Excess MCIT 600 8,800 150 2,060

Payable …. 6,000 12,600 15,400 . 3,600 5,210 21,000

Less: Excess MCIT – (2011, 2012 & 2013) …………………………………………. 11,010

Still Payable ………………………………………………………………………….. 9,990

6. Income Tax Payable in 2009 is P6,000

7. Income Tax Payable in 2010 is P___________

8. Income Tax Payable in 2011 is P___________

9. Income Tax Payable in 2012 is P___________

10. Income Tax Payable in 2013 is P___________

11. Income Tax still payable in 2014 is P___________

C. A corporation started operating in January 2005 presented the following:

Gross Income Net Income Excess MCIT

2010 …………………………….. 1,000,000 1,000 19,700

2011 ……………………………. 500,000 30,000 1,000

2012 ……………………………. 900,000 120,000

12. Income tax s for still payable for year 2010 is P20,000.

Entry:

Income Tax Expense ……………….. 300

Deferred Income Tax ………………19,700

Income Tax payable ……………………. P20,000

13 Income tax still payable for year 2011 is P 10,000.

14. Income tax still payable for year 2012 is P15,300.

Payable …………………………………. 36,000

Still Payable (36,000 – 20,700) ………….15,300

Less: Excess MCIT …2010 – 19,700

2011 - 1,000

Entry:

Income Tax Expense ………………… 36,000

Deferred Income Tax ………………….. 20,700

Income Tax Payable/Cash ……………. 15.300

You might also like

- Child Care Business PlanDocument15 pagesChild Care Business Plandeepakpinksurat100% (5)

- Case: Commercializing The Kunst 1600 Dry Piston Vacuum Pump: Submitted By: Ratandeep Burman - PGP/21/346Document3 pagesCase: Commercializing The Kunst 1600 Dry Piston Vacuum Pump: Submitted By: Ratandeep Burman - PGP/21/346SK CHANDANo ratings yet

- PSBA - Accounting 13 Long Quiz - Applied Auditing (Finals)Document14 pagesPSBA - Accounting 13 Long Quiz - Applied Auditing (Finals)Patty Lacson100% (2)

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- LGU Budget CycleDocument3 pagesLGU Budget CycleDelfinNo ratings yet

- Problem 5Document3 pagesProblem 5AyhuNo ratings yet

- Moduel 4 Financial Statement Modeling Theory and ConceptsDocument26 pagesModuel 4 Financial Statement Modeling Theory and ConceptsAkshay Krishnan P RCBSNo ratings yet

- Print IeuDocument13 pagesPrint Ieuroyroberto50% (2)

- Building Strategy and Performance Through Time: The Critical PathDocument19 pagesBuilding Strategy and Performance Through Time: The Critical PathBusiness Expert PressNo ratings yet

- SAP Fixed AssetsDocument45 pagesSAP Fixed Assetsrohitmandhania80% (5)

- Module 1 Intermediate Accounting 2Document37 pagesModule 1 Intermediate Accounting 2Andrei GoNo ratings yet

- JFINEX Accomplishment Report 1st Semester 2022 2023Document20 pagesJFINEX Accomplishment Report 1st Semester 2022 2023Jelwin BautistaNo ratings yet

- CH 5 - AdjustmentsDocument24 pagesCH 5 - Adjustmentsmuhamad elmiNo ratings yet

- JOB Order CostingDocument4 pagesJOB Order CostingWag NasabiNo ratings yet

- Similarity and Difference Between Accounting Concept and ConventionDocument23 pagesSimilarity and Difference Between Accounting Concept and ConventionravisankarNo ratings yet

- ARTICLE 1306 - Limitations On Contractual Stipulations Under POLICE POWERDocument6 pagesARTICLE 1306 - Limitations On Contractual Stipulations Under POLICE POWERFrances Tracy Carlos Pasicolan100% (1)

- 06.module & Task-Share Capital PDFDocument8 pages06.module & Task-Share Capital PDFJohn Lery YumolNo ratings yet

- Activity 2 ECODocument2 pagesActivity 2 ECOEugene AlipioNo ratings yet

- Problem With Solution For Intermediate Accounting 3Document1 pageProblem With Solution For Intermediate Accounting 3Luxx LawlietNo ratings yet

- Macroeconomics - IntroductionDocument10 pagesMacroeconomics - IntroductionRonnel Aldin FernandoNo ratings yet

- Reflection - Annual ReportsDocument1 pageReflection - Annual ReportsKhem Raj GyawaliNo ratings yet

- Merchandising ExampleDocument6 pagesMerchandising ExampleMarie Ann JoNo ratings yet

- Financial Marekts (Chapter 2)Document3 pagesFinancial Marekts (Chapter 2)Kyla DayawonNo ratings yet

- Blaw Prelims ReviewerDocument17 pagesBlaw Prelims ReviewerVanessa dela Torre0% (1)

- Reflection Paper - LanuzaDocument1 pageReflection Paper - LanuzaPrincess Pilove GawongnaNo ratings yet

- Accounting in Our Daily LifeDocument3 pagesAccounting in Our Daily LifeJaeseupeo JHas VicenteNo ratings yet

- Cash Cash Equivalents: Philippine Accounting Standards 7 Statement of Cash FlowsDocument2 pagesCash Cash Equivalents: Philippine Accounting Standards 7 Statement of Cash FlowsTrisha AlaNo ratings yet

- Diagnostic AssessmentDocument7 pagesDiagnostic AssessmentChristine JoyceNo ratings yet

- ECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsDocument4 pagesECODEV 18 Assignment No.2 Ten Lesson in Economics and Thinking Like An EconomistsCassie LyeNo ratings yet

- Problem 12 Accounting PDFDocument3 pagesProblem 12 Accounting PDFErika RepedroNo ratings yet

- Income TaxesDocument4 pagesIncome TaxesHana Grace MamangunNo ratings yet

- MODULE 5-Part 1Document5 pagesMODULE 5-Part 1Mary Joy CabilNo ratings yet

- Guabna Aldyn Bookkeeping TransactionsDocument40 pagesGuabna Aldyn Bookkeeping TransactionsSHIENNA MAE ALVIS100% (1)

- Economic-Development-Midterm-Reviewer 2Document8 pagesEconomic-Development-Midterm-Reviewer 2Toni Francesca MarquezNo ratings yet

- Statements of Dunkin DonutsDocument4 pagesStatements of Dunkin DonutsMariamiNo ratings yet

- Humborg Activity 4Document1 pageHumborg Activity 4Frances CarpioNo ratings yet

- Ca5101 Adjusting Entries La 1Document13 pagesCa5101 Adjusting Entries La 1Michael MagdaogNo ratings yet

- Pas 8, 10, 16Document7 pagesPas 8, 10, 16alliahnahNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Sales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitDocument5 pagesSales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitMichaela KowalskiNo ratings yet

- 1Document48 pages1Hamza Ali100% (2)

- Rizal LawDocument3 pagesRizal LawMark Angelo TemplanzaNo ratings yet

- Tax 321 Prelim Quiz 1 Key PDFDocument13 pagesTax 321 Prelim Quiz 1 Key PDFJeda UsonNo ratings yet

- CfasDocument32 pagesCfasLouiseNo ratings yet

- Final Term Assignment 2 On Financial Accounting and Reporting - Partnership OperationsDocument2 pagesFinal Term Assignment 2 On Financial Accounting and Reporting - Partnership OperationsAnne AlagNo ratings yet

- Exam in Accounting-FinalsDocument5 pagesExam in Accounting-FinalsIyarna YasraNo ratings yet

- Rich Angelie Muñez - Assignment 4 Adjusting EntriesDocument2 pagesRich Angelie Muñez - Assignment 4 Adjusting EntriesRich Angelie MuñezNo ratings yet

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDocument4 pagesLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNo ratings yet

- Common Account TitlesDocument4 pagesCommon Account TitlesJaydie CruzNo ratings yet

- Busana1 Reviewer For Quiz 4Document2 pagesBusana1 Reviewer For Quiz 4Alyssa GervacioNo ratings yet

- Ps Na Bago Sa ECONDocument10 pagesPs Na Bago Sa ECONJonelou CusipagNo ratings yet

- Projected FS For Boarding HouseDocument14 pagesProjected FS For Boarding HouseGlem Maquiling JosolNo ratings yet

- Economics ReportDocument32 pagesEconomics ReportGazelle Joy UlalanNo ratings yet

- Adjusting Entry - PrepaymentsDocument19 pagesAdjusting Entry - PrepaymentsShayne Aldrae CacaldaNo ratings yet

- GHI Company Comparative Balance Sheet For The Year 2015 & 2016Document3 pagesGHI Company Comparative Balance Sheet For The Year 2015 & 2016Kl HumiwatNo ratings yet

- Receivable FinancingDocument15 pagesReceivable FinancingshaneNo ratings yet

- BIR Form 1702-RTDocument8 pagesBIR Form 1702-RTDianne SantiagoNo ratings yet

- Lesson 3 Sales Budget and Schedule of Expected Cash CollectionDocument18 pagesLesson 3 Sales Budget and Schedule of Expected Cash CollectionZybel RosalesNo ratings yet

- Multiple Choice: Property of STIDocument2 pagesMultiple Choice: Property of STIJanineD.MeranioNo ratings yet

- Evaluating Firm Performance - ReportDocument5 pagesEvaluating Firm Performance - ReportJeane Mae BooNo ratings yet

- Final Pe Reflection PaperDocument11 pagesFinal Pe Reflection PaperAnnie Ruth CamiloNo ratings yet

- Action Systems Develop Because There Are Hybrid CostingDocument2 pagesAction Systems Develop Because There Are Hybrid CostingAndriaNo ratings yet

- Overseas Communication TaxDocument1 pageOverseas Communication TaxlyzleejoieNo ratings yet

- Lesson 3: Worksheet 3: Remedial Lesson 3: Adjusting EntriesDocument2 pagesLesson 3: Worksheet 3: Remedial Lesson 3: Adjusting EntriesAleana joy PabelicNo ratings yet

- Financial Preparation For Entrepreneurial VenturesDocument37 pagesFinancial Preparation For Entrepreneurial VenturesCzarina MichNo ratings yet

- Effect of Working Capital Management and Financial Leverage On Financial Performance of Philippine FirmsDocument9 pagesEffect of Working Capital Management and Financial Leverage On Financial Performance of Philippine FirmsGeorgina De LiañoNo ratings yet

- Project Management-An Integrated ApproachDocument3 pagesProject Management-An Integrated Approachutcm77No ratings yet

- Financial Management 2: Prepared By: Eunice Meanne B. SiapnoDocument33 pagesFinancial Management 2: Prepared By: Eunice Meanne B. SiapnoRyan TamondsNo ratings yet

- Exercise On Gross IncomeDocument2 pagesExercise On Gross IncomeDamdam AlunanNo ratings yet

- Notes:: Deduction Individuals Estates Trusts Corp. PartnershipsDocument19 pagesNotes:: Deduction Individuals Estates Trusts Corp. PartnershipsDamdam AlunanNo ratings yet

- Assignment On GI, NOLCO & MCIT - 2020Document1 pageAssignment On GI, NOLCO & MCIT - 2020Damdam AlunanNo ratings yet

- Deductions SummaryDocument8 pagesDeductions SummaryDamdam AlunanNo ratings yet

- Exercise On Gross IncomeDocument2 pagesExercise On Gross IncomeDamdam AlunanNo ratings yet

- Assignment On GI, NOLCO & MCIT - 2020Document1 pageAssignment On GI, NOLCO & MCIT - 2020Damdam AlunanNo ratings yet

- Deductions SummaryDocument8 pagesDeductions SummaryDamdam AlunanNo ratings yet

- IGNACIO, Angelie M. (USA MLS-Intern (IDH) ) Page 1Document10 pagesIGNACIO, Angelie M. (USA MLS-Intern (IDH) ) Page 1Damdam AlunanNo ratings yet

- PresentationDocument27 pagesPresentationMenuka WatankachhiNo ratings yet

- 7160 - FAR Preweek ProblemDocument14 pages7160 - FAR Preweek ProblemMAS CPAR 93No ratings yet

- New Construction Development Plan For XYZDocument5 pagesNew Construction Development Plan For XYZRoyNo ratings yet

- Lesson 1 - The Accountancy ProfessionDocument52 pagesLesson 1 - The Accountancy ProfessionAllen GonzagaNo ratings yet

- Cost Volume Profit Analysis ActivityDocument2 pagesCost Volume Profit Analysis ActivityYamateNo ratings yet

- Full Download Short Term Financial Management 3rd Edition Maness Test BankDocument35 pagesFull Download Short Term Financial Management 3rd Edition Maness Test Bankcimanfavoriw100% (31)

- 2,3,4 Ir Uzd PDFDocument31 pages2,3,4 Ir Uzd PDFLeonid LeoNo ratings yet

- Graduate Business School Faculty of Business ManagementDocument17 pagesGraduate Business School Faculty of Business ManagementSyahril NizamNo ratings yet

- Chapter 5 - Fund Flow Statement (FFS)Document36 pagesChapter 5 - Fund Flow Statement (FFS)T- SeriesNo ratings yet

- Deductions ExamplesDocument25 pagesDeductions ExamplesKezNo ratings yet

- SM Wal-Mart Group 3Document32 pagesSM Wal-Mart Group 3Kennedy Ng100% (2)

- Comparative Analysis Between The Fundamental and Technical Analysis 2016 PDFDocument6 pagesComparative Analysis Between The Fundamental and Technical Analysis 2016 PDFYoh Sandriano Naru HitangNo ratings yet

- Investopedia ExplainsDocument28 pagesInvestopedia ExplainsPankaj JoshiNo ratings yet

- Answer Final Exam (POA)Document2 pagesAnswer Final Exam (POA)Phâk Tèr ÑgNo ratings yet

- Financial Statement Analysis: by Uditha JayasingheDocument19 pagesFinancial Statement Analysis: by Uditha JayasinghesanjuladasanNo ratings yet

- Chapter 1: Accounting in ActionDocument31 pagesChapter 1: Accounting in ActionFarhan TariqNo ratings yet

- BSCDocument31 pagesBSCRashed MiaNo ratings yet

- Deepak ComputationDocument3 pagesDeepak ComputationRavi YadavNo ratings yet

- NonLinear ScaleDocument4 pagesNonLinear ScaleSid KrishNo ratings yet

- Coffee Shop Business PlanDocument11 pagesCoffee Shop Business PlanRamana Reddy0% (1)

- Frequently Asked Questions - NWPCDocument16 pagesFrequently Asked Questions - NWPCNap MissionnaireNo ratings yet