Professional Documents

Culture Documents

Cashflow Protection Plus - English

Uploaded by

Jagdeesh ShettyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cashflow Protection Plus - English

Uploaded by

Jagdeesh ShettyCopyright:

Available Formats

Edelweiss Tokio Life -

Cashflow Protection Plus

[An Individual, Non-Linked, Participating, Savings, Life Insurance Product]

Overview:

We all wish for a regular and continuous flow of income in all stages of our life. However, most of the time achieving

those over increasing age & passage of time is not possible. With the life expectancy steadily increasing over the

decades, many of us may end up having a post-retirement life which could be almost equal to our working years. To

avoid such a frightening scenario, we must plan for our second innings of life well in advance so that we can live

worry free for a life time.

Edelweiss Tokio Life - Cashflow Protection Plus enables an individual to sustain current standard of living and have a

regular flow of income till one is alive and empowers to pass on legacy to the generations to follow.

Product Description:

The Plan

• Is a Non-Linked, Participating, Savings, Life Insurance Plan.

• Gives protection till age 100.

• Provides a lumpsum amount in the form of Reversionary Bonus$ at the end of premium payment term or

death, whichever is earlier.

• Makes regular payout in the form of Cash Bonus$ and Money Back, starting one year after the premium

paying term till age 100 or death, whichever is earlier.

• Provides a guaranteed^ lumpsum amount on survival till age 100.

• Enables to pay premiums for a limited period and enjoy plan benefits for a longer period.

• Provides an option to enhance protection through a wide range of 6 riders.

• Allows to avail tax benefits under section 80C and 10(10D) of the Income Tax Act,1961.

Tax benefits are subject to changes in the tax laws.

Key Benefits:

Survival Benefit

On survival of the life insured during the policy term, he/she is eligible for the below three benefits:

1. Reversionary Bonus$

• Accrues from first policy year till the end of premium paying term, depending on the performance of the par fund.

• Becomes payable in lumpsum either on death or at the end of premium paying term, whichever is earlier.

2. Money Back

• Is a guaranteed^ annual payout, starting one year after the premium paying term and continues to be paid till maturity or

death whichever is earlier.

• Payout is equal to 5.5% of the Sum Assured on Maturity (SAM*).

3. Cash Bonus$

• Payout becomes payable annually along with the Money Back benefit.

• Is based on the performance of the par fund.

The guaranteed payout is applicable only if, all the due premiums are paid and the policy is in-force.

^

SAM is the base Sum Assured chosen by the policyholder.

*

Maturity Benefit

• On survival of the life insured till age 100, maturity benefit becomes payable.

Sum Assured on Terminal 105% of the Total Annualized

• Maturity Benefit = Higher of

Maturity (SAM) Bonus, if any

OR Premiums# Paid

# Annualized premium is the premium payable in a year, excluding applicable taxes, rider premiums, underwriting extra premiums & loadings for

modal premiums, if any.

Death Benefit

• On death of the life insured during the policy term, death benefit becomes payable and the policy terminates.

• Death Benefit = Sum Assured on Death (SAD) Accrued Reversionary Bonus, if not paid

SAD will be higher of the following

• 11 times of the Annualized Premium OR • Minimum Guaranteed Sum Assured on Maturity (SAM)

Note: At any point of time, minimum death benefit will be 105% of the Total Premiums Paid** as on date of death.

** Total of all the premiums paid excluding any extra premium, any rider premium & applicable taxes.

$

Bonuses are discretionary and not guaranteed and depends upon the performance of the participating fund. Please refer product brochure for more

details.

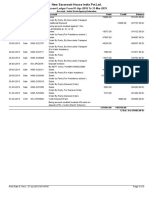

Illustration:

Age of Life Insured 25 years (Male)

Sum Assured Rs. 5,00,000

Premium Paying Term (PPT) 15 years

Policy Term (PT) 75 years

Annualized Premium (excluding applicable taxes) Rs. 46,225

Premium Payment Frequency Annual

Maturity Benefit

Rs. 7,28,044*

Accrued Reversionary Bonus$ paid in lumpsum

at the end of 15th policy year From 16th policy year company pays Money

Back Payout + Cash Bonus Payout till Maturity

Premiums Paid for 15 years Guaranteed Money Cash Bonus$

Back Payout - (if declared)

Rs. 16,50,000 Payout

Policy Term 1 15 16 75

*Assuming Terminal Bonus$ is nil

$

Bonuses are discretionary and not guaranteed and depends upon the performance of the participating fund.

Please refer product brochure for more details.

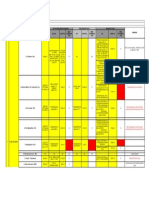

Boundary Conditions:

Below table shows the possible minimum &

Criteria Minimum Maximum maximum entry age for different premium

paying term options:

Entry Age (Last Birthday) 91 Days 55 Years

Premium Minimum Maximum

Maturity Age (Last Birthday) 100 years Paying Term Age at Entry Age at Entry

Sum Assured Rs. 2,00,000 No Limit 10 8 years 55 years

Policy Term 100 years less entry age of 15 3 years 55 years

Life Insured 20 91 days 50 years

Premium Paying Term 10/15/20/25 years 25 91 days 45 years

Annual Premium Rs. 9,835 No Limit

Premium Payment Frequency Annual, Semi Annual & Monthly

Edelweiss Tokio Life Insurance Company Limited

Registered Office: 6th Floor, Tower 3, Wing ‘B’, Kohinoor City, Kirol Road, Kurla (W), Mumbai 400070 | Corporate Office: 4th Floor, Tower 3, Wing ‘B’, Kohinoor City, Kirol Road, Kurla (W), Mumbai 400070

| Toll Free No.: 1800 212 1212 | Fax No.: +91 22 6117 7833 | www.edelweisstokio.in | IRDAI Reg. No.: 147 | CIN: U66010MH2009PLC197336 | UIN: 147N028V02 | Advt No.: OP/0751/Jun/2020

Disclaimer: Edelweiss Tokio Life – Cashflow Protection Plus is only the name of an Individual, Non-Linked, Participating, Savings, Life Insurance Product and does not in any way indicate the quality

of the contract, its future prospects, or returns. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary. Tax benefits are subject to

changes in the tax laws. For more details on risk factors and terms and conditions, please read sales brochure carefully before concluding a sale.

Flower & Edelweiss are trademarks of Edelweiss Financial Services Limited; Tokio is Trademark of Tokio Marine Holdings Inc. and used by Edelweiss Tokio Life Insurance Co. Ltd. under license.

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

You might also like

- Plan for a regular income in retirementDocument2 pagesPlan for a regular income in retirementarunNo ratings yet

- SBI Life - Smart Platina Assure - BrochureDocument12 pagesSBI Life - Smart Platina Assure - Brochuresourav agarwalNo ratings yet

- SBI Life - Smart Platina Assure - BrochureDocument12 pagesSBI Life - Smart Platina Assure - BrochureSanjeev KulkarniNo ratings yet

- Assured Returns Savings Plan Provides Life Cover & Guaranteed ReturnsDocument12 pagesAssured Returns Savings Plan Provides Life Cover & Guaranteed ReturnsVinodkumar ShethNo ratings yet

- Smart Platina Assure Brochure FinalDocument12 pagesSmart Platina Assure Brochure Finalsksen007No ratings yet

- Smart - Platina - Assure - Brochure - Brand ReimagineDocument12 pagesSmart - Platina - Assure - Brochure - Brand ReimaginepankajNo ratings yet

- One Pager Smart LifestyleDocument2 pagesOne Pager Smart LifestyleSam RamNo ratings yet

- Future PerfectDocument11 pagesFuture PerfectAditi SinghNo ratings yet

- Savings Advantage Plan LeafletDocument2 pagesSavings Advantage Plan LeafletNishanthNo ratings yet

- Wealth Gain Insurance Plan Brochure V03Document30 pagesWealth Gain Insurance Plan Brochure V03rajlal88No ratings yet

- Flexi Income IncomeDocument7 pagesFlexi Income Incomeharshad malusareNo ratings yet

- ICICI Future Perfect - BrochureDocument11 pagesICICI Future Perfect - BrochureChandan Kumar SatyanarayanaNo ratings yet

- Get annual cashback and income with ICICI Pru Lakshya GoldDocument2 pagesGet annual cashback and income with ICICI Pru Lakshya GoldMehul Bajaj100% (1)

- Tata AIA Life Insurance Diamond Savings Plan GuideDocument7 pagesTata AIA Life Insurance Diamond Savings Plan GuideneerajishanNo ratings yet

- SBI Life - Saral Retirement Saver - BrochureDocument14 pagesSBI Life - Saral Retirement Saver - BrochureNitin KumarNo ratings yet

- Future Wealth Gain PDFDocument23 pagesFuture Wealth Gain PDFviswanathbobby8No ratings yet

- Mahalife Gold: Tata Aia Life InsuranceDocument5 pagesMahalife Gold: Tata Aia Life InsuranceFrancis ReddyNo ratings yet

- Exide Life Guaranteed Wealth Plus Flier 1Document6 pagesExide Life Guaranteed Wealth Plus Flier 1vickyNo ratings yet

- Key Benefits: Enjoy Policy Benefits Till 99 Years of AgeDocument2 pagesKey Benefits: Enjoy Policy Benefits Till 99 Years of AgeRamesh SharmaNo ratings yet

- Sampoornajeevan FlierDocument6 pagesSampoornajeevan FlierArihant Jain K DigitalNo ratings yet

- Rakshakaran: A Non Linked, Participating, Whole Life Individual Savings PlanDocument6 pagesRakshakaran: A Non Linked, Participating, Whole Life Individual Savings PlanHemant ShakyaNo ratings yet

- Future Wealth GainDocument23 pagesFuture Wealth GainSudhirGajareNo ratings yet

- Money Back Advantage Plan Product Brochure NewDocument9 pagesMoney Back Advantage Plan Product Brochure NewSantosh KumarNo ratings yet

- BenefitIllustrationDocument4 pagesBenefitIllustrationshikha742642No ratings yet

- Guarantee Growth: When Partners WithDocument7 pagesGuarantee Growth: When Partners WithMahadevaNo ratings yet

- ENGLISH One Pager Sanchay Plus Long Term Income Retail FinalDocument2 pagesENGLISH One Pager Sanchay Plus Long Term Income Retail FinalAbhisek BrahmaNo ratings yet

- Know How The Plan Works CenturyDocument21 pagesKnow How The Plan Works Centurysspublicationservices indiaNo ratings yet

- ICICI Pru Savings SurakshaDocument8 pagesICICI Pru Savings SurakshaRojan G JosephNo ratings yet

- Brochure DSPDocument8 pagesBrochure DSPCHANDRAKANT RANANo ratings yet

- Smart Platina Assure - One - Pager FinalDocument2 pagesSmart Platina Assure - One - Pager FinalpankajNo ratings yet

- Money Back Advantage Plan: Guaranteed Payouts for MilestonesDocument10 pagesMoney Back Advantage Plan: Guaranteed Payouts for Milestonesdummy245No ratings yet

- Smart Wealth Goal: Bajaj Allianz LifeDocument7 pagesSmart Wealth Goal: Bajaj Allianz LifeSoumit DeyNo ratings yet

- HDFC Life Sanchay Maximizer One Pager 2 - V2Document2 pagesHDFC Life Sanchay Maximizer One Pager 2 - V2GaneshNo ratings yet

- Max Life Monthly Income Advantage Plan ProspectusDocument11 pagesMax Life Monthly Income Advantage Plan Prospectushemantchawla89No ratings yet

- MoneyBackPlus BrochureDocument7 pagesMoneyBackPlus BrochuremanjugnpNo ratings yet

- Saral Swadhan Supreme - Brochure - V01 15th JanDocument9 pagesSaral Swadhan Supreme - Brochure - V01 15th JanNitin KumarNo ratings yet

- Saral Jeevan Bima Brochure-BRDocument10 pagesSaral Jeevan Bima Brochure-BRprabuNo ratings yet

- PLAN FOR LIFE GOALS WITH ZERO WORRIESDocument21 pagesPLAN FOR LIFE GOALS WITH ZERO WORRIESshanmugamNo ratings yet

- Smart Privilege BrochureDocument17 pagesSmart Privilege BrochurecrkNo ratings yet

- ICICI Savings Suraksha BrochureDocument8 pagesICICI Savings Suraksha BrochureJetesh DevgunNo ratings yet

- IPru Signature LeafletDocument12 pagesIPru Signature Leafletharsh patelNo ratings yet

- Future Wealth GainDocument25 pagesFuture Wealth Gainharshad malusareNo ratings yet

- POS Goal Suraksha: Key Features of The PlanDocument5 pagesPOS Goal Suraksha: Key Features of The PlanSoumya BanerjeeNo ratings yet

- Bajaj 20 LakhsDocument9 pagesBajaj 20 LakhsgirlsbioNo ratings yet

- ProGrowth Flexi 2Document8 pagesProGrowth Flexi 2madhurima paulNo ratings yet

- Vision Endowment Plus PlanDocument12 pagesVision Endowment Plus PlanRoshith Mele AreekkalNo ratings yet

- HDFC Capital GuaranteeDocument34 pagesHDFC Capital GuaranteeRanjan SharmaNo ratings yet

- PWP LeafletDocument4 pagesPWP LeafletsatishbhattNo ratings yet

- Smart Income Protect BrochureDocument12 pagesSmart Income Protect BrochureSumit RpNo ratings yet

- INVESTMENT RISK BORNE BY POLICYHOLDER FOR UNIT-LINKED INSURANCE PLANDocument24 pagesINVESTMENT RISK BORNE BY POLICYHOLDER FOR UNIT-LINKED INSURANCE PLANVivek SinghalNo ratings yet

- Edelweiss Tokio Life - Income Builder - : OverviewDocument2 pagesEdelweiss Tokio Life - Income Builder - : OverviewarunNo ratings yet

- HDFC Life Smart Pension Plan BrochureDocument17 pagesHDFC Life Smart Pension Plan BrochureSatyajeet AnandNo ratings yet

- POS Goal Suraksha: Key Feature DocumentDocument6 pagesPOS Goal Suraksha: Key Feature DocumentPiyush VisputeNo ratings yet

- Sip 1Document8 pagesSip 1vickyNo ratings yet

- Dhan Varsha BrochureDocument16 pagesDhan Varsha BrochureJanagiramanNo ratings yet

- Kotak Guaranteed Fortune Builder Sales LiteratureDocument41 pagesKotak Guaranteed Fortune Builder Sales Literaturerohitis_me2169No ratings yet

- Awg BrochureDocument16 pagesAwg BrochureRameshwar RathodNo ratings yet

- Secure your family's future with this flexible premium insurance planDocument9 pagesSecure your family's future with this flexible premium insurance planGirish HemnaniNo ratings yet

- Product BrochureDocument27 pagesProduct BrochureSidhant kumarNo ratings yet

- Aramco Regulated Vendors List 2 15 PDFDocument684 pagesAramco Regulated Vendors List 2 15 PDFarslan0% (1)

- Molyslip Copaslip - SDS5084 PDFDocument11 pagesMolyslip Copaslip - SDS5084 PDFJagdeesh ShettyNo ratings yet

- Vietnam Pepper 2007 PDFDocument23 pagesVietnam Pepper 2007 PDFJagdeesh ShettyNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- MSDS Genel Tem-Zl-K 1Document5 pagesMSDS Genel Tem-Zl-K 1Jagdeesh ShettyNo ratings yet

- Molyslip Copaslip - SDS5084 PDFDocument11 pagesMolyslip Copaslip - SDS5084 PDFJagdeesh ShettyNo ratings yet

- Active Income Plan - English PDFDocument2 pagesActive Income Plan - English PDFJagdeesh ShettyNo ratings yet

- Active Income Plan - English PDFDocument2 pagesActive Income Plan - English PDFJagdeesh ShettyNo ratings yet

- Cashflow Protection Plus - EnglishDocument2 pagesCashflow Protection Plus - EnglishJagdeesh ShettyNo ratings yet

- Simply Protect - EnglishDocument2 pagesSimply Protect - EnglishJagdeesh ShettyNo ratings yet

- Active Income Plan - English PDFDocument2 pagesActive Income Plan - English PDFJagdeesh ShettyNo ratings yet

- Edelweiss Tokio Life Wealth Ultima ReviewDocument2 pagesEdelweiss Tokio Life Wealth Ultima ReviewJagdeesh ShettyNo ratings yet

- NCERT Solutions For Class 8 Science Chapter 18: Pollution of Air and WaterDocument3 pagesNCERT Solutions For Class 8 Science Chapter 18: Pollution of Air and WaterJagdeesh ShettyNo ratings yet

- Simply Protect - EnglishDocument2 pagesSimply Protect - EnglishJagdeesh ShettyNo ratings yet

- E-Commerce Lecture NotesDocument46 pagesE-Commerce Lecture NotesLasief DamahNo ratings yet

- Pabustan CivPro Task2Document1 pagePabustan CivPro Task2Mheryza De Castro PabustanNo ratings yet

- BG Tracker (V1)Document1 pageBG Tracker (V1)Sabneesh ChaveriyaNo ratings yet

- Permission Form SnowtubingDocument1 pagePermission Form Snowtubingapi-194561932No ratings yet

- Citf Practice TestDocument18 pagesCitf Practice TestKavitha selvarajNo ratings yet

- AchformDocument2 pagesAchformhancockmedicalsolutionsllcNo ratings yet

- Book train ticket ERS titleDocument1 pageBook train ticket ERS titleKrishna PrasadNo ratings yet

- Master DataDocument32 pagesMaster DataAshwini KanranjawanePasalkarNo ratings yet

- Chapter 1Document22 pagesChapter 1Low Joey100% (1)

- Internship ReportDocument36 pagesInternship Report570 BAF Drashti ShahNo ratings yet

- Prudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesDocument21 pagesPrudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesSubrahmanya ShastryNo ratings yet

- Contractors All Risk vs Professional Indemnity Insurance: Key DifferencesDocument11 pagesContractors All Risk vs Professional Indemnity Insurance: Key DifferenceshieutlbkreportNo ratings yet

- Credit Risk Assessment of A BankDocument3 pagesCredit Risk Assessment of A BankRajpreet KaurNo ratings yet

- VRCR Travels (148) : Yuva TechnologiesDocument1 pageVRCR Travels (148) : Yuva TechnologiesYuva TechnologiesNo ratings yet

- IAT-I Question Paper With Solution of 18CS81 Internet of Things May-2022-Dr. Srividya RDocument5 pagesIAT-I Question Paper With Solution of 18CS81 Internet of Things May-2022-Dr. Srividya RSOURAV CHATTERJEE100% (2)

- The Role of Internal Audit in CorporateDocument5 pagesThe Role of Internal Audit in CorporateNassyiwa Dwi KesyaNo ratings yet

- PIB-Panel-Workshop (Done Excel, Pending CC)Document57 pagesPIB-Panel-Workshop (Done Excel, Pending CC)Chyh KunNo ratings yet

- LiquidityDocument26 pagesLiquidityPallavi RanjanNo ratings yet

- Vitas Healthcare OrganizationDocument9 pagesVitas Healthcare OrganizationMoureen NdaganoNo ratings yet

- The Five Star DoctorDocument3 pagesThe Five Star DoctorTasya Laresa100% (1)

- Bank Reconciliation - CE and DSE - AnswerDocument14 pagesBank Reconciliation - CE and DSE - AnswerKwan Yin HoNo ratings yet

- DHP-W310 - A1 - Datasheet - 01 (HQ) (EU-Plug)Document3 pagesDHP-W310 - A1 - Datasheet - 01 (HQ) (EU-Plug)PEDRO ENRIQUE TEJADA MARINNo ratings yet

- Account LedgerDocument1 pageAccount LedgerAnurag JainNo ratings yet

- ConsignmentDocument3 pagesConsignmentBABITA AJAY DHAKATENo ratings yet

- Marketing Plan of Bkash - Group 2Document11 pagesMarketing Plan of Bkash - Group 2Sharmin A. Salma100% (1)

- Accounting Standards FrameworkDocument10 pagesAccounting Standards FrameworkArsénio Leonardo MataNo ratings yet

- GIM RulesDocument15 pagesGIM RulesvithaninNo ratings yet

- Accounting 502 Finals Part1 FDocument3 pagesAccounting 502 Finals Part1 Faldric taclanNo ratings yet

- AIA Elite Balanced Fund SGD Product Highlights SheetDocument4 pagesAIA Elite Balanced Fund SGD Product Highlights SheetdesmondNo ratings yet

- Xflow release note: version 2.4.2 improvementsDocument19 pagesXflow release note: version 2.4.2 improvementsVăn NguyễnNo ratings yet