Professional Documents

Culture Documents

Lyons Document Storage Corporation Bond Accounting

Uploaded by

Ratnesh Dubey100%(1)100% found this document useful (1 vote)

322 views6 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

322 views6 pagesLyons Document Storage Corporation Bond Accounting

Uploaded by

Ratnesh DubeyCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 6

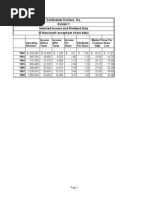

For the bond Issued in 1999

Par value $1,000

No. of bonds issued 10000

FV of bond $10,000,000

Coupon Rate: 8%

Coupon Payment per year: $800,000

Market Rate: 9%

Maturity (years): 20

Bond Price Calculation

Present Value of Coupon Payments: $7,360,634

Present value of Bond: $1,719,287

Price as on 2nd July, 1999: $9,079,921

Discounted by: $920,079

Premium Bond: If a bond is trading above the par value, then we can say that it is a premium bond.

This would occur if the bond offers an interest rate which is higher than the market rate. In simple

terms, investors would be ready to pay a higher value since the interest paid is higher.

Discount Bond: If a bond is trading below the par value, then we can say that it is a discount bond. This

would occur if the bond offers an interest rate which is lower than the market rate. In simple terms,

investors would prefer to pay a lesser amount since the interest offered is lower.

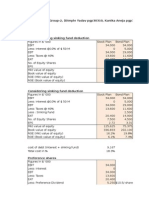

Balance from the

Date Coupon value Interest Expense Amortization Discount Value

7/2/1999 - $920,079

1/2/2000 $400,000 $408,596.44 $8,596.44 $911,482.79

7/2/2000 $400,000 $408,983.27 $8,983.27 $902,499.51

1/2/2001 $400,000 $409,387.52 $9,387.52 $893,111.99

7/2/2001 $400,000 $409,809.96 $9,809.96 $883,302.03

1/2/2002 $400,000 $410,251.41 $10,251.41 $873,050.62

7/2/2002 $400,000 $410,712.72 $10,712.72 $862,337.90

1/2/2003 $400,000 $411,194.79 $11,194.79 $851,143.10

7/2/2003 $400,000 $411,698.56 $11,698.56 $839,444.54

1/2/2004 $400,000 $412,225.00 $12,225.00 $827,219.55

7/2/2004 $400,000 $412,775.12 $12,775.12 $814,444.43

1/2/2005 $400,000 $413,350.00 $13,350.00 $801,094.43

7/2/2005 $400,000 $413,950.75 $13,950.75 $787,143.68

1/2/2006 $400,000 $414,578.53 $14,578.53 $772,565.14

7/2/2006 $400,000 $415,234.57 $15,234.57 $757,330.57

1/2/2007 $400,000 $415,920.12 $15,920.12 $741,410.45

7/2/2007 $400,000 $416,636.53 $16,636.53 $724,773.92

1/2/2008 $400,000 $417,385.17 $17,385.17 $707,388.74

7/2/2008 $400,000 $418,167.51 $18,167.51 $689,221.24

1/2/2009 $400,000 $418,985.04 $18,985.04 $670,236.19

7/2/2009 $400,000 $419,839.37 $19,839.37 $650,396.82

1/2/2010 $400,000 $420,732.14 $20,732.14 $629,664.68

7/2/2010 $400,000 $421,665.09 $21,665.09 $607,999.59

1/2/2011 $400,000 $422,640.02 $22,640.02 $585,359.57

7/2/2011 $400,000 $423,658.82 $23,658.82 $561,700.75

1/2/2012 $400,000 $424,723.47 $24,723.47 $536,977.29

7/2/2012 $400,000 $425,836.02 $25,836.02 $511,141.26

1/2/2013 $400,000 $426,998.64 $26,998.64 $484,142.62

7/2/2013 $400,000 $428,213.58 $28,213.58 $455,929.04

1/2/2014 $400,000 $429,483.19 $29,483.19 $426,445.85

7/2/2014 $400,000 $430,809.94 $30,809.94 $395,635.91

1/2/2015 $400,000 $432,196.38 $32,196.38 $363,439.52

7/2/2015 $400,000 $433,645.22 $33,645.22 $329,794.30

1/2/2016 $400,000 $435,159.26 $35,159.26 $294,635.05

7/2/2016 $400,000 $436,741.42 $36,741.42 $257,893.62

1/2/2017 $400,000 $438,394.79 $38,394.79 $219,498.84

7/2/2017 $400,000 $440,122.55 $40,122.55 $179,376.28

1/2/2018 $400,000 $441,928.07 $41,928.07 $137,448.22

7/2/2018 $400,000 $443,814.83 $43,814.83 $93,633.39

1/2/2019 $400,000 $445,786.50 $45,786.50 $47,846.89

7/2/2019 $400,000 $447,846.89 $47,846.89 $0.00

Lyons Document Storage’s controller, Eric Petro, told Rene that the bonds

were issued in 1999 at a discount and that only approximately $9.1

million was received in cash. Explain what is meant by the terms

“premium” or “discount” as they relate to bonds. Compute exactly how

much the company received from its 8% bonds if the rate prevailing at the

time of the original issue was 9% as indicated in Exhibit 2. Also, re-

compute the amounts shown in the balance sheet at December 31, 2006,

and December 31, 2007, for Long-Term Debt. What is the current market

value of the bonds outstanding at the current effective interest rate of

6%?

hat it is a premium bond.

e market rate. In simple

d is higher.

at it is a discount bond. This

ket rate. In simple terms,

ower.

Balance from the

Bond Value

$9,079,921

$9,088,517.21

$9,097,500.49

$9,106,888.01

$9,116,697.97

$9,126,949.38

$9,137,662.10

$9,148,856.90

$9,160,555.46

$9,172,780.45

$9,185,555.57

$9,198,905.57

$9,212,856.32

$9,227,434.86

$9,242,669.43

$9,258,589.55

$9,275,226.08

$9,292,611.26

$9,310,778.76

$9,329,763.81

$9,349,603.18

$9,370,335.32

$9,392,000.41

$9,414,640.43

$9,438,299.25

$9,463,022.71

$9,488,858.74

$9,515,857.38

$9,544,070.96

$9,573,554.15

$9,604,364.09

$9,636,560.48

$9,670,205.70

$9,705,364.95

$9,742,106.38

$9,780,501.16

$9,820,623.72

$9,862,551.78

$9,906,366.61

$9,952,153.11

$10,000,000.00

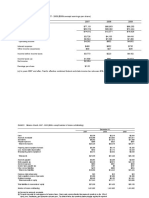

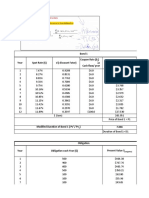

If you were Rene Cook, would you recommend issuing $10 million, 6%

bonds on January 2, 2009 and using the proceeds and other cash to

refund the existing $10 million, 8% bonds? Will it cost more, in terms

of principal and interest payments, to keep the existing bonds or to

issue new ones at a lower rate? Be prepared to discuss the impact of a

bond refunding on the following areas:

-->cash flows

-->current year’s earnings

-->future years’ earnings

Note: For purposes of your computations, assume that refunding, if

selected, occurs effective January 2, 2009, at a price of $1,154.15 per

bond. Ignore the effects of income taxes. How many new $1,000

bonds will Lyons have to issue to refund the old 9% bonds?

Assume 6% bonds could be issued and the proceeds used to refund

the existing bonds. Compare the effects of these transactions with

those calculated in Question 2. If you were Rene Cook, what amount

of new bonds would you recommend and why?

You might also like

- E11 - Lyons Corporation PDFDocument5 pagesE11 - Lyons Corporation PDFShadab HussainNo ratings yet

- LYons Bond Case SolutionDocument2 pagesLYons Bond Case SolutionGautam Sethi75% (4)

- MSDI AlcalaDeDocument2 pagesMSDI AlcalaDekjpcs12100% (1)

- MSDI Excel SheetDocument4 pagesMSDI Excel SheetSurya AduryNo ratings yet

- Lyons Document Storage CorporationDocument8 pagesLyons Document Storage CorporationSaurabh92% (13)

- Case 2: MSDI - Alcala de Henares, Spain For All Three Questions, Assume The FollowingsDocument2 pagesCase 2: MSDI - Alcala de Henares, Spain For All Three Questions, Assume The FollowingsSammy Dalie Soto BernaolaNo ratings yet

- Msdi - Alcala de Henares, SpainDocument4 pagesMsdi - Alcala de Henares, SpainDurgesh Nandini Mohanty100% (1)

- Lyonscasesolution 141026100118 Conversion Gate02Document9 pagesLyonscasesolution 141026100118 Conversion Gate02Ankur ChughNo ratings yet

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- Msdi Alcala de Henares, SpainDocument24 pagesMsdi Alcala de Henares, SpainVineet NairNo ratings yet

- Butler Lumber Company: Following Questions Are Answered in This Case Study SolutionDocument3 pagesButler Lumber Company: Following Questions Are Answered in This Case Study SolutionTalha SiddiquiNo ratings yet

- ATC Valuation - Solution Along With All The ExhibitsDocument20 pagesATC Valuation - Solution Along With All The ExhibitsAbiNo ratings yet

- Team 9A Case Analysis of Harris Seafoods Cash Flows and ValuationDocument2 pagesTeam 9A Case Analysis of Harris Seafoods Cash Flows and ValuationNadia Iqbal100% (1)

- Toy World - ExhibitsDocument9 pagesToy World - Exhibitsakhilkrishnan007No ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Case Study Lyons DocumentDocument3 pagesCase Study Lyons DocumentSandip GumtyaNo ratings yet

- Continental CarriersDocument3 pagesContinental CarriersCharleneNo ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Assessing Earnings Quality at NuwareDocument7 pagesAssessing Earnings Quality at Nuwaremyhellonearth0% (1)

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- 454K Loan for Cartwright Lumber CoDocument5 pages454K Loan for Cartwright Lumber CoRushil Surapaneni50% (2)

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Polar SportsDocument7 pagesPolar SportsShah HussainNo ratings yet

- Case TeuerDocument1 pageCase Teuergorkemkebir0% (1)

- MSDI SolnDocument4 pagesMSDI Solnhenuan0408100% (1)

- Harris Seafoods:: Case For Expansion Into Shrimp ProcessingDocument6 pagesHarris Seafoods:: Case For Expansion Into Shrimp ProcessingEdward BerbariNo ratings yet

- Polar SportDocument4 pagesPolar SportKinnary Kinnu0% (2)

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic TreemonemNo ratings yet

- DCF Case StudyDocument17 pagesDCF Case StudyVivekananda RNo ratings yet

- Flash Memory, Inc.Document2 pagesFlash Memory, Inc.Stella Zukhbaia0% (5)

- Analysis Butler Lumber CompanyDocument3 pagesAnalysis Butler Lumber CompanyRoberto LlerenaNo ratings yet

- Dollarama Case DCFDocument22 pagesDollarama Case DCFDaniel Jinhong Park25% (4)

- Msdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleDocument24 pagesMsdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleShashank Shekhar100% (1)

- SureCut Exhibits and QuestionsDocument16 pagesSureCut Exhibits and Questionssergej0% (1)

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Harris SeafoodsDocument2 pagesHarris SeafoodsNadia IqbalNo ratings yet

- MFIN Case Write-UpDocument7 pagesMFIN Case Write-UpUMMUSNUR OZCANNo ratings yet

- Sure CutDocument1 pageSure Cutchch917No ratings yet

- OceanCarriers KenDocument24 pagesOceanCarriers KensaaaruuuNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Mr. Butler's Loan Requirements for Lumber Company ExpansionDocument6 pagesMr. Butler's Loan Requirements for Lumber Company ExpansionamanNo ratings yet

- Jones Electrical SlidesDocument6 pagesJones Electrical SlidesRohit AwadeNo ratings yet

- WrigleyDocument28 pagesWrigleyKaran Rana100% (1)

- Wilson Lumber Company1Document5 pagesWilson Lumber Company1fica037No ratings yet

- Case of Joneja Bright Steels: The Cash Discount DecisionDocument10 pagesCase of Joneja Bright Steels: The Cash Discount DecisionRHEANo ratings yet

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezNo ratings yet

- Economy Shipping (HBS Case) - MSN SolutionDocument24 pagesEconomy Shipping (HBS Case) - MSN SolutionPrasanta Mondal100% (2)

- Massey Questions 1-4Document4 pagesMassey Questions 1-4Samir IsmailNo ratings yet

- Hampton Machine Tool CompanyDocument6 pagesHampton Machine Tool CompanyClaudia Torres50% (2)

- Polar SportsDocument15 pagesPolar SportsjordanstackNo ratings yet

- Science Technology Company Case Memo (TobyOdenheim)Document4 pagesScience Technology Company Case Memo (TobyOdenheim)todenheim100% (1)

- Merrill Lynch CaseDocument2 pagesMerrill Lynch CaseHailey Judkins100% (2)

- Sampa VideoDocument24 pagesSampa VideodoiNo ratings yet

- 4.15 Correct One !!Document6 pages4.15 Correct One !!TarekYehiaNo ratings yet

- 4.15 Correct One !!Document6 pages4.15 Correct One !!TarekYehiaNo ratings yet

- Bond 1 Coupon Rate (B) or Cash Flow/ Year PV ($)Document6 pagesBond 1 Coupon Rate (B) or Cash Flow/ Year PV ($)TarekYehiaNo ratings yet

- AnswerDocument1 pageAnswerRatnesh DubeyNo ratings yet

- Group2 - ST AssignmentDocument1 pageGroup2 - ST AssignmentRatnesh DubeyNo ratings yet

- Introduction To Debt PolicyDocument8 pagesIntroduction To Debt PolicyRatnesh DubeyNo ratings yet

- CF NotesDocument6 pagesCF NotesRatnesh DubeyNo ratings yet

- O&M Assignment: Group 2 - Section ADocument4 pagesO&M Assignment: Group 2 - Section ARatnesh DubeyNo ratings yet

- CF NotesDocument6 pagesCF NotesRatnesh DubeyNo ratings yet

- Group2 - O&M - The Johnsonville SausageDocument6 pagesGroup2 - O&M - The Johnsonville SausageRatnesh Dubey100% (1)

- Group2 - ST AssignmentDocument1 pageGroup2 - ST AssignmentRatnesh DubeyNo ratings yet

- Group2 - ST AssignmentDocument1 pageGroup2 - ST AssignmentRatnesh DubeyNo ratings yet

- Algerian Banking Sector Deposits and Loans Gap 2000-2011Document1 pageAlgerian Banking Sector Deposits and Loans Gap 2000-2011omm berNo ratings yet

- Rate of Return One ProjectDocument18 pagesRate of Return One ProjectMalek Marry Anne100% (1)

- MARKING KEY: ASSIGNMENT 1 ON FINANCIAL MANAGEMENT 2 MODULEDocument3 pagesMARKING KEY: ASSIGNMENT 1 ON FINANCIAL MANAGEMENT 2 MODULEWilliam MushongaNo ratings yet

- Npa Management SbiDocument104 pagesNpa Management Sbiparth jani100% (1)

- Financial Accounting Chapter 5Document31 pagesFinancial Accounting Chapter 5abhinav2018No ratings yet

- Raman AgarwalDocument26 pagesRaman Agarwalpkcoolboy85No ratings yet

- Breakfasting Mr. Ifan 31 Maret 2023Document2 pagesBreakfasting Mr. Ifan 31 Maret 2023Ifan FadilahNo ratings yet

- SavingsAccount History 09052023202613Document4 pagesSavingsAccount History 09052023202613lipieNo ratings yet

- How Are Exchange Rates DeterminedDocument2 pagesHow Are Exchange Rates Determinedsapfico2k8No ratings yet

- Australian Banking TermsDocument2 pagesAustralian Banking TermsSajith ShivashankaranNo ratings yet

- Manage Cash Flow & Optimize Business FinancesDocument125 pagesManage Cash Flow & Optimize Business FinancesJeam Endoma-ClzNo ratings yet

- Plastic MoneyDocument76 pagesPlastic MoneyMukesh ManwaniNo ratings yet

- Chapter 5 DDR A231Document14 pagesChapter 5 DDR A231Patricia TangNo ratings yet

- Problema in FAGL - FC ValuationDocument3 pagesProblema in FAGL - FC ValuationShankar KollaNo ratings yet

- Account Statement: Penyata AkaunDocument2 pagesAccount Statement: Penyata AkaunAIKAL ABDULLAHNo ratings yet

- Chapter-10: Valuation & Rates of ReturnDocument22 pagesChapter-10: Valuation & Rates of ReturnTajrian RahmanNo ratings yet

- 21Document8 pages21Ashish BhallaNo ratings yet

- A Study On Cashless Economy in India and Its Impact On SocietyDocument111 pagesA Study On Cashless Economy in India and Its Impact On SocietyUdbhav Singh100% (12)

- Soal Uas Praktikum Akun TambahanDocument20 pagesSoal Uas Praktikum Akun TambahanAl VengerNo ratings yet

- Dec 2003 - Qns Mod BDocument13 pagesDec 2003 - Qns Mod BHubbak Khan100% (2)

- FINMAN - Exercises - 4th and 5th Requirements - PimentelDocument10 pagesFINMAN - Exercises - 4th and 5th Requirements - PimentelOjuola EmmanuelNo ratings yet

- Financial Management Coursework Cash Flow AnalysisDocument3 pagesFinancial Management Coursework Cash Flow AnalysisA.A LastNo ratings yet

- MFE Solutions 2016 021517Document473 pagesMFE Solutions 2016 021517david smithNo ratings yet

- Foundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsDocument18 pagesFoundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsHamis Rabiam MagundaNo ratings yet

- F L J M I: Aculty OF AW Amia Illia SlamiaDocument37 pagesF L J M I: Aculty OF AW Amia Illia SlamiaMohd YasinNo ratings yet

- HO4Document2 pagesHO4Emily Dela CruzNo ratings yet

- Bajaj Auto Q3FY11 Result UpdateDocument4 pagesBajaj Auto Q3FY11 Result Updatealankar_sainNo ratings yet

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiNo ratings yet

- Chapter 005 PMDocument5 pagesChapter 005 PMHayelom Tadesse GebreNo ratings yet

- Shinhan bank services: Personal and corporateDocument2 pagesShinhan bank services: Personal and corporateNguyễn Quang MinhNo ratings yet