Professional Documents

Culture Documents

Global Financial Stability Update: Executive Summary

Uploaded by

Lucas GomesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Financial Stability Update: Executive Summary

Uploaded by

Lucas GomesCopyright:

Available Formats

Confidential

Confidential

June

2020 GLOBAL FINANCIAL STABILITY UPDATE

EXECUTIVE SUMMARY

Financial Conditions Have Eased, but Insolvencies Loom Large

The Global Financial Stability Update at a Glance

• Risk asset prices have rebounded following the precipitous fall early in the year, while benchmark

interest rates have declined, leading to an overall easing of financial conditions.

• Swift and bold actions by central banks aimed at addressing severe market stress have boosted

market sentiment, including in emerging markets, where asset purchases have been deployed in a

number of countries for the first time, helping bring about the easing in financial conditions.

• Amid huge uncertainties, a disconnect between financial markets and the evolution of the real

economy has emerged, a vulnerability that could pose a threat to the recovery should investor risk

appetite fade.

• Other financial system vulnerabilities may be crystallized by the COVID-19 pandemic. High

levels of debt may become unmanageable for some borrowers, and the losses resulting from

insolvencies could test bank resilience in some countries.

• Some emerging and frontier market economies are facing refinancing risks, and market access has

dried up for some countries.

• Authorities, while continuing to support the real economy, need to closely monitor financial

vulnerabilities and safeguard financial stability.

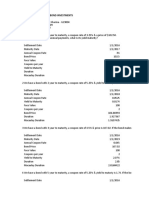

Figure 1. Global Financial Conditions Indices Risk asset prices have rallied on the back of

(Standard deviations from mean)

6

United Tightening

unprecedented central bank measures.

5 States

4

Over the two months since the publication of the

Euro

3 area April 2020 Global Financial Stability Report, global

2 China Other financial conditions have eased significantly

advanced

1 economies following the sharp tightening early in the year. This

0

easing has been driven by the combination of a marked

-1 Other emerging

market economies fall in interest rates and a strong rebound in risk asset

-2

market valuations (Figure 1).

2007

Mar-20

08

09

10

11

12

13

14

15

16

17

18

19

Jan-20

May-20

Sources: Bank for International Settlements; Bloomberg Looking at economies with systemically important

Finance L.P.; Haver Analytics; IMF, International Financial

Statistics database; and IMF staff calculations. financial sectors, equity markets have bounced

back from their March troughs, on balance,

recovering to about 85 percent of their mid-January

International Monetary Fund | June 2020 1

GLOBAL FINANCIAL STABILITY UPDATE , JUNE 2020

Figure 2. Equity Prices in Selected Economies, 2020 levels, on average, though there is some dispersion

(Index: January 17, 2020 = 100)

110 (Figure 2).1 While some equity markets have recouped

100

all of their losses, others are still about 25 percent lower

than they were in mid-January. In tandem with the

90

recovery in prices, equity market volatility has fallen

80 from its peak in March, though it remains above its

70 long-term average.

60 Swift and unprecedented central bank measures

50

Maximum-minimum range

Interquartile range

have been a major factor in the market recovery.

40

Median For example, in the United States the turnaround in

Jan Feb Mar Apr May Jun risk asset prices occurred around March 23 following

Sources: Bloomberg Finance L.P; and IMF staff calculations.

Note: The figure shows equity prices across the S29 economies the announcement by the US Federal Reserve of $2.3

(see footnote 1 in text) since January 17, 2020, when investor

concerns about the impact of COVID-19 on the economy came

trillion in crisis-era credit facilities (Figure 3). A similar

to the fore. pattern is evident in broader financial markets.

Figure 3. US Equities and Credit Indices

(Index: January 17, 2020 = 100) In credit markets, spreads have narrowed

S&P 500

Investment grade bond ETF significantly from their earlier peaks. On average,

120 High-yield bond ETF

Russell 2000 US Federal Reserve about 70 percent of the initial widening has been

Nasdaq 100 announces crisis-era

110

credit facilities retraced (Figure 4). There is, however, some divergence

100

in the level of spreads across ratings and geography.

90

Bond issuance has surged for higher-rated borrowers,

80

and markets have reopened for speculative grade

70

borrowers as well.

60

50

Investor sentiment toward emerging market

Jan Feb Mar

2020

Apr May Jun economies has also improved notably. Portfolio

Sources: Bloomberg Finance L.P; and IMF staff calculations. flows to these economies have stabilized following the

Note: ETF = exchange-traded fund.

Figure 4. Change in Credit Spreads historic outflows earlier this year (Figure 5). Investors,

(Basis points, since January 17, 2020) however, continue to differentiate across emerging and

800 Increase to June

700 Increase to maximum in 2020 frontier economies, with some inflows of capital into

600 selected countries and asset classes. Higher rated

500 countries have also been able to issue hard currency

400 debt at a historically high pace so far this year, faster

300

than economies with lower credit ratings. This

200

100

difference underscores the external pressures that some

0 emerging market economies are still facing.

United Euro area Sovereign Corporates United Euro area

States States This broad recovery in financial markets has been

High-yield Emerging Investment-grade

corporate bonds market bonds corporate bonds accompanied by growing investor optimism about

Sources: Bloomberg Finance L.P; and IMF staff calculations.

1Here, economies with systemically important financial sectors are those for which financial stability assessments under the Financial Stability Assessment

Programs are mandatory every five years, that is, the S29 economies: Australia, Austria, Belgium, Brazil, Canada, China, Denmark, France, Finland,

Germany, Hong Kong SAR, India, Ireland, Italy, Japan, Korea, Luxembourg, Mexico, the Netherlands, Norway, Poland, Russia, Singapore, Spain, Sweden,

Switzerland, Turkey, the United Kingdom, and the United States.

2 International Monetary Fund | June 2020

GLOBAL FINANCIAL STABILITY UPDATE , JUNE 2020

Figure 5. Emerging Market Portfolio Flows the prospects of a speedy economic recovery.

(Billions of US dollars)

40 Market sentiment has been bolstered by the reopening

20 of some economies and the easing of COVID-19–

0 related lockdown measures. In addition, investors

-20 apparently expect unprecedented monetary policy

-40

2018 emerging

market strains

accommodation to continue to support the global

-60 Asia excluding China COVID-19 economy for quite some time.

Latin America related

strains

-80 Europe, Middle East, and Africa

China equities

Actions by central banks have boosted investor

-100

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr

risk appetite. Policy rates in a number of countries

2017 18 19 20 have been cut further and investors expect interest

Sources: Bloomberg Finance L.P; Institute of International

Finance (IIF); and IMF staff calculations. rates to remain at very low levels for several years.

Note: The figure is based on high frequency daily or weekly Balance sheets of advanced economies’ monetary

flows as reported by Bloomberg and the IIF.

Figure 6. G10 Central Bank Assets authorities have swelled following new rounds of asset

(Trillions of US dollars) purchases, liquidity support for the banking system, US

24 US Federal Reserve

22 European Central Bank dollar swap lines, and other facilities intended to sustain

Bank of Japan

20

Other G10 central banks the flow of credit to the economy (Figure 6). Aggregate

18

16 assets of the Group of Ten (G10) central banks have

14 increased by about $6 trillion since mid-January, more

12

10 than double the increase seen during the two years of

8 the global financial crisis from December 2007, with

6

4 the rise in assets accounting for almost 15 percent of

2 G10 GDP.

0

20 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20

Sources: Bloomberg Finance L.P; and IMF staff calculations. A number of emerging market central banks have

Note: G10 = Group of Ten; other G10 central banks = central embarked on unconventional policy measures for

banks of Canada, Sweden, Switzerland, and the United

Kingdom. the first time. In some countries, these asset purchase

Figure 7. Selected Emerging Market Central Bank

Government Bond Purchases, March–June 2020

programs were started to support monetary policy; in

(Percent of GDP) other countries, the motivation was to support market

0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5

liquidity (Figure 7). These programs have included

Poland

Philippines

purchases of a range of assets, including government

Turkey bonds, state-guaranteed bonds, corporate debt, and

Thailand

mortgage-backed securities.

India

Indonesia

Fiscal and financial policy measures have also

Malaysia

South Africa helped support investor sentiment. Governments

Hungary around the world have provided large emergency

Colombia

Romania

lifelines to people and firms amounting to near $11

Sources: Bloomberg Finance L.P.; JP Morgan; and IMF staff trillion (as shown in the IMF’s Fiscal Monitor Database

calculations. of Country Fiscal Measures in response to the COVID-

Note: In some cases, central banks are purchasing other assets

as well as government bonds. For India and Indonesia, the 19 Pandemic).2 Financial authorities have also bolstered

figure includes primary and secondary market purchases; for the

Philippines this includes temporary and short-term funding for market confidence through a series of policies,

the government’s COVID-19 measures.

2 The database of fiscal measures is available at http://www.imf.org/en/Topics/imf-and-covid19/Fiscal-Policies-Database-in-Response-to-COVID-19.

International Monetary Fund | June 2020 3

GLOBAL FINANCIAL STABILITY UPDATE , JUNE 2020

Figure 8. S&P 500 Index Consensus Earnings including government credit guarantees, support for

Forecasts

Year-on-year growth (right scale) the restructuring of loans, and encouraging banks to

US dollars Percent

55

S&P 500 Index Earnings Per Share (left scale)

80

use available capital and liquidity buffers to support

50 60 lending (see the IMF Policy Tracker on responses to

40

45 COVID-19).3

20

40 0

This combination of unprecedented policy support

35 -20

-40 appears to have been successful in maintaining

30

25

-60 credit flows. The lift to investor risk appetite has

-80

20 -100

helped raise bond issuance in markets, and banks have

also continued to lend in most major economies.

2019:Q4

20:Q1

20:Q2

20:Q3

20:Q4

21:Q1

21:Q2

21:Q3

21:Q4

22:Q1

22:Q2

Sources: Bloomberg Finance L.P.; and IMF staff calculations. A disconnect between financial market optimism

Figure 9. US Equity Prices and Consumer

and the evolution of the global economy has

Confidence emerged.

(Indices)

160

Conference Board consumer confidence (left scale)

3,500

The bullish mood among investors is predicated

S&P 500 index (right scale)

on strong policy support amid huge uncertainties

140 3,000

about the extent and speed of the economic

120

2,500 recovery. Markets appear to be expecting a quick “v-

100 shaped” rebound in activity, as illustrated by the strong

2,000

80 recovery in the S&P 500 consensus forecasts of

60

1,500 company earnings (Figure 8). Recent economic data

1,000 and high frequency indicators, however, suggest a

40

deeper-than-expected downturn, as discussed in the

20 500

07 08 09 10 11 12 13 14 15 16 17 18 19 20

2007 June 2020 World Economic Outlook Update. This has

Sources: Bloomberg Finance L.P.; and IMF staff calculations. created a divergence between the pricing of risk in

Figure 10. US Corporate Bond Spreads financial markets and economic prospects, as investors

(Basis points) are apparently betting on continued and unprecedented

2019-20

220

170 support by central banks. This tension can be

120

400 70 illustrated, for example, by the recent rally in the US

Oct

Apr

Apr

Jan

Jul

Jan

350

equity market, on the one hand, and the steep decline

300

in consumer confidence, on the other hand (Figure 9).

250

200

This decoupling raises questions about the possible

150 sustainability of the current equity market rally if not

100 for the boost of sentiment provided by central bank

50 support.

0

1961

61 65 69 73 77 81 85 89 93 97 2001

01 05 09 13 17 This disconnect between markets and the real

Sources: Federal Reserve Board; and IMF staff calculations. economy raises the risk of another correction in

Note: The figure shows the spread between Baa-rated and Aaa-

rated bond yields. The shaded areas show periods of severe risk asset prices should investor risk appetite fade,

economic contraction, defined as when the Organisation for

Economic Co-operation and Development leading indicator of posing a threat to the recovery. For example, in

US economic growth is below its 5th percentile.

3 The policy tracker is available at https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#top.

4 International Monetary Fund | June 2020

GLOBAL FINANCIAL STABILITY UPDATE , JUNE 2020

Figure 11. Asset Price Misalignments, 2020:Q2 equity markets, bear market rallies have occurred

(Percentile during 1990–2020)

Under- Over- before, during periods of significant economic

valued stretched

0 10 20 30 40 50 60 70 80 90 100 pressure, often only to unwind subsequently. In

Equity markets corporate bond markets, spreads of investment-grade

United States

Japan companies are currently relatively contained, contrary

China

Euro area to the sharp widening experienced during previous

United Kingdom

India

significant economic shocks (Figure 10).

Brazil

In fact, market valuations appear stretched across

Bond markets

Euro high yield many equity and corporate bond markets.

US investment grade

US high yield According to IMF staff models, the difference between

Euro investment grade

market prices and fundamental valuations is near

Source: IMF staff calculations.

Note: If data are not available for 1990, the earliest available data historic highs across most major advanced economy

are used instead.

Figure 12. Nonfinancial Private Sector Debt and

equity and bond markets, though the reverse is true for

Economic Growth Forecasts stocks in some emerging market economies (Figure

Corporate debt: 2019:Q4 (percent of GDP, left scale)

300 Household debt: 2019:Q4 (percent of GDP, left scale) 12 11).4

250 IMF 2020 economic growth forecast (percent, right scale) 10

200 8

150 6

A number of triggers could result in a repricing of

100 4 risk assets, a development that could add financial

50 2

0 0 stress on top of an already unprecedented

-50 -2

-100 -4 economic recession. For example, the recession could

-150 -6

-200 -8 be deeper and longer than currently anticipated by

-250

-300

-10

-12

investors. There could be a second wave of the virus,

-350 -14 and containment measures could be reinstated. Market

-400 -16

expectations about the extent and length of central

ESP

CAN

AUS

USA

DEU

BRA

CHN

RUS

KOR

GBR

POL

JPN

ITA

MEX

NLD

IND

FRA

TUR

Sources: Bank for International Settlements; IMF, World banks’ support to financial markets may turn out to be

Economic Outlook database; and IMF staff calculations.

Note: Positive growth forecasts are not shown. Data labels use

too optimistic, leading investors to reassess their

International Organization for Standardization (ISO) country appetite for, and pricing of, risk. A resurgence of trade

codes.

Figure 13. Number of Corporate Bond Defaults tensions could sour market sentiment, putting the

Year to date United States Total for the year recovery at risk. Finally, a broadening of social unrest

160 300

Other advanced around the globe in response to rising economic

140 Emerging market

Annual total (right scale)

250 inequality could lead to a reversal of investor sentiment.

120

200

100 The pandemic could crystallize other financial

80 150 vulnerabilities that have built up over the past

60

100

decade.

40

50

First, in advanced and emerging market

20

economies alike, corporate and household debt

0 0

2008 10 12 14 16 18 20 burdens could become unmanageable for some

Sources: S&P Global; and IMF staff calculations.

4The model-based estimates of fundamental valuations may not fully account for the unprecedented financial policy measures that have been taken in

recent months, including central bank asset purchases and facilities intended to sustain the flow of credit to the economy, as well as credit guarantees that

have been provided by some governments. More information on the models is available in the Online Annex to the October 2019 Global Financial

Stability Report at: https://www.imf.org/~/media/Files/Publications/GFSR/2019/October/English/onlineannex11.ashx?la=en.

International Monetary Fund | June 2020 5

GLOBAL FINANCIAL STABILITY UPDATE , JUNE 2020

Figure 14. Bank Profitability and Economic borrowers in a severe economic contraction. As has

Growth Forecasts

Euro area Other advanced Europe

been discussed in previous Global Financial Stability

Advanced Asia-Pacific North America Reports, aggregate corporate debt has been rising over

Emerging market economies

several years to stand at historically high levels relative

Analysts' return on equity forecast, 2020

14

BRA

12 CHN

10

MEX

CAN to GDP. Household debt has also increased,

POL

8 KOR particularly in countries that managed to escape the

6

FRA USA

AUS

worst impact of the 2007-8 global financial crisis. This

4

ESP NLD means that there are now many economies with high

2

0

ITA GBR DEU levels of debt that are expected to face an extremely

-2 sharp economic slowdown (Figure 12). This

-14 -12 -10 -8 -6 -4 -2 0 2

IMF 2020 economic growth forecast (percent)

deterioration in economic fundamentals has already led

Sources: Bloomberg Finance L.P.; IMF, World Economic to the highest pace of corporate bond defaults since the

Outlook database; and IMF staff calculations.

Note: The vertical axis shows the median return on equity

global financial crisis, and there is a risk of a broader

forecast for a sample of listed banks in each economy. Data impact on the solvency of companies and households

labels use International Organization for Standardization (ISO)

country codes. (Figure 13).

Figure 15. Reserve Adequacy and External Second, insolvencies will test the resilience of the

Financing Requirements

350 banking sector. Banks have entered the crisis with

higher liquidity and capital buffers as a result of post-

Reserves (percent of reserve adequacy)

300 RUS

PER

250 Higher external financing requirements crisis reforms, and they can draw down these buffers to

THA

IND

support lending and absorb losses. Some banks have

200

PHL

BRA already started to provision more for expected losses

150

IDN

CHN MEX COL

POL

Reserve adequacy

range MYS

on their loans, as evidenced in their first quarter

100 HUN

EGY CHL TUR earnings reports. This is likely to continue as banks

ZAF

50

assess the ability of borrowers to repay their loans,

0 while also accounting for the support that governments

4 10 16 22 28 34

Average external financing requirements, 2020–22E (percent of GDP) have given households and companies.5 The

Sources: IMF, Assessing Reserves Adequacy database; and IMF, expectation of further pressure on banks, along with

World Economic Outlook database.

Note: External financing requirements are calculated using the low level of interest rates, is reflected in analysts’

estimates for the current account balance and short-term

external debt to remaining maturity. The metric used for

forecasts of bank profitability (Figure 14).

calculating reserves adequacy is adjusted for capital controls.

Data labels use International Organization for Standardization Third, nonbank financial companies and markets

(ISO) country codes. E = estimated.

may face further stress. The events in March, where

nonbank financial intermediaries benefited from large

policy support, suggests that they are vulnerable to

procyclical corrections in the face of an external shock.

These companies now have a greater role in the

financial system than before, as discussed in the April

2020 Global Financial Stability Report, and the behavior of

this larger sector during a deep downturn is untested.

5This support has been provided in different ways, including through state loans, public credit guarantees, restructuring of loan terms, and moratorium on

payments.

6 International Monetary Fund | June 2020

GLOBAL FINANCIAL STABILITY UPDATE , JUNE 2020

Figure 16. Emerging Market Ratings Downgrades There is a risk that nonbank financial companies could

(Percent of rated economies)

Downgrades by region Downgrades by type

also face shocks in the event of a broad wave of

48 of economy insolvencies. These companies could also act as an

42

amplifier of this stress. For example, a substantial

36

shock to asset prices could lead to further outflows

30

from investment funds, which could, in turn, trigger

24

18

fire sales from those fund managers that would

12

exacerbate market pressures.

6 Fourth, some emerging and frontier markets are

0

Middle

MCD Asia-

APD Western

WHD Africa

AFR Oil Non-oil

facing high external refinancing requirements. In

East Pacific Hemisphere exporters the current environment, economies that need to

Sources: Bloomberg Finance L.P.; and IMF staff calculations.

Note: The figure shows a downgrade by at least one of the main refinance more debt run a greater risk that this debt

rating agencies. Changes in the ratings outlook are not included. may have to be rolled over at a higher cost. Some

countries with high refinancing requirements also have

a relatively low level of reserve adequacy (Figure 15).

This could make it harder for authorities in these

economies to react to any further portfolio outflows,

especially if they do not have a flexible exchange rate.

Credit ratings downgrades could put additional

pressure on funding costs and capital flows. So far this

year, more than one-third of oil exporting economies

that are covered by the main rating agencies have been

downgraded, which compares to downgrades to about

one quarter of other economies (Figure 16).

Authorities need to strike the right balance in their

policy response to the pandemic.

In an environment of difficult policy trade-offs,

authorities need to continue to support the

recovery while ensuring the soundness of financial

institutions and preserving financial stability, as

highlighted in the “Financial Policy Priorities in

Response to the Crisis” box below. Authorities need to

be mindful of the intertemporal risk implications of

this support. The unprecedented use of unconventional

tools has undoubtedly cushioned the impact of the

pandemic on the global economy and lessened the

immediate danger faced by the global financial system.

However, care needs to be taken to avoid a further

buildup of vulnerabilities in an environment of easy

financial conditions. Once the recovery is firmly

underway, policymakers should urgently address

International Monetary Fund | June 2020 7

GLOBAL FINANCIAL STABILITY UPDATE , JUNE 2020

financial fragilities that could sow the seeds of future

problems and put growth at risk in the medium term.

Financial Policy Priorities in Response to the Crisis

Central banks should maintain their accommodative stance of monetary policy in pursuit of their inflation

and financial stability mandates through conventional and unconventional tools for as long as needed to

support the flow of credit to households and firms. They should also continue to provide liquidity to prevent

impairments to funding conditions and functioning in major money, foreign exchange, and securities markets.

At the same time, central banks should carefully assess which markets are critical for maintaining financial

stability and design support programs to minimize moral hazard and risks to themselves.

Authorities in emerging market and developing economies should use flexible exchange rates to absorb

external pressures, where feasible. For countries with adequate reserves, exchange rate intervention can lean

against market illiquidity and play a role in muting excessive volatility in currency markets. In the face of an

imminent crisis, capital outflow management measures could be part of a broad policy package, though such

measures should be implemented in a transparent manner, be temporary, and be lifted once crisis conditions

abate. Sovereign debt managers should put in place contingency plans for dealing with limited access to

external funding markets for a prolonged period.

Bank capital, liquidity, and macroprudential buffers should be used to absorb losses and manage liquidity

strains and to help support lending to the economy. Banks should halt dividend payments and buybacks while

the crisis lasts to help support capital buffers. In cases where banks face sizable and long-lasting shocks, and

where bank capital adequacy is affected, supervisors should take targeted actions, including asking banks to

submit credible capital restoration plans. Throughout the process, transparent risk disclosure and clear

guidance from supervisors will be important.

Insurance company regulators in countries facing periods of extreme market stress may need to use the

flexibility embedded in regulations, for example, to extend the allowed recovery period of affected insurers.

Supervisors, however, should not lower standards and should ask insurers to prepare credible plans to ensure

they can restore their solvency positions while continuing to provide necessary coverage to policyholders.

Asset managers should continue to ensure that liquidity risk management frameworks are being applied in a

robust and effective manner. Regulators should support the availability of a wide set of liquidity management

tools and encourage fund managers to make full use of the available tools where it would be in the interest of

unit holders to do so. Standard setters should revisit the macroprudential framework for asset managers.

Multilateral cooperation is needed to protect the global financial system. Bilateral and multilateral swap lines

may need to be provided to a broader range of countries to alleviate foreign currency funding pressures.

Furthermore, any rollback of international financial system regulation or fragmentation through domestic

actions that undermine international standards should be avoided.

8 International Monetary Fund | June 2020

You might also like

- Global Financial Stability ReportDocument5 pagesGlobal Financial Stability ReportGustavo SilvaNo ratings yet

- Central banks' shifting role as lenders of last resort in times of crisisDocument29 pagesCentral banks' shifting role as lenders of last resort in times of crisissh_chandraNo ratings yet

- Mind The Debt: Emerging and Frontier MarketsDocument10 pagesMind The Debt: Emerging and Frontier MarketsAnaMariaDimaNo ratings yet

- COVID-19 Pandemic: Financial Stability Implications and Policy Measures TakenDocument14 pagesCOVID-19 Pandemic: Financial Stability Implications and Policy Measures Takendesta yolandaNo ratings yet

- (9781513554228 - Global Financial Stability Report, October 2020) Global Financial Stability Report, October 2020Document117 pages(9781513554228 - Global Financial Stability Report, October 2020) Global Financial Stability Report, October 2020Inti Atipaq Sol VencedorNo ratings yet

- International Monetary Fund Global Financial Stability Report January 2010Document6 pagesInternational Monetary Fund Global Financial Stability Report January 2010http://besthedgefund.blogspot.comNo ratings yet

- Perspectivas de La Economía MundialDocument37 pagesPerspectivas de La Economía MundialCristianMilciadesNo ratings yet

- CH 01Document51 pagesCH 01Laurentiu SterescuNo ratings yet

- Global Prospects and Policies - IMF - April 2023Document44 pagesGlobal Prospects and Policies - IMF - April 2023Clasicos DominicanosNo ratings yet

- En Am 2020 Monthly Letter JulyDocument2 pagesEn Am 2020 Monthly Letter JulyFaustinNo ratings yet

- q4 Global Forecast ReportDocument8 pagesq4 Global Forecast ReportElysia M. AbainNo ratings yet

- Turkey Quarterly Outlook January2018 PDFDocument29 pagesTurkey Quarterly Outlook January2018 PDFChristian SchumacherNo ratings yet

- Global Financial Stability Report - 2020Document43 pagesGlobal Financial Stability Report - 2020Xara ChamorroNo ratings yet

- IMF - Corruption Apr 2019Document134 pagesIMF - Corruption Apr 2019TheAwein ChannelNo ratings yet

- 1ASSESSMENTPROSPECTSDocument12 pages1ASSESSMENTPROSPECTSfsadfNo ratings yet

- PVP August 2018Document2 pagesPVP August 2018cogitatorNo ratings yet

- BIS 80 Annual ReportDocument11 pagesBIS 80 Annual ReportZerohedgeNo ratings yet

- The Future of Emerging Markets Duttagupta and PazarbasiogluDocument6 pagesThe Future of Emerging Markets Duttagupta and PazarbasiogluMarkoNo ratings yet

- Saudi Macroeconomic Forecast 2019 - 2023 - SambaDocument23 pagesSaudi Macroeconomic Forecast 2019 - 2023 - SambaTeofilo Gonzalez MarzabalNo ratings yet

- PTJ Letter BitcoinDocument10 pagesPTJ Letter BitcoinZerohedge100% (3)

- Tudor May 2020 BVI Letter - Macro Outlook PDFDocument10 pagesTudor May 2020 BVI Letter - Macro Outlook PDFbrineshrimpNo ratings yet

- Acaps Yemen Analysis Hub The Yemeni Financial SectorDocument21 pagesAcaps Yemen Analysis Hub The Yemeni Financial SectorbulleisaNo ratings yet

- RBI Second Quarter Review of Monetary Policy 2010-11Document36 pagesRBI Second Quarter Review of Monetary Policy 2010-11tamirisaarNo ratings yet

- Ukraine War Impact-InflationDocument19 pagesUkraine War Impact-Inflationjohndavsg8022No ratings yet

- Text PDFDocument145 pagesText PDFNicolas AndreNo ratings yet

- 002 Article A001 enDocument75 pages002 Article A001 enTrang NguyenNo ratings yet

- Understanding Vietnam's Rising Economic PotentialDocument11 pagesUnderstanding Vietnam's Rising Economic PotentialHandy HarisNo ratings yet

- TextDocument118 pagesTextЛілія КуротчинNo ratings yet

- Pakistan: Causes and Management of The 2008 Economic Crisis: Rfan UL AqueDocument42 pagesPakistan: Causes and Management of The 2008 Economic Crisis: Rfan UL AqueKidwa ArifNo ratings yet

- CRISIL Fund Insights Feb2020Document4 pagesCRISIL Fund Insights Feb2020Rahul SharmaNo ratings yet

- RBI GUIDELINES ON COVID-19 IMPACT ON MICROFINANCE SECTORDocument23 pagesRBI GUIDELINES ON COVID-19 IMPACT ON MICROFINANCE SECTORGulshan JangidNo ratings yet

- Global Debt Monitor - April2020 IIF PDFDocument5 pagesGlobal Debt Monitor - April2020 IIF PDFAndyNo ratings yet

- The Unicredit Economics Chartbook: QuarterlyDocument41 pagesThe Unicredit Economics Chartbook: QuarterlyOrestis VelmachosNo ratings yet

- 2022 Federal Reserve Stress Test Results: June 2022Document66 pages2022 Federal Reserve Stress Test Results: June 2022ZerohedgeNo ratings yet

- Global Recession and Its Impact On Indian EconomyDocument4 pagesGlobal Recession and Its Impact On Indian EconomyPankaj DograNo ratings yet

- Italy: Financial System Stability AssessmentDocument63 pagesItaly: Financial System Stability AssessmentRaffaele DassistiNo ratings yet

- P B N - 1 Vietnam's Macroeconomic Instability: Causes and Policy Responses I. OverviewDocument10 pagesP B N - 1 Vietnam's Macroeconomic Instability: Causes and Policy Responses I. OverviewThuy DoanNo ratings yet

- Turbulence Ahead: Currency Wars to Regulatory BlurDocument7 pagesTurbulence Ahead: Currency Wars to Regulatory BlurTribhuvan Kumar SangerpalNo ratings yet

- 2015 Volatility Outlook PDFDocument54 pages2015 Volatility Outlook PDFhc87No ratings yet

- Adams, Nicole. Chinas Evolving Financial System and Its Global ImportanceDocument14 pagesAdams, Nicole. Chinas Evolving Financial System and Its Global ImportanceLuisNo ratings yet

- Event Update - The Equity Markets Rally Whats Next - HSBC - MF - 5 June 2020 (Revised)Document4 pagesEvent Update - The Equity Markets Rally Whats Next - HSBC - MF - 5 June 2020 (Revised)NACHIKETH89No ratings yet

- IIT eBook-L01 2021 11 EN V01Document10 pagesIIT eBook-L01 2021 11 EN V01mike2gonzaNo ratings yet

- IMF: Global Growth Weakening Calls for New Policy StimulusDocument5 pagesIMF: Global Growth Weakening Calls for New Policy Stimulusmaich60000No ratings yet

- Promoting Monetary StabilityDocument5 pagesPromoting Monetary Stabilitynur cherryNo ratings yet

- Eye On The Tiger: India EconomicsDocument52 pagesEye On The Tiger: India EconomicssharmaabhayNo ratings yet

- The Australian Financial System in The 1990s: 180 Marianne Gizycki and Philip LoweDocument36 pagesThe Australian Financial System in The 1990s: 180 Marianne Gizycki and Philip Loweaftab20No ratings yet

- CRISIL Fund Insights June 2018Document4 pagesCRISIL Fund Insights June 2018SHERINE SALINS 1811355No ratings yet

- Emerging Markets Economic Outlook Differentiation Across The RegionsDocument6 pagesEmerging Markets Economic Outlook Differentiation Across The RegionsFlametreeNo ratings yet

- Annual Economic Report 2019 Part 1Document30 pagesAnnual Economic Report 2019 Part 1sh_chandraNo ratings yet

- Investment Strategy: Société Générale Private Banking Investment Strategy Newsletter November 2010 - # 39Document9 pagesInvestment Strategy: Société Générale Private Banking Investment Strategy Newsletter November 2010 - # 39einaragustssonNo ratings yet

- fsr2019h2 en Full PDFDocument66 pagesfsr2019h2 en Full PDFkakakaNo ratings yet

- Mutual Fund Review: Equity MarketDocument15 pagesMutual Fund Review: Equity MarketHariprasad ManchiNo ratings yet

- AllianzGI Rates Mid Year Outlook 2023 ENG 2023Document14 pagesAllianzGI Rates Mid Year Outlook 2023 ENG 2023Tú Vũ QuangNo ratings yet

- C 1 PDFDocument48 pagesC 1 PDFyoumna tohamyNo ratings yet

- Lic Mutual FundDocument40 pagesLic Mutual FundMohammad MushtaqNo ratings yet

- The Role of Financial Markets and Institutions in Supporting The Global Economy During The COVID 19 PandemicDocument60 pagesThe Role of Financial Markets and Institutions in Supporting The Global Economy During The COVID 19 PandemicHanaSuhanaNo ratings yet

- World Bank East Asia and Pacific Economic Update October 2015: Staying the CourseFrom EverandWorld Bank East Asia and Pacific Economic Update October 2015: Staying the CourseNo ratings yet

- World Bank East Asia and Pacific Economic Update 2012, Volume 1: Capturing New Sources of GrowthFrom EverandWorld Bank East Asia and Pacific Economic Update 2012, Volume 1: Capturing New Sources of GrowthNo ratings yet

- Global Economic Prospects, Volume 8, January 2014: Coping with policy normalization in high-income countriesFrom EverandGlobal Economic Prospects, Volume 8, January 2014: Coping with policy normalization in high-income countriesNo ratings yet

- Valuing Bonds: Fundamentals of Corporate FinanceDocument26 pagesValuing Bonds: Fundamentals of Corporate FinanceNabeel Ahmed ShaikhNo ratings yet

- Chapter 7 Homework - Pratik JogDocument2 pagesChapter 7 Homework - Pratik JogPratik JogNo ratings yet

- Unit 3Document28 pagesUnit 3SAI GANESH M S 2127321No ratings yet

- Chap 2 BafinDocument5 pagesChap 2 BafinPhilip DizonNo ratings yet

- Chapter-Two Money Market AND Capital Market: 2.1. MoneymarketDocument29 pagesChapter-Two Money Market AND Capital Market: 2.1. Moneymarketyared haftuNo ratings yet

- Qatar Listed Stocks Handbook IIIDocument59 pagesQatar Listed Stocks Handbook IIIrazacbqNo ratings yet

- Problem Set 3Document2 pagesProblem Set 3david AbotsitseNo ratings yet

- Fixed Income Securities: IntroductionDocument33 pagesFixed Income Securities: IntroductionYogaPratamaDosen100% (1)

- Bond Valuation: Debashis Saha, Assistant Professor, F & B, Jahangirnagar UniversityDocument54 pagesBond Valuation: Debashis Saha, Assistant Professor, F & B, Jahangirnagar UniversityMasum HossainNo ratings yet

- Indian Debt Market PresentationDocument14 pagesIndian Debt Market PresentationDensil PintoNo ratings yet

- MGMT 109 HWDocument2 pagesMGMT 109 HWgorillaNo ratings yet

- PMS EXAM CHP 3Document3 pagesPMS EXAM CHP 3Rachaita AdhikaryNo ratings yet

- Bonds With Embedded Options - Valuation and AnalysisDocument75 pagesBonds With Embedded Options - Valuation and AnalysisShriya JanjikhelNo ratings yet

- 669 1354 1 SMDocument18 pages669 1354 1 SMFurqaan SyahNo ratings yet

- Government Securities Market in India: R.V.JoshiDocument4 pagesGovernment Securities Market in India: R.V.JoshiJackdeep AcharyaNo ratings yet

- Solutions To Questions - Chapter 20 The Secondary Mortgage Market: Cmos and Derivative Securities Question 20-1Document17 pagesSolutions To Questions - Chapter 20 The Secondary Mortgage Market: Cmos and Derivative Securities Question 20-1--bolabolaNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument41 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownUsman KWLNo ratings yet

- Note ôn tập MidtermDocument5 pagesNote ôn tập MidtermChu Thị Thanh ThảoNo ratings yet

- Why Study Financial Markets and InstitutionsDocument17 pagesWhy Study Financial Markets and InstitutionsJay Ann DomeNo ratings yet

- BH FFM13 PPT ch07Document44 pagesBH FFM13 PPT ch07Jona ResuelloNo ratings yet

- Materi Penilaian obligasi-LDLDocument23 pagesMateri Penilaian obligasi-LDLGustianNo ratings yet

- Report BondsDocument5 pagesReport BondsRawan SaberNo ratings yet

- Courts and Banks - Effects of Judicial Enforcement On Credit MarketsDocument43 pagesCourts and Banks - Effects of Judicial Enforcement On Credit Marketsvidovdan9852No ratings yet

- UK Gilts CalculationsDocument10 pagesUK Gilts CalculationsAditee100% (1)

- Financial Markets and Institutions 8th Edition Mishkin Solutions ManualDocument8 pagesFinancial Markets and Institutions 8th Edition Mishkin Solutions Manualmichaelkrause22011998gdj100% (32)

- Ch17 - Analysis of Bonds W Embedded Options.ADocument25 pagesCh17 - Analysis of Bonds W Embedded Options.Akerenkang100% (1)

- Transcript - Mike Green - Perils of Passive IndexationDocument24 pagesTranscript - Mike Green - Perils of Passive IndexationWilhelm BeekmanNo ratings yet

- Module 2 Financial MarketsDocument11 pagesModule 2 Financial MarketsNesty SarsateNo ratings yet

- Corporate Debt Market Issues and Policy RecommendationsDocument41 pagesCorporate Debt Market Issues and Policy Recommendations119cNo ratings yet

- FIS Assignment 1 Group 1Document16 pagesFIS Assignment 1 Group 1Souvik BoseNo ratings yet