Professional Documents

Culture Documents

Global Financial Stability Report

Uploaded by

Gustavo SilvaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Financial Stability Report

Uploaded by

Gustavo SilvaCopyright:

Available Formats

EXECUTIVE SUMMARY

T

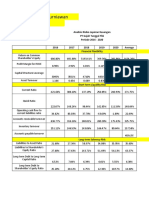

he world economy is experiencing stubbornly high Figure 1. Global Financial Conditions in Selected Regions

(Standard deviations from the mean)

inflation, a challenge it has not faced for decades.

Following the global financial crisis, with inflationary 7

April

2022

6

pressures muted, interest rates were extremely low for United

States

GFSR

5

years and investors became accustomed to low volatility. The Other

4 advanced

resulting easing of financial conditions supported economic economies

3

growth, but it also contributed to a buildup of financial vulner- Euro area

2

abilities. Now, with inflation at multidecade highs, monetary

1 China

authorities in advanced economies are accelerating the pace 0

of policy normalization. Policymakers in emerging markets –1 Other

have continued to tighten policy against a backdrop of rising –2

emerging

market

economies

inflation and currency pressures, albeit with notable differences –3

2006 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22

across regions. Global financial conditions have tightened nota-

Source: IMF staff calculations.

bly this year, leading to capital outflows from many emerging Note: GFSR = Global Financial Stability Report.

and frontier market economies with weaker macroeconomic

fundamentals. Amid heightened economic and geopoliti- Figure 2. Near-Term Growth-at-Risk Forecast

(Percentile)

cal uncertainties, investors have aggressively pulled back from

Quintiles

risk-taking in September. With conditions worsening in recent Worst Best

weeks, key gauges of systemic risk, such as higher dollar fund- 100

ing costs and counterparty credit spreads, have risen. There is a

80

risk of a disorderly tightening of financial conditions that may

be amplified by vulnerabilities built over the years. The report

60

will focus on the risks to global financial stability in the current

macro-financial environment—an environment that is new to

40

many policymakers and market participants.

The global economic outlook has deteriorated materially 20

since the April 2022 Global Financial Stability Report (GFSR).

A number of downside risks have crystallized, including higher- 0

2008 09 10 11 12 13 14 15 16 17 18 19 20 21 22

than-anticipated inflationary pressures, a worse-than-expected

Sources: Bloomberg Finance L.P.; and IMF staff calculations.

slowdown in China on the back of COVID-19 outbreaks and Note: The black line traces the evolution of the 5th percentile threshold (the

growth-at-risk metric) of near-term growth forecast densities.

lockdowns, and additional spillovers from Russia’s invasion of

Ukraine. As a result, the slowdown of the global economy has Figure 3. Emerging Market Hard Currency Sovereign Spreads

intensified. (Basis points)

Amid extraordinary uncertainty about the outlook and stub- 1,200

Emerging markets

bornly high inflation, central banks have continued to normal- Frontier markets

Emerging market IG

1,000 Emerging market HY

ize policy to restore price stability. Global financial conditions

have tightened in most regions since the April 2022 GFSR 800

(Figure 1)—partly an intended consequence of tighter monetary

policy and partly due to rising uncertainty about the outlook 600

since April. By contrast, conditions in China have eased some- 400

what, as policymakers have provided additional support to offset

a deterioration in the economic outlook and strains in the real 200

estate sector.

0

Global financial stability risks have increased since the April Jan.

2020

May

20

Sep.

20

Jan.

21

May

21

Sep.

21

Jan.

22

June

22

2022 GFSR, and the balance of risks is significantly skewed to Sources: Bloomberg L.P.; and IMF staff calculations.

the downside. The range of adverse GDP growth outcomes based Note: HY = high yield; IG = investment grade.

International Monetary Fund | October 2022 xi

GLOBAL FINANCIAL STABILIT Y REPORT: NAVIGATING THE HIGH-INFLATION ENVIRONMENT

Figure 4. Market-Implied Probability Distributions of Inflation on the probability distribution of future GDP growth is in the

Outcomes

worst 20th percentile of the last four decades (Figure 2). Finan-

1. United States

(Probability density)

2. Euro Area

(Probability density) cial vulnerabilities are elevated in the sovereign and nonbank

0.6 0.6

2021 end

2022 April

2021 end

2022 April

financial institution sectors, while market liquidity has deterio-

0.5

2018 end

Latest

2018 end

Latest 0.5

rated across some key asset classes.

Interest rates and prices of risk assets have been extremely

0.4 0.4 volatile since April, reflecting heightened uncertainty about

0.3

the economic and policy outlook. Risk assets sold off sharply

0.3

through June on fears that central banks would have to step

0.2 0.2 up the pace of policy rate hikes to fight high inflation. Emerg-

ing market assets suffered large losses, and sovereign spreads of

0.1 0.1

high-yield emerging markets rose nearly to levels last seen in

0.0 0.0 March 2020 (Figure 3). Crypto markets also experienced extreme

1 2 3 4 1 2 3 4

Percent Percent volatility leading to the collapse of some of the riskiest segments

Sources: Bloomberg L.P.; and IMF staff calculations. and the unwinding of some crypto funds.

In the middle of the year, as recession fears grew, risk assets

rallied on hopes that the monetary policy normalization cycle

Figure 5. US Treasury Bid-Ask Spread and Market Liquidity

Index would end sooner than previously anticipated. These moves, how-

(Basis points) ever, have been unwound and risk assets have experienced further

0.8

Bid-ask spread

4 losses, as major central banks have strongly reaffirmed their

Market liquidity index (right scale)

resolve to fight inflation and meet their price stability mandates.

0.6 3

Disagreement among investors around the most likely infla-

tion outcomes appears to have become more notable. In the euro

less liquid

area, there are significant odds of both low- and high-inflation

0.4 2

outcomes, likely reflecting heightened concerns about a slow-

down in aggregate growth (Figure 4). There is a risk, however,

0.2 1 that a rapid, disorderly repricing of risk in coming months could

interact with, and be amplified by, preexisting vulnerabilities and

0.0 0

poor market liquidity.

Jan. 2020 July 20 Jan. 21 July 21 Jan. 22 July 22

Market liquidity metrics have worsened across asset classes,

Sources: Bloomberg Finance L.P.; JPMorgan Chase & Co.; and IMF calculations.

Note: The market liquidity index is the average of Bloomberg US Government

including in markets that are generally highly liquid and

Securities Liquidity index and the JP Morgan US Treasury total root mean square

error (RMSE) index.

among standardized and exchange-traded products. US Trea-

sury bid-ask spreads have widened significantly, market depth

has declined sharply, and liquidity premiums have increased

Figure 6. Emerging Market Local Currency Bond and (Figure 5).

Equity Flows

(Cumulative, billions of US dollars) European financial markets have shown strains since the April

1. EM excluding China 2. China 2022 GFSR. Asset prices have sold off on the back of growing

20 20

recession fears amid natural gas shortages and the reemergence

0

of fragmentation risks in the euro area. However, spreads of

0 southern European government bond yield over German yields

–20

tightened after the European Central Bank’s announcement of a

–20 new tool to fight fragmentation in the euro area, the Transmis-

–40 sion Protection Instrument. In the UK, investor concerns about

the fiscal and inflation outlook following the announcement

–40 Cumulative

EM equities

(excluding China)

–60 of large debt-financed tax cuts and fiscal measures to deal with

Cumulative EM bonds

(excluding China)

China equities

China bonds

high energy prices weighed heavily on market sentiment. The

–60 –80 British pound depreciated abruptly, and sovereign bond prices

Apr. 22

Aug. 22

Sep. 22

Apr. 22

Aug. 22

Jan. 2022

Feb. 22

Mar. 22

May 22

June 22

July 22

Jan. 2022

Feb. 22

Mar. 22

May 22

June 22

July 22

dropped sharply. To prevent dysfunction in the gilt market from

Sources: Bloomberg Finance L.P.; national sources; and IMF staff calculations.

posing a material risk to UK financial stability, the Bank of

Note: EM = emerging market. England, in line with its financial stability mandate, announced

xii International Monetary Fund | October 2022

EXECUTIVE SUMMARY

on September 28 temporary and targeted purchases of long- Figure 7. House Prices at Risk: Advanced Economies and

Emerging Markets Three Years Ahead

dated UK government bonds. (Density; cumulative growth in percent)

Central banks in emerging and frontier markets have also 0.05 AEs

continued to tighten monetary policy. But regional differences EMs

remain stark, with some countries hiking policy rates earlier and 0.04

more aggressively in response to inflationary pressures. Condi-

tions in local currency bond markets have worsened materi- 0.03

ally, reflecting concerns about the macroeconomic outlook and

Density

rising debt levels. Sovereign bond term premiums have increased 0.02

5th percentile

sharply, especially for central and eastern Europe.

Emerging markets face a multitude of risks stemming from 0.01

high external borrowing costs, stubbornly high inflation, volatile

commodity markets, heightened uncertainty about the global eco- 0.00

–40 –20 0 20

Real house price growth (percent)

nomic outlook, and pressures from policy tightening in advanced

economies. Pressures are particularly acute in frontier markets, Sources: Bank for International Settlements; Bloomberg L.P.; Haver Analytics;

IMF, World Economic Outlook database; and IMF staff calculations.

where challenges are driven by a combination of tightening finan- Note: AEs = advanced economies; EMs = emerging markets.

cial conditions, deteriorating fundamentals, and high exposure to

Figure 8. Potential Credit Losses for Chinese Banks Related

commodity price volatility. Interest expenses on government debt to Real Estate Exposure

(Percent of total risk-weighted assets)

have continued to rise, increasing immediate liquidity pressures.

In an environment of poor fundamentals and lack of investor risk 10

appetite, defaults may follow. However, investors have continued

Remaining buffers in CAR over minimum requirement

8

to differentiate across emerging market economies so far, and

6

many of the largest emerging markets seem to be more resilient to

external vulnerabilities. Nonresident portfolio flows remain weak (percentage point)

4

despite some signs of stabilization after sizable outflows in the first 2

half of the year (Figure 6). Issuance of sovereign hard currency

0

bonds has deteriorated sharply. Without an improvement in mar-

ket access, many frontier market issuers will have to seek alterna- –2

tive funding sources and/or debt reprofiling and restructurings. –4

GSIBs DSIBs Other

The challenging macroeconomic environment is also pres-

suring the global corporate sector. Credit spreads have widened Sources: Bloomberg Finance L.P.; CEIC; S&P Capital IQ; and IMF staff calculations.

Note: CAR = capital adequacy ratio; DSIBs = domestic systemically important

banks; GSIBs = global systemically important banks.

substantially across sectors since April. Large firms have reported

a contraction in profit margins due to higher costs, while down-

Figure 9. Distribution of Banks by Capital Adequacy in an

ward revisions to global earnings growth forecasts appear to be Adverse Scenario

(Percent of assets)

gaining momentum on concerns about a possible recession. At

small firms, bankruptcies have already started to increase in major < 4.5%

[9%, 11%)

[4.5%, 7%)

[11%, 13%)

[7%, 9%)

≥ 13%

advanced economies because these firms are more affected by ris- 100

90

ing borrowing costs and declining fiscal support. Companies that

80

rely on leveraged finance markets are facing tighter lending terms

70

and standards against a challenging growth backdrop. The credit

60

quality of these assets may be tested during an economic down-

50

turn, with potential spillovers to the broader macroeconomy. 40

As central banks aggressively tighten monetary policy, soaring 30

borrowing costs and tighter lending standards, coupled with 20

stretched valuations after years of rising prices, could adversely 10

affect housing markets. In a worst-case scenario, real house price 0

2021

Trough

2024

2021

Trough

2024

2021

Trough

2024

2021

Trough

2024

declines could be significant, driven by affordability pressures

and deteriorating economic prospects (Figure 7). Advanced

economies

Emerging

market

GSIB Non-GSIB

In China, the property sector downturn has deepened as a Sources: Fitch Connect; and IMF staff calculations.

sharp decline in home sales during COVID-19 lockdowns has Note: The figure shows the composition of common equity Tier 1 (CET1).

GSIB = global systemically important bank.

International Monetary Fund | October 2022 xiii

GLOBAL FINANCIAL STABILIT Y REPORT: NAVIGATING THE HIGH-INFLATION ENVIRONMENT

Figure 10. Sustainable Debt Issuance in EMDEs Grew exacerbated the liquidity stress of property developers, raising

Strongly in 2021, with a Notable Rise in Sustainability-Linked

Instruments

concerns about broader solvency risks. Property developer failures

(Billions of US dollars; percent) could spill over into the banking sector, affecting some vulner-

Sustainability-linked loan

Sustainability bond

Sustainability-linked bond

Social bond

able small banks and domestic systemically important banks,

Green loan Green bond

Green instruments, percent of total (right scale)

given their lower capital buffers and higher property-related

300

Sustainability-linked instruments, percent of total (right scale)

100

concentration risk (Figure 8).

High levels of capital and ample liquidity buffers have

250

80 bolstered the resilience of the global banking sector. However,

200

the IMF’s Global Bank Stress Test shows that, in a scenario

60 with an abrupt and sharp tightening of financial conditions

150 that would send the global economy into recession in 2023

40 amid high inflation, up to 29 percent of emerging market

100

banks (by assets) would breach capital requirements, while

50

20

most advanced economy banks would remain resilient. To

rebuild buffers and the capital shortfall would require over

0 0

2010 11 12 13 14 15 16 17 18 19 20 21 22e $200 billion (Figure 9).

Sources: Bloomberg Finance L.P.; and IMF staff calculations. As outlined in Chapter 2, emerging market and developing

Note: Share of green instruments and sustainability linked instruments is shown

as a percent of total emerging market sustainable instrument issuance. economies will need significant climate financing in coming

22e = annualized estimate for 2022; EMDEs = emerging market and developing

economies. years to reduce their greenhouse gas emissions and to adapt to

the physical effects of climate change. Sustainable finance has

grown rapidly but emerging market and developing economies

Figure 11. Effect of Open-End Investment Fund Vulnerabilities

on Bond Return Volatility continue to be at a disadvantage. Decisively scaling up private

(Percent of median volatility)

climate finance faces significant challenges, including the lack of

25 supportive climate policies (such as effective carbon pricing) and

a still-weak climate information architecture (Figure 10).

20 Open-end investment funds are playing an increasingly impor-

tant role in financial markets. However, the liquidity mismatch

15

between their assets and liabilities raises financial stability con-

cerns. Chapter 3 looks at how open-end funds holding illiquid

10

assets while offering daily redemptions can be a key driver of

fragility in asset prices by raising the likelihood of investor runs

5

and asset fire sales (Figure 11). The vulnerabilities of open-end

0

funds can also have cross-border spillover effects and lead to a

All bonds All High yield Investment

grade tightening of overall domestic financial conditions, generating

Corporate bonds

potential risks to macrofinancial stability.

Sources: FactSet; Morningstar; Refinitiv Datastream; and IMF staff calculations.

Policy Recommendations

Central banks must act resolutely to bring inflation back to

target, keeping inflationary pressures from becoming entrenched

and avoiding de-anchoring of inflation expectations that would

damage credibility. The high uncertainty clouding the outlook

hampers the ability of policymakers to provide explicit and

precise guidance about the future path of monetary policy. But

clear communication about their policy reaction functions, their

unwavering commitment to achieve their mandated objectives,

and the need to further normalize policy is crucial to preserve

credibility and avoid unwarranted market volatility.

According to the IMF’s Integrated Policy Framework, where

appropriate, some emerging market economies managing the

xiv International Monetary Fund | October 2022

EXECUTIVE SUMMARY

global tightening cycle could consider using some timely assessment of liquidity risks. Given the increas-

combination of targeted foreign exchange interventions, ing importance of nonbank financial institutions, coun-

capital flow measures, and/or other actions to help terparties should carefully monitor intraday activity

smooth exchange rate adjustments to reduce financial and leverage exposures, strengthen their liquidity risk

stability risks and maintain appropriate monetary policy management practices, and enhance transparency and

transmission. data availability.

Sovereign borrowers in developing economies and Scaling up private climate finance will require

frontier markets should enhance efforts to contain risks new finance instruments and the involvement of

associated with their high debt vulnerabilities, including multilateral development banks to attract pri-

through early contact with their creditors, multilateral vate investors, leveraging private investment and

cooperation, and support from the international com- strengthening risk absorption capacity. A larger share

munity. Enacting credible medium-term fiscal consoli- of equity financing and additional resources for

dation plans following the recent shocks could help climate finance from multilateral development banks

contain borrowing and refinancing costs and alleviate would help countries achieve these objectives. The

debt sustainability concerns. IMF can help its members address climate change

Policymakers should contain further buildup of challenges by undertaking financial stability risk

financial vulnerabilities. While considering country- assessments, lending through its new Resilience and

specific circumstances and the near-term economic Sustainability Trust, and advocating for closing data

challenges, they should adjust selected macroprudential gaps and disclosures.

tools as needed to tackle pockets of elevated vulner- Policy action is warranted to mitigate vulnerabilities

abilities. Striking a balance between containing the and risks associated with open-end investment funds.

buildup of vulnerabilities and avoiding procyclicality Price-based liquidity management tools such as swing

and a disorderly tightening of financial conditions is pricing can be effective in lowering asset price fragilities

important given heightened economic uncertainty and but policymakers should provide further guidance on

the ongoing policy normalization process. their implementation. Additional tools could include

Implementation of policies to mitigate market liquid- linking the frequency of redemptions to the liquidity

ity risks is paramount to avoid possible amplification of funds’ portfolios. Policymakers should also consider

of shocks. Supervisory authorities should monitor tighter monitoring of funds’ liquidity risk management

the robustness of trading infrastructures and support practices, additional disclosures by open-end funds to

transparency in markets. In addition, improving the better assess vulnerabilities, and measures to bolster the

availability of data at the trade level would help with provision of liquidity.

International Monetary Fund | October 2022 xv

You might also like

- AllianzGI Rates 2023outlook ENG 2022Document10 pagesAllianzGI Rates 2023outlook ENG 2022JNo ratings yet

- C 1 PDFDocument48 pagesC 1 PDFyoumna tohamyNo ratings yet

- A Decade After The Global Financial Crisis: Are We Safer?Document54 pagesA Decade After The Global Financial Crisis: Are We Safer?madhurNo ratings yet

- World Bank East Asia and Pacific Economic Update October 2015: Staying the CourseFrom EverandWorld Bank East Asia and Pacific Economic Update October 2015: Staying the CourseNo ratings yet

- IMF World Economic Outlook, Chapter 2, Inflation ScaresDocument20 pagesIMF World Economic Outlook, Chapter 2, Inflation ScaresFabian AbajasNo ratings yet

- Global Macro Outlook 2023 q3Document10 pagesGlobal Macro Outlook 2023 q3Henry J AlvarezNo ratings yet

- CH 01Document51 pagesCH 01Laurentiu SterescuNo ratings yet

- 1ASSESSMENTPROSPECTSDocument12 pages1ASSESSMENTPROSPECTSfsadfNo ratings yet

- International Monetary Fund Global Financial Stability Report January 2010Document6 pagesInternational Monetary Fund Global Financial Stability Report January 2010http://besthedgefund.blogspot.comNo ratings yet

- Getting The Policy Mix Right: Financial Stability OverviewDocument48 pagesGetting The Policy Mix Right: Financial Stability OverviewTran NguyenNo ratings yet

- Outlook_2024_1701379659Document34 pagesOutlook_2024_1701379659Ranny ChooNo ratings yet

- Moody's Outlook For Global Banks 2024Document30 pagesMoody's Outlook For Global Banks 2024Tim MooreNo ratings yet

- The Return of The Bond Vigilantes: ObituaryDocument1 pageThe Return of The Bond Vigilantes: ObituaryKarya BangunanNo ratings yet

- Middle East Issue #15: Optimism Tempered by Uncertainties and Fundamental ChangeDocument13 pagesMiddle East Issue #15: Optimism Tempered by Uncertainties and Fundamental ChangeSithick MohamedNo ratings yet

- State Street Global Advisors Global Market Outlook 2022Document29 pagesState Street Global Advisors Global Market Outlook 2022Email Sampah KucipNo ratings yet

- Executive Summary: World Economic Outlook: Tensions From The Two-Speed RecoveryDocument3 pagesExecutive Summary: World Economic Outlook: Tensions From The Two-Speed RecoveryAndy LeNo ratings yet

- 2024 Global Market OutlookDocument16 pages2024 Global Market OutlookrockerhoonNo ratings yet

- Perspective On Real Interest Rates ImfDocument32 pagesPerspective On Real Interest Rates ImfsuksesNo ratings yet

- T G F C: C, A - C P F L: HE Lobal Inancial Risis Auses NTI Risis Olicies and Irst EssonsDocument5 pagesT G F C: C, A - C P F L: HE Lobal Inancial Risis Auses NTI Risis Olicies and Irst EssonsfyutkjdffyfcnfcbzNo ratings yet

- Microsoft Word - LETTER HEADDocument6 pagesMicrosoft Word - LETTER HEADVikram BhaveNo ratings yet

- AllianzGI Rates Mid Year Outlook 2023 ENG 2023Document14 pagesAllianzGI Rates Mid Year Outlook 2023 ENG 2023Tú Vũ QuangNo ratings yet

- Executive Summary: A Weakening ExpansionDocument2 pagesExecutive Summary: A Weakening Expansionprashantk_106No ratings yet

- Global Financial Stability Update: Executive SummaryDocument8 pagesGlobal Financial Stability Update: Executive SummaryLucas GomesNo ratings yet

- Case CompetitionDocument12 pagesCase CompetitionPark Ji EunNo ratings yet

- The Future of Emerging Markets Duttagupta and PazarbasiogluDocument6 pagesThe Future of Emerging Markets Duttagupta and PazarbasiogluMarkoNo ratings yet

- Management Discussions and AnalysisDocument12 pagesManagement Discussions and AnalysisMohanapriya JayakumarNo ratings yet

- BBT Scott Stringfellow Jan 2019Document3 pagesBBT Scott Stringfellow Jan 2019rchawdhry123No ratings yet

- Wesp MB134 PDFDocument4 pagesWesp MB134 PDFhanh nguyenNo ratings yet

- Russell Investments Q2 2020 GMO SummaryDocument4 pagesRussell Investments Q2 2020 GMO SummaryMichael WangNo ratings yet

- Fdi Expected Growth in 2006Document12 pagesFdi Expected Growth in 2006minasinvestNo ratings yet

- Indonesia 2022 Risk Opportunity Map Stagflation Benefits GrowthTITLE Higher Commodity Prices Boost Indonesia Revenue Infrastructure RecoveryDocument70 pagesIndonesia 2022 Risk Opportunity Map Stagflation Benefits GrowthTITLE Higher Commodity Prices Boost Indonesia Revenue Infrastructure RecoveryErixon SihiteNo ratings yet

- Impact of Covid-19 and Government Response On Capital MarketsDocument8 pagesImpact of Covid-19 and Government Response On Capital Marketsahsan habibNo ratings yet

- Event Update - The Equity Markets Rally Whats Next - HSBC - MF - 5 June 2020 (Revised)Document4 pagesEvent Update - The Equity Markets Rally Whats Next - HSBC - MF - 5 June 2020 (Revised)NACHIKETH89No ratings yet

- Saudi Macroeconomic Forecast 2019 - 2023 - SambaDocument23 pagesSaudi Macroeconomic Forecast 2019 - 2023 - SambaTeofilo Gonzalez MarzabalNo ratings yet

- Fidelity Annual Outlook 2023Document21 pagesFidelity Annual Outlook 2023Govind GuptaNo ratings yet

- Currency Crisis: Causes, Impacts and ImplicationsDocument40 pagesCurrency Crisis: Causes, Impacts and ImplicationsMohammad Tahmid HassanNo ratings yet

- The Global Economic EnvironnmentDocument51 pagesThe Global Economic EnvironnmentAbhinav AgrawalNo ratings yet

- DBS Insights into Positive Outlook for Global Equities, Asian Markets and EM Bonds in 2018Document78 pagesDBS Insights into Positive Outlook for Global Equities, Asian Markets and EM Bonds in 2018Ryan Hock Keong TanNo ratings yet

- Foreword Foreword: Emerging Markets Now The Major Engine of Global GrowthDocument3 pagesForeword Foreword: Emerging Markets Now The Major Engine of Global Growthdat_btNo ratings yet

- FINANCIAL CRISIS AND CHALLENGES: IMPACTS AND POLICY RESPONSESDocument16 pagesFINANCIAL CRISIS AND CHALLENGES: IMPACTS AND POLICY RESPONSESMaizatunisak Muhamad SaadNo ratings yet

- Lessons From The Crisis and Future ChallengesDocument44 pagesLessons From The Crisis and Future Challengesprateekmohan531396No ratings yet

- LCCI Newsletter - April 2019 EditionDocument40 pagesLCCI Newsletter - April 2019 EditionEileen ShaiyenNo ratings yet

- The Value Line View: Issue 7Document12 pagesThe Value Line View: Issue 7ric turnerNo ratings yet

- Adams, Nicole. Chinas Evolving Financial System and Its Global ImportanceDocument14 pagesAdams, Nicole. Chinas Evolving Financial System and Its Global ImportanceLuisNo ratings yet

- GEP January 2023 Executive SummaryDocument2 pagesGEP January 2023 Executive SummaryRuslanNo ratings yet

- To The Point, 2010 JanuaryDocument5 pagesTo The Point, 2010 JanuarySwedbank AB (publ)No ratings yet

- Intermediate Macroeconomics Macroeconomics - WINTER 2014 - : Francesco TrebbiDocument95 pagesIntermediate Macroeconomics Macroeconomics - WINTER 2014 - : Francesco TrebbiIves LeeNo ratings yet

- JP Morgan 1655406568Document27 pagesJP Morgan 1655406568Mohamed MaherNo ratings yet

- Outlook Report - ENDocument23 pagesOutlook Report - ENwopaxNo ratings yet

- Macro: Climate of Change Market Know-How 2021: Edition 1 - 1Document8 pagesMacro: Climate of Change Market Know-How 2021: Edition 1 - 1SharkyNo ratings yet

- REGIONAL ECONOMIC OUTLOOK No IMFDocument41 pagesREGIONAL ECONOMIC OUTLOOK No IMFAbeerh HallakNo ratings yet

- Dela Cruz - Financial MarketsDocument1 pageDela Cruz - Financial MarketsMa. Ana Dela CruzNo ratings yet

- CAM Perspectives en 012024Document16 pagesCAM Perspectives en 012024Anthony de SilvaNo ratings yet

- 01ar 3D82C8FC0Document31 pages01ar 3D82C8FC0Paulina FlorekNo ratings yet

- Global Fixed IncomeDocument5 pagesGlobal Fixed IncomeSpeculation OnlyNo ratings yet

- Global Economic CrisisDocument5 pagesGlobal Economic Crisisrahul100% (2)

- RBI Bulletin - Apr 2022Document322 pagesRBI Bulletin - Apr 2022Sowmya NarayananNo ratings yet

- Monetary Policy Report: July 2009Document31 pagesMonetary Policy Report: July 2009mintcorner100% (2)

- Risk Management BankingDocument19 pagesRisk Management Bankingksimanga@investec.co.zaNo ratings yet

- Recent Developments On Global Financial MarketsDocument31 pagesRecent Developments On Global Financial MarketsGustavo SilvaNo ratings yet

- Global Financial Markets and Oil Price ShocksDocument74 pagesGlobal Financial Markets and Oil Price ShocksGustavo SilvaNo ratings yet

- Global Financial Markets - Financial Deregulation and CrisesDocument12 pagesGlobal Financial Markets - Financial Deregulation and CrisesGustavo SilvaNo ratings yet

- Future Prospects For National Financial MarketsDocument36 pagesFuture Prospects For National Financial MarketsGustavo SilvaNo ratings yet

- Spanish Electricity System 2017Document108 pagesSpanish Electricity System 2017Gustavo SilvaNo ratings yet

- Sabmiller: Aidan Mcquade and Gerry JohnsonDocument9 pagesSabmiller: Aidan Mcquade and Gerry JohnsonDim SumNo ratings yet

- Hydrogen's Empty Environmental Promise Cato Briefing Paper No. 90Document8 pagesHydrogen's Empty Environmental Promise Cato Briefing Paper No. 90Cato InstituteNo ratings yet

- Saln Guide 2018Document120 pagesSaln Guide 2018Garsha HaleNo ratings yet

- PT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Document26 pagesPT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Ananda LukmanNo ratings yet

- General Power of Attorney FormDocument5 pagesGeneral Power of Attorney FormKeith Maynard100% (1)

- Chapter 5 Peter RoseDocument13 pagesChapter 5 Peter RoseRafiur Rahman100% (1)

- This Study Resource Was: RequiredDocument2 pagesThis Study Resource Was: RequiredJean MaeNo ratings yet

- Part 3 Auditing FinalsDocument1 pagePart 3 Auditing FinalsAiko E. LaraNo ratings yet

- Ckyc & Kra Kyc FormDocument27 pagesCkyc & Kra Kyc FormPerumal SNo ratings yet

- Oliver & Walker (2006) Reporting On Software Development Projects To Senior Managers and The BoardDocument23 pagesOliver & Walker (2006) Reporting On Software Development Projects To Senior Managers and The BoardgaryoliverNo ratings yet

- Guerrero v. YñigoDocument3 pagesGuerrero v. YñigoAmber AncaNo ratings yet

- Soa 1700471159825Document5 pagesSoa 1700471159825grv50215No ratings yet

- New Vendor Form Fy23Document4 pagesNew Vendor Form Fy23copias napolesNo ratings yet

- The Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallyDocument2 pagesThe Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallySi Reygie Rojas KoNo ratings yet

- LNPCN ReportDocument9 pagesLNPCN ReportKeesha ApolinarioNo ratings yet

- UBL Internship Report 2016Document52 pagesUBL Internship Report 2016SARDAR WAQAR HASSANNo ratings yet

- HSBC May22 q2Document28 pagesHSBC May22 q2Meishizuo ZuoshimeiNo ratings yet

- The Impact of Capital Structure On The Profitability of Publicly Traded Manufacturing Firms in BangladeshDocument5 pagesThe Impact of Capital Structure On The Profitability of Publicly Traded Manufacturing Firms in BangladeshAnonymous XIwe3KKNo ratings yet

- Cases in Corporation Law PDFDocument92 pagesCases in Corporation Law PDFredjanneNo ratings yet

- A Study On Customer Perception Towards Online Share TradingDocument3 pagesA Study On Customer Perception Towards Online Share TradingDeeplakhan BhanguNo ratings yet

- ABMF3184 AssignmentDocument10 pagesABMF3184 AssignmentChristyNo ratings yet

- Global Finance and Electronic BankingDocument2 pagesGlobal Finance and Electronic BankingMhars Dela CruzNo ratings yet

- List AccountDocument6 pagesList AccountBerkah CahayaNo ratings yet

- 07 RPB Vs CADocument2 pages07 RPB Vs CAArahbells100% (1)

- Secretary of Finance V IllardeDocument2 pagesSecretary of Finance V IllardeJanPalmaNo ratings yet

- Harrisburg Strong PlanDocument115 pagesHarrisburg Strong PlanPennLiveNo ratings yet

- Palileo v. CosioDocument4 pagesPalileo v. CosioHency TanbengcoNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List SummaryerlindaNo ratings yet

- Tri Party AgreementDocument1 pageTri Party AgreementShree Joytish SansthanNo ratings yet

- Objective of PAS 1Document8 pagesObjective of PAS 1ROB101512No ratings yet