Professional Documents

Culture Documents

How To Prepare The BIR Form 1604E

Uploaded by

claireOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Prepare The BIR Form 1604E

Uploaded by

claireCopyright:

Available Formats

How to Prepare the BIR Form 1604E

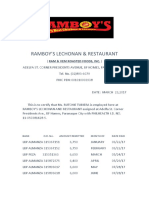

1. Collect to Record all BIR Form 1601E filed/paid for the month of JANUARY to DECEMBER of the

applicable year

1.) Record the details of the BIR Form 1601E from January to December of applicable

year in the BIR Form 1604E, as follows:

1.) Date Remitted

2.) Month

3.) Year

4.) Bank - where the payment was made. If no payment, put “Not Applicable”.

5.) ROR – put the Reference Number of filling or payment. If no reference number,

put “Not Applicable”>

6.) Tax Withheld – is the amount of withholding tax paid for the applicable return.

7.) Penalties – if there is penalty paid

2. Review and finalize the BIR Form1604E for the applicable year.

3. Prepare the Alphalist of Payees (schedule 3 and schedule 4) for the applicable year using the

BIR Alphalist Data Entry.

1.) Record each payee and their corresponding amount in the Alphalist Data Entry.

2.) Generate and save the “dat file” in file server together with the BIR Form

1604E.

4. Test the “dat file” in BIR Alphalist Validation Module to identify any errors. If no errors, procced

to filling in BIR.

How to File the BIR Form 1604E and the Alphalist of Payees to BIR

There’s three (3) ways to file the BIR Form 1604E:

1. Electronic Ffiling Payment System ( eFPS )

1.) Alphalist of payees ( dat file ) is then attached to the eFPS Form

2.) If cannot be attached via EFPS, emailed to esubmission@bir.gov.ph

2. Electronic BIR Form ( eBIR Form ) – for non-efps

1.) Alphalist of Payees ( dat file ) is emailed to esubmission@bir.gov.ph

3. Manual Filling of BIR – kindly check with your RDO if they still accept manual filing of BIR Form

1604E.

NOTE!!

Due Date: Every Year f MARCH 1

BIR TAX FORM: 1604-E

You might also like

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- C Ertificate of Creditable Tax W Ithheld at Source C Ertificate of Creditable Tax W Ithheld at SourceDocument3 pagesC Ertificate of Creditable Tax W Ithheld at Source C Ertificate of Creditable Tax W Ithheld at SourceVher Christopher Ducay0% (1)

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXRen A EleponioNo ratings yet

- 5.inventory Transfer ReportDocument1 page5.inventory Transfer ReportAlgie ReñonNo ratings yet

- Cooperatives Catching The TRAIN PDFDocument163 pagesCooperatives Catching The TRAIN PDFDeirdre Mae Pitpitunge100% (1)

- Withholding Taxes 2Document20 pagesWithholding Taxes 2hildaNo ratings yet

- 105 - Activity 1 - Cash FlowDocument11 pages105 - Activity 1 - Cash FlowElla DavisNo ratings yet

- Alpha ListDocument22 pagesAlpha ListArnold BaladjayNo ratings yet

- ATC HandbookDocument15 pagesATC HandbookPrintet08No ratings yet

- 1702 QDocument3 pages1702 Qappipinnim50% (2)

- Governance and Management Audit ReportDocument1 pageGovernance and Management Audit ReportPrincess SalvadorNo ratings yet

- Thesis FormatDocument63 pagesThesis FormatYves Christian PineNo ratings yet

- Optional Standard Deductions ExampleDocument7 pagesOptional Standard Deductions ExampleSandia EspejoNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- 01-BacarraIN2020 Audit ReportDocument91 pages01-BacarraIN2020 Audit ReportRichard MendezNo ratings yet

- AOM NTHP Below 4k (Revised)Document4 pagesAOM NTHP Below 4k (Revised)Arlea AsenciNo ratings yet

- Assignment - VAT On Sale of Services, Use or Lease of Property, ImportationDocument3 pagesAssignment - VAT On Sale of Services, Use or Lease of Property, ImportationBenzon Agojo OndovillaNo ratings yet

- Pas 28 Investments in Associates and Joint VenturesDocument2 pagesPas 28 Investments in Associates and Joint VenturesR.A.No ratings yet

- 62983rmo 5-2012Document14 pages62983rmo 5-2012Mark Dennis JovenNo ratings yet

- CAT Accelerated Level 1Document4 pagesCAT Accelerated Level 1aliciarigonan100% (1)

- COA Decision 2010-092 Hazard Pay Exposure To Risk QualificationDocument6 pagesCOA Decision 2010-092 Hazard Pay Exposure To Risk QualificationJasmine MontemayorNo ratings yet

- Government Accounting ManualDocument62 pagesGovernment Accounting ManualDez Za100% (1)

- 1 BTAC TG OverviewDocument7 pages1 BTAC TG OverviewRommel Cabalhin100% (1)

- BIR Form 2316 UndertakingDocument1 pageBIR Form 2316 UndertakingJan Paolo CruzNo ratings yet

- EMELINO T MAESTRO BIR Ask For ReceiptDocument1 pageEMELINO T MAESTRO BIR Ask For Receiptjuliet_emelinotmaestroNo ratings yet

- Group Letter of Request Sa OJTDocument1 pageGroup Letter of Request Sa OJTJinky Bulahan100% (1)

- BIR RULING NO. 363-13: Antonio Atendido TanDocument2 pagesBIR RULING NO. 363-13: Antonio Atendido TanDominique Shore100% (1)

- Special Economic ZoneDocument44 pagesSpecial Economic Zonedivyesh_varia100% (1)

- Year-End Tax Requirements and ProceduresDocument164 pagesYear-End Tax Requirements and ProceduresDarioNo ratings yet

- BIR Tax Filing and Deadlines For IndividualsDocument2 pagesBIR Tax Filing and Deadlines For IndividualsDRVBautistaNo ratings yet

- Bir Ruling (Da-031-07)Document2 pagesBir Ruling (Da-031-07)Stacy Liong BloggerAccountNo ratings yet

- 01-TalisayCity2012 Audit ReportDocument147 pages01-TalisayCity2012 Audit ReportGilbert Dela Serna IINo ratings yet

- Cta 2D CV 09224 M 2019feb12 AssDocument17 pagesCta 2D CV 09224 M 2019feb12 AssMelan YapNo ratings yet

- 2020 DITO CME SEC FS REISSUED - Separate - FinalDocument56 pages2020 DITO CME SEC FS REISSUED - Separate - FinalPaulNo ratings yet

- Oregon Public Employees Retirement (PERS) 2007Document108 pagesOregon Public Employees Retirement (PERS) 2007BiloxiMarxNo ratings yet

- Documentary Stamp TaxDocument7 pagesDocumentary Stamp TaxJenny KimmeyNo ratings yet

- Hanks Cindy Curriculum VitaeDocument6 pagesHanks Cindy Curriculum VitaeCindy Gilligan HanksNo ratings yet

- REMINDER LETTER Late Filing of Vat ReturnDocument2 pagesREMINDER LETTER Late Filing of Vat ReturnHanabishi Rekka100% (1)

- BIR Form 1701QDocument2 pagesBIR Form 1701QfileksNo ratings yet

- Certificate of Contribution PhilhealthDocument2 pagesCertificate of Contribution PhilhealthMmcmmc FcicNo ratings yet

- MC 2018-034 - Updated Guidelines On RATADocument7 pagesMC 2018-034 - Updated Guidelines On RATAKarla KatigbakNo ratings yet

- Client Request Form - EbankingDocument1 pageClient Request Form - EbankingEm NueraNo ratings yet

- Membership Savings Remittance Form (MSRF) : HQP-PFF-053Document2 pagesMembership Savings Remittance Form (MSRF) : HQP-PFF-053Steve SmithNo ratings yet

- Passive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCDocument10 pagesPassive Income Rc/Ra/Nrc Nra-ETB Nra - Netb DC RFC NRFCBARBEKS 202021No ratings yet

- DepEd-Prescribed-IPCRF-Parts-1-4-SY-2021-2021-ELEM-ORIOLA, KIM ALBERT N.Document7 pagesDepEd-Prescribed-IPCRF-Parts-1-4-SY-2021-2021-ELEM-ORIOLA, KIM ALBERT N.Clerica RealingoNo ratings yet

- Circular No. 355 - Mandatory Enrollment To and Remittance Through Accredited Electronic Payment and Collection Activities PDFDocument2 pagesCircular No. 355 - Mandatory Enrollment To and Remittance Through Accredited Electronic Payment and Collection Activities PDFJunei Liza Intong - Sampani100% (1)

- BIR From 1601E - August 2008Document4 pagesBIR From 1601E - August 2008mba_roxascapiz50% (4)

- Nput Vat On Mixed TransactionsDocument15 pagesNput Vat On Mixed TransactionsBSACCBLK1COLEEN CALUGAYNo ratings yet

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNo ratings yet

- Bir NCS2003 04BDocument176 pagesBir NCS2003 04BCha Gamboa De LeonNo ratings yet

- What Are The Corporations Exempt From Taxation?Document3 pagesWhat Are The Corporations Exempt From Taxation?ANGEL MAE LINABAN GONGOBNo ratings yet

- SC Decision-GSIS Hazard PayDocument10 pagesSC Decision-GSIS Hazard Paycrizalde de diosNo ratings yet

- Lesson 2 - Intro To Income TaxationDocument34 pagesLesson 2 - Intro To Income TaxationKaryl Magno Pajaroja100% (1)

- PF NotesDocument15 pagesPF NotesAbdul KhadhirNo ratings yet

- ISO 13616 International Bank Account Number (IBAN) Registration ProceduresDocument4 pagesISO 13616 International Bank Account Number (IBAN) Registration ProceduresBruno Mendonça Do CarmoNo ratings yet

- RR No. 9Document9 pagesRR No. 9John Paul de leonNo ratings yet

- Input Data For Incometax Fillling FY 2014-15 AY 2015-16Document3 pagesInput Data For Incometax Fillling FY 2014-15 AY 2015-16satishktNo ratings yet

- New Vendor PolicyDocument2 pagesNew Vendor PolicyDIDI9744No ratings yet

- Step by Step Guide On How To Submit Filed ITR and Attachments To BIR WebsiteDocument4 pagesStep by Step Guide On How To Submit Filed ITR and Attachments To BIR WebsiteLala VanzuelaNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- Science: Levels of Organization of Life/Human Body SystemsDocument4 pagesScience: Levels of Organization of Life/Human Body SystemsclaireNo ratings yet

- Science Lesson 5 - SkeletalDocument6 pagesScience Lesson 5 - SkeletalclaireNo ratings yet

- Resume of Ms. Helen AcepcionDocument2 pagesResume of Ms. Helen AcepcionclaireNo ratings yet

- Ackowledgment Receipt - SimpleDocument1 pageAckowledgment Receipt - SimpleclaireNo ratings yet

- Mary Savannah Bilan Mark Bilan: Roxas City Tagalog Congregation Roxas City Tagalog CongregationDocument1 pageMary Savannah Bilan Mark Bilan: Roxas City Tagalog Congregation Roxas City Tagalog CongregationclaireNo ratings yet

- Grade 4 6 - Araling PanlipunanDocument21 pagesGrade 4 6 - Araling PanlipunanclaireNo ratings yet

- WCA Travel 2018.ppsxDocument32 pagesWCA Travel 2018.ppsxclaireNo ratings yet

- ClimateDocument28 pagesClimateclaireNo ratings yet