Professional Documents

Culture Documents

This Chart (DAX-30 Index in Daily Timeframe) Is Illustrated For The Following Two Questions

Uploaded by

Ari Samuel Corcia BritoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Chart (DAX-30 Index in Daily Timeframe) Is Illustrated For The Following Two Questions

Uploaded by

Ari Samuel Corcia BritoCopyright:

Available Formats

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

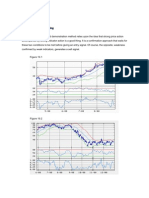

This chart (DAX-30 index in daily timeframe) is illustrated for the following two questions.

43

Determine the name of the chart pattern that is developing at the right part of this bar chart.

a) Inverted Head and Shoulders.

b) Double bottom.

c) Flag.

d) Symmetrical triangle.

e) None of the above.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

44

According to the traditional classification of chart patterns, this is a _________ pattern, while according to

the modern classification of chart patterns, this is a __________ pattern.

a) Continuation. Simple.

b) Continuation. Complex.

c) Reversion. Simple.

d) Reversion. Complex.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Alexey De La Loma ©FINANCER TRAINING Pag. 229/517

CFA, CMT, CAIA, FRM, EFA, CFTe

Topic 6. Chart and Pattern Analysis. CMT I. 2020.

This chart (DAX-30 index in daily timeframe) is illustrated for the following two questions.

45

Determine the name of the chart pattern that is developing at the right part of this bar chart.

a) Rectangle.

b) Double bottom.

c) Triple bottom.

d) Inverse head and shoulders.

e) Wedge.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

46

According to the traditional classification of chart patterns, this is a _________ pattern, while according to

the modern classification of chart patterns, this is a __________ pattern.

a) Continuation. Simple.

b) Continuation. Complex.

c) Reversion. Simple.

d) Reversion. Complex.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Pag. 230/517 ©FINANCER TRAINING Alexey De La Loma

CFA, CMT, CAIA, FRM, EFA, CFTe

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

This chart (DAX-30 index in daily timeframe) is illustrated for the following two questions.

47

Determine the name of the chart pattern that is developing at the right part of this bar chart.

a) Rectangle.

b) Double bottom.

c) Triple bottom.

d) Inverse head and shoulders.

e) Wedge.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

48

According to the traditional classification of chart patterns, this is a _________ pattern, while according to

the modern classification of chart patterns, this is a __________ pattern.

a) Continuation. Simple.

b) Continuation. Complex.

c) Reversion. Simple.

d) Reversion. Complex.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Alexey De La Loma ©FINANCER TRAINING Pag. 231/517

CFA, CMT, CAIA, FRM, EFA, CFTe

Topic 6. Chart and Pattern Analysis. CMT I. 2020.

This chart (DAX-30 index in daily timeframe) is illustrated for the following two questions.

49

Determine the name of the chart pattern that is developing at the right part of this bar chart.

a) Rectangle.

b) Double bottom.

c) Triple bottom.

d) Inverse head and shoulders.

e) Wedge.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

50

According to the traditional classification of chart patterns, this is a _________ pattern, while according to

the modern classification of chart patterns, this is a __________ pattern.

a) Continuation. Simple.

b) Continuation. Complex.

c) Reversion. Simple.

d) Reversion. Complex.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Pag. 232/517 ©FINANCER TRAINING Alexey De La Loma

CFA, CMT, CAIA, FRM, EFA, CFTe

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

This chart (Barnes Group in daily timeframe) is illustrated for the following two questions.

51

Determine the name of the chart pattern that is developing at the right part of this bar chart.

a) Rectangle.

b) Symmetrical triangle.

c) Ascending triangle.

d) Descending triangle.

e) Wedge.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

52

According to the traditional classification of chart patterns, this is a _________ pattern, while according to

the modern classification of chart patterns, this is a __________ pattern.

a) Continuation. Simple.

b) Continuation. Complex.

c) Reversion. Simple.

d) Reversion. Complex.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Alexey De La Loma ©FINANCER TRAINING Pag. 233/517

CFA, CMT, CAIA, FRM, EFA, CFTe

Topic 6. Chart and Pattern Analysis. CMT I. 2020.

This chart (TravelCenters of America in daily timeframe) is illustrated for the following two questions.

53

Determine the name of the chart pattern that is developing at the right part of this bar chart.

a) Rectangle.

b) Symmetrical triangle.

c) Ascending triangle.

d) Descending triangle.

e) Wedge.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

54

According to the traditional classification of chart patterns, this is a _________ pattern, while according to

the modern classification of chart patterns, this is a __________ pattern.

a) Continuation. Simple.

b) Continuation. Complex.

c) Reversion. Simple.

d) Reversion. Complex.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Pag. 234/517 ©FINANCER TRAINING Alexey De La Loma

CFA, CMT, CAIA, FRM, EFA, CFTe

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

This chart (Boeing in daily timeframe) is illustrated for the following two questions.

55

Determine the name of the chart pattern that is developing at the right part of this bar chart.

a) Rectangle.

b) Symmetrical triangle.

c) Ascending triangle.

d) Descending triangle.

e) Wedge.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

56

According to the traditional classification of chart patterns, this is a _________ pattern, while according to

the modern classification of chart patterns, this is a __________ pattern.

a) Continuation. Simple.

b) Continuation. Complex.

c) Reversion. Simple.

d) Reversion. Complex.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Alexey De La Loma ©FINANCER TRAINING Pag. 235/517

CFA, CMT, CAIA, FRM, EFA, CFTe

Topic 6. Chart and Pattern Analysis. CMT I. 2020.

57

Which of the following formations is often called a coil?

a) Flag

b) Diamond Top

c) Wedge

d) Symmetrical Triangle.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

58

A descending triangle has:

a) Sloping support and resistance lines.

b) A horizontal resistance line.

c) A horizontal support line.

d) A sloping support line.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

59

Symmetrical triangles shorter than three weeks in duration are more likely to be categorized as:

a) Flags.

b) Wedges.

c) Pennants.

d) Consolidations.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

60

Flags and pennants always require ______________ leading to them:

a) breakaway gap.

b) A strong advance/decline.

c) A major top/bottom formation.

d) An Intermediate top/bottom formation.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

61

In a Head & Shoulders pattern, volume is generally:

a) Consistent throughout the pattern.

b) Light as prices approach the peak.

c) Highest on a breakout from the neckline.

d) Heaviest during the formation of the left shoulder.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 16-17

Pag. 236/517 ©FINANCER TRAINING Alexey De La Loma

CFA, CMT, CAIA, FRM, EFA, CFTe

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

62

Which of the following would be a valid confirmation of the Head & Shoulders chart formation?

a) Sell when the head penetrates the neckline.

b) Sell when the right shoulder penetrates the neckline.

c) Sell when the right shoulder completes a 50% retracement of the ‘head’ formation.

d) Sell only if the right shoulder manages a greater than 50% retracement of the ‘head’ formation.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 16-17

63

Which of the following chart types does not show price gaps?

a) Bar.

b) Line.

c) Candlestick.

d) Equivolume.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 4-6

64

As a continuation variation, the rising wedge pattern would appear in:

a) An uptrend.

b) A downtrend.

c) A consolidation.

d) The right shoulder of a Head & Shoulder bottom.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

65

A __________ gap occurs at a point of clear resistance or support:

a) Area.

b) Runaway.

c) Breakaway.

d) Exhaustion.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 4-6

66

The basic purpose of a channel line is to:

a) Identify a trend reversal

b) Establish basic direction

c) Identify likely reversal points

d) Assess the probable direction of the trend

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 4-6

Alexey De La Loma ©FINANCER TRAINING Pag. 237/517

CFA, CMT, CAIA, FRM, EFA, CFTe

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

42

CMT ASSOCIATION Sample Exam D

Inverted Head and Shoulders.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

This chart (DAX-30 index in daily timeframe) is illustrated for the following two questions.

43

C

Flag.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

44

A

Flags are simple or small patterns according to the modern view of chart patterns and they are continuation

patterns according to the traditional view.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Alexey De La Loma ©FINANCER TRAINING Pag. 295/517

CFA, CMT, CAIA, FRM, EFA, CFTe

Topic 6. Chart and Pattern Analysis. CMT I. 2020.

This chart (DAX-30 index in daily timeframe) is illustrated for the following two questions.

45

A

Rectangle.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

46

B

Rectangles are complex patterns according to the modern view of chart patterns, and can be continuation

or reversion patterns according to the traditional view. In this case it is a continuation pattern.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Pag. 296/517 ©FINANCER TRAINING Alexey De La Loma

CFA, CMT, CAIA, FRM, EFA, CFTe

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

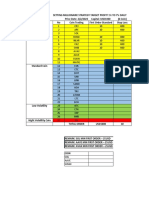

This chart (DAX-30 index in daily timeframe) is illustrated for the following two questions.

47

D

Inverse head and shoulder.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

48

B

Inverse H&S are complex patterns according to the modern view of chart patterns, and reversion patterns

according to the traditional view.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Alexey De La Loma ©FINANCER TRAINING Pag. 297/517

CFA, CMT, CAIA, FRM, EFA, CFTe

Topic 6. Chart and Pattern Analysis. CMT I. 2020.

This chart (DAX-30 index in daily timeframe) is illustrated for the following two questions.

49

E

Inverse head and shoulder.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

50

B

Wedges are complex patterns according to the modern view of chart patterns, and continuation patterns

according to the traditional view.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Pag. 298/517 ©FINANCER TRAINING Alexey De La Loma

CFA, CMT, CAIA, FRM, EFA, CFTe

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

This chart (Barnes Group in daily timeframe) is illustrated for the following two questions.

51

B

It is a symmetrical triangle.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

52

B

Symmetrical triangles are complex patterns according to the modern view of chart patterns, and

continuation patterns according to the traditional view.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Alexey De La Loma ©FINANCER TRAINING Pag. 299/517

CFA, CMT, CAIA, FRM, EFA, CFTe

Topic 6. Chart and Pattern Analysis. CMT I. 2020.

This chart (TravelCenters of America in daily timeframe) is illustrated for the following two questions.

53

D

It is a descending triangle.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

54

B

Descending triangles are complex patterns according to the modern view of chart patterns, and

continuation patterns according to the traditional view.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

Pag. 300/517 ©FINANCER TRAINING Alexey De La Loma

CFA, CMT, CAIA, FRM, EFA, CFTe

CMT I. 2020. Topic 6. Chart and Pattern Analysis.

This chart (Boeing in daily timeframe) is illustrated for the following two questions.

55

C

It is an ascending triangle.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

56

B

Ascending triangles are complex patterns according to the modern view of chart patterns, and continuation

patterns according to the traditional view.

Kirkpatrick and Dahlquist, Technical Analysis, 3rd Edition (Old Tappan, New Jersey: Pearson Education, Inc., 2016), Chapter 15

57

CMT ASSOCIATION Sample Exam D

Symmetrical triangle.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

58

CMT ASSOCIATION Sample Exam C

A horizontal support line.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

Alexey De La Loma ©FINANCER TRAINING Pag. 301/517

CFA, CMT, CAIA, FRM, EFA, CFTe

Topic 6. Chart and Pattern Analysis. CMT I. 2020.

59

CMT ASSOCIATION Sample Exam C

Pennants.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

60

CMT ASSOCIATION Sample Exam B

A strong advance/decline.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

61

CMT ASSOCIATION Sample Exam D

Heaviest during the formation of the left shoulder.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 16-17

62

CMT ASSOCIATION Sample Exam B

Sell when the right shoulder penetrates the neckline

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 16-17

63

CMT ASSOCIATION Sample Exam B

Line

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 4-6

64

CMT ASSOCIATION Sample Exam B

A downtrend

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 7-11

65

CMT ASSOCIATION Sample Exam C

Breakaway

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 4-6

66

CMT ASSOCIATION Sample Exam C

Identify likely reversal points

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 4-6

67

CMT ASSOCIATION Sample Exam D

An exhaustion gap appears at the end of a trend.

Thomas N. Bulkowski, Visual Guide to Chart Patterns (Hoboken, New Jersey: John Wiley & Sons, 2012), Chapters 4-6

Pag. 302/517 ©FINANCER TRAINING Alexey De La Loma

CFA, CMT, CAIA, FRM, EFA, CFTe

You might also like

- McGraw-Hill - Data Management (Full Textbook Online)Document664 pagesMcGraw-Hill - Data Management (Full Textbook Online)Varun Shah81% (16)

- CMT1Document14 pagesCMT1Qasim AnwarNo ratings yet

- Indicators Cheat SheetDocument6 pagesIndicators Cheat SheetMian Umar RafiqNo ratings yet

- Ifta Cfteii Mock ExamDocument16 pagesIfta Cfteii Mock Exammuneesa nisarNo ratings yet

- Master Trend FollowingDocument17 pagesMaster Trend FollowingRichard TsengNo ratings yet

- Ichimoku Charts by David LintonDocument76 pagesIchimoku Charts by David LintonKannan Srinivasan100% (1)

- CFT/CMT Course On Wiziq.Document15 pagesCFT/CMT Course On Wiziq.Shivgan Joshi100% (2)

- CMT Level 1 DefsDocument21 pagesCMT Level 1 DefsIxjnxNo ratings yet

- CMT Level 1 DefsDocument21 pagesCMT Level 1 DefsIxjnxNo ratings yet

- CMT Level I 2017Document9 pagesCMT Level I 2017Khandaker Amir Entezam100% (1)

- Step Two of The Wyckoff Method: Stock Market Trading StrategiesDocument3 pagesStep Two of The Wyckoff Method: Stock Market Trading StrategiesDeepak Paul TirkeyNo ratings yet

- 89903555776Document3 pages89903555776Themba Hope TshabalalaNo ratings yet

- Glossary of Technical IndicatorsDocument46 pagesGlossary of Technical Indicatorssujanreddy100% (1)

- Bollinger Band Keltner Cheat SheetDocument2 pagesBollinger Band Keltner Cheat SheetMian Umar RafiqNo ratings yet

- 2014may cmt2Document4 pages2014may cmt2Pisut OncharoenNo ratings yet

- Candle Book John GhattiDocument19 pagesCandle Book John GhattiMarvin AjavonNo ratings yet

- 6) Chart-Patterns-Cheat-SheetDocument14 pages6) Chart-Patterns-Cheat-SheetKumarVijayNo ratings yet

- Steve Nison - The Candlestick Course - PDF - Trading Software (PDFDrive)Document226 pagesSteve Nison - The Candlestick Course - PDF - Trading Software (PDFDrive)Đặng Văn TháiNo ratings yet

- Chartbook For Level 3.13170409Document65 pagesChartbook For Level 3.13170409calibertraderNo ratings yet

- Eight Best CandlesDocument4 pagesEight Best CandlesJonathan DominguezNo ratings yet

- MACD Indicator Explained, With Formula, Examples, and LimitationsDocument8 pagesMACD Indicator Explained, With Formula, Examples, and Limitationsbedul68No ratings yet

- 52-Week High and Momentum InvestingDocument32 pages52-Week High and Momentum InvestingCandide17No ratings yet

- CMTDocument284 pagesCMTAaron R. AllenNo ratings yet

- Certified Financial Technician (Cfte) I & Ii Syllabus & Reading MaterialDocument33 pagesCertified Financial Technician (Cfte) I & Ii Syllabus & Reading MaterialKeith SoongNo ratings yet

- Identifying Significant Chart FormationsDocument7 pagesIdentifying Significant Chart FormationsbobzingoNo ratings yet

- Exit Strategy Analysis With CAN SLIM StocksDocument58 pagesExit Strategy Analysis With CAN SLIM StocksKapil Nandwana100% (1)

- Boom 1000 Index Trading Strategy - Spike Catching Strategy BoomDocument17 pagesBoom 1000 Index Trading Strategy - Spike Catching Strategy BoomYoonNo ratings yet

- Session 11-WTC PPT (Mar 18, 2019)Document19 pagesSession 11-WTC PPT (Mar 18, 2019)MtashuNo ratings yet

- The Complete Guide To Forex Trading - by PriceActionLTD PDFDocument339 pagesThe Complete Guide To Forex Trading - by PriceActionLTD PDFLineekela90% (51)

- Macquarie TechnicalsDocument30 pagesMacquarie TechnicalsKevin MacCullough100% (2)

- Presented by Zonaira SarfrazDocument19 pagesPresented by Zonaira SarfrazZunaira SarfrazNo ratings yet

- 2023 02 01 IFTA Syllabus V19Document8 pages2023 02 01 IFTA Syllabus V19Ahmed Abdel HamidNo ratings yet

- January Batch MasterclassDocument16 pagesJanuary Batch MasterclassSaransh GuptaNo ratings yet

- CMT Level III 2020Document8 pagesCMT Level III 2020kien tranNo ratings yet

- Technical Analysis MagDocument44 pagesTechnical Analysis Magmerc2100% (1)

- 1311 Ew TaffDocument10 pages1311 Ew TaffrandeepsNo ratings yet

- Hikkake PatternDocument16 pagesHikkake PatternOxford Capital Strategies LtdNo ratings yet

- CMT L1 Question Bank (Set 1)Document25 pagesCMT L1 Question Bank (Set 1)Nistha SinghNo ratings yet

- RSI Fundamentals Beginning To Advanced Second EditionDocument179 pagesRSI Fundamentals Beginning To Advanced Second Editionadrhohmann100% (1)

- Glenn Neely - Mastering Elliott Wave - 수정Document169 pagesGlenn Neely - Mastering Elliott Wave - 수정account personalNo ratings yet

- Chart Technical AnalysisDocument56 pagesChart Technical Analysiscool_air1584956No ratings yet

- Level III Learning ObjectivesDocument7 pagesLevel III Learning ObjectiveschaudharyarvindNo ratings yet

- CMT Level I 2013 SummaryDocument7 pagesCMT Level I 2013 Summaryplantszombie0% (1)

- The Elliott Wave PrincipleDocument4 pagesThe Elliott Wave PrincipledewanibipinNo ratings yet

- IFTA CFTe SyllabusDocument127 pagesIFTA CFTe SyllabusHarshit Kumar50% (2)

- Basic of Chart Reading and CandlestickDocument10 pagesBasic of Chart Reading and CandlestickRobin WadhwaNo ratings yet

- IFTA Journal 2014 PDFDocument104 pagesIFTA Journal 2014 PDFRaptordinos100% (2)

- How To Trade With HeikinDocument7 pagesHow To Trade With HeikinAteeque Mohd100% (1)

- Journal 1978 MayDocument64 pagesJournal 1978 MaySumit Verma100% (1)

- Important CandlesticksDocument36 pagesImportant CandlesticksMayur SurbhalaviNo ratings yet

- Ifta Paper PreparationDocument4 pagesIfta Paper PreparationZeeshan Yaseen100% (1)

- TorikoDocument6 pagesTorikoSnapeSnapeNo ratings yet

- Suriduddella ScalprulesDocument10 pagesSuriduddella ScalprulesgianniNo ratings yet

- Role of Technical Analysis As A Tool For Trading DecisionsDocument43 pagesRole of Technical Analysis As A Tool For Trading DecisionsDeepak Shrivastava100% (1)

- MACD Bibliography PDFDocument5 pagesMACD Bibliography PDFJoe DNo ratings yet

- Session 06-WTC PPT (Feb 11, 2019)Document25 pagesSession 06-WTC PPT (Feb 11, 2019)MtashuNo ratings yet

- موجات اليوت الدرس الأولDocument13 pagesموجات اليوت الدرس الأولcadecortxNo ratings yet

- Market Outlook Oct 2013Document4 pagesMarket Outlook Oct 2013eliforu100% (1)

- 1.0 Technical Analysis 1.1 Crude Palm Oil Futures (FCPO)Document6 pages1.0 Technical Analysis 1.1 Crude Palm Oil Futures (FCPO)nur izzatiNo ratings yet

- CFTeDocument11 pagesCFTeAhmed Abdel Hamid100% (1)

- IFTA CFTeII Mock Exam ENG PDFDocument19 pagesIFTA CFTeII Mock Exam ENG PDFmissmawarlinaNo ratings yet

- Broadening Formations: A .The Orthodox Broadening TopDocument6 pagesBroadening Formations: A .The Orthodox Broadening TopKalfy WarspNo ratings yet

- Bollinger Bands Method - LLDocument4 pagesBollinger Bands Method - LLadoniscalNo ratings yet

- Ichimoku Kinko Hyo - A Japanese Technical ToolDocument3 pagesIchimoku Kinko Hyo - A Japanese Technical ToolMadhu50% (2)

- Mastering Ichimoku Kinko Hyo IndicatorDocument2 pagesMastering Ichimoku Kinko Hyo IndicatorBiantoroKunartoNo ratings yet

- CMT1Document8 pagesCMT1pmlopez22220000No ratings yet

- Five Minute Method - GatotDocument21 pagesFive Minute Method - Gatotagus purnomoNo ratings yet

- Level I Final Branded Exam Information Document 2019Document13 pagesLevel I Final Branded Exam Information Document 2019Zeeshan KhalidNo ratings yet

- Baeyens, Walter - RSI Logic, Signals & Time Frame Correlation-Đã Nén (PDF - Io) PDFDocument66 pagesBaeyens, Walter - RSI Logic, Signals & Time Frame Correlation-Đã Nén (PDF - Io) PDFthang dNo ratings yet

- Ebook Mmist09 v02Document52 pagesEbook Mmist09 v02abcplot123100% (1)

- Philakone Course ListDocument1 pagePhilakone Course ListprajwalNo ratings yet

- Technical AnalysisDocument65 pagesTechnical AnalysisrinekshjNo ratings yet

- (Ebook Trading) High Profit Candlestick Patterns and Conventional Technical AnalysisDocument4 pages(Ebook Trading) High Profit Candlestick Patterns and Conventional Technical AnalysisThie ChenNo ratings yet

- Cut LossDocument3 pagesCut LossAnonymous sDnT9yuNo ratings yet

- MCS 211Document3 pagesMCS 211Amish SinghNo ratings yet

- Algebra I m5 Topic B Lesson 6 TeacherDocument13 pagesAlgebra I m5 Topic B Lesson 6 TeacherjxhroyNo ratings yet

- The Co-Movement of U.S. Equity Returns With The Developed and Emerging Markets of Australasia and AsiaDocument16 pagesThe Co-Movement of U.S. Equity Returns With The Developed and Emerging Markets of Australasia and AsiaAri Samuel Corcia BritoNo ratings yet

- CV TemplateDocument2 pagesCV TemplateElbert EinsteinNo ratings yet

- ISUP 2020: International Summer University ProgrammeDocument2 pagesISUP 2020: International Summer University ProgrammeAri Samuel Corcia BritoNo ratings yet

- CV TemplateDocument2 pagesCV TemplateElbert EinsteinNo ratings yet

- Pseudo-Mathematics and Financial Charlatanism. The Effects of Backtest Overfitting On Out of Sample Performance PDFDocument14 pagesPseudo-Mathematics and Financial Charlatanism. The Effects of Backtest Overfitting On Out of Sample Performance PDFEduardo E. SalasNo ratings yet

- Terms Definitions: Last Updated: 05/20/2019Document10 pagesTerms Definitions: Last Updated: 05/20/2019Ari Samuel Corcia BritoNo ratings yet

- Technical Analysis of UltraTechDocument55 pagesTechnical Analysis of UltraTechbanhi.guhaNo ratings yet

- Formula Cointech2u Setting Trading 1k To 200k Update 12 04 2023Document45 pagesFormula Cointech2u Setting Trading 1k To 200k Update 12 04 2023AndhikaNo ratings yet

- Teach A Man How To FishDocument9 pagesTeach A Man How To FishRonak SinghNo ratings yet

- Volatility 75 Index Technical Analysis Knowledge Must Read!Document45 pagesVolatility 75 Index Technical Analysis Knowledge Must Read!John ChukwuemekaNo ratings yet

- NF Price Action-Kay MgagaDocument75 pagesNF Price Action-Kay MgagawandileNo ratings yet

- Diario de Trading - Live Trading RoomDocument683 pagesDiario de Trading - Live Trading RoomAlexisNo ratings yet

- Metastock FormulaDocument52 pagesMetastock FormulaMr. YILDIZNo ratings yet

- 3 Days Bullish Candlestick PatternsDocument3 pages3 Days Bullish Candlestick Patternsapi-3850984No ratings yet

- 2.2 Average Directional Index (ADX) - Forex Indicators GuideDocument4 pages2.2 Average Directional Index (ADX) - Forex Indicators Guideenghoss77No ratings yet

- Assignment Ind (FIN555)Document6 pagesAssignment Ind (FIN555)Mieshirl Vie0% (1)