100% found this document useful (1 vote)

1K views19 pagesPresented by Zonaira Sarfraz

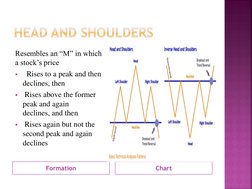

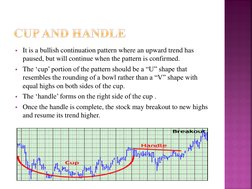

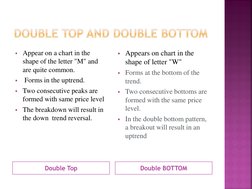

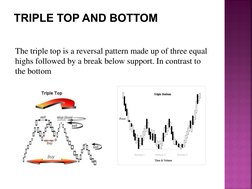

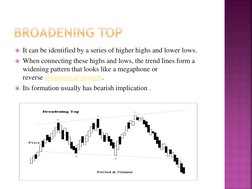

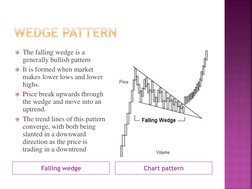

The document discusses various chart patterns used in technical analysis of stocks. It describes common continuation patterns like head and shoulders, double bottom, cup and handle, and flags/pennants. Reversal patterns discussed include double top, triple top/bottom, broadening formations, and triangles. The purpose of identifying these patterns is to predict future stock price movements and market trends. Characteristics of each pattern are provided along with examples in charts. Gaps in prices are also explained as technical indicators.

Uploaded by

Zunaira SarfrazCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

1K views19 pagesPresented by Zonaira Sarfraz

The document discusses various chart patterns used in technical analysis of stocks. It describes common continuation patterns like head and shoulders, double bottom, cup and handle, and flags/pennants. Reversal patterns discussed include double top, triple top/bottom, broadening formations, and triangles. The purpose of identifying these patterns is to predict future stock price movements and market trends. Characteristics of each pattern are provided along with examples in charts. Gaps in prices are also explained as technical indicators.

Uploaded by

Zunaira SarfrazCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

- Introduction to Chart Patterns

- Types of Chart Patterns

- Reversal Patterns

- Continuation Patterns

- Gap Patterns