Professional Documents

Culture Documents

Chart English Growth Shera

Uploaded by

Mann MannOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chart English Growth Shera

Uploaded by

Mann MannCopyright:

Available Formats

All rights reserved @ Growth Shera

Copyright Page

[ Book Title: Chart Pattern ] by [ Growth Shera ]

Published by [Self Published]

Copyright © [ 2023 ] [Growth Shera]

All rights reserved. No portion of this ebook may be reproduced &

Resell in any form without permission from the publisher &

Writer, except as permitted by U.S. copyright law.

Please contact us:

Growthshera7@gmail.com

Phone Number +91 9021491456

Cover by [ Adstar Digital Media ].

eBook Launch Date :- 15/04/2023

Paperback Launch Date :- 19/05/2023

Revised Edition:- 21/06/2023

All rights reserved @ Growth Shera

A Complete Guide For Stock Market Prediction By Proper

Technical Analysis

INDEX :-

Ascending Triangles

Symmetrical Triangle patter

Descending Triangle

Descending Triangle

Bump and Run Reversal

Cup And Handle Pattern

Double Bottom Pattern

Double Top Pattern

Falling Wedge Pattern

Flag Pattern

Pennant Pattern

Head and Shoulders Top Pattern

Inverse Head And Shoulders Pattern

Rounding Bottom Pattern

Price Channel Pattern

With Proper Diagrams , Chart patterns , Nature of Pattern , Condition

Of Breakout And Volume For Stock Market Analysis And Prediction.

All rights reserved @ Growth Shera

Ascending Triangles :-

The ascending triangle is a continuation pattern defined by an entry point, stop

loss and profit target. On a price chart, it appears as a horizontal support line

connecting the highs to the lows from an upward trend line. Each ascending

triangle has at least two highs and two lows. In comparison, a descending

triangle has a horizontal lower line and a descending upper trend line.

The above chart represents an ascending triangle. It consists of a horizontal

resistance line drawn at smaller highs, with a rising trend line connecting minor

lows, forming a triangular pattern.

Ascending triangles are continuation patterns because the price usually breaks

out in the direction it was going before the pattern. Like other types of triangles,

volume often shrinks during chart patterns. Investors usually enter when a price

breakout occurs, keeping an eye on false breakouts. The positions they take

depends on the direction of the breakout - buy in the up direction and sell in the

down direction. The stop loss is placed just outside the triangle. To calculate the

profit target, traders take into account the height of the triangle at the maximum

width and adjust that measurement according to the breakout price.

With ascending triangles, the wider the pattern, the higher the risk/reward. For

narrower patterns, the stop loss becomes smaller; However, the profit target is

still based on the most important part of the pattern. In terms of the challenges

faced by traders using this chart, false breakouts are an important consideration.

Price movement can fluctuate, moving in and out of the pattern in either

direction if it fails to break the upper resistance level.

All rights reserved @ Growth Shera

Hedge funds and other institutional organizations can buy hundreds of

thousands of shares in a company. After the stock has risen, and it has

concluded that there are better opportunities elsewhere, the organization will

exit the position. Here they have to sell their stock, but only up to a certain

point, in this example, we use $50. Since a large amount of stock is being

dumped in the market, the price of that stock cannot climb above $50, because

as soon as it does, it will trigger a sale from the organization.

When word on the stock is out, other sellers jump on the bandwagon and push

the stock down even further. Once all sellers are satisfied, buyers arrive,

thinking that the stock is a steal at this low price and overtook the shares, raising

it even higher than before.

Pattern Type: Continuity

Sign: Bullish

Breakout Confirmation: Confirmation of this pattern is near the high of average

trading volume.

Measurement: Subtract the height from the lowest low of the pattern and then

add to the breakout level.

Volume: Volume declines during an ascending triangle formation, expands

when a breakout occurs.

The ascending triangle pattern represents a high risk/reward scenario, truncating

other patterns that tend to narrow over time. The biggest issue with this chart

pattern is the potential for false breakouts. As a result, the chart pattern can be

redrawn several times as price action crosses the resistance level, but fails to

sustain the breakout price. To learn more about stock chart patterns and to fully

take advantage of technical analysis, be sure to check out our complete library

of predictable chart patterns. These include comprehensive descriptions and

images so that you can identify important chart pattern scenarios and become a

better trader.

All rights reserved @ Growth Shera

Symmetrical Triangle pattern

The symmetrical triangle pattern is relatively easy to notice because of its

distinctive form. It is one of the three important triangle patterns defined by

classical technical analysis. The other two are the descending triangle and the

ascending triangle.

A symmetrical triangle is a chart that can be identified by its lower highs and

higher lows. This pattern is indicated when two trend lines converge with

convergent trend lines connecting multiple peaks and troughs.

Once one of those peaks "breaks out" of this barrier, it can indicate a powerful

bullish or bearish move that investors can take advantage of if they know how to

look for it. If the breakout point appears at a trough point, it may indicate a

strong movement in bear territory and is an excellent sign that it is time to exit.

If the breakout point is extreme, it may indicate a bull movement and a good

time to invest.

Edwards and Maggie, authors of Technical Analysis of Stock Trends, suggest

that approximately 75% of symmetrical triangles are continuation patterns and

the rest mark reversals.

This indicates that we should not guess the direction of the breakout, but instead

be patient and wait for it to happen. Additional analysis can also be applied to

breakouts by looking at gaps, volume and quick price movement. When trading

the symmetrical triangle, it is important to wait for confirmation of the breakout

to be on the right side.

These patterns have two or more swing highs and lows when it comes to price,

All rights reserved @ Growth Shera

and investors need to be prepared to adjust to trend lines with more "swings" to

level the playing field. it occurs. These types of patents can often mislead

investors, and they lose volume because they appear to be "purposeless," but for

those who know how to look for breakouts, these patterns can give a great

indication of where to go. Know when to buy it and when to go.

A settling triangle can be set up for a breakout which can be calculated by

taking the distance from the upper support line and lower resistance at the

beginning of the pattern and then adding that to the breakout price point. For

example, a settled triangle may start at a price point of $40, then trade to $50

before the trading range narrows. So here, a breakout from the $45 price point

could result in a price target of $55 ($50 - $40 = $10 + $45 = $55).

The stop loss order should be placed slightly below the breakout point for the

symmetrical triangle pattern. For example, if the stock begins to break out at

above-average volume at $45, investors should place their stop loss orders

slightly below the $45 price point.

Why are there symmetrical triangles

When supply and demand are out of balance, the stock's price action will move

forward. Either the bulls will overtake the bears and push the stock higher, or

the bears will overtake the bulls and push the stock down—traders who can

accurately identify in which direction the symmetrical triangle will condense the

rewards of profit. .

Pattern Type: Continuation or Reversal

Indication: bullish or bearish

Breakout Confirmation: This pattern is confirmed above or below the

converging trend line at above average trading volume.

Measurement: Subtract the high of the pattern's lowest low and highest high and

then add or subtract this amount at the breakout level depending on how the

breakout progresses.

Volume: Expanding on breakouts, volume declines throughout the symmetrical

triangle formation.

Be careful when trading symmetrical triangles, as traders can be faked on

bullish and bearish signals that reverse soon after the trend begins. It is

All rights reserved @ Growth Shera

recommended to stop for a day after the breakout to determine whether the

pattern is real or not. Look for one-day closing price targets below the trend line

for a bullish signal and above the trend line for a bearish signal. To learn more

about stock chart patterns and to fully take advantage of technical analysis, be

sure to check out our complete library of predictable chart patterns. These

include comprehensive descriptions and images so that you can identify

important chart pattern scenarios and become a better trader.

All rights reserved @ Growth Shera

Descending Triangle

The descending triangle chart pattern, also known as the descending triangle,

allows traders to measure the distance from the beginning of the pattern,

represented by the highest point, all the way to the flat support line. This type of

technical analysis identifies a downward trend, which will eventually break

through resistance levels causing price action to drop.

Traders look for a descending triangle as the pattern indicates that a breakdown

is imminent. Usually, when there is a fall in price, buyers push up the price even

more. However, a descending triangle indicates that buying pressure is lacking.

Here, sellers begin selling at even lower prices, which suggests a series of lower

highs. A breakdown usually occurs when volumes are high, and the following

move is rapid and severe.

Descending triangles are popular because they provide traders with the

opportunity to make substantial profits in the short term. To trade the pattern,

technical traders take a bear position after a break of high volume. The price

target is usually equal to the entry point minus the vertical distance between the

lines drawn when the breakdown occurs. Stop loss positions are taken on the

upper trendline. To profit from a descending triangle, traders must identify clear

breakdowns and avoid false signals. They also need to consider that in case of

no breakdown, the price may test the upper resistance before moving to the

lower support line again.

Descending triangles are the opposite of ascending triangles because they have a

horizontal upper trend line and a rising lower. Reversals can also occur with

All rights reserved @ Growth Shera

descending triangles, but they are generally considered to be bullish in nature.

All triangle patterns provide traders with the opportunity to short the stock and

set profit targets.

It is important to note that when trying to anticipate a potential breakout, we

also want to look at other technical indicators. Simple moving averages help to

confirm the signal to execute the trend trade.

To help predict an upward breakout, when the price falls after a broken triangle,

we check to see if the price of the breakout is above or below the 200-day

simple moving average. The trend outperforms an average of 5% when the

breakout is below the 200-day simple moving average.

To help predict a downward breakout, the opposite is true. When the price

breaks out above the 200-day simple moving average, a broken triangle sees a

price increase of 13% compared to below the 200-day simple moving average.

Why is the descending triangle important?

The descending triangle is one of the most popular chart patterns because it is

easy to understand and clearly shows demand, or lack thereof, in a stock. When

the price falls below the support level, it indicates that the stock is likely to

continue declining. This bearish pattern enables traders to generate above

average returns over a short period of time. Descending triangles can also

indicate a reversal pattern or an uptrend, but in most cases, they represent a

bearish continuation pattern.

Pattern Type: Continuity

Hint: Bearish

Breakout Confirmation: Confirmation of this pattern is near the low of average

trading volume.

Measurement: Subtract the high from the high and low of the pattern and then

from the breakout level.

Volume: Volume declines during descending triangle formation, expands on

breakout

The descending triangle pattern can act as a great indicator of a future trend, but

it is not without its limitations. It is a favorite among traders because the pattern

All rights reserved @ Growth Shera

is easy to recognize, but it is known for false breakouts, so traders need to

manage their trades accordingly. To learn more about stock chart patterns and to

fully take advantage of technical analysis, be sure to check out our complete

library of predictable chart patterns. These include comprehensive descriptions

and images so that you can identify important chart pattern scenarios and

become a better trader.

All rights reserved @ Growth Shera

Bump and Run Reversal

The second phase of the pattern is the bump phase, in which prices move up

faster than the first phase. During this phase, the trend line becomes at least

50% faster than the lead-in trendline. Traders should validate the bump pattern

by checking the maximum-height of the bump in relation to the lead-in

trendline. The distance from the highest point of the bump to the lead-in

trendline should be twice (or more) the distance from the highest height to the

lead-in line in the lead-in phase.

The chart starts showing the right side of the collision once the prices reach

their peak and start declining towards the trend line. The volume expands after

the advance forms on the left side of the bump. The run phase begins when

prices reach the lead-in trendline.

After crossing the trendline, sometimes the price reverts back to the trendline,

which is now also a resistance level. Bump and Run Reversal Patterns can be

used for all types of trading from daily, weekly to monthly, with the

understanding that the movement is volatile over the long term.

How does bump and run reversal happen?

The setup works like this; The stock is making an upward sloping signal to

investors that they should acquire the stock, as the day progresses, investors

keep bidding for the stock and the price rises. Then an event occurs, such as

earnings, that causes traders to jump on the bandwagon and bid for even more

stocks. As momentum picks up, the price moves up to form a new higher

All rights reserved @ Growth Shera

sloping trend line. However, that is when things start going wrong.

Here supply catches up with demand, traders find that the stock's bid has gone

too high, and sellers come in and push the stock down. During the lead-in phase

the volume is often initially high, and then the volume decreases until the onset

of the percussion, which then increases suddenly.

Pattern Type: Nondirectional

Hint: Bearish

Breakout Confirmation: Confirmation of this pattern is below the lower

trendline drawn at a low level during the lead-in phase, with above-average

trading volume.

Measuring: The price target is the lowest point in the lead-in phase

Volume: Volume is usually high at the beginning of the phase and decreases

throughout the pattern.

The Bump and Run Reversal Pattern is a high probability trade that is being

used by many professional traders. It can be applied to any chart period, daily,

weekly or monthly. The pattern is an excellent indicator designed to identify

speculative demand that is likely to come to an end allowing traders to profit on

the stock. To learn more about stock chart patterns and to fully take advantage

of technical analysis, be sure to check out our complete library of predictable

chart patterns. These include comprehensive descriptions and images so that

you can identify important chart pattern scenarios and become a better trader.

All rights reserved @ Growth Shera

Cup And Handle Pattern

A cup and handle pattern occurs when the underlying asset forms a chart that

resembles a cup in the shape of a U, and represents a handle slightly downward

after the cup.

Shape is formed when a price wave is down, followed by a stabilization period,

followed by a rally of roughly the same size as the prior trend. This price action

identity makes up the cup and handle sizes.

The formation is usually initiated by low-trade volume, followed by high

volume as the left lip, declining volume at the bottom of the cup, which then

exits with increasing volume towards the right lip and a breakout. This process

can last anywhere from a few minutes to sixty-five weeks, beginning with a

period of stabilization followed by downward price volatility, then a rally that

returns to nearly or equal to the previous level before the price drops. brings.

Once this happens, the cup moves forward and forms a U, and the price curves

slightly downwards to form the handle.

The handle should be shorter than the cup and should only point slightly down

within the trading range - not less than a third of what is in the cup. Investors

who see a similar pattern where the handle goes deep may want to try to avoid

it.

However, when the handle is in the proper proportion to the edge of the cup, a

breakout that crosses the handle is a sign of an increase in price. In addition, it is

All rights reserved @ Growth Shera

important to note that this is not always the case, and investors should use

certain measures to minimize losses when investing in these types of patterns.

The image above displays the standard cup and handle pattern. To trade this

formation correctly, a trader should place a stop buy order slightly above the

upper trendline that forms the handle. This way, the buy order will be executed

only if the price breaks above the upper resistance level. This will avoid

jumping into a cup by entering a false breakout and handling the pattern too

early. For traders who want to add a little more certainty to their trades, they

should wait for the price handle to close above the upper trend line.

Often traders try to buy a stock at a lower price, when it breaks the upper

trendline, hoping that the price will temporarily move back down, but here they

run the risk of moving the price upwards, risking the trade. completely

disappear.

The Cup and Handle pattern features a lower failure rate than other chart

patterns, which means it is a good indicator of what is to come. The patterns

were short handles that had a higher success rate than patterns with longer

handles. A slightly higher upper left lip versus a right lip with a more

bottomless cupped pattern also has a higher success rate.

Pattern Type: Continuity

Sign: Bullish

Breakout confirmation: When there is above-average volume, and the stock

closes above the upper trendline drawn from the top of the handle.

Measuring: The price target is achieved by measuring the distance from the

right lip to the bottom of the cup and then connecting it to the price level of the

right lip.

Volume: Increased volume is normal after cup sizing, with volume as high as

the left lip, decreasing volume at the bottom of the cup, and increasing the

volume towards the right lip which continues on breakouts.

The cup and handle pattern was popularized by William O'Neill, which has now

expanded to all kinds of trading scenarios. Traders refer to the cup and handle

as a bullish continuation pattern that is a highly accurate predictor of sizable

breakouts. To learn more about stock chart patterns and to fully take advantage

All rights reserved @ Growth Shera

of technical analysis, be sure to check out our complete library of predictable

chart patterns. These include comprehensive descriptions and images so that

you can identify important chart pattern scenarios and become a better trader.

All rights reserved @ Growth Shera

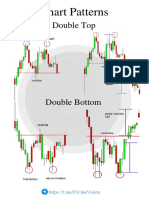

Double Bottom Pattern

When using technical analysis, the double bottom pattern indicates a long-term

or intermediate reversal in the overall trend. It is defined by a drop in price in a

stock or index that is preceded by a rebound, then another decline at roughly the

same level as the first drop, followed by a more significant rebound. The double

bottom pattern resembles the look of a W, where the low is considered a support

level.

The prerequisite for a double bottom pattern is a significant downward trend

that continues over an extended period of time - several months. The first

bottom or trough of the trend should be the lowest point of the current

downward trend. The first trough is followed by a 10 to 20% advance and,

occasionally, a drawn peak.

The second trough follows the advance and finds support from the first lower.

This formation can take weeks and months to form. Two cisterns can be

considered double bottom if the difference between them is within the range of

3%.

Volume is the most important factor for the double bottom pattern. Traders

should ensure that buying pressure and volume builds up during the second

trough advance. Traders should take note if volume is not down in the second

leg of this pattern as the stock or index is at risk of falling below the current

resistance level. When volume increases in the second leg of the pattern, buyers

finally rush in and push the stock up through the confirmation point.

Double bottom reversal is completed when the trend breaks the resistance from

All rights reserved @ Growth Shera

the highest point between the two bottoms. Now resistance becomes support.

This support is sometimes tested with improvements first.

To set a target, a trader should consider the distance from the resistance

breakout to the lower points below and add those values to the resistance

breakout. With double bottom patterns, it is a good idea to trade patterns that

have at least four weeks between lows.

Why is the double bottom pattern important?

When correctly identified, the double bottom pattern indicates that an investor

has an opportunity to enter the market with a bullish trade as there is now

significant support on the downside, preventing the stock from falling below the

resistance level. And now one is setting up upwards. Step. As soon as the

double bottom pattern is identified, a trader can initiate a well-timed bullish

investment to make some quick profits. However, if they are wrong about the

movement and the stock breaks the lower support level, they can quickly exit

for a small loss.

Pattern Type: Reversal

Sign: Bullish

Breakout Confirmation: Confirmation for this pattern is above the horizontally

drawn upper trendline between the lows and the middle highs with above

average volume.

Measuring: Take the distance between two lows and one high and add it to the

breakout level.

Volume: Volume decreases during formation and increases on breakout.

The double bottom pattern is highly effective when identified correctly.

However, traders should keep a close eye on the volume to ensure that it is

rising throughout the pattern. Therefore, it is important to ensure that all

elements of the pattern are correctly identified before jumping in and executing

a trade. To learn more about stock chart patterns and to fully take advantage of

technical analysis, be sure to check out our complete library of predictable chart

patterns. These include comprehensive descriptions and images so that you can

identify important chart pattern scenarios and become a better trader.

All rights reserved @ Growth Shera

Double Top Pattern

The Double Top Pattern is a twin-peak chart pattern that represents a bearish

reversal in which the price reaches the same level twice with a small drop

between the two peaks. A double top pattern usually signals an intermediate or

long-term change in trend. When identifying patterns, traders need to

understand that peaks and troughs do not need to form an ideal M shape for the

pattern to emerge.

Before the pattern emerges, there is a significant upward trend for several

months. The first top is the highest price the trend has reached during the

current trend. After the first top, there is usually a 10 to 20% price bearish. This

drop in asset value is generally negligible; However, sometimes the decline can

be prolonged due to a decrease in demand.

The movement towards the second peak is usually a small amount. Once the

value reaches the first peak level, it opposes an upward move. It may take 1-3

months for the price to reach this level. A difference of 3% between the two

heads is generally acceptable. After the second peak, there should be an increase

in volume with a quick decline.

At this stage, the double top still needs to be confirmed. For this purpose, the

trend should break through the lowest point between the two peaks with an

increase in acceleration and volume. To set a price target, traders must subtract

the distance from the breakpoint to the top of the break. If the gap between the

peaks is too small, the pattern may not indicate a long-term change in asset

All rights reserved @ Growth Shera

price.

Understanding the Double Top Pattern

Some argue that the hardest part of trading chart patterns is recognizing them

when they occur. Double tops make it easy, but there are rules to help with the

process. Otherwise, this indicator may misinterpret fake outs or reversal trends.

Although there are variations, the classic double top pattern marks a bullish

bearish trend change. Multiple double top patterns are likely to form throughout

the chart, but unless an important level of support is broken, the reversal pattern

cannot be confirmed and should not be acted upon.

The most important aspect of the double top pattern is to avoid pulling the

trigger too early on a trade. Any investor should wait for the support level to

break before jumping in. It is not uncommon to apply a price or time filter to

differentiate between confirmed and false support breaks.

Pattern Type: Reversal

Hint: Bearish

Breakout Confirmation: This pattern is confirmed when there is a close below

the horizontally drawn lower trendline in the middle of the middle of the high

with above-average volume.

Measurement: Take the distance between two of the following highs, and then

subtract that from the breakout level.

Volume: Volume declines during formation, expands on breakout.

A double top reversal pattern is usually followed by a failed move to the upside.

This indicates that the market is unable to break the upper resistance level.

When the pattern occurs, traders should avoid taking long positions; Instead the

focus should be on finding a bearish entry point. To learn more about stock

chart patterns and to fully take advantage of technical analysis, be sure to check

out our complete library of predictable chart patterns. These include

comprehensive descriptions and images so that you can identify important chart

pattern scenarios and become a better trader.

All rights reserved @ Growth Shera

Falling Wedge Pattern

A falling wedge pattern is a bullish pattern that starts widening from the top and

continues to shrink as the price declines. Like rising wedges, trading falling

wedges is one of the more challenging chart patterns to trade. A falling wedge

pattern indicates continuation or reversal depending on the prevailing trend.

However, in most cases, the pattern indicates a reversal. In terms of its

appearance, the pattern is widest at the top and narrows as it moves downwards

with tighter price action.

In an ideal scenario, an extended downward trend with a fixed bottom should be

preceded by a wedge. This decline should be maintained for at least 3 months. It

usually takes a quarter to half a year for the wedge pattern to form. The upper

trend line must have at least two high points and the second point must be lower

than the previous and so on. Similarly, there must be at least two lows, each

lower than the previous one.

Resistance and support should converge as the pattern continues to develop. A

change in lows indicates a decline in selling pressure, and it forms a support line

with a smaller slope than the resistance line. The pattern is confirmed when

resistance is strongly broken. In some cases, traders should wait for the previous

high to break through.

Another important factor in pattern confirmation is volume. If there is no

expansion in volume, the breakout will not be convincing. A falling wedge is

not an easy pattern to trade as it is difficult to identify.

When a stock or index price move falls over time, it can form a wedge pattern

All rights reserved @ Growth Shera

as the chart begins to converge on a downward path. Investors can look at the

beginning of a descending wedge pattern and measure the peak-to-trough

distance between support and resistance to see the pattern. As the price

continues to decline and loses momentum, buyers begin to step in and slow

down the rate of decline. Once the trend lines converge, this is where the price

breaks through the trendline and moves upward.

A falling wedge indicates a bullish reversal pattern in the price. It has three

general characteristics that traders should look for: First, it has convergent

trendlines. Thereafter, a pattern has declining volume as the trendline

progresses. Finally, it will be preceded by a breakout through the upper

trendline. Should all these things come together, you have a falling wedge

pattern, and a breakout to the upside should be anticipated.

The descending wedge pattern, as well as the rising wedge pattern, converges

into smaller price channels. This means that the distance between where a trader

will enter a trade and the price where they will open a stop loss order is

relatively tight. Here it can be relatively easy to exit the trade for minimal loss,

but if the stock moves to the trader's advantage, it can result in excellent returns.

Pattern Type: Reversal and Continuation Patterns

Sign: Bullish

Breakout Confirmation: The confirmation for this pattern is above the upper

trend line drawn at a higher level with volume above the average.

Measurement: The project target for the falling wedge pattern is the highest

high at the beginning of the price formation.

Volume: Volume decreases during formation and increases on breakout.

A falling wedge pattern can be an excellent tool for identifying market

reversals. Here traders can use technical analysis to combine lower lows and

lower highs to form a lower wedge pattern. In addition, the trader must meet

certain conditions before they can act. These include understanding the volume

indicator to see if the volume has increased when it goes up. Once the

requirements are met, and resistance is a close above the trendline, it signals

traders looking for a bullish entry point into the market. To learn more about

stock chart patterns and to fully take advantage of technical analysis, be sure to

check out our complete library of predictable chart patterns. These include

All rights reserved @ Growth Shera

comprehensive descriptions and images so that you can identify important chart

pattern scenarios and become a better trader.

All rights reserved @ Growth Shera

Flag Pattern

Flag patterns are similar to pennant patterns but are often smaller. This technical

analysis tool provides traders with the advantage of low risk investments

associated with quick profits. Flags appear throughout the price highway, you

find them in fast moving environments where the stock or index moves several

points over a few days, then the price stops at the flag and then continues to

move in the same direction. . Of course, eventually, the price reverses directions,

so it's important to hold the flag at the right point.

Like the pennant, the flag pattern is based on the market price consolidation of a

particular stock. The consolidation will have a narrow range and will only be

followed by a quick upward move. Like the pennant, this pattern has a flag

"pole", which may represent a vertical price movement. These fluctuations can

be bearish or bullish, and can give an investor a huge advantage if you know

how to spot these patterns.

For bullish patterns, the start will start with a sudden spike that can take many

investors by surprise and cause a volume frenzy as many are trying to buy

before and during an investment wave. After a while, the price will peak and

reverse slightly, giving the appearance of an inclined rectangle. A breakout

occurs when the resistance trend line is broken when prices begin to rise again

and then another breakout occurs as an explosive price shift as the accelerated

trend continues upward.

The bearish pattern is simply the reverse of the flag pattern, indicating a panic

price decline with an almost vertical initial decline. This time, when the trend

line breaks, it will induce panic selling to bring another downward-pointing leg

into the pattern. In terms of how sharp the decline is on the flag, it is also an

indicator of how bearish the pattern will be, and a wise investor will act

accordingly.

All rights reserved @ Growth Shera

Understanding the Flag Pattern

Flags are short-term technical analysis that typically last less than 21 days. In

many cases, the formation may take only 3 to 4 days, appearing as a horizontal

rectangle, then out of nowhere to quickly move up. Reliable flags appear during

fast, quick price action. Patterns can be up or down, but prices tend to rise or fall

very quickly, moving at many points over a short period of time. Volume also

usually decreases during formation but is not always the case.

If you think you have seen a flag to trade, the most important factor is the

increasingly bullish price trend. If the price action is slowly moving up and

down in the form of a flag, then it is better for you to look elsewhere.

Pattern Type: Continuity

Sign: Bullish

Confirmation of Breakout: This pattern is confirmed when the stock or index

closes above a higher trendline with above-average volume.

Measurement: Take the distance between the last steep move in the flag, and

then add that amount to the breakout.

Volume: Volume declines during formation, expands on breakout.

Flag patterns and technical analysis are used to identify a possible continuation

of a previous trend when the price moves against the same trend. When the

trend resumes, the price move should accelerate, making the trade more

profitable, taking into account the flag pattern, and this is a breakout. To learn

more about stock chart patterns and to fully take advantage of technical

analysis, be sure to check out our complete library of predictable chart patterns.

These include comprehensive descriptions and images so that you can identify

important chart pattern scenarios and become a better trader.

All rights reserved @ Growth Shera

Pennant Pattern

Traders pay close attention to pennants and flags while trading. The two are

very similar in terms of structure, and it may take some practice before an

investor can easily tell the difference between the two. These short-term patterns

that last only two to three weeks in length may be indicated by an initial

significant volume move followed by a tapered off period. Then there is a break

out and finally another strong volume move.

Investors can use this pattern to help gauge how high a stock will be by taking

the price below the "flag pole" in the initial pattern, then waiting until the price

consolidates. Once consolidated, the stock or index will break out at a slightly

higher level, and if you take the bottom price and add it to the break out price, it

will give an excellent indication of future price action for the pattern.

For example, if you have a stock that was priced at $10 based on a "flag pole"

and went aggressive to $20, then consolidated to $18.50, where it stood briefly

before breaking out at $19.00. sits for. Investors can find an estimated top for

this pattern by taking an initial $10 and adding it to $19.00, which gives a target

of $29.00 to hit for the price on this stock for this particular pattern. Typically,

investors will use this pattern in conjunction with other indicators to increase

their chances at an accurate forecast.

Most traders do not use pennants on their own, but combine them with other

technical analysis indicators so that they are not faked or duped into making bad

trades.

Pennants are short-term technical analysis that typically last less than 21 days.

All rights reserved @ Growth Shera

In many cases, formation may take only 3 to 4 days. Anything that takes longer

than 21 days is classified as a symmetrical triangle or a falling wedge.

To identify the Ensign pattern, look for a fast, fast acting price action leading up

to the pattern. This feature is important because it helps to make the pendant

easier. Fixed price direction can be up or down but in the short term many

points need to be moved.

Pattern Type: Continuity

Indication: bearish or bearish

Breakout Confirmation: This pattern is confirmed when there is a close above

the upper trendline drawn on a high for a bullish pennant below the lower

trendline for a bearish pennant with above-average volume.

Measurement: Take the distance between the last steep move in the pennant, and

then add it to the breakout level.

Volume: Volume declines during formation, expands on breakout.

The top performing pennants are those with breakouts near annual lows. Many

traders use pennants in conjunction with other chart patterns or technical

indicators that act as additional confirmations. For example, the relative strength

index (RSI) and balance volume pair well with pennants to establish oversold

levels during the consolidation phase, which can be used to predict run-ups or

breakouts in a stock or index. can be done for. To learn more about stock chart

patterns and to fully take advantage of technical analysis, be sure to check out

our complete library of predictable chart patterns. These include comprehensive

descriptions and images so that you can identify important chart pattern

scenarios and become a better trader.

All rights reserved @ Growth Shera

Head and Shoulders Top Pattern

A head and shoulders top pattern is one that has three peaks and looks like a

head and shoulders because the two outer peaks are similar in height, yet

smaller than the middle peak. This pattern is typically associated with a bullish

bearish trend and thus is considered very reliable in its ability to predict stock

action. This pattern is one of several top-notch patterns used to predict the end

of a bull market and the beginning of a bearish one.

This head and shoulders top pattern occurs when a stock climbs to its peak and

then falls back to the point before the uptrend. Then the stock will move upward

once again, but this time it will cross the previous spike and is called the "nose",

and then it will once again move upwards downwards. Once again, there will be

an upward tick that reaches the same level on the first spike and then drops

downward. This last downward tick is usually significant as it is at this point

where the bulls turn to the bears.

If you become very good at reading this pattern, you can immediately see the

gains an investor can make. Selling your stock at the point where the "nose" has

reached its peak would be an excellent idea, especially if you bought your stock

at one of those points based on the pattern. Buying below, then waiting for the

"heads" to appear, will give you the opportunity to profit from this market trend

before it turns bear. This will give you a significant advantage over other

investors who may not be able to predict the downturn in the times to come.

The head and shoulders top pattern is formed when the price of a stock or index

peaks and then suddenly reverts based on the previous move. It will then rise

All rights reserved @ Growth Shera

above the former summit to form the head, and then return to base level once

again. Then, in a final move, the stock or index will rise again, but only to the

level of the first peak of the formation, which is where it will last travel back up

to the baseline.

Is there a support break here which indicates a renewed desire to sell the stock

or index at lower prices? This decrease in price indicates an increase in supply

with an increase in quantity. This fierce combination can trigger a powerful

downward move that eliminates any chances of the stock returning to the

previous support level.

Pattern Type: Reversal

Hint: Bearish

Breakout Confirmation: This pattern is confirmed when there is a close below a

horizontally drawn lower trendline at an intermediate low with above-average

volume.

Measuring: Take the distance from the top of the head to the bottom half, then

subtract that amount from the neckline at the breakout.

Volume: Volume increases during the initial shoulder upward formation, then

decreases as price exits the left shoulder. Volume will then balance out during

the formation of the head, only to rise again as price breaks below the bottom

support level.

The head and shoulders top pattern is one of the most recognizable technical

charts. The left and right shoulders should be roughly the same height and

width, but they may be slightly staggered. It is important to understand that the

pattern is followed by an uptrend and usually a significant reversal in a stock or

index. To confirm that pattern it is necessary to identify the neckline and volume

at the break. To learn more about stock chart patterns and to fully take

advantage of technical analysis, be sure to check out our complete library of

predictable chart patterns. These include comprehensive descriptions and

images so that you can identify important chart pattern scenarios and become a

better trader.

All rights reserved @ Growth Shera

Inverted Head And Shoulders Pattern-

The inverted head and shoulders pattern indicates a movement towards a bullish

trend and is an excellent indicator for traders who know how to spot the pattern,

allowing them to capitalize on a bullish trade. . Similar to "triple bottom", the

only exception is that the "head" is lower than the other two points, making this

inverted head a shoulder.

The pattern can be recognized when the price of a stock falls into a trough and

then rises, then falls below the most recent trough, and then rises again.

Eventually, the price falls back but not as deep as last time. Once the last trough

is formed, the price action moves upwards towards the resistance level and

breaks out.

This pattern is just the opposite, with the traditional reversal head and shoulders

pattern indicating a move to the bearish zone. However, this pattern may also

tell you some things you want to know that it doesn't have an equivalent. For

example, this pattern can indicate how strong a bullish run will be if you read it

correctly.

If you look at the chart stretch coming before the formation of the head and

shoulders pattern, a long stretch could be a sign of a strong bull movement,

All rights reserved @ Growth Shera

while a short one could mean that you have to move before the bulls return.

Must get in and out quickly. , Furthermore, if the lead in the head and shoulders

pattern is abrupt, it could also indicate a more definite bullish trend.

A head and shoulders pattern with a downward-facing neckline can also

indicate a better performance than one without this movement. In addition, if

the "left shoulder" of the pattern is high, it may also mean that the pattern will

perform better than those with a high "right shoulder".

When executing the inverse head and shoulders pattern, stop loss orders should

be placed slightly below the neckline in anticipation of a breakout. Those

looking to trade more aggressively can place their stop loss orders below the

right shoulders of the inverse head and shoulders pattern.

Traders should be wary of this pattern as, after the initial decline, when the first

shoulder is formed, bears will enter the market and try to push the stock price

down even further. If they succeed, they may continue to hold their control,

forcing an extended downtrend.

The first and third kundas are considered as inverted shoulders, while the

second is considered as inverted heads. Traders who identify the pattern enter a

bull position when the price moves above the upper resistance level, which is

followed by the right inverted shoulder. Once the Stocker Index moves above

this level, it indicates a bullish move. An increase in volume also confirms the

breakout.

How long the bull run will last can be determined by measuring the distance

between the bottom of the head and the neckline, the same distance as when the

stock or index moves up on a breakout.

Pattern Type: Reversal

Sign: Bullish

Breakout Confirmation: This pattern is confirmed above the upper trendline

with above average volume.

Measurement: Take the distance between the first high and low of the head and

then add it to the upper resistance level on the breakout.

Volume: Volume has a tendency to increase, causing a shoulder downward

movement first, then falling as prices rise. Volume is balanced out during the

All rights reserved @ Growth Shera

formation of the head and rises when price breaks above the resistance level on

the other shoulder.

The inverted head and shoulders is one of the most familiar charts in technical

analysis. It is a favorite among many traders because of its strong and firm

signals. However, one should be cautious and wait for a confirmation, a

breakout above the neckline, before executing a bullish trade. It is also always

recommended to get additional confirmation from other technical techniques.

To learn more about stock chart patterns and to fully take advantage of technical

analysis, be sure to check out our complete library of predictable chart patterns.

These include comprehensive descriptions and images so that you can identify

important chart pattern scenarios and become a better trader.

All rights reserved @ Growth Shera

Rounding Bottom Pattern

Rounding bottom patterns sometimes referred to as "saucer bottom" patterns are

known to be able to predict a longer term uptrend. Similar to the cup and handle

pattern, only without the hassle of a temporary downward trend that creates a

"handle". The pattern is a long-term reversal pattern that is best applied to a

weekly chart representing a consolidation. It changes from bearish to bullish.

This circular bottom pattern can be seen at the end of a disappointingly long

downward trend. The time frame for this pattern can be weeks, months, or even

years in length and is considered one of the more rare patterns to form in the

market. Most of the time, this pattern indicates that a prolonged downward

trend, often caused by oversupply of stocks, is coming to an end as investors

begin buying at lower price points, reversing the downward movement. . Once

this is triggered, it generally increases demand and drives up the price of the

stock.

This allows the stock to "break out" and initiate a long-lasting and positive

reversal that investors can take advantage of if they choose to be one of those

people who buy short and hold onto the stock for some time. Willing to sit till it

pops up again. This is because the length of time for recovery can vary, and it

can take a long time to find its peak. Investors should be prepared for this long

period and should be patient till the price rises.

The rounded bottom pattern looks similar to the cup and handle pattern, but

without the brief downward trends represented by the handle. An initial drop of

All rights reserved @ Growth Shera

a round bottom indicates that there is too much supply coming into the market,

which pushes the stock or index down. Here traders begin to realize that the

stock is trading at a discount, and buyers start entering the market at the

discounted price. This increase in demand then pushes the stock higher as

demand continues to increase.

As the rounding bottom completes its formation, the stock breaks out of a full

bullish pattern. The whole process is indicative of a shift from bearish to bullish

in the sediment by investors, which increases the momentum upward. Although

the pattern has a high success rate, it is quite rare compared to other technical

analysis charts.

Pattern Type: Continuity

Sign: Bullish

Breakout confirmation: When there is above-average volume, and the stock

closes above the lip of the rounding bottom.

Measuring: The price target is achieved by measuring the distance between the

highest high and the lowest low and then adding it to the breakout level.

Volume: The rounded bottom shape has an increase in volume, balanced during

the middle, with volume increasing to the right, which continues on the

breakout.

The rounded bottom pattern, which is given by the visual resemblance to what

looks like a bowl. It represents a gradual price shift by investors from bearish to

bullish. The pattern is best confirmed by volume, which confirms a rounding

bottom by high volume during a decline, then flat volume during the mid range,

and again high volume when the price rises. Traders were able to successfully

identify the rounding bottom should they expect an upward price action equal to

the size of the pattern. To learn more about stock chart patterns and to fully take

advantage of technical analysis, be sure to check out our complete library of

predictable chart patterns. These include comprehensive descriptions and

images so that you can identify important chart pattern scenarios and become a

better trader.

All rights reserved @ Growth Shera

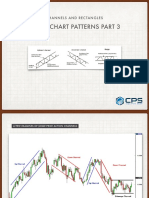

Price Channel Pattern ( ाइस चैनल चाट)

Used by traders for technical analysis-based trading, a price channel is a

continuation pattern in which price bounces between parallel resistance and

support lines. Resistance and support lines can move horizontally, downward

(bearish) or upward (bullish). One of the best things about the price channel

pattern is that it doesn't matter whether you are looking at the daily chart or if

you are a long term trader, this chart pattern works with any trading time frame.

The first line drawn in a price channel chart is called the main trend line. To

illustrate this line, an analyst should identify that there should be two lows in the

case of a bullish price channel, and two highs in the case of a bearish price

channel. The second line drawn in the chart pattern is called the channel line.

The channel line requires a higher or lower, the amount of which depends on the

analyst - some use two points while others use only one as price movement

moves through the trading channel.

In the case of a bearish price channel, the trend remains bearish if the price

moves down while staying within the descending channel lines. Signs of a

change in direction include price not meeting support levels. If the price follows

the first signal with a move above the resistance, it is another sign of a change.

If the price breaks the support, traders can expect a sharp drop in the price.

The bullish channel is the opposite of the bearish channel. Here the trendline

moves through the ascending channels while the price action remains within the

channel resistance levels. If the price does not reach the resistance and breaks

below the support then the trend may change. Similarly, a break above

All rights reserved @ Growth Shera

resistance is considered bullish. Price channel analysis is a flexible approach to

trading because the placement of the two trend lines is up to the trader - they

may prefer the exact price and line connection or tolerate margin.

Horizontal channels also exist but are more challenging for traders who are not

actively looking for them. A horizontal channel tends to move sideways in a

rectangular formation. Buying and seller pressure strikes an equilibrium that

forces price movement sideways through parallel lines. A new high in the price

above the upper resistance level represents a buying opportunity. A new low in

the price below the lower support level represents a technical sell signal.

A stock or security travels through a price channel when the underlying price is

buffered by the forces of supply and demand, which can be downward, upward

or sideways. The culmination of all these factors pushes the price movement

into a tunnel-like trending movement. When there is excess supply, the price

channel moves downward, when there is excess demand, the price channel

moves upward, and if there is an equal balance of supply and demand, the price

channel moves sideways.Traders typically look for stocks that trade within a

price channel. When the stock is trading at the upper end of the price channel, it

indicates that the stock will likely trade back to the center, and when the stock is

trading at the lower end of the price channel, it suggests that the stock will be

trending. The probability is higher.

Price channels are also useful when identifying stocks that are about to break

out, which is when a stock breaks an upper or lower trendline. If the price action

breaks above the upper trend line, it is likely that the stock will have an upside

breakout. If the stock breaks the lower trendline, traders expect a downside

move. A trader can see a price channel pattern if they can see at least two higher

highs and higher lows. The trader then draws a line connecting the high and low

to form a price channel pattern.

No matter which price channel you are dealing with, once you notice two highs

that fail to reach the top of the price channel pattern, the price will soon break

down. Similarly, once you see two lows that fail to reach the bottom of the price

channel pattern, the price is likely to break out of the upside. The larger the gap

between the price breaks in the resistance line, the more likely the trade is to be

established.

All rights reserved @ Growth Shera

Once the price breaks through one of the horizontal channels, the breakout is

confirmed. One of the worst mistakes a trader can make is to enter a trade

before price has entered one of the channel lines. Entering a trade too early can

cause the price to return within the channel, so it is always necessary to wait for

the breakout to be confirmed and for a break above an upper resistance level or

a break below a lower support level.

Pattern Type: Continuation or Reversal

Indication: bullish or bearish

Breakout Confirmation: This pattern is confirmed when the stock or index

closes higher above the upper trendline or breaks below the lower trendline with

above-average volume.

Measurement: middle of the last steep move Take the distance to the last push

before the breakout, and then add that amount to the breakout.

Volume: Volume declines and rises during formation, but will expand upon

breakout.

The price channel tells traders where a stock or index is likely to bounce around

within a specific trading range. Once it breaks the upper or lower trendline, a

breakout of the underlying is expected. On the upside, intense buying pressure

will prompt the stock to gain higher highs, while a breach on the downside will

show weakness, pushing the stock lower. Understanding the price channel

allows analysts to determine which major forces are likely to win, increase

selling pressure, or buy pressure. To learn more about stock chart patterns and

to fully take advantage of technical analysis, be sure to check out our complete

library of predictable chart patterns. These include comprehensive descriptions

and images so that you can identify important chart pattern scenarios and

become a better trader.

All rights reserved @ Growth Shera

©2023 Shraddha Thorat, Founder of Growth Shera,

All Rights Reserved No part of this publication may be reproduced or

stored in a retrieval system, or transmitted in any form or by any means,

electronic, mechanical, photocopying, recording or otherwise, without the

prior permission of the publishers.

The reader of this publication assumes responsibility for the use of the

information in this book. The author and the publisher assume no

responsibility or liability whatsoever , on the behalf of the reader of this

publication. While efforts have been made to verify information and use

accurate information, neither the author nor the publisher make any

warranties with respect to errors, inaccuracies, or omissions.

Note :- Do not rely on anyone's advice or tips to trade in the stock

market, you can work with the help of your financial advisor.

Follow Us on Instagram:-

https://www.instagram.com/growthshera.in/

Join Telegram Channel-

https://t.me/+anMtKSzaYfo0MzQ1

All rights reserved @ Growth Shera

You might also like

- Chart Petterns Ebook EnglishDocument48 pagesChart Petterns Ebook Englishharshmevada81133% (3)

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformFrom EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformNo ratings yet

- Learn 5 Strategies for Trading the Descending Triangle PatternDocument11 pagesLearn 5 Strategies for Trading the Descending Triangle PatternYahya IbraheemNo ratings yet

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.From EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.No ratings yet

- Micro Patterns 2Document18 pagesMicro Patterns 2Aris ResurreccionNo ratings yet

- Price Action CourseDocument3 pagesPrice Action CourseNjine PatrickNo ratings yet

- Chart Petterns Book EnglishDocument37 pagesChart Petterns Book EnglishHori Da100% (2)

- Mean Reversion Day Trading Strategies: Profitable Trading StrategiesFrom EverandMean Reversion Day Trading Strategies: Profitable Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Module 3, Day 3Document31 pagesModule 3, Day 3pravesh100% (1)

- High Probability Swing Trading Strategies: Day Trading Strategies, #4From EverandHigh Probability Swing Trading Strategies: Day Trading Strategies, #4Rating: 4.5 out of 5 stars4.5/5 (4)

- Chart PatternsDocument25 pagesChart PatternsAds Inquiries100% (1)

- Day Trading Strategies For Beginners: Day Trading Strategies, #2From EverandDay Trading Strategies For Beginners: Day Trading Strategies, #2No ratings yet

- Top 10 Chart Patterns for Technical Analysis TradersDocument8 pagesTop 10 Chart Patterns for Technical Analysis TradersP.sai.prathyusha100% (2)

- Pervert Trading: Advanced Candlestick AnalysisFrom EverandPervert Trading: Advanced Candlestick AnalysisRating: 2 out of 5 stars2/5 (1)

- 5.4 - Technical Analysis - Chart Patterns - Trading Crypto CourseDocument22 pages5.4 - Technical Analysis - Chart Patterns - Trading Crypto Course2f9p4bykt8No ratings yet

- Secrets of Technical Analysis in Forex TradingFrom EverandSecrets of Technical Analysis in Forex TradingRating: 3.5 out of 5 stars3.5/5 (2)

- Triangle StrategyDocument30 pagesTriangle Strategysuranta100% (1)

- Momentum Trading Strategies: Day Trading Made Easy, #4From EverandMomentum Trading Strategies: Day Trading Made Easy, #4Rating: 4 out of 5 stars4/5 (2)

- Chart Patterns: Cheat SheetDocument3 pagesChart Patterns: Cheat SheetGokulNo ratings yet

- Patterns PDFDocument18 pagesPatterns PDFVICTORINE AMOSNo ratings yet

- 2022-2023 Price Action Trading Guide for Beginners in 45 MinutesFrom Everand2022-2023 Price Action Trading Guide for Beginners in 45 MinutesRating: 4.5 out of 5 stars4.5/5 (4)

- Chart Pattern Guide for Reddit TradersDocument17 pagesChart Pattern Guide for Reddit TraderscorranNo ratings yet

- Chart PatternsDocument10 pagesChart Patternsvvpvarun100% (2)

- Candlestick PatternDocument6 pagesCandlestick Patterntraining division100% (1)

- Chart PatternsDocument6 pagesChart Patternshikmatraximov731No ratings yet

- Candlesticks Lesson 2: Single Candlestick PatternsDocument10 pagesCandlesticks Lesson 2: Single Candlestick Patternssaied jaberNo ratings yet

- GoodCrypto Patterns PresentationDocument13 pagesGoodCrypto Patterns Presentationcoolboyulug100% (1)

- TA Chapter 3Document56 pagesTA Chapter 3Phúc Thiên NguyễnNo ratings yet

- Classic Chart Patterns: A Quick Reference Guide For TradersDocument2 pagesClassic Chart Patterns: A Quick Reference Guide For TradersAbhay Pratap100% (1)

- Candle Pattern ForexDocument48 pagesCandle Pattern ForexAli Ghulam100% (1)

- Intraday Strategies (English Version) PDFDocument35 pagesIntraday Strategies (English Version) PDFmarcocahuas0% (1)

- 6) Chart-Patterns-Cheat-SheetDocument14 pages6) Chart-Patterns-Cheat-SheetKumarVijayNo ratings yet

- How To Trade Chart Patterns With Target and SL@Document39 pagesHow To Trade Chart Patterns With Target and SL@millat hossain100% (1)

- Chart Analysis Pattern - Head and ShoulderDocument24 pagesChart Analysis Pattern - Head and ShoulderHendra Setiawan100% (2)

- Presented by Zonaira SarfrazDocument19 pagesPresented by Zonaira SarfrazZunaira SarfrazNo ratings yet

- Treding HebitsDocument62 pagesTreding HebitsRitwik RoyNo ratings yet

- 19 Chart-Patterns PDFDocument25 pages19 Chart-Patterns PDFMahid HasanNo ratings yet

- Price Action Trading GuideDocument27 pagesPrice Action Trading GuideMohammad Ali Arbab100% (1)

- Forex Chart Patterns Part 3: Channels and RectanglesDocument10 pagesForex Chart Patterns Part 3: Channels and RectanglesJeremy NealNo ratings yet

- Cup and Handle Chart Pattern GuideDocument9 pagesCup and Handle Chart Pattern GuideVinay KumarNo ratings yet

- The Price Action Cheat SheetDocument19 pagesThe Price Action Cheat SheetAmirNo ratings yet

- New Rich Text FormatDocument25 pagesNew Rich Text Formatpradeephd100% (1)

- Continuation Chart PatternDocument25 pagesContinuation Chart PatternrgautomobilesstockNo ratings yet

- Market Framework GuideDocument33 pagesMarket Framework GuideAlex Adallom100% (2)

- 07 KM Reversal PatternsDocument7 pages07 KM Reversal PatternsKumarenNo ratings yet

- Free Price Action Trading PDF GuideDocument20 pagesFree Price Action Trading PDF GuideradhavenkateshwaranNo ratings yet

- Double Top: Chart PatternsDocument11 pagesDouble Top: Chart PatternsKrunal Jain100% (1)

- The 40-character for the document is:Accumulation, Alpha, Ascending Triangle & More Technical Terms DefinedDocument12 pagesThe 40-character for the document is:Accumulation, Alpha, Ascending Triangle & More Technical Terms DefinedUdit DivyanshuNo ratings yet

- The Monster Guide to Candlestick PatternsDocument29 pagesThe Monster Guide to Candlestick PatternsVatsal ParikhNo ratings yet

- Technical AnalysisDocument35 pagesTechnical AnalysisAkmal Hidayat100% (1)

- Price PatternsDocument40 pagesPrice PatternsHimadieNo ratings yet

- Price Action Trading PDFDocument26 pagesPrice Action Trading PDFAnil Kumar SinghNo ratings yet

- CRT PatternDocument10 pagesCRT PatternMD ASRAFUZZAMAN MAHTAF100% (1)

- Investment Analysis and Portfolio Management: G.Srianjaneyulu Rollno:18L31E0014 Mba-ADocument10 pagesInvestment Analysis and Portfolio Management: G.Srianjaneyulu Rollno:18L31E0014 Mba-Analla maheshNo ratings yet

- Price Action Chart PattermsDocument3 pagesPrice Action Chart PattermsAshieh Tanwar100% (1)

- Partnership AgreementDocument4 pagesPartnership AgreementMann MannNo ratings yet

- VedicReport22 02 202411 34 47Document55 pagesVedicReport22 02 202411 34 47Mann MannNo ratings yet

- Investment - Kamlesh KhichdiwalaDocument1 pageInvestment - Kamlesh KhichdiwalaMann MannNo ratings yet

- Cover LatterDocument1 pageCover LatterMann MannNo ratings yet

- Barangay Annual Gender and Development (Gad) Plan and Budget FY 2021Document8 pagesBarangay Annual Gender and Development (Gad) Plan and Budget FY 2021HELEN CASIANONo ratings yet

- Operations Management: Processes and Supply Chains Supplement A & Chapter 6 Selected Problems SolutionDocument7 pagesOperations Management: Processes and Supply Chains Supplement A & Chapter 6 Selected Problems SolutionQuynhLeMaiNo ratings yet

- Inventory Control Models EOQDocument59 pagesInventory Control Models EOQNguyen NinhNo ratings yet

- Honda Balance SheetDocument2 pagesHonda Balance Sheetmeri4uNo ratings yet

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Forward Rates - March 25 2021Document2 pagesForward Rates - March 25 2021Lisle Daverin BlythNo ratings yet

- (Terms and Conditions of Contract For Position of General Manager) Hanoi 22 January, 2021Document4 pages(Terms and Conditions of Contract For Position of General Manager) Hanoi 22 January, 2021Angel Beluso DumotNo ratings yet

- DS112 Development Perspectives I Course OverviewDocument68 pagesDS112 Development Perspectives I Course OverviewDanford DanfordNo ratings yet

- Analyzing The Role of Public Relations in Building Social Corporate ImageDocument3 pagesAnalyzing The Role of Public Relations in Building Social Corporate ImageOneeba MalikNo ratings yet

- Module 1 Engineering EconomicsDocument34 pagesModule 1 Engineering EconomicsSINGIAN, Alcein D.No ratings yet

- Tracxn Startup Research Global SaaS India Landscape May 2016 1Document125 pagesTracxn Startup Research Global SaaS India Landscape May 2016 1Shikha GuptaNo ratings yet

- Factors Affecting The Income Velocity of Money in The Commonwealth PDFDocument20 pagesFactors Affecting The Income Velocity of Money in The Commonwealth PDFmaher76No ratings yet

- Hallmark ScamDocument3 pagesHallmark ScamMiltu TalukderNo ratings yet

- Pump Quotation DetailsDocument2 pagesPump Quotation Detailsdhavalesh1No ratings yet

- Report of Accountability For Accountable FormsDocument2 pagesReport of Accountability For Accountable FormsDilg-car Baguio75% (4)

- 20211018-Chapter 4 - PPT MarxismDocument25 pages20211018-Chapter 4 - PPT Marxismuzair hyderNo ratings yet

- Suport Curs 13Document11 pagesSuport Curs 13Sorin GabrielNo ratings yet

- The Billabong CaseDocument14 pagesThe Billabong CaseRati Sinha100% (1)

- MoU - 2023 - 24 - LBAS - MADocument5 pagesMoU - 2023 - 24 - LBAS - MAMetilda AcademyNo ratings yet

- Advantages of Hybrid SecuritiesDocument2 pagesAdvantages of Hybrid SecuritiesRaksha MehtaNo ratings yet

- Human Resource Accounting Practices in Indian Companies: Bottorof$ ( - Tlosiop P CommerceDocument305 pagesHuman Resource Accounting Practices in Indian Companies: Bottorof$ ( - Tlosiop P CommerceSanaullah M SultanpurNo ratings yet

- Solid Investment, The HYIPDocument48 pagesSolid Investment, The HYIPshastaconnect0% (1)

- Logistics SsDocument18 pagesLogistics SsCarla Flor LosiñadaNo ratings yet

- Project Management Process OverviewDocument49 pagesProject Management Process OverviewIlyaas OsmanNo ratings yet

- Revenue Regulations on Compromise SettlementDocument6 pagesRevenue Regulations on Compromise SettlementMilane Anne CunananNo ratings yet

- Original Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full ChapterDocument41 pagesOriginal Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full Chapterbetty.neverson777100% (26)

- OpTransactionHistoryUX522 02 2024Document7 pagesOpTransactionHistoryUX522 02 2024Praveen SainiNo ratings yet

- GAAP: Generally Accepted Accounting PrinciplesDocument7 pagesGAAP: Generally Accepted Accounting PrinciplesTAI LONGNo ratings yet

- Thanos Industries Case StudyDocument48 pagesThanos Industries Case StudyWJ TanoNo ratings yet

- All Project ReportDocument8 pagesAll Project Reportsrin100% (1)

- SUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)From EverandSUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)Rating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsFrom EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsNo ratings yet

- Summary of Atomic Habits by James ClearFrom EverandSummary of Atomic Habits by James ClearRating: 5 out of 5 stars5/5 (169)

- Summary of Can’t Hurt Me by David Goggins: Can’t Hurt Me Book Analysis by Peter CuomoFrom EverandSummary of Can’t Hurt Me by David Goggins: Can’t Hurt Me Book Analysis by Peter CuomoRating: 5 out of 5 stars5/5 (1)

- Summary and Analysis of The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan HouselFrom EverandSummary and Analysis of The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan HouselRating: 5 out of 5 stars5/5 (11)

- Summary of The Hunger Habit by Judson Brewer: Why We Eat When We're Not Hungry and How to StopFrom EverandSummary of The Hunger Habit by Judson Brewer: Why We Eat When We're Not Hungry and How to StopNo ratings yet

- Summary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionFrom EverandSummary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionNo ratings yet

- Summary of Rich AF by Vivian Tu: The Winning Money Mindset That Will Change Your LifeFrom EverandSummary of Rich AF by Vivian Tu: The Winning Money Mindset That Will Change Your LifeNo ratings yet

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursFrom EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursNo ratings yet

- Summary Guide: Building a StoryBrand: Clarify Your Message So Customers Will Listen: By Donald Miller | The Mindset Warrior Summary Guide: ( Persuasion Marketing, Copywriting, Storytelling, Branding Identity )From EverandSummary Guide: Building a StoryBrand: Clarify Your Message So Customers Will Listen: By Donald Miller | The Mindset Warrior Summary Guide: ( Persuasion Marketing, Copywriting, Storytelling, Branding Identity )No ratings yet

- Summary of Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones by James ClearFrom EverandSummary of Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones by James ClearRating: 4.5 out of 5 stars4.5/5 (13)

- Summary of How to Know a Person By David Brooks: The Art of Seeing Others Deeply and Being Deeply SeenFrom EverandSummary of How to Know a Person By David Brooks: The Art of Seeing Others Deeply and Being Deeply SeenRating: 2.5 out of 5 stars2.5/5 (3)

- GMAT Prep 2024/2025 For Dummies with Online Practice (GMAT Focus Edition)From EverandGMAT Prep 2024/2025 For Dummies with Online Practice (GMAT Focus Edition)No ratings yet

- Summary of Poor Charlie’s Almanack by Charles T. Munger and Peter D. Kaufman: The Essential Wit and Wisdom of Charles T. Munger: The Essential Wit and Wisdom of Charles T. MungerFrom EverandSummary of Poor Charlie’s Almanack by Charles T. Munger and Peter D. Kaufman: The Essential Wit and Wisdom of Charles T. Munger: The Essential Wit and Wisdom of Charles T. MungerNo ratings yet

- PMP Exam Prep: Master the Latest Techniques and Trends with this In-depth Project Management Professional Guide: Study Guide | Real-life PMP Questions and Detailed Explanation | 200+ Questions and AnswersFrom EverandPMP Exam Prep: Master the Latest Techniques and Trends with this In-depth Project Management Professional Guide: Study Guide | Real-life PMP Questions and Detailed Explanation | 200+ Questions and AnswersRating: 5 out of 5 stars5/5 (2)

- Summary of The Coming Wave By Mustafa Suleyman: Technology, Power, and the Twenty-first Century's Greatest DilemmaFrom EverandSummary of The Coming Wave By Mustafa Suleyman: Technology, Power, and the Twenty-first Century's Greatest DilemmaRating: 3.5 out of 5 stars3.5/5 (3)

- GRE - Quantitative Reasoning: QuickStudy Laminated Reference GuideFrom EverandGRE - Quantitative Reasoning: QuickStudy Laminated Reference GuideNo ratings yet

- Summary of Win Every Argument By Mehdi Hasan:The Art of Debating, Persuading, and Public SpeakingFrom EverandSummary of Win Every Argument By Mehdi Hasan:The Art of Debating, Persuading, and Public SpeakingNo ratings yet

- Summary of Hidden Potential By Adam Grant: The Science of Achieving Greater ThingsFrom EverandSummary of Hidden Potential By Adam Grant: The Science of Achieving Greater ThingsNo ratings yet

- Summary of Forever Strong By Dr. Gabrielle Lyon : A New, Science-Based Strategy for Aging WellFrom EverandSummary of Forever Strong By Dr. Gabrielle Lyon : A New, Science-Based Strategy for Aging WellNo ratings yet

- Summary of Eat to Beat Disease by Dr. William LiFrom EverandSummary of Eat to Beat Disease by Dr. William LiRating: 5 out of 5 stars5/5 (52)

- Summary of The Dawn of Everything by David Graeber and David Wengrow: The Dawn of Everything Book Complete Analysis & Study GuideFrom EverandSummary of The Dawn of Everything by David Graeber and David Wengrow: The Dawn of Everything Book Complete Analysis & Study GuideRating: 5 out of 5 stars5/5 (1)

- Workbook & Summary of Becoming Supernatural How Common People Are Doing the Uncommon by Joe Dispenza: WorkbooksFrom EverandWorkbook & Summary of Becoming Supernatural How Common People Are Doing the Uncommon by Joe Dispenza: WorkbooksNo ratings yet

- Digital SAT Reading and Writing Practice Questions: Test Prep SeriesFrom EverandDigital SAT Reading and Writing Practice Questions: Test Prep SeriesRating: 5 out of 5 stars5/5 (2)

- Summary of Some People Need Killing by Patricia Evangelista:A Memoir of Murder in My CountryFrom EverandSummary of Some People Need Killing by Patricia Evangelista:A Memoir of Murder in My CountryNo ratings yet

- The Talented Mr Ripley by Patricia Highsmith (Book Analysis): Detailed Summary, Analysis and Reading GuideFrom EverandThe Talented Mr Ripley by Patricia Highsmith (Book Analysis): Detailed Summary, Analysis and Reading GuideNo ratings yet