Professional Documents

Culture Documents

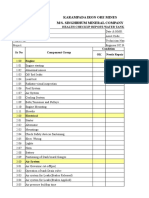

Time Table of Closure of Business

Uploaded by

Mandaragat GeronimoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time Table of Closure of Business

Uploaded by

Mandaragat GeronimoCopyright:

Available Formats

Time Table for Cessation of Business

A. Local Government Unit

1. Brgy. Level

Requirements Needed:

1. Valid ID of the owner of the business

2. Barangay Clearance

3. Letter of Request for Retirement/Closure of Business stating the following:

Date of Application

Contact details of the addressee (Barangay Hall)

Name of the Applicant

Registered business name

Date of registration with the Barangay

Business permit number

Reason/s for closure of business

Proposed date of closure

A declaration that the business has no outstanding obligation or liability with the barangay

4. Authorization Letter for authorized representative

5. Photocopy of 1 Valid ID of the sole proprietor with specimen signature

6. Original and Photocopy of 1 Valid ID of the authorized representative with specimen signature

7. Payment of Fees

Time Frame: 1-2 weeks

2. City Hall

Requirements Needed:

1. Brgy. Clearance

2. Valid ID of the owner of business

3. Barangay Certificate of Closure indicating Date of Closure

4. Latest Business Permit

5. Affidavit of Closure, must state the following:

Name of the owner

Address of the business

Registration number from DTI and/or BIR

Date of Closure

Reason for Closure

That the business has no outstanding liabilities

6. BIR Certificate of Registration

7. Latest Audited Financial Statements and Income Tax Returns for 3 preceding years

8. Latest VAT or Percentage Tax Returns

9. Books of Accounts

10. Payment of Assessment Fees

11. If with branches, proof of business tax payment from the LGU governing the branches

Time Frame: 1-2 months

Fees: P20,000 in total, P10,000 for each company.

B. Bureau of Internal Revenue

Requirements Needed:

1. Letter of Request for Retirement/Closure of Business, must state the following:

Date of application

Contact details of the addressee (RDO where registered)

Name of the applicant

Registered business name

Date of registration with the BIR

Certificate of Registration Number

Reason/s for closure of business

Proposed Date of Closure

A declaration that the business has no outsranding obligation or liability with the BIR

2. BIR Certificate of Registration

3. Books of Accounts

4. Inventory of Unused sales invoices and official receipts

5. Ask for Receipt Poster

6. Latest Audited Financial Statements and Income Tax Return for 3 preceding years

7. Duly Accomplished BIR Form 1905

8. City Hall Certificate of Closure indicating Date of Closure

9. Latest Authority to print issued and Form 0605 (Annual Registration Fee)

10. CMS Verification for open cases

11. Special Power of Attorney for Authorized Representative

12. Photocopy of Valid ID of Proprietor with 3 specimen signatures

13. Photocopy of Valid ID of Authorized Representative with 3 specimen signatures

14. Payment of Assessment Fees

Time Frame: 2-3 years

Fees: P20,000 in total, P10,000 for each company.

C. Department of Trade and Industry

Requirements Needed:

1. Letter of Request for Cancellation of Business Name, must state the following:

Date of Application

Contact details of the addressee (DTI Head Office)

Name of the owner of business

Registered business name

Date of registration of business name

Certificate of Registration Number

Reason/s for the closure of business

Proposed Date of Closure

2. Affidavit of Cancellation of the Registered Business Name

3. Original copy of the business name certificate of registration

4. Affidavit of Loss of the Business Name Certificate or Certificate of Registration, if applicable

5. Authorization Letter for authorized representative

6. Original and Photocopy of 1 Valid ID of the sole proprietor with specimen signature

7. Original and Photocopy of 1 Valid ID of the authorized representative with specimen signature

Time Frame: 1-2 weeks

Fees: P10,000 in total, P5,000 for each company

*Time Frame are estimated based on complete documents provided.

You might also like

- Purposive Communication: UNIT I - Module 2: Global and Intercultural CommunicationDocument17 pagesPurposive Communication: UNIT I - Module 2: Global and Intercultural CommunicationMandaragat Geronimo0% (1)

- Sample Accomplishment ReportDocument1 pageSample Accomplishment ReportMandaragat GeronimoNo ratings yet

- A. Law, Order, Social Contract, and The Deterrence TheoryDocument1 pageA. Law, Order, Social Contract, and The Deterrence TheoryMandaragat GeronimoNo ratings yet

- Top 10 Richest Personalities in The PhilippinesDocument1 pageTop 10 Richest Personalities in The PhilippinesMandaragat GeronimoNo ratings yet

- BALDEMOR - Peer EvaluationDocument1 pageBALDEMOR - Peer EvaluationMandaragat GeronimoNo ratings yet

- 12 Angry Men - DecisionDocument3 pages12 Angry Men - DecisionMandaragat GeronimoNo ratings yet

- My First Presentation: Rodel Baldemor JRDocument12 pagesMy First Presentation: Rodel Baldemor JRMandaragat GeronimoNo ratings yet

- Focus On The Legal ProfessionDocument4 pagesFocus On The Legal ProfessionMandaragat GeronimoNo ratings yet

- Module 3 Constitutional Principles and Inherent State PowersDocument7 pagesModule 3 Constitutional Principles and Inherent State PowersMandaragat GeronimoNo ratings yet

- Constitutional Law 1: Jose Arturo C. de Castro, J.D., LL.M., J.S.DDocument21 pagesConstitutional Law 1: Jose Arturo C. de Castro, J.D., LL.M., J.S.DMandaragat GeronimoNo ratings yet

- Constitutional Law 1: Jose Arturo C. de Castro, J.D., LL.M., J.S.DDocument10 pagesConstitutional Law 1: Jose Arturo C. de Castro, J.D., LL.M., J.S.DMandaragat GeronimoNo ratings yet

- Nego Notes Ni RodelDocument41 pagesNego Notes Ni RodelMandaragat GeronimoNo ratings yet

- Political Law - Fundamentally Derived From American JurisprudenceDocument5 pagesPolitical Law - Fundamentally Derived From American JurisprudenceMandaragat GeronimoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 01 - A Note On Introduction To E-Commerce - 9march2011Document12 pages01 - A Note On Introduction To E-Commerce - 9march2011engr_amirNo ratings yet

- Properties of LiquidsDocument26 pagesProperties of LiquidsRhodora Carias LabaneroNo ratings yet

- JP Selecta IncubatorDocument5 pagesJP Selecta IncubatorAhmed AlkabodyNo ratings yet

- Product Specifications Product Specifications: LLPX411F LLPX411F - 00 - V1 V1Document4 pagesProduct Specifications Product Specifications: LLPX411F LLPX411F - 00 - V1 V1David MooneyNo ratings yet

- Nestlé CASEDocument3 pagesNestlé CASEAli Iqbal CheemaNo ratings yet

- Internal Analysis: Pertemuan KeDocument15 pagesInternal Analysis: Pertemuan Kekintan utamiNo ratings yet

- Pt. Trijaya Agro FoodsDocument18 pagesPt. Trijaya Agro FoodsJie MaNo ratings yet

- Manual Samsung Galaxy S Duos GT-S7562Document151 pagesManual Samsung Galaxy S Duos GT-S7562montesjjNo ratings yet

- A SURVEY OF ENVIRONMENTAL REQUIREMENTS FOR THE MIDGE (Diptera: Tendipedidae)Document15 pagesA SURVEY OF ENVIRONMENTAL REQUIREMENTS FOR THE MIDGE (Diptera: Tendipedidae)Batuhan ElçinNo ratings yet

- Fmicb 10 02876Document11 pagesFmicb 10 02876Angeles SuarezNo ratings yet

- Freshers Jobs 26 Aug 2022Document15 pagesFreshers Jobs 26 Aug 2022Manoj DhageNo ratings yet

- CSEC SocStud CoverSheetForESBA Fillable Dec2019Document1 pageCSEC SocStud CoverSheetForESBA Fillable Dec2019chrissaineNo ratings yet

- Water Tanker Check ListDocument8 pagesWater Tanker Check ListHariyanto oknesNo ratings yet

- Formal Letter LPDocument2 pagesFormal Letter LPLow Eng Han100% (1)

- Final Prmy Gr4 Math Ph1 HWSHDocument55 pagesFinal Prmy Gr4 Math Ph1 HWSHKarthik KumarNo ratings yet

- Kidney Stone Diet 508Document8 pagesKidney Stone Diet 508aprilNo ratings yet

- Lect.1-Investments Background & IssuesDocument44 pagesLect.1-Investments Background & IssuesAbu BakarNo ratings yet

- Antibiotics MCQsDocument4 pagesAntibiotics MCQsPh Israa KadhimNo ratings yet

- LS01 ServiceDocument53 pagesLS01 ServicehutandreiNo ratings yet

- En 50124 1 2001Document62 pagesEn 50124 1 2001Vivek Kumar BhandariNo ratings yet

- Flying ColorsDocument100 pagesFlying ColorsAgnieszkaAgayo20% (5)

- Adverbs of Manner and DegreeDocument1 pageAdverbs of Manner and Degreeslavica_volkan100% (1)

- Grade9 January Periodical ExamsDocument3 pagesGrade9 January Periodical ExamsJose JeramieNo ratings yet

- 21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREDocument170 pages21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREpragya89No ratings yet

- HU - Century Station - PAL517PDocument232 pagesHU - Century Station - PAL517PTony Monaghan100% (3)

- Ac221 and Ac211 CourseoutlineDocument10 pagesAc221 and Ac211 CourseoutlineLouis Maps MapangaNo ratings yet

- Hindi ShivpuranDocument40 pagesHindi ShivpuranAbrar MojeebNo ratings yet

- Le Chatelier's Principle Virtual LabDocument8 pagesLe Chatelier's Principle Virtual Lab2018dgscmtNo ratings yet

- Neelima A Kulkarni ResumeDocument3 pagesNeelima A Kulkarni ResumeAcademics LecturenotesNo ratings yet