Professional Documents

Culture Documents

Lesson 7 - Accounting Cycle

Uploaded by

EyyyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 7 - Accounting Cycle

Uploaded by

EyyyCopyright:

Available Formats

Accounting Information System

LESSON SEVEN: THE ACCOUNTING CYCLE: Chart of Accounts

The Chart of Accounts is organized by drawers

and levels.

ü The organization of the chart of accounts

follows GAAP (Generally Accepted

Accounting Principles) in which there is a

separate “drawer” for accounts representing:

Assets, Liabilities, Equity (Capital and

Reserves), Revenues (Turnover), Cost of

Sales, Expenses (Operation Costs),

Financing (Non-Operating Income and

Expenditure), and Other Revenues and

Expenses (Taxation and Extraordinary

Items). These drawers, which have been

defined by SAP and cannot be changed,

organize your accounts by level in a logical

fashion appropriate to your financial

accounting and reporting processes.

Accounting Information System (AIS)

LESSON SEVEN: THE ACCOUNTING CYCLE: Chart of Accounts

BALANCE SHEET ACCOUNTS:

• The first 3 drawers: Assets,

Liabilities, Equity (Capital and

Reserves) hold the Balance

Sheet Accounts, such as the

Sales Tax account and the

Accounts Payable Account.

• The bookkeeping balance of

these accounts is kept from one

fiscal year to the next.

• The Balance Sheet Accounts –

reflect the monitory value of

the company - stock, assets,

etc.

Accounting Information System (AIS)

LESSON SEVEN: THE ACCOUNTING CYCLE: Chart of Accounts

PROFIT AND LOSS ACCOUNTS:

§ The last 5 drawers: Revenues (Turnover), Cost of

Sales, Expenses (Operation Costs), Financing

(Non-Operating Income and Expenditure), and

Other Revenues and Expenses (Taxation and

Extraordinary Items) hold the Profit and Loss

Accounts, such as the Income Accounts. Note

that in some localization, the lower drawers are

not all profit and loss account drawers.

§ The bookkeeping balance of these accounts has

to be cleared at the end of each fiscal year –

this is the Period End Closing process (will be

discussed in Unit 4: Financial Periods Process).

§ The Profit and Loss Accounts - reflect the

changes in the company value, such as: sell

stock – cost of goods sold, increase revenues.

Accounting Information System (AIS)

LESSON SEVEN: THE ACCOUNTING CYCLE: Chart of Accounts

REPORTS:

• The BALANCE SHEET - summarizes the

value of the business assets liabilities,

and owner’s equity accounts.

• The TRIAL BALANCE - details for each

account: beginning balance for a

particular period, all of the debits and

credits, and the ending balance.

• PROFIT AND LOSS STATEMENT – after

the end of the fiscal year, the balances

of the expense accounts will be

subtracted from the balances of the

revenue accounts to come up with the

profit or the loss for the fiscal year.

Accounting Information System (AIS)

LESSON SEVEN: THE ACCOUNTING CYCLE: Chart of Accounts

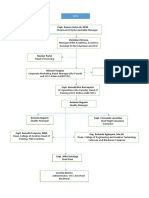

A CHART OF ACCOUNTS arranges a company's

general ledger accounts in a hierarchical structure.

ü The top level in the structure (level 1) consists of

sections or groups for different type of accounts

(assets, liabilities, capital and reserves, turnover,

and so on).

ü The number of account groups depends on the

localization that was selected when the company

was created and cannot be modified by the user

Accounting Information System (AIS)

LESSON SEVEN: THE ACCOUNTING CYCLE: Chart of Accounts

The system displays the section as a cabinet drawer

(see figure).

ü Each drawer has a section title, which you

cannot change. The system displays lower-level

titles in blue and normal active accounts in black.

ü Accounts that you have entered in the G/L

Account Determination (default accounts) are

displayed in green.

ü Levels 2 through 9 can contain either active

accounts or titles that combine several active

accounts. Level 10 only contains active accounts

ü Because only active accounts can be posted to in

SAP Business One, it is a good practice to have all

your active accounts at the same level.

ü In reports, a title account summarizes all the

balances of each active account below it.

Accounting Information System (AIS)

VIEWING CHART OF ACCOUNTS: To view existing Chart of Accounts:

Go to (1) Financials → (2) Chart of Accounts

Accounting Information System (AIS)

EDITING CHART OF ACCOUNTS:

To edit (add, modify, update) Chart of

Accounts

Go to (1) Financials → (2) Edit Chart

of Accounts

3. Tick the box beside the Chart of

Account drawer that you want to

edit

4. Click OK.

Accounting Information System (AIS)

EDITING CHART OF ACCOUNTS:

5. Click on Add Same Level Account

or Add Sub-level Account.

6. Input the necessary information

of the Account to be added.

7. Click OK.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Posting Periods

When you create a new company database, you create

the posting periods for the first fiscal year. Posting

periods split the fiscal year into sub-periods. Sub-

Periods are created automatically by SAP Business One

in the fiscal year. The available sub-periods are:

q Year (one sub-period)

q Quarters (four sub-periods)

q Months (twelve sub-periods)

q Days (any number of sub-periods)

Using this information, the system automatically

creates the corresponding number of posting periods.

You can change these periods, if necessary.

Accounting Information System (AIS)

The first posting period must

be defined at the time the

company database is created.

Afterwards, to set up new

posting periods, go to:

(1) Administration →

(2) System Initialization →

(3) Posting Periods.

4. On the lower right

corner of the Posting

Periods window, click

‘New Period’.

5. Input the necessary

information of the Period

to be added.

6. Click Add.

7. Click OK.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Journal Entry

In SAP Business One, a journal entry is

automatically posted from many

documents, such as A/R and A/P invoices.

Additionally, you can manually post a journal

entry directly to a G/L account or to a

business partner sub-ledger account.

All journal entries are posted to one file in SAP

Business One – the Journal Entries file. You

can set various defaults for journal entries.

You can also change some document settings

for an individual journal entry.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Journal Entry - HEADER

ü In automatic journal entries created by the documents in SAP Business One, the fields are filled

automatically from the document fields. In manual journal entries you set the values

ü The system automatically enters a number in the document header. This number is incremented

with every transaction. You can define numbering series for journal entries on the Document

Numbering screen, under the Administration → System initialization → Document Numbering.

The three dates in the header default to the current system date but you can change them:

POSTING DATE: This date determines the posting period and therefore the fiscal period for financial

reporting. You can post to an earlier or later date if the posting period is Unlocked for posting

DUE DATE: The date the transaction is due.

DOCUMENT DATE: The date used for tax reporting purposes.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Journal Entry – POSTING TOOLS

Ways of Posting Journal entry in SAP Business One:

ü Entering a manual journal entry.

ü From a journal voucher

ü Using a recurring postings

ü Using a posting template

To record Manual Journal entry (for non-routine transactions)

Go to (1) Financials → (2) Journal Entry

3. On the Remarks field, input a brief explanation for the Journal Entry being made.

4. On the G/L Account field, click the Pick List button.

5. List of Accounts window will open, select the Account affected by the Journal Entry being made.

6. Click Choose.

7. Input the amount on either the debit/credit side, depending on the nature of the transaction.

8. Add.

Note: Journal Entries created in this manner are not editable once added.

Accounting Information System (AIS)

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Journal Voucher

SAP Business One offers a two-stage procedure for creating

journal entries. You can create the journal entries as drafts first,

correct and post them later.

When the user is creating a journal voucher it is used for storing several

journal entry drafts. You can change journal voucher as long as they have

not been posted yet. Then, you can access the journal voucher, make any

necessary corrections, and post the entire journal voucher. You do not have

to post each journal entry individually. If you do want to post the

journal entries individually, however, you must create a separate journal

voucher for each journal entry draft

You can save an unbalanced journal vouchers

as long as it is in the draft mode.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Journal Voucher

To create, change and post journal vouchers, choose

(1) Financials → (2) Journal Vouchers → (3) Add Entry to New Voucher

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Journal Voucher

4. A Journal Voucher Entry window will appear, and the you can input the information just like in the

manner of a Manual Journal Entry. Click Add to Voucher.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Journal Voucher

5. Double click the Voucher if you want to edit it contents. You can also remove a journal voucher or delete

an entry from a journal voucher, as long as they have not been posted yet. Right-click the journal

voucher row, select Remove Journal Voucher.

6. Click Post Voucher

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Routine Transactions: Recurring Postings

SAP Business One features a recurring postings function for similar, fixed amount journal entries created on a

regular basis. Choose Financials → Recurring Postings to enter and maintain recurring postings.

RECURRING POSTINGS use a template that is stored with a code and a description. In this template, you define

(among other things) the frequency in which the journal entry is supposed to be created and until when the

recurring posting is valid. The possible entries in the Frequency field include:

Daily, Weekly, Monthly, Quarterly, Half-Yearly, Annually: You must also specify the next execution

date for these entries.

One time: Although a one-time recurring posting seems a bit odd, it serves a special purpose.

With this you can schedule a journal entry for a specific date.

Template: Journal entries that you need repeatedly but not on a regular basis can be created as this

type. You can access these templates from the manual journal entry. To do so, you must specify Recurring

Posting in the Template Type field

Not executed yet: If you do not need the recurring posting at present, you can turn it off with this entry

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Routine Transactions: Recurring Postings

In the Valid To field, you can enter a date until which the recurring posting is valid and will be executed by the

system.

ü The system duplicates the original recurring posting (instance 0) every time the execution date arrives. Once

you use this instance and add it to the system, it will be deleted.

ü You can display a list of all the recurring postings in the system. You can then adjust these postings and

confirm them. You can also configure the system so the execution list is displayed automatically in the

execution date as soon as you log on. Choose Administration → System Initialization → General

Settings and select the Display Recurring Postings on Execution indicator on at the the Services tab to

activate this service for your user.

ü You can add recurring postings to the cash flow, which appear in green in the report.

EXAMPLE: The company pays a 10,000 Repairs and Maintenance fee for its Office Building every 17th of

the month, for 1 year. Use the following information:

Code: RAME Description: Repairs and Maintenance Fee

Dr. Repairs and Renewals 10,000

Cr. Petty Cash 10,000

Accounting Information System (AIS)

To create the recurring

posting:

Go to (1) Financials →

(2) Recurring Postings

3. Input the code and

description

4. Input the recurring

Journal Entry

5. Set the frequency and

validity.

6. Click Add.

Accounting Information System (AIS)

The recurring posting will appear upon log-in on the specified day of the month. Select the recurring

posting and click Execute.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Routine Transactions: Posting Template

You can create posting templates for journal entries that have a very similar structure. These templates can

contain account numbers but you can also just specify an account description in a line item if you do not

yet know which exact account will be used for this line item.

ü Instead of fixed amounts, only percentages are entered here. These percentages indicate how the

total amount is distributed among the line items.

EXAMPLE: The posting template is stored under a code and with a description.

Choose (1) Financials → (2) Posting Templates to enter and maintain posting templates.

3. Input the following information

Code: PRE

Description: Allocation of Prepayments

Dr. Property Rent 70%

Dr. Premises Insurance 30%

Cr. Petty Cash 100%

4. Click Add.

Accounting Information System (AIS)

Accounting Information System (AIS)

5. When you enter a journal entry manually, choose Percentage in the Template Type field and enter the

template code in the Template field or press tab and choose it from a list.

6. Enter an amount in one of the line items and the template will allocate the amounts to the other lines

based on the percentage rate.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Financial Reports

Investors and financial analysts rely on financial data to analyze the performance of a company and

make predictions about its future direction of the company's stock price. One of the most important

resources of reliable and audited financial data is the annual report, which contains the firm's financial

statements.

The financial statements are used by investors, market analysts, and creditors to evaluate a company's

financial health and earnings potential.

Accounting Information System (AIS)

Go to (1) Financials >

(2) Financial Report >

(3) Financial >

(4) Trial Balance or

Balance Sheet or Profit

and Loss Statement.

5. Upon selecting the

report – Selection

Criteria window

appears, enter the

desired range dates.

6. Click OK.

Report will be generated. Analyze the report as you see fit.

Accounting Information System (AIS)

FINANCIAL STATEMENT ANALYSIS

TREND ANALYSIS

Trend analysis is also called time-series analysis. Trend analysis helps a firm's financial manager

determine how the firm is likely to perform over time, based on trends shown by past history.

• uses historical data from the firm's financial statements, along with forecasted data from the

company's pro forma, or forward-looking, financial statements, to assemble a longer-term view of its

financial activity and look for variations over time.

• One popular way of doing trend analysis is through financial ratio analysis. If you calculate

financial ratios for a business firm, you'll want to calculate at least two years of ratios to compare

side-by-side to provide any meaningful information.

• Trend analysis is even more powerful if you have and use several years of financial ratios. Some

firms also compare data to average ratios for their industry or competitors.

Accounting Information System (AIS)

FINANCIAL STATEMENT ANALYSIS

COMMON SIZE FINANCIAL STATEMENT ANALYSIS

Common-size financial statement analysis involves analyzing the balance sheet and income

statement using percentages. All income statement line items are stated as a percentage of sales. All

balance sheet line items are stated as a percentage of total assets

• This type of analysis enables the financial manager to view the income statement and balance sheet

in a percentage format, making it easier to interpret.

• As with financial ratio analysis, you can compare the common-size income statement from one

year to other years of data to see how your firm is doing. It is generally easier to make that

comparison using percentages rather than absolute numbers.

• Using percentages also makes it easier to compare two firms of very different sizes. Even if one

firm's three times larger than its competitor in sales terms, percentage-wise, it probably spends the

same proportions of expenses, for example.

Accounting Information System (AIS)

FINANCIAL STATEMENT ANALYSIS

BENCHMARKING

Benchmarking is also called industry analysis. Benchmarking involves comparing a company to other

companies in the same industry to see how one company is doing financially compared to others in the

industry

• This type of analysis is very useful to the financial manager as it helps them see if they have a

competitive advantage or spot inefficiencies relative to others in the same business

• Financial ratio analysis is often used for benchmarking. Financial ratios for individual, mainly

public companies, can be obtained from a number of sources. A few publications offer industry

average ratios, although they may require a paid subscription

• To do benchmarking, compare the ratios for one company to the ratios of other companies in

the same industry. Make sure that the industry average ratios are calculated in the same way the

ratios for your company are calculated when you perform benchmarking.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Period End Closing

At the end of a period

(month, quarter, or year),

you must transfer the

balances of the Profit and

Loss accounts to a retained

earnings account.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Period End Closing

Choose (1) Administration → (2)

Utilities → (3) Period-End Closing

to run Period-End Closing.

4. With the Period-End Closing

function, you can choose P&L

accounts and periods, and

specify a retained earnings and

period-end closing accounts.

5. When you execute the period-

end closing, the system

generates a list of proposals for

closing entries. You can accept

each proposal individually.

Accounting Information System (AIS)

THE ACCOUNTING CYCLE: Period End Closing

After you accept the proposals, the system transfers the account balances from the Expense and the

Revenue accounts to the Period-End Closing account on the same day (the last day of the period).

This sets the accounts balances to zero.

At the same time but with the first day of the following posting period as posting date, the system

transfers the balances form the Period-End Closing account to the Retained Earnings account (the

Period-End Closing is a clearing account).

Two transactions are created for each account and two journal entries are automatically created

to reflect those transactions

Now, the Retained Earnings account, which is a Balance Sheet account, contains the total brought

forward cumulated profit.

Journal Entries posted by the Period-End Closing Utility have the origin “BC”.

Accounting Information System (AIS)

You might also like

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- RCS Eastern Intertrade Corp. BIR Computerized Accounting System PresentationDocument107 pagesRCS Eastern Intertrade Corp. BIR Computerized Accounting System PresentationSALAMIDA, TABAMO & COMPANY ACCOUNTING FIRMNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Fi Overview 3Document87 pagesFi Overview 3Sushil KumarNo ratings yet

- Which of The Following Statements Are CorrectDocument18 pagesWhich of The Following Statements Are CorrectkaktosjaazNo ratings yet

- Financial Accounting and Taxation Using TallyDocument7 pagesFinancial Accounting and Taxation Using TallySanjay KumarNo ratings yet

- CO Manual CO-PA-04 Report PainterDocument55 pagesCO Manual CO-PA-04 Report PaintergirijadeviNo ratings yet

- Profit Center Accounting ConfigurationDocument4 pagesProfit Center Accounting ConfigurationSpandana SatyaNo ratings yet

- Sap Fico TipsDocument2 pagesSap Fico Tipsrandeep010189No ratings yet

- Multiple Partial Payments From An Invoice Through Automatic Payment ProgramDocument26 pagesMultiple Partial Payments From An Invoice Through Automatic Payment ProgramnasuuNo ratings yet

- AssetAccounting, Excise, Cash JournalDocument4 pagesAssetAccounting, Excise, Cash JournalsrinivasNo ratings yet

- SAP B1 - Sales ARDocument3 pagesSAP B1 - Sales ARRhon Ryan TamondongNo ratings yet

- Sap Accounting EntriesDocument5 pagesSap Accounting EntriesonionheadmonsterNo ratings yet

- Process Phases of Asset Under Construction in SAP: Asset Module Optimization & Accuracy in Costing / Depreciation RunDocument2 pagesProcess Phases of Asset Under Construction in SAP: Asset Module Optimization & Accuracy in Costing / Depreciation RunUppiliappan GopalanNo ratings yet

- F-02 General DoumentDocument9 pagesF-02 General DoumentP RajendraNo ratings yet

- Business Area: Tcode: Ox03: Whether A Single Business Area Can Be Used by Two or More Company Codes?Document41 pagesBusiness Area: Tcode: Ox03: Whether A Single Business Area Can Be Used by Two or More Company Codes?fharooksNo ratings yet

- Aap With Partial PaymentDocument6 pagesAap With Partial PaymentDas babuNo ratings yet

- SAP-Document Splitting: GL Account DR CR Profit Center Vendor Pur. 1 Pur. 2 TaxDocument16 pagesSAP-Document Splitting: GL Account DR CR Profit Center Vendor Pur. 1 Pur. 2 Taxharshad jain100% (1)

- FI/CO Frequently Used Transactions: General LedgerDocument7 pagesFI/CO Frequently Used Transactions: General LedgerShijo PrakashNo ratings yet

- FBRA Reset and Reverse An ACH Payment DocumentDocument3 pagesFBRA Reset and Reverse An ACH Payment DocumentLearn.onlineNo ratings yet

- GR&IR Clearing AccountDocument8 pagesGR&IR Clearing AccountWupankNo ratings yet

- FICO Interview AnswersDocument160 pagesFICO Interview Answersy janardhanreddy100% (1)

- ZBRS Flow Version 1.0Document13 pagesZBRS Flow Version 1.0Kaladhar GunturNo ratings yet

- Withholding Tax FinalDocument15 pagesWithholding Tax FinalAshwani kumarNo ratings yet

- POD - Series 1 POD - Series 2: RefurbishmentDocument3 pagesPOD - Series 1 POD - Series 2: RefurbishmentshekarNo ratings yet

- SAP - Premium.C TFIN52 67.by .VCEplus.96q-DEMO PDFDocument28 pagesSAP - Premium.C TFIN52 67.by .VCEplus.96q-DEMO PDFShashank MallepulaNo ratings yet

- Comparison IFRS VASDocument43 pagesComparison IFRS VAStieuquan42100% (3)

- Mr11 Grir Clearing Account MaintenanceDocument9 pagesMr11 Grir Clearing Account MaintenanceAzeddine EL ACHHABNo ratings yet

- Reverse Charge in Service TaxDocument14 pagesReverse Charge in Service TaxvishalsolsheNo ratings yet

- Fi MM IntegrationDocument9 pagesFi MM Integrationvenki1986No ratings yet

- Sap Fico Configuration-CinDocument25 pagesSap Fico Configuration-Cinpiyush3600No ratings yet

- What Is Special GL TransactionDocument4 pagesWhat Is Special GL TransactionRaj ShettyNo ratings yet

- House BanksDocument24 pagesHouse BanksNarsimha Reddy YasaNo ratings yet

- KEND Maintain RealignmentsDocument32 pagesKEND Maintain RealignmentsQingjin HuangNo ratings yet

- Fixed Asset Process GuideDocument15 pagesFixed Asset Process Guidekumar4868No ratings yet

- What is Production Order SettlementDocument2 pagesWhat is Production Order SettlementBasu GudageriNo ratings yet

- Depreciation Calculation MethodsDocument9 pagesDepreciation Calculation MethodsvinaygawasNo ratings yet

- Preparation For Consolidations in SAP ECC To Meet Your EPM Integration NeedsDocument25 pagesPreparation For Consolidations in SAP ECC To Meet Your EPM Integration NeedsarunvisNo ratings yet

- Year End Closing in Asset Accounting - Best PracticesDocument5 pagesYear End Closing in Asset Accounting - Best PracticesvairesatendraNo ratings yet

- Addon Integration ModuleDocument19 pagesAddon Integration ModuleRajib Bose100% (1)

- Bad Debt ConfigrationDocument4 pagesBad Debt Configrationsudershan9No ratings yet

- SAP FICO concepts for financial accounting and controllingDocument7 pagesSAP FICO concepts for financial accounting and controllinganuradha9787No ratings yet

- Accounts Payable & APP (Accounts Payment Program) - VenkateshbabuDocument40 pagesAccounts Payable & APP (Accounts Payment Program) - VenkateshbabuVenkatesh BabuNo ratings yet

- ABNAN PostCapDocument10 pagesABNAN PostCapmagnomagno1No ratings yet

- ControllingDocument21 pagesControllingPallavi ChittiNo ratings yet

- Asset Accounting User ManualDocument30 pagesAsset Accounting User ManualImim Yoma0% (1)

- Key Data StructureDocument38 pagesKey Data StructureroseNo ratings yet

- Primary Cost Planning - Asset Accounting (FI-AA) - SAP LibraryDocument4 pagesPrimary Cost Planning - Asset Accounting (FI-AA) - SAP LibraryRiddhi MulchandaniNo ratings yet

- Check Enter Company Code Global Parameters in Sap PDFDocument7 pagesCheck Enter Company Code Global Parameters in Sap PDFAMIT AMBRENo ratings yet

- SAP CO Training CurriculumDocument5 pagesSAP CO Training CurriculumVineet KumarNo ratings yet

- Controlling ConfigurationDocument58 pagesControlling ConfigurationHridya Prasad100% (1)

- Cost CentersDocument44 pagesCost CentersPallaviNo ratings yet

- Final AccountsDocument61 pagesFinal AccountsvimalaNo ratings yet

- Account Payable Sap TransactionsDocument3 pagesAccount Payable Sap Transactionschintan05ecNo ratings yet

- FINANCE CYCLE - Chart of Accounts: Within The Chart of Accounts, You Will Find That The Accounts Are Typically Listed inDocument5 pagesFINANCE CYCLE - Chart of Accounts: Within The Chart of Accounts, You Will Find That The Accounts Are Typically Listed inQueen ValleNo ratings yet

- Accounting Cheat SheetDocument6 pagesAccounting Cheat SheetTrisha Mae LandichoNo ratings yet

- ACTG121LEC (Reviewer)Document3 pagesACTG121LEC (Reviewer)Jenna BanganNo ratings yet

- Fatimatus Zehroh - SUMMARY ACCOUNTING SYSTEM INFORMATION Unit 5&6Document8 pagesFatimatus Zehroh - SUMMARY ACCOUNTING SYSTEM INFORMATION Unit 5&6Fatimatus ZehrohNo ratings yet

- Session 2-Setting - Up - General - LedgerDocument10 pagesSession 2-Setting - Up - General - LedgerTharushi NavodyaNo ratings yet

- Resource Assignment SectionDocument2 pagesResource Assignment SectionEyyyNo ratings yet

- PERT CPM v2-1Document8 pagesPERT CPM v2-1EyyyNo ratings yet

- International Marketing Plan: Dairy Queen: Holy Angel University School of Business and AccountancyDocument15 pagesInternational Marketing Plan: Dairy Queen: Holy Angel University School of Business and AccountancyEyyyNo ratings yet

- NORTH AMERICAN LITERATURE OVERVIEWDocument14 pagesNORTH AMERICAN LITERATURE OVERVIEWEyyyNo ratings yet

- X - Exercise On Pert CPM-1Document3 pagesX - Exercise On Pert CPM-1EyyyNo ratings yet

- Lesson 6 - Inventory CycleDocument42 pagesLesson 6 - Inventory CycleUnnamed homosapienNo ratings yet

- Deed of Real Estate MortgageDocument3 pagesDeed of Real Estate Mortgagejolly faith pariñasNo ratings yet

- Inventory Management: Exercise 5.1Document11 pagesInventory Management: Exercise 5.1EyyyNo ratings yet

- Cost Accounting Solman de Leon 2014 1Document181 pagesCost Accounting Solman de Leon 2014 1Mark Anthony Siva94% (16)

- Performance Task: A Research OnDocument8 pagesPerformance Task: A Research OnEyyyNo ratings yet

- WCC and CaapDocument2 pagesWCC and CaapEyyyNo ratings yet

- Case DigestDocument2 pagesCase DigestEyyyNo ratings yet

- PERT-CPM project analysisDocument3 pagesPERT-CPM project analysisEyyyNo ratings yet

- Kuro UsagiDocument2 pagesKuro UsagiEyyyNo ratings yet

- PERT-CPM project analysisDocument3 pagesPERT-CPM project analysisEyyyNo ratings yet

- Financial Rehabilitation and Insolvency Act (FRIA) of 2010: Commercial Law - Special LawsDocument30 pagesFinancial Rehabilitation and Insolvency Act (FRIA) of 2010: Commercial Law - Special LawsGlem JosolNo ratings yet

- Chapter04 (1) Advanced Accounting Larson Reference AnswersDocument31 pagesChapter04 (1) Advanced Accounting Larson Reference AnswersRamez AhmedNo ratings yet

- Assignment Chapter 12Document17 pagesAssignment Chapter 12Nicolas ErnestoNo ratings yet

- FM11 CH 21 ShowDocument47 pagesFM11 CH 21 ShowDaood AbdullahNo ratings yet

- 1 - Installment Sales Accounting - Docx, Francise, Constarction ContractDocument8 pages1 - Installment Sales Accounting - Docx, Francise, Constarction ContractJason BautistaNo ratings yet

- Financial Plan For FleekDocument20 pagesFinancial Plan For Fleeksheena leopardasNo ratings yet

- NSTP Report Group 4Document3 pagesNSTP Report Group 4torno amielNo ratings yet

- Ogl 260 Module 3 - UpdatedDocument5 pagesOgl 260 Module 3 - Updatedapi-538745701No ratings yet

- BAC 211 Group AssDocument12 pagesBAC 211 Group AssStephan Mpundu (T4 enick)No ratings yet

- Partnership Liquidation and AccountingDocument4 pagesPartnership Liquidation and Accountingnadea06_20679973No ratings yet

- Walmart Vs TargetDocument6 pagesWalmart Vs TargetNoble S WolfeNo ratings yet

- Financial Accounting and Reporting - QUIZ 7Document4 pagesFinancial Accounting and Reporting - QUIZ 7JINGLE FULGENCIONo ratings yet

- TVM and annuity calculationsDocument22 pagesTVM and annuity calculationsBeatrice Anne CanapiNo ratings yet

- Credit Policy and Loan Characteristics - 2nd UnitDocument33 pagesCredit Policy and Loan Characteristics - 2nd UnitDr VIRUPAKSHA GOUD GNo ratings yet

- FINA 4221 Corporate Finance Problem Set 1Document2 pagesFINA 4221 Corporate Finance Problem Set 1mahirahmed510% (1)

- Fundamental Accounting I Chapter 1$2 NewwDocument25 pagesFundamental Accounting I Chapter 1$2 NewwDere GurandaNo ratings yet

- Rainbow Paint LTD - Financial StatementsDocument25 pagesRainbow Paint LTD - Financial StatementsSamaksh VermaNo ratings yet

- UGBA103 Final Fall 2016Document5 pagesUGBA103 Final Fall 2016Billy bobNo ratings yet

- 2007 Jan U1 U2 PDFDocument31 pages2007 Jan U1 U2 PDFTharakaaNo ratings yet

- 1 Trimestre 2023 - Dashboard Bursátil BVLDocument14 pages1 Trimestre 2023 - Dashboard Bursátil BVLEddy GonzalesNo ratings yet

- Basel 1Document18 pagesBasel 1Choreo SiblingsNo ratings yet

- Chapter 26 MCQs On International TaxationDocument26 pagesChapter 26 MCQs On International TaxationSuranjali Tiwari100% (1)

- Business Accounting Question PaperDocument3 pagesBusiness Accounting Question PaperGajendra GargNo ratings yet

- Determinants of Equity Share Prices in IndiaDocument10 pagesDeterminants of Equity Share Prices in IndiaMuhammad RezaNo ratings yet

- Week 9 QuizDocument8 pagesWeek 9 QuizWang ChoiNo ratings yet

- Chap 012Document14 pagesChap 012HassaanAhmadNo ratings yet

- AdvAcc1 - Assignment #1 (Busi Com Pfrs 3)Document2 pagesAdvAcc1 - Assignment #1 (Busi Com Pfrs 3)Kyla de SilvaNo ratings yet

- Tier 4 ND MFIs Regulations 2018Document33 pagesTier 4 ND MFIs Regulations 2018Sam KNo ratings yet

- PROSPECTUS OVERVIEWDocument18 pagesPROSPECTUS OVERVIEWGUNGUN GUPTANo ratings yet

- 704Document10 pages704Bhoomi Ghariwala0% (1)