Professional Documents

Culture Documents

National Income Accounting

Uploaded by

Aprile Margareth HidalgoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

National Income Accounting

Uploaded by

Aprile Margareth HidalgoCopyright:

Available Formats

National Income Accounting

National income is measured in terms of total earnings of the factors of production or the

total market value of all final goods and services produced by the citizens. These are

presented in terms of Gross National Product (GNP), Gross Domestic Product (GDP), per

capita income (PCI) and per capita GNP. Such are the measures of economic performance

of the nation.

The National Economic Development Authority (NEDA) is the government agency in-

charge of maintaining the national accounting.

Gross National Product (GNP)

Gross National Product (GNP) measures the market value of all final goods and services

produced by a nation’s economic resources during a specified period of time. It reflects the

economic performance of a nation.

GNP = Pi Qi

Where Pi = price of ith commodity in the given year.

Qi = quantity of production of ith commodity for a given year.

Example:

GNP = Price Qrice + Pfish Qfish + Pmedicine Qmedicine +

Pservices Qservices + … + Pnthcommodity Qnthcommodity

GNP at current prices is the money GNP. It is obtained by multiplying the quantity of

final goods and services by the prevailing or current market prices.

Current GNP progressively increases every year. However, this does not necessarily

indicate an improving economic performance of the nation. Suppose that the quantity

remains the same, the GNP will still increase because the prices cannot be held constant

through the years. Hence, an increasing current GNP may only manifest that the prices of

the goods and services only increase or there is just an inflation.

To avoid a misleading interpretation of current GNP, the Real GNP must be used in

gauging the economic performance of the nation.

Current GNP

Real GNP = * 100%

Price Index

Price in any given year

Price Index = x 100%

Price in base year

A price index ensures that the comparison of the GNP is based on a common base

year (usually a period of normal economic condition).

Per Capita GNP refers to the GNP share of each person if national income is divided

equally among the population of the nation.

GNP

Per Capita GNP =

Population

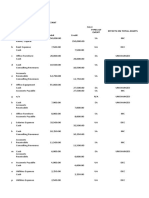

Table 22. Per capita GNP

Year Current GNP1 CPI1 Real GNP1 Population2 Per capita Per capita

(P Million) 2000=100 (P million) (Million) Current GNP Real GNP

2000 3,566,059 100.00 3,566,059 77 46,312 46,312

2001 3,876,603 102.26 3,791,030 79 49,071 47,988

2002 4,218,883 106.54 3,960,037 80 52,736 49,500

2003 4,631,479 112.87 4,103,364 82 56,481 50,041

2004 5,248,064 120.67 4,349,277 84 62,477 51,777

2005 5,885,050 127.10 4,630,280 85 69,236 54,474

2006 6,570,310 134.85 4,872,386 87 75,521 56,004

2007 7,274,660 145.36 5,004,613 89 81,738 56,232

1

Calcuted from the NCSO data with 1985 as base year, Economic and Social Statistics Office, National Statistical Coordination

Board

2

Based on the Projected population from 2000-2010 (Medium Assumption), NSO 2000 Census-based population

Limitations of GNP

1. It does not show the allocation of goods and services among members of the society. It

only shows the number of goods and services produced by the citizens in a given period.

In a nation where there is unequal distribution of income, an increasing GNP only

suggests that the economic welfare of the few rich people are better off. As a whole,

there is no real improvement because the many poor people remain poor.

2. GNP accounting in less developed countries is understated. Many economic

transactions especially in the rural areas are not included in the GNP accounting. These

activities constitute most of our daily activities like for instance when we ride a jeepney,

buy goods from the nearby sari-sari store or eat in the school canteen. In all the said

transactions, no official receipts are taken.

3. The evils of economic growth like pollution, congestion and dirty environment are not

reflected in the GNP.

4. GNP only measures the number of goods and services but not the quality of goods and

services.

5. Incomes or products from illegal sources are not included in the GNP.

(Reference: Fajardo, 1990)

Consumer Price Index (CPI)

A price index is a device for combining movements of many individual prices for the

purpose of estimating the average movement of some specified group of prices. It is often

used to deflate variables expressed in money terms to take out the effect of price changes.

Also, the inflation rate is reflected in the growth of the price index.

CPI is designed to measure changes in prices of the goods and services.

Table 23. Consumer Price Index 2000-2007

Year CPI Inflation Rate (%)

2000 100.00 -

2001 102.26 2.26

2002 106.54 4.18

2003 112.87 5.95

2004 120.67 6.91

2005 127.10 5.33

2006 134.85 6.10

2007 145.36 7.79

(Year 2000 is the base year, 2000=100)

Inflation is the continuous increase in the general level of prices. The formula for

determining inflation is as follows:

CPI2 - CPI1

Inflation rate = x 100%

CPI1

Where: 2 = present year

1 = base year

To illustrate, use the table above in determining the inflation rate between 1997 and

1998.

CPI2 - CPI1 136.9 – 124.8

Inflation rate = x 100% = x

100% = 9.7%

CPI1 124.8

Gross Domestic Product (GDP)

GDP is the total market value of all final goods and services produced within the

territories of a nation in a given year. An increasing GDP suggests an improving economy.

However, it should be noted that in most third world countries whose economy is dominated

by foreigners, GDP is usually bigger. This does not necessary mean an improving economy.

It may only mean that the value of final goods and services produced by the foreigners in

these third world countries is increasing.

In the computation of GDP, the incomes derived from investments or wealth in other

countries is excluded. Whereas in the case of GNP, the incomes of the citizens earned from

abroad are included. Hence, for the third world economy, the GNP is a better indicator of

growth than GDP.

Three Approaches of Measuring GNP

1. GNP via the Expenditure Approach – It is measured through the flow of

currently produced goods and services by accounting for all the expenditures of the

different sectors in the economy, i.e. the consumers, business, government and foreign

sectors.

The consumers spend for durable goods, non-durable goods and services. Altogether

these expenditures comprise the “Personal Consumption Expenditures”.

Expenditures of the business sectors are called “Gross Domestic

Investment”. These account for residential construction, business fixed

Investment and change in business inventories.

The government spends for national and local outlays. These are called

“Government Consumption Expenditures”.

Net Export, that is the value of export less import, reflects the foreign

sector in GNP accounting.

Table 24. Gross National Product via Expenditure Approach, 2007

Item Value

1. Personal consumption expenditures 1,059,466

2. General government consumption expenditures 86,523

3. Gross domestic capital formation or investment 239,667

a. Fixed capital formation 232,492

b. Increase in stocks 7,175

4. Exports of goods and non-factor services 648,297

5. Less: Imports of goods and non-factor services 620,328

6. Statistical discrepancy ( 46,607)

Expenditures on Gross Domestic Product 1,370,018

7. Net factor income from the rest of the world 138,600

Expenditures on Gross National Product 1,508,618

Source: National Statistical Coordination Board (NSCB)

2. GNP via Income Approach – It measures national income (GNP) through

the below-mentioned factored incomes that are earned by resource owners in current

production.

a. Compensation of employees – It includes all wages and salaries earned by

households, fringe benefits, private pensions and welfare funds.

b. Proprietors’ income – It is the net profits of unincorporated businesses and self-

employed professionals.

c. Rental income of persons - It is the income in the form of rent and royalties received

from the ownership of property.

d. Corporate profits – These include the profits of all private corporations.

e. Income from interests – It is the interests received by household and government

from capital.

Table 25. GNP via Income Approach*

Item Value

1. Compensation of employees and entrepreneurial 1,156,385

and property income of persons

2. General government income from property and 31,484

entrepreneurship

3. Corporate income 16,194

a. corporate tax 21,304

b. corporate savings (5,110)

National Income 1,204,063

4. Indirect taxes 132,506

5. Less: Subsidies 3,993

Net National Product 1,332,576

6. Capital consumption (depreciation) allowance 176,042

Gross National Product 1,508,618

*Hypothetical example

3. GNP via Value-Added Approach or Industrial Origin – It is the difference

between the market value of all goods produced and the cost of all the goods and

materials produced by other producers. It is the net contribution of the firm to the total

value of production.

Table 26. GNP by Industrial Origin, 2007

Industry Value

1. Agriculture, Fishery, Forestry 252,010

a. Agriculture industry 250,522

b. Forestry 1,488

2. Industry Sector 442,352

a. Mining & quarrying 23,516

b. Manufacturing 317,074

c. Construction 58,805

d. Elect, gas and water 42,957

3. Service Sector 675,656

a. Trans., comm. & stor. 120,582

b. Trade 237,128

c. Finance 80,838

d. O. dwellings & r. estate 63,333

e. Private services 116,718

f. Government services 57,056

Gross Domestic Product 1,370,018

Net factor income from abroad 138,600

Gross National Product 1,508,618

Source: National Statistical Coordination Board (NSCB)

You might also like

- Midterm Lesson 4 PDFDocument28 pagesMidterm Lesson 4 PDFJoshua CabinasNo ratings yet

- 10 National Income AccountingDocument21 pages10 National Income AccountingRobert Scott Madriago100% (1)

- IS and LMDocument18 pagesIS and LMM Samee ArifNo ratings yet

- Current, Resistance, and Electromotive ForceDocument3 pagesCurrent, Resistance, and Electromotive ForceAnn Margarette MoralesNo ratings yet

- Module 2Document17 pagesModule 2Maxine RubiaNo ratings yet

- Electric Current, Resistance and ResistivityDocument8 pagesElectric Current, Resistance and ResistivityPavan BoroNo ratings yet

- Public Debt Lesson 6 and 7Document19 pagesPublic Debt Lesson 6 and 7BrianNo ratings yet

- Theories of International Trade: Unit - IDocument24 pagesTheories of International Trade: Unit - IArun Mishra100% (1)

- Lesson 1 Introduction To EconomicsDocument56 pagesLesson 1 Introduction To EconomicsAthena LyNo ratings yet

- 9.6 Keynesian MultiplierDocument23 pages9.6 Keynesian MultiplierkimmoNo ratings yet

- Session 2Document73 pagesSession 2Sankit Mohanty100% (1)

- Ecodev Gr9 ReportDocument40 pagesEcodev Gr9 ReportJohn Jay NalicatNo ratings yet

- Inflation and DeflationDocument7 pagesInflation and Deflationelle06No ratings yet

- CH 3 Macroeconomics AAUDocument90 pagesCH 3 Macroeconomics AAUFaris Khalid100% (1)

- Unit 2 (NATIONAL INCOME)Document41 pagesUnit 2 (NATIONAL INCOME)Sophiya PrabinNo ratings yet

- Chapter 11 - Public FinanceDocument52 pagesChapter 11 - Public FinanceYuki Shatanov100% (1)

- MultiplierDocument47 pagesMultiplierShruti Saxena100% (3)

- Macro Lecture ch12 Money Growth and InflationDocument26 pagesMacro Lecture ch12 Money Growth and InflationKatherine SauerNo ratings yet

- Harvard Economics 2020a Problem Set 3Document2 pagesHarvard Economics 2020a Problem Set 3JNo ratings yet

- ch-3-Public-Expenditure (1) - 1Document30 pagesch-3-Public-Expenditure (1) - 1bghNo ratings yet

- Macroeconomics National Income AccountingDocument62 pagesMacroeconomics National Income AccountingCikgu Poli0% (1)

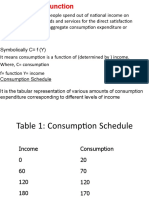

- Consumption Function and Its TypesDocument13 pagesConsumption Function and Its TypesTashiTamangNo ratings yet

- Applied Econometrics RegressionDocument38 pagesApplied Econometrics RegressionchatfieldlohrNo ratings yet

- Commercial PolicyDocument13 pagesCommercial Policynishantsaini0750% (2)

- International Economics I - Lecture NotesDocument2 pagesInternational Economics I - Lecture NotesMeer Hamza100% (1)

- Inflationary & Deflationary GapDocument6 pagesInflationary & Deflationary GaprosheelNo ratings yet

- Unemployment and Labour Market EquilibriumDocument16 pagesUnemployment and Labour Market EquilibriumNickNo ratings yet

- Economic Growth and DevelopmentDocument2 pagesEconomic Growth and DevelopmentJayson OliverosNo ratings yet

- Discuss The UNIDO Approach of Social-Cost Benefit AnalysisDocument3 pagesDiscuss The UNIDO Approach of Social-Cost Benefit AnalysisAmi Tandon100% (1)

- Principle of Economics Principle of Economics: Chapter Four Theory of Production and Theory of Production and CostDocument30 pagesPrinciple of Economics Principle of Economics: Chapter Four Theory of Production and Theory of Production and CostBiladenNo ratings yet

- National IncomeDocument4 pagesNational Incomesubbu2raj3372No ratings yet

- CHAPTER-TWO PUBLIC REVENUEDocument76 pagesCHAPTER-TWO PUBLIC REVENUEyebegashetNo ratings yet

- DRM Quiz2 AnswersDocument4 pagesDRM Quiz2 Answersde4thm0ng3rNo ratings yet

- II - 1 - Numerical Problems On National Income AccouningDocument13 pagesII - 1 - Numerical Problems On National Income AccouningSomya GuptaNo ratings yet

- Assignment #1 - 5064Document15 pagesAssignment #1 - 5064ShubhAm UpadhyayNo ratings yet

- Econ Chapter 3Document7 pagesEcon Chapter 3Kin LeeNo ratings yet

- Gains From International TradeDocument51 pagesGains From International Tradeitsmeprim100% (1)

- Leontief Input - Output ModelDocument7 pagesLeontief Input - Output ModelEKANSH DANGAYACH 20212619No ratings yet

- The Limited Value of The Historical Growth Experience: Differing Initial ConditionsDocument38 pagesThe Limited Value of The Historical Growth Experience: Differing Initial ConditionsBervin Jonh Espinosa100% (1)

- What is Finance in 40 CharactersDocument57 pagesWhat is Finance in 40 CharactersAndrea AlolorNo ratings yet

- Pure CompetitionDocument9 pagesPure Competitioncindycanlas_07No ratings yet

- Price EffectDocument6 pagesPrice EffectKarpagam MahadevanNo ratings yet

- Consumer Theory of Demand (Indifference Curve Analysis)Document32 pagesConsumer Theory of Demand (Indifference Curve Analysis)Breanna CampbellNo ratings yet

- Assignement - 2 Solution Masud RanaDocument16 pagesAssignement - 2 Solution Masud Ranaboom boomNo ratings yet

- 2013 01 12 Selected ExercisesDocument13 pages2013 01 12 Selected ExercisesSalehAbdallahNo ratings yet

- Concept of Short Run and Long Run in EconomicsDocument8 pagesConcept of Short Run and Long Run in EconomicsSagun P. PokharelNo ratings yet

- Classic Theories of Economic Development: 1) Linear Stages of Growth ModelDocument12 pagesClassic Theories of Economic Development: 1) Linear Stages of Growth ModelalyNo ratings yet

- Module 5: Theory and Policy of Urbanization and Rural-Urban MigrationDocument38 pagesModule 5: Theory and Policy of Urbanization and Rural-Urban MigrationAlyssa AlejandroNo ratings yet

- External Balance and Internal BalanceDocument4 pagesExternal Balance and Internal BalanceswatiNo ratings yet

- Lecture Notes - Welfare EconomicsDocument23 pagesLecture Notes - Welfare EconomicsJacksonNo ratings yet

- Answers OPERATIONDocument6 pagesAnswers OPERATIONAltea AroganteNo ratings yet

- Intro To Macroeconomics and GDP Problem Set Answer KeyDocument5 pagesIntro To Macroeconomics and GDP Problem Set Answer KeySid JhaNo ratings yet

- Chapter Four: Theory of Production and CostDocument33 pagesChapter Four: Theory of Production and CostfaNo ratings yet

- National IncomeDocument10 pagesNational IncomeSenthil Kumar GanesanNo ratings yet

- MCQ Revision Paper-Economic & ManagementDocument8 pagesMCQ Revision Paper-Economic & ManagementMohamed Musawir Nafees MohamedNo ratings yet

- Consumption Is An Increasing Function of IncomeDocument18 pagesConsumption Is An Increasing Function of IncomeRajesh Lamba100% (1)

- 4.application of Linear Equations in BusinessDocument11 pages4.application of Linear Equations in Businesszaheer9287No ratings yet

- Equilibrium in The Goods MarketDocument27 pagesEquilibrium in The Goods MarketPankaj Kumar BothraNo ratings yet

- Circular Flow of EconomyDocument19 pagesCircular Flow of EconomyAbhijeet GuptaNo ratings yet

- Ma Econ Pol 2Document81 pagesMa Econ Pol 2Edimarf SatumboNo ratings yet

- Overview of The National Service Training ProgramDocument21 pagesOverview of The National Service Training ProgramAprile Margareth HidalgoNo ratings yet

- Forms of Classical MusicDocument23 pagesForms of Classical MusicAprile Margareth HidalgoNo ratings yet

- Group Two - PCDocument11 pagesGroup Two - PCAprile Margareth HidalgoNo ratings yet

- Local and Global Communication in Multi-Cultural Settings: Presented By: Jessieca, Irish, and AprileDocument15 pagesLocal and Global Communication in Multi-Cultural Settings: Presented By: Jessieca, Irish, and AprileAprile Margareth HidalgoNo ratings yet

- Presentation by Group 2Document39 pagesPresentation by Group 2Aprile Margareth HidalgoNo ratings yet

- Universal / American Values: Presented By: Alondra Bantatua Aprile Margareth HidalgoDocument24 pagesUniversal / American Values: Presented By: Alondra Bantatua Aprile Margareth HidalgoAprile Margareth HidalgoNo ratings yet

- PreambleDocument1 pagePreambleAprile Margareth HidalgoNo ratings yet

- Universal Values KemeDocument2 pagesUniversal Values KemeAprile Margareth HidalgoNo ratings yet

- HEALTH (Injury)Document18 pagesHEALTH (Injury)Aprile Margareth HidalgoNo ratings yet

- Universal / American Values: Presented By: Alondra Bantatua Aprile Margareth HidalgoDocument24 pagesUniversal / American Values: Presented By: Alondra Bantatua Aprile Margareth HidalgoAprile Margareth HidalgoNo ratings yet

- Firms in Competitive MarketsDocument15 pagesFirms in Competitive MarketsAprile Margareth HidalgoNo ratings yet

- Morality and Ethics Are Terms Often Used As If They Have The Same MeaningDocument3 pagesMorality and Ethics Are Terms Often Used As If They Have The Same MeaningAprile Margareth HidalgoNo ratings yet

- Chapter Twenty-Eight: Game TheoryDocument81 pagesChapter Twenty-Eight: Game TheoryBibin BabyNo ratings yet

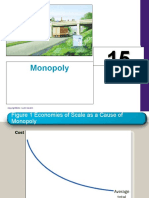

- MonopolyDocument15 pagesMonopolyAprile Margareth HidalgoNo ratings yet

- Chap11 MCDocument35 pagesChap11 MCAprile Margareth HidalgoNo ratings yet

- Demand Analysis Activity and Other ReadingsDocument3 pagesDemand Analysis Activity and Other ReadingsGennelyn Lairise RiveraNo ratings yet

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- Chap12 OLDocument34 pagesChap12 OLAprile Margareth HidalgoNo ratings yet

- CASE STUDY 1 Global WarmingDocument4 pagesCASE STUDY 1 Global WarmingGennelyn Lairise RiveraNo ratings yet

- Sales Promotion IBMDocument34 pagesSales Promotion IBMAprile Margareth HidalgoNo ratings yet

- MANAGERIAL ECONOMICS Lesson 1Document7 pagesMANAGERIAL ECONOMICS Lesson 1Gennelyn Lairise RiveraNo ratings yet

- Lesson 3Document40 pagesLesson 3Aprile Margareth HidalgoNo ratings yet

- Special Journals JessDocument13 pagesSpecial Journals JessAprile Margareth HidalgoNo ratings yet

- What Advice Would You Give To Monica?Document2 pagesWhat Advice Would You Give To Monica?Aprile Margareth HidalgoNo ratings yet

- Mas 8109 Decentralization - Performance - 20170623225858Document12 pagesMas 8109 Decentralization - Performance - 20170623225858Aprile Margareth HidalgoNo ratings yet

- C. Castro Company-Cdc 2018Document42 pagesC. Castro Company-Cdc 2018Gennelyn Lairise Rivera100% (1)

- Advertising: Alvarado, Jonalyn Apura, Janine-AnDocument54 pagesAdvertising: Alvarado, Jonalyn Apura, Janine-AnAprile Margareth HidalgoNo ratings yet

- Operations Management: An IntroductionDocument35 pagesOperations Management: An IntroductionAprile Margareth Hidalgo100% (1)

- PDF Transfer PricingDocument10 pagesPDF Transfer PricingAprile Margareth HidalgoNo ratings yet

- MANAGEMENT ADVISORY SERVICES REVIEW: Break Even Analysis, Sensitivity Analysis and LeverageDocument15 pagesMANAGEMENT ADVISORY SERVICES REVIEW: Break Even Analysis, Sensitivity Analysis and LeverageAprile Margareth Hidalgo0% (1)

- Specialty Fibers: Select SheetDocument4 pagesSpecialty Fibers: Select SheetсергейNo ratings yet

- Section 08500 - Windows: Whole Building Design Guide Federal Green Construction Guide For SpecifiersDocument7 pagesSection 08500 - Windows: Whole Building Design Guide Federal Green Construction Guide For SpecifiersAnonymous NMytbMiDNo ratings yet

- Cellulase ProductionDocument16 pagesCellulase ProductionTanvi JainNo ratings yet

- Sagrada Familia PDFDocument1 pageSagrada Familia PDFcristian1pNo ratings yet

- COPD medications and interventionsDocument34 pagesCOPD medications and interventionssaroberts2202100% (1)

- Icarus & DaedalusDocument2 pagesIcarus & DaedalusIsrael AsinasNo ratings yet

- HIST 1010 EXAM 3 TEST PREP (With Answers)Document2 pagesHIST 1010 EXAM 3 TEST PREP (With Answers)Ophelia ThorntonNo ratings yet

- 3-IBM-RB - Sales - Selling Ibm Innovative SolutionsDocument226 pages3-IBM-RB - Sales - Selling Ibm Innovative Solutionsjusak131No ratings yet

- Literature StudyDocument7 pagesLiterature StudySilver ShadesNo ratings yet

- Cissp NotesDocument83 pagesCissp NotesRobert Mota HawksNo ratings yet

- Lubricated Coupling TrainingDocument47 pagesLubricated Coupling TrainingTheerayootNo ratings yet

- Laptops and Desktop-MAY PRICE 2011Document8 pagesLaptops and Desktop-MAY PRICE 2011Innocent StrangerNo ratings yet

- Drill Pipe Performance DataDocument35 pagesDrill Pipe Performance DatasnatajNo ratings yet

- Project Management Remote ExamDocument4 pagesProject Management Remote ExamAnis MehrabNo ratings yet

- Hdpe Guide PDFDocument81 pagesHdpe Guide PDFbalotNo ratings yet

- Ingredient Branding: P. Kotler, Northwestern University, Evanston, USA W. Pfoertsch, China EuropeDocument1 pageIngredient Branding: P. Kotler, Northwestern University, Evanston, USA W. Pfoertsch, China EuropeCristea GianiNo ratings yet

- Unit 1Document32 pagesUnit 1Viyat RupaparaNo ratings yet

- Surgical Aspects of Pulmonary Infections: Kibrom Gebreselassie, MD, FCS-ECSA Cardiovascular and Thoracic SurgeonDocument60 pagesSurgical Aspects of Pulmonary Infections: Kibrom Gebreselassie, MD, FCS-ECSA Cardiovascular and Thoracic SurgeonVincent SerNo ratings yet

- WME01 01 Que 20220510Document15 pagesWME01 01 Que 20220510muhammad awaisNo ratings yet

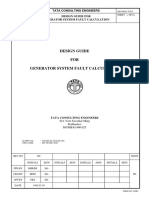

- Generator System Fault Calculation Design GuideDocument22 pagesGenerator System Fault Calculation Design Guidedheerajdorlikar100% (2)

- Cleaning Validation Master Plan PDFDocument9 pagesCleaning Validation Master Plan PDFBREWSKINo ratings yet

- Tafila Technical University Course Syllabus for Manufacturing Processes (1) / Metal CuttingDocument4 pagesTafila Technical University Course Syllabus for Manufacturing Processes (1) / Metal CuttingG. Dancer GhNo ratings yet

- Quality Control and Assurance Processes for Coffee ProductionDocument5 pagesQuality Control and Assurance Processes for Coffee ProductionSharifah NuruljannahNo ratings yet

- EOS Web and Multimedia L3Document53 pagesEOS Web and Multimedia L3ብርሃነ ኣፅብሃNo ratings yet

- 342 Mechanical and Fluid Drive Maintenance Course DescriptionDocument2 pages342 Mechanical and Fluid Drive Maintenance Course Descriptionaa256850No ratings yet

- Title of Training Presentation: Presented by Your NameDocument14 pagesTitle of Training Presentation: Presented by Your NameJudy UnreinNo ratings yet

- Karla Maganda PDFDocument29 pagesKarla Maganda PDFKalay Tolentino CedoNo ratings yet

- Maths English Medium 7 To 10Document13 pagesMaths English Medium 7 To 10TNGTASELVASOLAINo ratings yet

- 1 A Simulation Based Model For The BerthDocument9 pages1 A Simulation Based Model For The Berthmonu_vitsNo ratings yet

- Solar Bloc DatasheetDocument2 pagesSolar Bloc DatasheetandresNo ratings yet