Professional Documents

Culture Documents

10 Column Worksheet Template

10 Column Worksheet Template

Uploaded by

Emilia NatashaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Column Worksheet Template

10 Column Worksheet Template

Uploaded by

Emilia NatashaCopyright:

Available Formats

10-column worksheet template

Company name

Worksheet

For the year Ended

Balance Sheet

Unadjusted Adjusted Income & Statement

Trial Balance Adjustments Trial Balance Statement of Owner's Equity

Account Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Accumulated depreciation-

Equipment

Accounts Payable

Salaries payable

Unearned Revenue

Common Stock

Dividends

Service Revenue

Rent expense

Salaries Expense

Supplies expense

Depreciation expense

Insurance expense

Total

Net income/Loss 1 2 2 1

Total

Step 1 Undjusted trial balance - Trial balance is prepared by posting the balance of each accounts after all transaction entries (Before adjustments & closing) for period ended has been posted in each accounts

eg: Cash Accounst payable Prepaid insurance

10,000 2,000 3,000

Step 2 Adjustments - Adjusting entry is posted at year end. Adjusting entries are made for expired expenses which we prepaided, depreciation expenses for plant and machinerys, earned revenue

which we received in advance for the service to be performed, any expenses to be payable, any revenue which has to be receivable etc.

eg: Prepaid insurance got balance of 3000 which was prepaid on january 1 for three years, At year end, one year expired, so we have to pass entry for that

Insurance expense (3000/3) 1,000

Prepaid insurance 1,000

Step 3 Adjusted trial balance - Trial balance including the adjustment amounts.

eg: Cash Accounst payable Prepaid insurance Insurance expense

3,000 1,000 1,000

10,000 2,000 2,000

Step 4 Income statement - Only revenue and expenses are posted in income statement column from adjusted trial balance.

1) revenue > expenses, Difference should be in debit column (i.e Net income)

2) Expenses > revenue, Difference should be in credit column (i.e Net loss)

Step 5 Balance sheet - Assets, liabilities and equity should come in balance sheet from adjusted trial balance..

To tally the balance sheet, net income should be carried forward to credit side and if it is net loss, it should be carried forward to debit side of balance sheet to equal it.

Tutorial from:

www.studentpartnersite.com

You might also like

- Assignment 04 Cash Flow StatementDocument6 pagesAssignment 04 Cash Flow Statementumair iqbalNo ratings yet

- Excel As A Tool in Financial ModellingDocument5 pagesExcel As A Tool in Financial Modellingnikita bajpaiNo ratings yet

- Chapter 7 ReceivablesDocument87 pagesChapter 7 ReceivablesLEE WEI LONGNo ratings yet

- Financial Management and Accounting - 1Document26 pagesFinancial Management and Accounting - 1ssmodakNo ratings yet

- Bayer, George - Stock and Commodity Traders Hand-Book of Trend DeterminationDocument49 pagesBayer, George - Stock and Commodity Traders Hand-Book of Trend Determinationriri200410955288% (17)

- Adjusting Account, WORK SHEET-FINALDocument43 pagesAdjusting Account, WORK SHEET-FINALChowdhury Mobarrat Haider Adnan100% (1)

- Fairways v. Corp GovernanceDocument4 pagesFairways v. Corp GovernanceIsabella RodriguezNo ratings yet

- 6e ch08Document42 pages6e ch08Ever PuebloNo ratings yet

- Cash Flows AccountingDocument9 pagesCash Flows AccountingRosa Villaluz BanairaNo ratings yet

- Funds Flow Statements ProcessDocument10 pagesFunds Flow Statements ProcessNancy VermaNo ratings yet

- AisDocument7 pagesAisAnnaNo ratings yet

- Distinguish Between Cash Flow and Fund Flow StatementDocument3 pagesDistinguish Between Cash Flow and Fund Flow StatementSachin GodseNo ratings yet

- The Delphi Technique A Case StudyDocument3 pagesThe Delphi Technique A Case StudyFeisal Ramadhan MaulanaNo ratings yet

- Managing Finincial Principles & Techniques Ms - SafinaDocument22 pagesManaging Finincial Principles & Techniques Ms - SafinajojirajaNo ratings yet

- St-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsDocument13 pagesSt-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsGianfranco SpatolaNo ratings yet

- Unit # 4 Present Value For Cash FlowsDocument8 pagesUnit # 4 Present Value For Cash FlowsZaheer Ahmed SwatiNo ratings yet

- MC Case 1 - Mountain DewDocument1 pageMC Case 1 - Mountain DewkaranNo ratings yet

- Group Case 4 - Western Money Management Inc.Document8 pagesGroup Case 4 - Western Money Management Inc.HannahPojaFeriaNo ratings yet

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- Cornerstones of Cost Management, 3E: Process CostingDocument37 pagesCornerstones of Cost Management, 3E: Process CostingEhtesham HaqueNo ratings yet

- Wiley - Business Analytics The Art of Modeling With Spreadsheets, 5th Edition - 978-1-119-29833-5Document3 pagesWiley - Business Analytics The Art of Modeling With Spreadsheets, 5th Edition - 978-1-119-29833-5Farooq BarkatNo ratings yet

- Chapter 24 Homework SolutionsDocument18 pagesChapter 24 Homework Solutionslenovot61No ratings yet

- AT06 Further Audit Procedures (Substantive Procedures) PSA 520Document4 pagesAT06 Further Audit Procedures (Substantive Procedures) PSA 520John Paul SiodacalNo ratings yet

- New Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionDocument9 pagesNew Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionIleana StirbuNo ratings yet

- Partcost With Freight Table Rev. 7Document3 pagesPartcost With Freight Table Rev. 7RJLockNo ratings yet

- Inventory Management Basic ConceptsDocument10 pagesInventory Management Basic ConceptsTrisha Reman100% (3)

- Vicky Yang ThesisDocument75 pagesVicky Yang ThesisEmilia NatashaNo ratings yet

- Session 2 - by Catherine Rose Tumbali - PPTDocument25 pagesSession 2 - by Catherine Rose Tumbali - PPTCathy TumbaliNo ratings yet

- Axia College Material: Adjusting Entries, Posting, and Preparing An Adjusted Trial BalanceDocument8 pagesAxia College Material: Adjusting Entries, Posting, and Preparing An Adjusted Trial Balancetgibson621No ratings yet

- Starbucks Case Analysis Executive SummaryDocument18 pagesStarbucks Case Analysis Executive Summarysatesh singhNo ratings yet

- Budgeting Case Study Kraft PDFDocument2 pagesBudgeting Case Study Kraft PDFpoojahj100% (1)

- B Exercises: E3-1B (Transaction Analysis-Service Company)Document8 pagesB Exercises: E3-1B (Transaction Analysis-Service Company)Saleh RaoufNo ratings yet

- Soal P 7.2, 7.3, 7.5Document3 pagesSoal P 7.2, 7.3, 7.5boba milkNo ratings yet

- Lecture 9 M17EFA - Company Valuation 2 1Document48 pagesLecture 9 M17EFA - Company Valuation 2 1822407No ratings yet

- Week 4 Balance OffDocument16 pagesWeek 4 Balance OffNor LailyNo ratings yet

- Chapter 9 - Budgeting1Document27 pagesChapter 9 - Budgeting1Martinus WarsitoNo ratings yet

- Theoretical FrameworkDocument3 pagesTheoretical Frameworkm_ihamNo ratings yet

- Chapter 17 Notes INVESTMENTSDocument14 pagesChapter 17 Notes INVESTMENTSBusiness Administration DepartmentNo ratings yet

- CH 1 Assignment - An Overview of Financial Management PDFDocument13 pagesCH 1 Assignment - An Overview of Financial Management PDFPhil SingletonNo ratings yet

- Dupont Analysis: From Wikipedia, The Free EncyclopediaDocument3 pagesDupont Analysis: From Wikipedia, The Free Encyclopediacorporateboy36596No ratings yet

- Odev - Cash - Flow - and - Financial - Planning (1) - Fatih EkerDocument16 pagesOdev - Cash - Flow - and - Financial - Planning (1) - Fatih EkerfurkanNo ratings yet

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocument37 pagesAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Profit Planning: Budget - A Quantitative Plan For Acquiring and Using Resources Over A Specified Time PeriodDocument24 pagesProfit Planning: Budget - A Quantitative Plan For Acquiring and Using Resources Over A Specified Time PeriodDahlia Abiera OritNo ratings yet

- CH 01Document57 pagesCH 01junjjangieNo ratings yet

- Assignment No 2 BPDocument2 pagesAssignment No 2 BPBernadette AnicetoNo ratings yet

- BUSN1001 Tutorial Discussion Questions Week 6 - With AnswersDocument10 pagesBUSN1001 Tutorial Discussion Questions Week 6 - With AnswersXinyue Wang100% (1)

- Fsav 6e Test Bank Mod15 TF MC 102720Document21 pagesFsav 6e Test Bank Mod15 TF MC 102720pauline leNo ratings yet

- 6int 2011 Jun ADocument7 pages6int 2011 Jun AMuhmmad FahadNo ratings yet

- AISDocument2 pagesAISMichelle BabaNo ratings yet

- IAS 1 Presentation of Financial StatementsDocument23 pagesIAS 1 Presentation of Financial StatementsMinahilNo ratings yet

- Tsla Vs FordDocument5 pagesTsla Vs Fordapi-314942529No ratings yet

- Sample Mark Scheme Level 5 Effective Financial Management: Section A - 20 MarksDocument12 pagesSample Mark Scheme Level 5 Effective Financial Management: Section A - 20 MarksTheocryte SergeotNo ratings yet

- MGT 531Document5 pagesMGT 531rizwan aliNo ratings yet

- Financial Accounting AssignmentDocument2 pagesFinancial Accounting AssignmentAnip ShahNo ratings yet

- 7.2.8 Percentage-Of-Sales Method Worksheet and DiscussionDocument3 pages7.2.8 Percentage-Of-Sales Method Worksheet and DiscussionMikie AbrigoNo ratings yet

- Instructions SmithvilleDocument47 pagesInstructions SmithvilleDanielle Sullivan50% (4)

- Oracle Sales QuotaDocument21 pagesOracle Sales QuotaShehabAbdelhamidNo ratings yet

- Stryker LTP Final PaperDocument33 pagesStryker LTP Final Paperapi-239845860No ratings yet

- Federal Urdu University of Arts, Science and Technology, IslamabadDocument5 pagesFederal Urdu University of Arts, Science and Technology, IslamabadQasim Jahangir WaraichNo ratings yet

- Trade CreditDocument2 pagesTrade CreditTabbyPhotoNo ratings yet

- Sap For AltamDocument16 pagesSap For Altamzarfarie aron100% (1)

- Fixed Asset Accounting and ManagementDocument16 pagesFixed Asset Accounting and ManagementOni SegunNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- 10 Column Worksheet TemplateDocument3 pages10 Column Worksheet TemplatejepsyutNo ratings yet

- Fundamentals of ABM1 - Q4 - LAS1 DRAFTDocument17 pagesFundamentals of ABM1 - Q4 - LAS1 DRAFTSitti Halima Amilbahar AdgesNo ratings yet

- Advantages and Disadvantages of BioplasticDocument1 pageAdvantages and Disadvantages of BioplasticEmilia NatashaNo ratings yet

- Identify The Elements of Given Paragraph and Complete The TableDocument8 pagesIdentify The Elements of Given Paragraph and Complete The TableEmilia NatashaNo ratings yet

- Fortune 500 List Have 98 R&D Facilities in China and India. Some Have MoreDocument15 pagesFortune 500 List Have 98 R&D Facilities in China and India. Some Have MoreEmilia NatashaNo ratings yet

- Bbi 2001 Foundation English - SCL Worksheet Week 12 - Form: ScoreDocument14 pagesBbi 2001 Foundation English - SCL Worksheet Week 12 - Form: ScoreEmilia NatashaNo ratings yet

- Complete The Exercises in All of The Links BelowDocument1 pageComplete The Exercises in All of The Links BelowEmilia NatashaNo ratings yet

- Buku Teks Rujukan Pra Klinikal No. Discipline Book Author & EditionDocument1 pageBuku Teks Rujukan Pra Klinikal No. Discipline Book Author & EditionEmilia NatashaNo ratings yet

- Template AbstrakDocument1 pageTemplate AbstrakEmilia NatashaNo ratings yet

- Template AbstrakDocument1 pageTemplate AbstrakEmilia NatashaNo ratings yet

- Propagation of Rose (Rosa Hybrida L.) Under Tissue Culture TechniqueDocument5 pagesPropagation of Rose (Rosa Hybrida L.) Under Tissue Culture TechniqueEmilia NatashaNo ratings yet

- Assessing The Zero Hunger Target Readine PDFDocument15 pagesAssessing The Zero Hunger Target Readine PDFEmilia NatashaNo ratings yet

- Assessing The Zero Hunger Target Readiness in Africa in The Face of COVID-19 PandemicDocument20 pagesAssessing The Zero Hunger Target Readiness in Africa in The Face of COVID-19 PandemicEmilia NatashaNo ratings yet

- Number Answer Number Answer 1.: Bbi 2001 Foundation English - SCL Worksheet Week 10 - FormDocument1 pageNumber Answer Number Answer 1.: Bbi 2001 Foundation English - SCL Worksheet Week 10 - FormEmilia NatashaNo ratings yet

- Bbi 2001 Foundation English - SCL Worksheet Week 4 - Form: ScoreDocument1 pageBbi 2001 Foundation English - SCL Worksheet Week 4 - Form: ScoreEmilia NatashaNo ratings yet

- Ken Foundation'S Scholarship 2019: Eligibility Field or StudyDocument1 pageKen Foundation'S Scholarship 2019: Eligibility Field or StudyEmilia NatashaNo ratings yet

- OH S Quiz-TAMloginDocument2 pagesOH S Quiz-TAMloginsethtwardNo ratings yet

- Research Paper Topics On Supply Chain ManagementDocument8 pagesResearch Paper Topics On Supply Chain Managementgz46ktxrNo ratings yet

- Ch10 Returns & Risk 2020 Corporate Prof - KhaledDocument18 pagesCh10 Returns & Risk 2020 Corporate Prof - KhaledMhmood Al-saadNo ratings yet

- Investment Banking ProjectDocument29 pagesInvestment Banking ProjectAkshay BoteNo ratings yet

- DGM Marble Manufacturing: Property of STIDocument2 pagesDGM Marble Manufacturing: Property of STIGoose ChanNo ratings yet

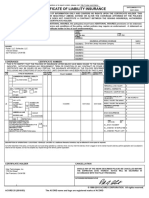

- NJ Coi Eats 20240301Document4 pagesNJ Coi Eats 20240301ibrahimyousef555No ratings yet

- ManagerzzDocument14 pagesManagerzzMittal Kirti MukeshNo ratings yet

- Ajmi Flour Mills (India) Private LimitedDocument6 pagesAjmi Flour Mills (India) Private LimitedBiju DivakaranNo ratings yet

- MKUKUTA SimplifiedDocument57 pagesMKUKUTA Simplifiedhst939100% (2)

- Accounts Paper Fy Bcom BAF BMS BBIDocument2 pagesAccounts Paper Fy Bcom BAF BMS BBIAkki GalaNo ratings yet

- Structured Finance: Benefits, Examples of Structured FinancingDocument10 pagesStructured Finance: Benefits, Examples of Structured FinancingsfNo ratings yet

- UNCDF Myanmar Towards Gender-Smart Microfinance Product Development and Enterprise LendingDocument44 pagesUNCDF Myanmar Towards Gender-Smart Microfinance Product Development and Enterprise LendingYar LayNo ratings yet

- Questionnaire Ankita KohliDocument4 pagesQuestionnaire Ankita KohliDona BanerjeeNo ratings yet

- Business CanvasDocument3 pagesBusiness CanvasPrathmeshBhokariNo ratings yet

- Preparing Adjusting EntriesDocument6 pagesPreparing Adjusting EntriesRey ArellanoNo ratings yet

- Table ofDocument17 pagesTable ofSwethaNo ratings yet

- Downloads CIEL Textile Annual Report 2012Document120 pagesDownloads CIEL Textile Annual Report 2012rahulvaliya0% (1)

- Gabriel Álvarez Cambronero: EducationDocument2 pagesGabriel Álvarez Cambronero: EducationGabriel Alvarez CambroneroNo ratings yet

- What Is Service Design-51 80Document30 pagesWhat Is Service Design-51 80Jose Vidal SalcedoNo ratings yet

- InvoiceDocument1 pageInvoiceSdeviitr11 KumarNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthJennylyn MontesaNo ratings yet

- Job Analysis - HRM - Sem 2 - Jaydeep RaoDocument5 pagesJob Analysis - HRM - Sem 2 - Jaydeep RaoMuskan MeghaniNo ratings yet

- A Summer Training Project Report On "Business Development On Online Food Ordering"Document6 pagesA Summer Training Project Report On "Business Development On Online Food Ordering"pmcmbharat264100% (1)

- This Study Resource Was: Asian Academy For Excellence Foundation, IncDocument5 pagesThis Study Resource Was: Asian Academy For Excellence Foundation, IncAnne Marieline BuenaventuraNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentImtiaz AhmadNo ratings yet

- Engaging The Global Countryside WoodsDocument25 pagesEngaging The Global Countryside WoodsRaluca TatianaNo ratings yet