Professional Documents

Culture Documents

Disadvantages of A Lockboxes

Uploaded by

Tk KimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Disadvantages of A Lockboxes

Uploaded by

Tk KimCopyright:

Available Formats

Lockboxes can be relatively costly.

The banks typically earn a fixed setup and continuous

monthly fee for each lockbox. They also charge a service / transaction fee for each payment

processed. As with many banking pricing models, their rate sheets are usually complicated

and hard to read. Typical lockbox candidates are processing many thousands of checks a

month so these minute charges that you see on the front end of signing up for the service,

end up adding up quickly. This is because while the bank maybe more efficient than your

own back office, they still are relying on a fair degree of manual effort and labor costs.

Lockboxes can have security concerns. Because lockboxes still require tedious manual

processing, many of the staff at banks that are responsible for the data entry are new to the

bank or are offshore contractors. The information from a lockbox payment provides all of

the necessary components needed to counterfeit a check. And the volume of lockbox

payments is usually so high that it becomes relatively easy to slip a fraudulent check

amongst many good payments. With these dangerous combinations, a criminal can exploit

both vulnerable process and personnel...not to mention that with any manual task, comes

margin for error - and when it comes to getting paid, a grantees leniency for oversight is

minimal; fraud or even a slight blunder has potential to tarnish business to business

relationships.

Lockboxes are still slow. While it's true a lockbox can be faster than a check sent to directly

to your organization, lockboxes are not a digital or electronic process. This means that while

they may lesson the time that a check is in the mail, they don't eliminate the time a check is

the mail. Further because the check still must be deposited and processed (albeit by a bank

employee), the funds are not available in real-time.

Lockboxes don't tie into your system. While Lockbox reports can certainly be sent to your

finance team, and your ERP system is aware of the deposits, an automatic matching of the

customer information at the time of payment to the information stored in your CRM & ERP

systems is unlikely to magically happen. Instead back-office teams sill likely need to reconcile

the deposit to the information in their system of record.

Lockboxes don't account for other payment types. Most business accept forms of payments

other than checks. Lockbox services do not directly integrate with payment methods such as

cards, ACH, EDI, or newer Internet based digital payment rails such as eCheck. This adds

complexity in a receivable process running different systems for different payment methods.

Lockboxes are becoming inconvenient for your customer's AP department. Many AP

departments are modernizing their invoice & payment process to reduce the number of

physical checks they have to manually cut & process. With commercial spend cards,

payment virtual cards, ACH, EDI & direct bank transfer all rapidly growing as preferred

methods for the AP department to improve efficiency, business process and security,

lockboxes ability to completely serve the customers payable team is fast on the decline,

making the Lockbox Service an antiquated one.

Electronic Lockbox Payments

An electronic lockbox service replaces the physical address of a traditional lockbox with a

digital web address and replaces paper checks with electronic forms of payments such as

eChecks, ACH, debit cards, credit cards and electronic bank transfers. These electronic

lockboxes are a natural evolution of physical lockboxes and aim to further improve

receivables in speed, security, efficiency and cost. We explore more about how electronic

lockboxes work in our part 2 of our Lockbox Guide:

You might also like

- Electronic Payment System Digital Cash, Plastic Card, PSO and PSP Sept 2023Document16 pagesElectronic Payment System Digital Cash, Plastic Card, PSO and PSP Sept 2023Meraj TalukderNo ratings yet

- E-Banking Opportunities and GuidelinesDocument14 pagesE-Banking Opportunities and GuidelinesAnonymous 22GBLsme1No ratings yet

- 4600 20180824 StatementDocument4 pages4600 20180824 StatementAnanda WijayaratnaNo ratings yet

- National Check Fraud Center Lock Box BankingDocument2 pagesNational Check Fraud Center Lock Box Bankingasrinu88881125No ratings yet

- Auditing and AssuranceDocument509 pagesAuditing and AssuranceSrinivasa Rao Bandlamudi80% (10)

- Procedure in Computing Vanishing DeductionDocument5 pagesProcedure in Computing Vanishing DeductionDon Tiansay100% (5)

- Electronic Payment SystemsDocument36 pagesElectronic Payment SystemsSaurabh G82% (11)

- Moving To E-PaymentsDocument8 pagesMoving To E-PaymentsJulieth Alejandra Vargas OchoaNo ratings yet

- American Express - BS 2019Document1 pageAmerican Express - BS 2019Max PatelNo ratings yet

- Chapter 21 Accounting For Non Profit OrganizationsDocument21 pagesChapter 21 Accounting For Non Profit OrganizationsHyewon100% (1)

- Electronic Payment SystemDocument23 pagesElectronic Payment SystemRonak Jain90% (10)

- Payment Gateway Essentials for Ecommerce SecurityDocument3 pagesPayment Gateway Essentials for Ecommerce Securitysachin sandbhorNo ratings yet

- qFKyxeZz 1Document7 pagesqFKyxeZz 1Rudi RepriadiNo ratings yet

- Everything You Need to Know About Electronic BankingDocument8 pagesEverything You Need to Know About Electronic BankingKarlene BacorayoNo ratings yet

- AP Process Automation WP 2284450Document10 pagesAP Process Automation WP 2284450HeroanNo ratings yet

- Auditing and AssuranceDocument23 pagesAuditing and AssuranceTk KimNo ratings yet

- Corporate LiquidationDocument2 pagesCorporate LiquidationTk KimNo ratings yet

- SWIFT FIN Payment Format Guide For European AcctsDocument19 pagesSWIFT FIN Payment Format Guide For European AcctsShivaji ManeNo ratings yet

- Unit-4.4-Payment GatewaysDocument8 pagesUnit-4.4-Payment GatewaysShivam SinghNo ratings yet

- CHAPTER 2 Caselette - Correction of ErrorsDocument37 pagesCHAPTER 2 Caselette - Correction of Errorsmjc24100% (4)

- E PaymentDocument8 pagesE PaymentPrashant SinghNo ratings yet

- IDM - E-Commerce - Payment Systems & SEODocument33 pagesIDM - E-Commerce - Payment Systems & SEOBhaswati PandaNo ratings yet

- Paypal Borderless Commerce Report 2021Document93 pagesPaypal Borderless Commerce Report 2021gauravc99No ratings yet

- Taxation Quizzer PDFDocument61 pagesTaxation Quizzer PDFPrince Guese86% (7)

- Natwest StatementDocument2 pagesNatwest Statementshahid2opu100% (2)

- ELECTRONIC PAYMENT SYSTEMS GUIDEDocument47 pagesELECTRONIC PAYMENT SYSTEMS GUIDEMilan Jain100% (1)

- Biztech SampleDocument4 pagesBiztech SamplesaimaNo ratings yet

- EY Fintech Ecosystem PlaybookDocument56 pagesEY Fintech Ecosystem PlaybookkwokNo ratings yet

- Accept Electronic Checks - E-Check Your Way to Another Form of PaymentDocument15 pagesAccept Electronic Checks - E-Check Your Way to Another Form of PaymentArun KolkarNo ratings yet

- E-Cheque in E-CommerceDocument22 pagesE-Cheque in E-CommerceSaran KumarNo ratings yet

- Lecture 10Document21 pagesLecture 10Rehan UllahNo ratings yet

- Cash AppsDocument10 pagesCash AppsShameera BegamNo ratings yet

- Secure Payment GatewayDocument3 pagesSecure Payment GatewayGul-e-hasnain WaseemNo ratings yet

- 3RD SemDocument34 pages3RD SemMohan kumar K.SNo ratings yet

- SSRN Id1446029Document5 pagesSSRN Id1446029Warranty KiaNo ratings yet

- E ChequeDocument5 pagesE ChequedeivaramNo ratings yet

- Banking Customer SatisfactionDocument34 pagesBanking Customer SatisfactionMohan kumar K.SNo ratings yet

- E-Banking or Online BankingDocument35 pagesE-Banking or Online BankingMohan kumar K.SNo ratings yet

- BBA-VI Semester BBAN606 Fundamental of E-Commerce Unit Iii NotesDocument16 pagesBBA-VI Semester BBAN606 Fundamental of E-Commerce Unit Iii NotesIsha BhatiaNo ratings yet

- 1stassignment of E-Commerce (Hema)Document29 pages1stassignment of E-Commerce (Hema)Abhishek GargNo ratings yet

- EFT1Document4 pagesEFT1AtharvaNo ratings yet

- Debate NotesDocument2 pagesDebate NotesByenz Hanerie JimenezNo ratings yet

- E-Commerce and Its Application: Unit-IVDocument37 pagesE-Commerce and Its Application: Unit-IVVasa VijayNo ratings yet

- Advantages of Online Banking for Customers and BanksDocument4 pagesAdvantages of Online Banking for Customers and BanksciwanroNo ratings yet

- Electronic Cash1Document4 pagesElectronic Cash1AtharvaNo ratings yet

- Electronic ChequesDocument4 pagesElectronic ChequesAtharvaNo ratings yet

- Chapter 2 Analysis Stage Online Bill Payment System Ver 2.0Document18 pagesChapter 2 Analysis Stage Online Bill Payment System Ver 2.0Mmoloki KaisaraNo ratings yet

- Lockbox SystemDocument7 pagesLockbox SystemnivethaNo ratings yet

- Dragonpay PS APIDocument23 pagesDragonpay PS APIwhittakersharoNo ratings yet

- Automation of Trade SettlementDocument7 pagesAutomation of Trade SettlementSasquatchNo ratings yet

- Evaluating and Managing Receivables Risk PDFDocument3 pagesEvaluating and Managing Receivables Risk PDFasadmir01No ratings yet

- E-Payment SystemDocument13 pagesE-Payment SystemDr. Azhar Ahmed SheikhNo ratings yet

- Decoding Card on File Tokenization and Accepting Credit Card Payments OnlineDocument6 pagesDecoding Card on File Tokenization and Accepting Credit Card Payments OnlineRahul Gupta RoyNo ratings yet

- E-Business Application: Benefits of E-Cash, E-Cheque and Smart CardsDocument21 pagesE-Business Application: Benefits of E-Cash, E-Cheque and Smart CardsYashi BokreNo ratings yet

- Electronic BankingDocument8 pagesElectronic BankingBatch 27No ratings yet

- Im Mini ProjectDocument10 pagesIm Mini Projectsrividya balajiNo ratings yet

- E-Payment Systems ExplainedDocument10 pagesE-Payment Systems ExplainedAakash RegmiNo ratings yet

- Unit Iv (Foit)Document48 pagesUnit Iv (Foit)varsha.j2177No ratings yet

- E-Comm 4Document14 pagesE-Comm 4Kanika GoelNo ratings yet

- Electronic Payment Systems: An OverviewDocument6 pagesElectronic Payment Systems: An OverviewKirti ParkNo ratings yet

- Advantages of E-BankingDocument3 pagesAdvantages of E-Bankingbenjie monasqueNo ratings yet

- E-payments: Credit Cards on the Internet Remain Unchanged Since 1980sDocument10 pagesE-payments: Credit Cards on the Internet Remain Unchanged Since 1980sFlaviub23No ratings yet

- ecomm ass1Document9 pagesecomm ass1SimbisoNo ratings yet

- A Review: Secure Payment System For Electronic TransactionDocument8 pagesA Review: Secure Payment System For Electronic Transactioneditor_ijarcsseNo ratings yet

- SR No Topic No: Data InterpretationDocument38 pagesSR No Topic No: Data Interpretationkunal detkeNo ratings yet

- Payment Gateway ThesisDocument5 pagesPayment Gateway Thesiskaraliuerie100% (2)

- Types of E-Commerce: B2B, B2C, C2C, C2B, C2A and B2A Models ExplainedDocument3 pagesTypes of E-Commerce: B2B, B2C, C2C, C2B, C2A and B2A Models Explainedally jumanneNo ratings yet

- Computer Banking: E - BankingDocument14 pagesComputer Banking: E - BankingMALKANI DISHA DEEPAKNo ratings yet

- Management of Float 4.1 Speeding Up CollectionsDocument5 pagesManagement of Float 4.1 Speeding Up CollectionsTanu YadavNo ratings yet

- Ecash: What Is E-Cash?Document6 pagesEcash: What Is E-Cash?Aarchi MaheshwariNo ratings yet

- Research Paper On Electronic Fund TransferDocument4 pagesResearch Paper On Electronic Fund Transferwzsatbcnd100% (1)

- Online Trade Finance - Future Prospects: Monitoring and CollectioDocument4 pagesOnline Trade Finance - Future Prospects: Monitoring and CollectioMeher Pramod MantravadiNo ratings yet

- FinalONLINE TRANSACTION INDEXDocument2 pagesFinalONLINE TRANSACTION INDEXLaraya, Roy MatthewNo ratings yet

- Accounting For Special Transactions: Welcome To The New School Year 2020-2021Document26 pagesAccounting For Special Transactions: Welcome To The New School Year 2020-2021cpacpacpa100% (1)

- Presentation 1Document4 pagesPresentation 1Tk KimNo ratings yet

- At 8503Document12 pagesAt 8503Tk KimNo ratings yet

- Types of ResearchDocument1 pageTypes of ResearchTk KimNo ratings yet

- FCL Midterm WPS OfficeDocument7 pagesFCL Midterm WPS OfficeTk KimNo ratings yet

- Make or BuyDocument2 pagesMake or BuytheswingineerNo ratings yet

- Term Paper Digital Marketing Term PaperDocument4 pagesTerm Paper Digital Marketing Term PaperJonathan Jezreel InocencioNo ratings yet

- Afar SolutionDocument2 pagesAfar SolutionTk KimNo ratings yet

- 2011 Bar ExamDocument139 pages2011 Bar ExamLarry BugaringNo ratings yet

- Annualreport 2019Document308 pagesAnnualreport 2019ziven zhangNo ratings yet

- Selective testing techniquesDocument4 pagesSelective testing techniquesTk KimNo ratings yet

- Far 01Document1 pageFar 01Tk KimNo ratings yet

- Marks: Taxation (Pakistan) and Marking SchemeDocument2 pagesMarks: Taxation (Pakistan) and Marking SchemeTk KimNo ratings yet

- Chapter 1 Why Study Money, Banking, and Financial Markets?Document23 pagesChapter 1 Why Study Money, Banking, and Financial Markets?oliviaNo ratings yet

- Types of LayoutDocument52 pagesTypes of LayoutTk KimNo ratings yet

- QUIZ 2 - ESTATE TAX (Late Quiz)Document3 pagesQUIZ 2 - ESTATE TAX (Late Quiz)Tk KimNo ratings yet

- A. Condonation or Remission of A DebtDocument3 pagesA. Condonation or Remission of A DebtTk KimNo ratings yet

- SW#1 - Specialized IndustriesDocument1 pageSW#1 - Specialized IndustriesTk KimNo ratings yet

- Budgeting Process ReviewerDocument3 pagesBudgeting Process ReviewerTk KimNo ratings yet

- D2 Drill (Tax - Afar.masDocument3 pagesD2 Drill (Tax - Afar.masTk KimNo ratings yet

- QUIZ 2 - ESTATE TAX (Late Quiz)Document3 pagesQUIZ 2 - ESTATE TAX (Late Quiz)Tk KimNo ratings yet

- Quiz-1Document2 pagesQuiz-1Tk KimNo ratings yet

- Estate Taxation - Filing and PaymentDocument10 pagesEstate Taxation - Filing and PaymentTk KimNo ratings yet

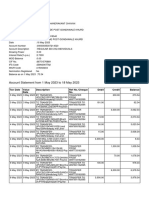

- Note: Posted Transactions Until The Last Working Day Are ShownDocument5 pagesNote: Posted Transactions Until The Last Working Day Are ShownKaleem AhmadNo ratings yet

- IR Subscription-Form PrepaidDocument2 pagesIR Subscription-Form PrepaidTouseefSayfullahNo ratings yet

- PNZ Device RegisterDocument15 pagesPNZ Device RegisterdejavueNo ratings yet

- Account PaymentDocument66 pagesAccount PaymentSpawn CyberNo ratings yet

- A/c Hoglo (876: AdjustmentDocument1 pageA/c Hoglo (876: AdjustmentUshat KanharNo ratings yet

- Phung Van Cung: Spend Account StatementDocument2 pagesPhung Van Cung: Spend Account StatementhienvvuNo ratings yet

- Account Statement and Loan Details for M/S. Harsiddh Engineering CoDocument2 pagesAccount Statement and Loan Details for M/S. Harsiddh Engineering CoSanjayNo ratings yet

- Nikhil CDocument3 pagesNikhil CRushikesh KhadeNo ratings yet

- CA CPT Fundamentals of Accounting PPT Bills of Exchange and Promissory Notes Part 1Document21 pagesCA CPT Fundamentals of Accounting PPT Bills of Exchange and Promissory Notes Part 1Palani Muthusamy100% (1)

- Crypto The Future of MoneyDocument13 pagesCrypto The Future of Moneyapi-597476436No ratings yet

- SC 631019357 Rev 1 - Price Item 1 & 2 RevisionDocument3 pagesSC 631019357 Rev 1 - Price Item 1 & 2 RevisionVenu Gopal SistlaNo ratings yet

- PPRO Product ListDocument22 pagesPPRO Product ListPushpa ValliNo ratings yet

- 4-30106C2P LP51021 CRYPT2Pay CRYPT2Protect Security Policy V2.2-1554489077.52112-DN PDFDocument87 pages4-30106C2P LP51021 CRYPT2Pay CRYPT2Protect Security Policy V2.2-1554489077.52112-DN PDFRifat Hasif PutrafebrianNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument29 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceawadhNo ratings yet

- Laporan Donasi Dakwah SurauTV 2019-2020 PDFDocument153 pagesLaporan Donasi Dakwah SurauTV 2019-2020 PDFZeniana RahayuNo ratings yet

- Bank StatementsDocument8 pagesBank StatementsMylene SantiagoNo ratings yet

- Payment Details: Telegraphic Transfer Instruction 电汇指示Document2 pagesPayment Details: Telegraphic Transfer Instruction 电汇指示Benedict Wong Cheng WaiNo ratings yet

- Fintech Regulation in AfricaDocument4 pagesFintech Regulation in AfricaChiomaNo ratings yet

- 1711087820916iifk3tRuaIZUbEyyDocument3 pages1711087820916iifk3tRuaIZUbEyyashutoshbbk786No ratings yet

- CCMT ProcedureDocument2 pagesCCMT ProcedureswapnilNo ratings yet

- Opportunities and Challenges of E - Payment System in IndiaDocument9 pagesOpportunities and Challenges of E - Payment System in IndiaSUJITH THELAPURATHNo ratings yet

- Statements Download 20231023194833Document2 pagesStatements Download 20231023194833martinsalexander489No ratings yet