Professional Documents

Culture Documents

IAS 36 - Impairment of Asset - Case Study 1

Uploaded by

CavipsotOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 36 - Impairment of Asset - Case Study 1

Uploaded by

CavipsotCopyright:

Available Formats

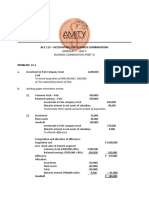

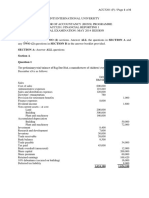

Case study 1 [p 492]

Magenta Ltd has two divisions, Turquoise and Pink, each of which is a separate cash-

generating unit. Magenta Ltd adopts a decentralised management approach whereby unit

managers are expected to operate their units. However, there is one corporate asset, the

information technology network to the company as a whole. The information technology

network is not a depreciable asset.

At 30 June 2010, the net assets of each division, including its allocated share of the

information technology network, were as follows

Turquoise Pink

Information technology network $ 284 000 $ 116 000

Land 450 000 290 000

Plant (20% p.a. straight-line depreciation) 1 310 000 960 000

Accumulated depreciation (917 000) (384 000)

Goodwill 46 000 32 000

Patent (10% straight-line amortisation) 210 000 255 000

Accumulated amortisation – patent (21 000) (102 000)

Cash 20 000 12 000

Inventory 120 000 80 000

Receivables 34 000 40 000

Liabilities (276 000) (189 000)

Net assets 1 260 000 1 110 000

Additional information as at 30 June 2010:

Turquoise land had a fair value less costs to sell of $437 000

Pink patent had acarrying amount below fair value less costs to sell

Pink plant had a fair value less costs to sell of $540 000

Receivables were considered to be collectable

The IT network is not depreciated, as it is assumed to have an indefinite life.

Magenta Ltd’s management undertook impairment testing at 30 June 2010 and

determined the recoverable amount of each cash-generating unit to be: $1 430 000 for

Turquoise and $1 215 000 for Pink

Required

Prepare any journal entries necessary to record the results of the impairment testing for each

of the CGUs.

You might also like

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Impairment of AssetDocument2 pagesImpairment of AssetQuỳnhNo ratings yet

- IAS 36 - Impairment of Asset - Case StudyDocument3 pagesIAS 36 - Impairment of Asset - Case StudyKim TiênNo ratings yet

- Week 11 Tutorial QuestionsDocument2 pagesWeek 11 Tutorial QuestionsMi ThaiNo ratings yet

- Accounting GovernmentDocument21 pagesAccounting GovernmentJolianne SalvadoOfcNo ratings yet

- P2-22, 28, 32Document8 pagesP2-22, 28, 32jyraEB9390No ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Homework - WaterkloofDocument3 pagesHomework - WaterkloofIrfaan CassimNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- Group RepoprtingDocument3 pagesGroup RepoprtingPaulNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Lecture Notes - Dash 1 Oct 23Document16 pagesLecture Notes - Dash 1 Oct 23だみNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- Downloaded by Rheigne Maxxene Gana Maglente (422000758@ntc - Edu.ph)Document7 pagesDownloaded by Rheigne Maxxene Gana Maglente (422000758@ntc - Edu.ph)RheigneNo ratings yet

- Downloaded by Rheigne Maxxene Gana Maglente (422000758@ntc - Edu.ph)Document7 pagesDownloaded by Rheigne Maxxene Gana Maglente (422000758@ntc - Edu.ph)RheigneNo ratings yet

- PROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan IDocument4 pagesPROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan Izsaw zsawNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Profe03 Activity Chapter 7Document5 pagesProfe03 Activity Chapter 7eloisa celisNo ratings yet

- Trial Balance As On 31Document3 pagesTrial Balance As On 31Lipson ThomasNo ratings yet

- Activity 2 - Spoke and WheelDocument5 pagesActivity 2 - Spoke and WheelSze ChristienyNo ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- Impairment ExerciseDocument3 pagesImpairment ExerciseAfif AsnawiNo ratings yet

- CRANBERRY PLC Scenario Chapter 12Document3 pagesCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Financial Reporting and Analysis Final OSADocument9 pagesFinancial Reporting and Analysis Final OSATracy-lee JacobsNo ratings yet

- Chap 14 3-6Document4 pagesChap 14 3-6Buenaventura, Lara Jane T.No ratings yet

- 20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Document3 pages20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Takudzwa LanceNo ratings yet

- Exam 5 May 2011, Answers Exam 5 May 2011, AnswersDocument10 pagesExam 5 May 2011, Answers Exam 5 May 2011, AnswerscandiceNo ratings yet

- SeatworkDocument10 pagesSeatworkRochelle Mae DiestroNo ratings yet

- Assignment IV Advanced Financial Accounting Chapter 4&5Document6 pagesAssignment IV Advanced Financial Accounting Chapter 4&5Lidya AberaNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Acc 113 - Accounting For Business CombinationsDocument8 pagesAcc 113 - Accounting For Business CombinationsAlthea CagakitNo ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- Acaccountancy and Advanced AccounatcnyDocument323 pagesAcaccountancy and Advanced AccounatcnyAayush GhdoliyaNo ratings yet

- Of Financial PositionDocument3 pagesOf Financial PositionIrah LouiseNo ratings yet

- Project in Government Accounting and Accounting FoDocument11 pagesProject in Government Accounting and Accounting FoRosy MoradosNo ratings yet

- Full Download Advanced Accounting 4th Edition Jeter Solutions ManualDocument35 pagesFull Download Advanced Accounting 4th Edition Jeter Solutions Manualjacksongubmor100% (36)

- 3analysis of Financial StatementDocument29 pages3analysis of Financial StatementRichard David SondaNo ratings yet

- Co Accg 1 - Tut QN - Oct 2022Document10 pagesCo Accg 1 - Tut QN - Oct 2022Xuan Hui LohNo ratings yet

- Cashflow Statements IAS 7 - P4Document10 pagesCashflow Statements IAS 7 - P4Vardhan Chulani100% (1)

- Test 1 - 2022 08 17Document3 pagesTest 1 - 2022 08 17MiclczeeNo ratings yet

- Problem Relates To A Chapter AppendixDocument15 pagesProblem Relates To A Chapter AppendixsameerNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- Solution Practice 9 Business Combinations and ImpairmentDocument8 pagesSolution Practice 9 Business Combinations and ImpairmentGuinevereNo ratings yet

- Government Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BDocument10 pagesGovernment Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BRacelle FlorentinNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Module 3Document17 pagesModule 3Alpha RamoranNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Final Accounts ProblemsDocument7 pagesFinal Accounts ProblemsTushar SahuNo ratings yet

- Financial Reporting in Hyperinflationary Economies: AssetsDocument4 pagesFinancial Reporting in Hyperinflationary Economies: AssetsKian GaboroNo ratings yet

- Illustration Financial Reptg. in HyperinflationaryDocument4 pagesIllustration Financial Reptg. in HyperinflationaryKian GaboroNo ratings yet

- AFA IIP.L IIIQuestion June 2016Document4 pagesAFA IIP.L IIIQuestion June 2016HossainNo ratings yet

- Assignment 1 Fall 2017Document3 pagesAssignment 1 Fall 2017YaseenTamerNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Worksheet - cashflowIAL CHAPTERWISE WORKSHEET QPDocument25 pagesWorksheet - cashflowIAL CHAPTERWISE WORKSHEET QPAsifulNo ratings yet

- Practice Question Bells LTD LTDDocument2 pagesPractice Question Bells LTD LTDShaikh Hafizur RahmanNo ratings yet

- Wo - Repaid Oxpenses: Schedule/ 9tatememtDocument19 pagesWo - Repaid Oxpenses: Schedule/ 9tatememtThe BadinageNo ratings yet

- Final Exam Intermediate Acctg. 3 Copy of Long ProblemsDocument3 pagesFinal Exam Intermediate Acctg. 3 Copy of Long ProblemsFerlyn Trapago ButialNo ratings yet

- Introduce Gia YếnDocument2 pagesIntroduce Gia YếnCavipsotNo ratings yet

- Toeic Answer Sheet - ORI TOEICDocument2 pagesToeic Answer Sheet - ORI TOEICCavipsotNo ratings yet

- T9 1 IAS 37 - 2016 - RevisedDocument49 pagesT9 1 IAS 37 - 2016 - RevisedCavipsotNo ratings yet

- T8. IAS 36 - 2016 - RevisedDocument34 pagesT8. IAS 36 - 2016 - RevisedCavipsotNo ratings yet

- T1 - KMLT 2015 - ThanhDocument35 pagesT1 - KMLT 2015 - ThanhCavipsotNo ratings yet

- Topic 5 - Presentation of FS (IAS 1)Document50 pagesTopic 5 - Presentation of FS (IAS 1)CavipsotNo ratings yet

- Topic 4 - Events After Reporting Period (IAS 10)Document15 pagesTopic 4 - Events After Reporting Period (IAS 10)CavipsotNo ratings yet

- T3. PPE - Case Study 1Document2 pagesT3. PPE - Case Study 1CavipsotNo ratings yet