Professional Documents

Culture Documents

China US Trade War To Cost PDF

China US Trade War To Cost PDF

Uploaded by

Quan Bao NguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

China US Trade War To Cost PDF

China US Trade War To Cost PDF

Uploaded by

Quan Bao NguyenCopyright:

Available Formats

opinion

By Peter Fabricius

POLITICAL ECONOMY

China, US trade war to cost

South Africa jobs

“w

New tariffs imposed by US president Donald Trump in the trade war between the US and China could

result in thousands of job losses in the steel and aluminium industries.

hen the elephants fight, the ants take a pounding,” about 85% of the 1 333 Chinese products that the US targeted on 3 April,

said trade and industry minister Rob Davies in “are intermediate inputs and capital goods, so the tariffs would damage

March about the rising tensions of a possible trade American companies’ supply chains and competitiveness in making

war between the US and China. goods and services to sell in the US and the world”.

He was sure that South Africa wasn’t in any country’s sights in such a Van Staden says the upward spiral of input costs in a global trade

war. But it could suffer considerable collateral damage nonetheless. war among economic giants would hurt SA likewise, mainly its vehicle

Trump fired the opening shots on 22 January by approving global assemblers and other manufacturers.

safeguard tariffs on $8.5bn in imports of solar panels and $1.8bn of Nedbank economists Nicky Weimar and Dennis Dykes warned on

washing machine imports. Then, on 1 March, he announced tariffs of 10 April that SA’s already faltering manufacturing production output was

25% on all imported steel and 10% on imported aluminium, “particularly vulnerable to any further escalation in the trade war

on national security grounds. currently raging between the US and China”.

On 2 April, China retaliated by imposing tariffs on This could undermine an already patchy recovery of the

about $2.4bn of US imports of aluminium waste and economy from a bad 2017. Inflation would then be pushed

scrap, wine, pork, fruits, nuts and other products. up by a falling rand.

On 3 April, the Trump administration threatened to The eventual impact on SA depends of course

slap a 25% import tariff on a further 1 333 Chinese on whether the US-China trade war heats up. Some

products, worth $46.2bn, mainly machinery, economists have warned of a severe global recession

mechanical appliances and electrical equipment. or even depression, noting that it was America’s Smoot

Two weeks later, on 17 April, China slapped anti- Hawley Act of 1930, imposing heavy tariffs to try to save

dumping duties of 178.6% on sorghum from the US. jobs, rather than the great stock market crash of 1929, that

The most direct harm to SA could come from Trump’s plunged the US and the world economy into the Depression.

new import tariffs on steel and aluminium. Last year SA exported Peter Draper, director of Pretoria-based Tutwa Consulting, doesn’t

about $375m (R4.7bn) worth of aluminium and $950m (R11.8bn) think it will get that bad. He suggests that Trump and his Chinese

worth of steel to the US. The new tariffs would override the duty and counterpart, Xi Jinping, could still sign a truce.

quota-free access that SA has to the US market under the Africa Growth Trump is under growing pressure from agricultural groups, Republicans

and Opportunity Act (Agoa). The likely loss of those sales because of the worried about this year’s mid-term elections, and others, to back off. But

steep new import tariffs would seriously damage a few there is broader support for investment measures being drafted

companies and cost thousands of jobs, Davies said. An A US-China trade war could in Congress to tighten controls over Chinese investment in US

estimated 7 500 jobs in the steel supply chain alone be good news for South high-tech industries, and perhaps also controls over US outward

African wine, fruit and nut

are at risk. investment in “sensitive” industries. Underlying this is a strategic

15%

producers because of the

Aggravating the impact, the US has exempted concern, shared by key US allies like the EU and Japan, about

Canada, Mexico, the EU, South Korea, Brazil, Argentina China seeking to take the lead in the high-tech industries of the

and Australia from the tariffs, giving them a huge future, Draper, says.

advantage over local manufacturers. SA tried to However the hardening ideological stance at the heart of

negotiate an exemption from the tariffs on the grounds retaliatory tariff China the Trump administration, mirrored on the Chinese side by Xi’s

that its exports represent such a tiny part of total US imposed on these US ‘”strong leader” projection and mobilisation of anti-US sentiment

imports, but did not succeed. products. around the “100 years of humiliation” narrative – are mitigating

A US-China trade war could be good news for South against a resolution.

African wine, fruit and nut producers, because of the 15% retaliatory tariff The impact on SA depends on how these tensions play out.

China imposed on these US products, the Western Cape tourism and “In a full trade war scenario, it is difficult to see how anybody wins.

investment agency Wesgro told Business Insider. As the markets have been signalling, trade wars are bad for growth,

But Cobus van Staden, senior researcher on China-Africa relations which would be bad for us. The bigger worry is that a sustained tussle

at the South African Institute of International Affairs, believes the will undermine the WTO, and the foundations of the multilateral trade

opportunities for local agricultural exporters would be small, in part order. It is already under enormous stress, not least owing to US

because of our low yields. He believes the downside would be greater than pressure on the dispute settlement system, but it could conceivably

the upside, largely because of the impact on manufacturing. break in a worst case scenario,” says Draper.

In a world economy where products are increasingly made in global And that, clearly, would be a catastrophe for all. ■

Shutterstock

supply chains, Trump is clearly shooting himself in the foot. The Peterson editorial@finweek.co.za

Institute for International Economics in Washington has pointed out that Peter Fabricius is a consultant to the Institute for Security Studies and a freelance foreign affairs journalist.

8 finweek 10 May 2018 www.fin24.com/finweek

Copyright of Finweek is the property of Media 24 and its content may not be copied or

emailed to multiple sites or posted to a listserv without the copyright holder's express written

permission. However, users may print, download, or email articles for individual use.

You might also like

- The Destructive New Logic That Threatens GlobalizationDocument5 pagesThe Destructive New Logic That Threatens GlobalizationdibanezparraNo ratings yet

- Us Manufacturing RennaissanceDocument19 pagesUs Manufacturing RennaissanceWilliam Tan CebrianNo ratings yet

- Place of Supply Under GST ActDocument16 pagesPlace of Supply Under GST ActSaatwik100% (1)

- Hesco BillDocument2 pagesHesco BillAdv Sohail BhattiNo ratings yet

- History of USA V China Trade WarDocument11 pagesHistory of USA V China Trade WarmiguelNo ratings yet

- Assignment No 5 2019 Trade War China USA UPDATING 2020Document7 pagesAssignment No 5 2019 Trade War China USA UPDATING 2020mariel sanabriaNo ratings yet

- Group BFF5230 Workshop1Document5 pagesGroup BFF5230 Workshop1MeloNo ratings yet

- How Would The Trade War Affect China'S Pib Growth?Document2 pagesHow Would The Trade War Affect China'S Pib Growth?CARLOS SUAREZNo ratings yet

- US China Trade WarDocument28 pagesUS China Trade WarNagabhushan Rajashekarappa67% (3)

- Implications of The On-Going Trade WarDocument6 pagesImplications of The On-Going Trade WarMary Joyce YuNo ratings yet

- Trump S TariffsDocument8 pagesTrump S Tariffsgalanjusto70No ratings yet

- Us China Trade WarDocument7 pagesUs China Trade WarTushar MidgeNo ratings yet

- ANKUR'21Document2 pagesANKUR'21SAKTHI B 2337053No ratings yet

- GDP Dropped For China and UDocument7 pagesGDP Dropped For China and USaumyajit DeyNo ratings yet

- Us China Trade WarDocument13 pagesUs China Trade Warpiyush kumarNo ratings yet

- Peterson - Semiconductor War US-ChinaDocument34 pagesPeterson - Semiconductor War US-ChinaChama Letters100% (1)

- Main Causes: - Reduce The Deficit of Bilateral Trade and Bring American Jobs Back HomeDocument26 pagesMain Causes: - Reduce The Deficit of Bilateral Trade and Bring American Jobs Back HomeTuyết TrinhNo ratings yet

- China's View On Trump and TradeDocument48 pagesChina's View On Trump and TradeNational Press FoundationNo ratings yet

- The Wall Street Journal Asia November 14 2016Document22 pagesThe Wall Street Journal Asia November 14 2016Hameleo1000No ratings yet

- Economic EssayDocument2 pagesEconomic EssayShana PerezNo ratings yet

- US Laws To Promote Home-Grown Industries Will Hurt African EconomiesDocument4 pagesUS Laws To Promote Home-Grown Industries Will Hurt African EconomiesCrypto KoploNo ratings yet

- The U.S.-China Trade War and Options For TaiwanDocument5 pagesThe U.S.-China Trade War and Options For TaiwanThe Wilson CenterNo ratings yet

- Adverse Effects of Excessive Tariffs On EconomyDocument4 pagesAdverse Effects of Excessive Tariffs On EconomySallyNo ratings yet

- A Global Outbreak Is Fueling The Backlash To GlobalizationDocument5 pagesA Global Outbreak Is Fueling The Backlash To GlobalizationYouNo ratings yet

- Global - IA - Economics IBDocument5 pagesGlobal - IA - Economics IBmimingomontoyaNo ratings yet

- Tariff StrategyDocument5 pagesTariff StrategyEvie LiuNo ratings yet

- (Group 4) Usa-China TradewarDocument40 pages(Group 4) Usa-China Tradewarhathimydung060903No ratings yet

- Trade War - US-China Trade Battle in Charts - BBC NewsDocument6 pagesTrade War - US-China Trade Battle in Charts - BBC NewsTechbotix AppsNo ratings yet

- Tariffs: By-Shantanu Mishra Gaurav Gupta Salil Batra Abhijeet Pande Rachit VarshneyDocument12 pagesTariffs: By-Shantanu Mishra Gaurav Gupta Salil Batra Abhijeet Pande Rachit Varshneyabhijeet pandeNo ratings yet

- Trump's Trade War Timeline: An Up-to-Date GuideDocument23 pagesTrump's Trade War Timeline: An Up-to-Date GuideVandana GuptaNo ratings yet

- Impact of Tariff War On IndiaDocument5 pagesImpact of Tariff War On IndiaSiddharth JaswalNo ratings yet

- Currenc I Aug'18Document16 pagesCurrenc I Aug'18RationallyIrrationalSamikshaNo ratings yet

- The US China Trade WarDocument12 pagesThe US China Trade WarNGUYET NGUYEN NGOC NHUNo ratings yet

- Could A Recession Be Just Around The CornerDocument5 pagesCould A Recession Be Just Around The Cornerey_miscNo ratings yet

- SSRN Id3766574Document40 pagesSSRN Id3766574Joey NguyenNo ratings yet

- US - Chinese Trade War - Group 05's ReportDocument35 pagesUS - Chinese Trade War - Group 05's ReportDương Ngọc LamNo ratings yet

- The Trade War Between Usa and China andDocument10 pagesThe Trade War Between Usa and China andvbn7rdkkntNo ratings yet

- COVID-19 Could Bring Down The Trading System: How To Stop Protectionism From Running AmokDocument6 pagesCOVID-19 Could Bring Down The Trading System: How To Stop Protectionism From Running AmokFer VdcNo ratings yet

- Global Market Structures and The High Price of ProtectionismDocument9 pagesGlobal Market Structures and The High Price of ProtectionismHeisenbergNo ratings yet

- The New Industrial Age - Foreign AffairsDocument8 pagesThe New Industrial Age - Foreign AffairsMarion DeriloNo ratings yet

- Trade War PDFDocument7 pagesTrade War PDFAmi KeNo ratings yet

- Deglobalization - Freiend-Shoring Is Dangerous. RajanDocument3 pagesDeglobalization - Freiend-Shoring Is Dangerous. Rajangovind.dm252025No ratings yet

- Welcome To Our Presentation!Document170 pagesWelcome To Our Presentation!Tuyết TrinhNo ratings yet

- A Quick Guide To The US-China Trade War - BBC NewsDocument4 pagesA Quick Guide To The US-China Trade War - BBC NewsTechbotix AppsNo ratings yet

- Is A Global Recession Coming? Here Are Seven Warning Signs - UK News - The GuardianDocument1 pageIs A Global Recession Coming? Here Are Seven Warning Signs - UK News - The GuardianPin Pon2No ratings yet

- The U.S Trump TarrifsDocument8 pagesThe U.S Trump TarrifsDinda syafiraNo ratings yet

- Debate - Cyber-Industrial Warfare As The Biggest Threat Am Vs CHDocument12 pagesDebate - Cyber-Industrial Warfare As The Biggest Threat Am Vs CHMarian George MorosacNo ratings yet

- China Without A Private Sector 2Document8 pagesChina Without A Private Sector 2gabrieltropiNo ratings yet

- Case Study: Trade War Between Us and ChinaDocument9 pagesCase Study: Trade War Between Us and ChinaShubhangi VirkarNo ratings yet

- Trade WarDocument9 pagesTrade WarjoseluckNo ratings yet

- Protecting America's Technology Industry From China Tariffs Aren't The AnswerDocument7 pagesProtecting America's Technology Industry From China Tariffs Aren't The AnswerJorge Yeshayahu Gonzales-LaraNo ratings yet

- Irwin FalsePromiseProtectionism 2017Document13 pagesIrwin FalsePromiseProtectionism 2017Alishba AsifNo ratings yet

- Numericals PPC CurveDocument2 pagesNumericals PPC Curvefosejo7119No ratings yet

- Act II For American Manufacturing?: by Bruce StokesDocument9 pagesAct II For American Manufacturing?: by Bruce StokesJafar Al HejjiNo ratings yet

- Rough (Autosaved)Document16 pagesRough (Autosaved)Sarika MahajanNo ratings yet

- GeopoliticsDocument12 pagesGeopoliticsmonika rautNo ratings yet

- Trump's Trade War Timeline: An Up-to-Date GuideDocument26 pagesTrump's Trade War Timeline: An Up-to-Date GuideMuhammad Aditya TMNo ratings yet

- 0115 全球化趋向零和博弈Document2 pages0115 全球化趋向零和博弈- amelieee-No ratings yet

- Trade Wars Are Never - Easy To Win - Economist Robert Pollin On Trump's China Policy - Global Policy JournalDocument5 pagesTrade Wars Are Never - Easy To Win - Economist Robert Pollin On Trump's China Policy - Global Policy Journalkaleem ullahNo ratings yet

- This Study Resource Was: US-China Trade War Impact On Global EconomyDocument4 pagesThis Study Resource Was: US-China Trade War Impact On Global EconomyKhanh Linh HoangNo ratings yet

- Summary Of "The American Crisis And The Persian Gulf War" By Pablo Pozzi: UNIVERSITY SUMMARIESFrom EverandSummary Of "The American Crisis And The Persian Gulf War" By Pablo Pozzi: UNIVERSITY SUMMARIESNo ratings yet

- 20.0 PP 634 646 IndexDocument13 pages20.0 PP 634 646 IndexEdwinNo ratings yet

- .............................. Cash Receipt Journal .............................. (.................................... )Document22 pages.............................. Cash Receipt Journal .............................. (.................................... )Atalya PearlNo ratings yet

- Atharv Gupta A15 SIPDocument42 pagesAtharv Gupta A15 SIPAditya TarasNo ratings yet

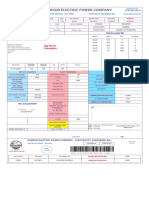

- Bill For Current Month (7) - 1Document1 pageBill For Current Month (7) - 1Ankit Gupta0% (1)

- International Trade LawDocument16 pagesInternational Trade LawAyush Pratap SinghNo ratings yet

- Tariff and Non TariffDocument243 pagesTariff and Non TariffQuynh LeNo ratings yet

- GO Ms 381 GST 26112018Document4 pagesGO Ms 381 GST 26112018hussainNo ratings yet

- Eff CHP 4 Mvsir Charts May 23Document35 pagesEff CHP 4 Mvsir Charts May 23Abhinav AgarwalNo ratings yet

- Sepco Online Bill PDFDocument1 pageSepco Online Bill PDFSyed Junaid BukhariNo ratings yet

- People of The Philippines, Petitioners, SANDIGANBAYAN (Fourth Division) and BIENVENIDO A. TAN JR., RespondentDocument2 pagesPeople of The Philippines, Petitioners, SANDIGANBAYAN (Fourth Division) and BIENVENIDO A. TAN JR., RespondentJoshua Erik Madria100% (1)

- Lotus Enclave (Phase-Ii) - 2/3 BHK Villas: Preferential Location Charges (PLC)Document2 pagesLotus Enclave (Phase-Ii) - 2/3 BHK Villas: Preferential Location Charges (PLC)SAROJNo ratings yet

- Understanding of WTO - Facts About WTO - Principles and Functions of WTO - Structure of WTO - Agreements - Impact On Indian Economy - Pros and ConsDocument22 pagesUnderstanding of WTO - Facts About WTO - Principles and Functions of WTO - Structure of WTO - Agreements - Impact On Indian Economy - Pros and Conssreekala spNo ratings yet

- Midterm Practice Questions SolutionsDocument5 pagesMidterm Practice Questions SolutionsRazeq AziziNo ratings yet

- Taxation Sec B May 2024 1703584133Document11 pagesTaxation Sec B May 2024 1703584133abhishekkapse654No ratings yet

- Telephone Oct 2022Document4 pagesTelephone Oct 2022shyamyeoleNo ratings yet

- Reimbursement MergedDocument5 pagesReimbursement MergedSandeep DubeyNo ratings yet

- Ibo 3Document25 pagesIbo 3vinodh kNo ratings yet

- Chapter 3 - International TradeDocument70 pagesChapter 3 - International TradeHay JirenyaaNo ratings yet

- Guidelines & Application Form: 19 - 23 January 2024, BengaluruDocument28 pagesGuidelines & Application Form: 19 - 23 January 2024, BengaluruARVIND PALNo ratings yet

- Monthly Statement: This Month's SummaryDocument3 pagesMonthly Statement: This Month's SummarySibiviswa RajendranNo ratings yet

- 04-06-2021 5307013 Vehicle Sale DocumentsDocument1 page04-06-2021 5307013 Vehicle Sale DocumentsangelNo ratings yet

- NSD EnterpriseDocument1 pageNSD EnterpriseParminder SinghNo ratings yet

- W16 (CH24-25) (6Q)Document5 pagesW16 (CH24-25) (6Q)Mohammed NajihNo ratings yet

- WAPCOS LimitedCentre For Planning and DevelopmentDocument3 pagesWAPCOS LimitedCentre For Planning and DevelopmentRafikul RahemanNo ratings yet

- Your Vi Bill: Mr. Saketkumar BorgaonkarDocument3 pagesYour Vi Bill: Mr. Saketkumar BorgaonkarSaket BorgaonkarNo ratings yet

- Final Criteria - Jps 2019-2024 Rate Review ProcessDocument137 pagesFinal Criteria - Jps 2019-2024 Rate Review Processcsf571No ratings yet

- CGST CircularsDocument18 pagesCGST Circularsdinesh kasnNo ratings yet

- Applied Economics: Module No. 5: Week 5: First QuarterDocument9 pagesApplied Economics: Module No. 5: Week 5: First QuarterhiNo ratings yet