Professional Documents

Culture Documents

The World Nuclear Supply Chain: Outlook 2030 (2014)

Uploaded by

Greg KaserCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The World Nuclear Supply Chain: Outlook 2030 (2014)

Uploaded by

Greg KaserCopyright:

Available Formats

The World Nuclear Supply Chain

Outlook 2030 (2014 revision)

World Nuclear Association

December 2014

2 | The World Nuclear Supply Chain: Outlook 2030

Title: The World Nuclear Supply Chain: Outlook 2030 (2014 revision)

Produced by: World Nuclear Association

Published: December 2014

Series: WNA Report

Report No.: 2014/004

ISBN: 978-0-9550784-9-1

© World Nuclear Association 2014

All rights reserved. No part of this

publication may be reproduced or

transmitted in any form or by any

means, including photocopying and

recording, without the written

permission of the copyright holder.

Such written permission must be

obtained before any part of this

publication is stored in a retrieval

system of any nature.

The information and opinions are

those of the WNA. This report reflects

the views of industry experts but does

not necessarily represent those of any

of the WNA’s individual member

organizations or any government or

organization with which individual

member organizations may be

associated.

World Nuclear Association

10 Southampton Street

London WC2E 7HA

United Kingdom

Telephone: +44 (0)20 7839 1520

Website: www.world-nuclear.org

Email: wna@world-nuclear.org

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | i

Executive summary

This 2014 edition of The World Nuclear Supply Chain focuses on nuclear power plants and

their supply chain, looking at the challenges and opportunities, including scenarios for the

evolution of nuclear power in the longer term. In particular it examines the advantages

arising from an increasingly global supply chain as well as three potential barriers to a

competitive and reliable supply chain: the control of construction costs and schedules;

ensuring exceptional quality; and the maintenance of confidence among stakeholders.

Nuclear power is making a growing contribution to supplying low-carbon energy worldwide.

Alongside the 435 operational reactors in 31 countries and territories, there are 69

commercial civil reactors under construction with another ten countries are building or

planning to build new plants. Over 60 percent of the world’s people already live in countries

where nuclear generated electricity is being supplied. By 2030 this figure will have risen to

70 percent (from 4.3 billion to 6.1 billion), even after allowing for the fact that a few countries

(Germany, for example) have decided to phase out the technology. The spread of nuclear

technology from the mature industrial economies to emerging markets is well underway.

The majority of nuclear power plants in the world are light water reactors (LWRs), mainly

pressurized water reactors (PWRs) and boiling water reactors (BWRs). For many utilities the

choice lies between these two technologies and there is accordingly considerable

competition between the technology vendors. Apart from the LWRs, pressurized heavy

water reactors (PHWRs) are the norm in Argentina, Canada, India and Romania.

There are today ten consolidated technology vendors offering their technology and services

across much of the nuclear fuel cycle. They are AREVA, Candu Energy, China National

Nuclear Corporation, China’s State Nuclear Power Technology Corporation, GE and Hitachi,

Korea Electric Power Corporation, Mitsubishi Heavy Industries, the Nuclear Power

Corporation of India, RosAtom and Toshiba/ Westinghouse. In addition, other significant

technology vendors are becoming active in the international market, including Babcock and

Wilcox, China General Nuclear, Doosan and Škoda. Each has developed a supply chain that

is increasingly global in scope. There are around 240 major independent suppliers of nuclear

grade structures, systems, components and services. While the industry remains weighted

towards domestic markets, the leading vendors are, for the most part, internationally

diversified in terms of their corporate make-up and their supplier base. International trade in

nuclear components has the potential to reach US$ 30 billion a year.

Competitive pressures are encouraging the localization of manufacturing, joint ventures and

international procurement. As a result, production is located in several jurisdictions with

materials, semi-processed and finished fabrications perhaps crossing several borders prior

to reaching the final destination for assembly and installation. Services are also performed in

different countries either as a result of sub-contracting or through the participation of

specialist divisions of the same transnational corporation or industrial group. Globalization, in

short, is as much a part of the civil nuclear scene as it is in other industries. The World

Nuclear Association (WNA) believes that the system for import and export controls should be

reviewed to streamline procedures between countries while preserving a sound safeguards

regime.

© World Nuclear Association 2014

ii | The World Nuclear Supply Chain: Outlook 2030

A competitive global market exists for the construction and procurement of nuclear power

plants. Around a decade ago, there were concerns that some ‘choke points’ existed along

the supply chain, for instance in terms of heavy forging capacity. However, a combination of

factors, including the cancellation of some planned plants, which followed the Fukushima

Daiichi accident, investment by existing suppliers and the transfer of technology and

localization of manufacturing (especially to China), means there are now sufficient suppliers

available to fabricate key reactor components under currently known plans. Potentially

bottlenecks could re-emerge in the event of multiple reactor orders being issued at the same

time, should the world economy recover from the prolonged recession it has been going

through and see an upturn in capital investment.

In recent years, the time taken to build a nuclear power plant has been significantly longer in

the Americas, Western Europe and South Asia than in East Asia. Chinese-designed reactors

have typically taken around 60 months to construct with some projects being closer to 48

months. This was also the case for South Korean and, prior to the Fukushima accident,

Japanese reactors. The nuclear industry could probably bring down construction times from

70-80 to 50-60 months through the adoption of best practices in project management and

‘lean’ construction techniques and greater use of off-site assembly. A reliable and efficient

supply chain is crucial to ensuring that projects are accomplished to budget and schedule.

Managing the quality and capability challenges along the supply chain is just as important. In

the nuclear industry, the aim of mandatory quality assurance programs is to manufacture

safety-related items within a well-prescribed expected performance set, and so provide

assurance that the finished products will operate reliably over their lifetime. But unlike some

other industries, there is no general quality assurance standard specific to the civil nuclear

sector. Reactor technology vendors and suppliers have had to rely on guidance, codes and

standards issued by national standard development organizations, such as the American

ASME and the French AFCEN. Drawing on the example of the aerospace industry, the

Nuclear Quality Standard Association published a standard for nuclear safety and quality

management in 2011, NSQ-100, that supplements the widely-used ISO 9001 quality

management standard.

Market developments must be seen within the wider framework of energy and electricity

supply over the long-term. Deregulation has not always succeeded in establishing a well-

functioning electricity market that delivers competitive, safe and environmentally-friendly

forms of energy. In most industrialized countries the energy sector is no longer under direct

state control and governments must influence the behaviour of generators, utilities and

consumers indirectly through a mix of tax incentives, subsidies and general market rules to

ensure the long-term reliability of electricity supply. Moreover, business undertakings are not

best placed to manage public interest issues such as combatting global warming and ocean

acidification. There is a danger that the necessary governmental measures to encourage a

shift towards nuclear energy as an affordable, reliable and low-carbon technology will not be

pursued vigorously enough.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | iii

Key points

There are 435 operable commercial nuclear power reactors around the world and 69

under construction. Nuclear power worldwide generates sales revenues worth around

US$ 330 billion a year for electricity utilities.

A competitive global market exists for the construction and procurement of nuclear

power plants, and although heavy forging capacity is more limited there are sufficient

suppliers available to fabricate major reactor components.

The decline in the number of new units commissioned since the mid-1980s was reversed

at the turn of the century. There are specific plans for another 158 power reactors with a

total net capacity of some 167 200 MWe and another 334 (representing nearly 362 050

MWe) are proposed.

Three scenarios for the world nuclear generating capacity are presented, referred to as

the reference, upper and lower cases. In the reference case the number of nuclear

reactors worldwide grows to 477 by 2020 and 589 by 2030. The upper case sees a rise

to 512 by 2020 and 714 by 2030 and in the lower case, under which little new

construction takes place, the number of reactors stabilizes at 442 in 2020 and falls to

343 by 2030.

Of the 266 new units projected to come into operation before 2030 under the reference

case, including the 69 under construction, 58 will be in the OECD group of developed

industrial countries, 120 in China, 37 in the former Soviet Union and 26 in India.

Under the reference case, the market for nuclear power equipment is expected to grow

at 2 percent annually over the coming two decades with 72 percent of the growth

occurring in the emerging industrial economies (the non-OECD area, including China).

© World Nuclear Association 2014

iv | The World Nuclear Supply Chain: Outlook 2030

The value of the investment in new nuclear build to 2030 is of the order of US$ 1.2

trillion, with significant international procurement of around US$ 575 billion, or US$ 26

billion a year. About US$ 530 billion will consist of equipment purchases, with US$ 110

billion in power generating equipment orders.

The total value of work for long-term operation could amount to some US$ 50-100 billion

(depending on the amount of refurbishment deemed necessary by the regulatory body).

This could amount to around US$ 4 billion a year of international procurement.

The market for decommissioning is also substantial. The value of decommissioning work

on projects involving immediate dismantling by 2030 could total US$ 95 billion, of which

US$ 12.4 billion is the estimated cost for cleaning up the Fukushima Daiichi site and at

least US$ 24.2 billion has to be spent in Germany.

Standardization, lesson learning and competitive pressures are expected to maintain the

advantages in terms of generating costs and environmental benefits that the nuclear

option enjoys in relation to alternative low-carbon sources of electricity generation.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | v

Contents

Page

1 Introduction 1

1.1 Background to the report 1

1.2 Methodology and structure 2

1.3 The drivers of electricity growth 3

1.4 The present position of nuclear power 7

1.5 Principal reactor types 11

1.6 Safety 15

Part 1: Market Outlook

2 Outlook for nuclear power 19

2.1 A changing economic and energy landscape 19

2.2 WNA scenarios 20

2.3 Market value projections 34

3 Major projects 39

3.1 Long-term operation 39

3.2 New build 45

3.3 Decommissioning and waste management 57

Part 2: Industry Status and Trends

4 The international marketplace 71

4.1 The emerging global market 71

4.2 Vendor consolidation 73

4.3 Vendor competition 77

4.4 Localization of production 81

5 The nuclear supply chain 89

5.1 Components of the supply chain 90

5.2 Capacity along the supply chain 95

5.3 The role of EPC contractors 104

5.4 Professional services support 107

6 Harmonizing the regulatory framework 125

6.1 Licensing 125

6.2 Securing nuclear technology from misuse 129

6.3 Import and export controls 131

6.4 Supplier liability 134

6.5 Benefits of a collaborative and international regulatory regime 138

© World Nuclear Association 2014

vi | The World Nuclear Supply Chain: Outlook 2030

Part 3: Challenges for Industry

7 Project management 143

7.1 Construction costs and schedules 144

7.2 Lean manufacturing and construction 149

7.3 Project organizational development 150

7.4 Modularization 152

7.5 Small modular reactors 153

8 Quality management 155

8.1 Safety culture 155

8.2 Supplier oversight 158

8.3 Enhance quality assurance 165

8.4 Exceptional performance 168

9 Stakeholder management 173

9.1 Maintaining community support 173

9.2 Government support and energy markets 174

9.3 Investors and financing 177

Appendices

A Acronyms and Abbreviations 183

B Glossary 188

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 1

1 Introduction

Nuclear power has the potential to deliver clean energy affordably on a global scale. It also

faces challenges, ranging from the economic (large upfront capital cost), through to the

technological sophistication of its supply chain and the importance of maintaining safety and

safeguarding its materials from misuse. Between now and 2050, as the world’s population

approaches nine billion, humankind will consume more energy than the combined total in all

its history. Under present conditions of supply, the consequences could strain the planet’s

carrying capacity for life severely. Pollution from fossil fuels already takes its toll on human

health, while the worrisome prospects from accelerated global warming are becoming

clearer day by day. Nuclear energy is a relatively mature technology, whose principal risk –

the release of radiation into the biosphere – is by now well understood within science, even if

it is widely misunderstood amongst the public at large. But it is the economic risk that is

arguably the major factor holding back the expansion of nuclear power as the preferred

option for around the clock electricity supplies. Unfortunately any postponement of civil

nuclear investment on a large scale makes it more difficult to develop the integrated and

reliable global nuclear supply chain that can deliver the cost-efficiencies needed to cement

nuclear power as the preferred option for a low carbon future.

The World Nuclear Association (WNA) is the international organization that supports the

global nuclear industry, its people, technology and enterprises. Its mission is to promote

valuable connections within the industry and create an informed public policy environment

around it. Representing about 175 member companies from 40 nations in key international

forums, WNA facilitates business-to-business interaction to advance good practice and

seeks to improve the policy context and public confidence through the provision of objective

information. In anticipation of an epoch of worldwide nuclear new build, WNA is devoting

increased attention to supporting companies and investors in the task of constructing robust

supply chains to ensure timely and efficient construction of nuclear power plants. The special

regulations that apply to the nuclear supply chain call for relationships that must be enduring,

responsive to emerging challenges and, above all, socially and environmentally responsible.

1.1 Background to the report

This 2014 edition of The World Nuclear Supply Chain Outlook, which supplements WNA’s

regular report on The Global Nuclear Fuel Market, updates the 2012 report with additional

analysis and a more comprehensive description of major projects. For the purposes of this

report, the nuclear supply chain relates to the structures, systems and components that

make up a nuclear power plant. It excludes the ‘front end’ of the fuel cycle, involving the

mining and manufacture of nuclear fuels (covered by WNA’s The Global Nuclear Fuel

Market report) but includes the ‘back-end’ that deals with decommissioning and the

management of used fuel and radioactive waste materials. It aims to provide the nuclear

power industry, energy suppliers, the investment community and policy-makers with:

an up-to-date picture of ongoing and planned nuclear power plant construction, major

refurbishment, decommissioning and waste management projects;

© World Nuclear Association 2014

2 | The World Nuclear Supply Chain: Outlook 2030

an analysis of the market potential worldwide for major components and the capacity

of leading suppliers;

a review of industry trends and challenges; and,

an outline presenting WNA’s approach to developing a robust global supply chain

offering exceptional quality, reliable project delivery and competitive costs.

At a time when the sector is under scrutiny from policy-makers and the public, the report

provides a strategic frame of reference to help the industry address the economic and

industrial challenges ahead.

1.2 Methodology and structure

For several years the World Nuclear Association (WNA) has prepared its authoritative Global

Nuclear Fuel Market Report, which presents three scenarios for the evolution of nuclear

capacity. The present report on the nuclear supply chain deepens this analysis by linking

WNA’s nuclear capacity projections to a set of estimates for the value of the nuclear

generation business. The WNA recognizes the importance of complying with competition law

and interaction between its member organizations during the preparation of this report was

monitored to ensure that no commercially relevant information that was not already in the

public domain was shared.

1.2.1 Methodology

This report has been compiled on the basis of reports and studies in the public domain,

including reports from WNA’s World Nuclear News service, and supplemented by

information derived from WNA member companies. The analysis was undertaken by the

WNA’s secretariat and the findings discussed at its Working Groups, particularly the Supply

Chain Working Group. The scenarios have been checked by a drafting group drawn from

WNA’s membership to make sure that the information contained and opinions expressed are

reliable and reflect the market situation. The information and opinions are those of WNA as

at the date of publication and they do not necessarily represent those of any individual

member organization, government or other company or organization.

Three scenarios for the development of nuclear to 2030 are presented:

The Reference case assumes the continuation of known policies and investment

strategies, whereby utilities continue to rely upon fossil fuels and maintain a stable

share of nuclear generation while accommodating a growing share from renewable

sources.

The Lower case assumes that policy changes impede the development of nuclear

power in all countries, leading to a falling share from nuclear generation.

The Upper case assumes that the economic case for nuclear power is favourable

relative to other generation options, government policies promote clean energy and

public support for nuclear energy strengthens.

The projections for nuclear generating capacity are based upon data collected and

maintained by the WNA on the number of nuclear reactors in operation or planned. The

three cases are not meant to be forecasts, but an illustration of the range in the size of the

potential market for the nuclear power sector.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 3

Energy demand projections are taken from the World Energy Outlook 2013 published by the

International Energy Agency (IEA). The IEA has generated projections for energy supply and

demand up to 2035 for alternative scenarios, which incorporate different assumptions

concerning energy prices and government policies. Although WNA’s Reference case for

nuclear power is developed independently, it is similar to the IEA’s New Policies scenario,

which attempts to capture the policy commitments made by governments to reduce

greenhouse gas emissions following the summit at Copenhagen in December 2009.

1.2.2 Report structure

Part 1 examines the market outlook for nuclear power, including the scenario analysis

already mentioned. The size of global market for new build, refurbishment to allow long-term

operation, and for decommissioning and waste management is estimated.

A more detailed analysis of industry status and trends is presented in Part 2. It looks at the

extent of consolidation and competition within the industry, the potential for the localization of

component manufacturing, supplier segmentation and the prospects for a more

internationally harmonized regulatory regime.

In Part 3 the focus shifts to the challenges facing the industry, especially in relation to the

economics of nuclear power and how cost escalation is being addressed through quality

initiatives, lean manufacturing and construction, new technologies, stakeholder engagement

and financial innovation.

The report includes two appendices providing a list of acronyms and abbreviations

(Appendix A) and a glossary (Appendix B).

1.3 The drivers of electricity growth

Use of nuclear energy is recognized as crucial for sustainable development and to mitigate

global warming and ocean acidification. UN Secretary-General Ban Ki-moon launched a

sustainable energy for all initiative to help mobilize resources for what he called a “historic

energy transition” to clean energy, in the lead-up to the Rio+20 UN Conference on

Sustainable Development held in June 2012. He highlighted three challenges: energy

poverty, dangerous planetary warming and the need to catalyze low carbon economic

opportunity, especially in developing countries.1 The Rio+20 Conference recognized the

importance of renewable sources and other low-emission technologies, which would include

nuclear power, as well as advanced energy technologies, such as cleaner fossil fuels, for

sustainable modern energy services.2 The recent report from the UN's Intergovernmental

Panel on Climate Change (IPCC) has again highlighted the unequivocal and urgent need to

reduce greenhouse gas emissions, necessitating among other things a transition to a low-

1

Speech to the UN General Assembly on 1 November 2011 and Vision Statement by Ban Ki-moon

on Sustainable Energy for All.

2

UN, 2012, The Future we Want - our common vision, para. 127; at

<http://www.un.org/ga/search/view_doc.asp?symbol=A/RES/66/288&Lang=E>.

© World Nuclear Association 2014

4 | The World Nuclear Supply Chain: Outlook 2030

carbon energy system.3 The IPCC report confirmed nuclear energy among the lowest

carbon forms of generation, taking into account both direct emissions and its lifecycle

impacts.

Figure 1.1 shows the build-up of worldwide nuclear electricity production since 1971. The

rate of expansion was high in the period to the late 1980s, but has since slowed as fewer

new plants came into operation.

Figure 1.1: World nuclear electricity production (TWh) (Source: IAEA)4

3000

2500

2000

1500

1000

500

0

1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013

Almost all of this growth has occurred in developed industrial countries. Energy policies

typically aim to balance concerns for availability and affordability. Nuclear energy offers

electricity supply utilities the advantage of base-load reliability and low operating costs.5 It is

also an energy technology that can contribute to a nation’s energy security. Uranium is

abundant and supplied by many countries and can be stockpiled in large quantities relatively

inexpensively. Furthermore, nuclear power costs are relatively insensitive to fuel price

movements. That said, the industry faces considerable challenges – discussed in more

detail in Part 3. In deregulated energy markets it has proved difficult to finance investment in

nuclear power plants in recent years. The experience of mature energy markets shows that

nuclear units have performed well, generating not just electricity around the clock for

3

IPCC, 2014, Climate change 2014: Mitigation of climate change, Summary for Policymakers,

Intergovernmental Panel on Climate Change Working Group III Contribution to Assessment Report 5.

4

IAEA, 2014, Energy, Electricity and Nuclear Power Estimates for the Period up to 2050, Reference

Data Series No. 1: Table 1: p. 13.

5

Base-load power is the electricity a utility generates around the clock in anticipation of minimum

customer demand that will occur regardless of daily and seasonal fluctuations. This is usually around

60 percent of the maximum demand for electricity, the peak-load.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 5

consumers but also a decent return on investment for their owners. Nuclear remains a

significant part of the energy scene in developed and emerging industrial countries and is

viewed by many governments as vital to the pursuit of low carbon development.

Table 1.1 shows world electricity generation by source for major areas of the world. The

nuclear share within Western Europe has stabilized at 25 percent, the highest of the major

areas covered. The region also boasts the largest contribution from non-hydro renewable

sources.

Table 1.1: Electricity generation by fuel type and region in 2012, %

Region Thermal Hydro Nuclear Renewable Total

North America 64 15 18 3 100

6

Latin America 43 54 2 1 100

7

Western Europe 49 19 25 7 100

8

Eastern Europe 66 15 19 0 100

East Asia 78 16 5 1 100

Middle East & South Asia 87 10 2 1 100

Southeast Asia & Pacific 89 9 0 2 100

Africa 80 17 2 1 100

World 69 18 11 2 100

Source: IAEA, 2013, Energy, Electricity and Nuclear Power Estimates for the period up to 2050,

Table 9.

The share of mostly fossil-fuelled thermal power plants has declined over recent years and is

being replaced by renewable energy sources. The contribution from nuclear power is small

outside of Europe and North America, although it is of growing importance in East Asia.

In developing countries where, according to estimates by the International Energy Agency,

1.3 billion people lack access to electricity (living mostly in rural areas and slums), the case

for nuclear energy is equally compelling. An even larger number, 2.7 billion, rely on

traditional biomass fuels.9 About 500 million of those who lack electricity live in countries with

nuclear power plants, such as India (289 million) and Pakistan (64 million), as well as South

Africa, China and Brazil. Under current plans by governments and utilities no-one should

lack a power supply connection by 2030 in Latin America, India and South Africa. But,

despite investment in rural electrification and urban development (including slum clearance

and re-housing), in the rest of Sub-Saharan Africa and parts of South Asia there will remain

significant pools of energy poverty, possibly for decades to come. Even with power

connection, poor people may continue to rely upon traditional fuels like wood, charcoal and

animal dung for cooking and heating as they cannot afford to pay for more than a few units

6

Includes Mexico.

7

Includes Turkey.

8

Includes Armenia, Bulgaria, Czech Republic, Hungary, Romania, Russia, Slovakia, Slovenia and

Ukraine.

9

IEA, 2011, World Energy Outlook 2011: p. 472.

© World Nuclear Association 2014

6 | The World Nuclear Supply Chain: Outlook 2030

of electricity. As a result, breathing in smoke from open stoves will remain one of the world’s

biggest causes of premature death, as well as posing a fire hazard. The black carbon from

burning traditional biomass fuels is thought to contribute to global warming.10 The UN

Development Program is advocating a global initiative for universal access to energy, to form

part of the international community’s adoption of new sustainable development goals after

2015.11 Integrating such targets with other development priorities, like water supply and

sanitation, will generate substantial benefits. In many rural areas young women spend at

least an hour a day fetching water for the home, with a minimum of 15 liters per person per

day needed for sustenance, cooking and washing. Women also collect firewood, sometimes

over long distances. Access to reliable and affordable energy, including nuclear power, was

recognized as critical to sustainable development when the G20 countries met in 2013.12

The provision of affordable power is major part of the development solution. Other fuels,

such as liquefied petroleum gas canisters to replace kerosene and biomass, and

decentralized or off-grid solutions using renewable sources, will also play a part. Many poor

people use kerosene for lighting, which is inefficient, expensive and dangerous.13 Electricity,

however, once it is available through the national grid, can also displace more expensive,

and polluting, diesel generators and coal or oil-fired furnaces. The challenge lies in ensuring

that the power is affordable to medium and low income households and available (40

percent of Indian households have supplies for less than four hours a day).14 Most

developing countries do not have the resources to provide social assistance payments to the

disadvantaged so a business solution has to be found if these consumers are to benefit from

electrification.

Urbanization and rising incomes will enable utilities to restructure their tariffs and introduce

‘smart metering’. Wireless technology and ‘smart metering’ enable consumers to manage

their consumption and budgets conveniently, using, for instance, pre-payment systems

accessible from their cell phones or a local vendor.15 In principle, utilities using nuclear

power, and some renewable sources, can provide base-load electricity at a marginal cost.

Provided that their capital costs can be recovered from large-scale commercial customers,

public electricity suppliers should be in a position to pass on operating and maintenance

expenses fully to middle income and richer residential consumers as well as being able to

10

IEA, 2010c: pp. 243-249; and USAID, 2010, Black carbon emissions in Asia: Sources, impacts and

abatement opportunities, Washington DC: US Agency for International Development: pp. 20-22.

11

UNDP, 2011, Human Development Report 2011, New York: p. 98.

12

G20 Leaders’ Declaration made at the St Petersburg Summit of 5-6 September 2013: paras. 90

and 97.

13

A kerosene lamp will provide 60 lumens whereas a 60W tungsten bulb will provide over 700

lumens. A kerosene lamp also gives off harmful fumes and is a fire hazard. Estimates from India

indicate a cost of around US$ 0.07/kWh for kerosene compared to US$ 0.05/kWh for electricity

charged to Indian households; see <http://saurorja.org/2011/07/18/kerosene-vs-klean-lighting-up-

rural-india-cost-and-emission-analysis/>.

14

Statement by Dr. Srikumar Banerjee, Chairman of the Atomic Energy Commission of India, to the

WNA India International Nuclear Symposium held on 22 February 2012 in New Delhi.

15

Electricity can be purchased by means of a scratch card using a cell phone, ATM, or local/ street

corner vendor, or from an internet café. The scratch card contains a unique number that can be

entered on the keypad of the meter providing credit for a defined number of units of electricity.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 7

offer concessionary tariffs (or a limited tranche of free power) to the poor.16 Revenue

collection goes up when ‘smart meters’ are installed, so the provision of concessionary tariffs

need not result in a much larger overall cost to the utility. Public-private partnership models

could be designed with such poverty reduction objectives in mind and utilities with low

marginal cost generating sources are in a position to shape their market demand and build

their customer base. These types of initiatives might be eligible for financial support from the

Global Environment Facility, set up in 1991 to assist developing countries in combatting

climate change and other environmental challenges, and from government-owned

infrastructure banks like the Asian Development Bank’s Energy for All Initiative, the Inter-

American Development Bank’s Sustainable Energy and Climate Change Initiative, the

Islamic Development Infrastructure Fund and its energy sector financing, and the World

Bank’s Climate Investment Fund.

1.4 The present position of nuclear power

There are 435 nuclear power reactors operating commercially around the world and 69

under construction. They exploit the physics of nuclear fission, pioneered in the 1930s and

developed during and after the Second World War for weaponry and subsequently as a

source of energy. Nuclear energy has grown into an international industry over a period of

sixty years. These next sections look at the different technologies used to generate nuclear

energy and the approach taken to safety.

Table 1.2 shows the number of nuclear power reactors operating commercially and planned

or under construction in the world today.

Past growth in nuclear power occurred largely in the industrialized countries of Europe and

North America, and in Japan and South Korea in Asia. Today the emphasis has shifted to

the rapidly expanding economies of Asia, especially in China and the Indian sub-continent.

There is nonetheless continuing new build in Europe and North America as older plants are

taken out of service, and require replacement, or reflecting the relocation of economic

activity from the traditional industrial regions to growing regions, such as the Southern States

of the USA.

The share of nuclear power in worldwide electricity production is shown in Figure 1.2,

illustrating that it now represents about 11 percent of the total. The share has declined

slightly from the plateau at around 17 percent reached in the late 1980s onwards, owing to

recent rapid growth in power demand in the developing world. Rather than being the result of

investment into new plants, the relatively stable nuclear share for many years can be

explained by much better operating performance of nuclear plants and some capacity

uprates.

16

The World Bank suggests that poor households should receive 1kWh a day as a ‘lifeline’ supply;

see The World Bank, 2008, Country Strategy for Republic of India for the period FY 2009-2012,

Report No. 46509-IN: Annex 11, p. 5. ‘Smart meters’ can be programmed to provide an initial kWh

free of charge daily; see Engerati, 18 June 2014, Smart meters for Africa – Now is the right time, on

<www.engerati.com/article/smart-meters-africa-now-right-time>.

© World Nuclear Association 2014

8 | The World Nuclear Supply Chain: Outlook 2030

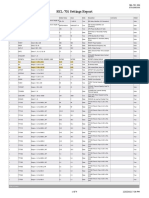

Table 1.2: Nuclear power reactors by region, number of reactors and capacity

(as of 1 October 2014)

Region Operable Under construction Planned

Reactors GWe Reactors GWe Reactors GWe

North America 119 111.3 5 5.6 7 7.2

Latin America 7 4.8 2 1.3 0 0

European Economic 136 124.5 4 4.0 19 22.4

17

Area

18

CIS 48 36.6 11 9.6 30 31.8

East Asia 98 86.4 37 41.0 66 70.6

19

West Asia 1 0.9 3 4.2 7 7.5

South Asia 24 6.0 7 4.1 24 22.3

Southeast Asia & Pacific 0 0 0 0 4 4.1

Africa 2 1.8 0 0 1 1.2

World 435 372.3 69 69.8 158 167.1

20

of which, OECD 324 297.0 16 18.6 36 43.8

Note: Operable reactors exclude a fast reactor in Russia as this is not a commercial project. Such

demonstration reactors are similarly excluded from the number under construction and from the

estimates for planned reactors.

17

Member countries of the European Economic Area comprise the member states of the European

Union and its associated countries: Austria, Belgium, Bulgaria, Czech Republic, Croatia, Denmark,

Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg,

Netherlands, Norway, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, Sweden,

Switzerland and the United Kingdom.

18

The Commonwealth of Independent States consists of Armenia, Azerbaijan, Belarus, Kazakhstan,

Kyrgyzstan, Russian Federation, Tajikistan, Ukraine and Uzbekistan.

19

Includes Turkey.

20

OECD membership in mid-2014 comprised 34 countries: Australia, Austria, Belgium, Canada,

Chile, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland,

Ireland, Israel, Italy, Japan, Republic of Korea, Luxembourg, Mexico, Netherlands, New Zealand,

Norway, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, United

Kingdom and the United States of America.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 9

Figure 1.2: Nuclear share in world electricity production, % (Source: IAEA21)

20

18

16

14

12

10

0

1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013

Figure 1.3 shows the share of nuclear power as a percentage of total electricity generation in

each of the countries where nuclear plants were in operation in 2012. Nuclear power

accounts for over 40 percent of electricity generation in five of these, including France,

Belgium and some countries of Central and Eastern Europe.

21

IAEA, 2014, Energy, Electricity and Nuclear Power Estimates for the Period up to 2050, Reference

Data Series No. 1: Table 1: p. 13.

© World Nuclear Association 2014

10 | The World Nuclear Supply Chain: Outlook 2030

Figure 1.3: Nuclear of electricity by country or territory in 2013, % (Source: IAEA)22

FRANCE

BELGIUM

SLOVAKIA

HUNGARY

UKRAINE

SWEDEN

SWITZERLAND

CZECH REPUBLIC

SLOVENIA

FINLAND

BULGARIA

ARMENIA

SOUTH KOREA

ROMANIA

SPAIN

UNITED STATES OF AMERICA

CHINA - TAIWAN

UNITED KINGDOM

RUSSIA

CANADA

GERMANY

SOUTH AFRICA

MEXICO

PAKISTAN

ARGENTINA

INDIA

NETHERLANDS

BRAZIL

CHINA - MAINLAND

JAPAN

IRAN

0 10 20 30 40 50 60 70 80

The contribution from nuclear power to electricity production has remained fairly stable over

the past decade, although in recent years it has fallen in Germany and Japan as a result of

reactor shutdowns following the Fukushima accident.

Based on International Energy Agency (IEA) output, consumption and price data, WNA

estimate that nuclear power plants generate gross revenues worth around US$ 330 billion a

year for electricity utilities (see Table 1.3).

22

IAEA, 2014, Nuclear Power Reactors in the World, Reference Data Series No. 2: Table 6 and

Figure 3: pp. 18 and 76.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 11

Table 1.3: Output & revenues from nuclear power plants, 2000-2013

2000 2005 2010 2011 2012 2013

OECD Output from NPPs (TWh) 2 249 2 346 2 182 1 990 1 866 1 877

Revenue (US$ billion) 164.2 220.3 284.8 285.8 292.3 293.9

Non- Output from NPPs (TWh) 346 422 468 497 480 482

OECD

Revenue (US$ billion) : 28.1 41.2 43.7 35.2 35.4

World Output from NPPs (TWh) 2 595 2 768 2 650 2 487 2 346 2 359

Revenue (US$ billion) : 248.4 326.0 329.5 327.5 329.3

Sources: IEA, 2011, Electricity Information 2011: Tables 1.2, 2.6, 2.14, 3.5, 3.7 and previous editions;

US Energy Information Administration, 2010, Electricity Prices for Households; WNA estimates.

1.5 Principal reactor types

Nuclear power technology has evolved considerably over the past 60 years. Progress has

been incremental and although the basic functions of the nuclear steam supply system

(NSSS) have not altered, the reliability and efficiency of the system has improved many

times over. Over the history of civil nuclear power, many different reactor designs have been

built and tested. Some designs have never made it past a few prototypes, while a few have

been widely deployed and form the bulk of the current operating fleet.

There is a distinction between the reactor process and the model. The process

distinguishes different classes of reactor based mostly upon the choice of moderator,

primary coolant and, sometimes, their fuel. Table 1.4 lists the operating reactors types by

process.

Table 1.4: Nuclear power reactors in operation on 1 October 2014

Reactor type Main locations Number Capacity Fuel Coolant Moderator

(process) GWe

Pressurized Water US, DE, FR, 273 248.3 Enriched Water Water

Reactor (PWR) JP, KR, RU, CN UO2

Boiling Water Reactor US, JP, DE, SE 84 81.0 Enriched Water Water

(BWR) UO2

Pressurized Heavy CA, IN, AR, RO 48 24.8 Natural Water Heavy

Water Reactor (PHWR) UO2 water

Gas-cooled Reactor UK 15 8.0 Natural U, CO2 Graphite

(GCR) Enriched

UO2

Light Water Graphite RU 15 10.2 Enriched Water Graphite

Reactor (LWGR) UO2

Fast Neutron Reactor RU 1 0.5 PuO2 and Liquid None

(FNR) UO2 Sodium

436 372.8

Of the reactors in Table 1.4, only the top three favoured processes – the PWR, BWR and

PHWR – are still being actively marketed today. Collectively boiling water reactors (BWRs)

and pressurized water reactors (PWRs) are referred to as light water reactors (LWRs), and

© World Nuclear Association 2014

12 | The World Nuclear Supply Chain: Outlook 2030

combined they dominate current global nuclear capacity. They use pure water (H2O) as their

moderator and coolant. Pressurized heavy water reactor (PHWR) designs, such as the

Candu type reactors, are the next most common variety and use heavy water (D2O) for their

moderator and water as reactor coolant.

For various reasons the graphite moderated reactors (GCR and the LWGRs) have not

shown the best operating track record and no vendors are offering models of this kind any

longer. Gas-cooled reactor (GCR) type reactors refer mainly to the Magnox and Advanced

Gas-cooled Reactors (AGRs) models indigenous to the UK. They use carbon dioxide (CO2)

gas as a primary coolant. The light water gas-cooled reactor (LWGR) type reactors (water-

cooled and graphite-moderated) refer mainly to the RBMK, the design made infamous by the

Chernobyl accident and now only operating inside the Russian Federation, where, in any

case, the design is being phased out.

The fast neutron reactors (FNRs) are a special case; only a handful of prototypes have ever

been built and operated. In current versions of FNRs, more fissile fuel is formed than is

consumed; typically 239Pu is formed from the neutron capture of 238U. This requires a ‘fast’

neutron, and thus such reactors – known as fast breeder reactors – require little or no

moderator in order to function. Since 238U makes up over 99 percent of mined uranium this

increases the fuel resource significantly, but it comes at a capital cost premium, both for the

reactor and the subsequent reprocessing.

The idea of a reactor model is actually a fairly recent concept, as, in the past, the level of

customization of each nuclear power plant meant that many reactors were essentially

unique. This situation came about as each new plant sought to implement improvements

that had become evident through the construction and operation of older plant. It is only as

more recent plants have been built that the benefits of standardization for fleet management

have become apparent, and what might be thought of as a reactor model has become a

valid definition.

Reactor models have in turn been divided into four ‘generations’ on the basis of the

sophistication of their design. It must be emphasized that all operating reactors are safe

enough to have received a licence and the improvements introduced over the years in

performance and risk reduction, while significant, represent the maturation of the technology

as experience is fed back into designs. These generations are defined as follows: 23

Generation I: early prototype and power reactors in the 1950s and 1960s, such as

Shippingport, Calder Hall, Dresden and Fermi 1. None remain in operation.

Generation II: large commercial power reactors built since the 1970s and still in

operation, including PWR/VVER, BWR, Candu, and AGR types. Nearly all currently

operating reactors are second generation and are still being built in a number of

countries. Safety upgrades have been incorporated in the light of operating

experience and evolving regulatory requirements.

23

US DoE, 2002, A Technology Roadmap for Generation IV Nuclear Energy Systems, GIF-002-00.

See also NEA, 2010, Nuclear Energy Outlook 2008, Paris: OECD: pp. 371-377.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 13

Generation III: reactors developed since the 1990s with advanced safety features,

better economy in operation and a 60 year design life, satisfying the Advanced Light

Water Reactor (ALWR) requirements developed in the US under the Utility

Requirements Document (issued by EPRI) or in Europe under the European Utilities

Requirements group. Some reactor technology vendors have designated their

models as Generation III+ to indicate that yet more features have been added.

Generation IV: reactors that are still at design stage and many of which will not be

operational even as prototypes until the later 2020s at the earliest. They offer the

prospect of further safety features, material safeguard and economic advantages,

whilst minimizing waste production and improving physical protection.24

The technological evolution of Generation II reactor was focused on addressing problems

that had become apparent during their operating lives, including incidents and accidents, as

part of a commitment to continuous improvement. In-service and periodic maintenance times

tended to be lengthier than anticipated originally by vendors and operators. Improving

capacity factors for nuclear power plants through greater on-line maintenance and shorter

shutdown times was therefore a priority. Steam generators tended to under-perform to

expectation due to early stress induced tube corrosion and/or vibration problems. This led to

changes in the size and materials used, including stronger turbine blades, and steam-water

separators to secure higher quality steam. Periodic safety reviews taking account normal

operating experience as well as safety incidents led to improved man-machine interfaces

and reinforcement of safety systems to address external hazards.

Moving from Generation II to Generation III models allowed designers to introduce the safety

requirements from regulatory bodies more efficiently at the design stage, as well as

providing a more economical design through simplification or standardization. Design

simplification has reduced the amount of equipment found in some Generation III reactors

compared to Generation II. In BWRs large external recirculation loops, with their pumps,

valves and piping, were replaced in the ABWR by reactor internal pumps that recirculated

coolant flow within the reactor core. The reactor containment and its housing were made

more compact, reducing the quantity of building materials.25 Big reductions in the volume of

radioactive waste could also be achieved.

There are several reactor models under construction: the ABWR, the ACPR1000, the

AP1000, the APR1400, the CNP-300, the CPR-1000, the EPR, the OPR-1000 and several

types of VVER (e.g. the AES-2006). In addition there are a number of reactor models that

are licenced for construction (or close to gaining such a licence), such as the APWR, the

Atmea1, the CAP1400, the EC6, the ESBWR, the Hualong, the MIR-1200 and the VVER-

TOI. Table 1.5 provides a matrix showing the inter-relationship between reactor types and

the major technology vendors.

24

Most designs are types of fast neutron reactor (FNR), with some based on prototypes built in the

1960s and 1970s. Japan’s prototype FNR at Monju, which started operation in 1994 but has had a

troubled history, may be decommissioned prematurely. Russia completed its first commercial scale

FNR in June 2014, the BN-800 at Beloyarsk, which is also the site of its prototype FNR, and is

cooperating with China in its FNR and high temperature reactor programs. Construction of a high

temperature reactor (HTR) is underway at Shidaowan. India is also constructing a prototype FNR at

Kalpakkam.

25

NEA/OECD, 2000, Reduction of capital costs of nuclear power plants, Paris: NEA/OECD: p. 97.

© World Nuclear Association 2014

14 | The World Nuclear Supply Chain: Outlook 2030

Table 1.5: Nuclear power reactors models

Reactor vendor Reactor type

Process Generation Models

AREVA BWR III Kerena

GE Hitachi III+ ESBWR-1550

Hitachi GE III ABWR-1350 & 1600

Toshiba III ABWR-1400 & 1600

AREVA PWR III+ EPR

AREVA + MHI III Atmea1

China General Nuclear (CGN) II+ CPR-1000

China General Nuclear (CGN) III ACPR1000

China National Nuclear Corp. (CNNC) II CNP-600 & 1000

China National Nuclear Corp. (CNNC) III ACP600

CGN + CNNC III+ Hualong

State Nuclear Power Technology Co. III+ CAP1400

KEPCO + Doosan II OPR1000

26

KEPCO + Doosan III APR1400

Mitsubishi Heavy Industries (MHI) III APWR-1400 & 1700

RosAtom III AES-92

RosAtom III+ AES-2006

RosAtom III+ VVER-TOI

RosAtom + Škoda III+ MIR-1200

Westinghouse III+ AP1000

Candu Energy PHWR III EC6

Candu Energy III+ ACR

Nuclear Power Corp. of India Ltd (NPCIL) II PHWR-700

Other technological advances have been incorporated into modern reactors or retrofitted to

existing ones, for example digital instrumentation and control (I&C) systems. Today’s

reactors have high fuel efficiency and feature streamlined construction and flexible

operation. Some types are designed to permit better load-following, so that their output can

be modified in line with variable electricity demand. The EPR, for instance, is able to

maintain its output at 25 percent and then ramp up to full output much faster. This means

that potentially the unit can change its output from 25 to 100 percent in less than 30 minutes,

26

A Generation III+ design gained approval in 2013.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 15

though this may be at some expense of wear and tear to certain components. Other reactor

types, like ABWRs, have load following capability.

Improvements in fuelling are being incorporated that also offer gains in safety and efficiency.

1.6 Safety

Nuclear safety and security are priorities for the industry. Safety, along with the need to

manage radioactive wastes, is usually cited as being the biggest concern amongst the public

regarding nuclear technology. There is no doubt that nuclear power carries a low health and

safety risk. Notwithstanding, after nearly a century of research our knowledge of the range of

effects of radiation on health is well established (and there is no measurable evidence of

harm at low dose levels). Radiation protection standards nonetheless assume that there is

no ‘safe’ level of exposure. This rule arises from the application of the precautionary

principle. The industry keeps exposures to a fraction of the dose everyone receives from

natural sources of radiation. During operation, workers are monitored to make sure that their

exposure is kept to as low as is reasonably achievable, the ALARA principle. Their shift

patterns and duties are also organized to avoid unnecessary exposure. Operators of nuclear

power plants are subject to stringent oversight and actively manage their operation to

maintain safety.

Safety is an outcome. It is ensured through a combination of design, engineering, quality

assurance in manufacturing and construction and intelligent and rigorously controlled

operational activity by management and staff. Nuclear power plants are designed to

minimize the likelihood of any accidental release of radioactive material into the

environment. The industry has adopted a ‘defence-in-depth approach’, with multiple safety

systems supplementing the natural features of the nuclear reaction. Systems are

manufactured to assure high reliability. Physical barriers prevent the release of radioactive

substances and the penetration of harmful radiation. Back-up electrical and mechanical

systems are available to control the reaction and confine any problems, such as the loss of

cooling, to the reactor’s containment structure. Operational and engineered systems are

designed to accommodate human error and deliberate sabotage or external attack. Most

reactor designs incorporate a mix of so-called active safety systems, including emergency

diesel generators, with inherent or passive safety features, which depend on physical

phenomena such as convection, gravity and neutronic feedback or on materials that are

resistant to high temperatures, radiation damage and corrosion, to continue operating safely

in the event of a problem.

The industry is regulated closely. Vendors submit a design for approval by the regulatory

body. Operators must demonstrate that they will undertake high quality manufacturing and

construction and comprehensive testing before a construction and operating licence is

awarded. Management systems and procedures are formulated to take account of all actions

and events that could compromise safety. Standards set by the International Atomic Energy

Agency (IAEA) specify that safety be paramount within the management system.27 High

levels of technical competence are achieved through the recruitment and training of qualified

staff. The nuclear industry has a safety culture that supports individuals and teams in

27

IAEA, 2006, The Management System for Facilities and Activities, Safety Requirements No. GS-R-

3: p. 5.

© World Nuclear Association 2014

16 | The World Nuclear Supply Chain: Outlook 2030

carrying out their tasks safely and successfully, reinforces an attitude of learning and

questioning at all levels and continuously seeks to improve its performance. All nuclear

power plants have guidelines for handling and mitigating severe accidents and incidents.

These fundamental safety principles are incorporated into the Convention on Nuclear Safety

adopted in 1994.

Nuclear reactors are in any case designed to avoid run-away criticality accidents where

there is a surge of energy not mitigated by the normal controls. However, as the Chernobyl

disaster of 1986 showed, serious accidents of this type are possible. Significant lessons

have been learned from this and other incidents, such as the 1979 meltdown at Three Mile

Island (see Table 1.6). The emergency at Fukushima Daiichi in 2011 has been reviewed by

regulatory authorities and industry bodies like the World Association of Nuclear Operators

(WANO). New reactor designs are less vulnerable to core melt accidents. Accident

scenarios that were once considered ‘beyond design basis’ are now included in newer

designs, providing additional reassurance. In a modern reactor a serious problem is more

likely to take the plant off-line temporarily rather than damage it permanently.

The emergency at the Fukushima Daiichi plant exposed safety vulnerabilities. Although

radiation from Fukushima inflicted no fatalities – nor are the public or plant workers expected

to endure any harmful effects – the precautionary evacuation of 100 000 people had a major

social and economic impact. In the aftermath, countries around the world that use nuclear

power have reviewed their energy policies and, with few exceptions, reaffirmed their

commitment to this low-carbon energy resource. The industry is committed to being part of

this wider review process and will apply all lessons learned to its activities.

Table 1.6: Reactor accidents, causes and lessons learned

Reactor Severity Safety Contributing Lessons learned

28

accident (INES) function lost factors

Three Mile Island 2 5 Cooling Lack of operator Need for human

USA training. Failure in performance programs and

1979 the man-machine improved instrumentation,

interface. information and procedures.

Chernobyl 4 7 Control of Lack of safety Need for improved

USSR (Ukraine) reactivity culture. Flaws in exchange on good practice

1986 reactor design. across the industry,

including the fostering of a

safety culture.

Fukushima Daiichi 7 Cooling Failure to consider Need for better emergency

(Units 1-4), Japan worst case accident preparedness and response

2011 scenarios. to improve resilience against

natural hazards and other

extreme events.

28

The International Nuclear Event Scale tries to grade the safety-significance of incidents; see

<http://www-ns.iaea.org/tech-areas/emergency/ines.asp>.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 17

Part 1: Market Outlook

© World Nuclear Association 2014

18 | The World Nuclear Supply Chain: Outlook 2030

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 19

2 Outlook for nuclear power

The chapter uses a scenario approach to examine the industry’s prospects to 2030. It

summarizes the three scenarios for the development of nuclear power that were prepared in

relation to the WNA’s report on The Global Nuclear Fuel Market (2013). A scenario

methodology seeks to delineate the long-term development trajectories that could plausibly

arise.

Energy markets are undergoing structural change as governments seek to unbundle and

privatize vertically integrated suppliers and to deregulate markets to promote competition.

Climate change is altering the calculus of governments, civil society and business

enterprises. Companies’ strategic planning now needs to examine widely different scenarios.

Business as usual is no longer an option. Given the efficiency advantages that nuclear

power enjoys over alternative low-carbon energy sources, WNA’s scenario analysis

suggests that market drivers will favour the take-up of nuclear power by electricity suppliers,

but only over the longer term. In the shorter term the outlook for nuclear power is less

promising.

2.1 A changing economic and energy landscape

Traditionally governments have adopted long-term energy policies to guide investment but

with the privatization of utilities and the deregulation of electricity markets the relevance of

such policies has diminished. Many governments now aim to provide a legal and policy

environment in which competitive energy markets are expected to deliver secure, sufficient

and environmentally sensitive power to all citizens and enterprises. To be sure, governments

still have a role, through the licensing system for nuclear power plants and related

installations, in setting the terms of the liability insurance framework and in supporting

research and development. But governments have tried to avoid taking an active role in the

energy business and the responsibility to plan the configuration of the power supply system

has therefore fallen upon the public electricity suppliers.

Unfortunately, some deregulated markets have failed to generate the forward prices to

provide sufficient incentive to invest in long-lived capital-intensive projects. A peculiarity of

electricity markets is that the product is produced and consumed at the same instant. Since

electricity is considered an essential service, the market is not able to adjust the quantity

supplied, by cutting off supply, for example, without penalty; or by storing surplus electricity

through a pumped storage scheme, as it is usually more efficient to invest in stand-by

capacity that is ready to generate when required. The result is a volatile spot price as

electricity demand changes and this uncertainty arising from price volatility may, in turn,

send the ‘wrong’ signals and deter investment in additional capacity, especially if this is

capital-intensive. Several governments have therefore begun to re-regulate and design

market interventions that address these market failures.

Other governments, such as in China and India, continue to manage their economic

development actively, and their investment planning encompasses the energy supply sector

accordingly. Developing countries in particular support the extension of the electricity supply

© World Nuclear Association 2014

20 | The World Nuclear Supply Chain: Outlook 2030

system to permit grid access in the countryside and to the poor and to regulate the price

charged for power to ensure its affordability. Even in developed economies many

governments retain an ownership share in public electricity supply companies, although they

try to manage these assets at ‘arm’s length’, leaving investment decisions to be taken on

largely commercial criteria.

The greater uncertainty regarding future energy prices in deregulated markets has meant

that power producers and utilities must take on a higher level of risk when investing in new

capacity. Nuclear power plants (NPPs) are capital-intensive investments with lengthy pay-

back periods and it has not proved viable to finance such projects on normal commercial

terms in recent years. Almost all NPPs under construction currently were initiated at a time

of regulated energy markets. The problem of potential under-investment in capacity has

affected non-nuclear plants as well and it has provoked concern within regulatory bodies and

government.

The control of greenhouse gases (GHGs) is still in its infancy and counter measures arouse

controversy. The trend towards a more uniform and stable carbon price is hard to predict

and therefore poses a significant risk impacting all forms of energy industry investment. To

date, the volatility of the ‘carbon price’ on the European Emission Trading System (ETS) has

failed to elicit any supply-side response in terms of investment in low-carbon sources of

energy. It is clear that public policy, the scientific consensus, consumer perceptions and

market forces are pulling in contradictory directions. In time, if greenhouse gas

concentrations rise inexorably, governments may choose to stand back from the

complexities of intervening in every market sector to encourage climate change mitigation

activity by civil society and instead proscribe greenhouse gas emission in much the same

way as other harmful pollutants were eliminated through air quality legislation. Generators

could then find themselves with stranded fossil fuel assets.

2.2 WNA scenarios

The WNA does not prepare its own forecasts of world energy and electricity supply and

demand, but relies on the analysis of international organizations such as the International

Energy Agency (IEA) and the International Atomic Energy Agency (IAEA). Population,

economic growth and urbanization are the clear long-term drivers of energy demand but

rising concerns over global warming and the imperative to reduce absolute poverty in

developing countries are increasingly shaping the pattern of supply. Significant innovations

in business practices and technology will take shape, altering energy economics

fundamentally. The drivers of innovation are government policy and the commercial risks

associated with continued reliance upon fossil fuels, with the latter probably being the more

significant factor. Business strategies will have to adapt to a much more complex

environment than that hitherto encountered (see box).

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 21

Scenarios for strategic planning

Strategic planning under conditions of considerable uncertainty calls for the intelligent use of

scenarios. Scenarios are not forecasts but they nonetheless attempt to provide a frame of

reference for strategic thinking under conditions of uncertainty. Each projection describes a

coherent development pathway resulting from an explicit set of assumptions. Scenarios are

tools to give decision-makers the opportunity to think through the options, opportunities and

threats, and trade-offs, as they relate to their own sector of business. The pathway and its

impacts can be identified but the likelihood of it happening is much harder to estimate. The

energy industry must evaluate the plausibility of such scenarios against its own experience

and insight but it is important to remember that it is the whole set of scenarios that describes

collectively the probable future outcomes. A business strategy cannot assume that a

particular scenario will in fact come about and therefore must take account of a range of

possible futures. Key factors in the sustainable development of energy supply systems are:

Affordability – the cost-effectiveness of generation options relative to each other

and to other energy sources;

Availability – the location of resources, be they natural, financial, human or

technological;

Accessibility – the quality of energy in terms of reliability and coverage; and,

Acceptability – concerning the safety and environmental impact of forms of energy

supply.29

To reflect the range of uncertainties which surround any forecast, three scenarios have been

prepared; these are referred to as the Lower, Reference and Upper cases. The three cases

reflect the states of the world that are possible given the interplay of energy policy and

economics. The aim with this approach is to cover the full range of possible outcomes for the

future in a comprehensive, logical and internally consistent way.

No attempt is made to attach probabilities to the projections. In principle, the starting point is

that all three must be plausible as representations of future events. Companies may wish to

test their own plans and forecasts against each of the cases. Although there is a natural

tendency to consider the Reference case, as it stands in the middle, to be the most plausible

outcome, the Upper and Lower cases must not be ignored, as they also are judged as fully

credible, depending on underlying political and economic trends. Indeed, until the Fukushima

accident, the greater optimism surrounding nuclear power naturally meant that the Upper

case was becoming increasingly likely and the Lower case less so. Arguably the most

significant impact of Fukushima is that it has changed the likelihood of the scenarios in the

other direction. The Upper case may now be viewed as less likely and the Lower case,

sometimes effectively forgotten at the time of much increased optimism about nuclear, has

suddenly become seriously considered once again.

29

See World Energy Council, 2007, Deciding the Future: Energy Policy Scenarios to 2050, London:

WEC: p.15.

© World Nuclear Association 2014

22 | The World Nuclear Supply Chain: Outlook 2030

2.2.1 Reference case

The Reference case reflects the current energy market situation, where relatively high fossil

fuel prices and weak regulation of emissions coexist. It is based upon the following

assumptions:

Affordability:

Continued improvements occur in the relative economics of nuclear power

generation against alternatives such as natural gas and coal, with only minor

increases to fossil fuel prices.

The gradual restructuring and liberalization of electricity sectors continues in many

key countries. The climate for both state and private investment in large, long-term

projects begins to improve.

Availability:

Interest in nuclear power from emerging industrial economies continues and

encourages the international community and governments to help them build

technical and regulatory capacity.

Acceptability:

Concerns about the threat of global warming continue, and moves to incorporate the

external costs of fossil fuel electricity generation into relative prices begin to achieve

a slow shift in the mix of energy sources. Governments realize that renewable energy

sources will be insufficient to meet targets for stabilizing GHG emissions worldwide

and recognize nuclear as a non-greenhouse gas energy resource.

The Fukushima accident has an impact in some countries, but most governments

continue with their previous plans.

Public acceptance problems for nuclear projects begin to diminish. Slow but steady

progress on waste management improves public acceptance in most countries.

Accessibility:

Rural electrification is completed in Asia and southern Africa, contributing to rising

demand for power.

2.2.2 Upper case

The Upper case is consistent with the world moving to a situation in which governments

introduce tough emission curbs and markets reflect higher carbon prices. Such a state of the

world is the most stable scenario presented, but involves market actors and policy-makers

working in coherence. The Upper case assumes:

Affordability:

Significant improvements occur in the relative economics of nuclear power, based on

higher market prices for fossil fuels and improvements in reactor construction, design

and operation.

Electricity market restructuring revitalizes the sector and leads to many new

investment projects, contributing to stated national and international energy and

environmental policy goals.

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 23

Availability:

Interest in nuclear power from emerging industrial economies builds up and

encourages the international community and governments to help them build

technical and regulatory capacity and provide investment finance through the

international development banks.

Acceptability:

Policies are introduced around the world to encourage energy sources with zero or

low greenhouse gas emissions, in order to alter the energy mix sufficiently to reduce

such emissions and limit global warming.

Fukushima has little adverse impact on government regulation of the nuclear sector.

Substantial progress is made on the public acceptance of nuclear safety, waste

management and decommissioning.

Accessibility:

Utilities in emerging industrial markets take advantage of the low marginal costs of

nuclear generation to expand their share of sales to poorer households.

2.2.3 Lower case

The Lower case involves no movement from a world where weak emissions control, a low

carbon price and relatively low fossil fuel prices prevail. It also represents an economically

stable state of the world, although vulnerable to a sudden policy reversal as the effects of

climate change begin to constrain agricultural output in vulnerable zones and alter

communicable disease profiles around the world. For the Lower case the following

assumptions apply:

Affordability:

Investment in new nuclear power projects appears uncompetitive, as a result of low

gas prices, high nuclear power plant construction costs, and political and regulatory

risks. The emergence of shale gas reserves as economically viable sources helps

keep fossil fuel prices down.

Electricity market restructuring in many key countries leaves major energy

investment decisions to be taken by private investors with relatively short-term

horizons.

Availability:

Interest in nuclear power from emerging industrial economies wanes and few

countries embark on the necessary preparation for a nuclear power program.

Acceptability:

Governments are slow to introduce substantial measures to alter the fuel mix, despite

increasing acceptance of the evidence of global warming.

Fukushima has a significant impact on nuclear prospects by discouraging

government interest in the technology.

Public acceptance problems for nuclear power increase, curtailing operating reactor

lives and constraining any new nuclear growth.

© World Nuclear Association 2014

24 | The World Nuclear Supply Chain: Outlook 2030

Government-inspired phase-out plans for existing reactors and moratoria on new

nuclear plant construction remain in place in some countries.

Accessibility:

Off-grid solutions based on decentralized distribution of power from small-scale

renewable energy sources are encouraged but comprehensive rural electrification is

impeded by the higher relative cost of nuclear and renewable energy sources, which

reduces the take-up by poor households in developing countries.

2.2.4 Nuclear power projections

Figure 2.1 shows the scenarios all the way to 2030. From 2015 onwards the three

scenarios begin to diverge as reactor construction programs get better established in the

Upper case and closures increase in the Lower. Beyond 2020, the projections begin to

diverge much more significantly. The general resilience of nuclear generation under the

Lower case ends, as reactor closures become very significant and new build peters out.

The Reference case shows nuclear capacity increasing more quickly to reach 574 GWe by

2030 (from 334 GWe in 2012). Growth in the Upper case also accelerates, as substantial

reactor building programs take off around the world. The Reference case implies an annual

growth rate of 3.0 percent versus 4.2 percent for the Upper and zero percent for the Lower,

although this includes a projected re-opening of some Japanese reactors.

It is worth noting that the projected growth rates for the Upper and Reference cases are

higher than at any time in the last twenty years.

Figure 2.1: Nuclear generating capacity to 2030, GWe

© World Nuclear Association 2014

The World Nuclear Supply Chain: Outlook 2030 | 25

Table 2.1 breaks down WNA’s projections on a regional basis. It will be noted that the OECD