Professional Documents

Culture Documents

PE Exit

PE Exit

Uploaded by

Rahul GargOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PE Exit

PE Exit

Uploaded by

Rahul GargCopyright:

Available Formats

IFDC Extra III Fund, a private equity fund raised $100 million towards the first close of its

fourth fund in

January 2017. The commitments have come from domestic institutional investors and a final close of

$300 million is expected by end of 2018. IFDC is looking at investing in 8-10 companies with a ticket size

of around $30-50 million.

IFDC makes the following projections regarding the investments and gains from this fund over the next

few years.

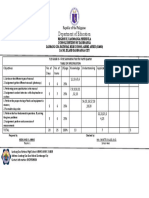

By end of year Drawdowns Cash flows from

investments

2017 63

2018 32

2019 30

2020 35 20

2021 35 80

2022 35 110

2023 120

2024 370

The fee and sharing arrangement it has with its limited partners is contracted as below.

a. Management fees @2% on committed capital during the investment period until all

committed capital was invested or 2 years after final closing, whichever is earlier; 1% of total

invested capital afterward.

b. Net investment income or loss, net realized gain or loss, and unrealized gain or loss on

investments are allocated to the limited partners pro rata in proportion to their respective

capital contributions; however, the allocation of profits and losses is divided between the

limited partners and the General Partner as follows:

• 100% to all partners until all the partners have received an amount equal to the capital

contributed

• 100% to limited partners until the limited partners have received an aggregate amount equal to

an 8% cumulative internal rate of return, compounded annually, on the outstanding balance of

the limited partners’ capital contributions

• 100% to the General Partner until the General Partner has received 20% of the aggregate

amount allocated to the general and limited partners pursuant to clause (II) above

• Thereafter, 80% to the limited partners and 20% to the General Partner.

Use the template provided to work out whether the fund’s expected performance will be able to match

the required compounded average annual return of 30% p.a. of IFDC’s limited partners by the end of

2024. What will be their cash-on-cash multiple over the life of the fund? What percentage of the total

distributions do the general partners receive under this arrangement?

You might also like

- Park Hotel 3 GDocument6 pagesPark Hotel 3 GRahul GargNo ratings yet

- DipIFR TextbookDocument375 pagesDipIFR TextbookEmin SaftarovNo ratings yet

- A Guide To Criminal Offending and Sentencing 4Document47 pagesA Guide To Criminal Offending and Sentencing 4Jason ClarkNo ratings yet

- Customer ExperienceDocument9 pagesCustomer ExperienceRahul GargNo ratings yet

- AQoNs PWC 7 July 2023Document35 pagesAQoNs PWC 7 July 2023AFRNo ratings yet

- Gujarat State Road TransportationDocument19 pagesGujarat State Road TransportationRahul GargNo ratings yet

- An Ocean Without ShoreDocument199 pagesAn Ocean Without ShoreBogdan Scupra50% (2)

- Afar 2 Module CH 9 & 10Document126 pagesAfar 2 Module CH 9 & 10Ella Mae TuratoNo ratings yet

- MAC3761 - Assignment01 - 2021Document16 pagesMAC3761 - Assignment01 - 2021Waseem KhanNo ratings yet

- At Sea (Return of The Woodland Warriors)Document23 pagesAt Sea (Return of The Woodland Warriors)Tess MercerNo ratings yet

- Key Quiz 2 2022 2023Document4 pagesKey Quiz 2 2022 2023Leslie Mae Vargas ZafeNo ratings yet

- Hibernate NotesDocument338 pagesHibernate NotesAnirudha Gaikwad100% (1)

- Tax Planning With Reference To Financial Management DecisionsDocument5 pagesTax Planning With Reference To Financial Management Decisionsasifanis70% (10)

- Centrum Private Credit Fund - Annual NewsLetterDocument17 pagesCentrum Private Credit Fund - Annual NewsLettersuraj211198No ratings yet

- Acccob 2 - Exercise 4-1 - 4-10Document19 pagesAcccob 2 - Exercise 4-1 - 4-10Ayanna CameroNo ratings yet

- Mergers & Acquisitions: Philip-Indal CaseDocument20 pagesMergers & Acquisitions: Philip-Indal CaseRahul GargNo ratings yet

- Yog Mimnsha PDFDocument6 pagesYog Mimnsha PDFrahul guptaNo ratings yet

- Python NotesDocument1,018 pagesPython NotesRameshwar KanadeNo ratings yet

- Questoes Acme Investment TrustDocument2 pagesQuestoes Acme Investment Trustveda20No ratings yet

- Monthly Dividend Distribution HKDocument58 pagesMonthly Dividend Distribution HKwayne.ilearnacadhkNo ratings yet

- I-Great Mega: ArketingDocument12 pagesI-Great Mega: ArketingApakElBuheiriGetbNo ratings yet

- Investment in AssociateDocument33 pagesInvestment in AssociateKimivy BusaNo ratings yet

- Quiz No. 1Document6 pagesQuiz No. 1Elboy Son DecanoNo ratings yet

- CPU - Financial Acctg & Reporting II - CHAPTER 2Document25 pagesCPU - Financial Acctg & Reporting II - CHAPTER 2Princess Jonabelle BaylonNo ratings yet

- Quiz 2 Lesson 3Document5 pagesQuiz 2 Lesson 3Andreau Granada0% (1)

- Tgpala Aicte Income Tax Programme 2015 16 UPDATEDDocument27 pagesTgpala Aicte Income Tax Programme 2015 16 UPDATEDniranjannlgNo ratings yet

- Investments in Associate PAS 28 Part 3Document8 pagesInvestments in Associate PAS 28 Part 3EgieMae GarcesNo ratings yet

- Long Term SolvencyDocument6 pagesLong Term SolvencyHoàng HoàngNo ratings yet

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentYared AddiseNo ratings yet

- 2 Partnership OperationDocument2 pages2 Partnership OperationMichael CayabyabNo ratings yet

- HW On Cash Surrender Value CDocument1 pageHW On Cash Surrender Value CCha PampolinaNo ratings yet

- QUIZ 3 Accounting For Special Transactions 4Document1 pageQUIZ 3 Accounting For Special Transactions 4ninocastillo316No ratings yet

- GIT - Total Income Exam QP - 18-3-2020Document18 pagesGIT - Total Income Exam QP - 18-3-2020geddadaarunNo ratings yet

- DCLP Termsheet-20200429Document8 pagesDCLP Termsheet-20200429api-511192507No ratings yet

- FINAN204-21A - Tutorial 8 QuestionsDocument4 pagesFINAN204-21A - Tutorial 8 QuestionsDanae YangNo ratings yet

- Fundamentals 2024 PDF SPCCDocument82 pagesFundamentals 2024 PDF SPCCJeetalal GadaNo ratings yet

- 08 Bond InvestmentDocument3 pages08 Bond InvestmentAllegria Alamo100% (1)

- Company 2 - HDFCDocument7 pagesCompany 2 - HDFCGourishNo ratings yet

- Alert: The Finance (Miscellaneous Provisons) BillDocument11 pagesAlert: The Finance (Miscellaneous Provisons) BillJohn SmithNo ratings yet

- Declaration Payment of Dividend 71Document5 pagesDeclaration Payment of Dividend 71Anshul RathiNo ratings yet

- Accounting For Special Transaction 2Document3 pagesAccounting For Special Transaction 2Nicole Gole CruzNo ratings yet

- Sample Final Exam QuestionsDocument28 pagesSample Final Exam QuestionsHuyNo ratings yet

- One Advice For Investors Earning Dividend Income - Unlearn, Then Relearn!Document6 pagesOne Advice For Investors Earning Dividend Income - Unlearn, Then Relearn!Ramasayi Gummadi100% (1)

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- 2nd Long Quiz StudentDocument8 pages2nd Long Quiz StudentDumb MushNo ratings yet

- 9402 - Partnership OperationDocument3 pages9402 - Partnership OperationLuzviminda SaspaNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument29 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisBharat NotnaniNo ratings yet

- Memo EverrestDocument3 pagesMemo EverrestEllen MarkNo ratings yet

- Class Question 20 April 2023Document4 pagesClass Question 20 April 2023lesediNo ratings yet

- USAA Growth and Tax Strategy Fund - 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund - 2Q '22ag rNo ratings yet

- Special Qualifying Examination Review 2019: Partnership OperationsDocument4 pagesSpecial Qualifying Examination Review 2019: Partnership OperationszoeNo ratings yet

- Section e - QuestionsDocument4 pagesSection e - QuestionsAhmed Raza MirNo ratings yet

- FM Cia 3Document14 pagesFM Cia 3MOHAMMED SHAHIDNo ratings yet

- 2020-08-31 Ar20Document68 pages2020-08-31 Ar20Daniel ManNo ratings yet

- Bank of North Dakota Buydown ProgramDocument3 pagesBank of North Dakota Buydown ProgramJeremy TurleyNo ratings yet

- A-Enrich RezekiDocument12 pagesA-Enrich RezekiAIA Sunnie YapNo ratings yet

- Test Advance Financial AccountingDocument2 pagesTest Advance Financial AccountingSaadullah ChannaNo ratings yet

- Chapter - 7 Income From Other SourcesDocument31 pagesChapter - 7 Income From Other SourcesAnonymous duzV27Mx3No ratings yet

- Fin QusDocument3 pagesFin QusFardin RehabNo ratings yet

- 8553-1 2nd ProjectDocument24 pages8553-1 2nd ProjectmrzeettsNo ratings yet

- Class 12 Mock Test AccountancyDocument13 pagesClass 12 Mock Test AccountancyLPS ANJALI SHARMANo ratings yet

- 12 - Acc - Ch2 - Learning FeedbackDocument2 pages12 - Acc - Ch2 - Learning FeedbackSHAH SHREYANo ratings yet

- Estimated Liabilities: Lecture NotesDocument7 pagesEstimated Liabilities: Lecture NotesDaniel Apuan SalviejoNo ratings yet

- X423.8 Assignment 8Document5 pagesX423.8 Assignment 8FBNo ratings yet

- HW On Bonds Payable T1 2020-2021Document2 pagesHW On Bonds Payable T1 2020-2021Luna MeowNo ratings yet

- Acc224 Ca3Document9 pagesAcc224 Ca3MohitNo ratings yet

- Questions 1Document4 pagesQuestions 1calvin sijabatNo ratings yet

- Group Assignment 2 - Fall 2021 - BlankDocument13 pagesGroup Assignment 2 - Fall 2021 - Blankhalelz69No ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Colin Shaw: Founder & CEO, Beyond PhilosophyDocument8 pagesColin Shaw: Founder & CEO, Beyond PhilosophyRahul GargNo ratings yet

- Data File Used: 1a. Creating Cross Tab - TWBXDocument7 pagesData File Used: 1a. Creating Cross Tab - TWBXRahul GargNo ratings yet

- Case Analysis: RKS GuitarsDocument6 pagesCase Analysis: RKS GuitarsRahul GargNo ratings yet

- Trip CalendarDocument11 pagesTrip CalendarRahul GargNo ratings yet

- The Park Hotel: Desigining Luxury ExperienceDocument6 pagesThe Park Hotel: Desigining Luxury ExperienceRahul GargNo ratings yet

- Il&Fs Crisis: Failure of Corporate GovernanceDocument9 pagesIl&Fs Crisis: Failure of Corporate GovernanceRahul GargNo ratings yet

- Group 2Document23 pagesGroup 2Rahul GargNo ratings yet

- A Maximum of 10 Points Will Be Awarded For Clarity and Consistency of Logic, Ease of Reading and FlowDocument1 pageA Maximum of 10 Points Will Be Awarded For Clarity and Consistency of Logic, Ease of Reading and FlowRahul GargNo ratings yet

- T-4 MCFP PDFDocument9 pagesT-4 MCFP PDFRahul GargNo ratings yet

- T4 - PM PDFDocument5 pagesT4 - PM PDFRahul GargNo ratings yet

- Strategic Management-II: Cooperative StrategyDocument17 pagesStrategic Management-II: Cooperative StrategyRahul GargNo ratings yet

- Biases Used in EdTechDocument3 pagesBiases Used in EdTechRahul GargNo ratings yet

- QuizDocument1 pageQuizRahul GargNo ratings yet

- I. Below Are The Abridged Financials of SBI AMC Ltd. and Two Mutual Funds From Their Stable - Fund 1 and Fund 2. All Figures Are in Rs. CroreDocument4 pagesI. Below Are The Abridged Financials of SBI AMC Ltd. and Two Mutual Funds From Their Stable - Fund 1 and Fund 2. All Figures Are in Rs. CroreRahul GargNo ratings yet

- Do Banks Need To Advertise?Document19 pagesDo Banks Need To Advertise?Rahul GargNo ratings yet

- Quiz 2Document1 pageQuiz 2Rahul GargNo ratings yet

- Founder's Round Angel Investment Series A Investment Rs. % Rs. Nos. % Rs. NosDocument2 pagesFounder's Round Angel Investment Series A Investment Rs. % Rs. Nos. % Rs. NosRahul GargNo ratings yet

- Asset Management Companies: Mutual FundsDocument10 pagesAsset Management Companies: Mutual FundsRahul GargNo ratings yet

- Course Outline - Data VisualizationDocument6 pagesCourse Outline - Data VisualizationRahul GargNo ratings yet

- Private Equity Exits: A PE Firm Can Exit From Investments in Multiple Ways Some Common Ones Being Secondary Sale (Where It Sells Its Stake To AnotherDocument6 pagesPrivate Equity Exits: A PE Firm Can Exit From Investments in Multiple Ways Some Common Ones Being Secondary Sale (Where It Sells Its Stake To AnotherRahul GargNo ratings yet

- Linuxengines Blogspot inDocument9 pagesLinuxengines Blogspot inShitesh SachanNo ratings yet

- Asprova ScriptDocument109 pagesAsprova ScriptAnh VuNo ratings yet

- Mining Plan: M/S Gyanchandani Purshotam Stone CrusherDocument45 pagesMining Plan: M/S Gyanchandani Purshotam Stone Crushervarun2860No ratings yet

- Unit 5-Nervous System Brain Retina QuestionsDocument70 pagesUnit 5-Nervous System Brain Retina Questionsareyouthere92No ratings yet

- This Paper Was Presented at The International Seminar On HumanisticDocument6 pagesThis Paper Was Presented at The International Seminar On HumanisticSivarajan RajangamNo ratings yet

- IC3 Corporate Finance Photocopiable Teachers NotesDocument10 pagesIC3 Corporate Finance Photocopiable Teachers NotesОля ИгнатенкоNo ratings yet

- Senate Hearing, 108TH Congress - Embryonic Stem Cell Research: Exploring The ControversyDocument87 pagesSenate Hearing, 108TH Congress - Embryonic Stem Cell Research: Exploring The ControversyScribd Government Docs100% (1)

- Importance of The EnglishDocument3 pagesImportance of The EnglishMaria Alejandra Rivas HueteNo ratings yet

- Chapter 9 Gem The Life and Works of RizalDocument8 pagesChapter 9 Gem The Life and Works of Rizalrmm0415No ratings yet

- 24 Global Currency Fund Mid-May 2020 Term SheetDocument1 page24 Global Currency Fund Mid-May 2020 Term SheeterdNo ratings yet

- Financial Accounting 17th Edition by Williams ISBN Solution ManualDocument90 pagesFinancial Accounting 17th Edition by Williams ISBN Solution Manualjames100% (26)

- Centres and Peripheries in Ottoman Architecture Rediscovering A Balkan Heritage Ed Maximilian Hartmuth Sarajevo Stockholm Cultural Heritage Witho PDFDocument173 pagesCentres and Peripheries in Ottoman Architecture Rediscovering A Balkan Heritage Ed Maximilian Hartmuth Sarajevo Stockholm Cultural Heritage Witho PDFRebecca378No ratings yet

- Vocabulary ClothesDocument2 pagesVocabulary ClothesKeeo100% (2)

- Antimicrobial, Antioxidant and Phytochemical Assessment of Wild Medicinal Plants From Cordillera Blanca (Ancash, Peru)Document16 pagesAntimicrobial, Antioxidant and Phytochemical Assessment of Wild Medicinal Plants From Cordillera Blanca (Ancash, Peru)Carmen Tamariz AngelesNo ratings yet

- MURLIDocument4 pagesMURLIrabinpadhanNo ratings yet

- Jurnal Kepimpinan Pendidikan - : Kepuasan Kerja Dan Komitmen Guru Sekolah Menengah Cemerlang Di KelantanDocument14 pagesJurnal Kepimpinan Pendidikan - : Kepuasan Kerja Dan Komitmen Guru Sekolah Menengah Cemerlang Di KelantanNaliny MalaiNo ratings yet

- Total Quality Management Multiple Choice Questions and Answers. Page 7Document3 pagesTotal Quality Management Multiple Choice Questions and Answers. Page 7Prakash prajapatiNo ratings yet

- Tos Tle 1ST Sum - Test 4TH QuaterDocument1 pageTos Tle 1ST Sum - Test 4TH QuaterFatima AdilNo ratings yet

- Inverter Outdoor Unit: For Air Source Split Heat Pump Air To Water and Air To Air 2 To 16 KW Output Heating and CoolingDocument3 pagesInverter Outdoor Unit: For Air Source Split Heat Pump Air To Water and Air To Air 2 To 16 KW Output Heating and CoolingVlad PandichiNo ratings yet

- En ReckonerDocument130 pagesEn ReckonerH.A. KhanumNo ratings yet

- ChallengesDocument5 pagesChallengesMERVE İREM ALTUNTAŞNo ratings yet

- LogDocument16 pagesLogMAYSHIELLA CANDOLENo ratings yet

- Passive and Active ComponenetsDocument30 pagesPassive and Active Componenetsalmuhseen24No ratings yet