Professional Documents

Culture Documents

QUIZ 3 Accounting For Special Transactions 4

Uploaded by

ninocastillo316Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QUIZ 3 Accounting For Special Transactions 4

Uploaded by

ninocastillo316Copyright:

Available Formats

8

EEE, FFF and GGG are partners with capital balances on January 2, 2020 of P350,000, P525,000

and P700,000, respectively. Their profit ratio and capital interest ratio is 4:4:2. On July 1, 2020,

HHH was admitted by the partnership for 20% interest in capital and in profits by contributing

P200,000 cash, and the old partners agree to bring their capital to their profit interest sharing

ratio. The partnership had net income of P210,000 before admission of HHH and the partners

agree to revalue its overvalued equipment by P35,000.

How much is the capital balance of GGG after admission? *

(2 Points)

736,400.00

Using the same information in Number 8, how much is the amount paid/received by EEE? *

(2 Points)

422,800.00

10

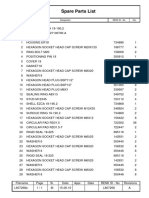

The following balances as of the end of 2020 for IJK Partnership together with the respective

profit and loss ratios of partners, were as follows (see image below).

III decided to retire from the partnership. Parties agreed to adjust the assets to their fair market

value of P432,000 as of December 31, 2020. III will be paid P150,000 by the partnership for his

interest.

How much is the capital balance of JJJ after retirement of III? *

(2 Points)

This study source was downloaded by 100000882773886 from CourseHero.com on 03-21-2024 04:55:05 GMT -05:00

https://www.coursehero.com/file/97735433/QUIZ-3-Accounting-for-Special-Transactions-4pdf/

Powered by TCPDF (www.tcpdf.org)

You might also like

- Passenger Elevator Operation ManualDocument24 pagesPassenger Elevator Operation ManualJahn Ray B. Lanozo100% (1)

- Ancient Indian ArchitectureDocument86 pagesAncient Indian ArchitectureRishika100% (2)

- Key Quiz 2 2022 2023Document4 pagesKey Quiz 2 2022 2023Leslie Mae Vargas ZafeNo ratings yet

- Ccie DC Full Scale Labs PDFDocument185 pagesCcie DC Full Scale Labs PDFnaveedrana100% (2)

- Flutter Entertainment PLCDocument73 pagesFlutter Entertainment PLCprajwal sedhaiNo ratings yet

- EQUITY SECURITIES With Answer For Uploading PDFDocument10 pagesEQUITY SECURITIES With Answer For Uploading PDFMaricon Berja100% (1)

- Review of PartnershipDocument13 pagesReview of PartnershipKristine BlancaNo ratings yet

- QUIZ 2 Accounting For Special Transactions 2nd Sem SY2122 1Document24 pagesQUIZ 2 Accounting For Special Transactions 2nd Sem SY2122 1Mika MolinaNo ratings yet

- Combined Quiz No. 1 ACCO 30013 Accounting For Special TransactionsDocument11 pagesCombined Quiz No. 1 ACCO 30013 Accounting For Special TransactionsYes ChannelNo ratings yet

- Far Compre DraftDocument27 pagesFar Compre DraftMika MolinaNo ratings yet

- Logix 5000 Controllers Tasks, Programs, and RoutinesDocument73 pagesLogix 5000 Controllers Tasks, Programs, and Routinesobi SalamNo ratings yet

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFDocument16 pages1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAANo ratings yet

- Partnership Formation and Operation.Document4 pagesPartnership Formation and Operation.May RamosNo ratings yet

- Virgin Galactic Profile & Performance Business ReportDocument10 pagesVirgin Galactic Profile & Performance Business ReportLoic PitoisNo ratings yet

- Afar 2 Module CH 9 & 10Document126 pagesAfar 2 Module CH 9 & 10Ella Mae TuratoNo ratings yet

- Rod and Pump DataDocument11 pagesRod and Pump DataYoandri Stefania Guerrero CamargoNo ratings yet

- Bombardier Zefiro Technical Description enDocument15 pagesBombardier Zefiro Technical Description ennickerlesstezla100% (1)

- Quiz 1 Bsa 3 1Document6 pagesQuiz 1 Bsa 3 1Angela Miles DizonNo ratings yet

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- Prequalifying ExaminationDocument7 pagesPrequalifying Examinationablay logeneNo ratings yet

- UB FINALS 1stSEMDocument9 pagesUB FINALS 1stSEMChristian GarciaNo ratings yet

- Quiz No. 1Document6 pagesQuiz No. 1Elboy Son DecanoNo ratings yet

- September 1 - AndrewDocument11 pagesSeptember 1 - AndrewDrewNo ratings yet

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoNo ratings yet

- College of Business and AccountancyDocument6 pagesCollege of Business and AccountancyTracy Miranda BognotNo ratings yet

- Print SW PartnershipDocument5 pagesPrint SW PartnershipMike MikeNo ratings yet

- 03 - Handout - Partnership DissolutionDocument4 pages03 - Handout - Partnership DissolutionJanysse CalderonNo ratings yet

- Partnership Operations (Additional Sample Problems)Document5 pagesPartnership Operations (Additional Sample Problems)Pauline Anne LopezNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- Afar Partnerships Ms. Ellery D. de Leon: True or FalseDocument6 pagesAfar Partnerships Ms. Ellery D. de Leon: True or FalsePat DrezaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- HW On Bonds Payable T1 2020-2021Document2 pagesHW On Bonds Payable T1 2020-2021Luna MeowNo ratings yet

- Accounting 2020 P1 Info BookDocument9 pagesAccounting 2020 P1 Info BookodiantumbaNo ratings yet

- Investment in AssociateDocument33 pagesInvestment in AssociateKimivy BusaNo ratings yet

- Corporate Reporting Paper 3.1 July 2023Document32 pagesCorporate Reporting Paper 3.1 July 2023Prof. OBESENo ratings yet

- Easy Trip Planners Limited ReportDocument7 pagesEasy Trip Planners Limited Reportankur taunkNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- 4 Financial Management Questions Nov Dec 2019 PL PDFDocument5 pages4 Financial Management Questions Nov Dec 2019 PL PDFShahriar ShihabNo ratings yet

- Summary of TotalsDocument1 pageSummary of Totalsrene nonatoNo ratings yet

- May 2013 Advanced TaxationDocument4 pagesMay 2013 Advanced TaxationTIMOREGHNo ratings yet

- Government Service Insurance System Ebilling and Collection System Summary of Totals Due Month - Sep, 2020Document1 pageGovernment Service Insurance System Ebilling and Collection System Summary of Totals Due Month - Sep, 2020Diana HermidaNo ratings yet

- ACCTG 029 - Final Quiz 1Document1 pageACCTG 029 - Final Quiz 1mcespressoblendNo ratings yet

- FAR-2 Mock September 2021 FinalDocument8 pagesFAR-2 Mock September 2021 FinalMuhammad RahimNo ratings yet

- Extraordinary General Assembly Dividend Distribution ProposalDocument3 pagesExtraordinary General Assembly Dividend Distribution Proposalrefik_rfkNo ratings yet

- QUIZ 4 Accounting For Business Combinations 1st Sem SY2223 PDFDocument33 pagesQUIZ 4 Accounting For Business Combinations 1st Sem SY2223 PDFssslll2No ratings yet

- Advacc Take Home 1answer Key Part 1Document4 pagesAdvacc Take Home 1answer Key Part 1RIZLE SOGRADIELNo ratings yet

- IA2 Prelim Exam Invt in AssocDocument5 pagesIA2 Prelim Exam Invt in AssocJoel RagosNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- Partnership Dissolution: QuizDocument5 pagesPartnership Dissolution: QuizLee SuarezNo ratings yet

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocument6 pagesAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNo ratings yet

- FarDocument19 pagesFarsarahbeeNo ratings yet

- ACCO 20043 FAR Final Departmental Exam 7.19.2021 PDFDocument32 pagesACCO 20043 FAR Final Departmental Exam 7.19.2021 PDFCrizlen FloresNo ratings yet

- LiabilitiesDocument2 pagesLiabilitiesFrederick AbellaNo ratings yet

- Summary of TotalsDocument1 pageSummary of Totalsanthony calzoNo ratings yet

- Module 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonDocument3 pagesModule 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonJoshua Daarol0% (1)

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- Verotel Merchant Services B.V. v. Rizal Commercial Bank 2021Document90 pagesVerotel Merchant Services B.V. v. Rizal Commercial Bank 2021hyenadogNo ratings yet

- Rapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Document5 pagesRapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Swami NarangNo ratings yet

- Quiz 1Document2 pagesQuiz 1Nathalie GetinoNo ratings yet

- Dividend Summary As On 26 Dec 2021: Client ID Client Name From Date To Date Portfolio For Asset Class Account SubtypeDocument4 pagesDividend Summary As On 26 Dec 2021: Client ID Client Name From Date To Date Portfolio For Asset Class Account SubtypeCA Nikhil MunjalNo ratings yet

- Mirae Asset Sekuritas Indonesia SCMA 3 Q22 697cf1eab1Document9 pagesMirae Asset Sekuritas Indonesia SCMA 3 Q22 697cf1eab1Ira KusumawatiNo ratings yet

- Assignment Accounting VillinoDocument10 pagesAssignment Accounting Villinomuslineh haidinNo ratings yet

- Assignment Accounting VillinoDocument10 pagesAssignment Accounting Villinomuslineh haidin100% (2)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Weekly Home Learning Plan - KindergartenDocument3 pagesWeekly Home Learning Plan - KindergartenPrecious ArniNo ratings yet

- Program Orientation HandoutsDocument125 pagesProgram Orientation Handoutsapi-391214898No ratings yet

- 344W11MidTermExamI Solution PDFDocument22 pages344W11MidTermExamI Solution PDFTrường TùngNo ratings yet

- Percakapan BHS Inggris Penerimaan PasienDocument5 pagesPercakapan BHS Inggris Penerimaan PasienYulia WyazztNo ratings yet

- Aciclovir 400mg and 800mg TabletsDocument2 pagesAciclovir 400mg and 800mg TabletsKalyan NandanNo ratings yet

- TDS - 0121 - CapaCare Classic - 201912Document5 pagesTDS - 0121 - CapaCare Classic - 201912ayviwurbayviwurbNo ratings yet

- (267.) SWOT - Cruise Industry & CarnivalDocument2 pages(267.) SWOT - Cruise Industry & CarnivalBilly Julius Gestiada100% (1)

- L807268EDocument1 pageL807268EsjsshipNo ratings yet

- Have To, Has To, Had To - Exercise 1 - Worksheet English GrammarDocument1 pageHave To, Has To, Had To - Exercise 1 - Worksheet English Grammarjonni jonsonNo ratings yet

- Timely Hints OctoberDocument5 pagesTimely Hints OctoberDane McDonaldNo ratings yet

- Astm E1216Document5 pagesAstm E1216koalaboi100% (1)

- Review of The Householder's Guide To Community Defence Against Bureaucratic Aggression (1973)Document2 pagesReview of The Householder's Guide To Community Defence Against Bureaucratic Aggression (1973)Regular BookshelfNo ratings yet

- Development of Design Air For Tunnel Lining Design Using Analytical MethodDocument93 pagesDevelopment of Design Air For Tunnel Lining Design Using Analytical MethodChin Thau WuiNo ratings yet

- ExcaDrill 45A DF560L DatasheetDocument2 pagesExcaDrill 45A DF560L DatasheetИгорь ИвановNo ratings yet

- A Sensorless Direct Torque Control Scheme Suitable For Electric VehiclesDocument9 pagesA Sensorless Direct Torque Control Scheme Suitable For Electric VehiclesSidahmed LarbaouiNo ratings yet

- The Enemy Within - v18Document8 pagesThe Enemy Within - v18Matt WillisNo ratings yet

- Rasi Navamsa: As Mo Ke Su Ve Mo JuDocument11 pagesRasi Navamsa: As Mo Ke Su Ve Mo JuRavan SharmaNo ratings yet

- 4 Structure PDFDocument45 pages4 Structure PDFAnil SuryawanshiNo ratings yet

- Imran Index 1Document11 pagesImran Index 1api-387022302No ratings yet

- QMM Epgdm 1Document113 pagesQMM Epgdm 1manish guptaNo ratings yet

- Group1 App 005 Mini PTDocument8 pagesGroup1 App 005 Mini PTAngelito Montajes AroyNo ratings yet